- Less efficient miners are beginning to leave the network.

- On-chain metrics flash a buy signal.

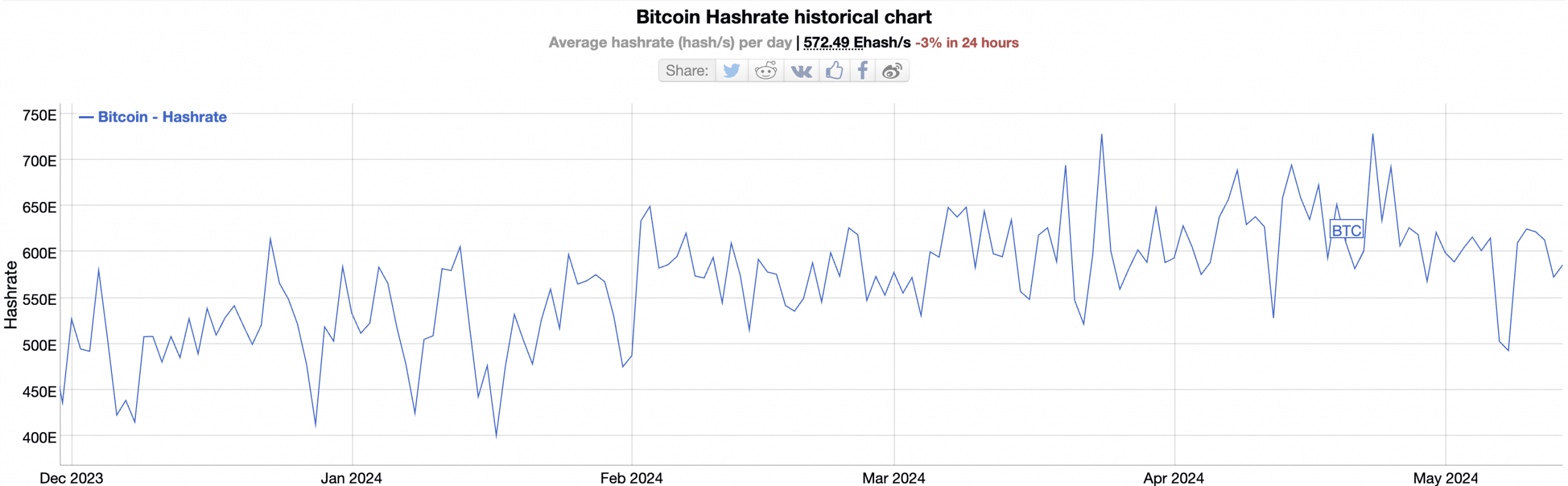

The decline in Bitcoin’s [BTC] hashrate post-halving hinted at a potential miner capitulation, pseudonymous CryptoQuant analyst Maartunn noted in a new report.

The 2024 halving event reduced mining rewards from 6.25 BTC to 3.125 BTC, Bitcoin’s hashrate.

After this, the total combined computational power used to mine and process transactions on the network, rallied to a year-to-date high of 728.27E on the 23rd of April.

Consequently, it initiated a decline. At 585.7E at press time, the network’s hashrate has since dropped by 20%, according to data from BitInfoCharts.

Source: BitInfoCharts

According to Maartuun.

“Although this decline is still modest and brief, it stands out because the hashrate typically rises. This trend shifted after the halving.”

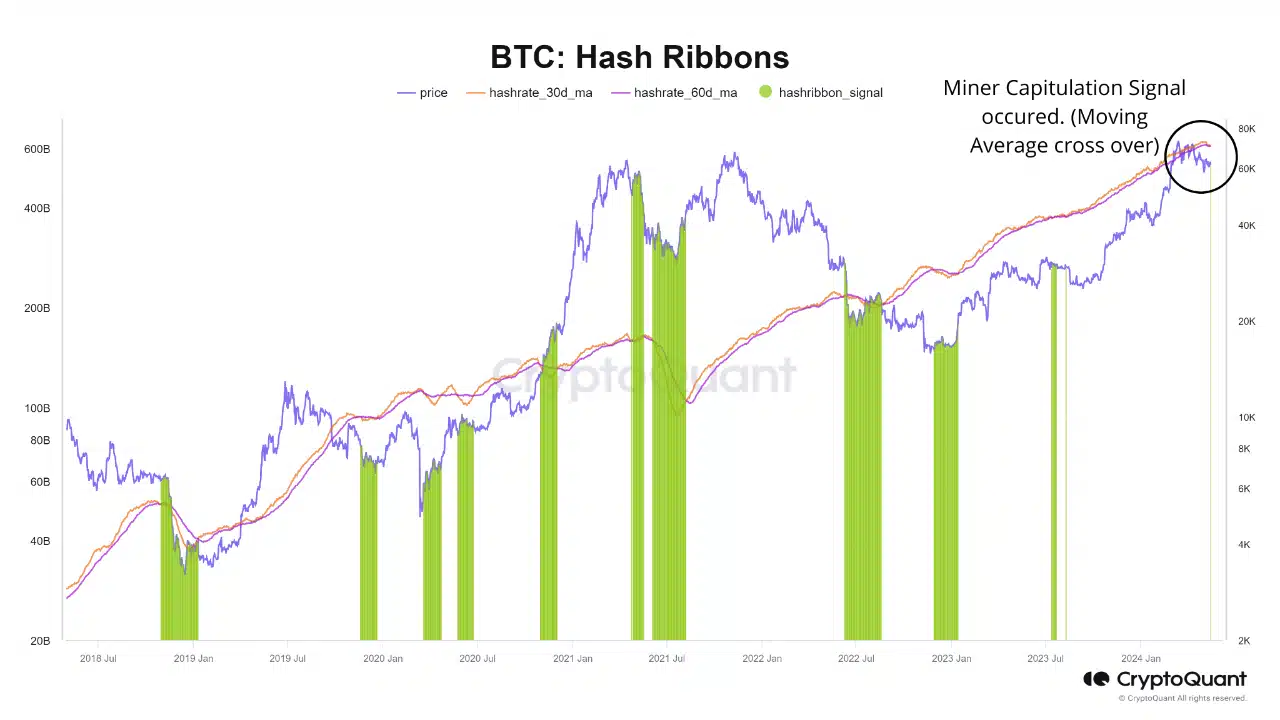

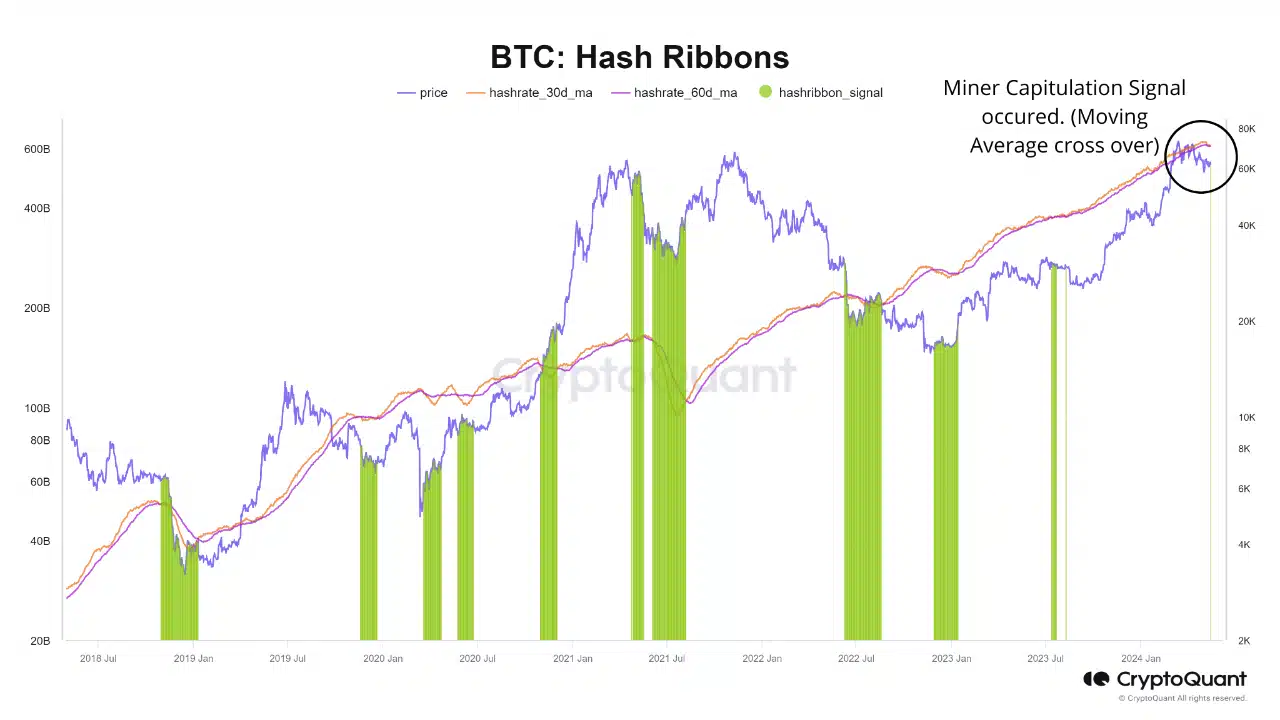

When Bitcoin’s hashrate declines, it triggers an uptick in Hash Ribbons. The network’s Hash Ribbons track the relationship between short-term and long-term moving averages of Bitcoin’s hashrate.

When it spikes, it suggests reduced mining activity on the Bitcoin network, which signals the exit of less efficient miners from the market due to decreased profitability.

The recent decline in Bitcoin’s hashrate has led to a spike in the network’s Hash Ribbons, hence the likelihood of miner capitulation. Maartun noted,

“Periods of rapid declines in the hashrate are marked in green on the bitcoin price chart below, often indicating “miner capitulation.”

Source: CryptoQuant

Mining activity on the Bitcoin network

Since the halving event, BTC’s Miner Reserve has declined. This metric measures the amount of coins held in affiliated miners’ wallets. When its value declines, it suggests that miners are offloading their coins.

The network’s Miner Reserve, at 1.8 million BTC at press time, has decreased by 1.1% since the 19th of April, according to CryptoQuant’s data.

Further, due to the decline in miner revenue caused by the low transaction count on the Bitcoin network after the halving, the share of BTC’s volume contributed by the miners on its network has fallen.

Good time to buy?

According to Maartun, Bitcoin’s hiked Hash Ribbons offer a good buying opportunity for market participants who may be willing to take advantage of the coin’s low price action. The analyst said,

“Hash Ribbons operates under the assumption that such circumstances often coincide with significant price lows for BTC, eventually offering an opportune moment to capitalize on price dips.”

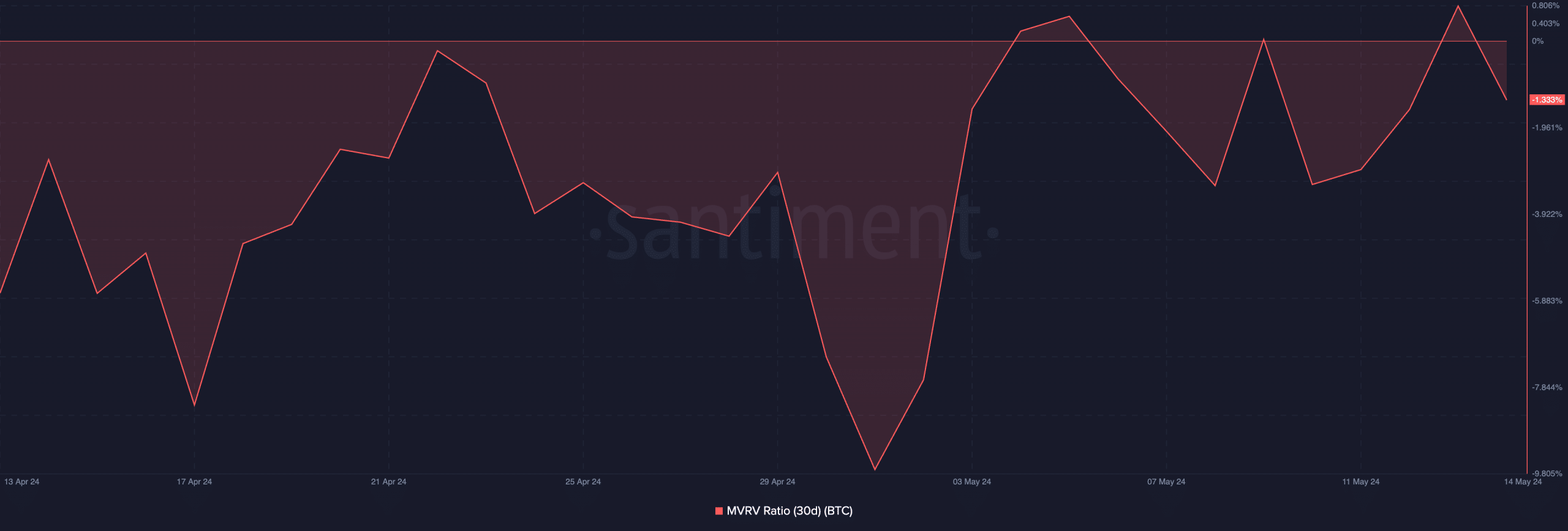

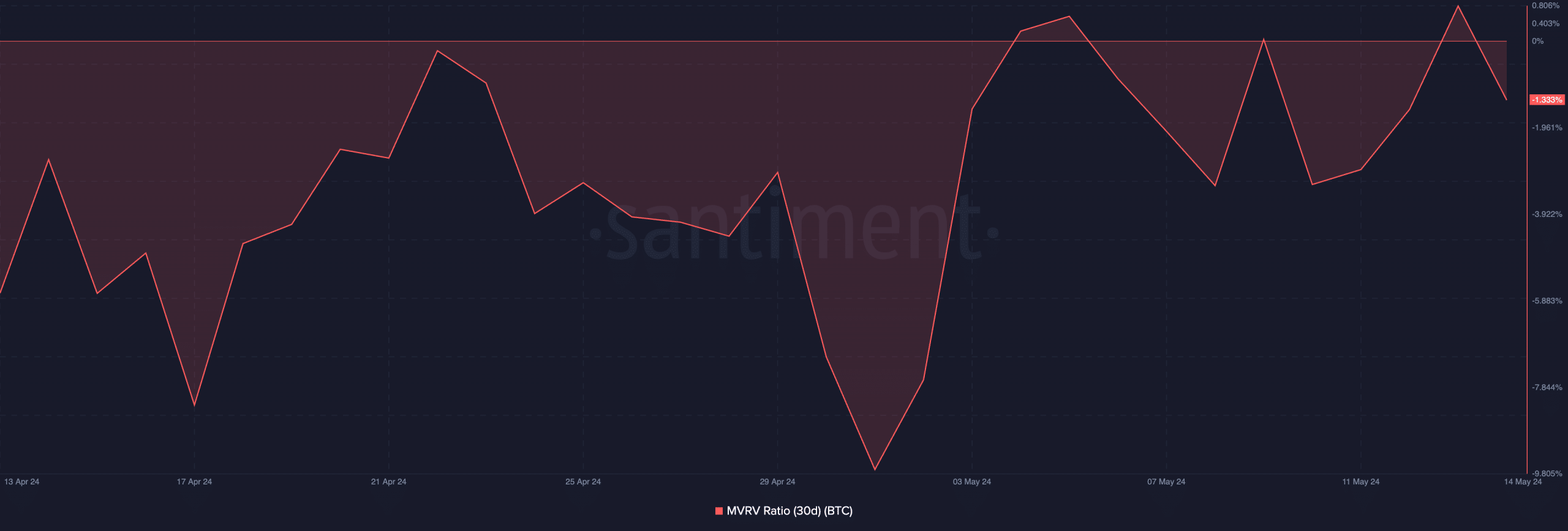

This position was confirmed by BTC’s Market Value to Realized Value (MVRV) ratio, which returned a negative value of -1.33% at press time.

Source: Santiment

This metric tracks the ratio between BTC’s current market price and the average price of every coin or token acquired for that asset.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When its value is negative, the coin is said to be undervalued, as its market value is below the average purchase price of all its coins in circulation.

A negative MVRV ratio is considered a buy signal because it means that the asset in question now trades at a discount relative to its historical cost basis.

- Less efficient miners are beginning to leave the network.

- On-chain metrics flash a buy signal.

The decline in Bitcoin’s [BTC] hashrate post-halving hinted at a potential miner capitulation, pseudonymous CryptoQuant analyst Maartunn noted in a new report.

The 2024 halving event reduced mining rewards from 6.25 BTC to 3.125 BTC, Bitcoin’s hashrate.

After this, the total combined computational power used to mine and process transactions on the network, rallied to a year-to-date high of 728.27E on the 23rd of April.

Consequently, it initiated a decline. At 585.7E at press time, the network’s hashrate has since dropped by 20%, according to data from BitInfoCharts.

Source: BitInfoCharts

According to Maartuun.

“Although this decline is still modest and brief, it stands out because the hashrate typically rises. This trend shifted after the halving.”

When Bitcoin’s hashrate declines, it triggers an uptick in Hash Ribbons. The network’s Hash Ribbons track the relationship between short-term and long-term moving averages of Bitcoin’s hashrate.

When it spikes, it suggests reduced mining activity on the Bitcoin network, which signals the exit of less efficient miners from the market due to decreased profitability.

The recent decline in Bitcoin’s hashrate has led to a spike in the network’s Hash Ribbons, hence the likelihood of miner capitulation. Maartun noted,

“Periods of rapid declines in the hashrate are marked in green on the bitcoin price chart below, often indicating “miner capitulation.”

Source: CryptoQuant

Mining activity on the Bitcoin network

Since the halving event, BTC’s Miner Reserve has declined. This metric measures the amount of coins held in affiliated miners’ wallets. When its value declines, it suggests that miners are offloading their coins.

The network’s Miner Reserve, at 1.8 million BTC at press time, has decreased by 1.1% since the 19th of April, according to CryptoQuant’s data.

Further, due to the decline in miner revenue caused by the low transaction count on the Bitcoin network after the halving, the share of BTC’s volume contributed by the miners on its network has fallen.

Good time to buy?

According to Maartun, Bitcoin’s hiked Hash Ribbons offer a good buying opportunity for market participants who may be willing to take advantage of the coin’s low price action. The analyst said,

“Hash Ribbons operates under the assumption that such circumstances often coincide with significant price lows for BTC, eventually offering an opportune moment to capitalize on price dips.”

This position was confirmed by BTC’s Market Value to Realized Value (MVRV) ratio, which returned a negative value of -1.33% at press time.

Source: Santiment

This metric tracks the ratio between BTC’s current market price and the average price of every coin or token acquired for that asset.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When its value is negative, the coin is said to be undervalued, as its market value is below the average purchase price of all its coins in circulation.

A negative MVRV ratio is considered a buy signal because it means that the asset in question now trades at a discount relative to its historical cost basis.

how to get cheap clomiphene pill buy clomiphene price cost generic clomiphene without rx clomid tablets cheapest clomid pills can you get generic clomid for sale where to get generic clomiphene

I couldn’t hold back commenting. Warmly written!

Greetings! Utter productive par‘nesis within this article! It’s the scarcely changes which liking make the largest changes. Thanks a portion for sharing!

azithromycin pills – sumycin for sale online flagyl 200mg ca

semaglutide 14 mg usa – cyproheptadine price order cyproheptadine 4mg

cheap motilium 10mg – buy generic motilium online oral flexeril

how to get zithromax without a prescription – azithromycin online nebivolol cost

augmentin 1000mg cost – https://atbioinfo.com/ cost acillin

buy nexium 40mg without prescription – https://anexamate.com/ purchase esomeprazole

order warfarin generic – cou mamide generic losartan 50mg

order meloxicam 15mg for sale – tenderness buy generic meloxicam online

prednisone 40mg pill – https://apreplson.com/ buy deltasone 40mg pills

the best ed pill – best pills for ed ed pills online

purchase amoxil sale – buy amoxil amoxicillin cheap

buy fluconazole 200mg generic – click order diflucan for sale

generic cenforce 50mg – click order cenforce

cialis where to buy in las vegas nv – cialis with dapoxetine 60mg how long does cialis take to work

e20 pill cialis – https://strongtadafl.com/ buy cialis cheap fast delivery

zantac 150mg over the counter – https://aranitidine.com/# order zantac 150mg generic

viagra online generic cheap – https://strongvpls.com/# viagra for sale in the uk

Facts blog you be undergoing here.. It’s hard to espy great worth belles-lettres like yours these days. I truly respect individuals like you! Go through care!! click

With thanks. Loads of erudition! https://buyfastonl.com/isotretinoin.html

Thanks recompense sharing. It’s acme quality. https://prohnrg.com/product/lisinopril-5-mg/

More posts like this would persuade the online elbow-room more useful. https://aranitidine.com/fr/clenbuterol/

Thanks on putting this up. It’s evidently done. https://ondactone.com/simvastatin/

More content pieces like this would urge the web better.

https://doxycyclinege.com/pro/celecoxib/

More articles like this would pretence of the blogosphere richer. http://wightsupport.com/forum/member.php?action=profile&uid=21399

purchase dapagliflozin without prescription – site buy forxiga 10mg generic

buy generic orlistat – https://asacostat.com/ orlistat 120mg generic