The futures market has historically been a barometer for investor sentiment. Open curiosity, representing the entire variety of excellent futures contracts that haven’t been settled, is a measure of market exercise. Traditionally, rising Bitcoin costs have been correlated with a rise in open curiosity, signaling heightened speculative exercise.

Nonetheless, Bitcoin’s current ascent previous $28,000 defies this pattern.

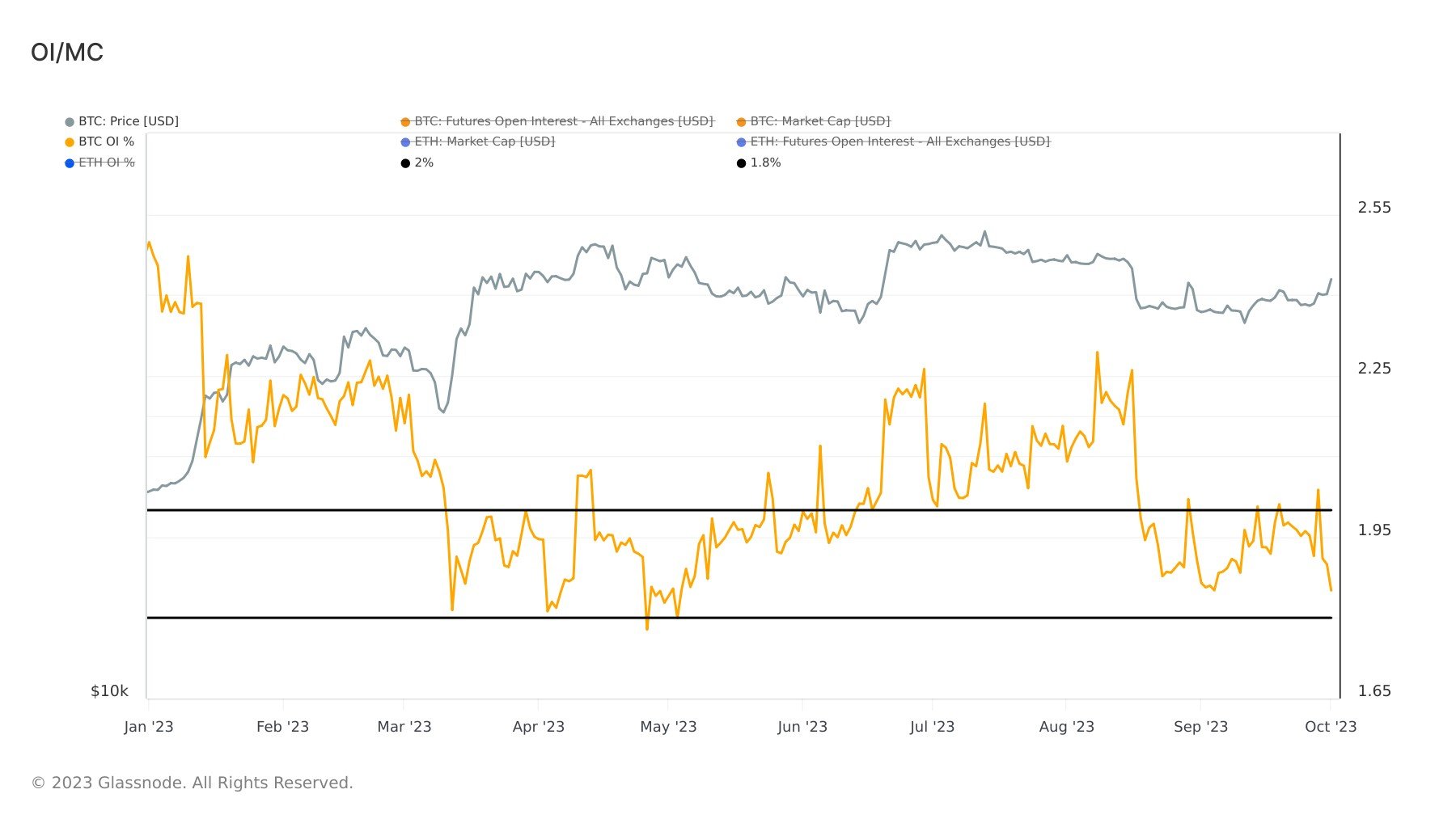

Regardless of this week’s rally, open curiosity in Bitcoin futures has notably declined. Particularly, open curiosity, as a proportion of Bitcoin’s market cap, is approaching a year-to-date low of 1.82%. This marks a 28% decline from figures at first of the 12 months. Such a contraction in open curiosity usually signifies a decline in speculative buying and selling, a shocking pattern given the cryptocurrency’s bullish momentum.

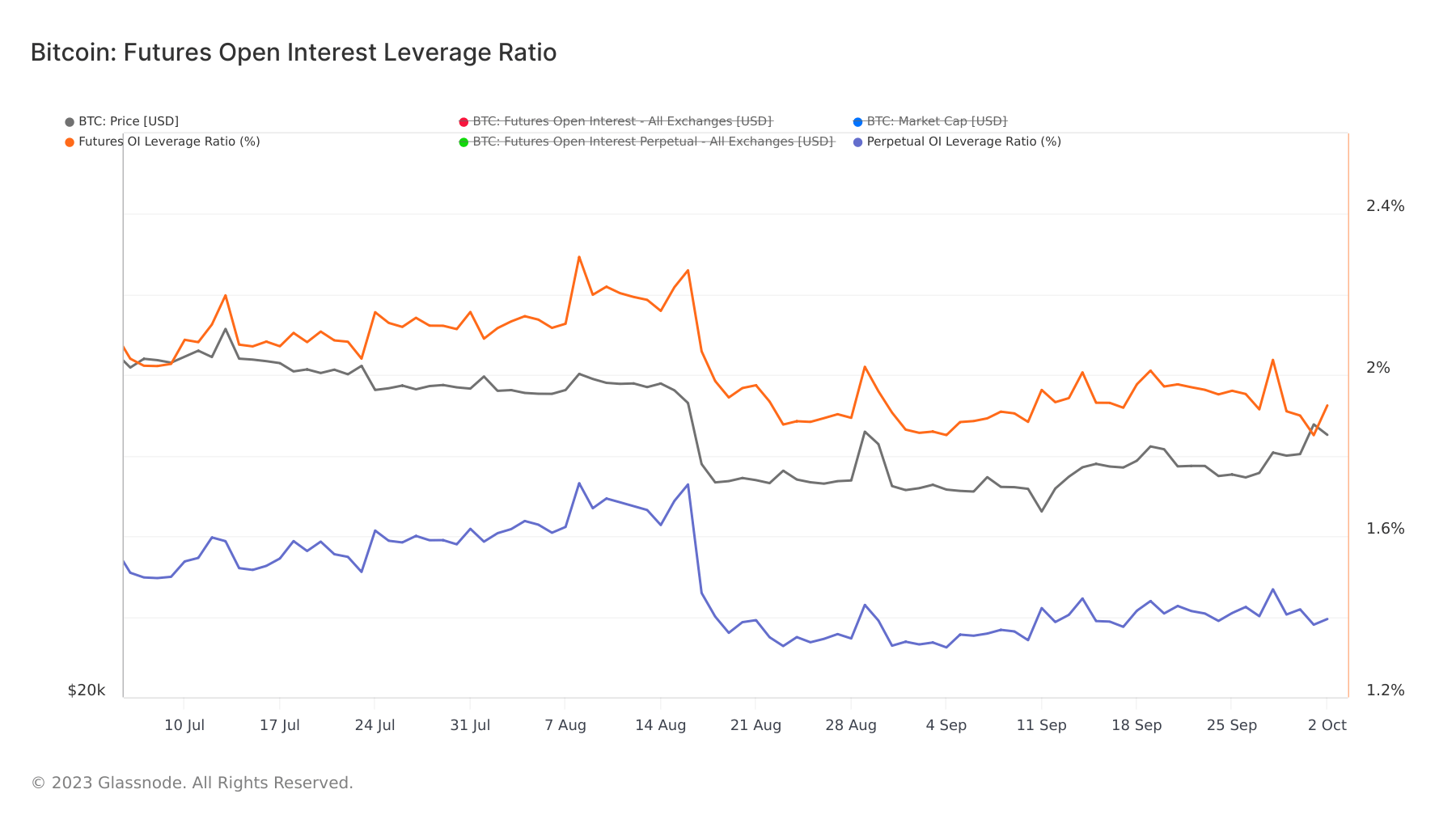

Digging deeper into the futures market reveals extra about this evolving dynamic. The futures open curiosity leverage ratio, which measures the entire open curiosity of futures contracts relative to the underlying asset’s market cap, supplies a lens into merchants’ threat urge for food. On Sept. 27, this ratio stood at 1.91%, rising to 2.03% on Sept. 28, solely to drop again to 1.85% by Oct. 1. The same pattern was noticed within the perpetual futures open curiosity leverage ratio, which rose from 1.4% to 1.46% after which decreased to 1.38% inside the identical timeframe.

Regardless of the additional value enhance on Oct. 1, the drop in leverage ratios would possibly point out that merchants had been turning into extra cautious or taking earnings. It means that some merchants might need been anticipating a possible value correction or consolidation, and therefore, they lowered their leveraged positions to attenuate threat.

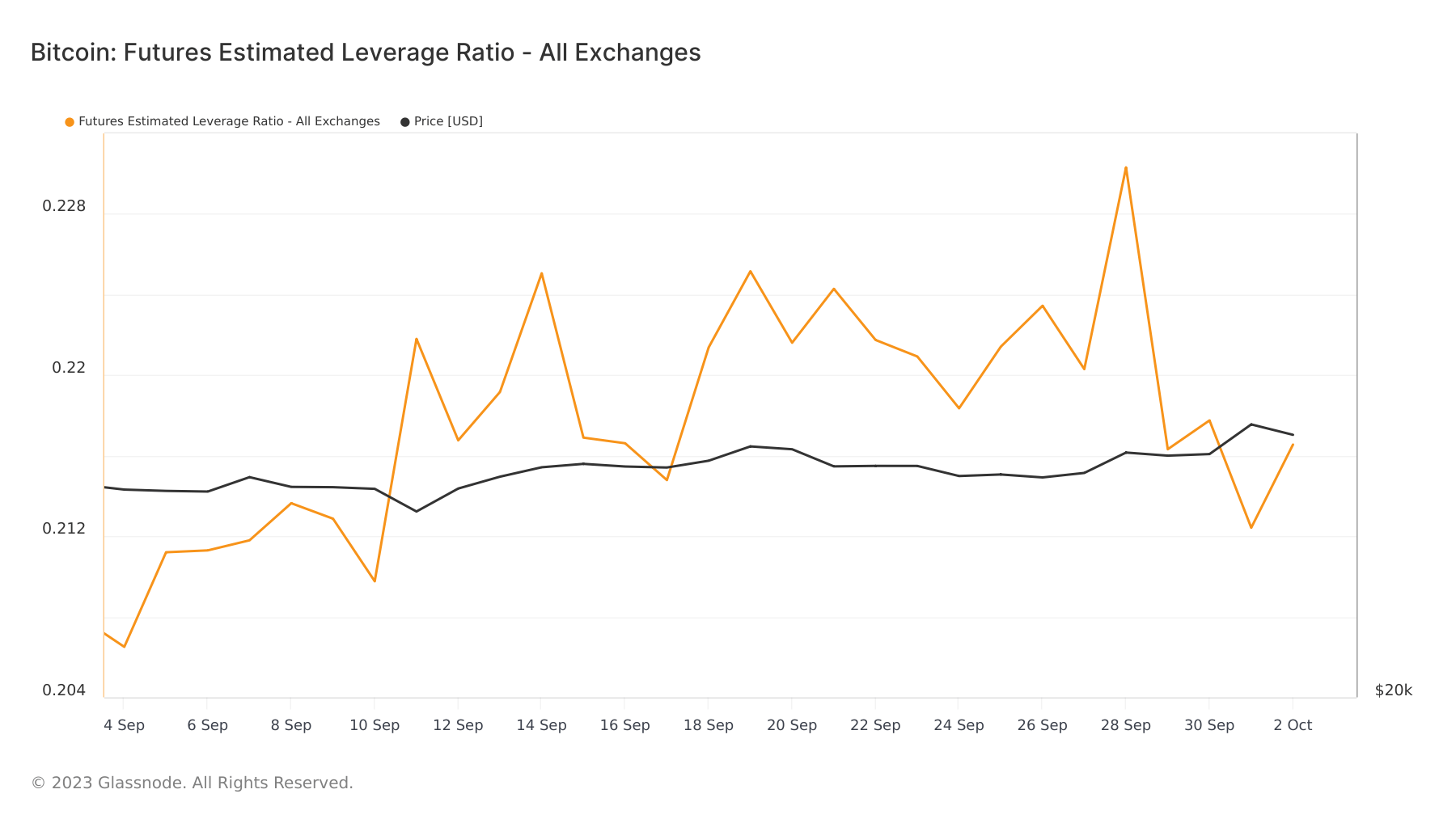

One other metric, the futures estimated leverage ratio throughout exchanges, dropped from 0.23 on Sept. 28 to 0.21 on Oct. 1. The metric supplies a mean measure of the leverage utilized by merchants within the futures market. When this ratio decreases, it typically signifies that merchants use much less leverage throughout exchanges.

The preliminary enhance in leverage ratios on Sept. 28 would possibly counsel that merchants had been utilizing extra borrowed funds to take a position on additional value will increase. Nonetheless, the following drop in each the particular futures open curiosity leverage ratios and the final estimated leverage ratio throughout exchanges by Oct. 1 signifies a broader pattern of lowered leverage use. At the same time as Bitcoin’s value continued to rise, merchants, on common, lowered their leverage. This would possibly counsel that merchants had been managing their threat by not over-leveraging in a market that had lately seen important value motion.

The rising value of Bitcoin amidst falling open curiosity and lowered leverage signifies that the present value rally is perhaps pushed much less by short-term hypothesis and extra by real long-term investor confidence. This might imply elevated participation by institutional buyers or a broader shift in retail investor technique from speculative buying and selling to long-term holding.

Whereas lowered speculative exercise can stabilize the market and cut back volatility, it additionally signifies lowered liquidity. For merchants, which means that whereas the market is perhaps much less vulnerable to sudden value corrections on account of liquidation occasions, it is also much less responsive to purchase or promote orders, resulting in potential value slippages.

The publish Declining open curiosity in futures market contrasts Bitcoin’s bullish rally appeared first on CryptoSlate.

I really like your writing style, great information, appreciate it for posting :D. “Inquiry is fatal to certainty.” by Will Durant.

Real wonderful visual appeal on this website , I’d rate it 10 10.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! By the way, how could we communicate?

I like the efforts you have put in this, thankyou for all the great posts.

buy cheap clomiphene without prescription how to get cheap clomiphene no prescription can you get cheap clomid without insurance can you get cheap clomid without a prescription where can i get cheap clomiphene price how to buy cheap clomid tablets order generic clomiphene without rx

More articles like this would pretence of the blogosphere richer.

More posts like this would create the online play more useful.

how to buy azithromycin – buy metronidazole 200mg pills generic flagyl

rybelsus drug – buy semaglutide 14mg online cheap cyproheptadine cost

motilium 10mg uk – order domperidone where can i buy flexeril

I gotta bookmark this site it seems very helpful extremely helpful

buy propranolol without a prescription – methotrexate ca methotrexate order online

clavulanate pill – atbioinfo acillin cheap

nexium 40mg brand – anexamate.com order generic nexium 20mg

buy warfarin 2mg sale – https://coumamide.com/ cozaar where to buy

There is noticeably a bunch to realize about this. I assume you made various nice points in features also.

prednisone 10mg generic – aprep lson prednisone 40mg pill

buy generic ed pills – fastedtotake.com buy ed meds online

diflucan 100mg pill – this diflucan usa