What is a decentralized physical infrastructure network (DePIN)? Discover how this framework is changing real-world infrastructure.

The relatively new concept of a decentralized physical infrastructure network, or DePIN, aims to fundamentally change sectors such as telecommunications, cloud computing, transportation, and energy distribution.

Tech giants have traditionally dominated these sectors, wielding considerable control and maintaining their market share through vast capital investments and sophisticated logistics. DePIN offers a framework where the community builds, maintains, and collectively operates physical infrastructure using blockchain protocols.

So, what exactly is DePIN, and how is it poised to turn infrastructure services on its head? Read on to find out more.

DePIN explained: what is DePIN in crypto?

DePIN is the convergence of blockchain technology with solid infrastructure services. These networks are using cryptocurrency to help grow important services, leveraging the growing popularity of online connections to start a new type of dapps that combines digital and real-world services.

The crypto analytics platform Messari first introduced the term DePIN in November 2022, following a public poll on X to find a name for web3’s physical framework.

DePIN won more than 31% of the vote, outperforming other proposed names like “proof of physical work (PoPw)” and “token-incentivized physical networks (TIPIN).”

Web3 physical infrastructure needs a name!

Often referred to as Proof of Physical Work (PoPw), Token Incentivized Physical Networks (TIPIN), EdgeFi, or Decentralized Physical Infrastructure Networks (DePIN), crypto has yet to reach a consensus.

Vote below, or add a suggestion⬇️

— Messari (@MessariCrypto) November 5, 2022

As Messari highlights, DePIN represents a standout trend for peer-to-peer infrastructure. In 2023, the sector grew to more than 650 projects with a combined market cap north of $20 billion.

Additionally, the Messari report indicated that the DePIN industry was the most resilient crypto sub-sector in 2023, experiencing price drops of between 20-60% compared to the 70-90% registered in the broader crypto market.

Messari’s analysis of decentralized physical infrastructure networks revealed two primary DePIN categories based on the nature of their contributions.

The first type, physical resource networks (PRNs), are geographically anchored entities that supply location-specific resources—from connectivity to mobility—from a consortium of independent providers. Such resources are inherently unique, tied to the locale, and non-transferable.

The second type, known as digital resource networks (DRNs), involves contributors who offer transferable digital resources like computational power, bandwidth, or storage. These resources transcend geographical restrictions, broadening the scope and fluidity of digital asset provisioning.

Additionally, real-world applications of DePIN technology span across four main categories, each offering unique solutions to diverse challenges:

Cloud and storage networks: This category encompasses services like file storage, relational databases, content delivery networks (CDNs), and virtual private networks (VPNs). Projects like Filecoin (FIL) exemplify decentralized cloud networks, enabling individuals to monetize their spare computer storage space. By participating in Filecoin, users contribute to a digital storage rental service where available space is tracked on a blockchain, earning cryptocurrency rewards in return.

Wireless networks: With a focus on technologies like 5G and low-power wide-area networks (LoRaWAN), this category is particularly relevant to the Internet of Things (IoT). Initiatives such as Helium empower individuals to establish hotspots in their homes, extending coverage and supporting IoT devices. Participants earn cryptocurrency by contributing to the Helium network.

Sensor networks: This category involves devices equipped with sensors to collect real-time data from the environment, including geographical information systems (GIS). One example is Hivemapper, a platform involving people mapping their communities. It encourages individuals to share local knowledge and real-time data captured through their dashcams. In exchange for their contributions, users are rewarded with virtual currency.

Energy networks: This category aims to improve power grid reliability and efficiency by using various renewable energy sources. Arkreen is one such platform that connects green energy providers, allowing them to share data from their renewable resources. By bringing these providers together, Arkreen encourages the integration of sustainable energy into the wider energy infrastructure.

How do DePINs work?

DePINs function through the decentralized blockchain technology framework, effectively distributing control and responsibility across a network rather than allowing it to pool within a singular entity.

At the heart of the DePIN sector lies a cryptocurrency-based economy that rewards participants for contributing resources such as computing power, internet connectivity, or storage capabilities.

When the concept started, most of these DePIN crypto rewards did not hold tangible value, akin to early speculative investments. Participants essentially functioned as “risk miners”, betting on the potential of nascent DePIN projects and eyeing rewards in the form of future token value hikes and accumulation.

Every DePIN application is built upon four fundamental pillars:

- Physical network infrastructure includes tangible assets needed for network functions, like servers and transportation systems.

- Off-chain computing systems bridge real-world contributions to blockchain incentives and provide smart contract data.

- Blockchain framework is a transparent and immutable ledger that employs smart contracts to manage network transactions.

- Token rewards system encourages infrastructure contributions that feed the early growth of the network until it matures into a self-sustaining ecosystem through transaction fees.

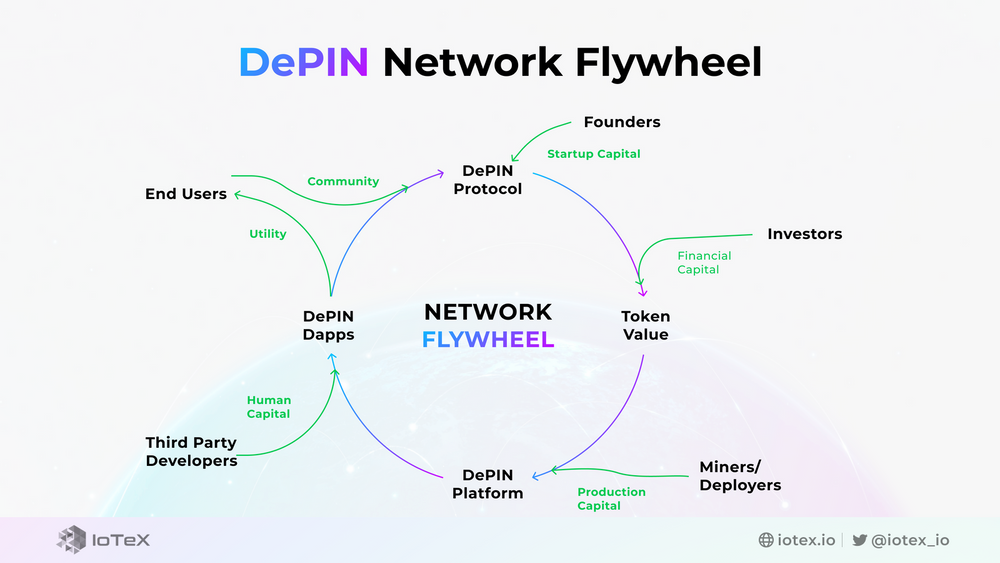

The DePIN flywheel

DePIN projects tend to harness the potential of their native crypto tokens to drive a self-reinforcing cycle known as a flywheel effect. As user engagement rises, the demand for DePIN crypto tokens naturally grows, increasing their market value.

DePIN flywheel | Source: iotex.io

This surge in value then incentivizes developers and contributors to double down on their efforts to improve the network as the rewards for their work become more lucrative.

The expansion of the network then piques the interest of investors, drawing additional capital and support, which, in turn, propels network growth.

Open-source projects and those sharing data openly serve as fertile ground for building dapps on top of this data layer, thus enhancing the ecosystem’s value. This, in turn, attracts a broader base of users and contributors, further spinning the flywheel and continuing this cycle of growth and innovation.

You might also like: Institutional adoption of crypto is growing. What can boost it further?

Advantages of DePIN technology

Decentralized physical infrastructure networks (DePINs) offer several advantages that could change the way we approach scalability and community empowerment:

Scalability: DePINs leverage crowdsourced infrastructure, enabling faster and more cost-effective expansion compared to traditional frameworks. This horizontal scalability allows them to adapt to changes in demand without requiring significant resource increases, maintaining efficiency without major reorganization.

Community empowerment: Unlike centralized platforms controlled by a select few, DePINs distribute hardware ownership among users, fostering collaboration and community involvement. This democratized approach promotes equal access and participation, empowering users at every level.

Transparent governance: DePINs champion transparent governance, replacing opaque practices with open and democratic decision-making processes. This ensures equal access for all users and encourages community-driven initiatives.

Accessible participation: By eliminating centralized gatekeepers, DePINs prioritize open access and censorship resistance. This inclusive model promotes accessible participation for all users, regardless of background or location.

Cost efficiency: DePINs aim to lower costs by leveraging a diverse network of service providers who can competitively offer their services. This competitive environment encourages fair pricing and reduces the inflated costs often associated with centralized services.

Incentivization: Within the DePIN framework, incentivization structures drive participation and growth by offering service providers opportunities for passive or active income. These incentives further boost network engagement and expansion.

You might also like: A guide to crypto passive income opportunities

DePIN challenges

As DePIN navigates its early stages within the blockchain realm, it encounters several hurdles that may impede its progress:

Limited interest and adoption: One of the primary challenges stems from the novelty of DePIN, resulting in limited interest from both the blockchain community and infrastructure owners. Without a critical mass of participants, the ecosystem’s growth and success are at stake.

Complexity and education: The inherent complexity of DePIN technology poses a barrier to entry, requiring extensive education to engage potential adopters effectively. Overcoming this hurdle involves simplifying the technology and providing comprehensive educational resources.

Financial requirements: Maintaining private networks comes with substantial operational costs, often without external funding. This financial burden makes it challenging to attract prospective network hosts and sustain network operations in the absence of sufficient resources.

Provider profitability: Profitability serves as a key motivator for network providers. DePIN platforms must strike a delicate balance between compensations and costs to ensure provider profitability. However, achieving this balance proves difficult amid low engagement rates from both users and providers.

Are DePINs paving the way for web3’s future?

Some experts in the blockchain and crypto community see DePIN advancements as a significant step forward in shaping the future of web3 by addressing the limitations of centralized systems. By distributing tasks across multiple components, DePINs aim to prevent bottlenecks and create a more resilient network. However, widespread adoption is crucial for this concept to drive the evolution of digital interaction and infrastructure.

The potential benefits of DePINs could lead to greater accessibility in web3, especially in areas where traditional centralized networks are lacking. By bridging this gap, DePINs could enable advanced technology to reach a broader audience, promoting access to decentralized solutions worldwide.

Examining practical applications, initiatives like Render (RNDR) showcase the capabilities of DePIN projects. Analysts suggest that Render could disrupt the 3D graphics market by offering high-quality rendering capabilities at a lower cost compared to traditional centralized competitors.

Industry experts anticipate a grassroots movement toward increased crypto engagement as more innovative projects emerge. These projects empower communities to collaborate in building and maintaining infrastructure, potentially reducing costs through collective efforts. This approach aims to challenge monopolistic practices, often leading to inflated pricing due to market control. Successful ventures in this direction could highlight the benefits of decentralized approaches in democratizing technology and processes.

Read more: What is the ERC-404 token standard: revolution or failure?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

cost of generic clomid pills where can i buy generic clomid where to buy clomid how to buy clomid tablets clomid contraindications good rx clomid buying generic clomid tablets

The thoroughness in this section is noteworthy.

The sagacity in this serving is exceptional.

how to buy azithromycin – azithromycin 250mg ca buy metronidazole 400mg generic

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

buy rybelsus for sale – buy rybelsus generic cyproheptadine cheap

buy motilium pill – tetracycline 500mg brand order cyclobenzaprine online

buy generic augmentin – https://atbioinfo.com/ where can i buy acillin

nexium where to buy – https://anexamate.com/ order nexium 40mg pill

buy generic coumadin online – blood thinner order losartan 50mg pill

generic mobic 15mg – https://moboxsin.com/ meloxicam over the counter

prednisone tablet – https://apreplson.com/ buy prednisone 40mg generic

ed pills that really work – site buy generic ed pills

cheap amoxil generic – amoxil usa oral amoxicillin

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

buy fluconazole 200mg online – order diflucan pills buy forcan generic

cenforce 50mg ca – https://cenforcers.com/# cenforce 50mg for sale