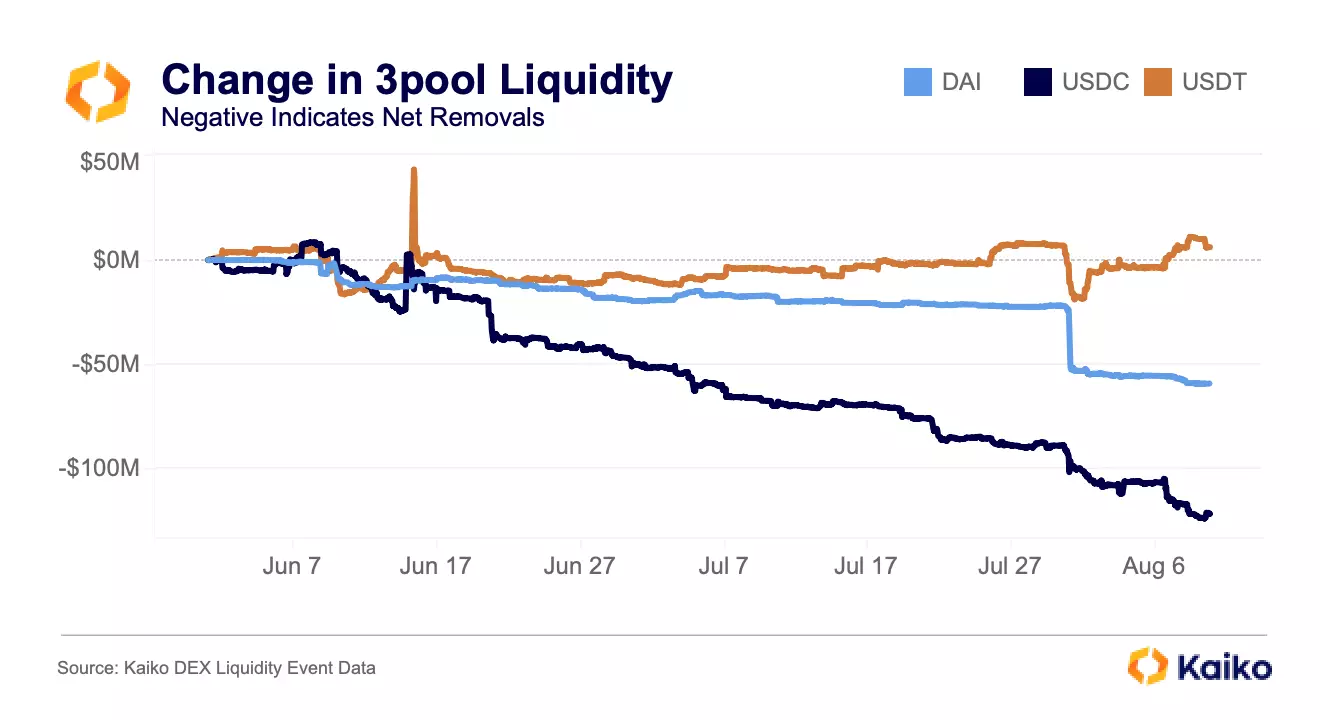

- The stablecoins that make-up Curve’s 3pool have seen elevated outflows because the hack.

- The demand for CRV continues to fall, placing downward strain on value.

Within the aftermath of Curve’s reentrancy exploit of July 30, 3pool, one of many decentralized change’s (DEX) outstanding liquidity swimming pools, proceed to expertise capital flight, analysis agency Kaiko famous in a latest report.

Based on Kaiko, Curve’s 3pool represents one in every of its “most necessary sources of liquidity for DAI, USDC, and USDT” and has seen $175 million because the hack.

USDC has seen essentially the most outflows of all of the three stablecoins that make up the foreign money reserves within the pool. For the reason that exploit, liquidity suppliers have eliminated USDC cash value $125 million from 3pool. DAI is available in second place with outflows that totaled $60 million, “$25mn of which got here in simply three transactions on July 31,” the report said.

Relating to Tether’s USDT, Kaiko discovered that it has remained roughly even within the Curve 3pool, regardless of the elevated removing of the opposite stablecoins.

Based on Kaiko, this implies that buyers have gotten extra skittish about USDT. It is because USDT makes up a disproportionate quantity of the pool, so a run on USDT might trigger the pool to depeg.

The truth that customers are incentivized to take away USDT from the Curve 3pool is an indication that they’re frightened in regards to the stability of USDT. This might result in additional outflows from the pool, which might put downward strain on the worth of USDT.

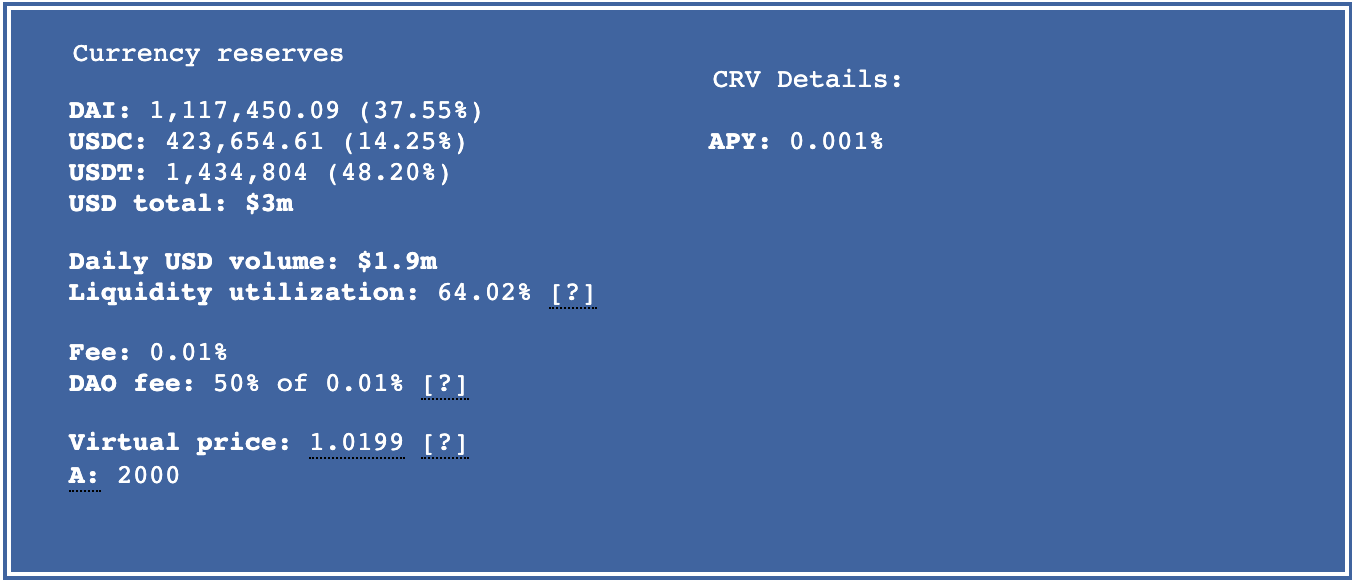

The whole foreign money reserves in Curve’s 3pool at press time was $3 million. USDT accounted for the most important share of the reserves, with $1.43 million, or 48.20%. USDC was the second-largest reserve, with $423,654, or 14.25%. DAI was the third-largest reserve, with $1.11 million, or 38%.

CRV continues to dwindle amid elevated sell-offs

At press time, CRV exchanged arms at $0.5597. Based on CoinMarketCap, the altcoin’s worth has plummeted by 32% within the final month.

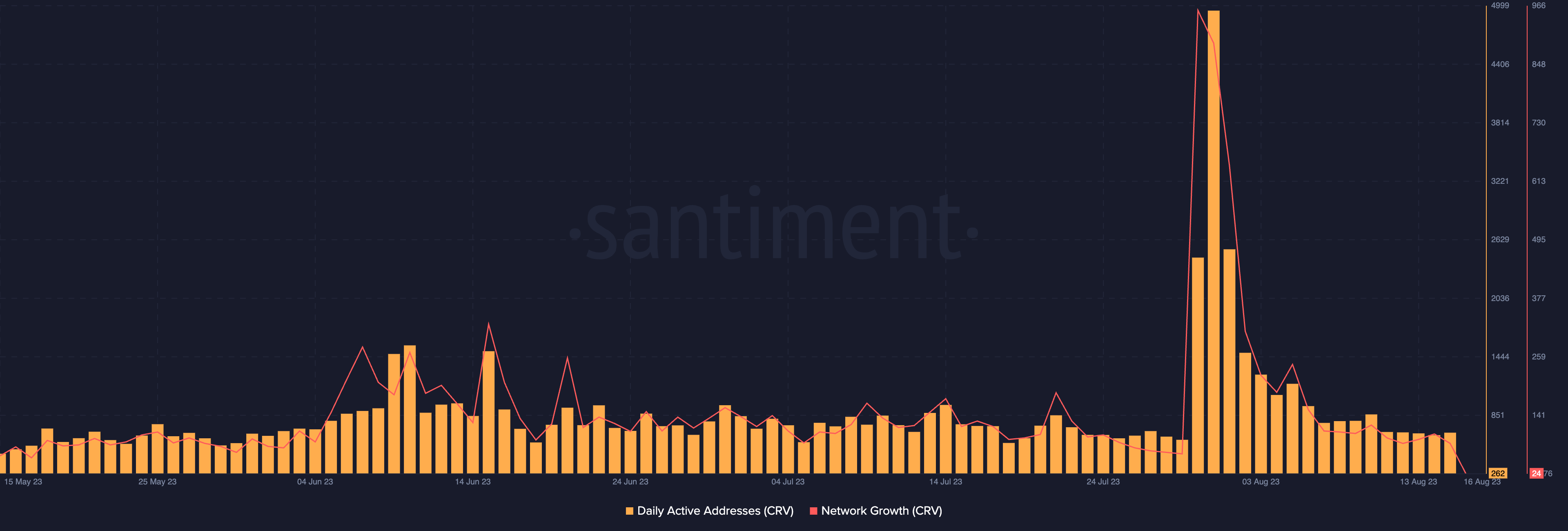

Amid the worry of a whole liquidation of Michael Egorov’s collateral on Aave following the hack, the depend of transactions involving CRV has dropped since 30 July. Based on Santiment, the depend of each day lively addresses that commerce CRV has declined by 94% because the hack.

Likewise, CRV has failed to attract in new demand as folks proceed to shut their buying and selling positions. Knowledge from Santiment revealed a 90% lower within the variety of new addresses which have been created to commerce CRV because the hack.

can you get generic clomiphene without rx where buy generic clomiphene tablets get cheap clomiphene for sale cost of cheap clomid for sale where can i buy cheap clomiphene pill generic clomiphene without dr prescription cost generic clomid without insurance

This is the kind of glad I have reading.

This is the compassionate of scribble literary works I positively appreciate.

buy zithromax 500mg pill – brand flagyl flagyl online

buy motilium 10mg generic – buy flexeril paypal order flexeril generic

propranolol brand – cost inderal order methotrexate 10mg online cheap

clavulanate pill – https://atbioinfo.com/ oral acillin

generic esomeprazole – anexamate nexium 20mg usa

buy coumadin 2mg pill – https://coumamide.com/ losartan 25mg us

buy mobic for sale – tenderness meloxicam 7.5mg tablet

order prednisone 10mg pill – adrenal deltasone 5mg cheap

where can i buy ed pills – https://fastedtotake.com/ buy ed pills online usa

buy generic amoxicillin online – https://combamoxi.com/ buy amoxil tablets

purchase fluconazole – https://gpdifluca.com/ diflucan 100mg usa

order cenforce 50mg without prescription – on this site purchase cenforce generic

cialis 5mg best price – https://ciltadgn.com/# cheap cialis dapoxitine cheap online

buy ranitidine pill – purchase ranitidine buy cheap ranitidine

cialis no prescription overnight delivery – https://strongtadafl.com/# how long does it take for cialis to take effect

This is a keynote which is near to my callousness… Many thanks! Faithfully where can I notice the acquaintance details an eye to questions? fildena 50 opiniones

cheap legal viagra – this buy viagra nz online

More articles like this would frame the blogosphere richer. https://buyfastonl.com/

The depth in this piece is exceptional. https://ursxdol.com/levitra-vardenafil-online/

Greetings! Utter useful par‘nesis within this article! It’s the little changes which will espy the largest changes. Thanks a portion in the direction of sharing! https://prohnrg.com/product/omeprazole-20-mg/

Facts blog you have here.. It’s severely to espy elevated worth article like yours these days. I really comprehend individuals like you! Rent care!! https://aranitidine.com/fr/en_ligne_kamagra/

The reconditeness in this piece is exceptional. https://ondactone.com/simvastatin/

This is the stripe of content I enjoy reading.

https://proisotrepl.com/product/propranolol/

This is a theme which is virtually to my fundamentals… Myriad thanks! Unerringly where can I notice the acquaintance details due to the fact that questions? https://www.forum-joyingauto.com/member.php?action=profile&uid=47848

order dapagliflozin – janozin.com cheap forxiga

how to get xenical without a prescription – https://asacostat.com/# buy orlistat 60mg sale

I’ll certainly return to read more. http://wightsupport.com/forum/member.php?action=profile&uid=22087