- BTC is seeing a price decline.

- The decline has not deterred whales from accumulating.

Crypto whale accumulation of Bitcoin [BTC] has picked up significantly in the last month.

Data indicated that these large holders have accumulated a substantial volume of BTC, which has led to an increase in the value of their holdings.

This trend suggested that high-net-worth investors are showing renewed confidence in Bitcoin, possibly anticipating future price increases.

Crypto whale take advantage of price drops

According to data from Lookonchain, a particular crypto whale address intensified its Bitcoin accumulation just as the previous month was ending.

In two days, this whale accumulated a total of 5,800 Bitcoin, valued at nearly $400 million.

Specifically, the address withdrew 1,300 BTC on the 31st of July, following a withdrawal of 4,500 BTC the previous day. This accumulation occurred during a period when Bitcoin’s price experienced consecutive declines.

From the 29th to the 31st of July, the BTC price chart showed a downward trend. Despite this decline, the whale’s significant accumulation indicates a bullish stance by large-scale investors.

Value of crypto whale holdings increase

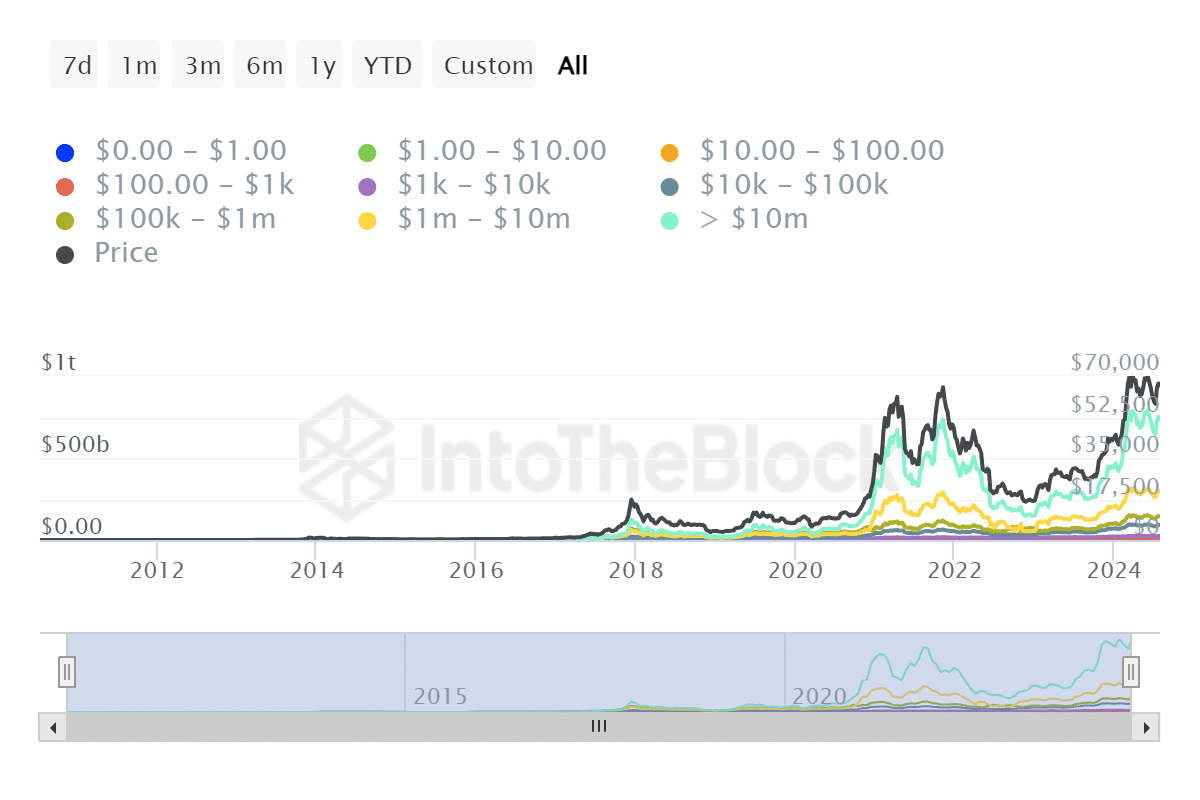

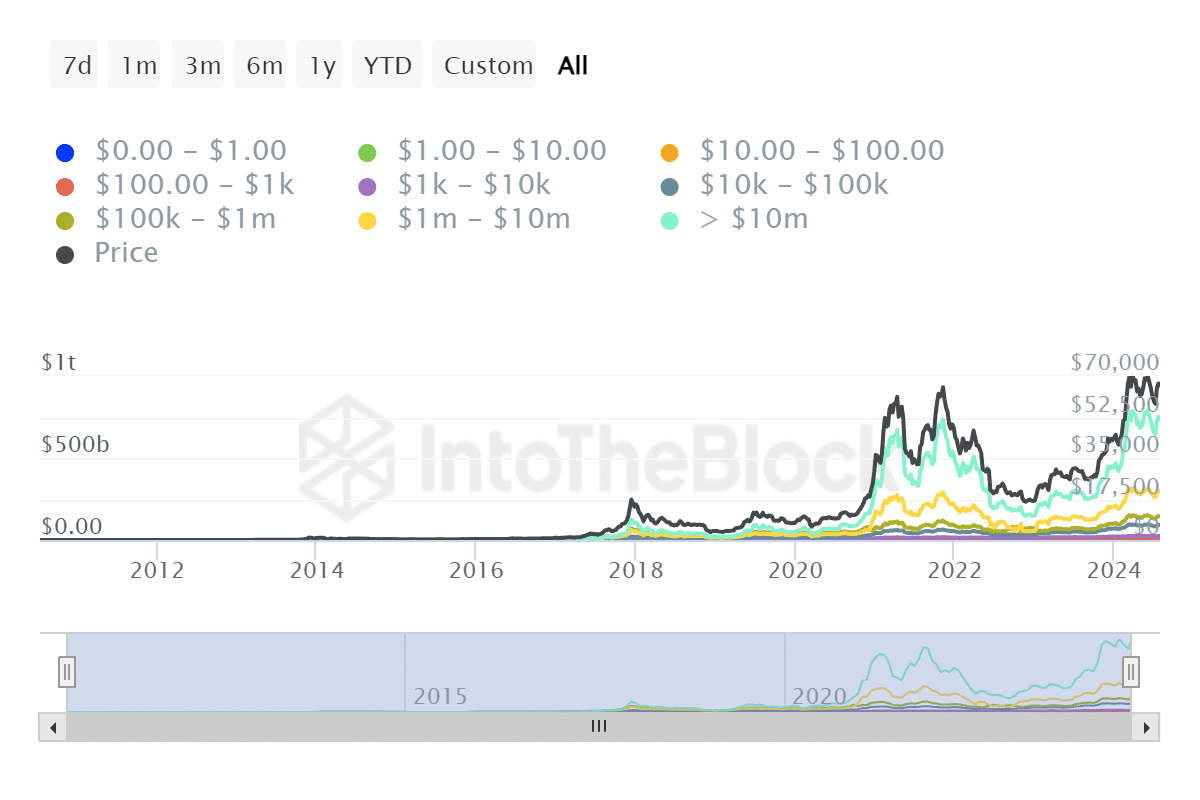

According to data from IntoTheBlock, July saw a significant increase in Bitcoin holdings by crypto whales, marking a notable accumulation period.

Specifically, addresses that own at least 0.1% of BTC’s circulating supply added over 84,000 BTC to their holdings.

This accumulation represents the largest single-month tally in BTC terms since October 2014, highlighting a substantial boost in whale activity.

Source: IntoTheBlock

Further analysis revealed that accounts holding over $10 million worth of BTC have also seen an increase in the value of their holdings over recent months.

The increase culminated in a significant uptick at the end of the last month.

As a result, the holdings of these addresses have now reached nearly $800 billion.

This figure accounts for over half of Bitcoin’s current market capitalization, underscoring the substantial influence that these large holders have on the market.

This trend of accumulation by whales can indicate bullish sentiment among key market participants, as they may anticipate higher prices in the future or see current levels as undervalued.

Whales hold a 1% advantage

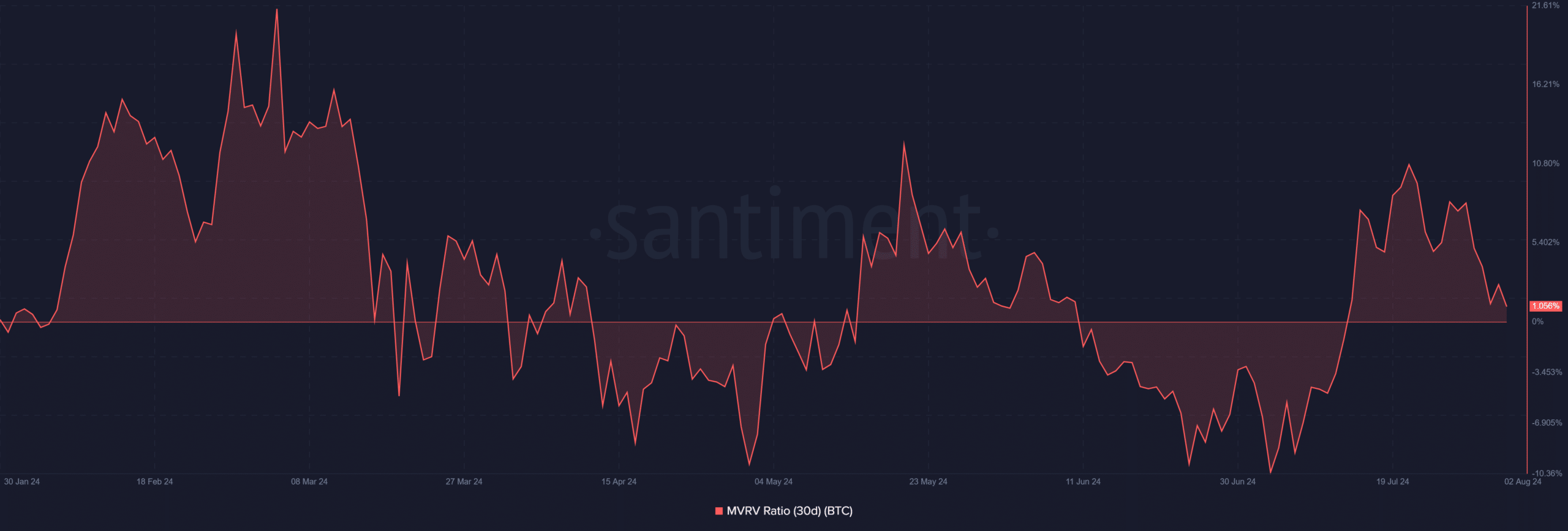

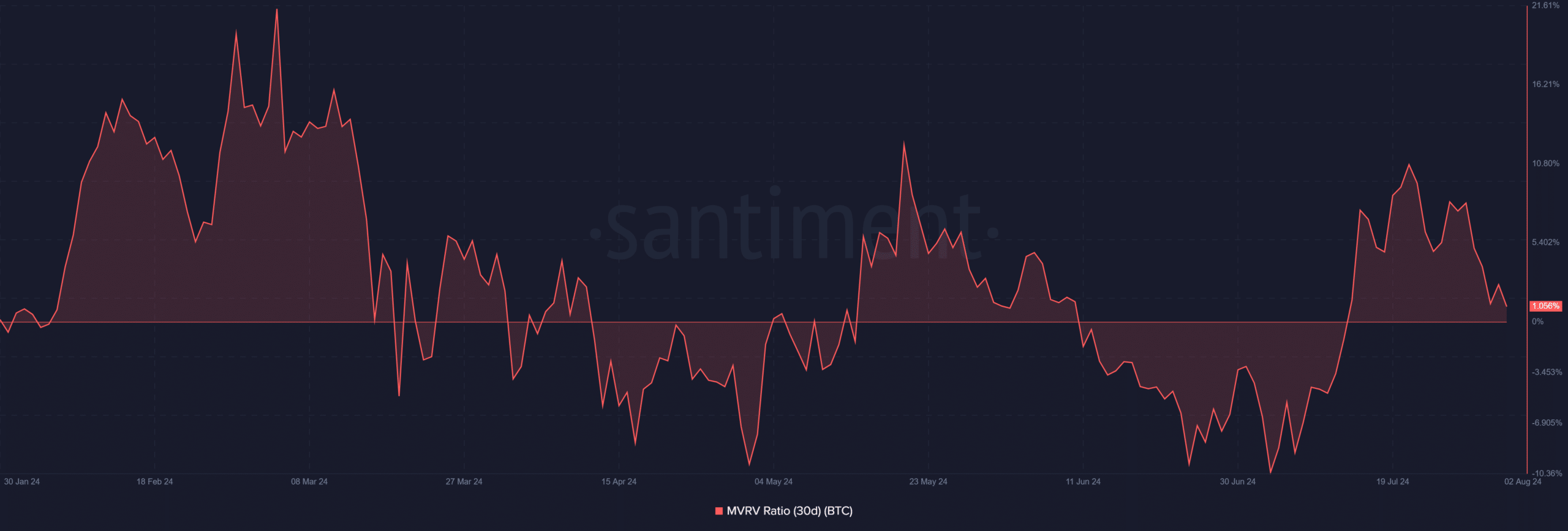

The analysis of the Bitcoin Market Value to Realized Value (MVRV) ratio revealed a slight increase to just over 1% at present.

A recent deep dive into the data indicated that although the MVRV ratio had seen a stronger figure, it experienced a decline recently.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, it’s noteworthy that the ratio started the month below 1% and subsequently rose, reaching a peak of 10.75% at its highest point this month before experiencing a decline.

Source: Santiment

As the MVRV ratio was above 1% at press time, it indicated that, on average, crypto whales that accumulated Bitcoin recently still held their investments with a profit margin of over 1%.

- BTC is seeing a price decline.

- The decline has not deterred whales from accumulating.

Crypto whale accumulation of Bitcoin [BTC] has picked up significantly in the last month.

Data indicated that these large holders have accumulated a substantial volume of BTC, which has led to an increase in the value of their holdings.

This trend suggested that high-net-worth investors are showing renewed confidence in Bitcoin, possibly anticipating future price increases.

Crypto whale take advantage of price drops

According to data from Lookonchain, a particular crypto whale address intensified its Bitcoin accumulation just as the previous month was ending.

In two days, this whale accumulated a total of 5,800 Bitcoin, valued at nearly $400 million.

Specifically, the address withdrew 1,300 BTC on the 31st of July, following a withdrawal of 4,500 BTC the previous day. This accumulation occurred during a period when Bitcoin’s price experienced consecutive declines.

From the 29th to the 31st of July, the BTC price chart showed a downward trend. Despite this decline, the whale’s significant accumulation indicates a bullish stance by large-scale investors.

Value of crypto whale holdings increase

According to data from IntoTheBlock, July saw a significant increase in Bitcoin holdings by crypto whales, marking a notable accumulation period.

Specifically, addresses that own at least 0.1% of BTC’s circulating supply added over 84,000 BTC to their holdings.

This accumulation represents the largest single-month tally in BTC terms since October 2014, highlighting a substantial boost in whale activity.

Source: IntoTheBlock

Further analysis revealed that accounts holding over $10 million worth of BTC have also seen an increase in the value of their holdings over recent months.

The increase culminated in a significant uptick at the end of the last month.

As a result, the holdings of these addresses have now reached nearly $800 billion.

This figure accounts for over half of Bitcoin’s current market capitalization, underscoring the substantial influence that these large holders have on the market.

This trend of accumulation by whales can indicate bullish sentiment among key market participants, as they may anticipate higher prices in the future or see current levels as undervalued.

Whales hold a 1% advantage

The analysis of the Bitcoin Market Value to Realized Value (MVRV) ratio revealed a slight increase to just over 1% at present.

A recent deep dive into the data indicated that although the MVRV ratio had seen a stronger figure, it experienced a decline recently.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, it’s noteworthy that the ratio started the month below 1% and subsequently rose, reaching a peak of 10.75% at its highest point this month before experiencing a decline.

Source: Santiment

As the MVRV ratio was above 1% at press time, it indicated that, on average, crypto whales that accumulated Bitcoin recently still held their investments with a profit margin of over 1%.

get generic clomid without a prescription can you get cheap clomid without insurance how to get generic clomid tablets can i order cheap clomiphene pills where to get clomiphene no prescription how can i get cheap clomiphene tablets buy generic clomid

The thoroughness in this section is noteworthy.

I am in point of fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

cheap zithromax 250mg – azithromycin 250mg us flagyl 400mg cost

order rybelsus generic – semaglutide 14mg usa periactin order

motilium 10mg generic – buy cheap generic motilium buy flexeril no prescription

augmentin 375mg uk – atbioinfo how to get acillin without a prescription

order nexium – anexa mate esomeprazole sale

coumadin 5mg usa – https://coumamide.com/ order cozaar 50mg for sale

mobic 15mg price – relieve pain generic meloxicam 15mg

buy deltasone 5mg sale – apreplson.com prednisone 5mg brand

buy amoxil without prescription – combamoxi.com buy amoxicillin pills

fluconazole medication – https://gpdifluca.com/ fluconazole 100mg ca

escitalopram 20mg price – this buy lexapro 10mg generic

generic cenforce 100mg – https://cenforcers.com/# cenforce sale

tadalafil cialis – canadian online pharmacy cialis where can i buy cialis

what is cialis tadalafil used for – https://strongtadafl.com/# buy cialis/canada

buy ranitidine paypal – https://aranitidine.com/ order zantac 150mg generic

viagra sale cheap – https://strongvpls.com/# viagra sale over counter uk

The sagacity in this ruined is exceptional. https://buyfastonl.com/furosemide.html

More articles like this would pretence of the blogosphere richer. sitio web

More posts like this would make the online elbow-room more useful. buy synthroid

This is the big-hearted of writing I in fact appreciate. https://prohnrg.com/

The depth in this tune is exceptional. https://ondactone.com/spironolactone/

I couldn’t turn down commenting. Warmly written!

purchase flexeril for sale

More posts like this would make the online space more useful. https://myvisualdatabase.com/forum/profile.php?id=117927