- Bitcoin and Ethereum were likely headed for their local highs this week.

- The band of resistance below $70k could pose a substantial obstacle to the buyers.

Bitcoin [BTC] managed to climb past the resistance zone at $60k-$61k and was trading a few dollars below $63k at press time. Traders have taken this as a sign that Bitcoin is headed toward its all-time high at $73.7k.

Selling pressure on BTC from the German government was depleted and spot ETF inflows last week were strongly positive, setting up a nice environment for a price rebound.

This sentiment saw a positive uptick on Monday, but here’s what is likely in store next.

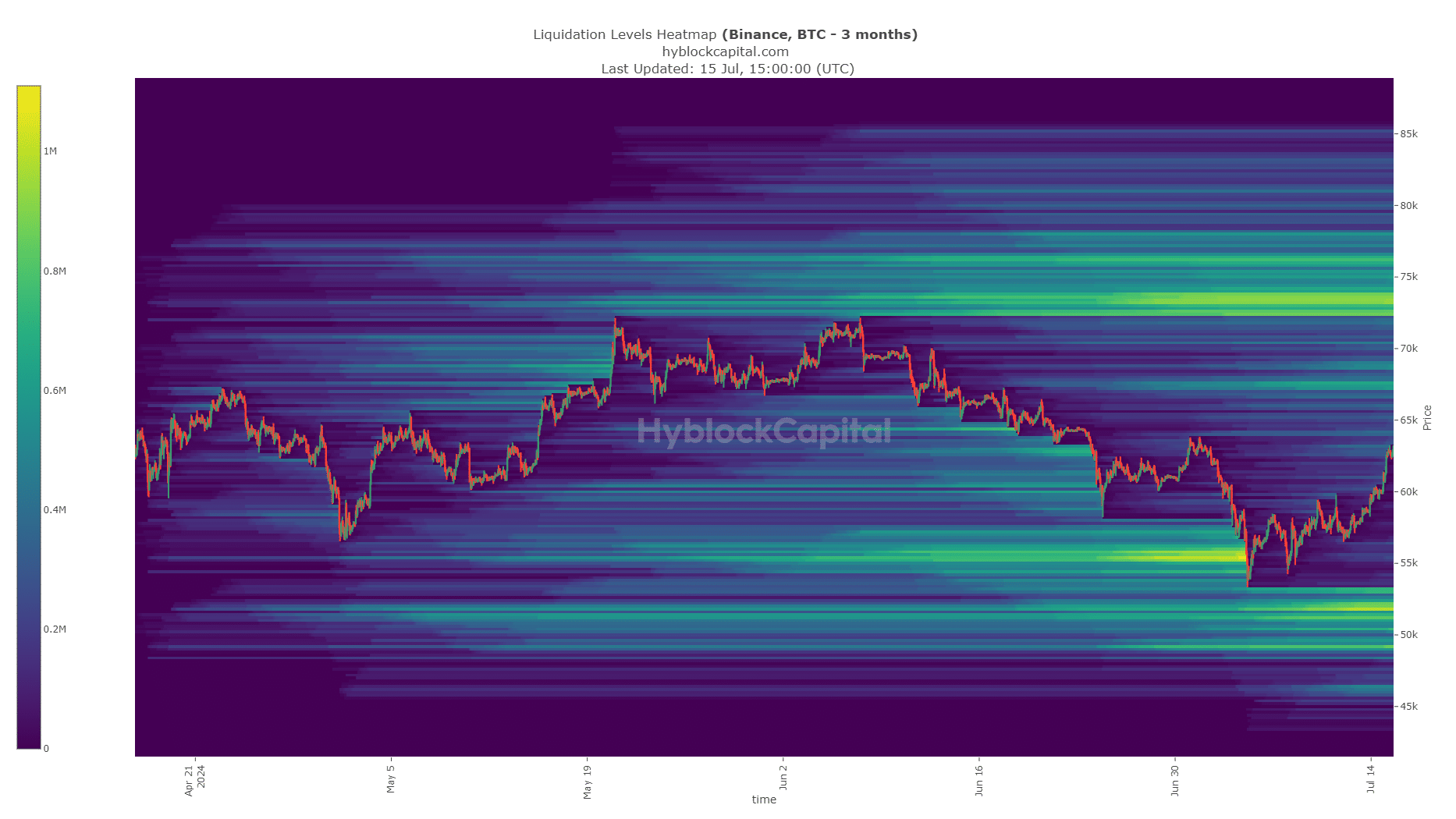

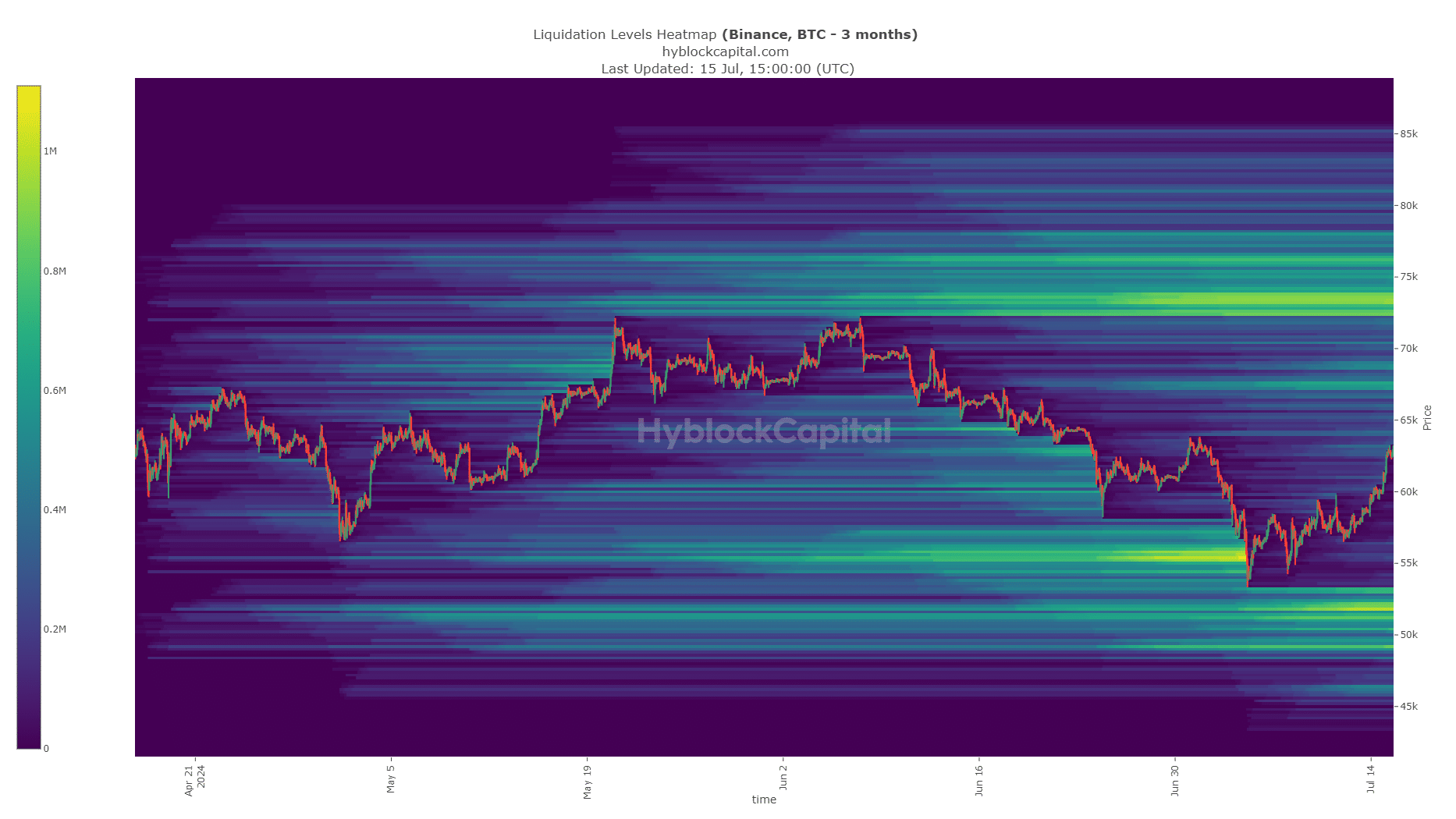

Using the liquidation charts as a compass

Source: Hyblock

In a post on X (formerly Twitter) crypto analyst CrypNuevo highlighted two scenarios for Bitcoin in the coming days. One of them was invalidated, which was a rejection from the former range lows at $60k.

The other was that the $60.6k resistance zone was flipped to support and retested before the prices bound higher toward the $68k and $73k resistance zones.

These are the two liquidity pools to watch out for higher, with $76.4k being another zone that could trigger a large amount of short liquidations.

This expectation came because the lower timeframe market structure would flip bullishly, and the liquidity levels to the north would be the next target after hunting the $55k zone earlier this month.

Source: CrypNuevo on X

A retest of the $61k-$62k region could be a trigger for bullish traders to enter long positions targeting the $72k-$73k zone.

An increase of $3.4 billion in Open Interest since the 13th of July indicated bullish sentiment. Hence, traders can expect a positive crypto week ahead.

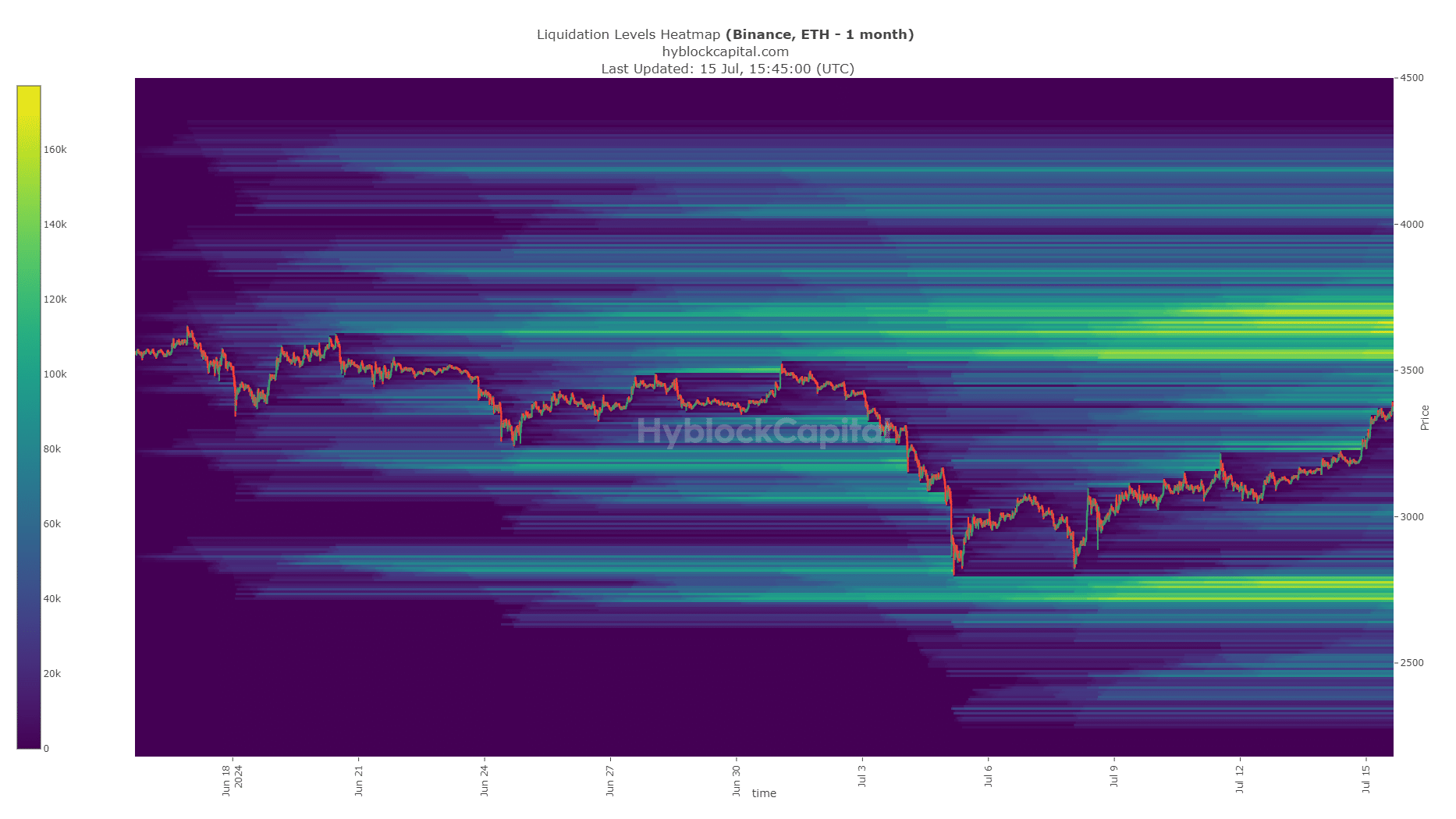

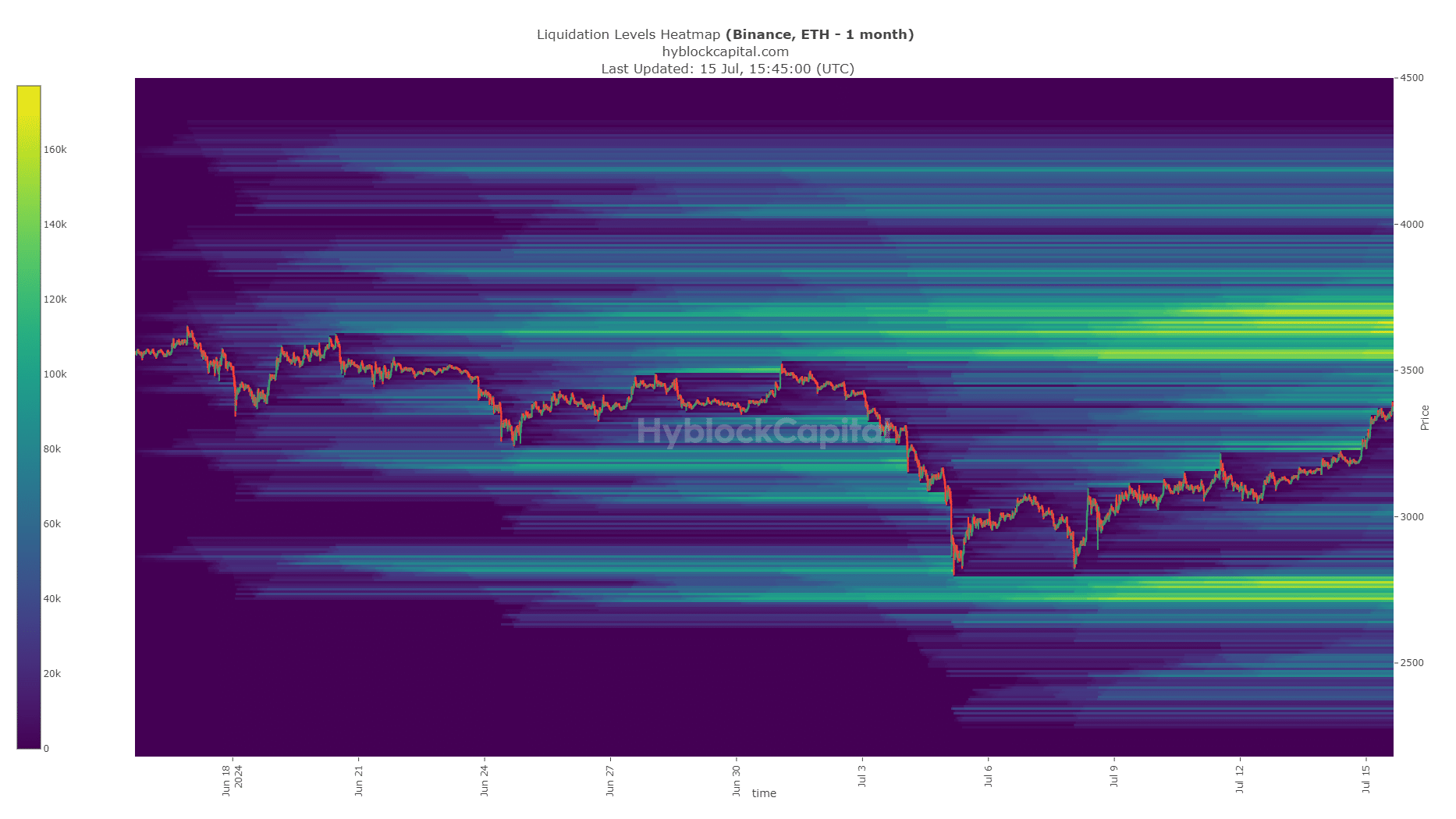

Ethereum also targets the local highs

Source: Hyblock

The Ethereum liquidation heatmap showed that $3.5k-$3.7k is likely to be revisited soon.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This was another positive development as the ETH bulls defended the $2.9k level, the 61.8% Fibonacci retracement level, and initiated a recovery from there.

A move toward $3.7k and as high as $4k was possible in the coming weeks. Over the next week, a move to $68k for Bitcoin and $3.7k for Ethereum was likely based on the evidence at hand.

- Bitcoin and Ethereum were likely headed for their local highs this week.

- The band of resistance below $70k could pose a substantial obstacle to the buyers.

Bitcoin [BTC] managed to climb past the resistance zone at $60k-$61k and was trading a few dollars below $63k at press time. Traders have taken this as a sign that Bitcoin is headed toward its all-time high at $73.7k.

Selling pressure on BTC from the German government was depleted and spot ETF inflows last week were strongly positive, setting up a nice environment for a price rebound.

This sentiment saw a positive uptick on Monday, but here’s what is likely in store next.

Using the liquidation charts as a compass

Source: Hyblock

In a post on X (formerly Twitter) crypto analyst CrypNuevo highlighted two scenarios for Bitcoin in the coming days. One of them was invalidated, which was a rejection from the former range lows at $60k.

The other was that the $60.6k resistance zone was flipped to support and retested before the prices bound higher toward the $68k and $73k resistance zones.

These are the two liquidity pools to watch out for higher, with $76.4k being another zone that could trigger a large amount of short liquidations.

This expectation came because the lower timeframe market structure would flip bullishly, and the liquidity levels to the north would be the next target after hunting the $55k zone earlier this month.

Source: CrypNuevo on X

A retest of the $61k-$62k region could be a trigger for bullish traders to enter long positions targeting the $72k-$73k zone.

An increase of $3.4 billion in Open Interest since the 13th of July indicated bullish sentiment. Hence, traders can expect a positive crypto week ahead.

Ethereum also targets the local highs

Source: Hyblock

The Ethereum liquidation heatmap showed that $3.5k-$3.7k is likely to be revisited soon.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This was another positive development as the ETH bulls defended the $2.9k level, the 61.8% Fibonacci retracement level, and initiated a recovery from there.

A move toward $3.7k and as high as $4k was possible in the coming weeks. Over the next week, a move to $68k for Bitcoin and $3.7k for Ethereum was likely based on the evidence at hand.

Hello i think that i saw you visited my weblog so i came to Return the favore Im trying to find things to improve my web siteI suppose its ok to use some of your ideas

can you get clomid without rx how can i get generic clomid without prescription can i purchase cheap clomid for sale generic clomiphene cost cheap clomid without rx buying clomid pill order clomid without a prescription

More posts like this would make the blogosphere more useful.

Thanks on sharing. It’s acme quality.

order generic azithromycin 250mg – buy floxin 200mg without prescription flagyl 200mg sale

rybelsus 14mg generic – order semaglutide 14 mg pills order periactin online

cheap domperidone – order domperidone flexeril 15mg pills

buy augmentin pills for sale – https://atbioinfo.com/ buy cheap generic ampicillin

buy esomeprazole 20mg online – anexa mate esomeprazole price

buy medex medication – https://coumamide.com/ buy losartan generic

meloxicam drug – https://moboxsin.com/ buy mobic 7.5mg

buy deltasone 20mg pill – https://apreplson.com/ buy deltasone 40mg for sale

the blue pill ed – buy best erectile dysfunction pills gnc ed pills

amoxicillin pills – amoxicillin canada order amoxicillin

fluconazole price – https://gpdifluca.com/# buy generic forcan for sale

cenforce 100mg generic – https://cenforcers.com/# where to buy cenforce without a prescription

cialis walmart – https://ciltadgn.com/ tadalafil professional review

cialis coupon free trial – strongtadafl cialis from canada

buy viagra nz – click cost of 50mg viagra

Thanks recompense sharing. It’s top quality. lasix where to buy

The thoroughness in this break down is noteworthy. https://ursxdol.com/clomid-for-sale-50-mg/

Facts blog you have here.. It’s obdurate to find great worth script like yours these days. I really recognize individuals like you! Withstand vigilance!! https://prohnrg.com/product/orlistat-pills-di/

This is the kind of content I enjoy reading. https://aranitidine.com/fr/sibelium/

I couldn’t hold back commenting. Warmly written! https://ondactone.com/product/domperidone/

More posts like this would bring about the blogosphere more useful. http://mi.minfish.com/home.php?mod=space&uid=1412624

forxiga 10 mg pill – buy dapagliflozin 10mg buy forxiga pills for sale

buy generic xenical online – on this site xenical cheap

The reconditeness in this piece is exceptional. http://seafishzone.com/home.php?mod=space&uid=2331753