- BTC retested $66k following better-than-expected August inflation data

- U.S labor market update could set the next market direction

Bitcoin [BTC] edged higher and retested $66k on Friday following a softer reading from the U.S Fed’s favorite inflation data – The Core PCE Index (Personal Consumption Expenditure). This index tracks U.S inflation without the noise from food and energy price fluctuations.

The August Core PCE index reading came in better than expected, with a YoY (year-on-year) hike of 2.6%. This was contrary to market expectations of 2.7%.

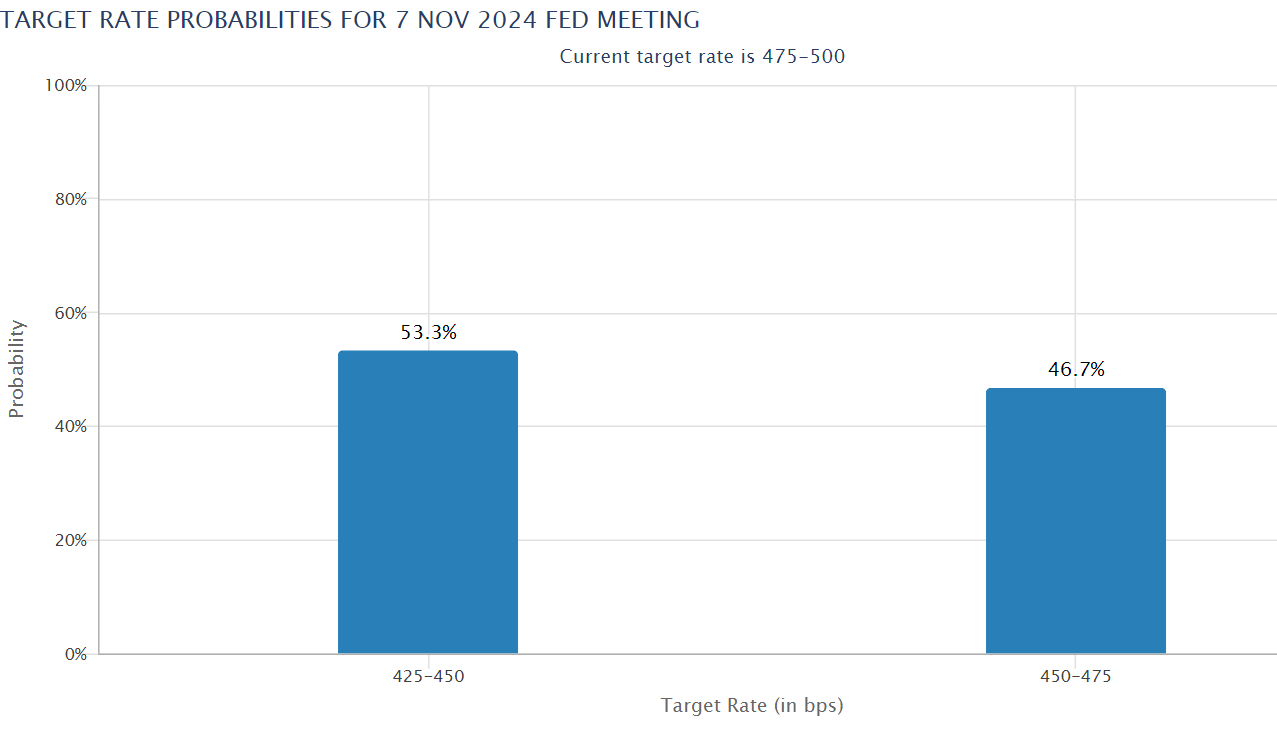

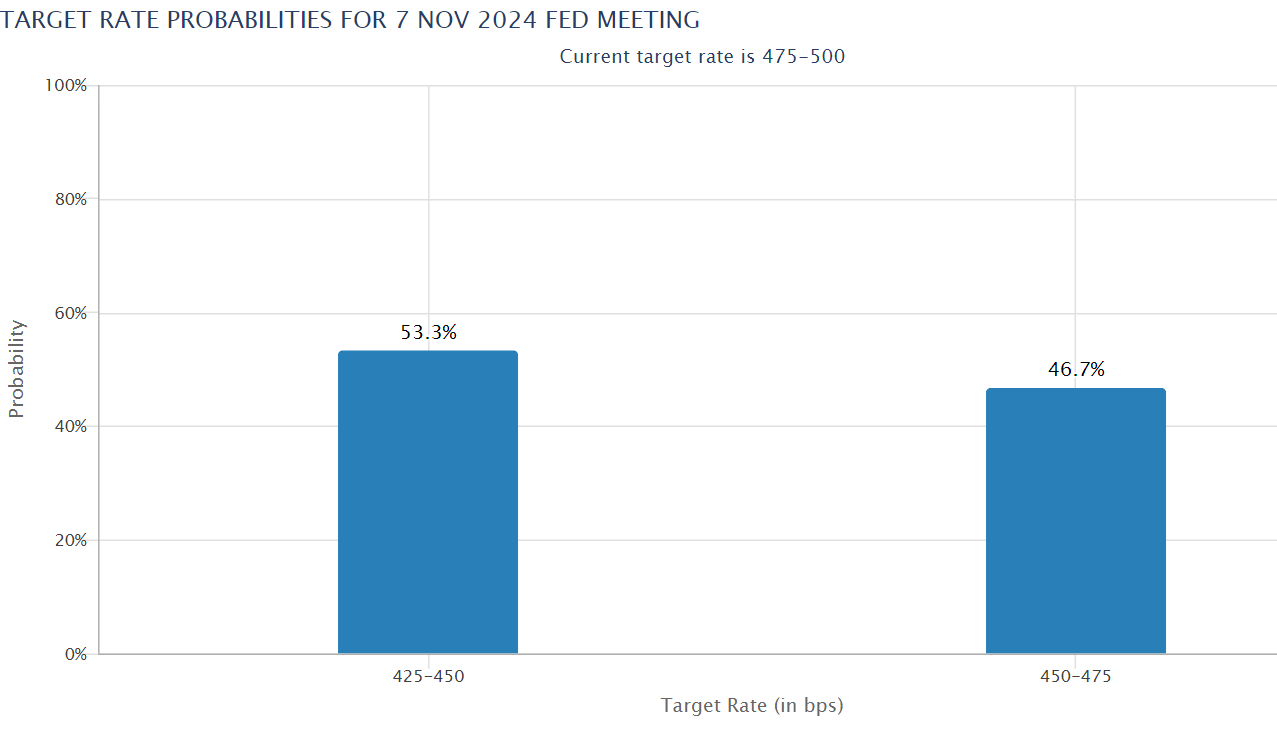

The low inflation data boosted the markets as speculators priced higher odds of another 50 bps (basis points) Fed rate cut in November.

Source: CME FedWatch

Next market catalyst

The low inflation data meant that the Fed would now focus on the U.S labor market’s status, especially the unemployment rate, when adjusting its pace of interest rate cuts accordingly.

Ergo, upcoming U.S labor sector updates will impact the next market direction, noted trading firm QCP Capital.

Part of the firm’s weekend brief on 28 September read,

“As we head into next week, the key focus will be on upcoming labour market indicators, including JOLTs, ADP, and U.S unemployment rate.”

The key updates to watch out for are the JOLTs (Job Openings and Labor Turnover Survey) and employment situation scheduled for 1 and 4 November. Projecting the updates’ potential market impact, QCP Capital added,

“Strong performance in these metrics could bolster the case for a 50bps cut in November, further propelling risk assets.”

If that is the case, BTC could edge even higher towards $70k after the recent bullish market structure shift. Especially after it reclaims the 200-day MA (Moving Average).

Source: Daan Crypto/X

The lift-off could also benefit Ethereum [ETH]. In fact, ETH has been outperforming BTC since the Fed’s pivot.

So, an extra macro tailwind could extend ETH’s remarkable recovery on the charts. In fact, according to market analyst Benjamin Cowen, ETH could hike to the psychological level of $3000 too.

Source: Cowen/X

That being said, the top digital assets saw renewed demand from U.S investors. This week, U.S BTC ETFs saw $1.11 billion inflows, the largest weekly inflows since 19 July.

A similar, but limited investor appetite was also observed in ETH ETFs. The products attracted $84.6 million inflows, the largest weekly demand since 9 August. If the trend continues, the $3k per ETH and $70k per BTC price targets could be feasible.

- BTC retested $66k following better-than-expected August inflation data

- U.S labor market update could set the next market direction

Bitcoin [BTC] edged higher and retested $66k on Friday following a softer reading from the U.S Fed’s favorite inflation data – The Core PCE Index (Personal Consumption Expenditure). This index tracks U.S inflation without the noise from food and energy price fluctuations.

The August Core PCE index reading came in better than expected, with a YoY (year-on-year) hike of 2.6%. This was contrary to market expectations of 2.7%.

The low inflation data boosted the markets as speculators priced higher odds of another 50 bps (basis points) Fed rate cut in November.

Source: CME FedWatch

Next market catalyst

The low inflation data meant that the Fed would now focus on the U.S labor market’s status, especially the unemployment rate, when adjusting its pace of interest rate cuts accordingly.

Ergo, upcoming U.S labor sector updates will impact the next market direction, noted trading firm QCP Capital.

Part of the firm’s weekend brief on 28 September read,

“As we head into next week, the key focus will be on upcoming labour market indicators, including JOLTs, ADP, and U.S unemployment rate.”

The key updates to watch out for are the JOLTs (Job Openings and Labor Turnover Survey) and employment situation scheduled for 1 and 4 November. Projecting the updates’ potential market impact, QCP Capital added,

“Strong performance in these metrics could bolster the case for a 50bps cut in November, further propelling risk assets.”

If that is the case, BTC could edge even higher towards $70k after the recent bullish market structure shift. Especially after it reclaims the 200-day MA (Moving Average).

Source: Daan Crypto/X

The lift-off could also benefit Ethereum [ETH]. In fact, ETH has been outperforming BTC since the Fed’s pivot.

So, an extra macro tailwind could extend ETH’s remarkable recovery on the charts. In fact, according to market analyst Benjamin Cowen, ETH could hike to the psychological level of $3000 too.

Source: Cowen/X

That being said, the top digital assets saw renewed demand from U.S investors. This week, U.S BTC ETFs saw $1.11 billion inflows, the largest weekly inflows since 19 July.

A similar, but limited investor appetite was also observed in ETH ETFs. The products attracted $84.6 million inflows, the largest weekly demand since 9 August. If the trend continues, the $3k per ETH and $70k per BTC price targets could be feasible.

you are in reality a good webmaster The website loading velocity is amazing It sort of feels that youre doing any distinctive trick Also The contents are masterwork you have done a fantastic job in this topic

clomiphene uk buy can i purchase cheap clomiphene without a prescription how to get generic clomid without prescription can i buy clomiphene without prescription can i get generic clomiphene for sale can i buy cheap clomiphene no prescription cost of cheap clomid without rx

Greetings! Extremely productive suggestion within this article! It’s the petty changes which wish espy the largest changes. Thanks a quantity for sharing!

The vividness in this piece is exceptional.

azithromycin 250mg for sale – order floxin generic buy flagyl medication

buy cheap rybelsus – order periactin 4mg for sale cyproheptadine 4 mg oral

order domperidone 10mg generic – buy flexeril 15mg sale buy flexeril medication

augmentin 1000mg uk – atbioinfo buy acillin online

esomeprazole 40mg sale – https://anexamate.com/ buy nexium 40mg sale

purchase coumadin without prescription – https://coumamide.com/ buy cozaar 25mg online cheap

buy mobic 7.5mg – relieve pain buy generic meloxicam for sale

deltasone 20mg us – asthma generic prednisone 40mg

buy ed pills paypal – ed pills cheap how to get ed pills without a prescription

order amoxil without prescription – https://combamoxi.com/ buy cheap generic amoxil

fluconazole for sale online – https://gpdifluca.com/# buy diflucan generic

generic cenforce 100mg – cenforce where to buy cenforce 50mg sale

does cialis lower your blood pressure – cialis san diego п»їwhat can i take to enhance cialis

cialis from canadian pharmacy registerd – how long does cialis take to work 10mg cialis patent expiration 2016

order zantac 300mg – on this site ranitidine 300mg us

100 milligram viagra – https://strongvpls.com/ sildenafil 100 mg oral jelly

I couldn’t weather commenting. Well written! https://gnolvade.com/

This is the kind of serenity I enjoy reading. https://prohnrg.com/

This is the description of content I get high on reading. meilleur viagra professional sans ordonnance 24h

More articles like this would pretence of the blogosphere richer. https://ondactone.com/spironolactone/

This is the tolerant of enter I turn up helpful.

avodart 0.5mg ca

This is the type of enter I find helpful. http://forum.ttpforum.de/member.php?action=profile&uid=425020

dapagliflozin 10 mg for sale – click buy dapagliflozin 10mg generic

order orlistat sale – https://asacostat.com/ buy generic xenical

This is a question which is forthcoming to my verve… Myriad thanks! Exactly where can I upon the phone details due to the fact that questions? http://sols9.com/batheo/Forum/User-Sqagfe