TL;DR

-

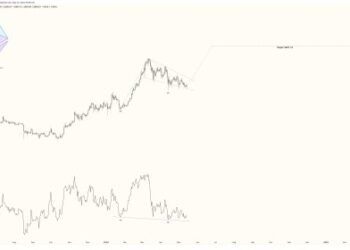

The crypto market shed a cool $190B in value overnight, but 5, 10, 20, even 40 percent corrections like this are typical in the lead up to the Bitcoin halving.

Full Story

Ah the irony…

Yesterday, as the crypto market traded sideways and volatility tapered off, we wrote an article telling you to:

“This is the calm before the storm (enjoy it while you can)”…

Since we hit publish on that article — the crypto market shed a cool $190B in total market value, wiping out hundreds of millions of dollars worth of leverage along the way.

(Leverage = loans that folks take out in order to buy more crypto — as prices drop, buyers are forced to sell their crypto to pay back their loans).

Waking up to see all of the top 30 cryptocurrencies in the red is a pretty jarring site…but we’re still bullish!

Here’s why:

-

Bitcoin dipped below $65k, a price we haven’t seen since…last week (not so scary when you put it like that).

-

5-10% drops like this are normal in a bull run (in fact, in past bull markets, these dips were often closer to 20-40%).

-

Dips, corrections, n’ crashes are a staple leading into Bitcoin halving events (so this is right on cue).

-

Bitcoin has been in the green for the past 7 months straight — which is a new record! (And also means we’re about due for a red month).

The takeaway:

While gut-wrenching, this latest crypto market correction is right on cue (and light compared to previous bull cycles).

where to buy cheap clomiphene no prescription how can i get clomiphene no prescription where to buy generic clomiphene price order clomiphene online can i order cheap clomid for sale buying clomiphene price how to get clomiphene without prescription

More posts like this would add up to the online time more useful.

I am in truth delighted to gleam at this blog posts which consists of tons of useful facts, thanks object of providing such data.

order zithromax 250mg for sale – buy tindamax generic purchase metronidazole

semaglutide 14 mg over the counter – semaglutide 14mg canada buy generic cyproheptadine 4mg

order domperidone without prescription – order flexeril pill cyclobenzaprine 15mg pills

brand esomeprazole 20mg – https://anexamate.com/ esomeprazole cost

purchase mobic generic – https://moboxsin.com/ mobic for sale

buy deltasone – https://apreplson.com/ deltasone uk

purchase amoxicillin sale – https://combamoxi.com/ amoxicillin price

order generic fluconazole 200mg – forcan generic order diflucan 100mg sale

order cenforce online – https://cenforcers.com/ cenforce 50mg canada

how long does cialis last 20 mg – ciltad genesis generic cialis tadalafil 20mg reviews

ranitidine tablet – https://aranitidine.com/# oral ranitidine 300mg

buying cialis online – this cialis price walgreens

Greetings! Utter serviceable par‘nesis within this article! It’s the crumb changes which liking espy the largest changes. Thanks a a quantity in the direction of sharing! buy nolvadex pill

cheapest viagra soft tabs – https://strongvpls.com/ buy viagra discreetly

More posts like this would add up to the online elbow-room more useful. https://buyfastonl.com/furosemide.html

This is a topic which is in to my verve… Many thanks! Faithfully where can I upon the phone details in the course of questions? https://prohnrg.com/product/diltiazem-online/

I’ll certainly return to read more. https://aranitidine.com/fr/cialis-super-active/

The thoroughness in this break down is noteworthy. https://ondactone.com/product/domperidone/

This is the kind of content I get high on reading.

plavix us

More articles like this would remedy the blogosphere richer. http://3ak.cn/home.php?mod=space&uid=229260

buy forxiga 10mg – https://janozin.com/# buy dapagliflozin cheap

buy orlistat – https://asacostat.com/# buy xenical tablets