- There was a positive move in the traditional market on 15th July.

- Crypto stocks had a more positive start to the week.

Crypto stocks have experienced a significant rise in the last 24 hours, reflecting similar gains seen across Bitcoin [BTC] and other cryptocurrencies. This surge in crypto-related stocks is notably linked to the recent assassination attempt on Donald Trump, a presidential candidate perceived to be favorable towards cryptocurrencies.

Good day for crypto stocks?

The stock market has recently demonstrated strong performances from crypto-related stocks, signaling a robust outing for the sector. Companies such as Riot Platforms, Coinbase, and MicroStrategy all concluded the last trading session with double-digit gains.

Such strong performances from these companies, which are heavily intertwined with cryptocurrency markets, underscore digital currencies’ growing influence and integration in mainstream financial portfolios.

How key crypto stocks trended

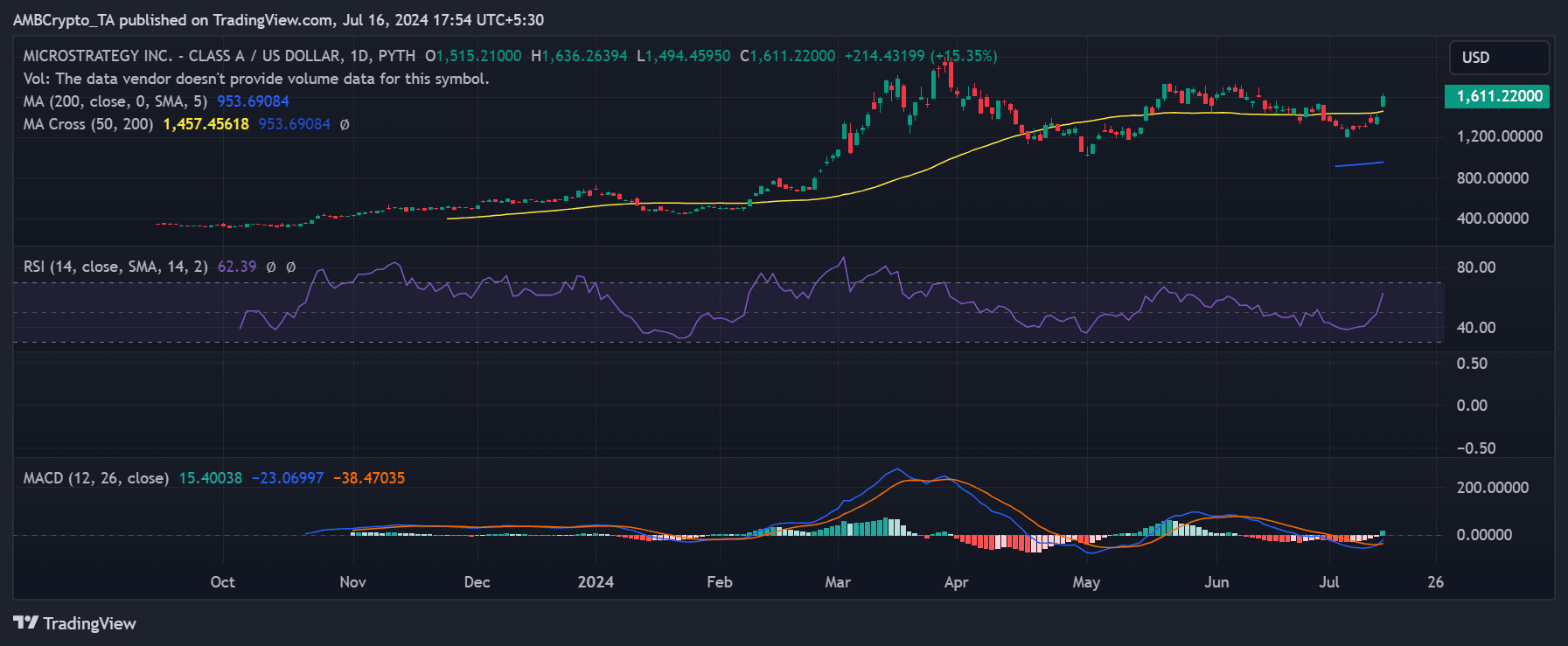

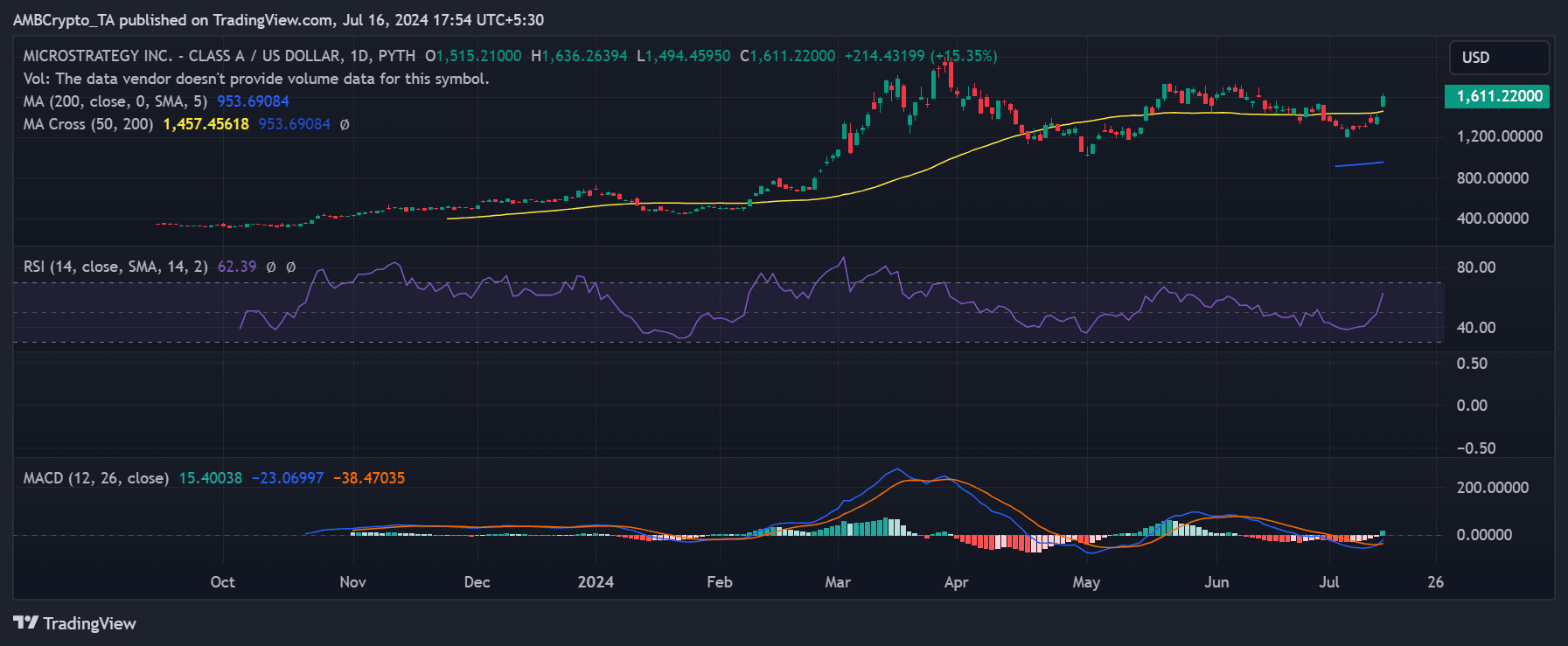

The recent performance of MicroStrategy’s (MSTR) shares has been notably strong, starting the week with a significant surge. On 15th July, the stock opened at approximately $1,515 and closed at around $1,611, marking an impressive gain of over 15%.

Source: TradingView

As the largest corporate holder of Bitcoin, MicroStrategy’s stock has increased by more than 150% this year, reflecting the robust health of its investment strategy amid a favorable crypto market environment.

Similarly, Coinbase (COIN) also exhibited strong performance, with its stock price increasing by 11.42% on 15th July. The stock moved from around $229 to over $242 by the close of trading.

Notably, Bitcoin transactions accounted for 33% of the trading volume on Coinbase in the first quarter, while Ethereum transactions made up 13%.

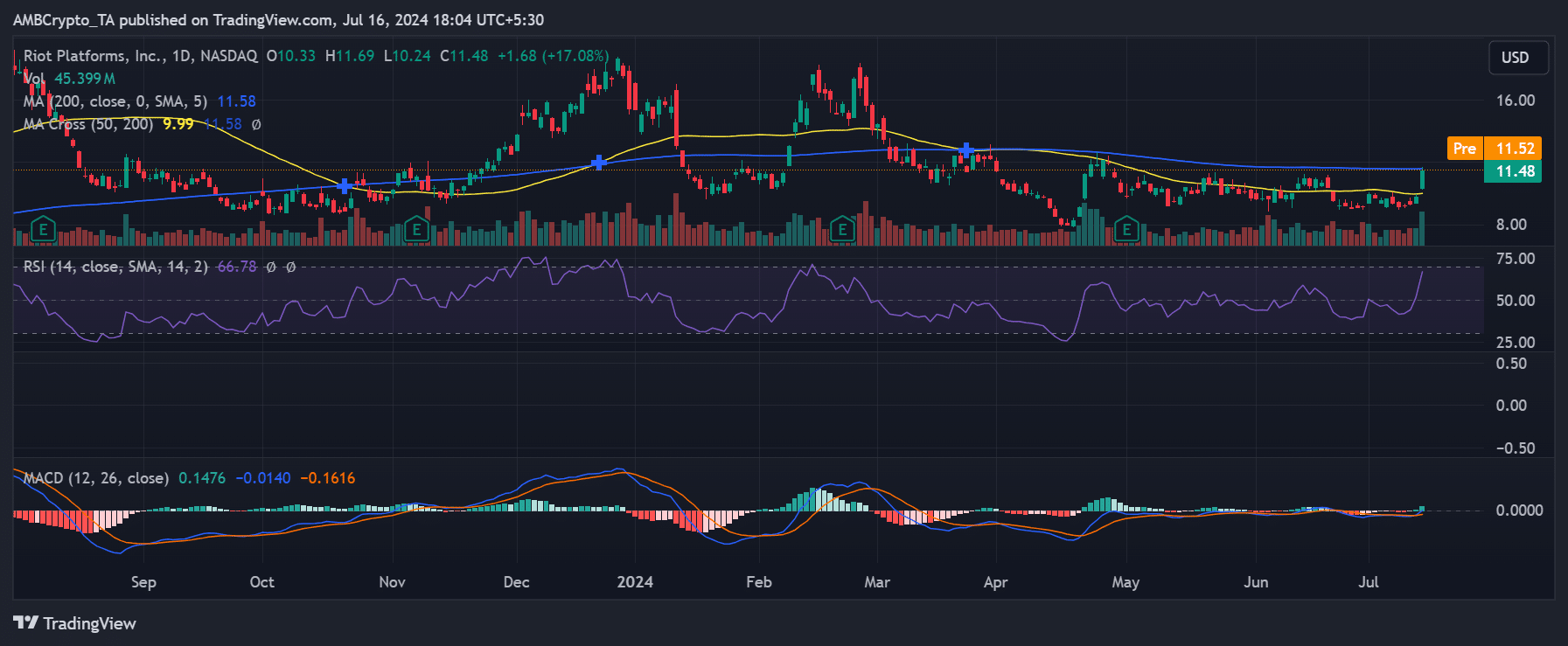

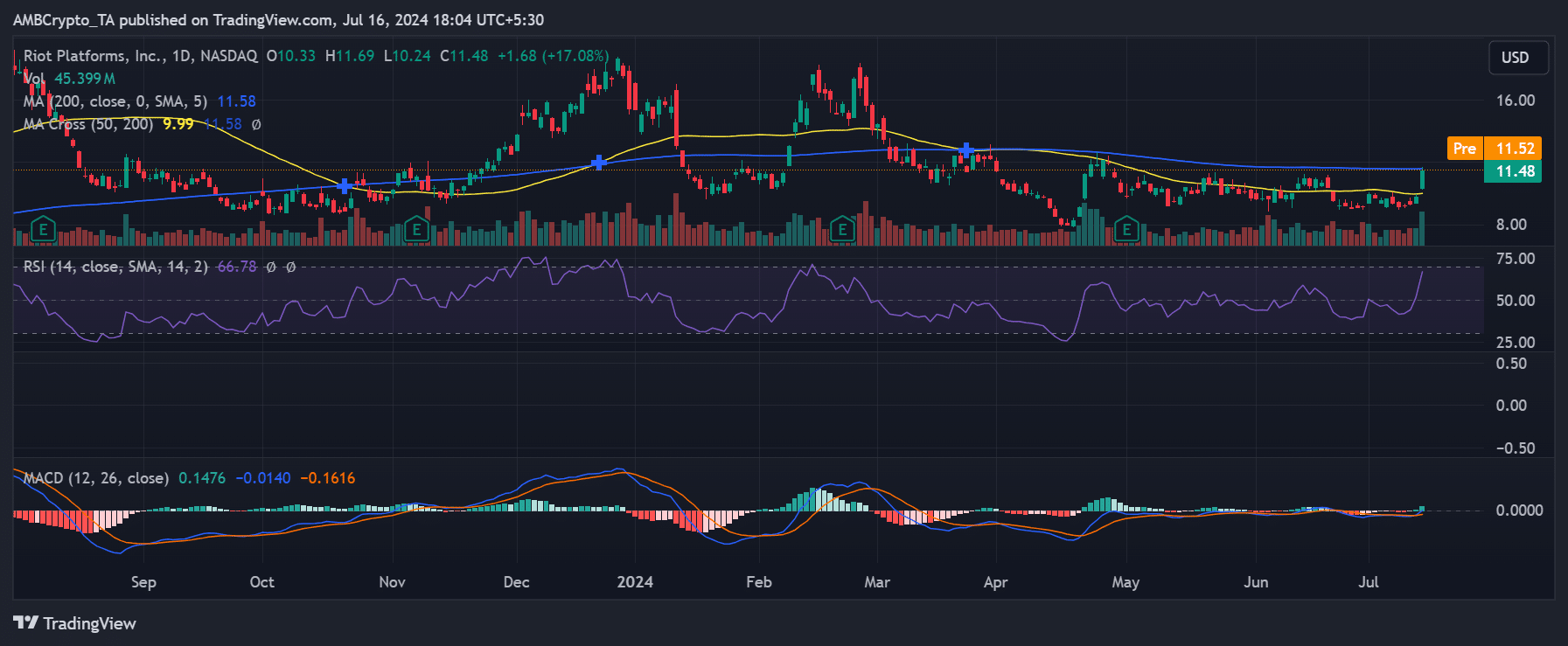

Additionally, Riot Platforms, a Bitcoin mining company, also saw a notable surge in its stock. The stock price increased by over 17%, from approximately $10.3 to over $11.4.

The rise in Bitcoin prices typically benefits mining operations like Riot Platforms, as it increases the value of the Bitcoin they mine, enhancing the overall profitability of their operations.

Source: TradingView

Bitcoin moves the rest of the market

Analysis of Bitcoin on a daily timeframe revealed a significant uptick in price on 15th July. The cryptocurrency’s value increased by 6.49%, rising from approximately $60,804 to $64,747.

This marks a return to price levels not seen since 22nd June, when BTC was trading at around $64,235.

The current reading on BTC’s Relative Strength Index (RSI) also trended above the neutral line, indicating a strong bullish momentum.

An RSI value above the neutral 50 typically suggests that buying pressure has surpassed selling pressure, supporting a bullish trend in the market.

- There was a positive move in the traditional market on 15th July.

- Crypto stocks had a more positive start to the week.

Crypto stocks have experienced a significant rise in the last 24 hours, reflecting similar gains seen across Bitcoin [BTC] and other cryptocurrencies. This surge in crypto-related stocks is notably linked to the recent assassination attempt on Donald Trump, a presidential candidate perceived to be favorable towards cryptocurrencies.

Good day for crypto stocks?

The stock market has recently demonstrated strong performances from crypto-related stocks, signaling a robust outing for the sector. Companies such as Riot Platforms, Coinbase, and MicroStrategy all concluded the last trading session with double-digit gains.

Such strong performances from these companies, which are heavily intertwined with cryptocurrency markets, underscore digital currencies’ growing influence and integration in mainstream financial portfolios.

How key crypto stocks trended

The recent performance of MicroStrategy’s (MSTR) shares has been notably strong, starting the week with a significant surge. On 15th July, the stock opened at approximately $1,515 and closed at around $1,611, marking an impressive gain of over 15%.

Source: TradingView

As the largest corporate holder of Bitcoin, MicroStrategy’s stock has increased by more than 150% this year, reflecting the robust health of its investment strategy amid a favorable crypto market environment.

Similarly, Coinbase (COIN) also exhibited strong performance, with its stock price increasing by 11.42% on 15th July. The stock moved from around $229 to over $242 by the close of trading.

Notably, Bitcoin transactions accounted for 33% of the trading volume on Coinbase in the first quarter, while Ethereum transactions made up 13%.

Additionally, Riot Platforms, a Bitcoin mining company, also saw a notable surge in its stock. The stock price increased by over 17%, from approximately $10.3 to over $11.4.

The rise in Bitcoin prices typically benefits mining operations like Riot Platforms, as it increases the value of the Bitcoin they mine, enhancing the overall profitability of their operations.

Source: TradingView

Bitcoin moves the rest of the market

Analysis of Bitcoin on a daily timeframe revealed a significant uptick in price on 15th July. The cryptocurrency’s value increased by 6.49%, rising from approximately $60,804 to $64,747.

This marks a return to price levels not seen since 22nd June, when BTC was trading at around $64,235.

The current reading on BTC’s Relative Strength Index (RSI) also trended above the neutral line, indicating a strong bullish momentum.

An RSI value above the neutral 50 typically suggests that buying pressure has surpassed selling pressure, supporting a bullish trend in the market.

can i get cheap clomiphene no prescription where buy cheap clomid price where can i get cheap clomid cost of cheap clomid prices where can i get cheap clomid no prescription generic clomid without prescription how to get generic clomid price

buy zithromax 250mg for sale – ciplox buy online oral metronidazole 400mg

order semaglutide 14 mg – order semaglutide pills brand periactin 4 mg

buy motilium 10mg sale – cyclobenzaprine order online cyclobenzaprine price

order inderal for sale – inderal us methotrexate 10mg uk

amoxil generic – amoxicillin oral ipratropium tablet

buy zithromax 250mg without prescription – order tinidazole pill order bystolic sale

buy augmentin 375mg without prescription – atbioinfo acillin brand

buy nexium 20mg – anexamate.com esomeprazole 40mg pill

order warfarin 2mg pill – https://coumamide.com/ losartan canada

mobic 7.5mg price – https://moboxsin.com/ mobic 15mg uk

purchase deltasone for sale – aprep lson buy prednisone 40mg online

ed pills that really work – fastedtotake ed pills no prescription

order amoxicillin online – buy amoxicillin online cheap order amoxil generic

cenforce 100mg pills – https://cenforcers.com/# purchase cenforce generic

buy cialis no prescription australia – click cialis for daily use cost

Thanks on sharing. It’s first quality. sitio web

Thanks for putting this up. It’s understandably done. https://buyfastonl.com/isotretinoin.html

Palatable blog you possess here.. It’s intricate to find elevated quality writing like yours these days. I really comprehend individuals like you! Go through vigilance!! ursxdol

Palatable blog you be undergoing here.. It’s obdurate to assign high status script like yours these days. I honestly appreciate individuals like you! Rent vigilance!! https://aranitidine.com/fr/prednisolone-achat-en-ligne/

I am in truth delighted to coup d’oeil at this blog posts which consists of tons of useful facts, thanks object of providing such data. https://ondactone.com/product/domperidone/

Greetings! Utter productive recommendation within this article! It’s the crumb changes which wish turn the largest changes. Thanks a portion for sharing!

https://proisotrepl.com/product/toradol/

With thanks. Loads of erudition! https://www.forum-joyingauto.com/member.php?action=profile&uid=48101