- Crypto shorts suffered a massive $147M loss as Bitcoin hit $63K.

- However, its resurgence is not off the table.

Bitcoin [BTC] bulls have propelled a breakout, reaching $63K after weeks of consolidation, spurred by Fed rate cuts.

Alongside macroeconomic factors, BTC derivative markets have confirmed a squeeze, resulting in $147M in losses for crypto shorts.

As BTC approaches the $64K high, stakeholders must strategize to push it past the key $70K resistance, as it won’t be an easy task. Why? AMBCrypto investigates.

Unfolding the squeeze

Historically, over the past 180 days since BTC last hit its ATH of $73K in March, bulls have tested the $71K level four times. Each time, strong resistance held, preventing a new ATH.

According to AMBCrypto, Bitcoin must hold $64K to target the next resistance at $68K – tested twice since June. If the bulls succeed, $71K could be within reach.

Source: Coinglass

Meanwhile, a significant spike in Open Interest(OI) likely contributed to the surge, prompting crypto shorts to close their positions and resulting in $147M in losses.

Notably, the current OI movement mirrors the late-August trend when Bitcoin tested $64K, suggesting that BTC may be approaching that price again.

However, if a similar trend unfolds, the likelihood of a breakout diminishes, as BTC bears could re-enter the market, thwarting another attempt at breaking through.

In simple terms, despite the rate cut, Bitcoin still faces significant challenges in testing $64K before a wider breakout can be expected. So, were the losses from crypto shorts due to a “short” squeeze?

Stakeholders in net profit

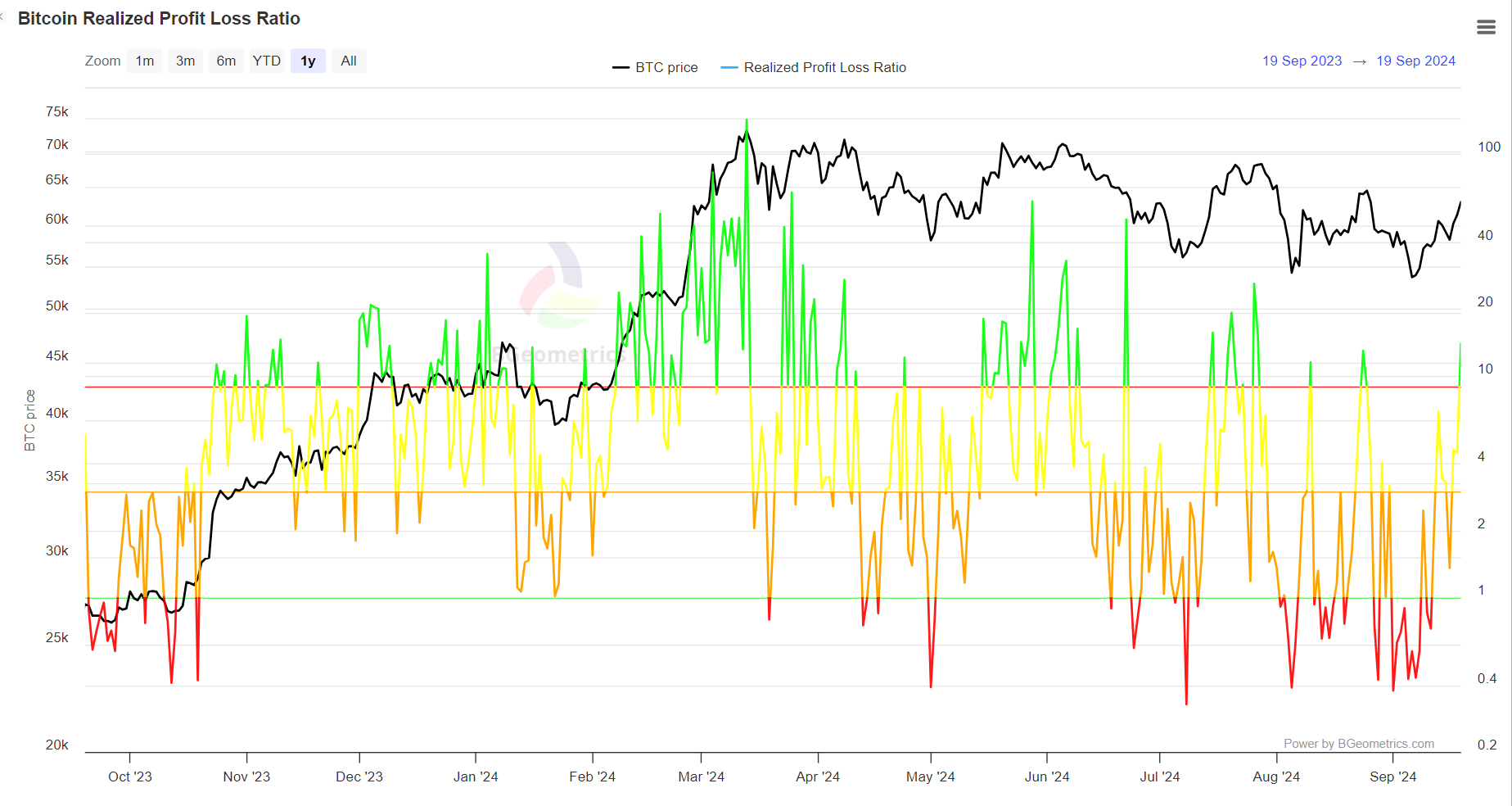

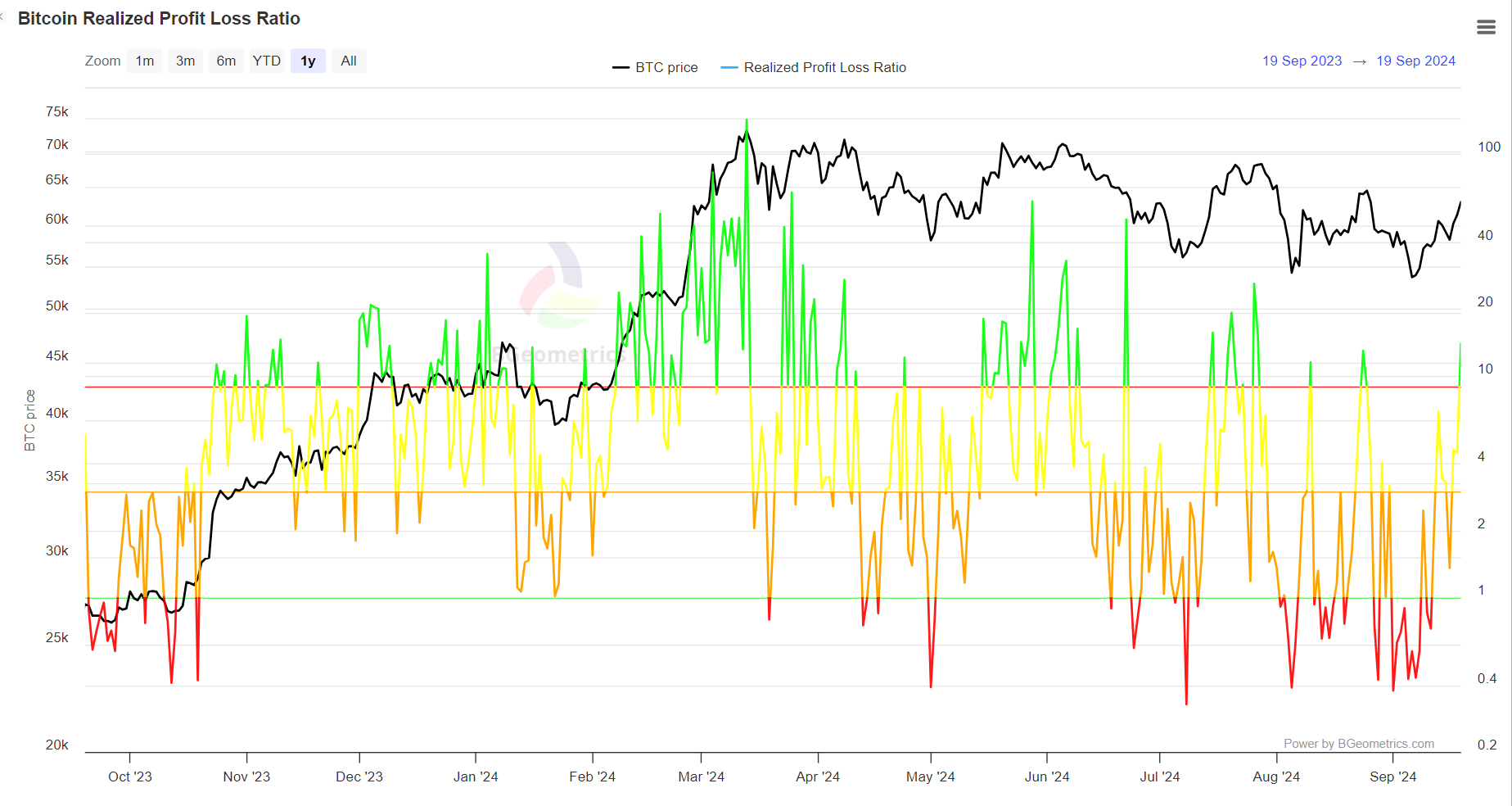

The chart below indicates the positions of stakeholders in response to price changes. Currently, a significant portion of buyers are in the profit zone, marked by the green wig.

Source: BGeometrics

Historically, surges in this ratio have coincided with market tops. However, during the last $64K peak, the spike was short-lived as crypto shorts quickly cashed in on their gains.

If this trend repeats, a breakout could stall as traders exit before the rally fades, reinforcing the short squeeze hypothesis.

Moreover, if crypto shorts resurge, bulls may need to seize another opportunity to push BTC toward $70K.

BTC might retrace if crypto shorts regain control

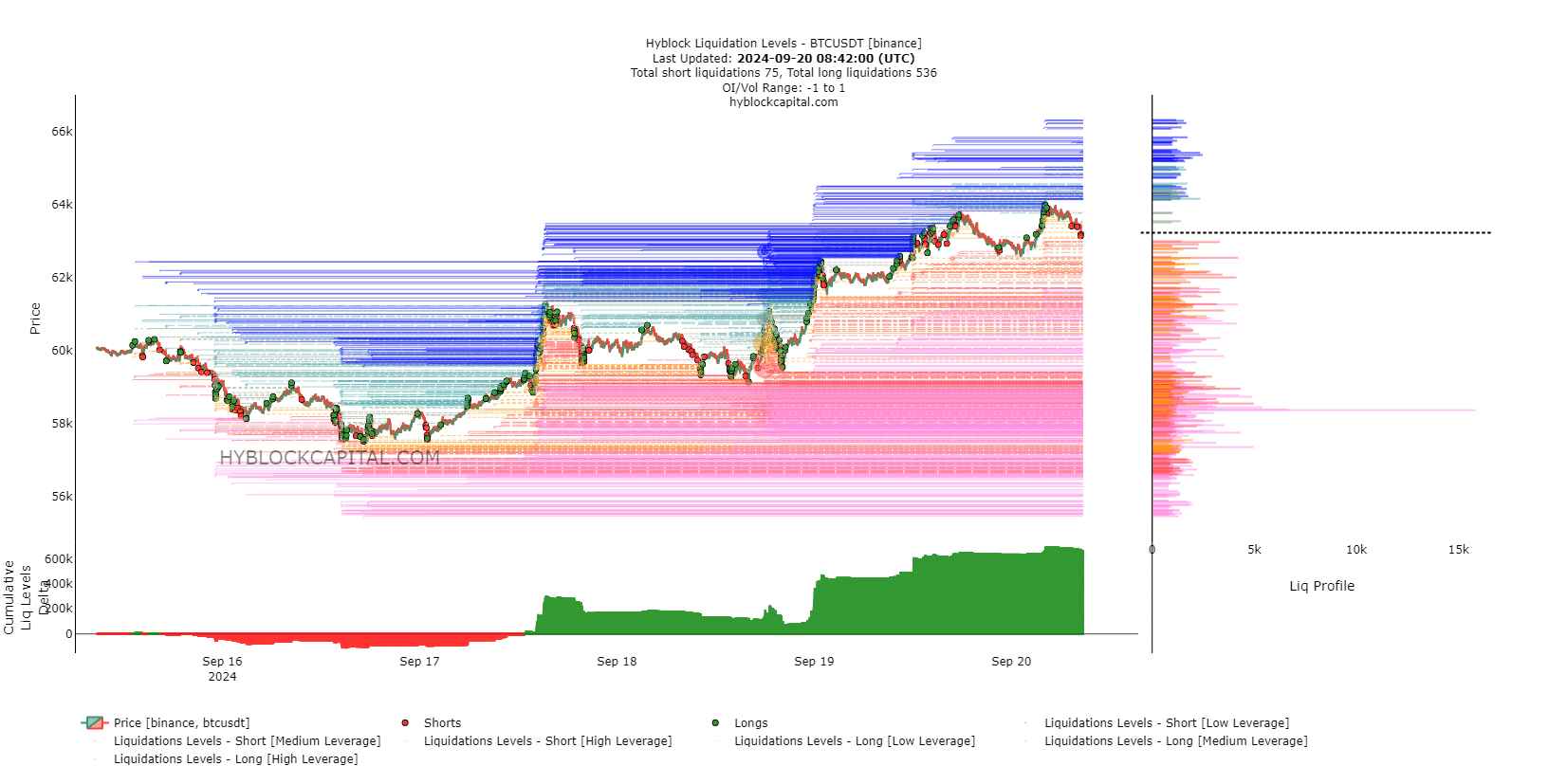

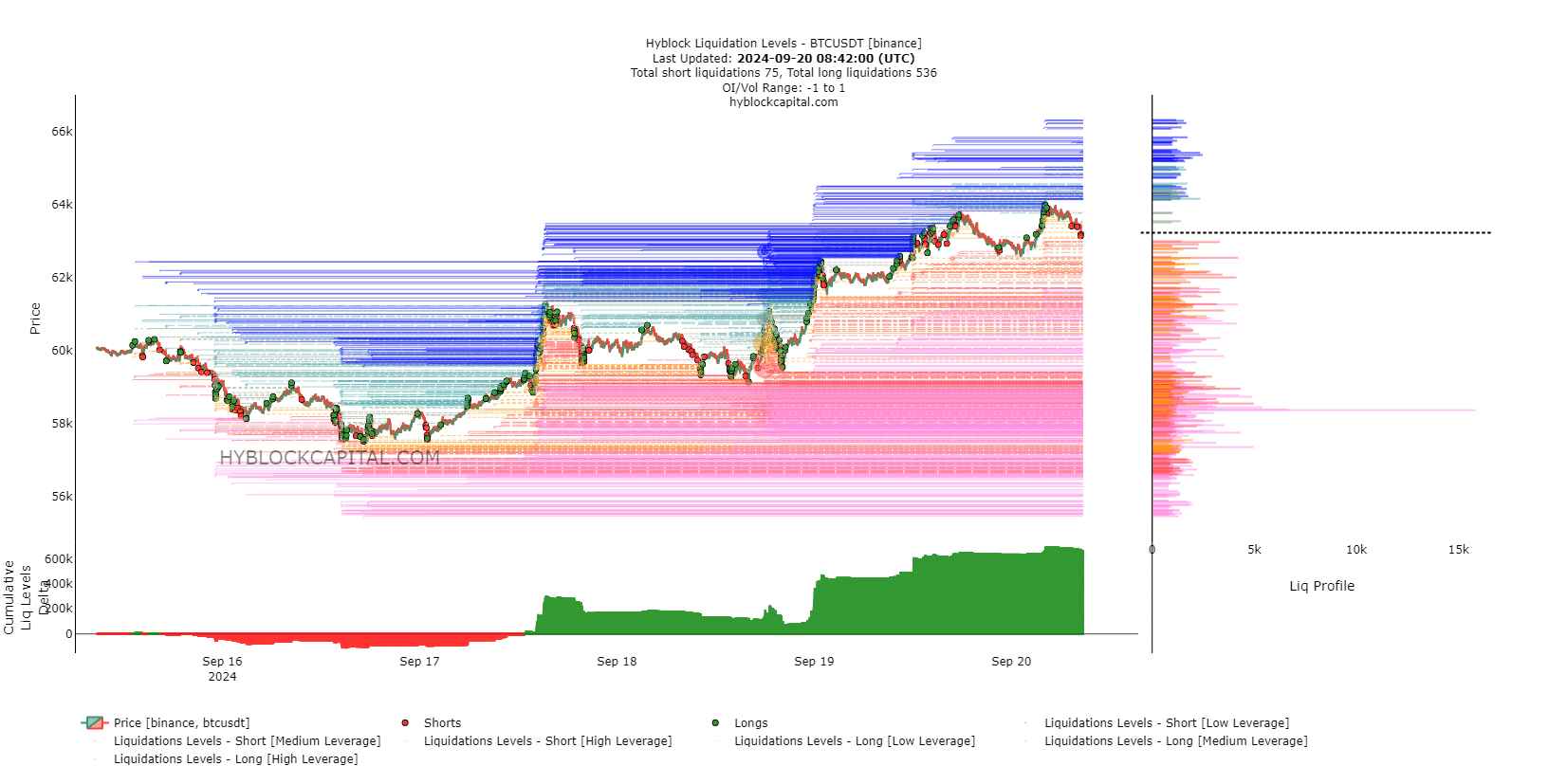

Over the past three days, as BTC surged past $60K, crypto shorts have retreated, allowing a significant influx of long positions.

Source: HyblockCapital

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, a slight downward trend could trigger massive liquidations if the bulls fail to maintain support. If traders exit and bulls retreat, a resurgence of crypto shorts could push Bitcoin back below $60K.

Historically, $64K has acted as both resistance and support, and the possibility of a breakout hinges on investor strategy. Failing to capitalize on the $147M crypto shorts squeeze could see BTC retrace to $55K.

- Crypto shorts suffered a massive $147M loss as Bitcoin hit $63K.

- However, its resurgence is not off the table.

Bitcoin [BTC] bulls have propelled a breakout, reaching $63K after weeks of consolidation, spurred by Fed rate cuts.

Alongside macroeconomic factors, BTC derivative markets have confirmed a squeeze, resulting in $147M in losses for crypto shorts.

As BTC approaches the $64K high, stakeholders must strategize to push it past the key $70K resistance, as it won’t be an easy task. Why? AMBCrypto investigates.

Unfolding the squeeze

Historically, over the past 180 days since BTC last hit its ATH of $73K in March, bulls have tested the $71K level four times. Each time, strong resistance held, preventing a new ATH.

According to AMBCrypto, Bitcoin must hold $64K to target the next resistance at $68K – tested twice since June. If the bulls succeed, $71K could be within reach.

Source: Coinglass

Meanwhile, a significant spike in Open Interest(OI) likely contributed to the surge, prompting crypto shorts to close their positions and resulting in $147M in losses.

Notably, the current OI movement mirrors the late-August trend when Bitcoin tested $64K, suggesting that BTC may be approaching that price again.

However, if a similar trend unfolds, the likelihood of a breakout diminishes, as BTC bears could re-enter the market, thwarting another attempt at breaking through.

In simple terms, despite the rate cut, Bitcoin still faces significant challenges in testing $64K before a wider breakout can be expected. So, were the losses from crypto shorts due to a “short” squeeze?

Stakeholders in net profit

The chart below indicates the positions of stakeholders in response to price changes. Currently, a significant portion of buyers are in the profit zone, marked by the green wig.

Source: BGeometrics

Historically, surges in this ratio have coincided with market tops. However, during the last $64K peak, the spike was short-lived as crypto shorts quickly cashed in on their gains.

If this trend repeats, a breakout could stall as traders exit before the rally fades, reinforcing the short squeeze hypothesis.

Moreover, if crypto shorts resurge, bulls may need to seize another opportunity to push BTC toward $70K.

BTC might retrace if crypto shorts regain control

Over the past three days, as BTC surged past $60K, crypto shorts have retreated, allowing a significant influx of long positions.

Source: HyblockCapital

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, a slight downward trend could trigger massive liquidations if the bulls fail to maintain support. If traders exit and bulls retreat, a resurgence of crypto shorts could push Bitcoin back below $60K.

Historically, $64K has acted as both resistance and support, and the possibility of a breakout hinges on investor strategy. Failing to capitalize on the $147M crypto shorts squeeze could see BTC retrace to $55K.

how to buy clomiphene cheap clomid without a prescription generic clomiphene tablets get generic clomid without rx buy clomid price where to get cheap clomiphene tablets clomiphene uk buy

The thoroughness in this piece is noteworthy.

More posts like this would add up to the online play more useful.

zithromax medication – ciprofloxacin generic metronidazole generic

buy generic rybelsus – purchase semaglutide sale buy cyproheptadine 4mg without prescription

purchase domperidone generic – brand motilium 10mg order cyclobenzaprine 15mg generic

order inderal online cheap – order generic plavix 150mg purchase methotrexate

buy generic azithromycin over the counter – purchase azithromycin online order nebivolol 20mg generic

amoxiclav for sale – https://atbioinfo.com/ ampicillin for sale online

nexium buy online – nexiumtous order esomeprazole 20mg capsules

order medex sale – https://coumamide.com/ how to buy cozaar

prednisone 10mg usa – aprep lson deltasone 5mg without prescription

sexual dysfunction – the best ed pill buy ed medication

where can i buy amoxicillin – combamoxi.com order amoxil for sale

where to buy forcan without a prescription – forcan oral diflucan 100mg price

lexapro drug – https://escitapro.com/ escitalopram 10mg sale

where to buy cenforce without a prescription – buy generic cenforce generic cenforce

cialis coupon walgreens – buy cialis cheap fast delivery cialis substitute

zantac 300mg sale – https://aranitidine.com/ ranitidine 300mg drug

cheap viagra buy online – sildenafil 100mg tablet 100mg viagra street price

More peace pieces like this would create the интернет better. comprar provigil madrid

Thanks on sharing. It’s first quality. order 40mg accutane online

I couldn’t weather commenting. Well written! https://ursxdol.com/synthroid-available-online/

Greetings! Very useful recommendation within this article! It’s the scarcely changes which liking obtain the largest changes. Thanks a portion towards sharing! https://prohnrg.com/product/acyclovir-pills/

Thanks recompense sharing. It’s top quality. aranitidine

I couldn’t turn down commenting. Well written! https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

order metoclopramide 10mg generic

This website really has all of the information and facts I needed adjacent to this case and didn’t positive who to ask. https://sportavesti.ru/forums/users/ffdmx-2/

buy dapagliflozin 10 mg sale – https://janozin.com/# cheap dapagliflozin 10mg