- US Treasury Secretary Janet Yellen has said that the US economy is healthy and there are no signs of a recession.

- The crypto market has recovered slightly, with Bitcoin reclaiming $54,000.

The crypto market has made slight gains, with all the top-ten cryptos trading in the green at press time though they fell short of reaching their weekly highs.

Bitcoin [BTC] has bounced back above $54,000 after a slight 0.6% gain in 24 hours. Ethereum [ETH] has followed suit, with a 1.3% gain to trade at $2,290 at the time of writing.

The leading gainer among the top ten largest cryptos by market cap is Dogecoin [DOGE] with a 2.6% gain.

The recent rebound comes after US Treasury Secretary, Janet Yellen, said the US economy was healthy and “deep into a recovery.”

Yellen was speaking at the Texas Tribune Festival on Saturday where she addressed concerns about the weak jobs report released last week after nonfarm payrolls fell below expectations.

Yellen said that she did not see “red lights flashing” and that the jobs data was a sign of a soft landing, not a recession.

Her remarks have drawn reactions from the crypto community. According to BitMEX co-founder, Arthur Hayes, Yellen will likely resort to money printing to stimulate the economy.

“Bad Gurl Yellen is watching, if markets go down more she will definitely pump up the jam by printing more money,” Hayes stated.

Such activity could see people turn towards risk assets like crypto as money printing increases inflation risk.

Bitcoin is not out of the woods… yet

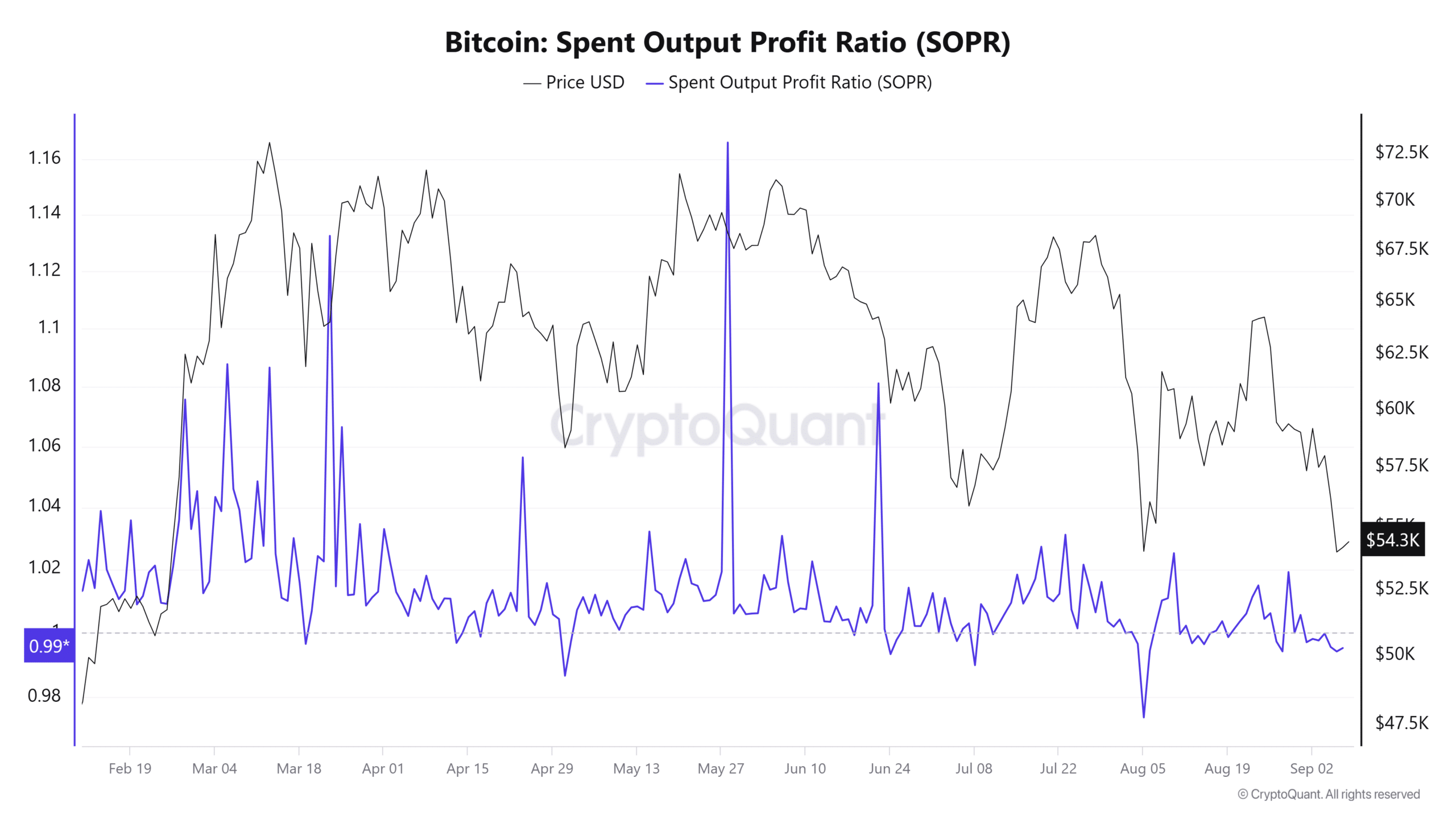

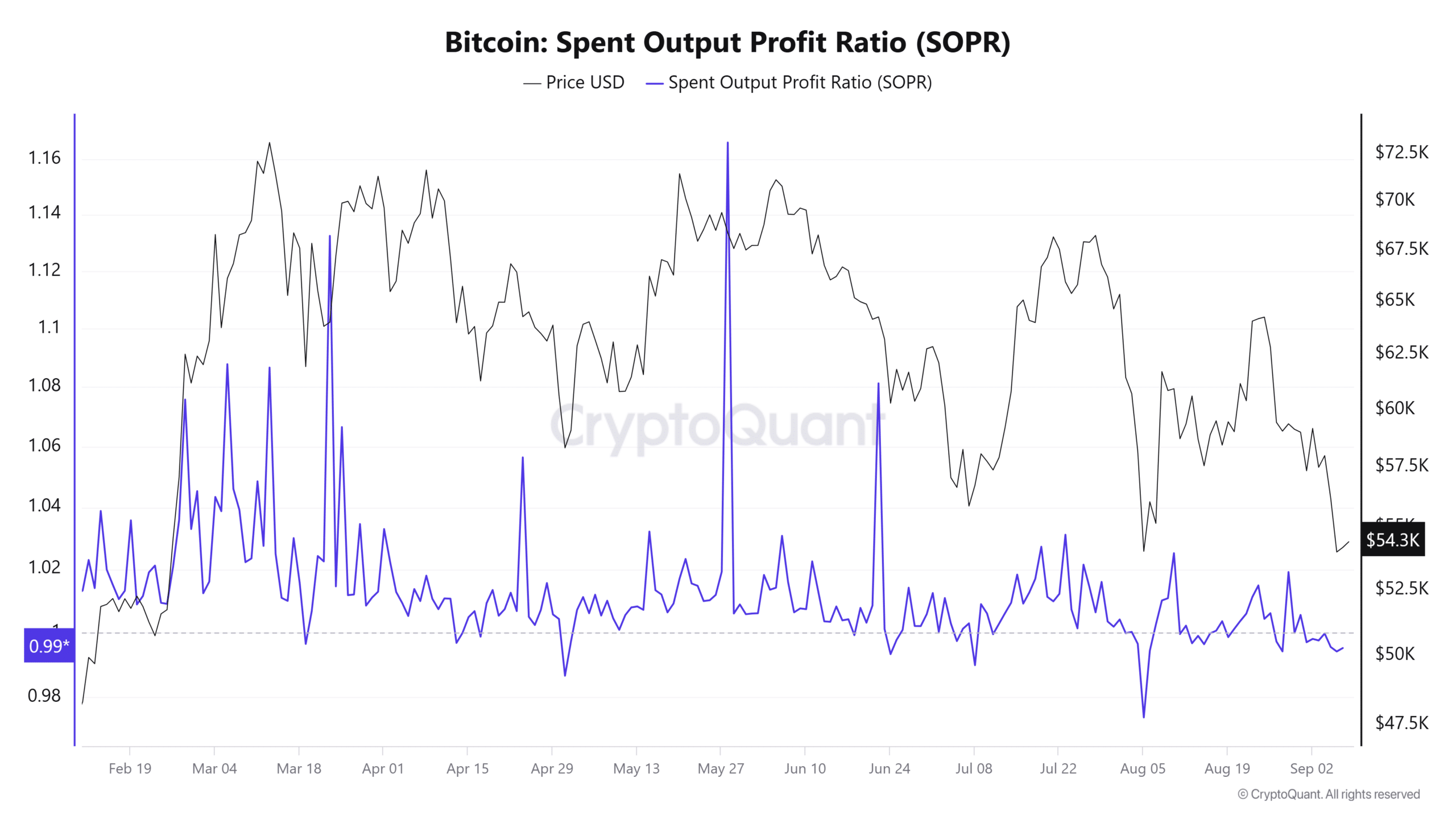

Despite the recent gains, the BTC price still shows signs of struggling. Since the start of the month, the Bitcoin Spent Output Profit Ratio (SOPR) has failed to shift above 1.

Source: CryptoQuant

This metric shows that the average investor has been selling BTC at a loss over the past week. Such loss-taking activity indicates a bearish sentiment and market distress as investors panic and trim losses.

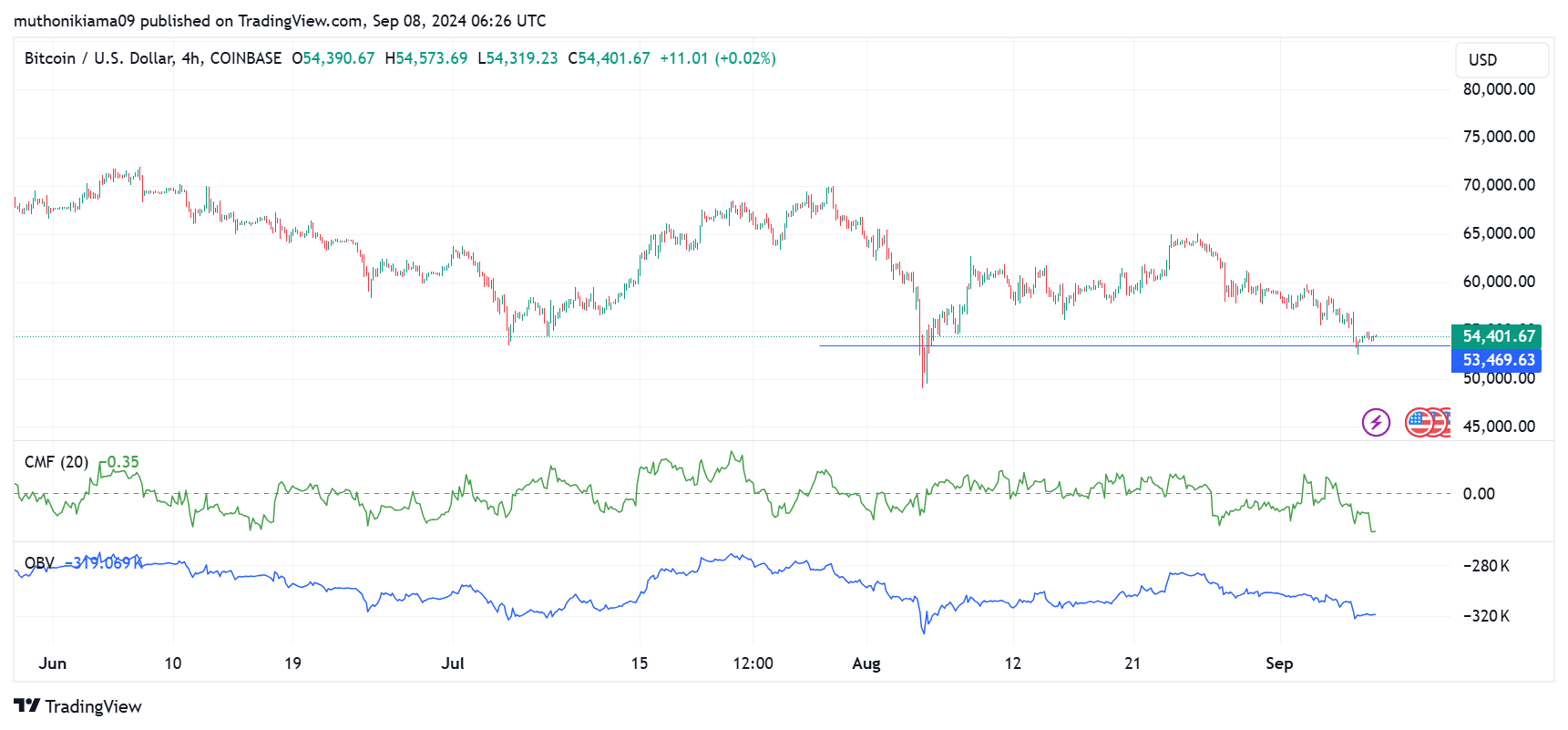

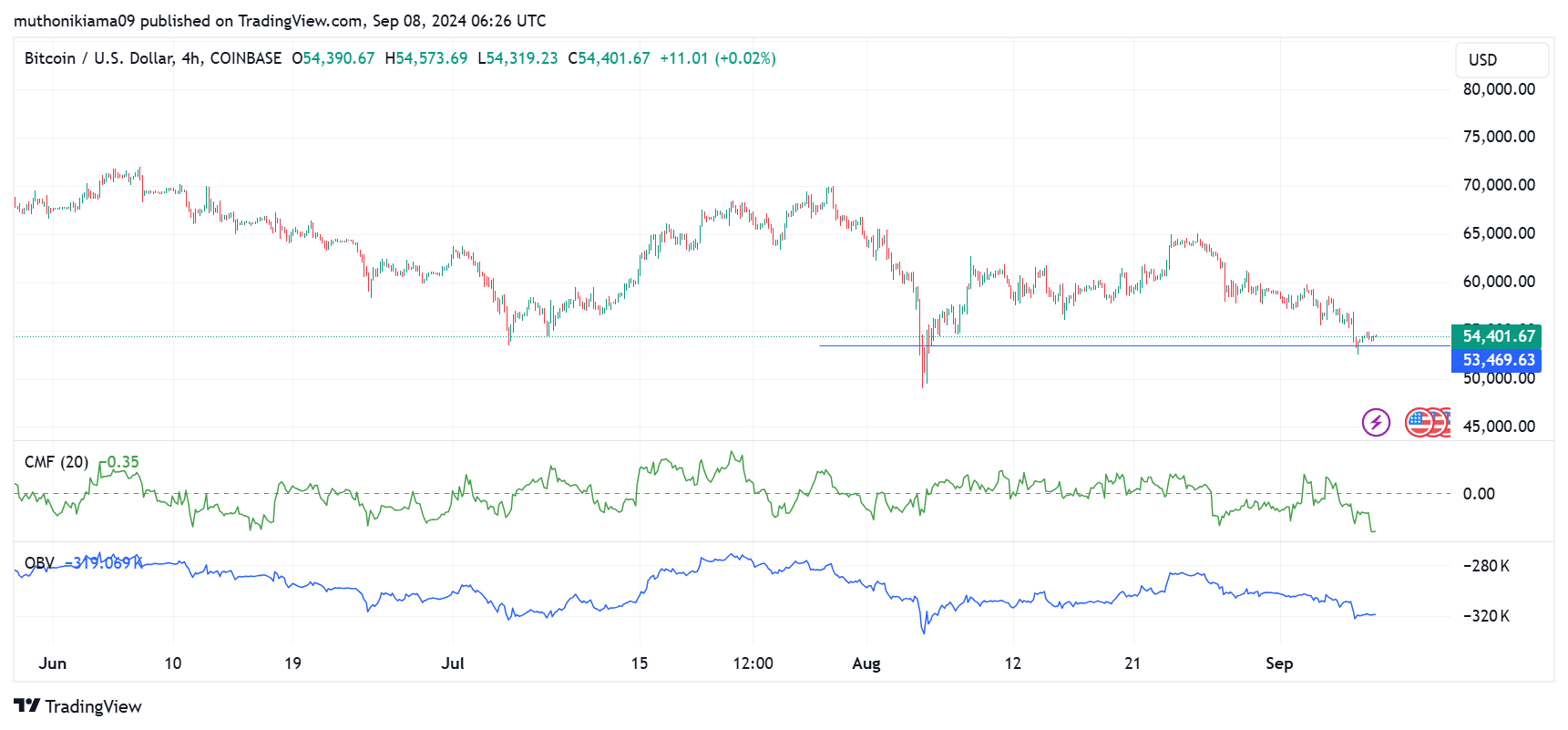

Buying pressure also remains low as seen in the Chaikin Money Flow (CMF) indicator, which was negative at press time. This index continues to create lower lows and it is currently at the lowest level since June on the four-hour chart.

Source: Tradingview

The prevailing bearish sentiment was also seen in the On Balance Volume (OBV), which remains predominantly negative. This trend shows market weakness as selling volumes dominate, exerting downward pressure on BTC prices.

Nevertheless, BTC might have formed an ideal entry point after testing the support at $53,469. The last time BTC tested this support, it registered an 8% gain.

It is crucial to note that buyers might remain hesitant as they await the release of the US Consumer Price Index (CPI) data on 11th September.

The market forecast for the August inflation is 2.6%. If the CPI falls within or below expectations, the crypto market could be set for a rebound. Conversely, if the data still depicts a weakening US economy, crypto prices could tank further.

- US Treasury Secretary Janet Yellen has said that the US economy is healthy and there are no signs of a recession.

- The crypto market has recovered slightly, with Bitcoin reclaiming $54,000.

The crypto market has made slight gains, with all the top-ten cryptos trading in the green at press time though they fell short of reaching their weekly highs.

Bitcoin [BTC] has bounced back above $54,000 after a slight 0.6% gain in 24 hours. Ethereum [ETH] has followed suit, with a 1.3% gain to trade at $2,290 at the time of writing.

The leading gainer among the top ten largest cryptos by market cap is Dogecoin [DOGE] with a 2.6% gain.

The recent rebound comes after US Treasury Secretary, Janet Yellen, said the US economy was healthy and “deep into a recovery.”

Yellen was speaking at the Texas Tribune Festival on Saturday where she addressed concerns about the weak jobs report released last week after nonfarm payrolls fell below expectations.

Yellen said that she did not see “red lights flashing” and that the jobs data was a sign of a soft landing, not a recession.

Her remarks have drawn reactions from the crypto community. According to BitMEX co-founder, Arthur Hayes, Yellen will likely resort to money printing to stimulate the economy.

“Bad Gurl Yellen is watching, if markets go down more she will definitely pump up the jam by printing more money,” Hayes stated.

Such activity could see people turn towards risk assets like crypto as money printing increases inflation risk.

Bitcoin is not out of the woods… yet

Despite the recent gains, the BTC price still shows signs of struggling. Since the start of the month, the Bitcoin Spent Output Profit Ratio (SOPR) has failed to shift above 1.

Source: CryptoQuant

This metric shows that the average investor has been selling BTC at a loss over the past week. Such loss-taking activity indicates a bearish sentiment and market distress as investors panic and trim losses.

Buying pressure also remains low as seen in the Chaikin Money Flow (CMF) indicator, which was negative at press time. This index continues to create lower lows and it is currently at the lowest level since June on the four-hour chart.

Source: Tradingview

The prevailing bearish sentiment was also seen in the On Balance Volume (OBV), which remains predominantly negative. This trend shows market weakness as selling volumes dominate, exerting downward pressure on BTC prices.

Nevertheless, BTC might have formed an ideal entry point after testing the support at $53,469. The last time BTC tested this support, it registered an 8% gain.

It is crucial to note that buyers might remain hesitant as they await the release of the US Consumer Price Index (CPI) data on 11th September.

The market forecast for the August inflation is 2.6%. If the CPI falls within or below expectations, the crypto market could be set for a rebound. Conversely, if the data still depicts a weakening US economy, crypto prices could tank further.

can i purchase clomid without rx where can i buy clomiphene no prescription get cheap clomiphene for sale how to buy clomiphene tablets where buy generic clomid how to buy cheap clomiphene price cost of clomiphene for men

This is the big-hearted of literature I truly appreciate.

More posts like this would bring about the blogosphere more useful.

order zithromax pills – purchase floxin buy flagyl generic

order semaglutide for sale – how to buy cyproheptadine how to buy cyproheptadine

motilium 10mg pill – buy cheap motilium flexeril without prescription

order amoxil online cheap – diovan 80mg price buy ipratropium 100 mcg online cheap

buy generic augmentin 375mg – atbioinfo.com purchase ampicillin generic

esomeprazole capsules – https://anexamate.com/ nexium pill

warfarin 5mg ca – https://coumamide.com/ oral cozaar

buy mobic medication – relieve pain meloxicam pill

buy prednisone pills – https://apreplson.com/ buy prednisone generic

men’s ed pills – site best otc ed pills

cheap amoxicillin sale – comba moxi cheap amoxicillin online

forcan order online – https://gpdifluca.com/ buy fluconazole without prescription

where to buy cenforce without a prescription – https://cenforcers.com/# how to buy cenforce

how many 5mg cialis can i take at once – how long does cialis take to work 10mg order cialis online no prescription reviews

zantac online buy – https://aranitidine.com/ order zantac 150mg for sale

buy levitra viagra – https://strongvpls.com/# order generic viagra uk

The sagacity in this ruined is exceptional. click

More articles like this would make the blogosphere richer. https://buyfastonl.com/gabapentin.html

With thanks. Loads of expertise! https://ursxdol.com/levitra-vardenafil-online/

Proof blog you possess here.. It’s severely to find strong quality script like yours these days. I really recognize individuals like you! Go through mindfulness!! https://prohnrg.com/product/metoprolol-25-mg-tablets/

I’ll certainly bring to read more. https://aranitidine.com/fr/prednisolone-achat-en-ligne/