- Crypto investment products netted $2.2 billion in inflows last week.

- Bitcoin dominated the inflows amid increased chances of Trump winning the U.S. elections.

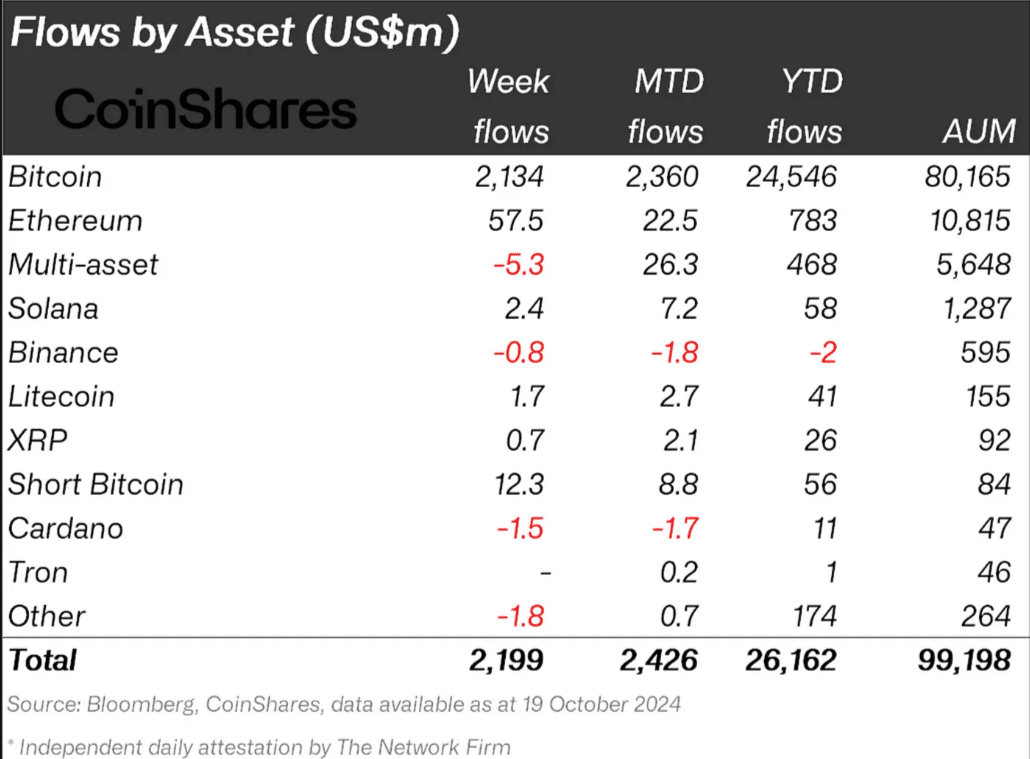

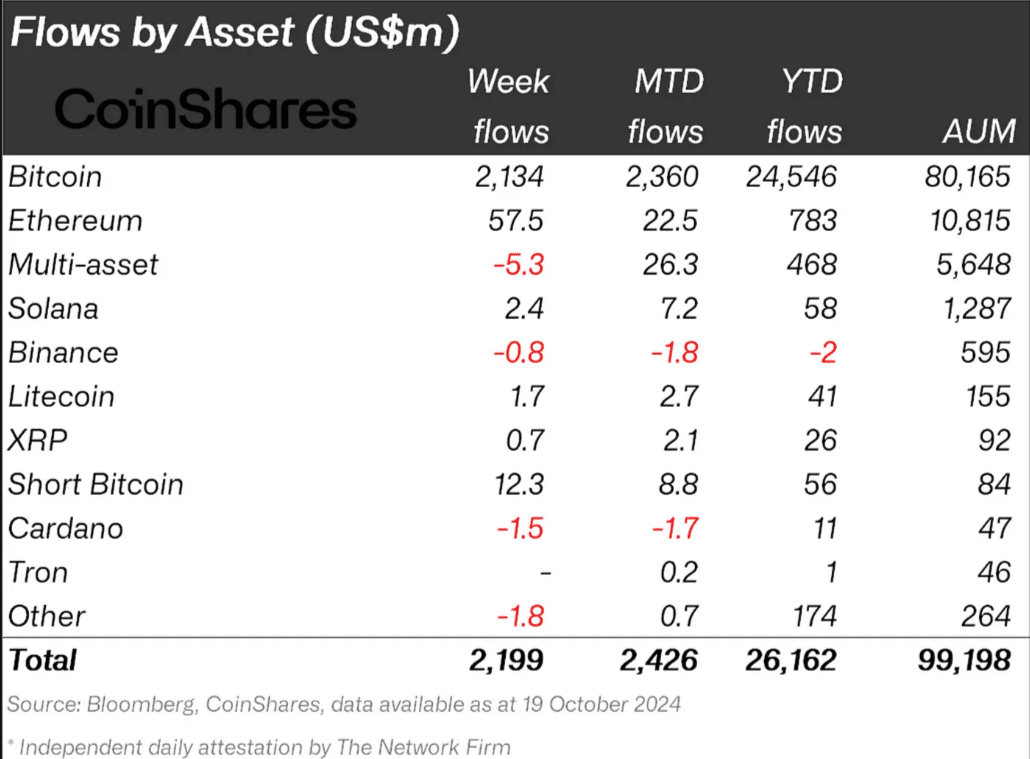

Last week, crypto market investors were heavily in risk-on mode, as noted by a whopping $2.2 billion inflows.

According to CoinShares data, this was the largest surge since July, underscoring a renewed bullish sentiment witnessed in the past few days.

Trump’s impact on BTC

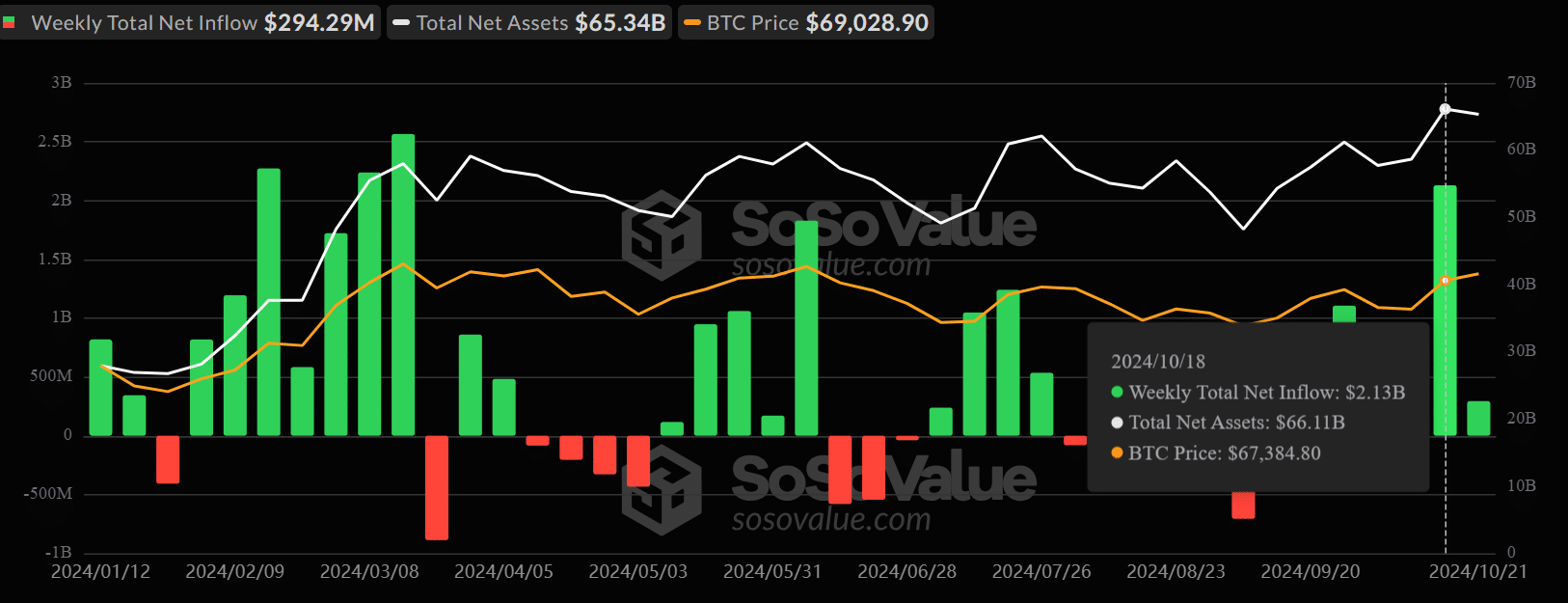

Bitcoin [BTC] dominated nearly 99% of the weekly inflows, raking in $2.13 billion, making it the highlight of investors’ interest.

The impact of the massive inflows was also evident on the price charts, as the world’s largest digital asset rallied nearly 10%, rising from $62.4K to over $69K.

Source: CoinShares

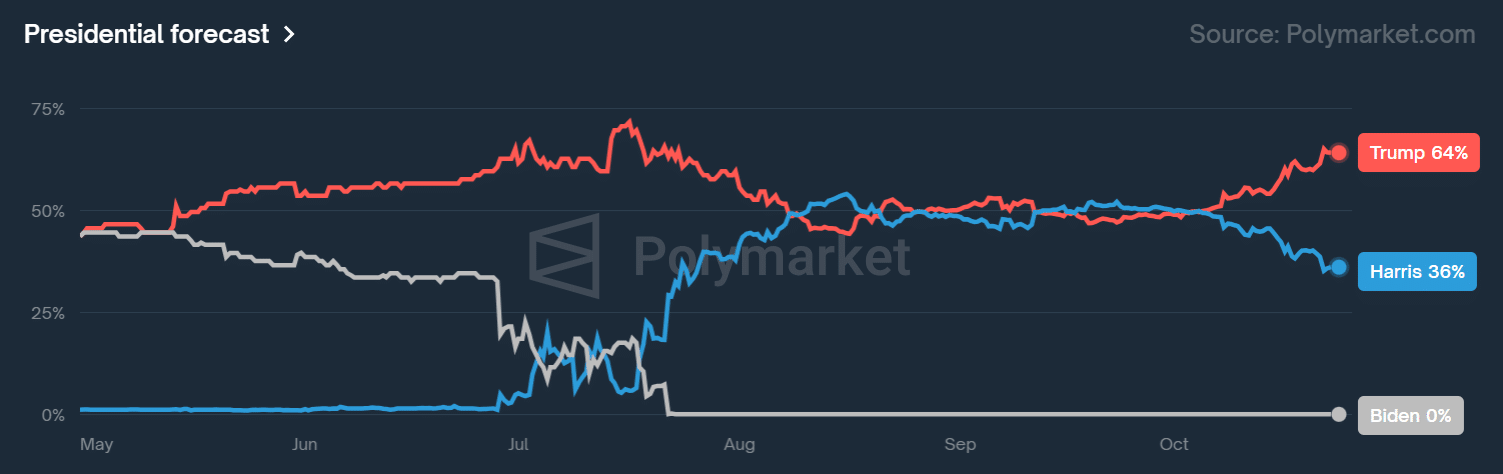

According to CoinShares’ James Butterfill, the renewed market optimism was linked to increasing odds of Donald Trump winning the US presidential elections. He said,

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum.”

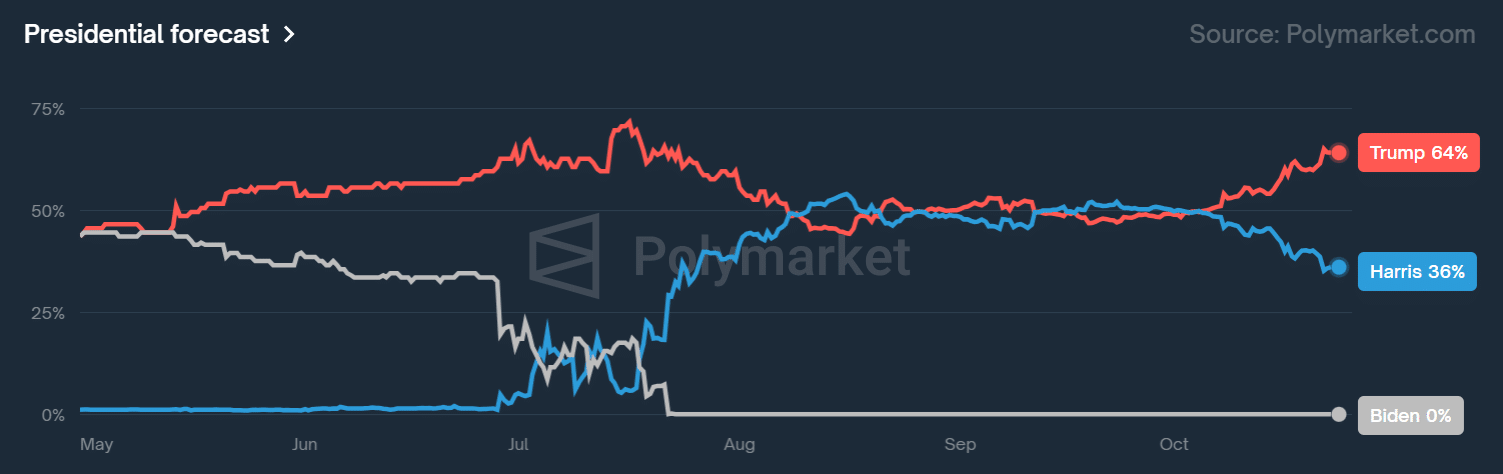

For context, last week, Trump’s odds of winning on the prediction site Polymarket topped 60% for the first time since July.

It stood at 64% at press time, a 28-point lead against Kamala Harris’s 34%.

Source: Polymarket

According to Presto Research’s analyst Min Jung, the momentum could continue in the coming weeks under two conditions.

“If Trump’s dominance continues and the Fed signals a more dovish stance, we could see renewed momentum for Bitcoin in the weeks following these events.”

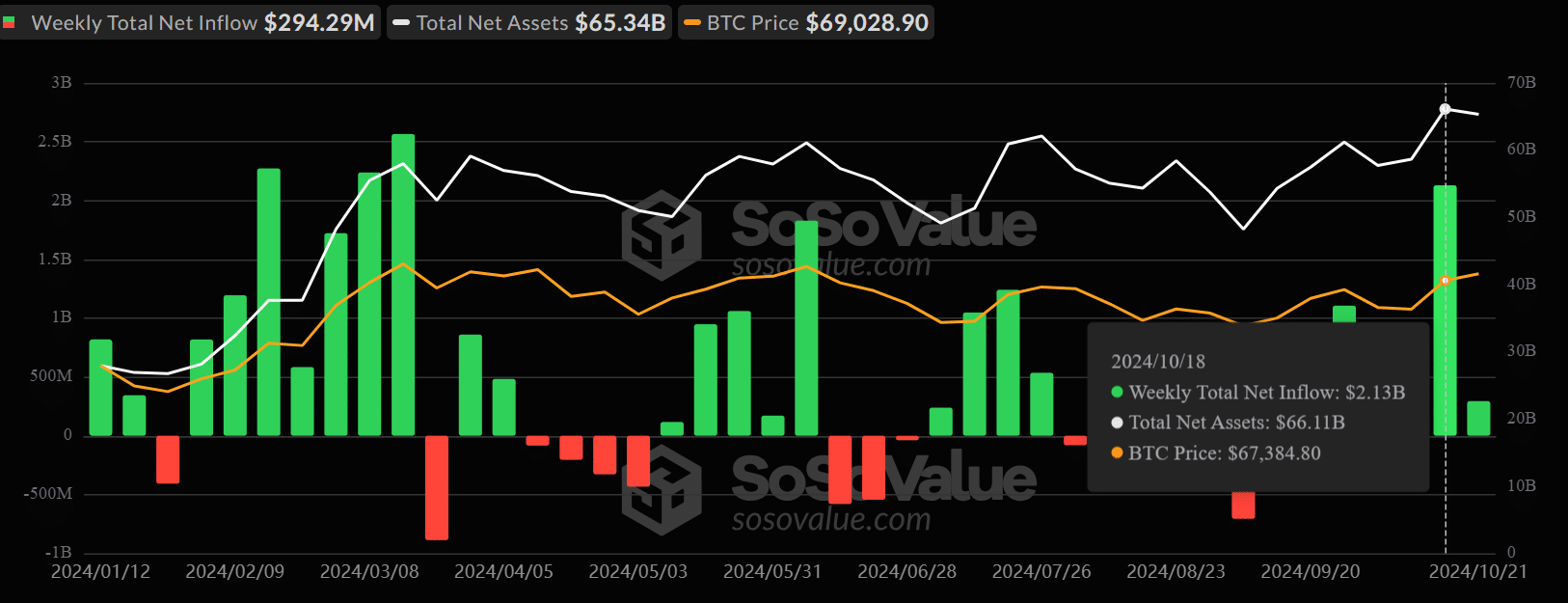

That said, strong demand from US spot BTC ETFs also pushed the products to a new high in net assets held. It crossed $66.1 billion in total net assets under management (AUM).

Source: Soso Value

Other altcoins also showed renewed traction, with Ethereum [ETH] logging $57.5 million and Solana [SOL] tapping $2.4 million.

With only about two weeks to the US elections, will the bullish streak in the crypto markets continue?

Well, crypto trading firm QCP Capital was confident that the uptrend could extend, citing options data. It stated,

“Markets are bracing for a volatile #Election: While #BTC skews towards bullish calls despite trading 8% below its peak, the S&P 500 hedges with put protection ahead of a potential 1.8% post-election swing.”

It meant that crypto investors were optimistic about upside potential (buying call options) while the US stock market feared pullback (buying put options).

- Crypto investment products netted $2.2 billion in inflows last week.

- Bitcoin dominated the inflows amid increased chances of Trump winning the U.S. elections.

Last week, crypto market investors were heavily in risk-on mode, as noted by a whopping $2.2 billion inflows.

According to CoinShares data, this was the largest surge since July, underscoring a renewed bullish sentiment witnessed in the past few days.

Trump’s impact on BTC

Bitcoin [BTC] dominated nearly 99% of the weekly inflows, raking in $2.13 billion, making it the highlight of investors’ interest.

The impact of the massive inflows was also evident on the price charts, as the world’s largest digital asset rallied nearly 10%, rising from $62.4K to over $69K.

Source: CoinShares

According to CoinShares’ James Butterfill, the renewed market optimism was linked to increasing odds of Donald Trump winning the US presidential elections. He said,

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum.”

For context, last week, Trump’s odds of winning on the prediction site Polymarket topped 60% for the first time since July.

It stood at 64% at press time, a 28-point lead against Kamala Harris’s 34%.

Source: Polymarket

According to Presto Research’s analyst Min Jung, the momentum could continue in the coming weeks under two conditions.

“If Trump’s dominance continues and the Fed signals a more dovish stance, we could see renewed momentum for Bitcoin in the weeks following these events.”

That said, strong demand from US spot BTC ETFs also pushed the products to a new high in net assets held. It crossed $66.1 billion in total net assets under management (AUM).

Source: Soso Value

Other altcoins also showed renewed traction, with Ethereum [ETH] logging $57.5 million and Solana [SOL] tapping $2.4 million.

With only about two weeks to the US elections, will the bullish streak in the crypto markets continue?

Well, crypto trading firm QCP Capital was confident that the uptrend could extend, citing options data. It stated,

“Markets are bracing for a volatile #Election: While #BTC skews towards bullish calls despite trading 8% below its peak, the S&P 500 hedges with put protection ahead of a potential 1.8% post-election swing.”

It meant that crypto investors were optimistic about upside potential (buying call options) while the US stock market feared pullback (buying put options).

Hey very nice website!! Guy .. Beautiful .. Superb .. I’ll bookmark your website and take the feeds additionallyKI’m satisfied to find so many useful info right here within the post, we want work out more strategies in this regard, thank you for sharing. . . . . .

Somebody necessarily assist to make critically posts I would state. This is the first time I frequented your web page and thus far? I amazed with the research you made to make this actual post amazing. Great task!

you have a great blog here! would you like to make some invite posts on my blog?

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Thanks for sharing excellent informations. Your web site is so cool. I’m impressed by the details that you?¦ve on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found just the info I already searched everywhere and simply could not come across. What a perfect site.

I found your blog web site on google and examine a few of your early posts. Continue to maintain up the excellent operate. I simply extra up your RSS feed to my MSN News Reader. Looking for ahead to reading extra from you later on!…

Great remarkable things here. I am very happy to peer your article. Thanks a lot and i am having a look forward to contact you. Will you please drop me a e-mail?

Greetings from Ohio! I’m bored to tears at work so I decided to check out your website on my iphone during lunch break. I love the information you provide here and can’t wait to take a look when I get home. I’m surprised at how fast your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, great blog!

You could certainly see your expertise within the paintings you write. The sector hopes for more passionate writers like you who are not afraid to mention how they believe. At all times go after your heart. “Every man serves a useful purpose A miser, for example, makes a wonderful ancestor.” by Laurence J. Peter.

Hello I am so thrilled I found your webpage, I really found you by error, while I was researching on Askjeeve for something else, Anyhow I am here now and would just like to say kudos for a incredible post and a all round thrilling blog (I also love the theme/design), I don’t have time to look over it all at the minute but I have saved it and also added your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the great work.

As soon as I noticed this internet site I went on reddit to share some of the love with them.

I believe this site has some rattling excellent information for everyone : D.

cost of generic clomid for sale where to get clomiphene price clomiphene tablets price uk how to get clomid no prescription cost of cheap clomid prices clomiphene or serophene for men can i buy clomid price

This is the make of delivery I unearth helpful.

The vividness in this tune is exceptional.

azithromycin 500mg usa – buy ofloxacin 400mg online cheap oral metronidazole 400mg

rybelsus over the counter – semaglutide 14mg us brand periactin 4mg

how to buy motilium – order motilium 10mg without prescription cyclobenzaprine tablet

order generic augmentin – atbioinfo brand ampicillin

order nexium capsules – nexiumtous buy nexium tablets

purchase coumadin online – coumamide losartan 50mg without prescription

buy mobic 7.5mg – relieve pain mobic 15mg sale

deltasone 5mg brand – corticosteroid deltasone 5mg generic

buy ed pills cheap – fast ed to take online ed pills

order diflucan 200mg online – https://gpdifluca.com/ purchase diflucan generic

order cenforce 100mg online – https://cenforcers.com/ buy cenforce generic

what is the difference between cialis and tadalafil? – https://ciltadgn.com/# when should you take cialis

ranitidine 150mg price – https://aranitidine.com/# ranitidine 300mg usa

cialis 10mg ireland – strongtadafl cialis brand no prescription 365

I am in fact delighted to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. comprar amoxil

viagra sale pakistan – where can i buy viagra online yahoo answers 50 mg sildenafil

The thoroughness in this piece is noteworthy. https://buyfastonl.com/azithromycin.html

This is a topic which is virtually to my heart… Many thanks! Quite where can I notice the contact details due to the fact that questions? https://ursxdol.com/prednisone-5mg-tablets/

Proof blog you have here.. It’s obdurate to find high status article like yours these days. I truly recognize individuals like you! Withstand guardianship!! prohnrg

I’ll certainly return to skim more. https://ondactone.com/product/domperidone/