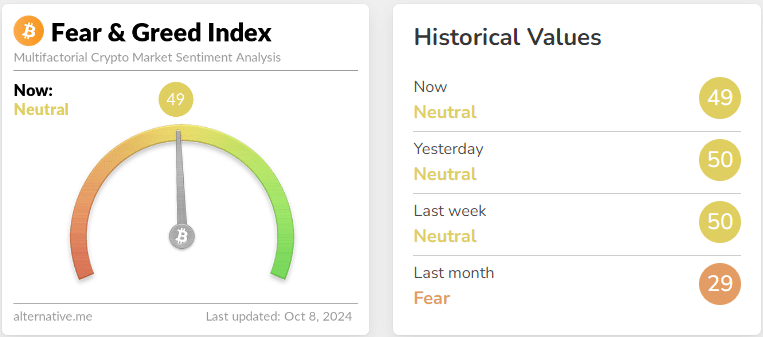

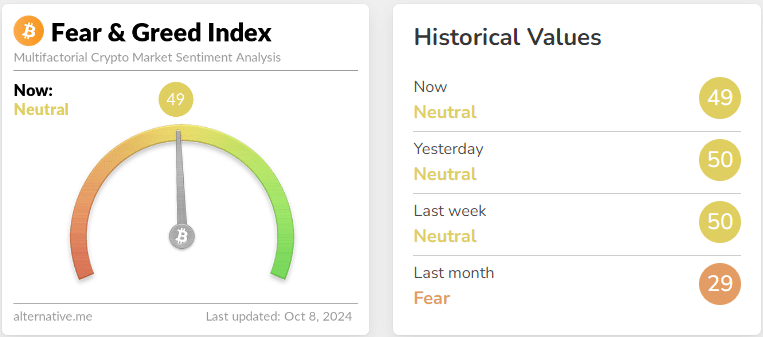

- The crypto Fear and Greed Index was not overextended in either direction.

- The Tether Dominance chart has been trending higher since April — bulls would want this to change.

The crypto Fear and Greed Index showed that market sentiment was neutral at press time, which was an improvement from early September’s fearful outlook.

The recent correction from $66.5k to $60k has not hurt the market participants too badly.

A recent AMBCrypto report outlined the liquidation pockets around the price that could serve as potential magnet zones. The $66.2k zone is still a resistance and a revisit to this area could rebuff the bulls.

On the other hand, a massive bullish move was possible, based on historical trends.

Where is the crypto market sentiment at

Source: Alternative.me

The helpful Bitcoin Fear and Greed Index chart showed that sentiment was neutral. This was understandable given the price action of the past two weeks.

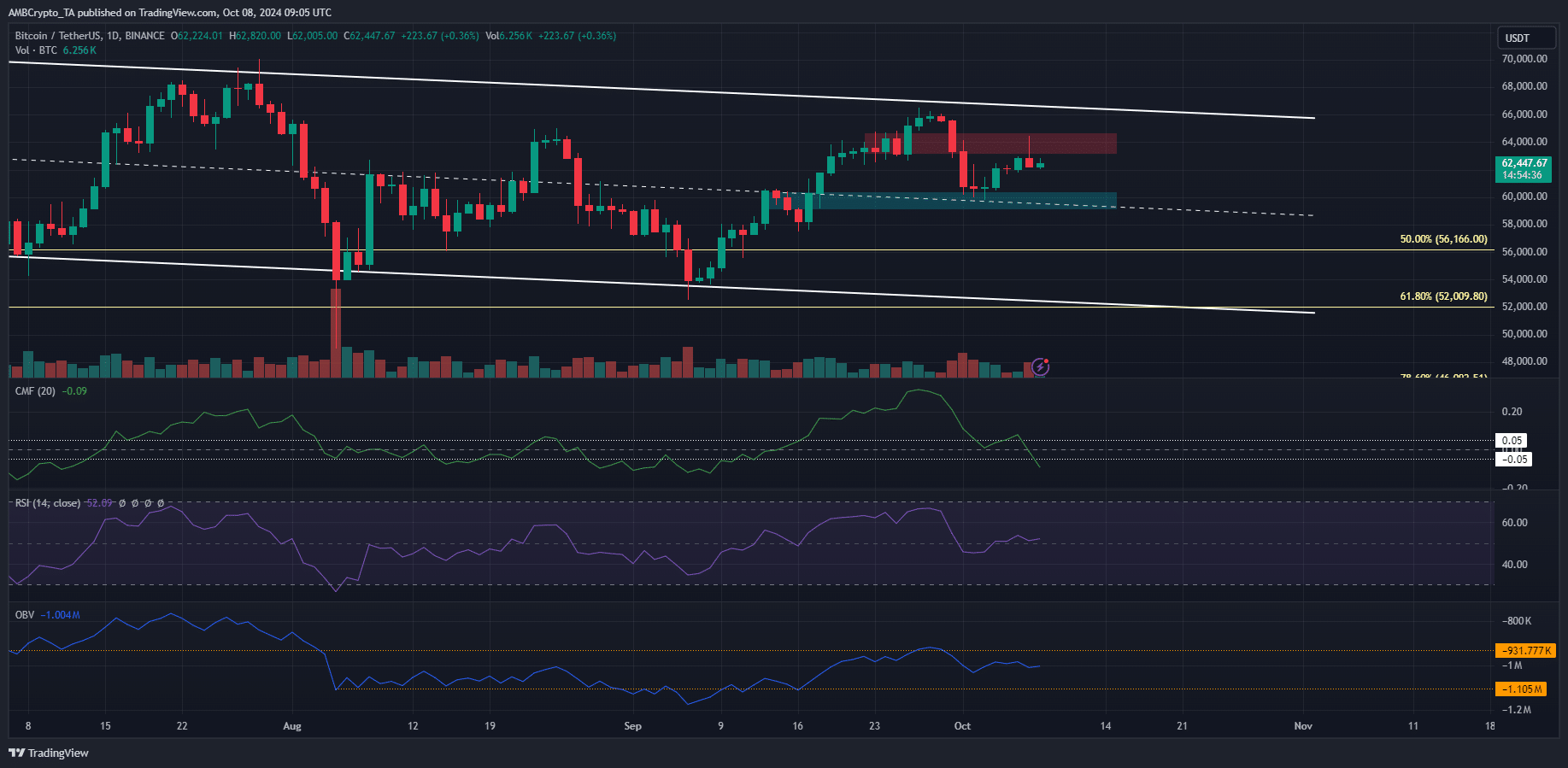

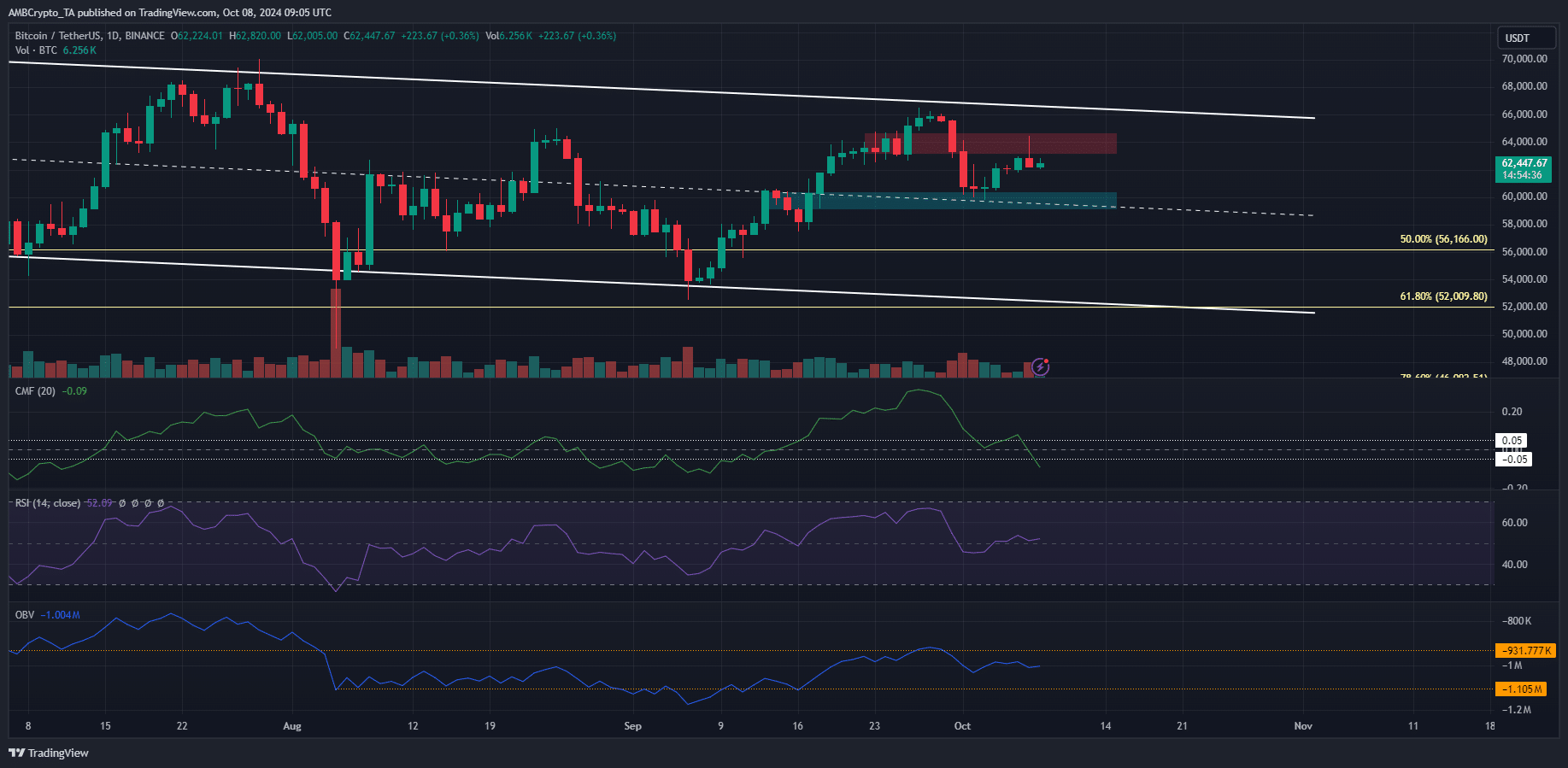

Source: BTC/USDT on TradingView

The descending channel (white) saw its mid-point broken on the 18th of September. A rally nearly reached the channel highs but was rejected. Since then the $64k zone has been flipped to resistance.

The CMF was at -0.09 to show significant capital flow out of the market and firm selling pressure. The OBV also indicated steady selling in the past two weeks, but it has recovered slightly.

The RSI espoused a neutral outlook with its reading of 52.

A drop to the $58k-$60k would present a buying opportunity. A surge beyond $66k-$67k and a retest of the same level as support would also be a chance to go long. The latter scenario is likely to shift market sentiment towards greed.

Findings from the Tether chart for BTC trends

Source: USDT.D on TradingView

The Tether [USDT] dominance trend is inversely related to the crypto market. An uptrend in this metric generally means the market is trending downward, and investors are moving to stablecoins.

The 5.79% level is a resistance level and USDT.D could move further downward in the coming days. A short-term Bitcoin rally is possible.

Is your portfolio green? Check out the BTC Profit Calculator

However, the metric has trended upward since March, as captured by the ascending trendline.

Until it is broken, investors and swing traders across the crypto market need to be conservative with their bullish targets.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The crypto Fear and Greed Index was not overextended in either direction.

- The Tether Dominance chart has been trending higher since April — bulls would want this to change.

The crypto Fear and Greed Index showed that market sentiment was neutral at press time, which was an improvement from early September’s fearful outlook.

The recent correction from $66.5k to $60k has not hurt the market participants too badly.

A recent AMBCrypto report outlined the liquidation pockets around the price that could serve as potential magnet zones. The $66.2k zone is still a resistance and a revisit to this area could rebuff the bulls.

On the other hand, a massive bullish move was possible, based on historical trends.

Where is the crypto market sentiment at

Source: Alternative.me

The helpful Bitcoin Fear and Greed Index chart showed that sentiment was neutral. This was understandable given the price action of the past two weeks.

Source: BTC/USDT on TradingView

The descending channel (white) saw its mid-point broken on the 18th of September. A rally nearly reached the channel highs but was rejected. Since then the $64k zone has been flipped to resistance.

The CMF was at -0.09 to show significant capital flow out of the market and firm selling pressure. The OBV also indicated steady selling in the past two weeks, but it has recovered slightly.

The RSI espoused a neutral outlook with its reading of 52.

A drop to the $58k-$60k would present a buying opportunity. A surge beyond $66k-$67k and a retest of the same level as support would also be a chance to go long. The latter scenario is likely to shift market sentiment towards greed.

Findings from the Tether chart for BTC trends

Source: USDT.D on TradingView

The Tether [USDT] dominance trend is inversely related to the crypto market. An uptrend in this metric generally means the market is trending downward, and investors are moving to stablecoins.

The 5.79% level is a resistance level and USDT.D could move further downward in the coming days. A short-term Bitcoin rally is possible.

Is your portfolio green? Check out the BTC Profit Calculator

However, the metric has trended upward since March, as captured by the ascending trendline.

Until it is broken, investors and swing traders across the crypto market need to be conservative with their bullish targets.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

cost of generic clomid without rx where can i buy cheap clomiphene price can i get clomid prices cost cheap clomid without insurance cost generic clomiphene without insurance can i buy clomid without prescription zei: buying generic clomid tablets

I couldn’t turn down commenting. Adequately written!

Thanks an eye to sharing. It’s first quality.

cheap zithromax 250mg – flagyl pills buy generic metronidazole 400mg

buy semaglutide online cheap – rybelsus ca order periactin 4 mg generic

cost motilium – cyclobenzaprine 15mg us cyclobenzaprine medication

order generic amoxiclav – https://atbioinfo.com/ buy acillin for sale

esomeprazole 20mg over the counter – anexamate.com esomeprazole oral

buy coumadin 2mg sale – https://coumamide.com/ oral losartan 25mg

generic meloxicam 7.5mg – https://moboxsin.com/ meloxicam 7.5mg uk

deltasone for sale online – https://apreplson.com/ cost prednisone

the best ed pill – where to buy ed pills without a prescription buy ed pills us

oral amoxicillin – amoxicillin canada amoxicillin oral

order diflucan 100mg pill – flucoan purchase diflucan pill

buy cenforce pills – https://cenforcers.com/ buy cenforce 50mg pill

is tadalafil as effective as cialis – site cialis from india online pharmacy

ranitidine tablet – https://aranitidine.com/ zantac 300mg oral

buy viagra from canada online – https://strongvpls.com/ buy priligy viagra

More posts like this would make the blogosphere more useful. this

I am actually happy to coup d’oeil at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://buyfastonl.com/

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. https://ursxdol.com/provigil-gn-pill-cnt/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/cytotec-online/

I couldn’t resist commenting. Adequately written! cialis professional generique en ligne

I couldn’t resist commenting. Adequately written! https://ondactone.com/simvastatin/

I couldn’t resist commenting. Adequately written! http://wightsupport.com/forum/member.php?action=profile&uid=21400

purchase forxiga pills – https://janozin.com/ order dapagliflozin without prescription