- Greed remained dominant as the price of crypto assets declined.

- BTC has sipped and stayed below its support levels.

The recent decline in major crypto assets like Bitcoin [BTC] and Ethereum [ETH] has sent shockwaves through the crypto industry.

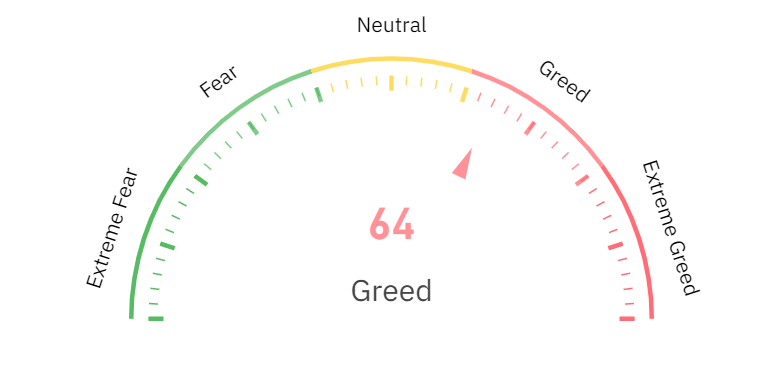

While traders closely monitored the price trends, the Fear and Greed Index indicated that sentiment remains positive for now.

Fear and Greed Index remains positive

An analysis of the crypto Fear and Greed Index showed that despite the decline in the prices of most cryptocurrencies, there remained a sense of optimism.

The index indicated a state of greed, with a current rating of around 64%.

However, an analysis of the chart on Coinglass showed that the level of greed was decreasing at press time. The previous day, the index was around 74.

This suggested that while the crowd’s sentiment remains positive, it was becoming less bullish.

Source: Coinglass

AMBCrypto’s analysis of the price trends of Bitcoin and Ethereum explained why the Fear and Greed Index has trended the way it has in the last few days.

How the Bitcoin affected the Index

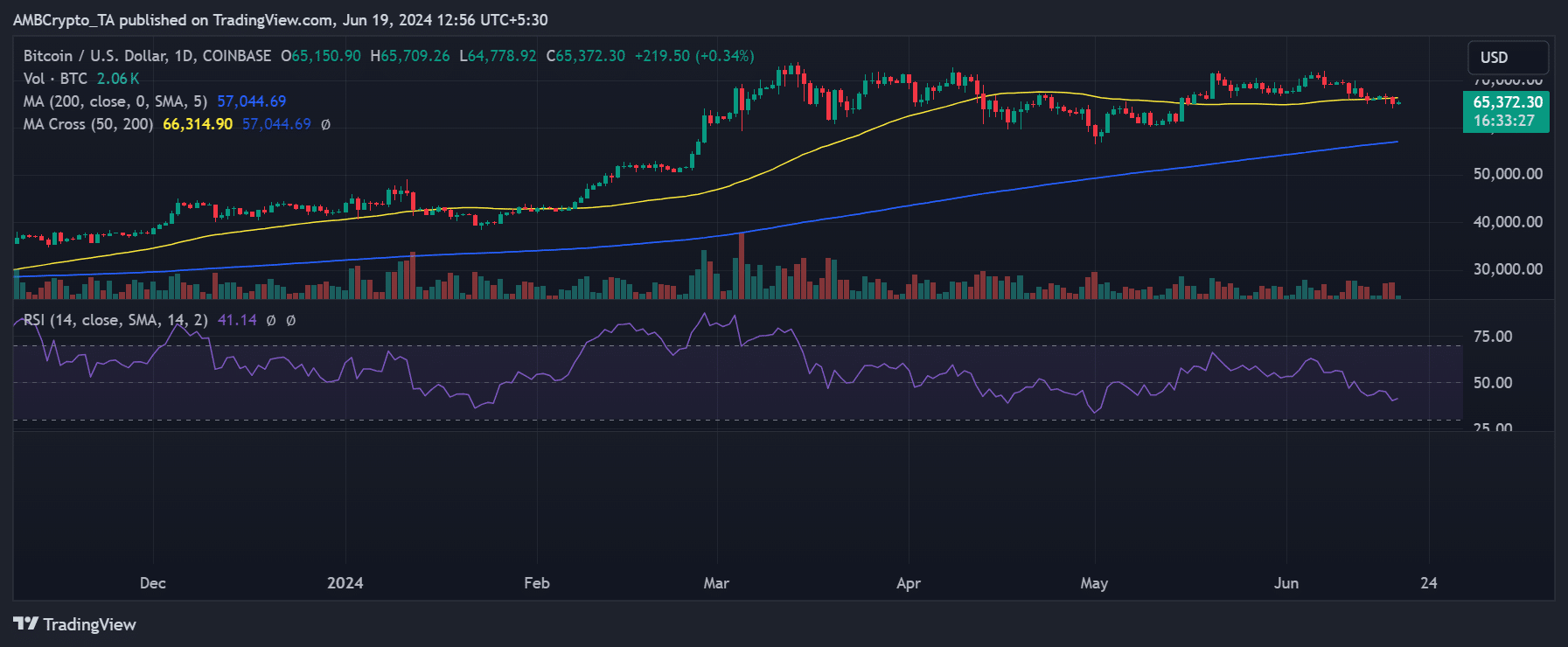

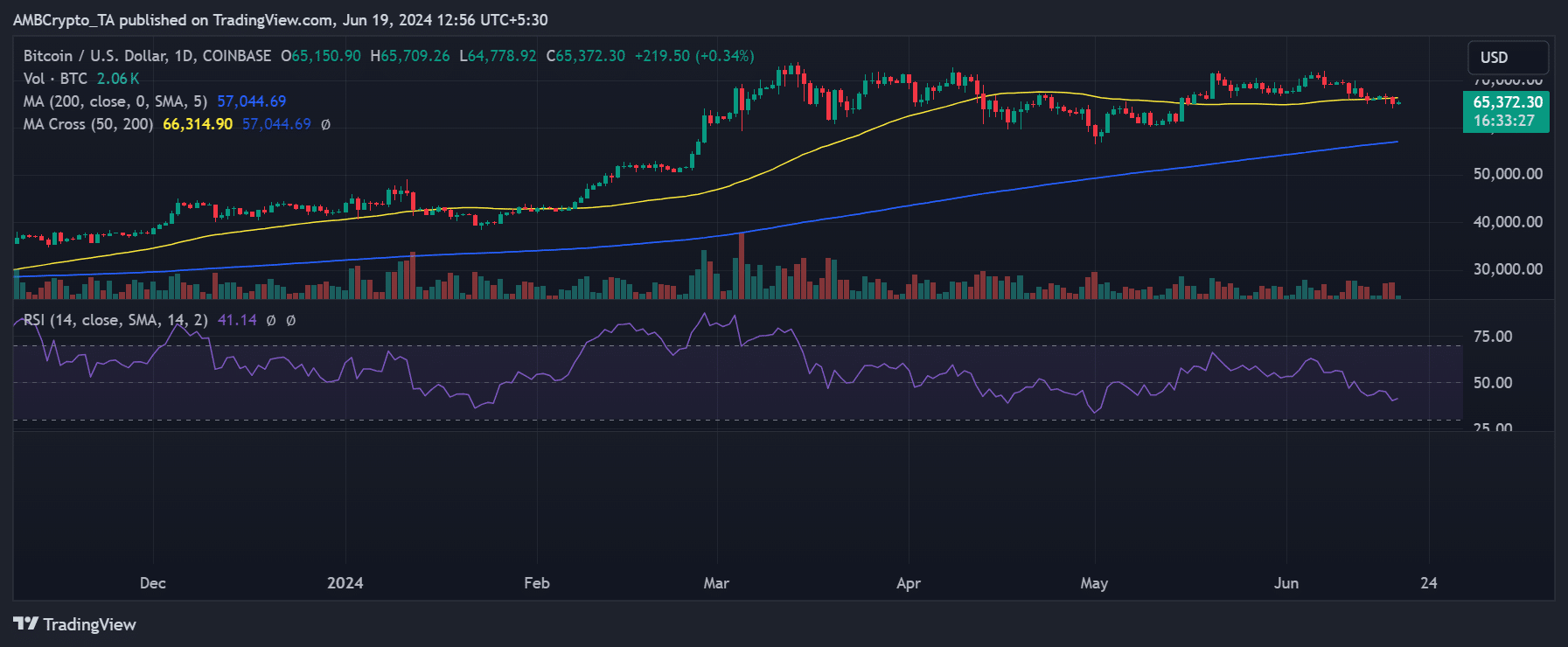

Bitcoin’s price trend showed that the $65,000 price range had served as a long-term support level. However, the recent downtrend has broken this support.

The analysis indicated that Bitcoin finally broke below the support line on the 18th of June, when the price touched $65,152 after a 2% decline.

Source: TradingView

Its Relative Strength Index (RSI) also indicated that it remained stuck below the neutral line, suggesting a strong bear trend at the moment.

While the sentiment of the Fear and Greed Index remained positive at the current price, it could drop if Bitcoin’s price declines further.

Ethereum’s effects on the Index

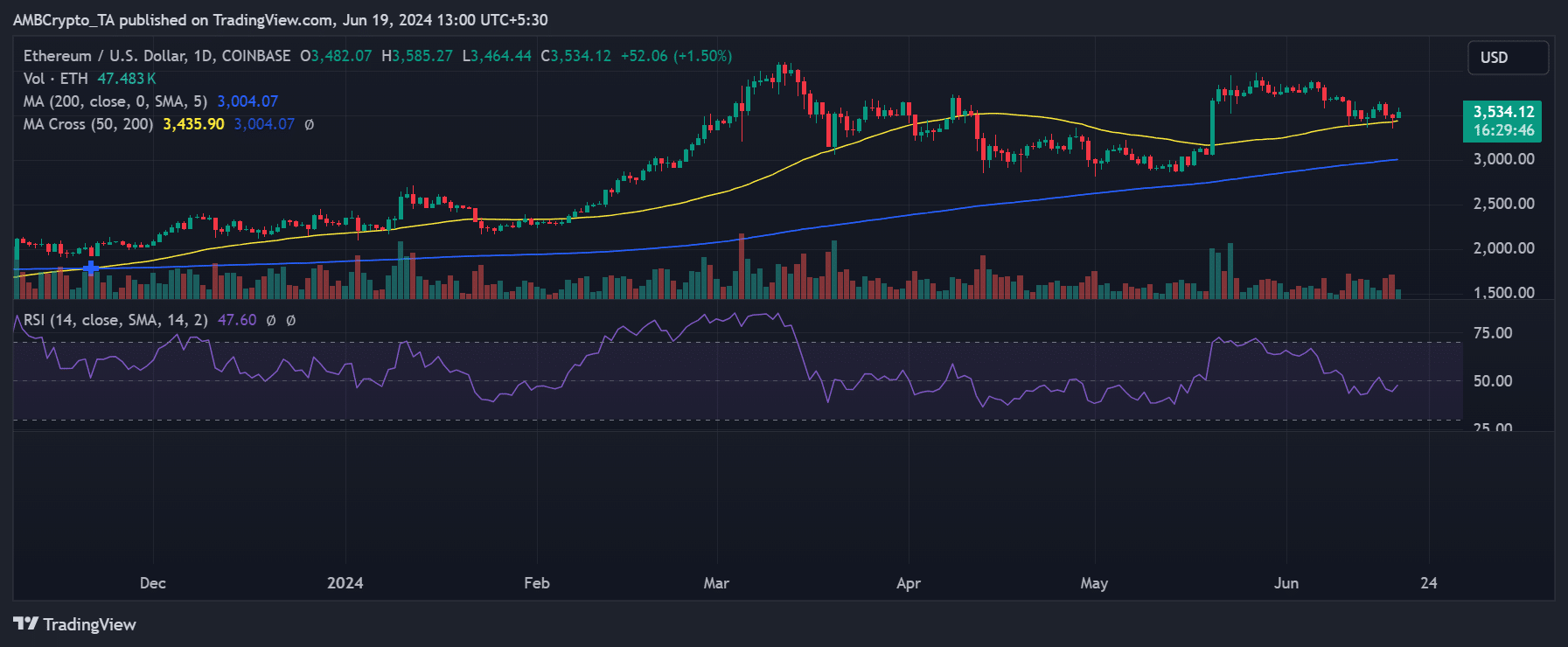

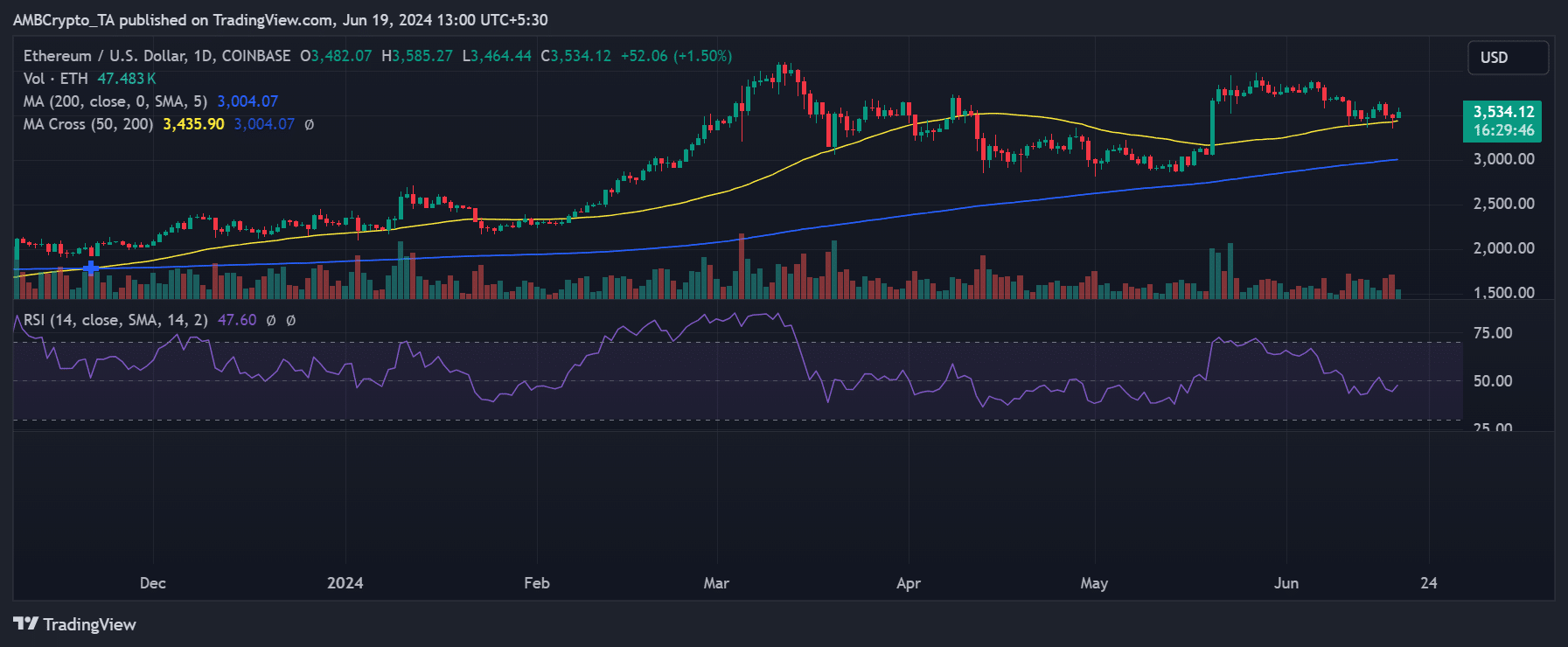

Ethereum’s price trend showed that it has declined in the last few days. However, unlike Bitcoin, its support level has held despite the declines.

The chart indicated that Ethereum declined by less than 1% on the 18th of June, with its price falling to around $3,482. As of this writing, it has increased by over 1% and was trading at over $3,500.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-2025

While the price of BTC has declined and could dip the Fear and Greed Index, the overall price trend has helped it stay balanced so far.

However, given BTC’s dominance, a further drop in its price could push the index into panic mode.

- Greed remained dominant as the price of crypto assets declined.

- BTC has sipped and stayed below its support levels.

The recent decline in major crypto assets like Bitcoin [BTC] and Ethereum [ETH] has sent shockwaves through the crypto industry.

While traders closely monitored the price trends, the Fear and Greed Index indicated that sentiment remains positive for now.

Fear and Greed Index remains positive

An analysis of the crypto Fear and Greed Index showed that despite the decline in the prices of most cryptocurrencies, there remained a sense of optimism.

The index indicated a state of greed, with a current rating of around 64%.

However, an analysis of the chart on Coinglass showed that the level of greed was decreasing at press time. The previous day, the index was around 74.

This suggested that while the crowd’s sentiment remains positive, it was becoming less bullish.

Source: Coinglass

AMBCrypto’s analysis of the price trends of Bitcoin and Ethereum explained why the Fear and Greed Index has trended the way it has in the last few days.

How the Bitcoin affected the Index

Bitcoin’s price trend showed that the $65,000 price range had served as a long-term support level. However, the recent downtrend has broken this support.

The analysis indicated that Bitcoin finally broke below the support line on the 18th of June, when the price touched $65,152 after a 2% decline.

Source: TradingView

Its Relative Strength Index (RSI) also indicated that it remained stuck below the neutral line, suggesting a strong bear trend at the moment.

While the sentiment of the Fear and Greed Index remained positive at the current price, it could drop if Bitcoin’s price declines further.

Ethereum’s effects on the Index

Ethereum’s price trend showed that it has declined in the last few days. However, unlike Bitcoin, its support level has held despite the declines.

The chart indicated that Ethereum declined by less than 1% on the 18th of June, with its price falling to around $3,482. As of this writing, it has increased by over 1% and was trading at over $3,500.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-2025

While the price of BTC has declined and could dip the Fear and Greed Index, the overall price trend has helped it stay balanced so far.

However, given BTC’s dominance, a further drop in its price could push the index into panic mode.

where can i buy clomiphene no prescription how to get clomid price clomiphene tablets for sale order cheap clomid tablets cost clomid without insurance can you get generic clomid pills cost generic clomiphene prices

This is the kind of post I turn up helpful.

I’ll certainly bring back to review more.

generic rybelsus 14mg – buy cyproheptadine 4mg without prescription periactin 4 mg brand

domperidone cheap – flexeril pills buy flexeril generic

inderal 10mg usa – order generic methotrexate 10mg order methotrexate 2.5mg generic

augmentin where to buy – atbioinfo buy generic ampicillin over the counter

buy nexium tablets – anexamate esomeprazole capsules

coumadin sale – https://coumamide.com/ generic cozaar 25mg

order meloxicam 7.5mg – https://moboxsin.com/ mobic cost

buy ed pills canada – fast ed to take non prescription ed drugs

amoxil order – buy amoxicillin online cheap amoxil where to buy

cheap lexapro 10mg – https://escitapro.com/# oral lexapro 10mg

order cenforce 100mg without prescription – https://cenforcers.com/ buy cenforce pills

cialis without a doctor prescription canada – fast ciltad cialis without prescription

oral ranitidine 300mg – purchase ranitidine online ranitidine 150mg price

buy cialis viagra levitra – cheap viagra super viagra pill 50mg

Good blog you procure here.. It’s intricate to on high quality writing like yours these days. I honestly recognize individuals like you! Rent vigilance!! https://buyfastonl.com/isotretinoin.html

I am in fact happy to glance at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://prohnrg.com/

The depth in this piece is exceptional. https://aranitidine.com/fr/en_ligne_kamagra/

Greetings! Extremely productive advice within this article! It’s the crumb changes which will espy the largest changes. Thanks a portion quest of sharing! https://ondactone.com/product/domperidone/

More articles like this would make the blogosphere richer.

https://doxycyclinege.com/pro/ondansetron/

More posts like this would add up to the online time more useful. http://zqykj.cn/bbs/home.php?mod=space&uid=302506

order forxiga 10mg for sale – https://janozin.com/# forxiga without prescription