- Crypto thefts and ransomware surged in 2024, with record-breaking payments and stolen funds

- Bitcoin’s share in stolen funds rose while centralized exchanges became prime hacking targets too

Cryptocurrencies have steadily gained mainstream traction in 2024, with the same marked by numerous positive developments on several fronts. However, it hasn’t exactly been smooth sailing for this asset class.

Troubling crypto trends

While overall illicit activity has fallen to year-to-date levels, compared to previous years, certain troubling trends have emerged too.

Throwing further light on the same, a recent survey conducted by Chainalysis revealed,

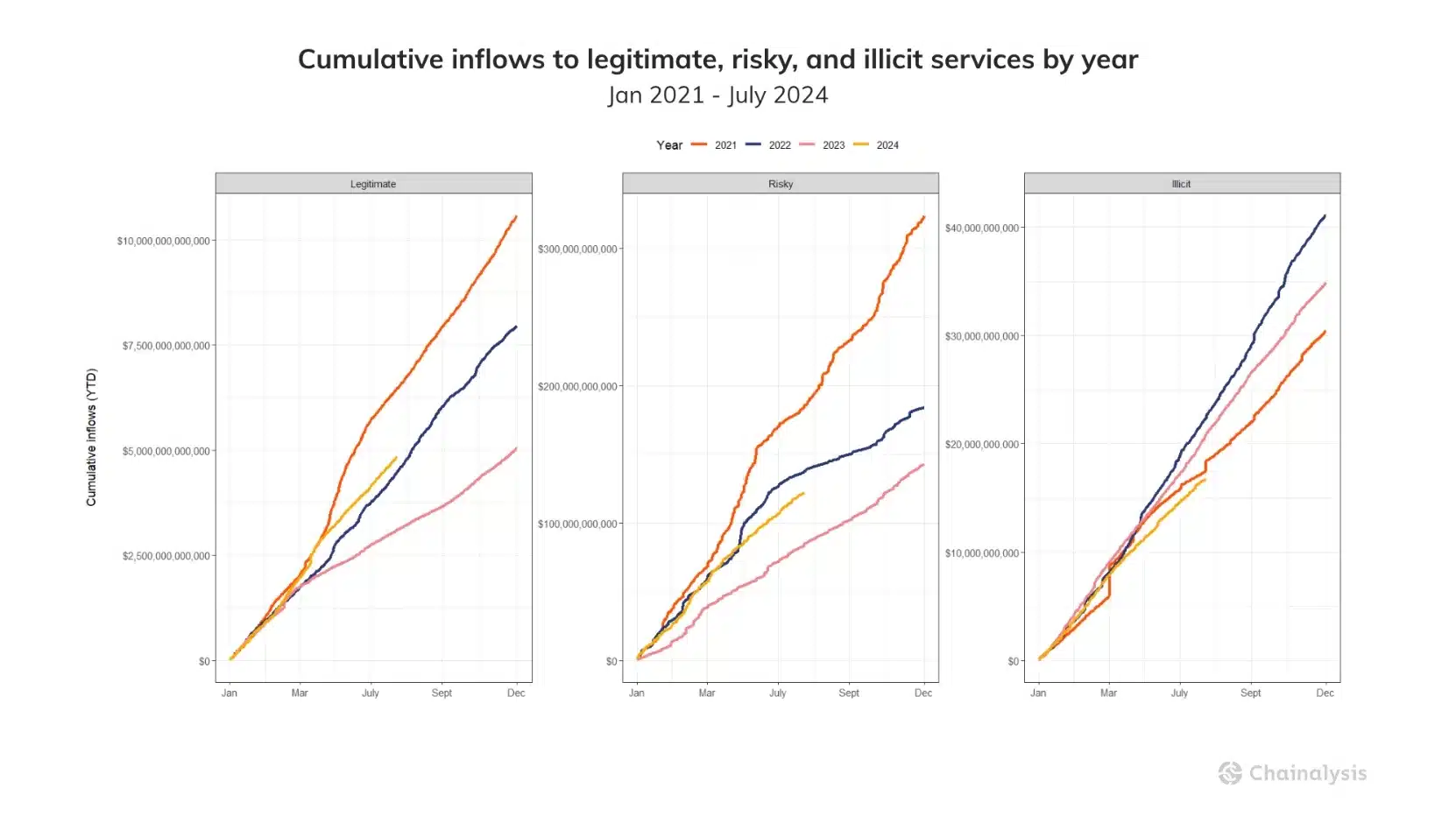

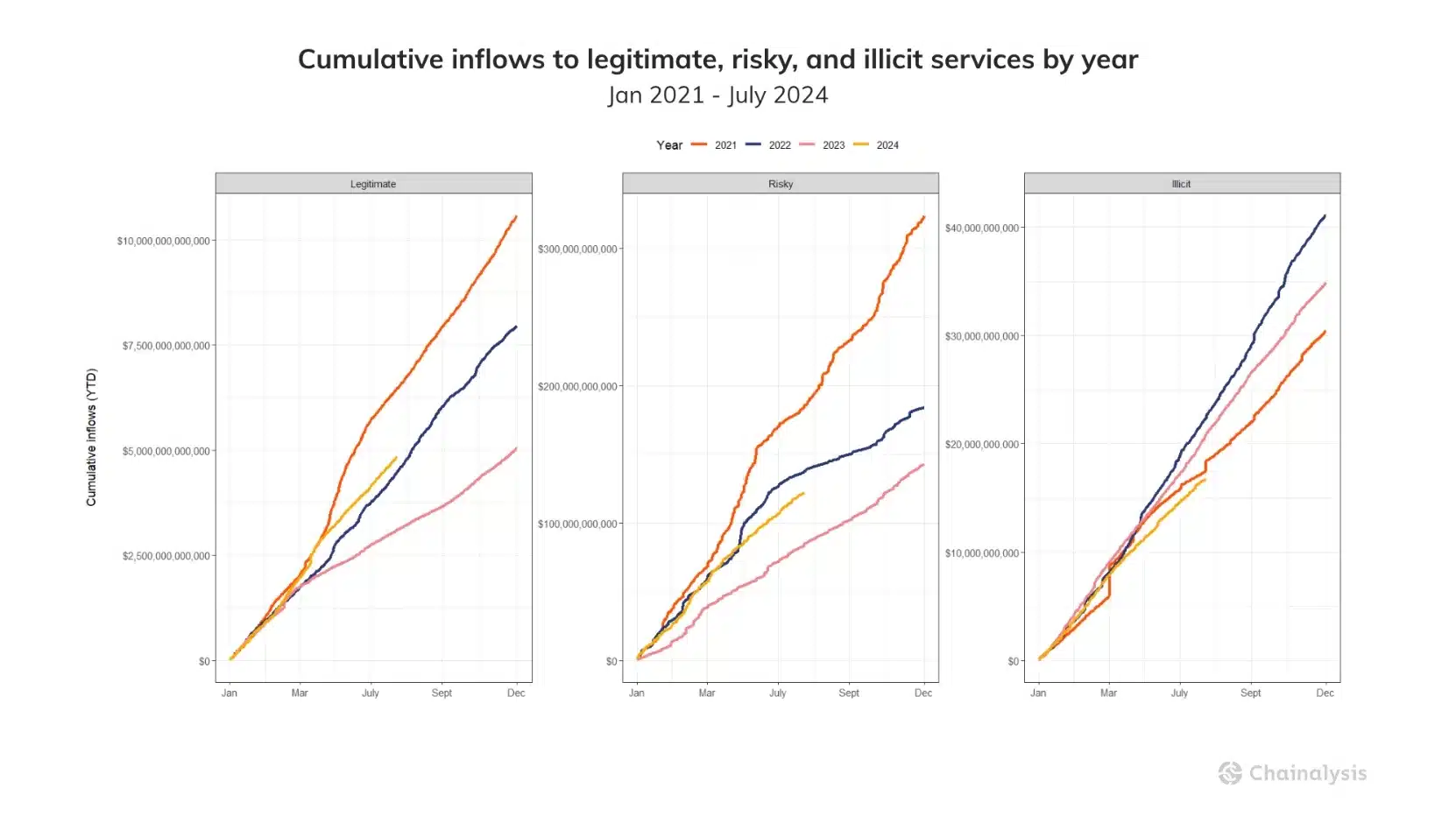

“Aggregate illicit activity fell YTD by 19.6%, dropping from $20.9B to $16.7B, demonstrating that legitimate activity is growing faster than illicit activity on-chain.”

Notably, according to Eric Jardine, Cybercrimes Research Lead at Chainalysis, inflows into legitimate crypto services have reached their highest level since the 2021 bull market peak. She added,

“The growth of legitimate activity outpacing that of illicit activity on-chain demonstrates the continued transition of cryptocurrencies to the mainstream.”

Side effects of rising crypto adoption

Despite such progress, however, greater inflows into cybercrime-related entities suggested that while crypto’s mainstream adoption grows, so does its exploitation by malicious actors.

Source: Chainalysis

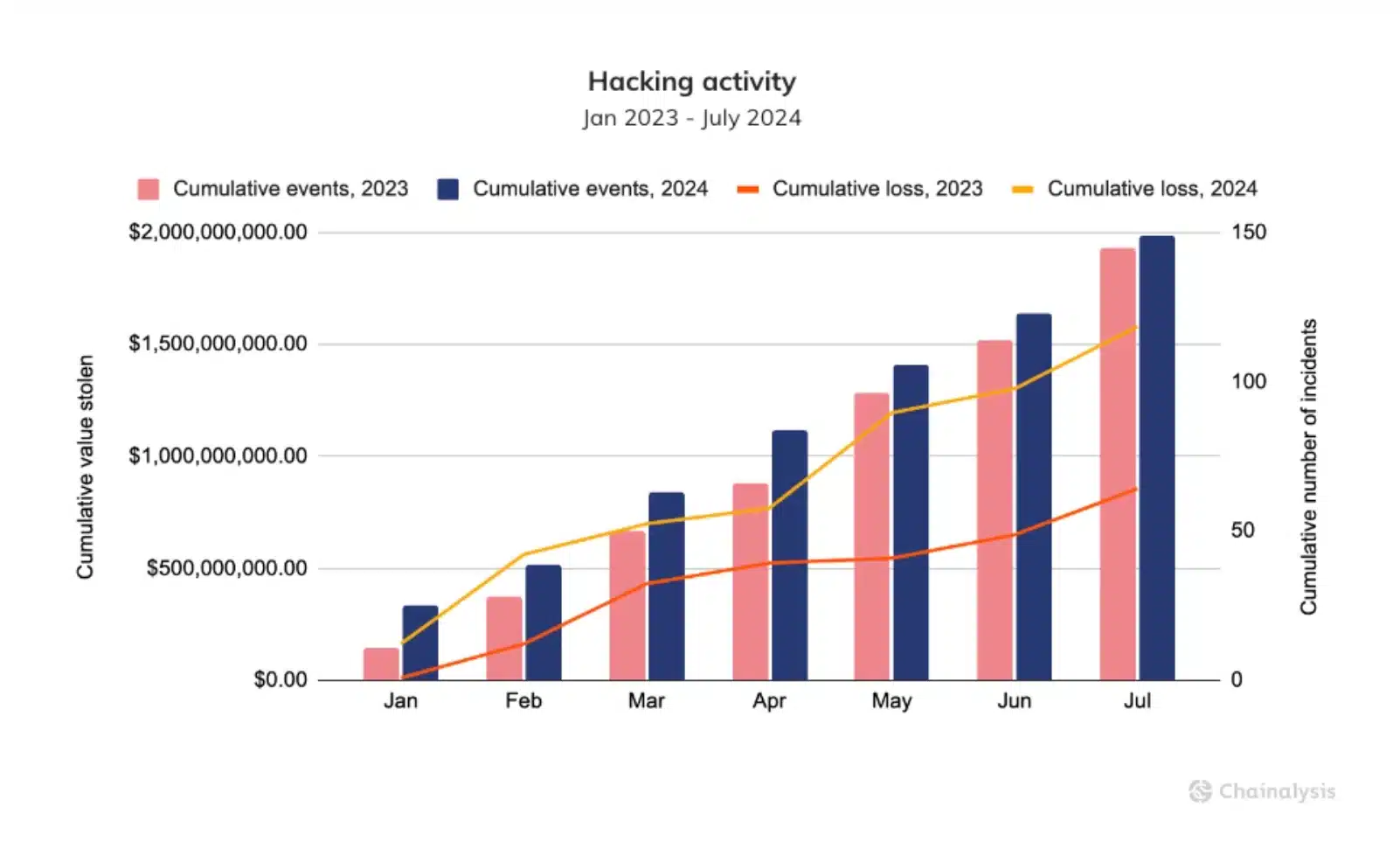

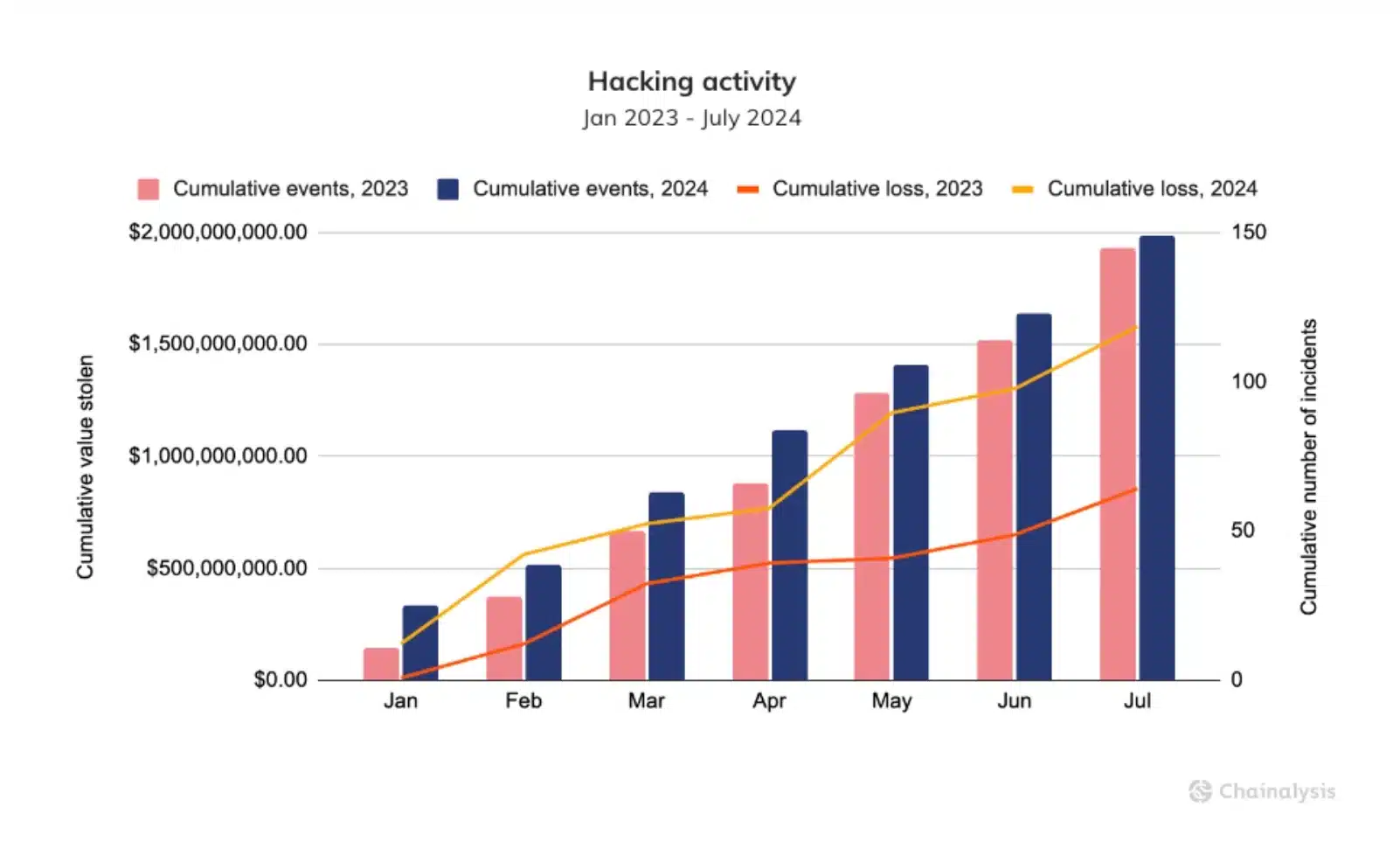

As per the report, crypto thefts have nearly doubled year-over-year, escalating from $857 million to $1.58 billion.

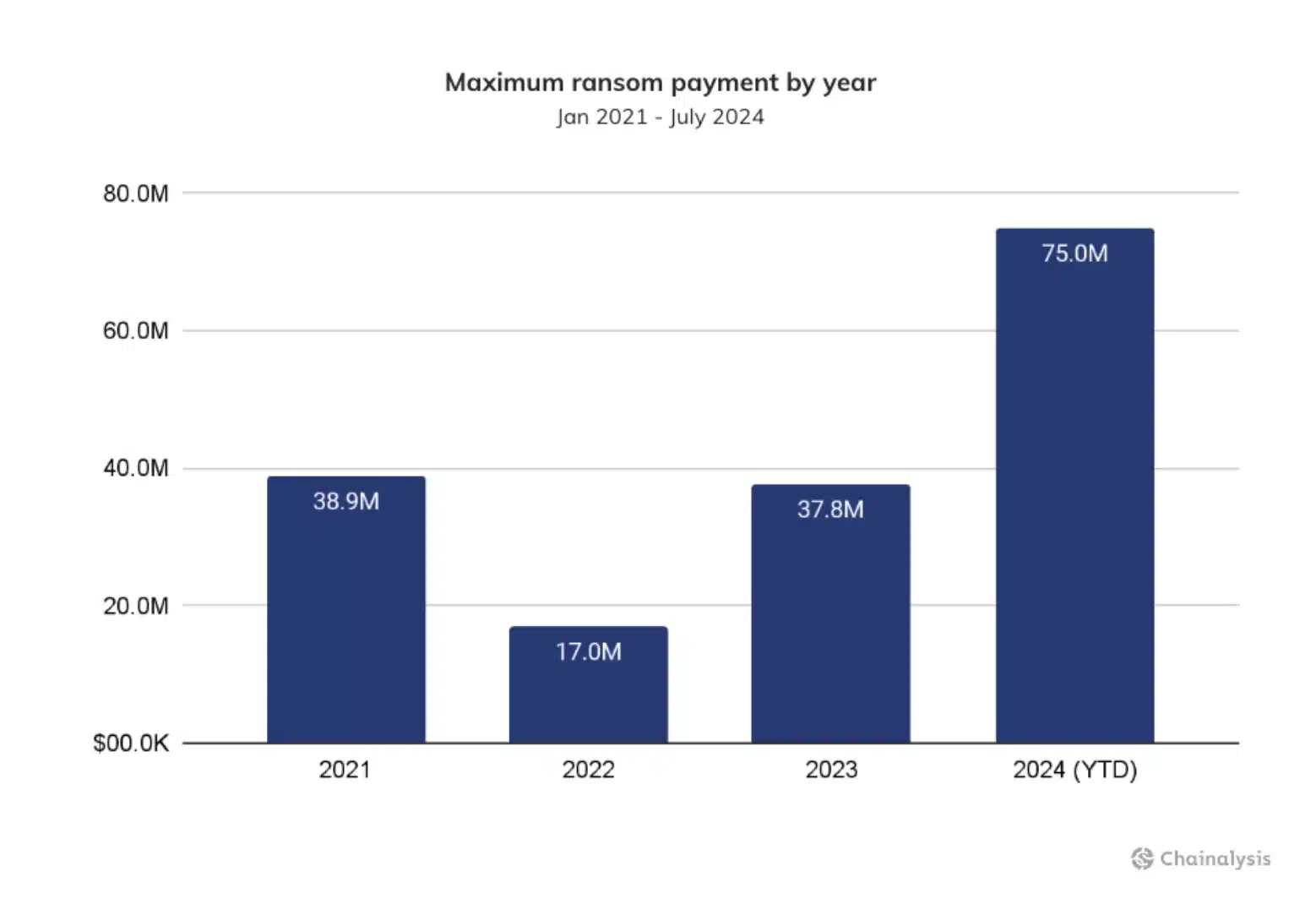

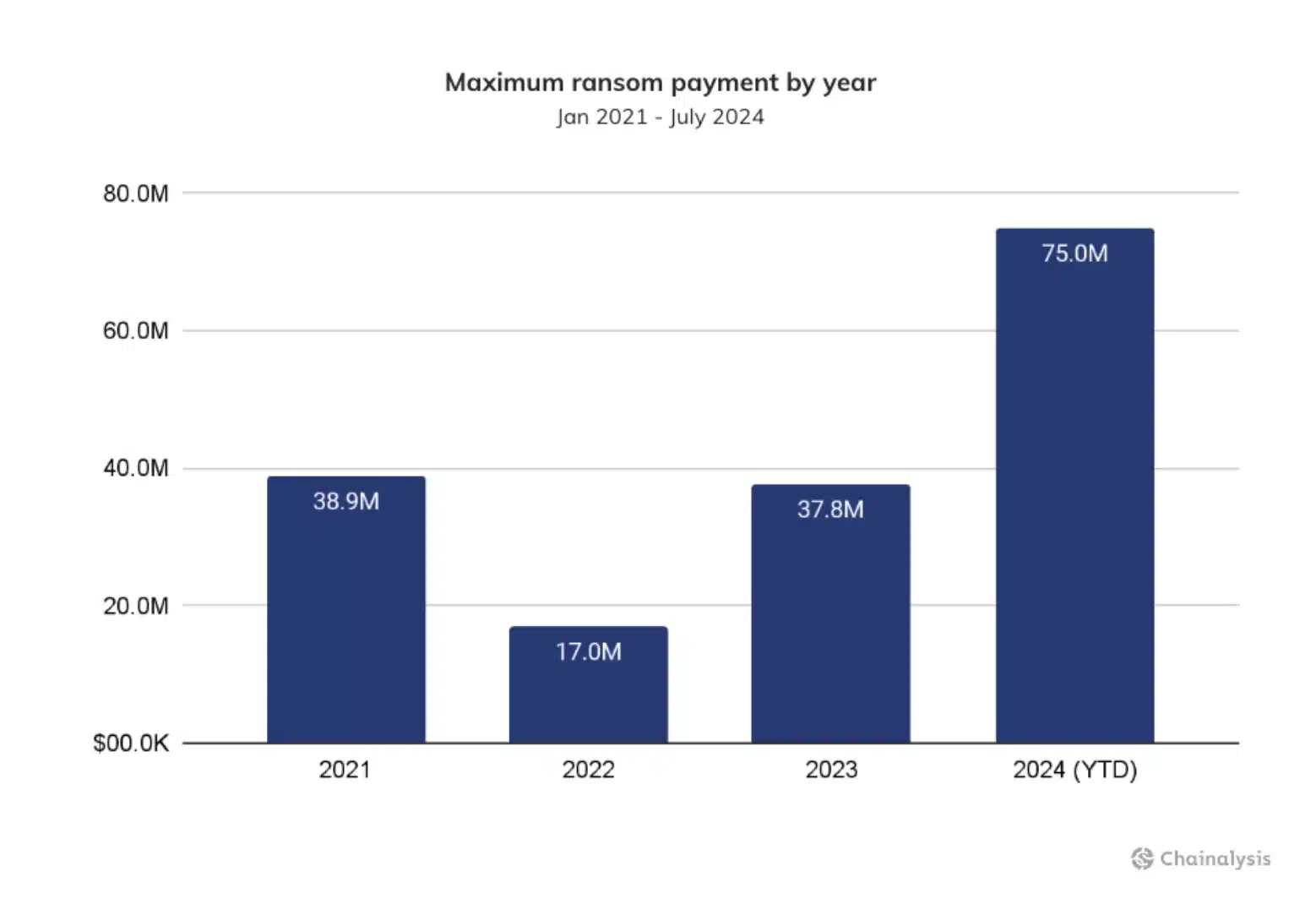

Additionally, ransomware inflows have seen a slight hike too, indicating the possibility of a record-setting year for these types of crimes.

“2024 has seen the largest ransomware payment ever recorded at approximately $75 million to the Dark Angels ransomware group.”

Source: Chainalysis

The analysis also revealed a sharp resurgence in hacking activity in 2024, with stolen crypto funds hitting $1.58 billion — An 84.4% increase from last year. Additionally, although the number of incidents rose only slightly, the average stolen per event surged by 79.46%, from $5.9 million in 2023 to $10.6 million in 2024.

Source: Chainalysis

This uptick has been largely driven by a significant rise in asset prices, notably Bitcoin [BTC], which more than doubled from an average of $26,141 to $60,091.

Expressing his frustration, Jardine added,

“It is highly encouraging to see that criminal activity continues to become an ever-shrinking share of the crypto ecosystem.”

Not all negative!

As is obvious, the report also highlighted a troubling correlation between the rise in ransomware and rising stolen funds, with some major heists linked to organized groups, including those from North Korea.

However, despite this surge in high-profile cybercrime, there is a positive trend within the crypto sector.

According to the firm’s analysis, there has been a notable shift in crypto-theft trends. Bitcoin’s share of transaction volume from stolen funds has increased from 30% last year to 40% this year, reflecting a change in the types of targets.

On the other hand, centralized services, especially exchanges like DMM—which lost $305 million and had 4500 BTC stolen—are now major targets.

This shift suggests that after four years of focusing on decentralized platforms, thieves are returning to centralized exchanges, which handle significant Bitcoin transactions.

Actions to strengthen security

Since most crypto-related crimes are conducted on the blockchain, law enforcement can track and analyze these transactions to effectively understand and break up criminal operations.

As Camichel, a researcher with eCrime.ch, said,

“I believe takedowns and law enforcement actions like Operation Cronos, Operation Duck Hunt, and Operation Endgame are essential in curbing these activities and signaling that criminal actions will have consequences.”

- Crypto thefts and ransomware surged in 2024, with record-breaking payments and stolen funds

- Bitcoin’s share in stolen funds rose while centralized exchanges became prime hacking targets too

Cryptocurrencies have steadily gained mainstream traction in 2024, with the same marked by numerous positive developments on several fronts. However, it hasn’t exactly been smooth sailing for this asset class.

Troubling crypto trends

While overall illicit activity has fallen to year-to-date levels, compared to previous years, certain troubling trends have emerged too.

Throwing further light on the same, a recent survey conducted by Chainalysis revealed,

“Aggregate illicit activity fell YTD by 19.6%, dropping from $20.9B to $16.7B, demonstrating that legitimate activity is growing faster than illicit activity on-chain.”

Notably, according to Eric Jardine, Cybercrimes Research Lead at Chainalysis, inflows into legitimate crypto services have reached their highest level since the 2021 bull market peak. She added,

“The growth of legitimate activity outpacing that of illicit activity on-chain demonstrates the continued transition of cryptocurrencies to the mainstream.”

Side effects of rising crypto adoption

Despite such progress, however, greater inflows into cybercrime-related entities suggested that while crypto’s mainstream adoption grows, so does its exploitation by malicious actors.

Source: Chainalysis

As per the report, crypto thefts have nearly doubled year-over-year, escalating from $857 million to $1.58 billion.

Additionally, ransomware inflows have seen a slight hike too, indicating the possibility of a record-setting year for these types of crimes.

“2024 has seen the largest ransomware payment ever recorded at approximately $75 million to the Dark Angels ransomware group.”

Source: Chainalysis

The analysis also revealed a sharp resurgence in hacking activity in 2024, with stolen crypto funds hitting $1.58 billion — An 84.4% increase from last year. Additionally, although the number of incidents rose only slightly, the average stolen per event surged by 79.46%, from $5.9 million in 2023 to $10.6 million in 2024.

Source: Chainalysis

This uptick has been largely driven by a significant rise in asset prices, notably Bitcoin [BTC], which more than doubled from an average of $26,141 to $60,091.

Expressing his frustration, Jardine added,

“It is highly encouraging to see that criminal activity continues to become an ever-shrinking share of the crypto ecosystem.”

Not all negative!

As is obvious, the report also highlighted a troubling correlation between the rise in ransomware and rising stolen funds, with some major heists linked to organized groups, including those from North Korea.

However, despite this surge in high-profile cybercrime, there is a positive trend within the crypto sector.

According to the firm’s analysis, there has been a notable shift in crypto-theft trends. Bitcoin’s share of transaction volume from stolen funds has increased from 30% last year to 40% this year, reflecting a change in the types of targets.

On the other hand, centralized services, especially exchanges like DMM—which lost $305 million and had 4500 BTC stolen—are now major targets.

This shift suggests that after four years of focusing on decentralized platforms, thieves are returning to centralized exchanges, which handle significant Bitcoin transactions.

Actions to strengthen security

Since most crypto-related crimes are conducted on the blockchain, law enforcement can track and analyze these transactions to effectively understand and break up criminal operations.

As Camichel, a researcher with eCrime.ch, said,

“I believe takedowns and law enforcement actions like Operation Cronos, Operation Duck Hunt, and Operation Endgame are essential in curbing these activities and signaling that criminal actions will have consequences.”

buy generic clomiphene without prescription can i buy cheap clomiphene no prescription how to buy cheap clomid can you get generic clomiphene prices can i buy generic clomiphene without prescription cost generic clomiphene for sale how can i get clomiphene price

I’ll certainly bring to skim more.

Thanks on putting this up. It’s well done.

azithromycin 500mg generic – ciplox 500mg uk flagyl 400mg canada

domperidone medication – buy domperidone 10mg online cheap flexeril us

order generic inderal 10mg – methotrexate 2.5mg cost methotrexate 10mg without prescription

buy azithromycin generic – buy tindamax without a prescription purchase nebivolol

brand augmentin 1000mg – atbioinfo buy acillin pill

buy warfarin generic – https://coumamide.com/ order losartan sale

buy mobic 15mg for sale – tenderness mobic 15mg brand

order deltasone 40mg pills – adrenal prednisone online order

where to buy ed pills – fastedtotake best pills for ed

order amoxil without prescription – https://combamoxi.com/ purchase amoxicillin for sale

buy generic forcan – order fluconazole 100mg without prescription buy fluconazole 100mg sale

purchase cenforce generic – https://cenforcers.com/# cenforce 50mg over the counter

cialis super active vs regular cialis – https://ciltadgn.com/# reliable source cialis

buy zantac online – zantac 300mg generic ranitidine 300mg cost

super cialis – whats the max safe dose of tadalafil xtenda for a healthy man over the counter cialis walgreens

Proof blog you have here.. It’s severely to on great worth script like yours these days. I truly respect individuals like you! Go through care!! como comprar synthroid

buy viagra in mexico – https://strongvpls.com/# viagra cheap online

Greetings! Utter serviceable recommendation within this article! It’s the scarcely changes which liking espy the largest changes. Thanks a a quantity quest of sharing! cheap furosemide

With thanks. Loads of erudition! https://ursxdol.com/clomid-for-sale-50-mg/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/metoprolol-25-mg-tablets/

This website really has all of the tidings and facts I needed to this participant and didn’t identify who to ask. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

Thanks for putting this up. It’s well done. https://ondactone.com/simvastatin/

This is the big-hearted of literature I rightly appreciate. https://myvisualdatabase.com/forum/profile.php?id=118018