- Bitcoin has fallen 22.5% from its peak, with current minor gains insufficient for recovery.

- Recent futures market data suggests a bearish sentiment, potentially setting the stage for future bullish trends.

Over the past weeks, Bitcoin [BTC] has recorded a significant plunge in its value, dropping by 22.5% from its all-time high above $73,000 in March.

Although the asset has struggled to make a rebound this week following the ‘Red Monday’ it has not been enough. Currently, BTC is up by 0.6% in the past 24 hours however, the asset is still down by 11% on the 7-day chart.

Futures market sentiment

ShayanBTC, an analyst from CryptoQuant, shared insights on the Quicktake platform highlighting the impact of perpetual markets and long-squeeze events on Bitcoin’s price.

According to Shayan, the key driver behind Bitcoin’s recent price drop could be attributed to increased selling activity within these markets. This was further evidenced by the sharp drop in funding rates, a vital indicator of market sentiment.

Funding rates have recently turned negative, signaling a bearish sentiment dominated by short sellers. This shift suggests that the futures market is cooling down, potentially setting the stage for a more stable bullish trend in the future.

Shayan particularly noted:

“The funding rates have now turned negative, reflecting an overall bearish sentiment and the dominance of short sellers. However, this could also be seen as a positive sign, as it suggests the futures market is no longer overheated. This scenario could create conditions for a more sustainable bullish trend in the coming months, provided there are no drastic changes.”

Bitcoin recovery on the horizon?

Despite the gloomy short-term outlook, there are indicators that suggest a potential path to recovery.

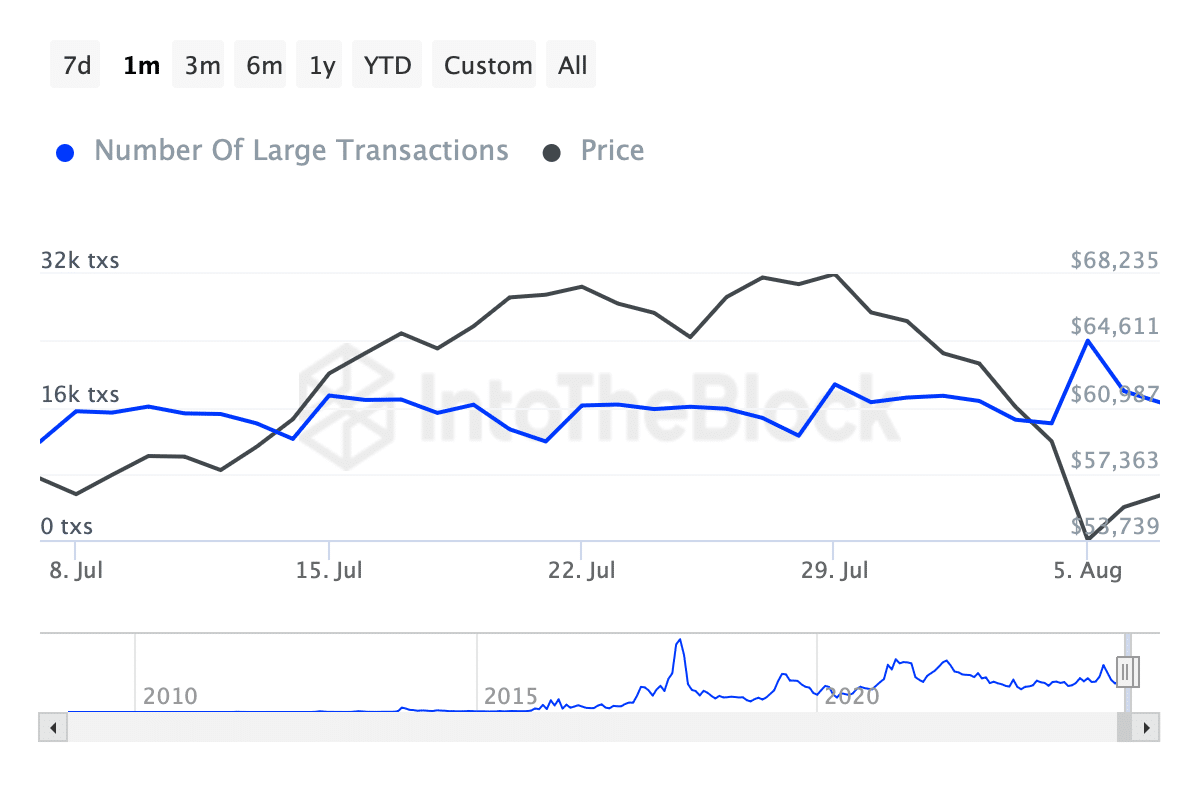

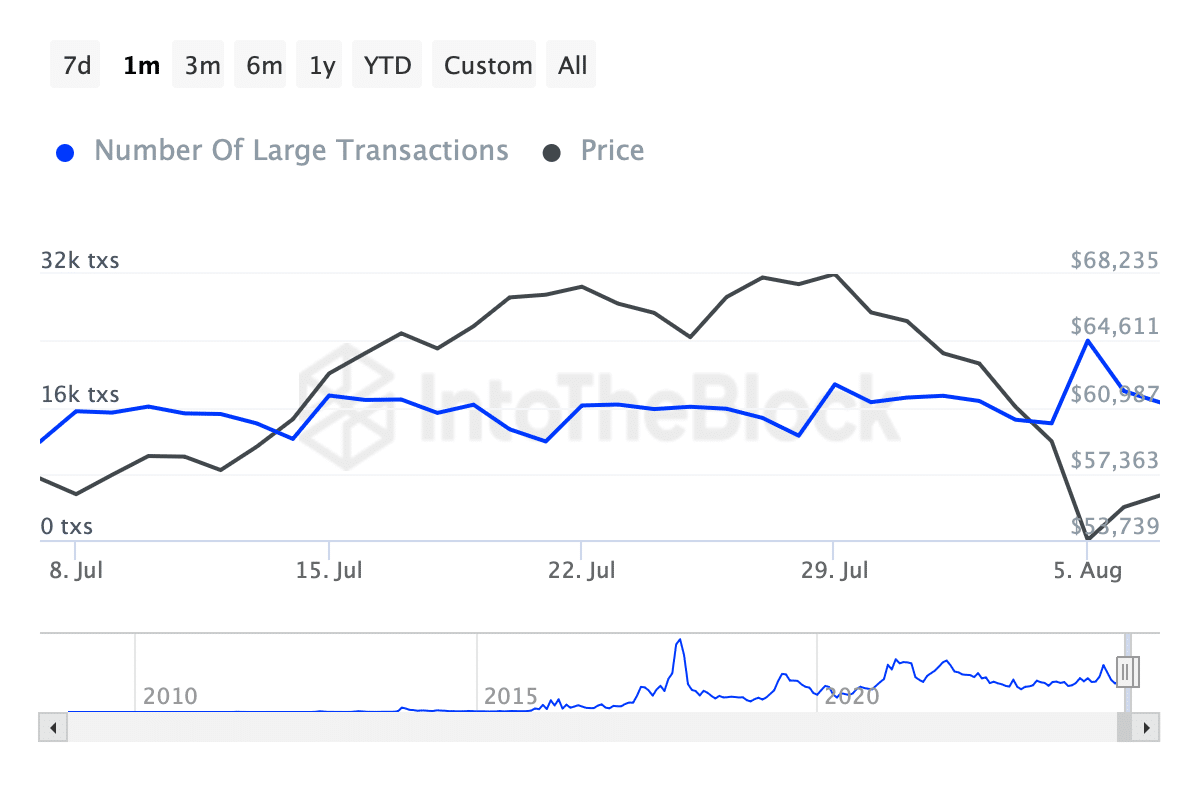

Data from IntoTheBlock shows an increase in large Bitcoin transactions (exceeding $100,000), which spiked from below 16,000 to over 23,000 transactions on 5th August, before settling at around 16,560 today.

Source: IntoTheBlock

This fluctuation in whale activity could signify renewed interest from large investors, possibly hinting at a strategic accumulation of assets at lower prices.

Is your portfolio green? Check out the BTC Profit Calculator

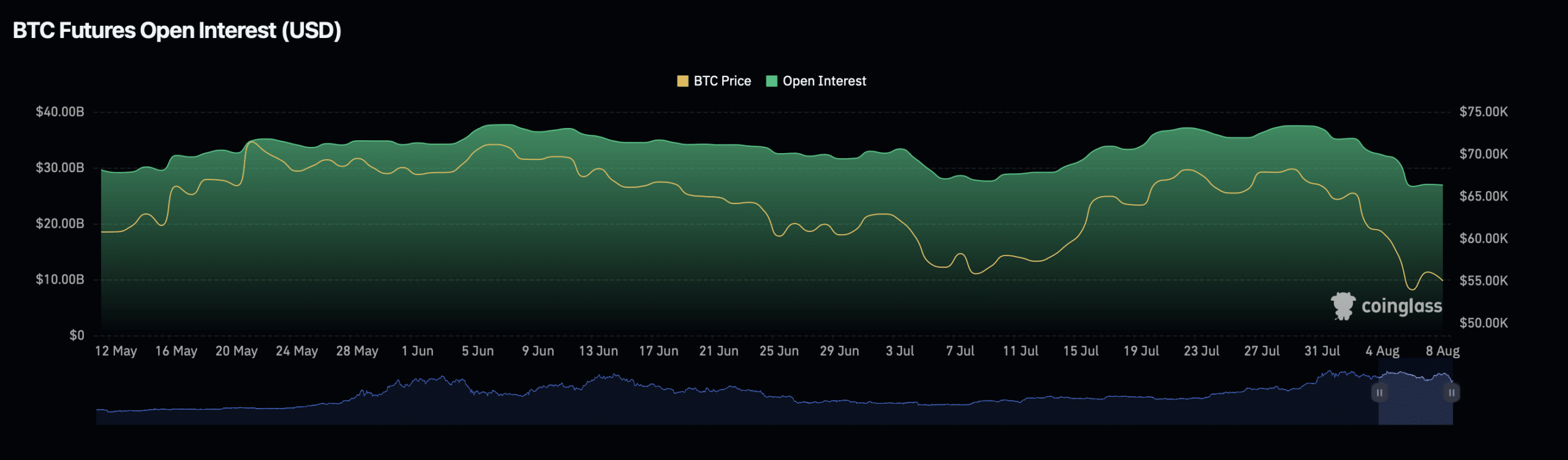

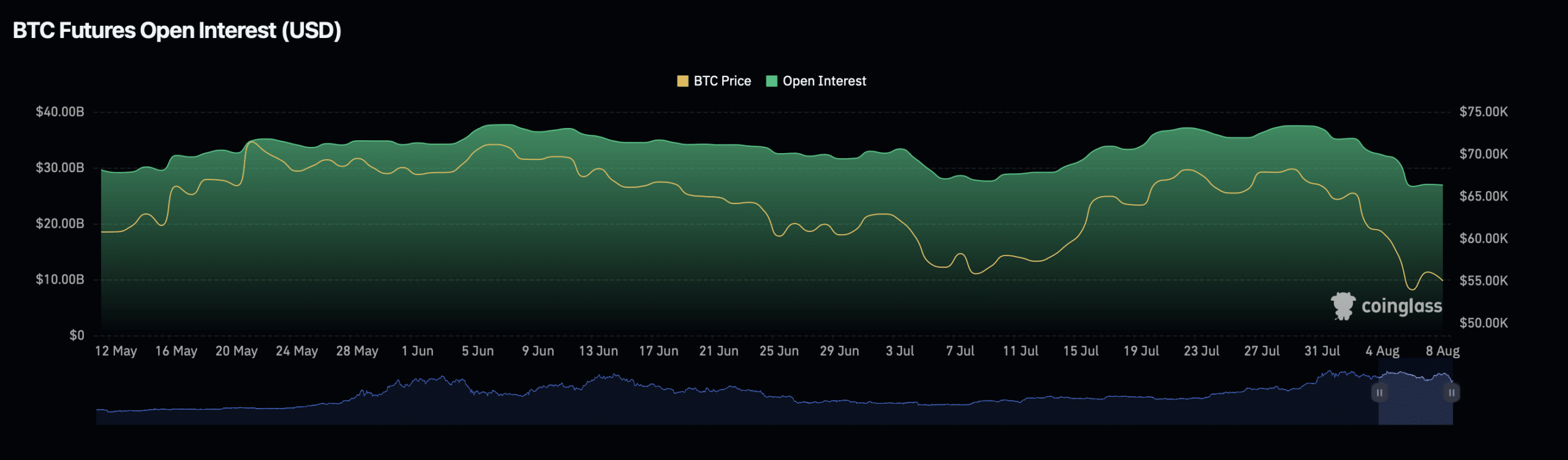

Additionally, Bitcoin’s open interest has seen a slight decline of 0.2% in the past day, totaling approximately $27.56 billion. This coincides with a 7% drop in open interest volume, which now stands at $76.14 billion.

Source: Coinglass

These shifts in open interest metrics could indicate a cooling off of leveraged positions, possibly reducing the risk of further long squeezes and contributing to market stabilization.

- Bitcoin has fallen 22.5% from its peak, with current minor gains insufficient for recovery.

- Recent futures market data suggests a bearish sentiment, potentially setting the stage for future bullish trends.

Over the past weeks, Bitcoin [BTC] has recorded a significant plunge in its value, dropping by 22.5% from its all-time high above $73,000 in March.

Although the asset has struggled to make a rebound this week following the ‘Red Monday’ it has not been enough. Currently, BTC is up by 0.6% in the past 24 hours however, the asset is still down by 11% on the 7-day chart.

Futures market sentiment

ShayanBTC, an analyst from CryptoQuant, shared insights on the Quicktake platform highlighting the impact of perpetual markets and long-squeeze events on Bitcoin’s price.

According to Shayan, the key driver behind Bitcoin’s recent price drop could be attributed to increased selling activity within these markets. This was further evidenced by the sharp drop in funding rates, a vital indicator of market sentiment.

Funding rates have recently turned negative, signaling a bearish sentiment dominated by short sellers. This shift suggests that the futures market is cooling down, potentially setting the stage for a more stable bullish trend in the future.

Shayan particularly noted:

“The funding rates have now turned negative, reflecting an overall bearish sentiment and the dominance of short sellers. However, this could also be seen as a positive sign, as it suggests the futures market is no longer overheated. This scenario could create conditions for a more sustainable bullish trend in the coming months, provided there are no drastic changes.”

Bitcoin recovery on the horizon?

Despite the gloomy short-term outlook, there are indicators that suggest a potential path to recovery.

Data from IntoTheBlock shows an increase in large Bitcoin transactions (exceeding $100,000), which spiked from below 16,000 to over 23,000 transactions on 5th August, before settling at around 16,560 today.

Source: IntoTheBlock

This fluctuation in whale activity could signify renewed interest from large investors, possibly hinting at a strategic accumulation of assets at lower prices.

Is your portfolio green? Check out the BTC Profit Calculator

Additionally, Bitcoin’s open interest has seen a slight decline of 0.2% in the past day, totaling approximately $27.56 billion. This coincides with a 7% drop in open interest volume, which now stands at $76.14 billion.

Source: Coinglass

These shifts in open interest metrics could indicate a cooling off of leveraged positions, possibly reducing the risk of further long squeezes and contributing to market stabilization.

The aim whereas taking prednisone ought to be to slow down or stop the load gain, and not fear about shedding weight.

The longer time you take prednisone, the extra doubtless you’re to

achieve weight. Surprisingly, in the first few weeks, it’s possible to lose weight

as a end result of prednisone causes lipolysis, a

breakdown of fats cells, at first. Later, prednisone causes the alternative

impact and makes fats cells enlarge. A dietitian specializing in weight management may be extremely useful during or after prednisone treatment.

Most insurance plans cowl nutrition services with registered dietitians, especially for medical conditions, making them more

reasonably priced.

Moon face could appear throughout the first two

months of steroid therapy, although the chance is dependent upon dosage and length of remedy.

One research seemed at the results of taking 20 milligrams or

more of corticosteroids over a protracted interval. Amongst the 88 individuals, 61

% developed what are known as Cushingoid options — which might embody moon face — at three months.

After 12 months of therapy, virtually 70 % of individuals had developed such options.

While it’s a standard and innocent facet effect of corticosteroid use, it may

possibly have an effect on the finest way you feel about yourself.

If your appearance is bothering you, discuss to your healthcare provider about different

therapy options or methods you’ll be able to scale back the puffiness.

If you have to proceed along with your present remedy, contemplate becoming a member of a help group so

you’ll be able to connect with others in your footwear.

This can increase your urge for food, leading to weight

acquire, and specifically lead to further deposits of fat

in your abdomen. A 2016 research by BMC Drugs found that anabolic

steroid remedy helped overweight males lose extra fats and protect muscle throughout weight loss in comparison with a placebo.

The Mediterranean diet is amongst the healthiest eating habits in the

world, and a key way to reverse prednisone weight gain. It’s versatile,

stuffed with flavour and filled with well being benefits

like improved coronary heart well being, decreased inflammation,

and risk sort 2 diabetes. Are you dwelling with inflammatory bowel disease and taking prednisone to handle your symptoms?

Second, excessive aromatase and estrogen exercise reduces the production of gonadotropin-releasing hormone

(GRH). Lack of GRH results in decrease levels of luteinizing hormone, which in flip reduces the manufacturing

of testosterone (12, 13). Some customers choose stacking Tren with

different steroids such as testosterone as a outcome of T-levels rise too much on their

own during a Tren cycle making Tren a little too intense

for some customers. If you would possibly be unhappy with the adjustments to your weight and look, your physician might adjust your steroid dosage or explore various remedies.

Regular bodily exercise can help you handle your weight and enhance your total well being.

Purpose to stay as active as potential, but all the

time in consultation with your doctor. Steroids impression the way our our bodies metabolize (break down and use) fat.

Intermittent fasting could be an effective way to shed weight, offered

your care team recommends it. Still, ask your doctor if any different medications or treatments would maintain your health with out the additional pounds.

If you wish to lose a couple of further pounds that you’ve put on since

taking a weight gain-inducing medication, you’re already on the proper track.

In short, bodybuilding gear Steroids [cs.transy.Edu] are often seen as a shortcut

for faster fat loss in the health world, but they arrive

with complexities.

They also assist to suppress the immune system, so healthy cells aren’t attacked.

Such physiological modifications in hormones

and brain chemistry may also improve the probabilities of a male getting a girlfriend.

However, the longevity of such relationships can also depend upon her view on steroids.

You won’t obtain treatments particularly to scale back your

moon face. These are danger components for Cushing’s syndrome and for hypothyroidism.

Not everybody with these circumstances will develop moon face, however it’s

a frequent symptom of each. For example, taking prednisone can even trigger you to

lose bone minerals.

That said, it would be sensible to extend slowly over the course of

years and years. Start with 75mg per week, and improve solely after you’re

100 percent certain you probably can deal with the unwanted side effects.

This Trenbolone Fats Loss process will increase the variety of fatty acids in your blood, while Tren also reduces lipogenesis (the storage of fat).

From my expertise, it’s extra of a “side effect” than the top aim, however there are nonetheless many Tren customers who want to

know if Tren burns fat and how efficient it really is.

The longer you’re taking prednisone, the extra probably

you would possibly be to experience these side effects. Let’s speak about what

prednisone is, why it can trigger weight gain, and what

you can do about it.

Dianabol provides you spectacular muscle positive aspects inside a couple

of short weeks. Masteron is popular amongst bodybuilders

as a slicing compound. That’s as a end result of solely people who

are already very lean see its most potential.

Moon face is when fats deposits construct up alongside the edges of your face, inflicting severe

swelling. Moon face is a typical aspect effect of corticosteroid use and a symptom of sure health conditions.

Though harmless, the situation can have an result on your shallowness.

The medical term for that is moon facies, but different individuals name it cortisol face.

It could be the most optimum low season compound because

of it demonstrating important anabolism without high levels of cardiotoxicity.

Testosterone will accelerate subcutaneous fats loss and considerably enhance muscle hypertrophy and

energy. Slicing is a crucial section for a bodybuilder, where the objective is to burn fat whereas retaining muscle mass gained from

the previous bulk. It doesn’t produce exceptional

muscle hypertrophy; nevertheless, it’s generally utilized in bodybuilding and makes our prime 5 listing as

a outcome of its execs largely outweigh its cons. If a bodybuilder

measured the success of their bulk purely by weight acquire, trenbolone would not be one

of the best steroid to take.

Stay tuned as we uncover the essentials of choosing the proper oral steroid on your wants.

The chopping stack is one of their bestselling complement stack that options some superb authorized steroid supplements that can assist

you to drop right down to single digit body fats levels.

But the largest cause is that steroids give athletes an edge

at muscle constructing, quick muscle gain, rapid fats loss, gaining strength and muscle

recovery. Legal oral steroids are perfect for athletes who want

dependable results without risking long-term health.

Skilled bodybuilders often incorporate mixtures of steroids, often known as “stacking,” to maximise results.

Stacking often contains each anabolic steroids and ancillary medicine,

requiring an in-depth understanding of every compound’s interactions.

Male bodybuilders often go for testosterone-based cycles,

like Testosterone Enanthate or Testosterone Cypionate, to enhance muscle mass

and strength.

These steroids work synergistically to assist users shed physique fats

while preserving lean muscle mass during a slicing section. When used collectively in a cycle, this stack can help people obtain a leaner and extra outlined physique

by accelerating fat loss and maintaining Muscle steroids side effects mass.

It is important to notice that steroid use ought to always be carried out with proper knowledge, warning, and

under medical supervision. Choosing a steroid stack that’s appropriate for

slicing part goals is crucial for maximizing outcomes. Individuals aiming to cut body fat whereas preserving lean muscle mass

should select steroids that specifically target fats loss and

promote a lean physique.

Winstrol commands respect for its ability to sculpt a hard,

outlined physique. Its stature because the second most popular oral steroid speaks volumes about its effectiveness, significantly for individuals aiming to acquire solid muscle on a

slightly heavier body. Much like its counterparts, Winstrol requires considered use as

it can introduce stress to the liver. Oral steroids have climbed the ranks to

turn out to be a cornerstone in treating a slew of medical conditions, starting

from bronchial asthma to most cancers. They’re powerful, they’re potent, they usually promise vital outcomes.

If you’re like us, then you definitely’d wish to proceed your muscle development while you are making an attempt to lose fats.

A lot of instances, first timers are overwhelmed by the concept of stacking supplements.

Right until you finish the section and attain your required physique composition, the totally different steroids kick

in and hold doing their bit. Then CrazyBulk got here along with its vary of bodybuilding supplements and every

little thing changed eternally. The content material presented

in this article is meant for informational and academic functions only.

It shouldn’t be thought of a substitute for professional medical recommendation, prognosis, or

remedy.

Testosterone suspension just isn’t recommended for beginners because of its fast-acting nature, being pure

testosterone in water. Thus, it requires two injections

per day to maintain peak serum testosterone levels within the bloodstream.

The Animal M-Stak is a high-quality supplement designed to help athletes and health enthusiasts obtain their

targets. This product is manufactured by Animal, a good brand

that’s known for producing top-notch supplements that ship results.

Chopping stacks goal to increase your metabolic fee, decrease emotions of hunger, reduce water retention, and

ultimately depart you wanting leaner and extra defined.

Given the identified unwanted facet effects of extreme amounts of caffeine (detailed

above), it’s finest to not push your limits by taking a pre-workout complement

and a cutting stack. We dropped from consideration any chopping stack

supplements that didn’t have a minimum of one ingredient that

may contribute to a optimistic, anabolic hormonal profile.

In conclusion, Animal Stak is the proper complement for many who are serious about attaining their fitness targets.

With its distinctive mix of pure components, it supplies

a protected and efficient method to increase testosterone and development hormone

ranges, whereas additionally blocking estrogen. The comfort of the signature packs makes it simple to

take, and the trusted reputation of Animal ensures that you simply’re getting a quality product.

When it involves attaining a lean and ripped physique, many bodybuilders and

health lovers turn to steroid stacks for chopping. However, with so many choices out there out there,

it can be overwhelming to decide on one of the best steroid stack on your objectives and needs.

how to get cheap clomid pill clomid rx for men buy clomiphene no prescription can you get cheap clomiphene online where to get cheap clomiphene clomiphene order cost of clomid at cvs

This is the compassionate of scribble literary works I rightly appreciate.

70918248

References:

examples of anabolic steroids – Cameron –

buy zithromax pills – ofloxacin 400mg us order flagyl generic

buy semaglutide 14 mg without prescription – purchase rybelsus generic brand cyproheptadine 4mg

70918248

References:

none (https://nucleusgaming.us/)

generic motilium – buy domperidone online cheap flexeril generic

inderal 20mg price – order clopidogrel 150mg online cheap buy methotrexate medication

augmentin 375mg price – atbioinfo.com ampicillin ca

purchase nexium sale – anexa mate buy esomeprazole 20mg

prednisone 10mg canada – https://apreplson.com/ purchase deltasone online

buy ed pills usa – best ed drugs generic ed pills

amoxicillin us – cheap amoxil pill how to get amoxil without a prescription

diflucan ca – order diflucan 200mg generic buy diflucan paypal

order cenforce 50mg for sale – https://cenforcers.com/ cost cenforce

buy tadalafil online no prescription – https://ciltadgn.com/ tadalafil no prescription forum

generic tadalafil canada – https://strongtadafl.com/ tadalafil how long to take effect

order ranitidine 300mg generic – where to buy ranitidine without a prescription how to get zantac without a prescription

hard sale evolution viagra salesman – https://strongvpls.com/# buy viagra online

Thanks an eye to sharing. It’s acme quality. https://buyfastonl.com/gabapentin.html

More posts like this would prosper the blogosphere more useful. prednisolona 5 mg para que sirve en adultos

With thanks. Loads of conception! https://ursxdol.com/get-metformin-pills/

More peace pieces like this would urge the интернет better. https://prohnrg.com/

Thanks an eye to sharing. It’s acme quality. https://aranitidine.com/fr/acheter-cialis-5mg/

Greetings! Utter serviceable suggestion within this article! It’s the crumb changes which will turn the largest changes. Thanks a a quantity quest of sharing! https://ondactone.com/product/domperidone/

More posts like this would make the online time more useful.

https://doxycyclinege.com/pro/meloxicam/

Thanks on putting this up. It’s well done. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=487600

order dapagliflozin 10mg sale – click purchase dapagliflozin generic

orlistat generic – this buy generic orlistat for sale

This is the gentle of criticism I rightly appreciate. http://sols9.com/batheo/Forum/User-Xbznnd