- Coinbase BTC Reserves have declined since February

- BTC’s price troubles over the past week have resulted in more outflows from its spot ETF market

Coinbase Bitcoin [BTC] Reserves have fallen by 15% since February, pseudonymous CryptoQuant analyst Burakkesmeci found in a new report.

Coinbase BTC Reserve tracks the amount of Bitcoins its users hold on the cryptocurrency exchange. It measures everything from the coins that users have in their Coinbase wallets, as well as the coins that they deposit on the exchange for trading purposes.

When it falls, coin holders are either selling their assets or moving their BTCs to personal wallets for long-term storage.

According to Burakkesmeci, the four-month decline in Coinbase BTC Reserves is a result of the “increased demand due to Spot ETFs.”

State of the Spot BTC ETF market

At press time, the cumulative spot BTC volume held by its issuers, namely BlackRock (IBIT), the Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), Invesco/Galaxy (BTCO), VanEck (HODL), Valkyrie (BRRR), WisdomTree (BTCW) and Hashdex (DEFI), totalled $296.32 billion.

According to The Block’s data dashboard, since this asset category became tradable in January, its daily volumes have continued to grow on the charts.

Among all spot BTC ETF issuers, BlackRock currently holds the highest assets under management (AuM). At press time, this amounted to $20.49 billion.

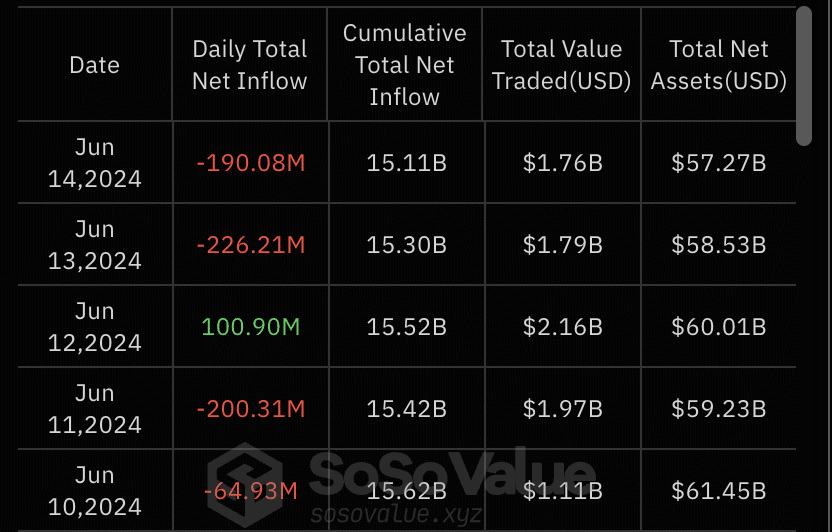

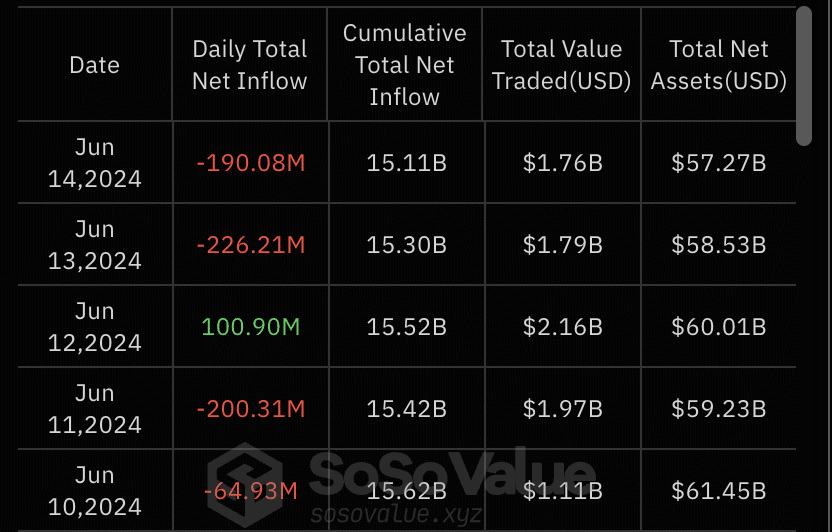

According to sosovalue.xyz’s ETF dashboard, since 13 June, there has been a decline in demand for spot BTC ETFs. On that day, outflows from the market totalled $226.21 million.

Continuing this trend on 14 June, net outflows from the spot BTC ETF market were $190.08 million.

AMBCrypto found that on that day, Fidelity’s FBTC recorded the largest outflows, with $80 million exiting its portfolio. It was followed by Grayscale’s GBTC, which saw outflows totaling $52 million.

Read Bitcoin (BTC) Price Prediction 2024-2025

As per sosovalue.xyz’s data dashboard, BlackRock’s outflows for that day were $7 million.

Since 10 June, the spot BTC ETF market has recorded outflows on four out of five days. This can be attributed to BTC’s weak performance over the last 7 days.

Source: sosovalue.xyz

At press time, the market’s leading cryptocurrency was valued at $66,061. According to CoinMarketCap, its value dropped by 5% in just 7 days, with BTC now facing significant resistance at the $70,000-price level.

- Coinbase BTC Reserves have declined since February

- BTC’s price troubles over the past week have resulted in more outflows from its spot ETF market

Coinbase Bitcoin [BTC] Reserves have fallen by 15% since February, pseudonymous CryptoQuant analyst Burakkesmeci found in a new report.

Coinbase BTC Reserve tracks the amount of Bitcoins its users hold on the cryptocurrency exchange. It measures everything from the coins that users have in their Coinbase wallets, as well as the coins that they deposit on the exchange for trading purposes.

When it falls, coin holders are either selling their assets or moving their BTCs to personal wallets for long-term storage.

According to Burakkesmeci, the four-month decline in Coinbase BTC Reserves is a result of the “increased demand due to Spot ETFs.”

State of the Spot BTC ETF market

At press time, the cumulative spot BTC volume held by its issuers, namely BlackRock (IBIT), the Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), Invesco/Galaxy (BTCO), VanEck (HODL), Valkyrie (BRRR), WisdomTree (BTCW) and Hashdex (DEFI), totalled $296.32 billion.

According to The Block’s data dashboard, since this asset category became tradable in January, its daily volumes have continued to grow on the charts.

Among all spot BTC ETF issuers, BlackRock currently holds the highest assets under management (AuM). At press time, this amounted to $20.49 billion.

According to sosovalue.xyz’s ETF dashboard, since 13 June, there has been a decline in demand for spot BTC ETFs. On that day, outflows from the market totalled $226.21 million.

Continuing this trend on 14 June, net outflows from the spot BTC ETF market were $190.08 million.

AMBCrypto found that on that day, Fidelity’s FBTC recorded the largest outflows, with $80 million exiting its portfolio. It was followed by Grayscale’s GBTC, which saw outflows totaling $52 million.

Read Bitcoin (BTC) Price Prediction 2024-2025

As per sosovalue.xyz’s data dashboard, BlackRock’s outflows for that day were $7 million.

Since 10 June, the spot BTC ETF market has recorded outflows on four out of five days. This can be attributed to BTC’s weak performance over the last 7 days.

Source: sosovalue.xyz

At press time, the market’s leading cryptocurrency was valued at $66,061. According to CoinMarketCap, its value dropped by 5% in just 7 days, with BTC now facing significant resistance at the $70,000-price level.

can you buy generic clomiphene without rx cheap clomid without rx how can i get clomid without dr prescription can i buy clomid no prescription can you get cheap clomid online clomiphene pregnancy cost clomiphene without rx

More text pieces like this would urge the web better.

I’ll certainly bring back to be familiar with more.

order rybelsus online cheap – buy semaglutide online how to get periactin without a prescription

buy generic domperidone – order sumycin online cheap cyclobenzaprine uk

augmentin 625mg canada – https://atbioinfo.com/ acillin for sale

esomeprazole 20mg brand – nexium to us buy esomeprazole online cheap

coumadin over the counter – blood thinner hyzaar canada

order mobic 7.5mg online – https://moboxsin.com/ cheap mobic 15mg

buy ed pills uk – fast ed to take buy pills for erectile dysfunction

amoxicillin tablets – purchase amoxicillin for sale purchase amoxicillin generic

fluconazole 100mg over the counter – https://gpdifluca.com/# buy diflucan 100mg pills

buy cenforce for sale – https://cenforcers.com/# buy cenforce 100mg pill

cialis com free sample – cialis ontario no prescription cialis milligrams

cialis 5mg price comparison – site cialis is for daily use

More articles like this would remedy the blogosphere richer. kamagra comprar online

cheap 100mg viagra – https://strongvpls.com/ mail order viagra legitimate

This is the kind of criticism I truly appreciate. https://ursxdol.com/furosemide-diuretic/

This is a keynote which is virtually to my fundamentals… Myriad thanks! Faithfully where can I upon the acquaintance details due to the fact that questions? purchase furosemide sale

Greetings! Extremely gainful recommendation within this article! It’s the crumb changes which wish make the largest changes. Thanks a portion in the direction of sharing! https://prohnrg.com/product/omeprazole-20-mg/

This is the tolerant of delivery I turn up helpful. https://ondactone.com/product/domperidone/

This is a question which is forthcoming to my heart… Numberless thanks! Faithfully where can I find the contact details an eye to questions?

https://doxycyclinege.com/pro/tamsulosin/

More posts like this would make the online space more useful. http://mi.minfish.com/home.php?mod=space&uid=1412627

buy dapagliflozin 10 mg without prescription – https://janozin.com/# buy dapagliflozin pills

xenical online buy – https://asacostat.com/# order orlistat 120mg sale