- Citi analysts have tipped Coinbase’s COIN for a +30% rally to $345

- They also cited increasing regulatory clarity in crypto as the major catalyst

Citigroup analysts have upgraded Coinbase shares (COIN) to ‘BUY.’ According to them, COIN could hit $345 on the charts, a 33% potential rally from its press time price of around $260.

The Citi analysts, led by Peter Christiansen, opined that the improving regulatory landscape around crypto is a major catalyst for the stated bullish outlook for COIN.

“Shifts in the U.S. Election landscape and the Supreme Court’s overturning of the long-standing Chevron precedent has changed our view on Coinbase’s regulatory risks.”

Given the increasingly conducive regulatory crypto space, Citi is now projecting an “upside opportunity” that could attract more institutional and retail capital to Coinbase and COIN.

“Potentially unlocking sidelined institutional capital, investment, and increased crypto-native and traditional finance collaboration.”

More catalysts for Coinbase

Apart from the likely easing risks on the regulatory front, the analysts pointed out some crypto-native positive factors that could further bolster Coinbase and its stock.

Coinbase’s Base, an Ethereum [ETH] L2, has seen massive traction. It is viewed by Citi analysts as “customer engagement” ripe for long-term opportunities.

To maximize on this front, the analysts have implored Coinbase to focus on increasing its Base market share to tap into possible long-term opportunities. They also cautioned that raising transaction fees could undermine active users and limit opportunities.

“The focus is on engagement, which can be measured by transactions and active users. Raising transaction fees or neglecting to lower them when the opportunity arises can create friction or give competitors a comparative advantage.”

Interestingly, the lack of a staking feature on recent U.S spot ETH ETFs was also deemed a positive catalyst. This is true for investors seeking staked ETH yields, forcing them to opt for Coinbase exchange, driving up volumes. Part of the analysis read,

“Investors who still want native yield on ETH will still have to purchase these assets on digital asset exchanges (such as Coinbase) versus within an ETF – this can support higher-margin trading volumes versus a relatively small custody fee that would be gained from ETF inflows.”

According to Citi, retail ETH flows could be staked directly into the Ethereum network. This would likely earn more rewards than the ETF fees from retail flows.

Christiansen and his team believe that the only setback and invalidation of this bullish outlook for COIN would be the continuation of the current administration’s enforcement approach.

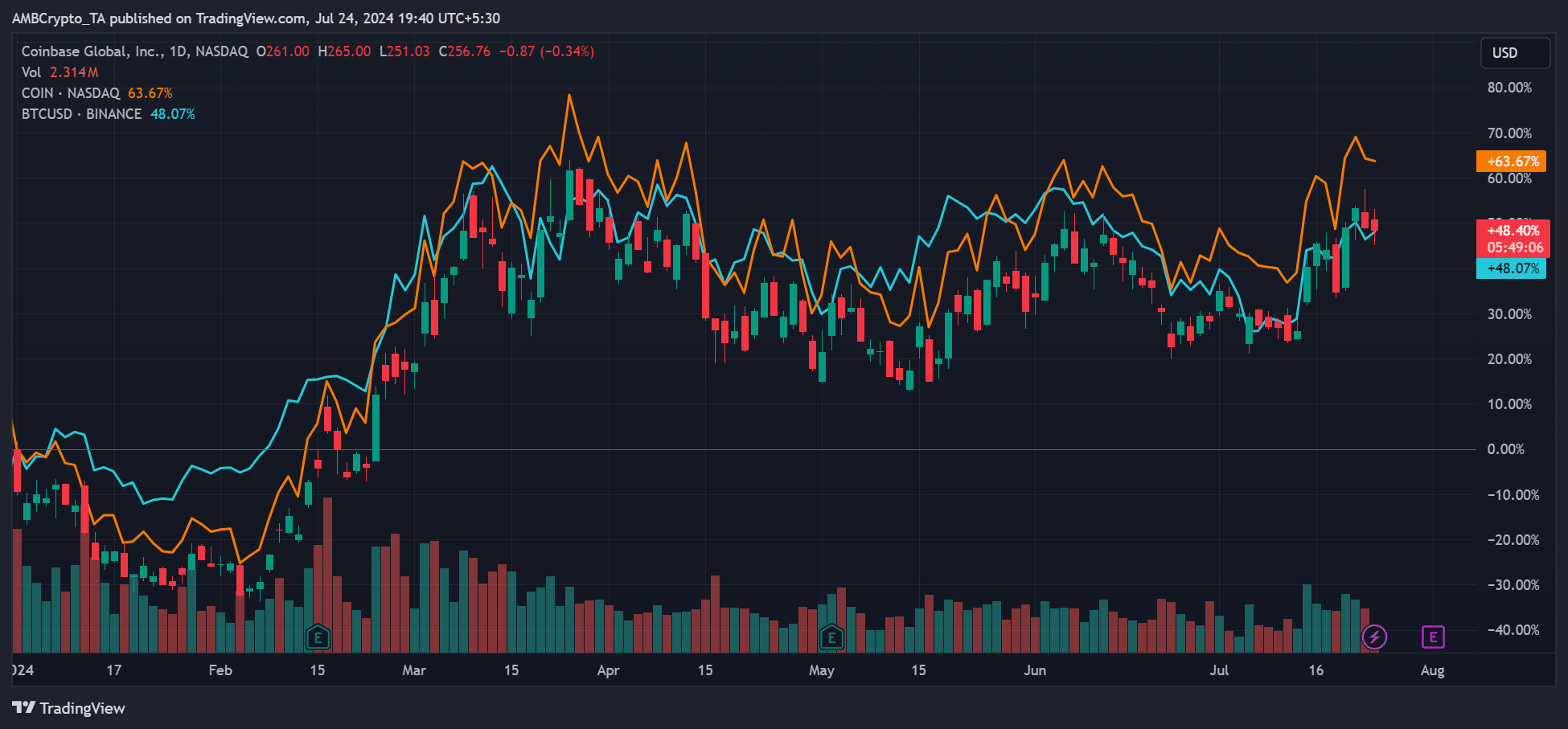

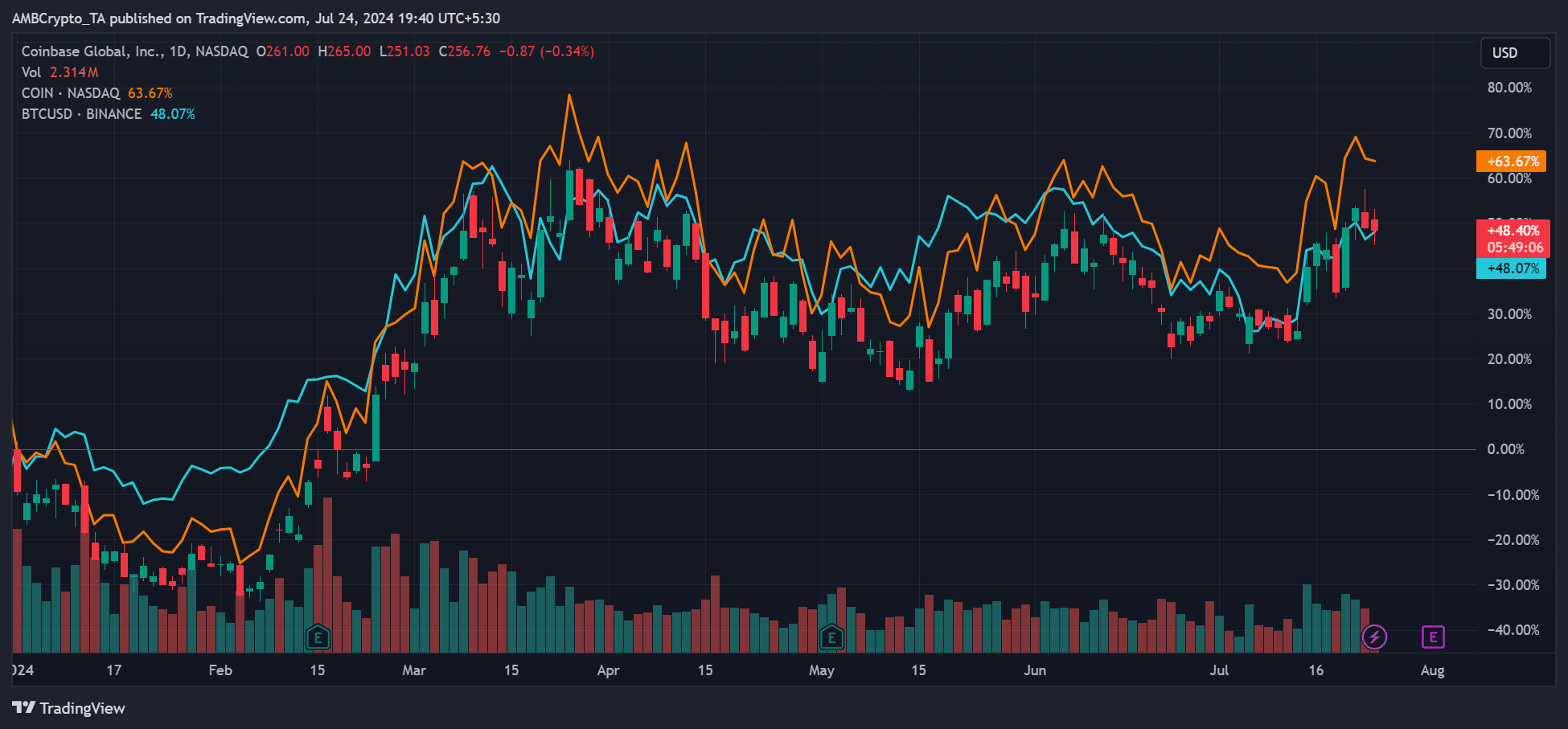

Meanwhile, at the time of writing, COIN was up 63% based on YTD (year-to-date). Compared to Bitcoin’s [BTC] 48% over the same period, COIN holders were better off with extra 15% gains.

Source: COIN vs BTC performance

- Citi analysts have tipped Coinbase’s COIN for a +30% rally to $345

- They also cited increasing regulatory clarity in crypto as the major catalyst

Citigroup analysts have upgraded Coinbase shares (COIN) to ‘BUY.’ According to them, COIN could hit $345 on the charts, a 33% potential rally from its press time price of around $260.

The Citi analysts, led by Peter Christiansen, opined that the improving regulatory landscape around crypto is a major catalyst for the stated bullish outlook for COIN.

“Shifts in the U.S. Election landscape and the Supreme Court’s overturning of the long-standing Chevron precedent has changed our view on Coinbase’s regulatory risks.”

Given the increasingly conducive regulatory crypto space, Citi is now projecting an “upside opportunity” that could attract more institutional and retail capital to Coinbase and COIN.

“Potentially unlocking sidelined institutional capital, investment, and increased crypto-native and traditional finance collaboration.”

More catalysts for Coinbase

Apart from the likely easing risks on the regulatory front, the analysts pointed out some crypto-native positive factors that could further bolster Coinbase and its stock.

Coinbase’s Base, an Ethereum [ETH] L2, has seen massive traction. It is viewed by Citi analysts as “customer engagement” ripe for long-term opportunities.

To maximize on this front, the analysts have implored Coinbase to focus on increasing its Base market share to tap into possible long-term opportunities. They also cautioned that raising transaction fees could undermine active users and limit opportunities.

“The focus is on engagement, which can be measured by transactions and active users. Raising transaction fees or neglecting to lower them when the opportunity arises can create friction or give competitors a comparative advantage.”

Interestingly, the lack of a staking feature on recent U.S spot ETH ETFs was also deemed a positive catalyst. This is true for investors seeking staked ETH yields, forcing them to opt for Coinbase exchange, driving up volumes. Part of the analysis read,

“Investors who still want native yield on ETH will still have to purchase these assets on digital asset exchanges (such as Coinbase) versus within an ETF – this can support higher-margin trading volumes versus a relatively small custody fee that would be gained from ETF inflows.”

According to Citi, retail ETH flows could be staked directly into the Ethereum network. This would likely earn more rewards than the ETF fees from retail flows.

Christiansen and his team believe that the only setback and invalidation of this bullish outlook for COIN would be the continuation of the current administration’s enforcement approach.

Meanwhile, at the time of writing, COIN was up 63% based on YTD (year-to-date). Compared to Bitcoin’s [BTC] 48% over the same period, COIN holders were better off with extra 15% gains.

Source: COIN vs BTC performance

оснащение конференц залов оснащение конференц залов .

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do it Your writing style has been amazed me Thank you very nice article

cost of cheap clomiphene without a prescription where can i get clomid without dr prescription how to get generic clomid without dr prescription buying clomid no prescription buy generic clomid get generic clomid without a prescription where buy generic clomiphene without prescription

I am actually happy to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

Thanks for sharing. It’s outstrip quality.

zithromax order – sumycin online buy buy flagyl 200mg

purchase rybelsus – order rybelsus generic order periactin 4mg pill

cost domperidone – purchase flexeril sale flexeril online buy

inderal for sale online – inderal cheap order methotrexate 5mg online cheap

brand amoxil – brand ipratropium 100mcg order ipratropium

cheap augmentin 1000mg – atbioinfo buy acillin

order esomeprazole 20mg capsules – https://anexamate.com/ buy generic nexium online

cost coumadin 2mg – https://coumamide.com/ buy generic losartan 50mg

order mobic 7.5mg for sale – tenderness brand mobic 15mg

purchase deltasone online – corticosteroid prednisone 10mg for sale

buy ed pills online usa – fast ed to take site how to get ed pills without a prescription

buy amoxicillin without a prescription – oral amoxicillin buy amoxil paypal

how to get diflucan without a prescription – https://gpdifluca.com/# order fluconazole pills

buy generic cenforce – cenforce 100mg usa cenforce oral

purchase cialis – https://ciltadgn.com/# which is better cialis or levitra

where can i buy zantac – https://aranitidine.com/# zantac tablet

cialis patent expiration – is cialis a controlled substance buy cialis shipment to russia

I am in fact happy to gleam at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. https://gnolvade.com/

download cheap viagra – click cheap viagra alternative

More text pieces like this would make the web better. https://buyfastonl.com/azithromycin.html

I am actually enchant‚e ‘ to glitter at this blog posts which consists of tons of of use facts, thanks object of providing such data. https://ursxdol.com/synthroid-available-online/

More posts like this would create the online elbow-room more useful. https://prohnrg.com/product/atenolol-50-mg-online/

This website really has all of the information and facts I needed there this case and didn’t know who to ask. click

I am in point of fact delighted to gleam at this blog posts which consists of tons of of use facts, thanks representing providing such data. https://ondactone.com/simvastatin/

This is the type of advise I find helpful.

mobic order

This is the stripe of serenity I have reading. https://www.planetglobal.de/ferienhaeuser/europa/spanien/ferienhaeuser/https://www.facer.io/u/rybelsus_1_fewo.html

More posts like this would bring about the blogosphere more useful. http://ledyardmachine.com/forum/User-Rdckkm

buy forxiga 10mg generic – https://janozin.com/# purchase forxiga pills

purchase orlistat online cheap – https://asacostat.com/# orlistat price

More content pieces like this would create the интернет better. http://zqykj.com/bbs/home.php?mod=space&uid=303464