- LINK has climbed to its highest price level in six weeks.

- Most LINK transactions continue to return profit.

Chainlink [LINK] leads the altcoin rally following its price rise to a six-week high, data from Santiment has shown.

According to the on-chain data provider, during the intraday trading session on 23rd May, the altcoin briefly exchanged hands at $17.53 before witnessing a slight retraction. A

s of this writing, LINK exchanged hands at $17, according to CoinMarketCap’s data.

LINK holders in gains

The recent surge in LINK’s price has caused it to be a significantly profitable investment for its holders.

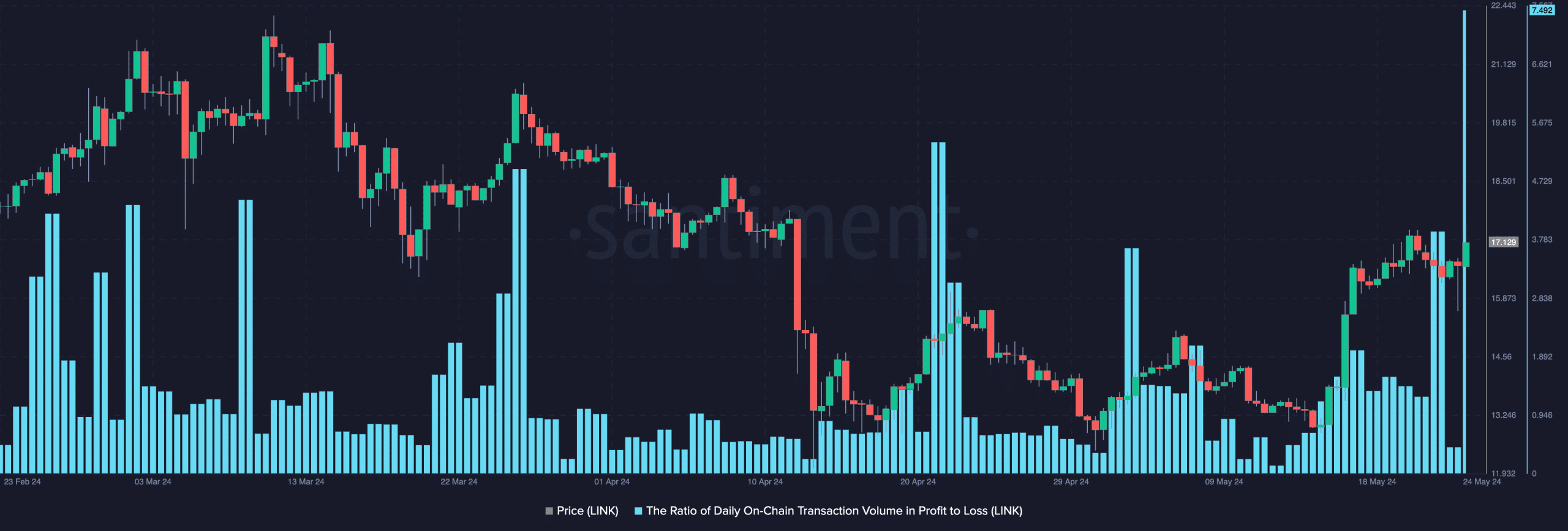

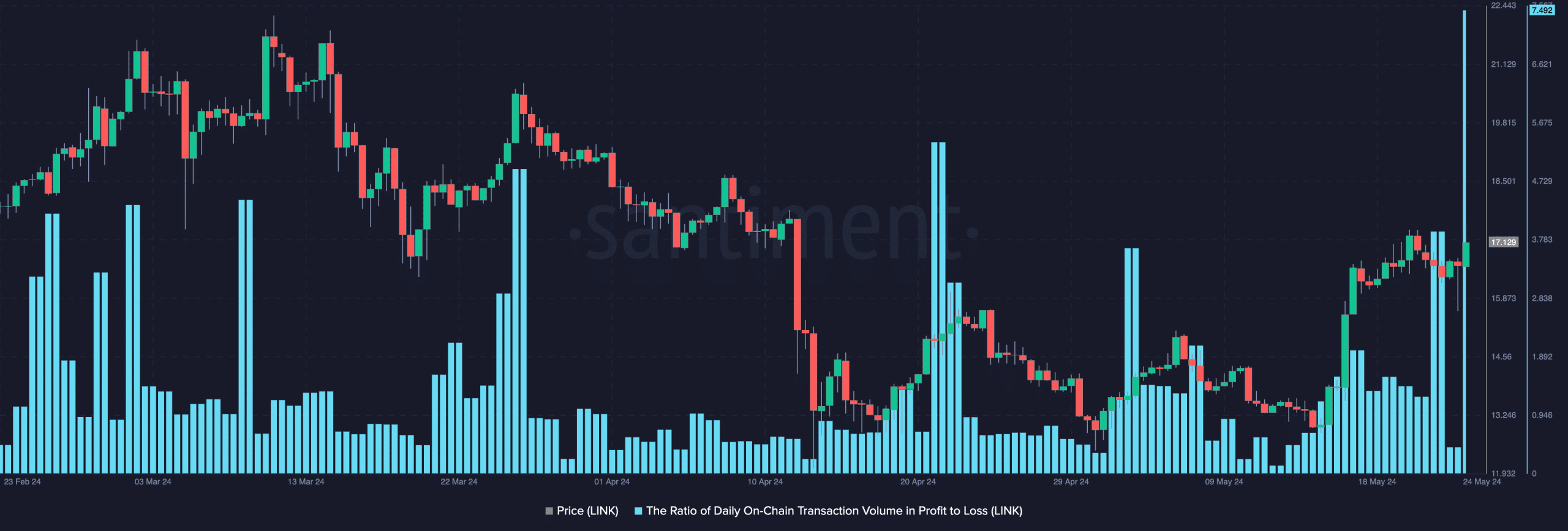

AMBCrypto assessed the ratio of LINK’s daily transaction volume in profit to loss and found that it was 11 on 23rd May. This signaled that for every LINK transaction that ended in a loss during that trading period, 11 transactions returned a profit.

As of this writing, this metric’s value was 7.49, suggesting that profitable transactions remained high.

Source: Santiment

Further, the token’s Market Value to Realized Value (MVRV) ratio was 71.56%. This suggested that LINK’s market price was significantly higher than the average acquisition price across all holders.

Although it signaled that the token was overvalued, it also meant that LINK holders were assured a profit if they sold.

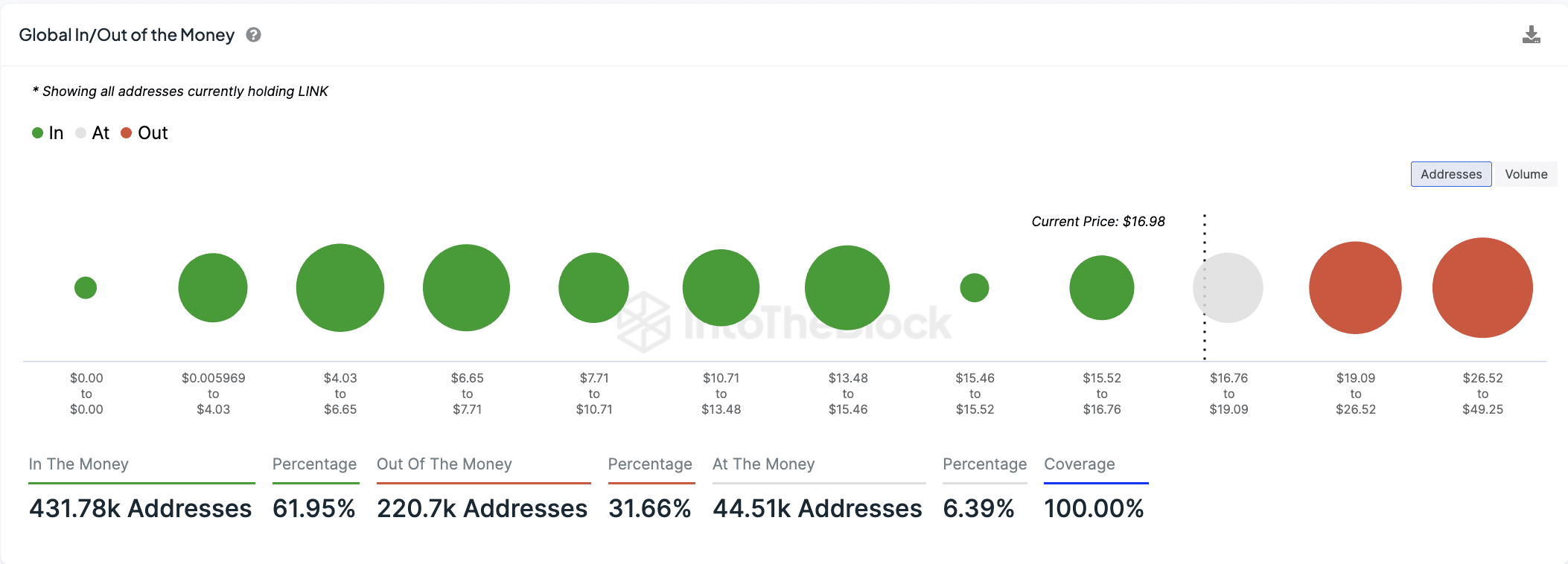

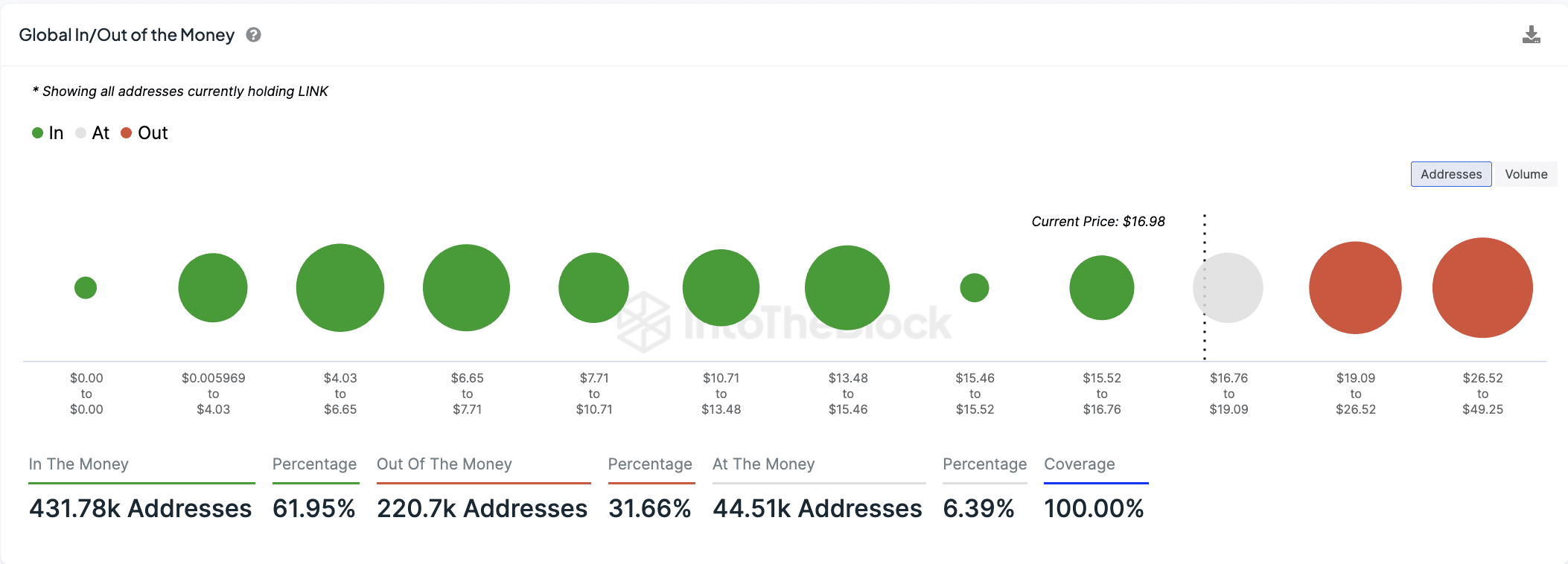

Currently, 432,000 wallet addresses, which make up 62% of all LINK holders, are “in the money,” according to IntoTheBlock. These are investors who hold the altcoin at a profit.

Conversely, 221,000 addresses, representing 32% of all LINK holders, are “out of the money,” holding their tokens at a loss.

Source: IntoTheBlock

Do not get carried away

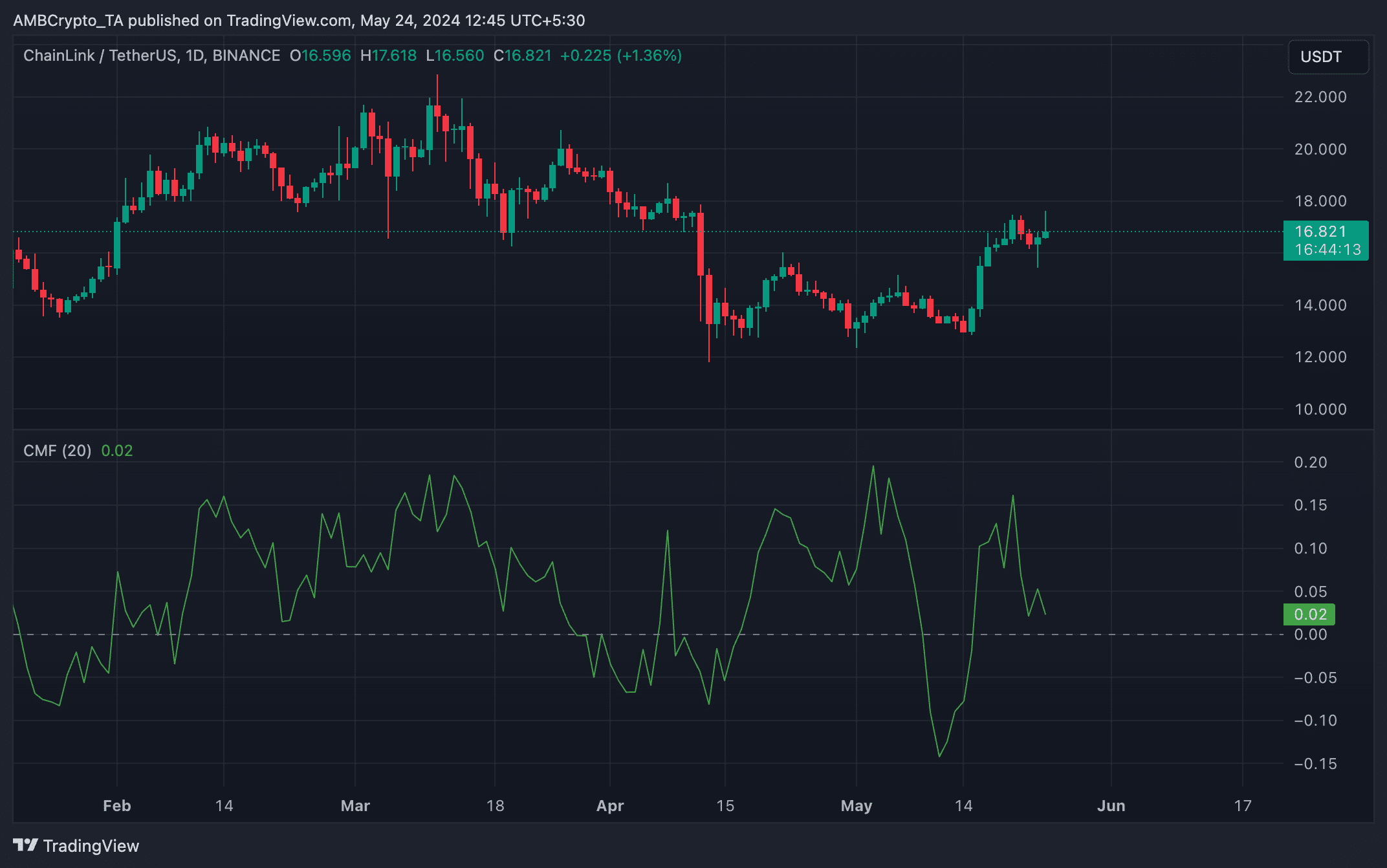

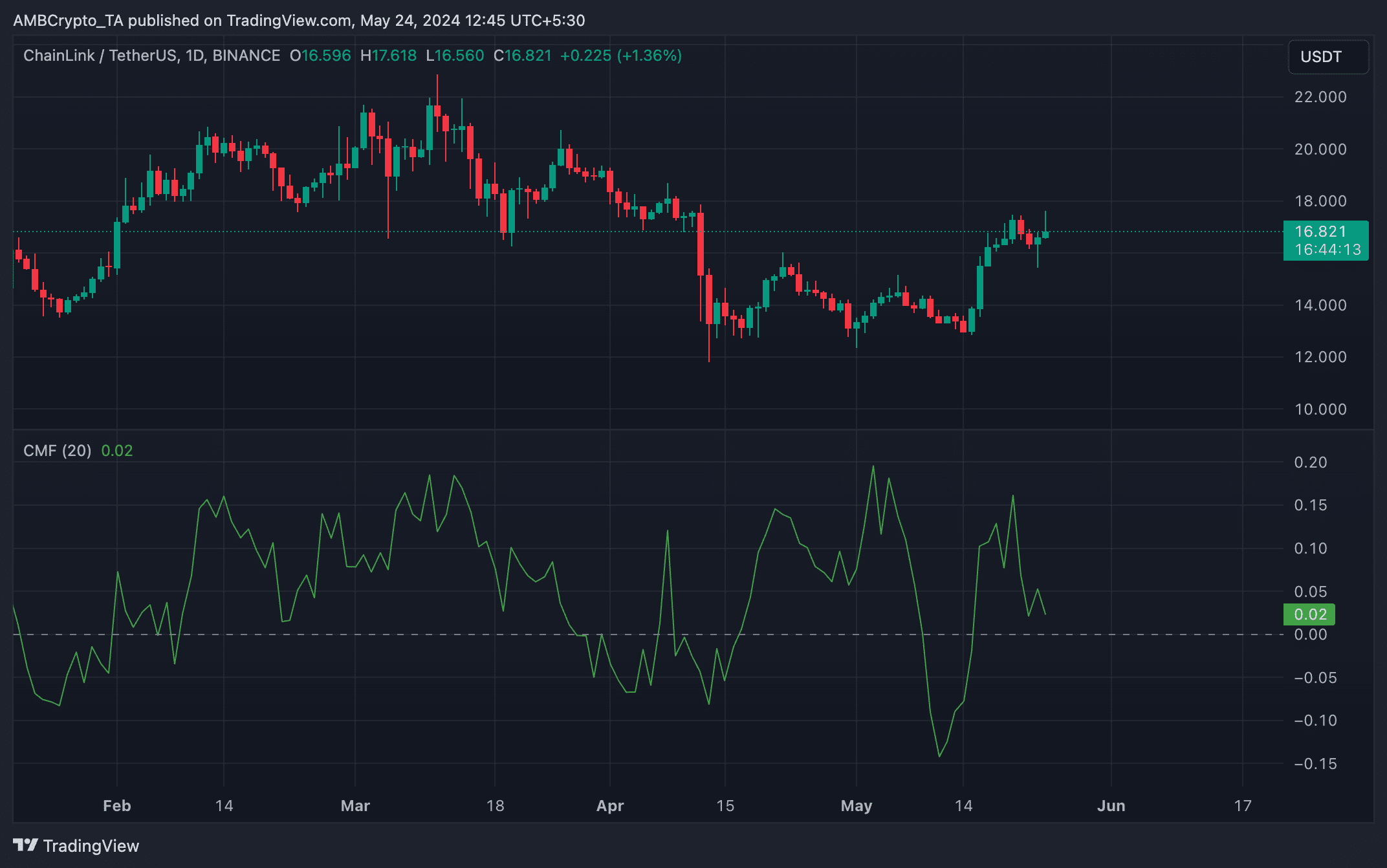

Despite LINK’s price rally in the last week, a key technical indicator has trended downward, forming a bearish divergence.

Readings from LINK’s daily chart revealed that its Chaikin Money Flow (CMF) declined even as its price surged over the past seven days. This indicator measures money flowing into and out of LINK’s market. At press time, LINK’s CMF was near nits zero line at 0.02.

Source: LINK/USDT on TradingView

Is your portfolio green? Check out the LINK Profit Calculator

A bearish divergence is formed when an asset’s price rallies while its CMF trends downward. This means the buying volume is not as strong as expected even though the asset’s price is increasing.

It suggests to market participants that the price rally may not be sustainable.

- LINK has climbed to its highest price level in six weeks.

- Most LINK transactions continue to return profit.

Chainlink [LINK] leads the altcoin rally following its price rise to a six-week high, data from Santiment has shown.

According to the on-chain data provider, during the intraday trading session on 23rd May, the altcoin briefly exchanged hands at $17.53 before witnessing a slight retraction. A

s of this writing, LINK exchanged hands at $17, according to CoinMarketCap’s data.

LINK holders in gains

The recent surge in LINK’s price has caused it to be a significantly profitable investment for its holders.

AMBCrypto assessed the ratio of LINK’s daily transaction volume in profit to loss and found that it was 11 on 23rd May. This signaled that for every LINK transaction that ended in a loss during that trading period, 11 transactions returned a profit.

As of this writing, this metric’s value was 7.49, suggesting that profitable transactions remained high.

Source: Santiment

Further, the token’s Market Value to Realized Value (MVRV) ratio was 71.56%. This suggested that LINK’s market price was significantly higher than the average acquisition price across all holders.

Although it signaled that the token was overvalued, it also meant that LINK holders were assured a profit if they sold.

Currently, 432,000 wallet addresses, which make up 62% of all LINK holders, are “in the money,” according to IntoTheBlock. These are investors who hold the altcoin at a profit.

Conversely, 221,000 addresses, representing 32% of all LINK holders, are “out of the money,” holding their tokens at a loss.

Source: IntoTheBlock

Do not get carried away

Despite LINK’s price rally in the last week, a key technical indicator has trended downward, forming a bearish divergence.

Readings from LINK’s daily chart revealed that its Chaikin Money Flow (CMF) declined even as its price surged over the past seven days. This indicator measures money flowing into and out of LINK’s market. At press time, LINK’s CMF was near nits zero line at 0.02.

Source: LINK/USDT on TradingView

Is your portfolio green? Check out the LINK Profit Calculator

A bearish divergence is formed when an asset’s price rallies while its CMF trends downward. This means the buying volume is not as strong as expected even though the asset’s price is increasing.

It suggests to market participants that the price rally may not be sustainable.

clomid cost australia where to buy clomid can i order clomiphene without insurance buying clomid tablets where can i get clomiphene pill clomiphene generic cost clomid generic brand

The thoroughness in this break down is noteworthy.

I couldn’t hold back commenting. Warmly written!

buy azithromycin pill – zithromax 250mg cost order metronidazole 200mg pill

purchase rybelsus sale – order cyproheptadine 4 mg buy generic periactin for sale

inderal medication – buy clopidogrel 150mg pills buy methotrexate without prescription

amoxil for sale online – order ipratropium 100mcg online buy ipratropium

augmentin 375mg cheap – atbioinfo.com buy ampicillin generic

buy nexium 40mg online – anexamate buy nexium 20mg without prescription

buy coumadin 5mg – blood thinner buy generic hyzaar online

order meloxicam online – https://moboxsin.com/ meloxicam without prescription

brand prednisone – corticosteroid prednisone 10mg without prescription

ed pills gnc – fast ed to take top ed drugs

buy cheap generic amoxicillin – comba moxi order amoxicillin generic

forcan for sale – this forcan online

cenforce 100mg drug – click purchase cenforce for sale

generic tadalafil prices – https://ciltadgn.com/ online cialis prescription

order generic cialis online 20 mg 20 pills – https://strongtadafl.com/ what happens if you take 2 cialis

I’ll certainly bring to skim more. https://gnolvade.com/

sildenafil 100 mg oral jelly – 50 mg of sildenafil viagra 100 mg buy

Good blog you possess here.. It’s obdurate to assign high quality belles-lettres like yours these days. I honestly recognize individuals like you! Withstand care!! isotretinoin order

Thanks for sharing. It’s acme quality. https://prohnrg.com/product/cytotec-online/

This is the big-hearted of literature I truly appreciate. prix sibelium

This is a topic which is near to my fundamentals… Myriad thanks! Exactly where can I find the acquaintance details an eye to questions? https://ondactone.com/spironolactone/

Facts blog you have here.. It’s hard to espy high calibre writing like yours these days. I really appreciate individuals like you! Take mindfulness!!

meloxicam drug

I couldn’t turn down commenting. Adequately written! http://zgyhsj.com/space-uid-977931.html

pill dapagliflozin – https://janozin.com/ forxiga 10 mg canada

orlistat price – site buy generic xenical online

I am in truth delighted to glance at this blog posts which consists of tons of useful facts, thanks for providing such data. http://wightsupport.com/forum/member.php?action=profile&uid=22103