- ADA was down by more than 23% over the last seven days.

- Most metrics and indicators supported the possibility of ADA testing the bull pattern.

Similar to most cryptos, Cardano [ADA] bears were leading the market as the token’s price charts remained red. However, there were changes of a trend reversal as a bull pattern formed on ADA’s chart.

Will this allow ADA to turn its charts green while Bitcoin [BTC] undergoes its next halving on the 19th of April?

Cardano bulls are waking up

The last week was disastrous for ADA investors as the token’s price declined by a whopping 23%. According to CoinMarketCap, in the last 24 hours, ADA dropped by over 2.5%.

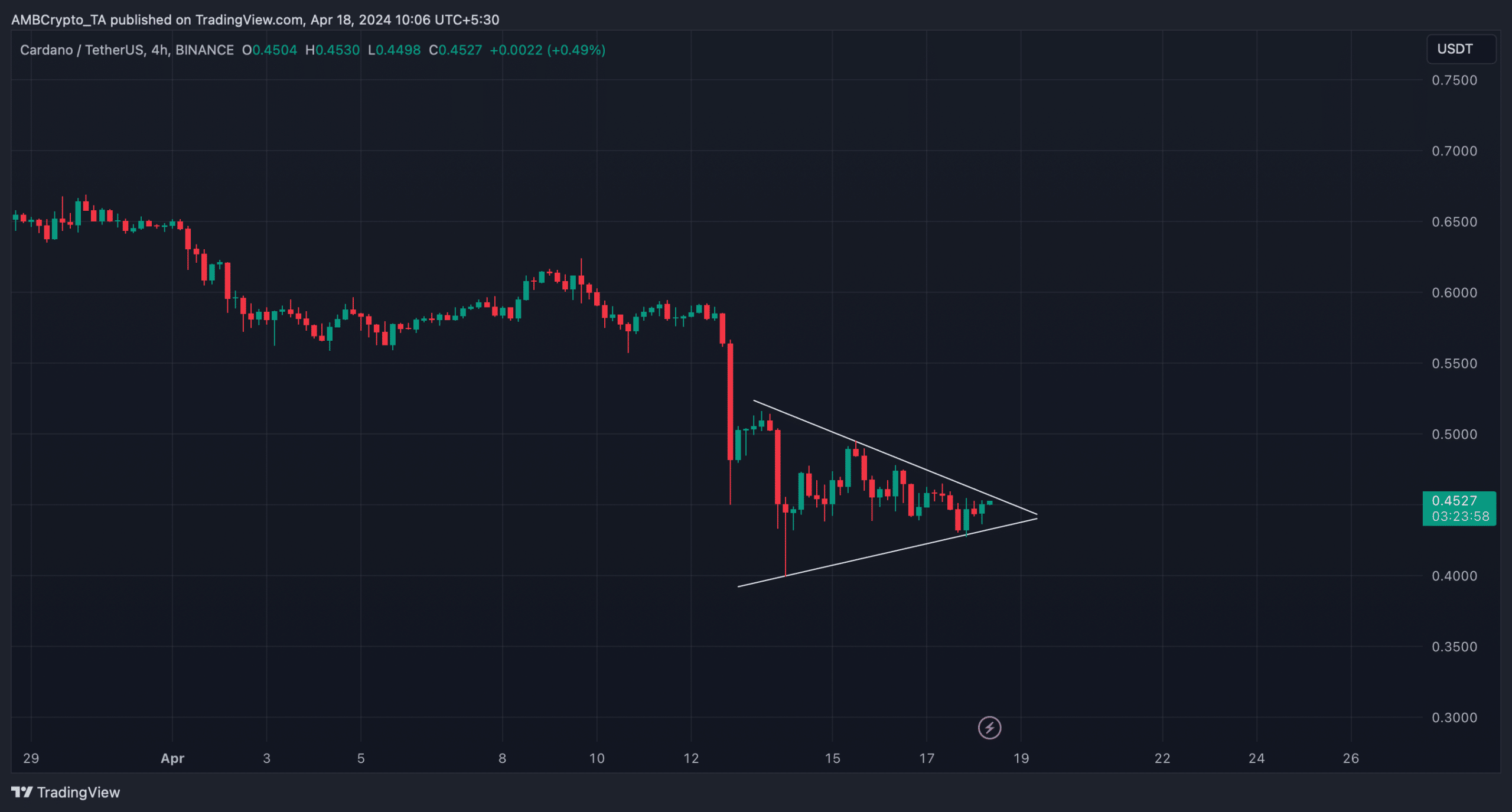

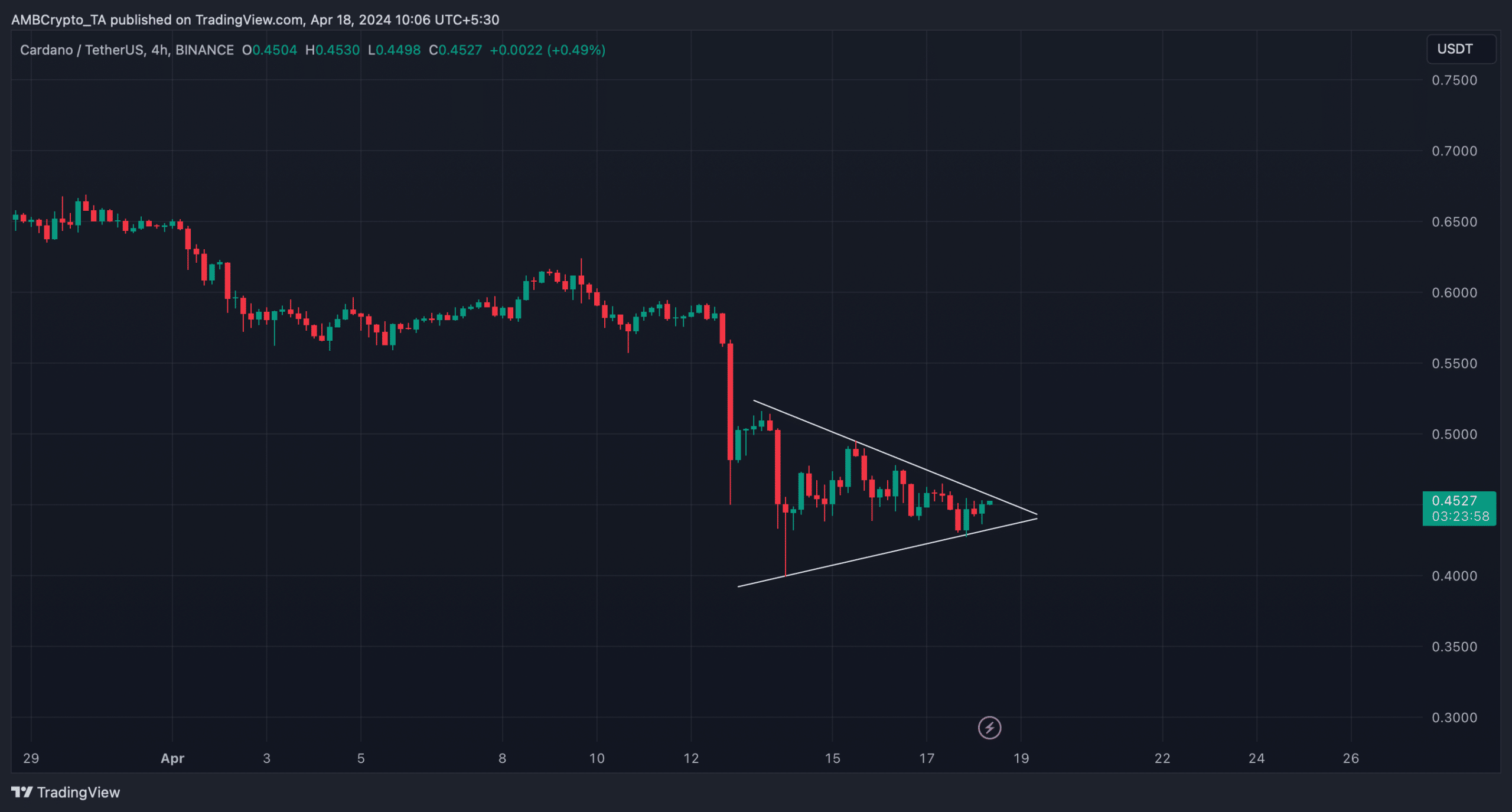

But there was more to the story, as ADA’s price was consolidating inside a bullish symmetrical triangle pattern at press time, which hinted at a bull rally.

Source: TradingView

AMBCrypto’s analysis of ADA’s 4-hour chart revealed that if the token’s price breaks above the $0.454 resistance level, then it might witness a strong bull rally as BTC undergoes its fourth halving process.

The possibility of ADA testing the pattern seemed high, as the token’s price had increased by 1.15% in the last 60 minutes.

At press time, it was trading at $0.4498 with a market capitalization of over $16 billion, making it the 10th largest crypto.

ADA on the right track

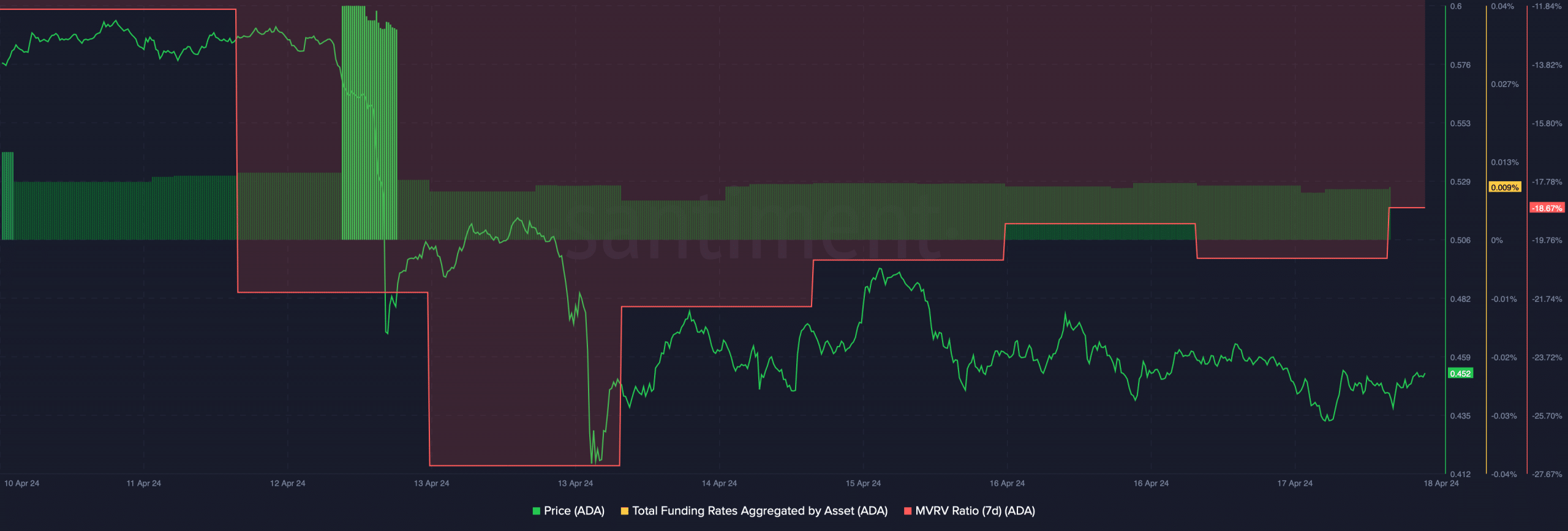

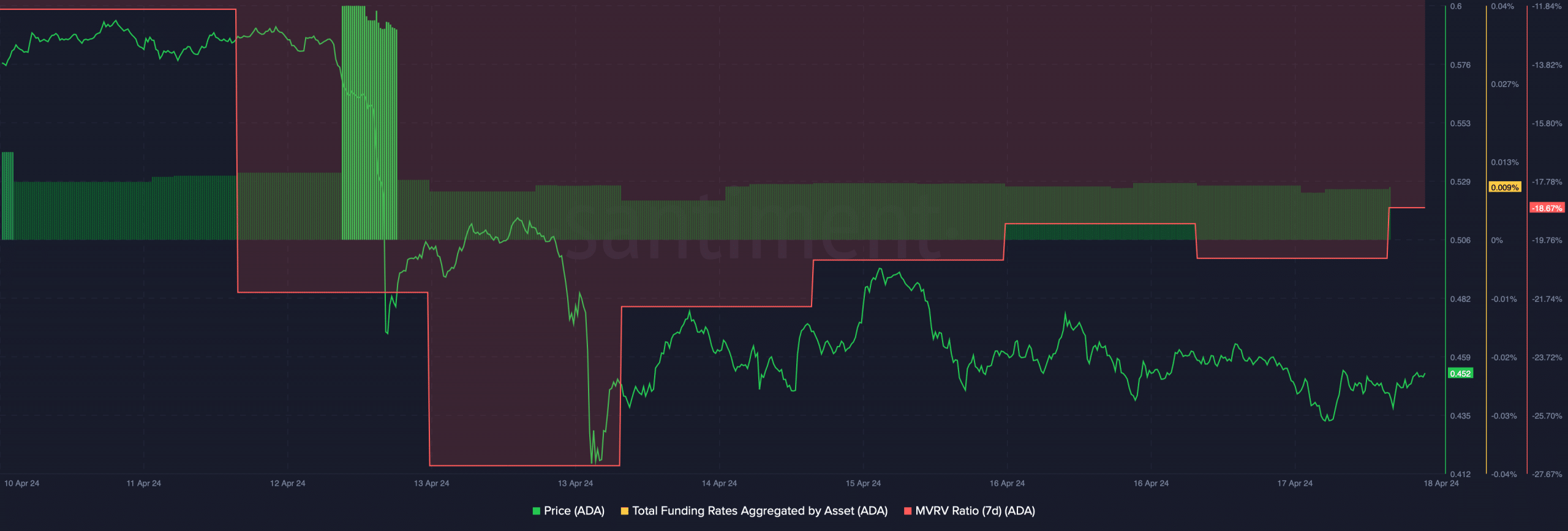

Apart from price action, a few of the metrics also looked bullish. AMBCrypto’s check on Santiment’s data pointed out that ADA’s 7-day MVRV ratio improved over the last few days.

Its Funding Rate had also dropped. Since prices tend to move the other way than the funding rate, there was a possibility of ADA registering a price uptick soon.

Source: Santiment

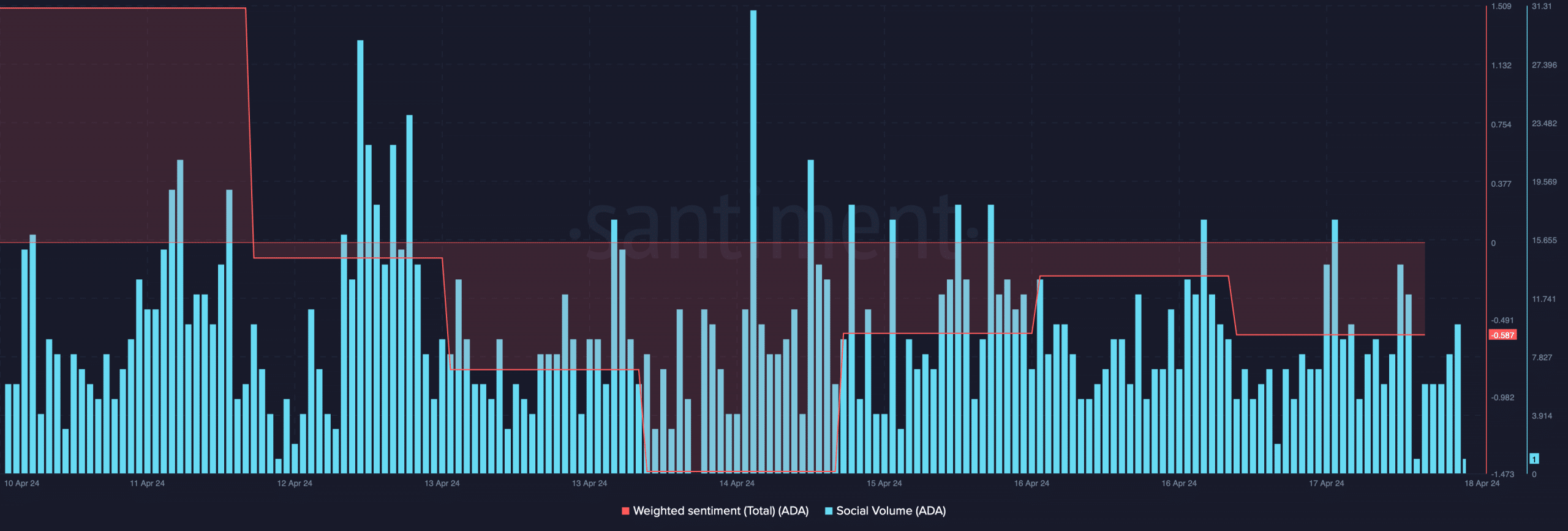

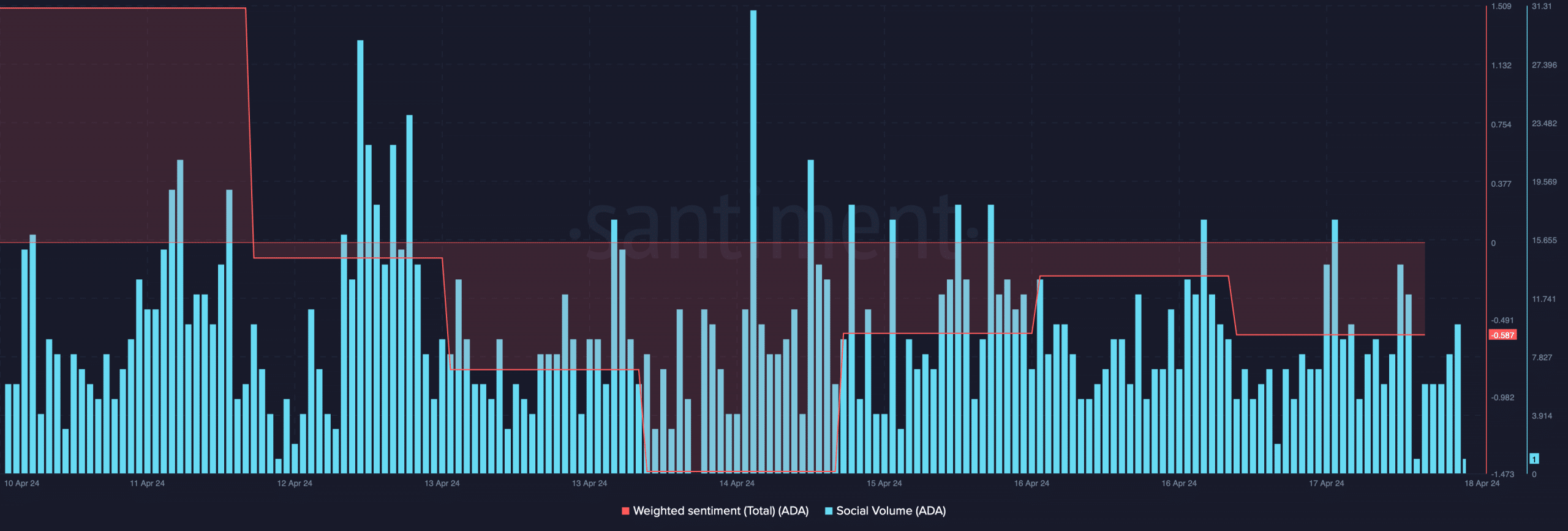

The token’s social volume remained relatively high throughout the last week, with a substantial spike on the 14th of April. The rise in social volume clearly reflected Cardano’s popularity in the crypto space.

Moreover, its Weighted Sentiment rose last week after dropping on the 14th of April, suggesting that bearish sentiment around the token started to decline.

Source: Santiment

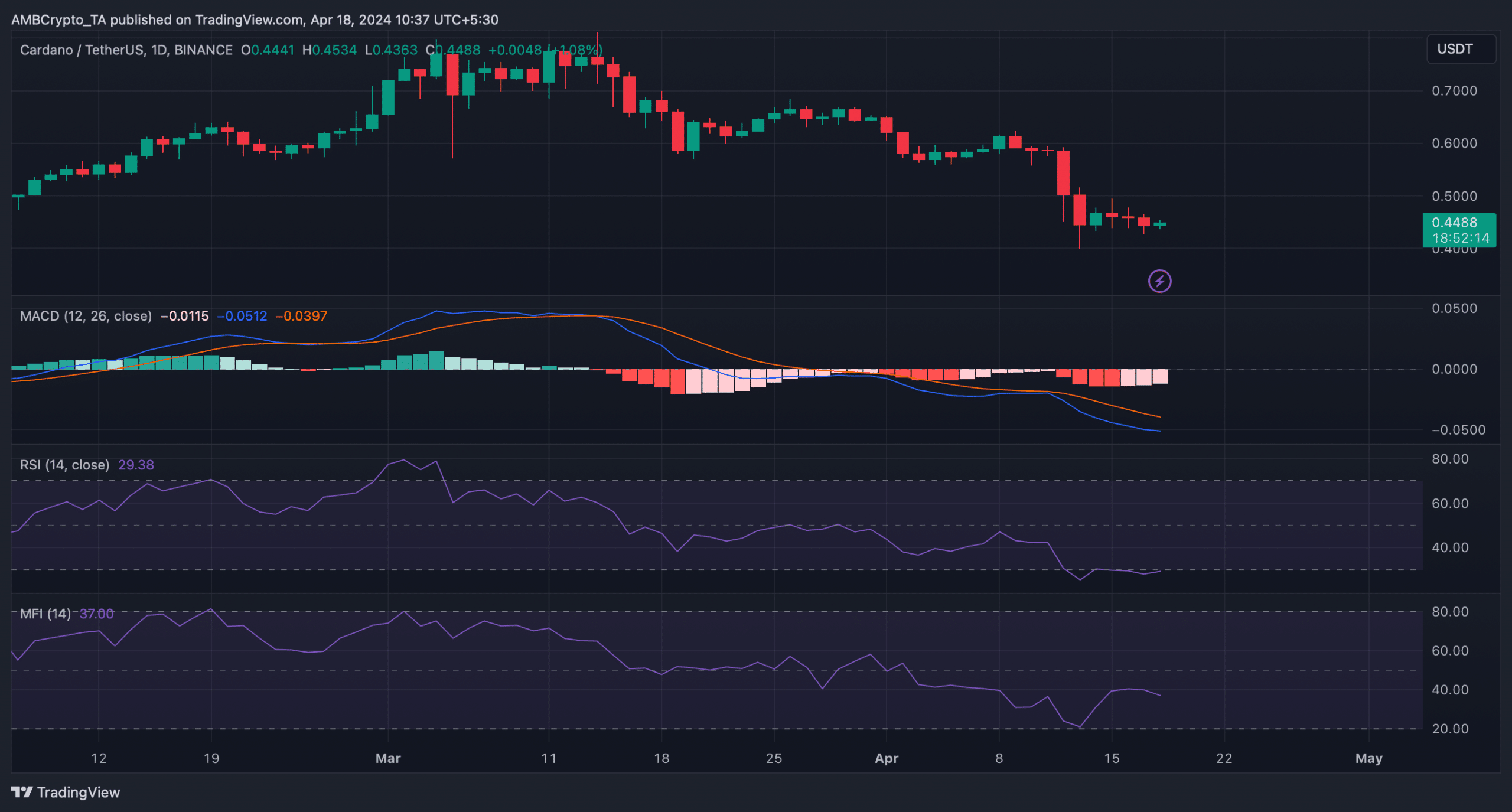

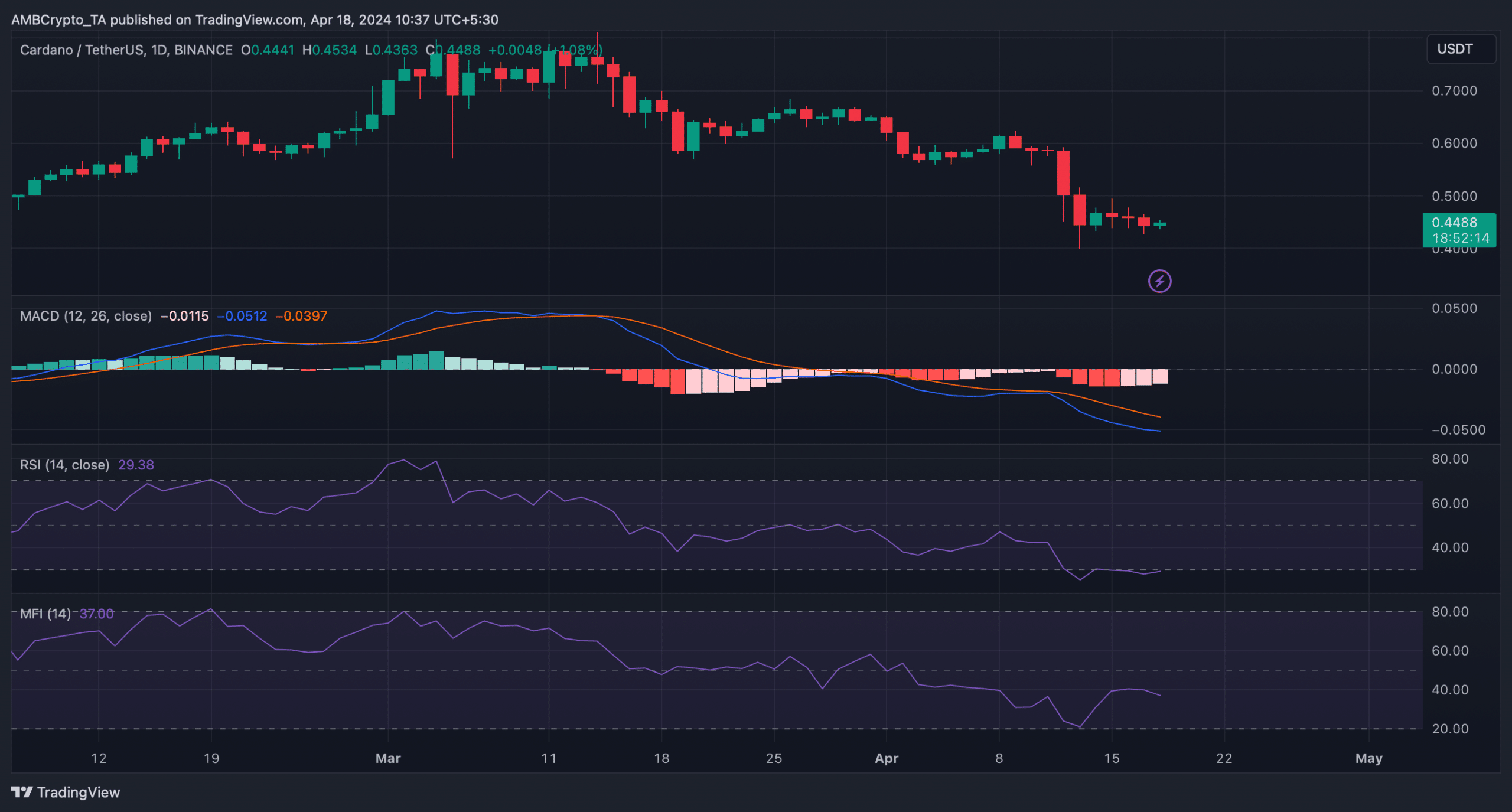

To better understand whether ADA will manage to go above the $0.454 resistance level, we then took a look at its daily chart. We found that Cardano’s Relative Strength Index (RSI) was in the oversold zone.

Read Cardano’s [ADA] Price Prediction 2024-25

This indicated that buying pressure on the token might increase soon, resulting in a price increase. However, the MACD displayed a bearish advantage in the market.

The Money Flow Index (MFI) also declined, which hinted that ADA might take more time to turn bullish.

Source: TradingView

- ADA was down by more than 23% over the last seven days.

- Most metrics and indicators supported the possibility of ADA testing the bull pattern.

Similar to most cryptos, Cardano [ADA] bears were leading the market as the token’s price charts remained red. However, there were changes of a trend reversal as a bull pattern formed on ADA’s chart.

Will this allow ADA to turn its charts green while Bitcoin [BTC] undergoes its next halving on the 19th of April?

Cardano bulls are waking up

The last week was disastrous for ADA investors as the token’s price declined by a whopping 23%. According to CoinMarketCap, in the last 24 hours, ADA dropped by over 2.5%.

But there was more to the story, as ADA’s price was consolidating inside a bullish symmetrical triangle pattern at press time, which hinted at a bull rally.

Source: TradingView

AMBCrypto’s analysis of ADA’s 4-hour chart revealed that if the token’s price breaks above the $0.454 resistance level, then it might witness a strong bull rally as BTC undergoes its fourth halving process.

The possibility of ADA testing the pattern seemed high, as the token’s price had increased by 1.15% in the last 60 minutes.

At press time, it was trading at $0.4498 with a market capitalization of over $16 billion, making it the 10th largest crypto.

ADA on the right track

Apart from price action, a few of the metrics also looked bullish. AMBCrypto’s check on Santiment’s data pointed out that ADA’s 7-day MVRV ratio improved over the last few days.

Its Funding Rate had also dropped. Since prices tend to move the other way than the funding rate, there was a possibility of ADA registering a price uptick soon.

Source: Santiment

The token’s social volume remained relatively high throughout the last week, with a substantial spike on the 14th of April. The rise in social volume clearly reflected Cardano’s popularity in the crypto space.

Moreover, its Weighted Sentiment rose last week after dropping on the 14th of April, suggesting that bearish sentiment around the token started to decline.

Source: Santiment

To better understand whether ADA will manage to go above the $0.454 resistance level, we then took a look at its daily chart. We found that Cardano’s Relative Strength Index (RSI) was in the oversold zone.

Read Cardano’s [ADA] Price Prediction 2024-25

This indicated that buying pressure on the token might increase soon, resulting in a price increase. However, the MACD displayed a bearish advantage in the market.

The Money Flow Index (MFI) also declined, which hinted that ADA might take more time to turn bullish.

Source: TradingView

On this site offers multifunctional timepieces crafted by trusted manufacturers.

Browse through top-loading CD players with digital radio and twin alarm functions.

Many models include AUX jacks, device charging, and backup batteries.

The selection covers affordable clocks to luxury editions.

radio with cd player and alarm clock

All clocks include snooze functions, auto-off timers, and bright LED displays.

Purchases using Walmart with fast shipping.

Choose the best disc player alarm clock for home daily routines.

On this platform, you can access lots of casino slots from top providers.

Users can experience traditional machines as well as modern video slots with vivid animation and exciting features.

Even if you’re new or a casino enthusiast, there’s something for everyone.

casino slots

The games are available 24/7 and designed for PCs and mobile devices alike.

You don’t need to install anything, so you can jump into the action right away.

Site navigation is user-friendly, making it convenient to browse the collection.

Register now, and enjoy the excitement of spinning reels!

Покупка туристического полиса для заграничной поездки — это обязательное условие для финансовой защиты отдыхающего.

Документ покрывает расходы на лечение в случае травмы за границей.

Помимо этого, документ может включать оплату на транспортировку.

страховка осаго

Определённые государства настаивают на предоставление документа для въезда.

Без страховки обращение к врачу могут обойтись дорого.

Оформление полиса заблаговременно

Новый летний период обещает быть стильным и инновационным в плане моды.

В тренде будут многослойность и игра фактур.

Модные цвета включают в себя мягкие пастели, сочетающиеся с любым стилем.

Особое внимание дизайнеры уделяют принтам, среди которых популярны винтажные очки.

https://hashnode.com/@lepodium

Возвращаются в моду элементы модерна, интерпретированные по-новому.

На подиумах уже можно увидеть трендовые образы, которые вдохновляют.

Будьте в курсе, чтобы встретить лето стильно.

Analog watches will always remain in style.

They reflect tradition and showcase a sense of artistry that smartwatches simply lack.

Every model is powered by precision mechanics, making it both functional and sophisticated.

Collectors cherish the hand-assembled parts.

https://whitezorro.ru/zorro/270-novaya-kollektsiya-yuvelirnogo-brenda-alkor-vdohnovlena-multfilmami/

Wearing a mechanical watch is not just about checking hours, but about making a statement.

Their designs are timeless, often passed from one owner to another.

To sum up, mechanical watches will forever hold their place.

Our service makes it possible to hire experts for one-time hazardous tasks.

Visitors are able to quickly arrange services for particular situations.

All workers are experienced in executing complex tasks.

hitman-assassin-killer.com

The website guarantees discreet interactions between users and workers.

If you require urgent assistance, this website is the perfect place.

List your task and connect with an expert in minutes!

Questa pagina consente la selezione di lavoratori per attività a rischio.

Gli interessati possono trovare candidati qualificati per incarichi occasionali.

Tutti i lavoratori vengono verificati con severi controlli.

sonsofanarchy-italia.com

Attraverso il portale è possibile leggere recensioni prima di procedere.

La sicurezza rimane un nostro impegno.

Esplorate le offerte oggi stesso per portare a termine il vostro progetto!

В этом разделе вы можете обнаружить рабочую копию сайта 1xBet без ограничений.

Мы регулярно обновляем ссылки, чтобы предоставить беспрепятственный доступ к порталу.

Используя зеркало, вы сможете участвовать в играх без задержек.

зеркало 1хбет

Наш ресурс поможет вам без труда открыть актуальный адрес 1хбет.

Мы стремимся, чтобы все клиенты мог не испытывать проблем.

Проверяйте новые ссылки, чтобы всегда быть онлайн с 1хБет!

Этот сайт — аутентичный онлайн-магазин Bottega Veneta с доставкой по территории России.

В нашем магазине вы можете приобрести фирменную продукцию Bottega Veneta напрямую.

Каждый заказ подтверждаются оригинальными документами от бренда.

bottega veneta

Доставка осуществляется оперативно в любой регион России.

Наш сайт предлагает безопасные способы оплаты и лёгкий возврат.

Выбирайте официальном сайте Bottega Veneta, чтобы быть уверенным в качестве!

Лето 2025 года обещает быть стильным и нестандартным в плане моды.

В тренде будут многослойность и яркие акценты.

Актуальные тона включают в себя природные тона, подчеркивающие индивидуальность.

Особое внимание дизайнеры уделяют принтам, среди которых популярны винтажные очки.

https://420dc.xyz/read-blog/6966

Набирают популярность элементы модерна, интерпретированные по-новому.

На улицах мегаполисов уже можно увидеть захватывающие образы, которые поражают.

Следите за обновлениями, чтобы создать свой образ.

在这个网站上,您可以雇佣专门从事临时的危险工作的专业人士。

我们整理了大量经验丰富的行动专家供您选择。

无论需要何种危险需求,您都可以方便找到理想的帮手。

为了钱而下令谋杀

所有执行者均经过严格甄别,保证您的隐私。

网站注重专业性,让您的任务委托更加顺利。

如果您需要详细资料,请立即联系!

Through this platform, you can find trusted platforms for CS:GO gambling.

We have collected a diverse lineup of gaming platforms dedicated to CS:GO.

Each site is thoroughly reviewed to guarantee trustworthiness.

new csgo gambling sites

Whether you’re a seasoned bettor, you’ll effortlessly choose a platform that suits your needs.

Our goal is to help you to access proven CS:GO wagering platforms.

Dive into our list today and enhance your CS:GO playing experience!

На этом сайте вы обнаружите всю информацию о партнёрской программе: 1win.

Доступны все особенности взаимодействия, условия участия и возможные бонусы.

Любой блок четко изложен, что позволяет легко разобраться в особенностях системы.

Также доступны FAQ по теме и практические указания для новичков.

Информация регулярно обновляется, поэтому вы можете быть уверены в актуальности предоставленных данных.

Портал будет полезен в освоении партнёрской программы 1Win.

Looking for qualified workers ready to tackle short-term dangerous assignments.

Need someone for a perilous task? Connect with trusted laborers via this site to manage time-sensitive risky work.

order the kill

This website matches clients with licensed professionals willing to accept hazardous one-off positions.

Recruit pre-screened freelancers for perilous duties securely. Ideal when you need emergency assignments demanding safety-focused expertise.

Humans think about ending their life due to many factors, frequently stemming from deep emotional pain.

Feelings of hopelessness can overwhelm their motivation to go on. Frequently, lack of support is a major factor to this choice.

Mental health issues impair decision-making, preventing someone to recognize options to their pain.

how to kill yourself

Life stressors can also push someone to consider drastic measures.

Limited availability of resources might result in a sense of no escape. Keep in mind that reaching out is crucial.

您好,这是一个面向18岁以上人群的内容平台。

进入前请确认您已年满18岁,并同意遵守当地法律法规。

本网站包含成人向资源,请理性访问。 色情网站。

若您未满18岁,请立即退出页面。

我们致力于提供合法合规的成人服务。

This website, you can discover a great variety of online slots from top providers.

Players can experience traditional machines as well as new-generation slots with high-quality visuals and bonus rounds.

If you’re just starting out or a casino enthusiast, there’s something for everyone.

sweet bonanza

All slot machines are available 24/7 and optimized for PCs and mobile devices alike.

No download is required, so you can jump into the action right away.

Site navigation is intuitive, making it convenient to find your favorite slot.

Register now, and enjoy the thrill of casino games!

本网站 提供 海量的 成人材料,满足 各类人群 的 需求。

无论您喜欢 什么样的 的 视频,这里都 一应俱全。

所有 材料 都经过 专业整理,确保 高品质 的 视觉享受。

偷窥

我们支持 不同平台 访问,包括 手机,随时随地 自由浏览。

加入我们,探索 激情时刻 的 私密乐趣。

The Audemars Piguet 15300 st merges meticulous craftsmanship and sophisticated aesthetics. Its 39mm stainless steel case guarantees a modern fit, achieving harmony between prominence and wearability. The distinctive geometric bezel, secured by eight hexagonal screws, defines the brand’s revolutionary approach to luxury sports watches.

AP Royal Oak 15300ST

Featuring a luminescent-coated Royal Oak hands dial, this model incorporates a 60-hour energy reserve via the selfwinding mechanism. The signature textured dial adds dimension and uniqueness, while the 10mm-thick case ensures discreet luxury.

The Audemars Piguet Royal Oak 15400ST features a robust steel construction launched as a modern classic among AP’s most coveted designs.

Crafted in 41mm stainless steel features a signature octagonal bezel accented with eight iconic screws, embodying the collection’s iconic DNA.

Driven by the self-winding Cal. 3120, it ensures precise timekeeping featuring a practical date window.

https://www.vevioz.com/read-blog/359857

The dial showcases a black Grande Tapisserie pattern highlighted by luminous appliqués for effortless legibility.

Its matching steel bracelet offers a secure, ergonomic fit, finished with an AP folding clasp.

Celebrated for its high recognition value, the 15400ST stands as a pinnacle for those seeking understated prestige.

Лицензирование и сертификация — ключевой аспект ведения бизнеса в России, гарантирующий защиту от непрофессионалов.

Обязательная сертификация требуется для подтверждения безопасности товаров.

Для 49 видов деятельности необходимо специальных разрешений.

https://ok.ru/group/70000034956977/topic/158862647867569

Игнорирование требований ведут к приостановке деятельности.

Дополнительные лицензии помогает усилить конкурентоспособность бизнеса.

Соблюдение норм — залог успешного развития компании.

clomid without dr prescription where to get generic clomid tablets where to get cheap clomid pill cost of cheap clomid pills clomid tablets uses in urdu can you buy generic clomid for sale can i purchase generic clomid online

Searching for special 1xBet coupon codes ? Here is your ultimate destination to unlock top-tier offers designed to boost your wagers.

If you’re just starting or a seasoned bettor , our curated selection ensures exclusive advantages for your first deposit .

Keep an eye on daily deals to maximize your betting experience .

https://www.google.com.uy/url?q=https://www.manaolahawaii.com/articles/1xbet_promo_code_latest_version_and_bonus_200_.html

All listed codes are frequently updated to work seamlessly for current users.

Act now of limited-time opportunities to revolutionize your gaming journey with 1xBet.

Premium mechanical timepieces stay in demand for countless undeniable reasons.

Their engineering excellence and history make them unique.

They symbolize wealth and sophistication while merging practicality and style.

Unlike digital gadgets, they become timeless heirlooms due to rarity and durability.

https://payhip.com/MaxBezel/blog/news/maxbezel-your-premier-destination-for-luxury-watches

Collectors and enthusiasts value the human touch that no battery-powered watch can replace.

For many, possessing them means legacy that transcends trends.

Thanks towards putting this up. It’s understandably done.

Access detailed information about the Audemars Piguet Royal Oak Offshore 15710ST here , including price trends ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with automatic movement and rugged aesthetics, crafted in stainless steel .

Authentic Piguet Royal Oak 15710 st price

Check secondary market data , where limited editions reach up to $750,000 , alongside rare references from the 1970s.

Request real-time updates on availability, specifications, and resale performance , with free market analyses for informed decisions.

More peace pieces like this would urge the интернет better.

buy generic zithromax over the counter – ciprofloxacin online metronidazole sale

Founded in 2001 , Richard Mille revolutionized luxury watchmaking with avant-garde design. The brand’s iconic timepieces combine high-tech materials like carbon fiber and titanium to balance durability .

Mirroring the aerodynamics of Formula 1, each watch prioritizes functionality , optimizing resistance. Collections like the RM 011 Flyback Chronograph set new benchmarks since their debut.

Richard Mille’s collaborations with experts in materials science yield skeletonized movements tested in extreme conditions .

Real Mille Richard prices

Rooted in innovation, the brand challenges traditions through bespoke complications for collectors .

Since its inception, Richard Mille epitomizes modern haute horlogerie, captivating discerning enthusiasts .

buy semaglutide generic – semaglutide order online order cyproheptadine without prescription

Стальные резервуары используются для сбора нефтепродуктов и соответствуют стандартам температур до -40°C.

Вертикальные емкости изготавливают из нержавеющих сплавов с усиленной сваркой.

Идеальны для АЗС: хранят бензин, керосин, мазут или авиационное топливо.

Емкость пожарная 125 м3

Двустенные резервуары обеспечивают защиту от утечек, а наземные установки подходят для разных условий.

Заводы предлагают индивидуальные проекты объемом до 500 м³ с технической поддержкой.

Ce modèle Jumbo arbore un boîtier en acier inoxydable ultra-mince (8,1 mm d’épaisseur), équipé du nouveau mouvement Manufacture 7121 offrant une réserve de marche de 55 heures.

Le cadran « Bleu Nuit Nuage 50 » présente un motif Petite Tapisserie associé à des chiffres luminescents et des aiguilles Royal Oak.

Une glace saphir anti-reflets garantit une lisibilité optimale.

royal oak 15300st

Outre l’affichage heures et minutes, la montre intègre une fonction date à 3h. Étanche à 5 ATM, elle résiste aux activités quotidiennes.

Le maille milanaise ajustable et la carrure à 8 vis reprennent les codes du design signé Gérald Genta (1972). Un boucle personnalisée assure un maintien parfait.

Appartenant à la collection Extra-Plat, ce garde-temps allie innovation technique et élégance discrète, avec un prix estimé à plus de 75 000 €.

Premium mechanical timepieces are still sought after for multiple essential causes.

Their engineering excellence and history place them above the rest.

They symbolize achievement and refinement while mixing purpose and aesthetics.

Unlike digital gadgets, they endure through generations due to rarity and durability.

https://www.tumblr.com/sneakerizer/779521637367316480/7-reasons-parenai-watches-will-make-you-question

Collectors and enthusiasts treasure the engineering marvels that no gadget can ever equal.

For many, owning one is owning history that lasts forever.

buy generic domperidone – order generic cyclobenzaprine 15mg purchase flexeril generic

buy amoxicillin paypal – order valsartan 80mg pills combivent uk

cheap azithromycin 250mg – azithromycin 250mg sale nebivolol drug

Этот бот способен найти данные по заданному профилю.

Укажите никнейм в соцсетях, чтобы сформировать отчёт.

Система анализирует публичные данные и цифровые следы.

глаз бога поиск по фото

Результаты формируются в реальном времени с проверкой достоверности .

Идеально подходит для анализа профилей перед сотрудничеством .

Конфиденциальность и точность данных — наш приоритет .

esomeprazole oral – nexium to us buy cheap esomeprazole

buy coumadin 2mg generic – https://coumamide.com/ brand losartan 25mg

Хотите собрать информацию о пользователе? Наш сервис предоставит полный профиль мгновенно.

Используйте уникальные алгоритмы для поиска цифровых следов в открытых источниках.

Узнайте контактные данные или активность через автоматизированный скан с верификацией результатов.

глаз бога бот тг

Система функционирует с соблюдением GDPR, обрабатывая общедоступную информацию.

Получите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте проверенному решению для digital-расследований — точность гарантирована!

Ответственная игра — это принципы, направленный на предотвращение рисков, включая ограничение доступа несовершеннолетним .

Сервисы должны внедрять инструменты контроля, такие как лимиты на депозиты , чтобы минимизировать зависимость .

Обучение сотрудников помогает реагировать на сигналы тревоги, например, частые крупные ставки.

казино вавада вход

Предоставляются ресурсы консультации экспертов, где можно получить помощь при проявлениях зависимости.

Следование нормам включает аудит операций для предотвращения мошенничества .

Ключевая цель — создать условия для ответственного досуга, где риск минимален с психологическим состоянием.

На этом сайте доступны частные фотографии моделей, созданные с вниманием к деталям .

Контент включает архивные съемки, эксклюзивные кадры , тематические подборки для узких интересов.

Все данные проверяются перед публикацией, чтобы соответствовать стандартам и безопасность просмотра.

lesbian photos

Чтобы упростить поиск посетителей добавлены фильтры по стилю , возрастным группам .

Платформа соблюдает конфиденциальность и защиту авторских прав согласно международным нормам .

cheap amoxicillin for sale – comba moxi amoxil ca

Подбирая компании для квартирного переезда важно проверять её лицензирование и репутацию на рынке.

Изучите отзывы клиентов или рекомендации знакомых , чтобы оценить профессионализм исполнителя.

Сравните цены , учитывая объём вещей, сезонность и услуги упаковки.

https://forum.sportmashina.com/index.php?threads/zamoviti-kvartirnij-perejizd-z-vantazhnikami-v-kijevi.8141/

Требуйте наличия гарантий сохранности имущества и уточните условия компенсации в случае повреждений.

Оцените уровень сервиса: дружелюбие сотрудников , гибкость графика .

Узнайте, используются ли специализированные грузчики и упаковочные материалы для безопасной транспортировки.

Осознанное участие в азартных развлечениях — это принципы, направленный на защиту участников , включая ограничение доступа несовершеннолетним .

Сервисы должны внедрять инструменты саморегуляции , такие как временные блокировки, чтобы минимизировать зависимость .

Регулярная подготовка персонала помогает выявлять признаки зависимости , например, частые крупные ставки.

https://sacramentolife.ru

Предоставляются ресурсы консультации экспертов, где обратиться за поддержкой при проблемах с контролем .

Следование нормам включает аудит операций для предотвращения мошенничества .

Ключевая цель — создать безопасную среду , где риск минимален с вредом для финансов .

Дом Patek Philippe — это pinnacle механического мастерства, где соединяются прецизионность и художественная отделка.

Основанная в 1839 году компания славится авторским контролем каждого изделия, требующей сотен часов .

Инновации, такие как автоматические калибры, сделали бренд как новатора в индустрии.

Часы Patek Philippe приобрести

Коллекции Grand Complications демонстрируют вечные календари и ручную гравировку , подчеркивая статус .

Современные модели сочетают инновационные материалы, сохраняя механическую точность.

Это не просто часы — символ семейных традиций, передающий инженерную элегантность из поколения в поколение.

fluconazole 200mg us – buy diflucan online cheap diflucan online

cenforce cost – cenforce buy online cenforce 100mg oral

cialis experience reddit – cialis manufacturer coupon no presciption cialis

order zantac 150mg sale – ranitidine drug buy ranitidine medication

erectile dysfunction tadalafil – https://strongtadafl.com/ cialis professional

viagra coupons – strong vpls sildenafil citrate tablets ip 50 mg

Модель Submariner от представленная в 1953 году стала первой дайверской моделью, выдерживающими глубину до 330 футов.

Модель имеет вращающийся безель , Triplock-заводную головку, обеспечивающие герметичность даже в экстремальных условиях.

Дизайн включает хромалитовый циферблат , стальной корпус Oystersteel, подчеркивающие спортивный стиль.

rolex-submariner-shop.ru

Механизм с запасом хода до 70 часов сочетается с автоматическим калибром , что делает их идеальным выбором для активного образа жизни.

За десятилетия Submariner стал эталоном дайверских часов , оцениваемым как эксперты.

This is a keynote which is in to my verve… Numberless thanks! Faithfully where can I notice the acquaintance details in the course of questions? https://ursxdol.com/doxycycline-antibiotic/

This is a keynote which is near to my fundamentals… Diverse thanks! Faithfully where can I upon the contact details in the course of questions? https://buyfastonl.com/gabapentin.html

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/metoprolol-25-mg-tablets/

Системы управления персоналом помогают компаниям , автоматизируя учёт времени работы.

Современные платформы предоставляют точный мониторинг онлайн, минимизируя ошибки при подсчёте.

Совместимость с кадровыми системами облегчает подготовку аналитики и управление больничными, сверхурочными.

анализ действий сотрудников

Упрощение задач экономит время HR-отделов, позволяя сосредоточиться на развитии команды.

Простое управление гарантирует удобство использования даже для новичков , сокращая период адаптации.

Надёжные решения генерируют отчёты в реальном времени, способствуя принятию решений на основе данных.

Татуировка представляет собой форму самовыражения, где каждая линия несёт личную историю и подчеркивает индивидуальность человека.

Для многих тату — вечный символ , который напоминает о преодолённых трудностях и дополняет жизненный опыт.

Сам акт нанесения — это творческий диалог между мастером и человеком, где тело становится живым холстом .

запчасти для машинок

Современные стили , от минималистичных узоров до биомеханических композиций, позволяют воплотить любую идею в гармоничном исполнении.

Красота тату в их вечности вместе с человеком, превращая воспоминания в незабываемый визуальный язык .

Подбирая эскиз, люди раскрывают душу через цвета , создавая личное произведение, которое наполняет уверенностью каждый день.