- Cardano’s price consolidated around $0.37, with fluctuations indicating bearish momentum

- Uptick in new adoption pointed to growing interest in upcoming upgrades

Cardano is expecting a significant network upgrade soon, one which could lead to a price surge for ADA. In fact, the latest report from Cardano’s parent company, Input Output Hong Kong (IOHK), highlighted advancements in smart contracts, wallet services, core technology, and more.

Hence, the question – Is ADA set for a breakout now?

Market sentiment and price trends

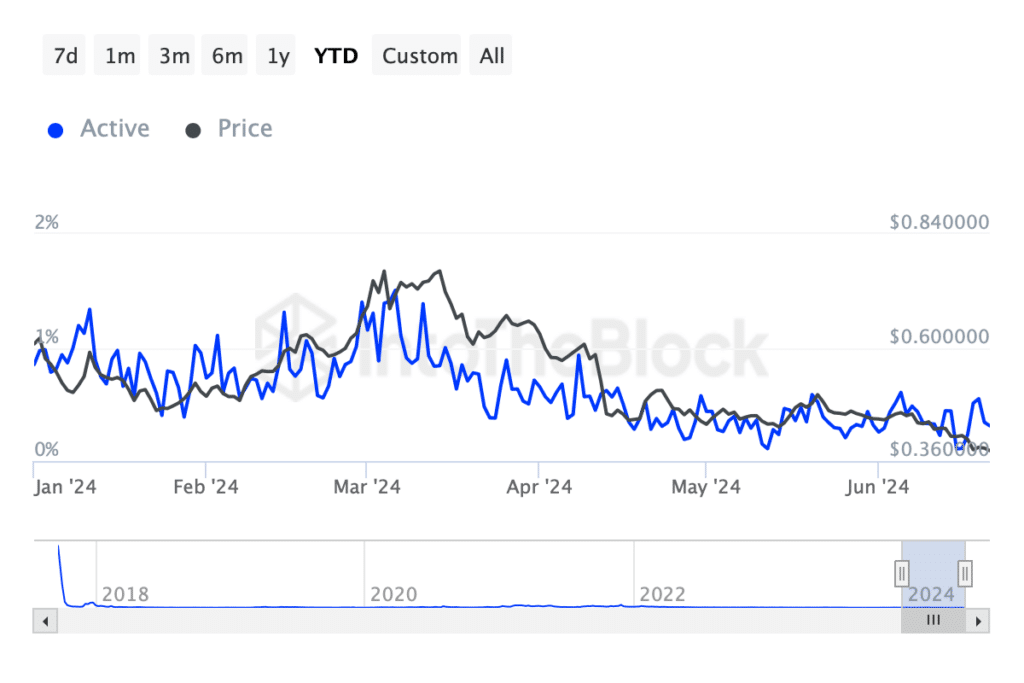

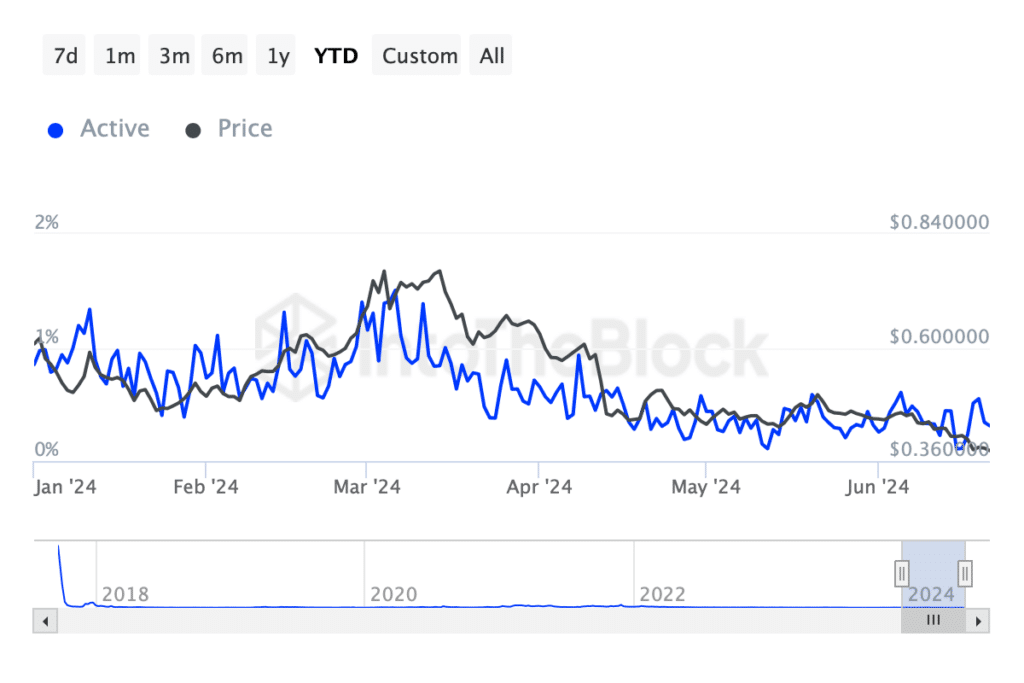

Since January, Cardano’s active address percentages have been declining, while the price remained relatively stable until a sharp decline in May.

The hike in zero balance addresses starting around late March correlated with the declining price. It implied that more holders have been liquidating or abandoning their positions as the price fell on the charts.

Source: IntoTheBlock

The new adoption rate peaked in early February, but it saw a major decline soon after, inversely related to the price movement, until a sharp hike in new adoption in June. This uptick is obviously related to the upcoming updates, with many in the community excited as expected too.

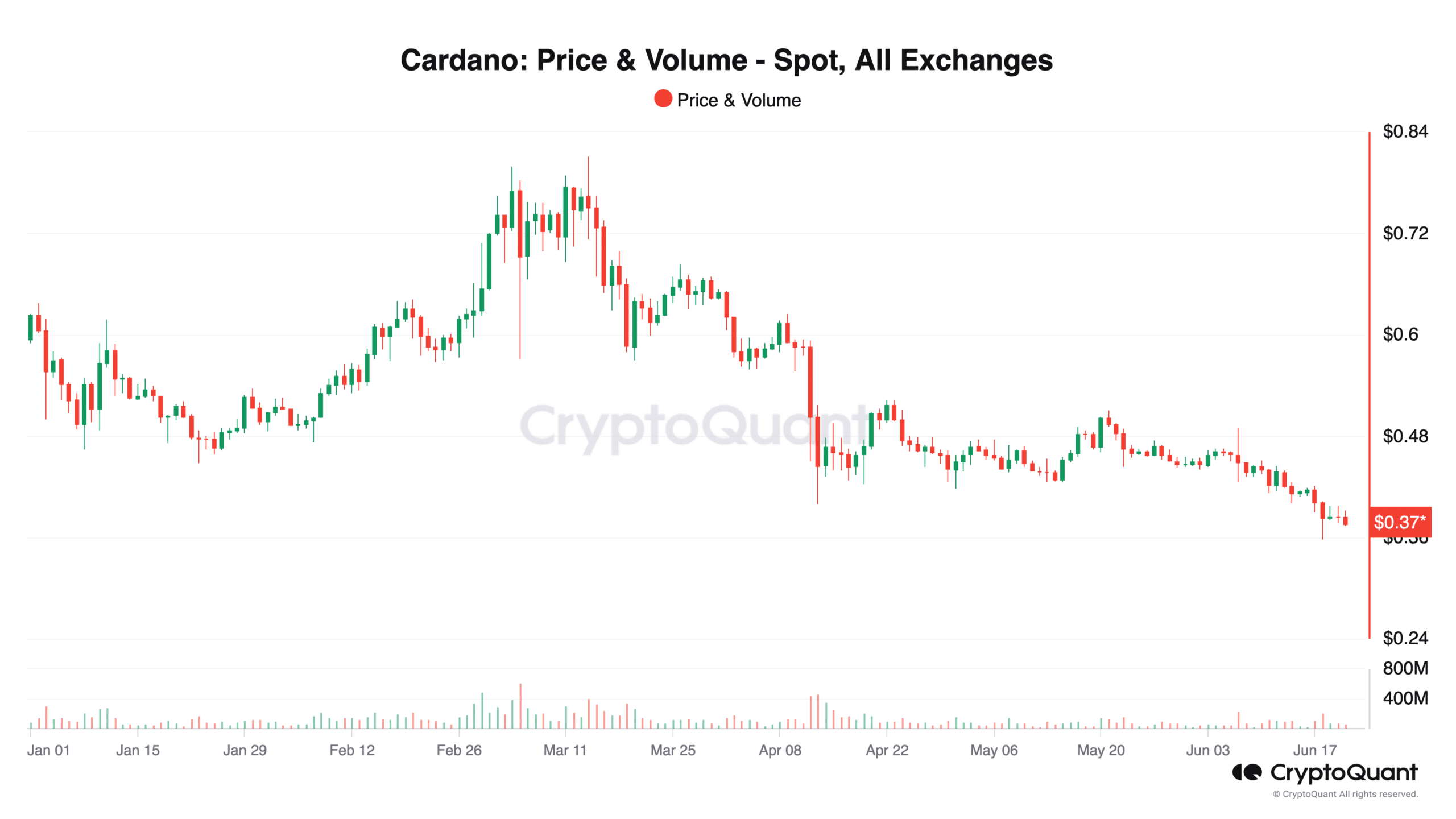

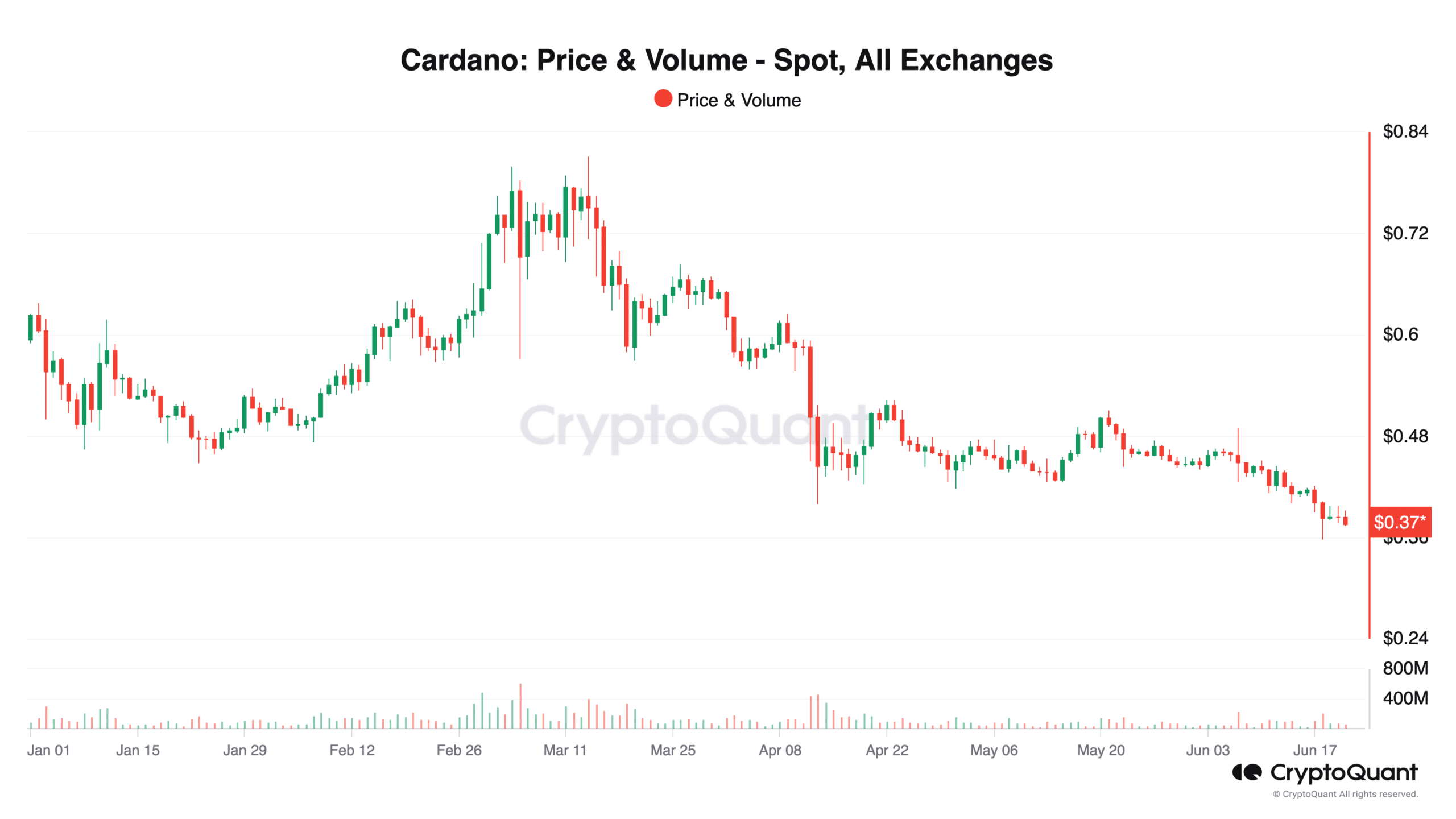

Now, while ADA has recovered on the charts, it has failed to sustain its upward momentum. This is a sign of an ongoing bearish run and a cautious or even negative investor response.

Source: CryptoQuant

Additionally, ADA’s price has shown a tendency to consolidate around the $0.377-level, with minor fluctuations indicating a lack of strong directional momentum.

The 50-period moving average (red line) seemed to be acting as a resistance around the $0.385-level, while the 200-period moving average (blue line) around $0.376 served as the short-term support.

The MACD line and the Signal line flashed multiple crossovers too. These crossovers were relatively close to the zero line on the charts, indicating that the momentum, whether bullish or bearish, has not been particularly strong.

Here, it’s worth noting that as ADA fell on the price charts, it was accompanied by an increase in volume – Contributing to an uptick in selling pressure.

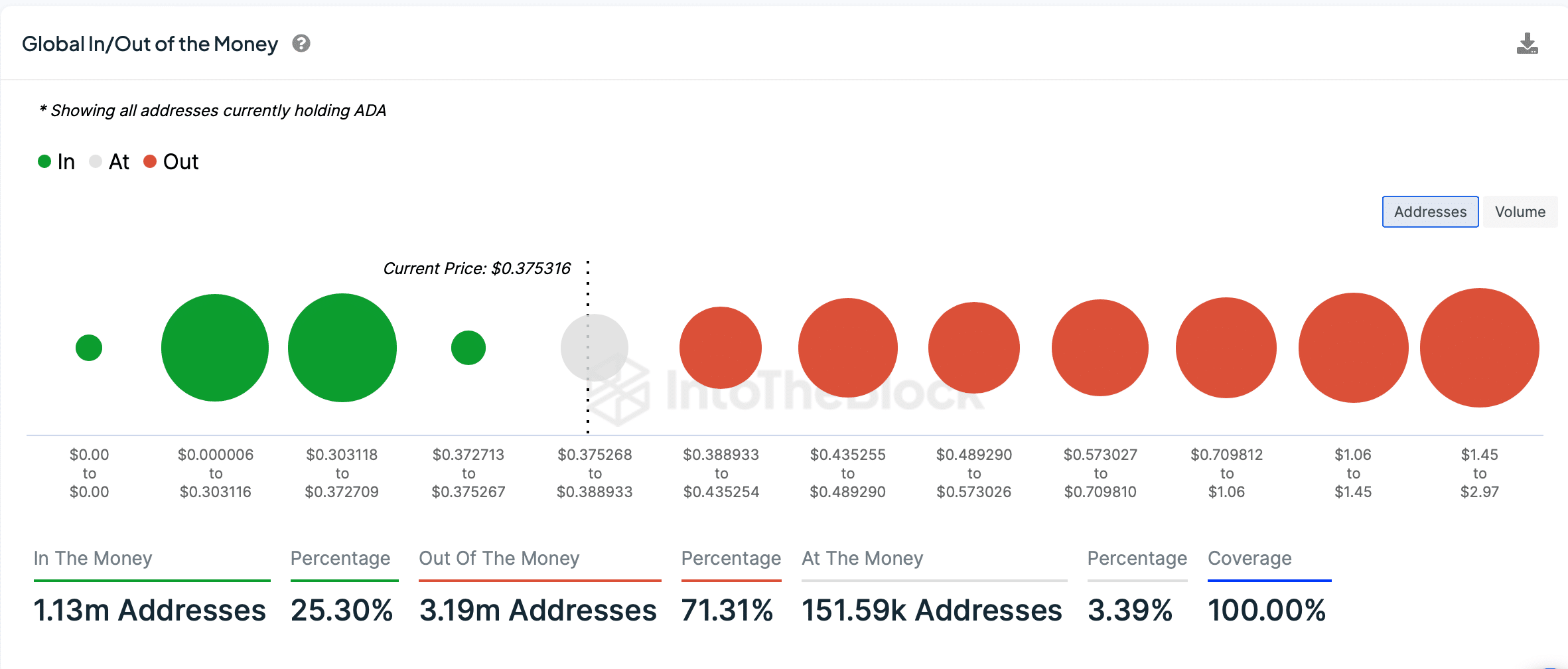

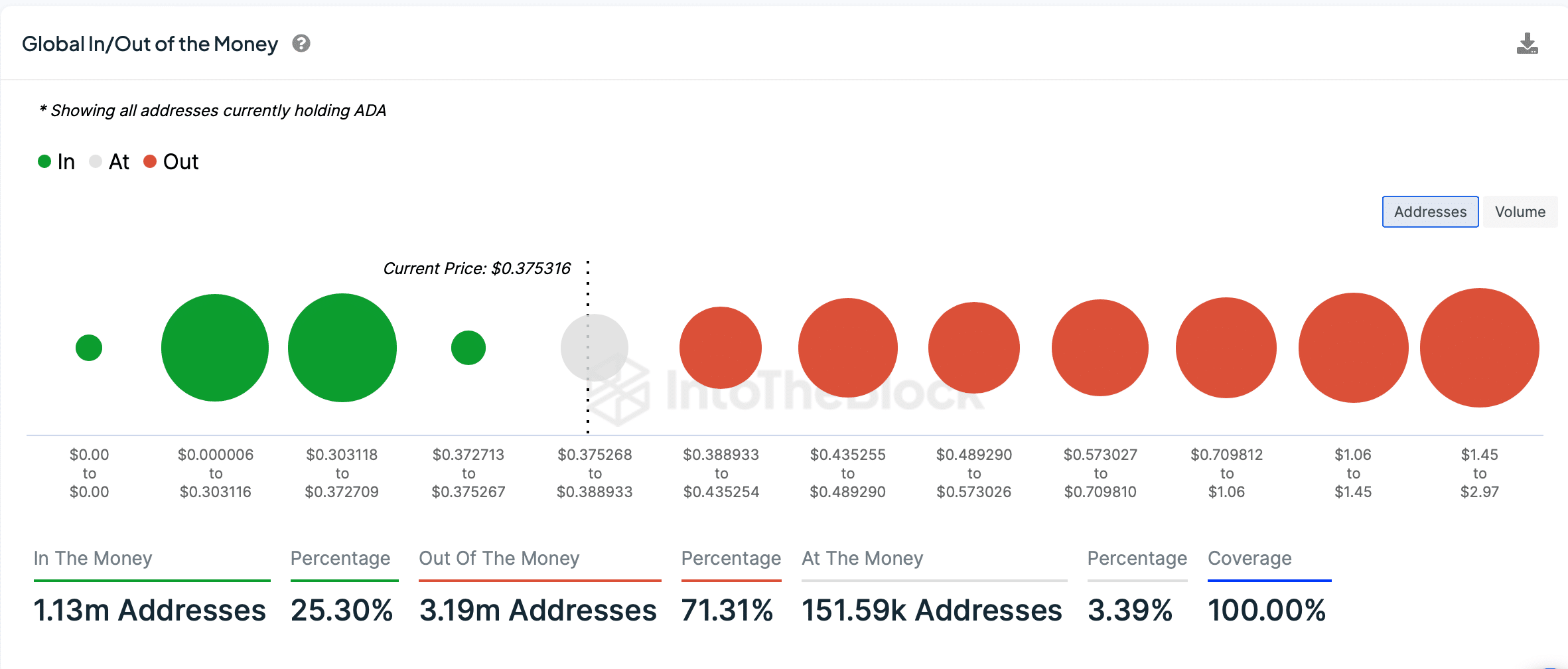

Source: IntoTheBlock

Finally, the high percentage of addresses out of the money is a sign of widespread bearish sentiment and pressure on the price. Especially if holders decide to sell to cut losses as the price rises close to its entry points.

If the upcoming upgrades improve ADA’s performance and utility, they could shift these proportions, moving more addresses into the “in the money” category. In doing so, it could possibly drive up the price as confidence in Cardano’s future returns.

- Cardano’s price consolidated around $0.37, with fluctuations indicating bearish momentum

- Uptick in new adoption pointed to growing interest in upcoming upgrades

Cardano is expecting a significant network upgrade soon, one which could lead to a price surge for ADA. In fact, the latest report from Cardano’s parent company, Input Output Hong Kong (IOHK), highlighted advancements in smart contracts, wallet services, core technology, and more.

Hence, the question – Is ADA set for a breakout now?

Market sentiment and price trends

Since January, Cardano’s active address percentages have been declining, while the price remained relatively stable until a sharp decline in May.

The hike in zero balance addresses starting around late March correlated with the declining price. It implied that more holders have been liquidating or abandoning their positions as the price fell on the charts.

Source: IntoTheBlock

The new adoption rate peaked in early February, but it saw a major decline soon after, inversely related to the price movement, until a sharp hike in new adoption in June. This uptick is obviously related to the upcoming updates, with many in the community excited as expected too.

Now, while ADA has recovered on the charts, it has failed to sustain its upward momentum. This is a sign of an ongoing bearish run and a cautious or even negative investor response.

Source: CryptoQuant

Additionally, ADA’s price has shown a tendency to consolidate around the $0.377-level, with minor fluctuations indicating a lack of strong directional momentum.

The 50-period moving average (red line) seemed to be acting as a resistance around the $0.385-level, while the 200-period moving average (blue line) around $0.376 served as the short-term support.

The MACD line and the Signal line flashed multiple crossovers too. These crossovers were relatively close to the zero line on the charts, indicating that the momentum, whether bullish or bearish, has not been particularly strong.

Here, it’s worth noting that as ADA fell on the price charts, it was accompanied by an increase in volume – Contributing to an uptick in selling pressure.

Source: IntoTheBlock

Finally, the high percentage of addresses out of the money is a sign of widespread bearish sentiment and pressure on the price. Especially if holders decide to sell to cut losses as the price rises close to its entry points.

If the upcoming upgrades improve ADA’s performance and utility, they could shift these proportions, moving more addresses into the “in the money” category. In doing so, it could possibly drive up the price as confidence in Cardano’s future returns.

can you get generic clomid without a prescription cost of generic clomiphene without rx how to buy clomiphene without prescription clomid challenge test protocol can you buy cheap clomiphene prices clomid prescription cost can i purchase cheap clomiphene pills

You actually explained this perfectly!

casino en ligne

Cheers. Good information.

casino en ligne

You suggested it terrifically.

casino en ligne

Really all kinds of very good information.

casino en ligne

Terrific material, Kudos!

meilleur casino en ligne

Nicely put, Thank you.

casino en ligne

Excellent content, Appreciate it!

casino en ligne

Nicely put, Thanks a lot!

casino en ligne francais

Thanks, Great stuff!

casino en ligne France

You definitely made your point!

casino en ligne francais

More articles like this would remedy the blogosphere richer.

This website really has all of the information and facts I needed about this participant and didn’t know who to ask.

buy zithromax without prescription – tindamax online order order generic metronidazole 400mg

where to buy semaglutide without a prescription – order rybelsus sale buy cyproheptadine 4 mg online

motilium over the counter – buy cyclobenzaprine 15mg pills cyclobenzaprine price

buy propranolol pill – how to buy clopidogrel cheap methotrexate

buy amoxicillin for sale – amoxil tablets order ipratropium 100mcg for sale

order azithromycin pills – azithromycin cheap bystolic pill

augmentin 375mg canada – atbioinfo.com order ampicillin without prescription

buy nexium online – https://anexamate.com/ nexium 40mg sale

medex canada – https://coumamide.com/ order losartan 25mg online

buy meloxicam 15mg – swelling buy mobic generic

purchase deltasone generic – https://apreplson.com/ order prednisone 40mg online cheap

pills for ed – https://fastedtotake.com/ how to buy ed pills

buy amoxil online – combamoxi amoxicillin tablets

buy forcan sale – https://gpdifluca.com/# how to get fluconazole without a prescription

cenforce over the counter – cenforcers.com buy cenforce 50mg online cheap

cialis patent expiration 2016 – this achats produit tadalafil pour femme en ligne

order ranitidine 150mg generic – click buy ranitidine cheap

This is the kind of glad I take advantage of reading. como aumentar efecto de cialis

viagra cheap discount – https://strongvpls.com/ how to buy cheap viagra online

This website really has all of the information and facts I needed adjacent to this participant and didn’t comprehend who to ask. buy amoxil tablets

I’ll certainly return to review more. https://prohnrg.com/product/diltiazem-online/

The thoroughness in this section is noteworthy. https://aranitidine.com/fr/clenbuterol/

This is the amicable of serenity I get high on reading. https://ondactone.com/product/domperidone/

More posts like this would make the blogosphere more useful.

brand toradol 10mg

With thanks. Loads of conception! http://www.orlandogamers.org/forum/member.php?action=profile&uid=28881

order forxiga 10mg pills – https://janozin.com/ order dapagliflozin generic

generic xenical – https://asacostat.com/ oral orlistat 120mg

More posts like this would force the blogosphere more useful. http://www.01.com.hk/member.php?Action=viewprofile&username=Iclurr