- Uniswap has recorded a 13.34% surge in the last four days

- Key indicators show a continued bullish momentum and a breakout from $12.

Uniswap [UNI], the decentralized exchange, has been in recovery for the last seven days as it’s price surged by over 13%. However, in the last 24 hours, it has recorded a 2.7% drop after experiencing a price surge the previous day.

In fact, at press time, UNI was trading at $11 following its latest correction at $6.7. Since starting a bullish trend, the asset has gained over 70% in three weeks, pushing the prices to $11.9.

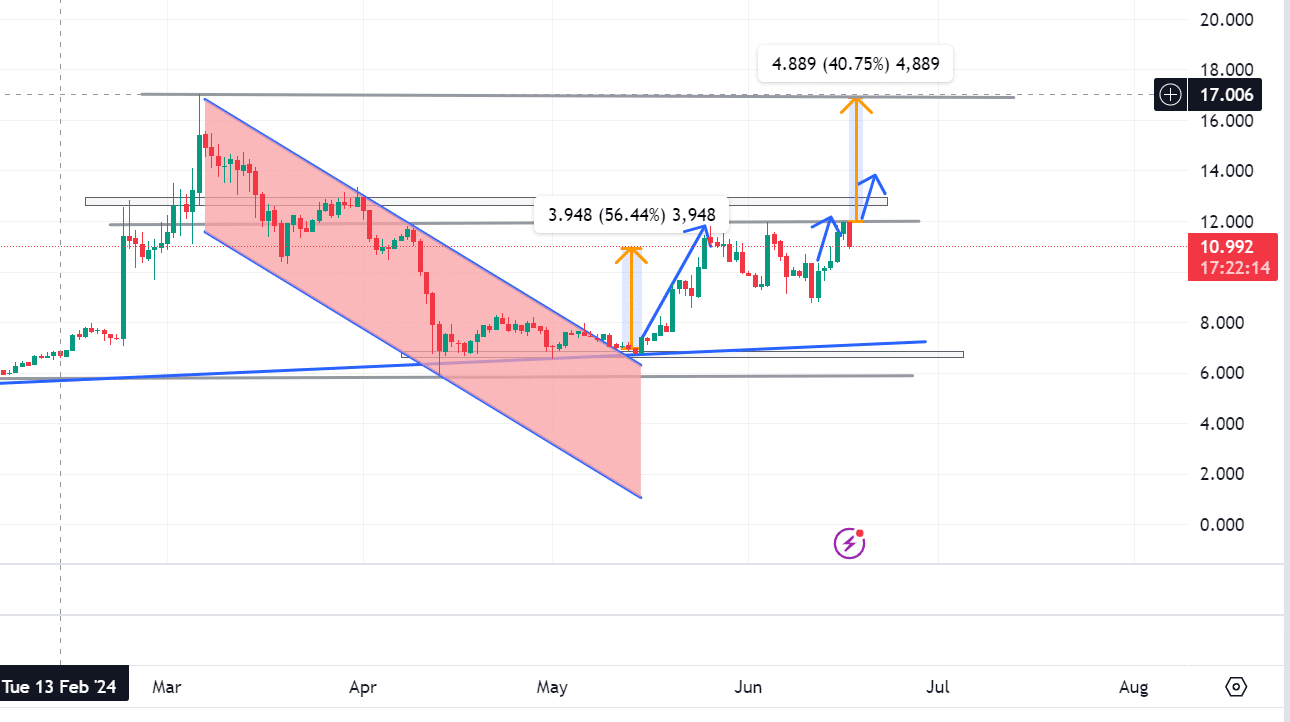

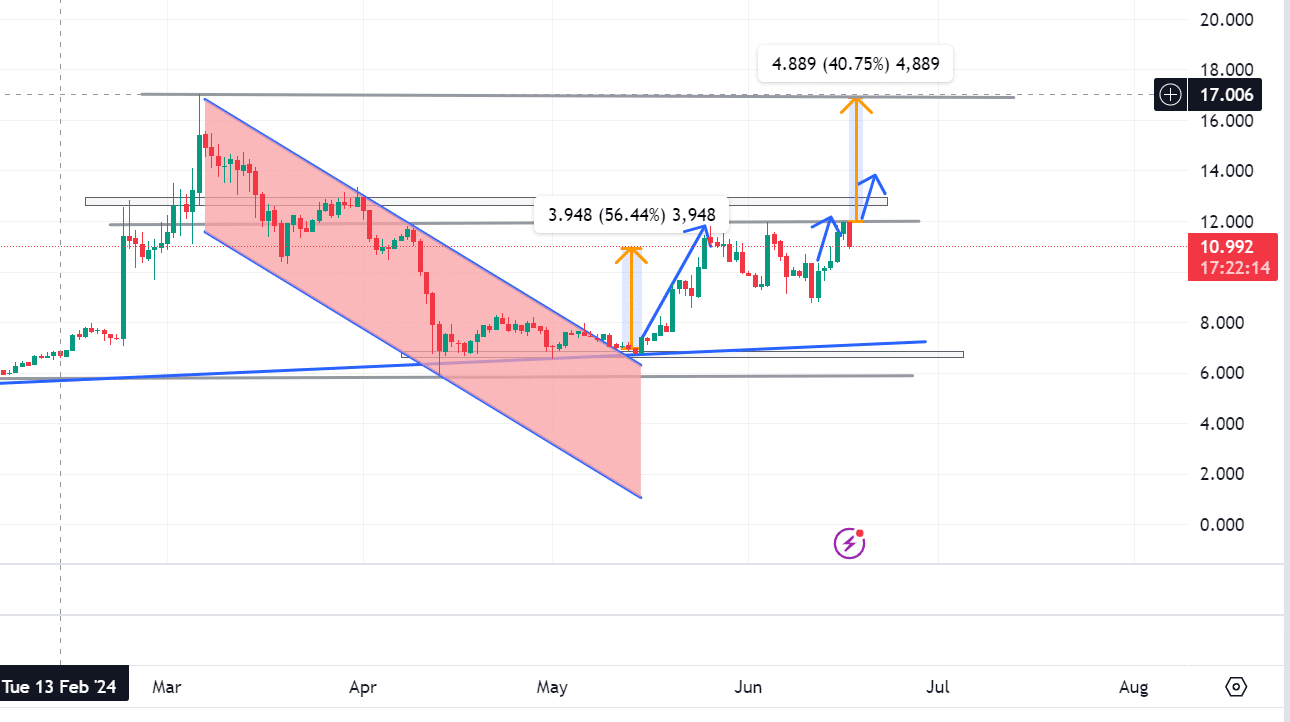

Source: Tradingview

AMBCrypto’s analysis indicates that the current price was 74% below its highest level while enjoying a 2540% increase from ATL. From its lowest price of $6.9 on 3rd May, it has recovered by 56.4% to $10.92.

The current price indicates a continued bullish trend with the potential to break the $12 resistance level. With a 56% rise above the resistance level, the prices can surge past $14 with $13.7 as its potential next price shift.

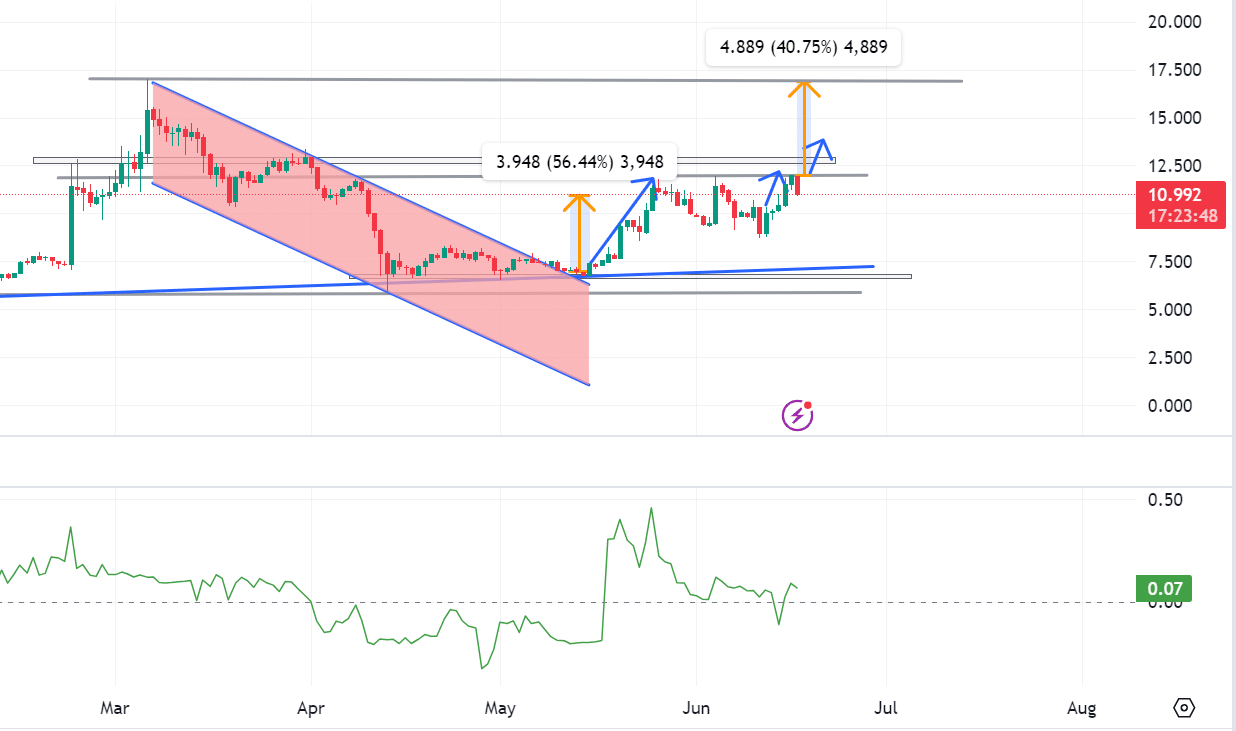

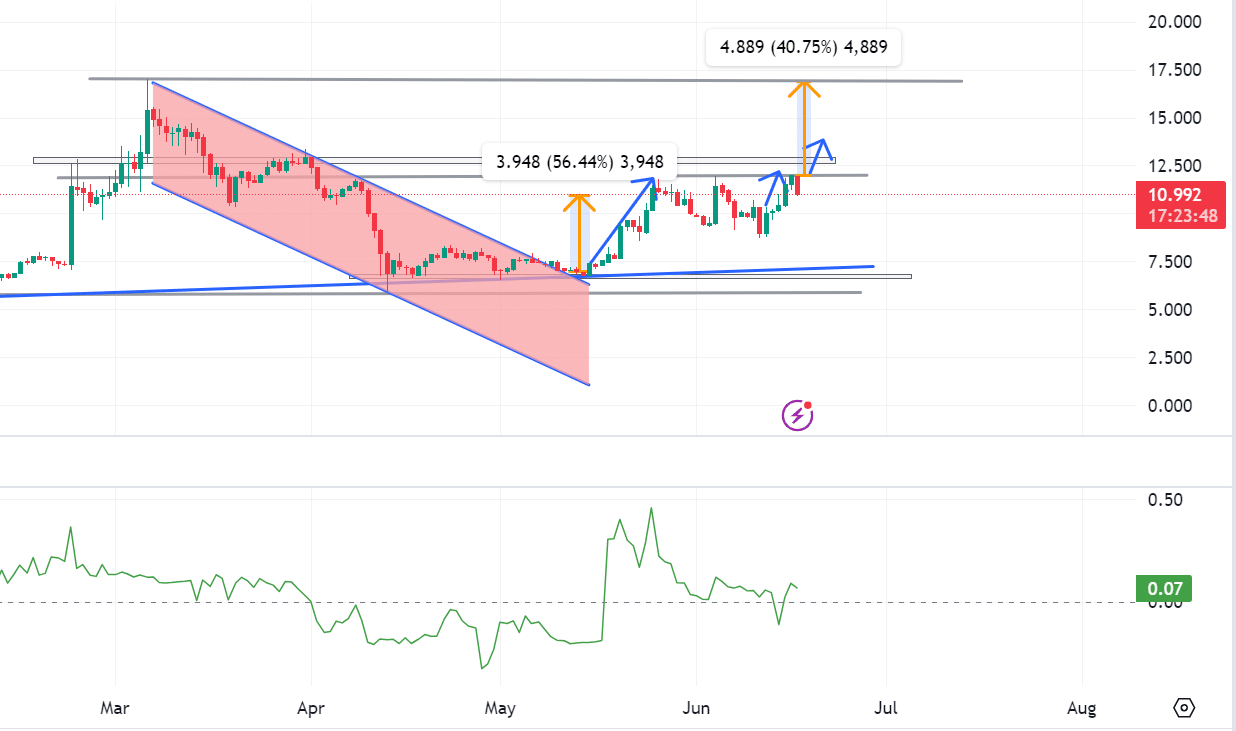

Source: Tradingview

Also, the current positive CMF of 0.07 indicates higher buying pressure than selling. A higher buying pressure implies extended accumulation rates than sell-offs.

The indicators reinforce the bullish trend’s continuity.

Uniswap’s market outlook

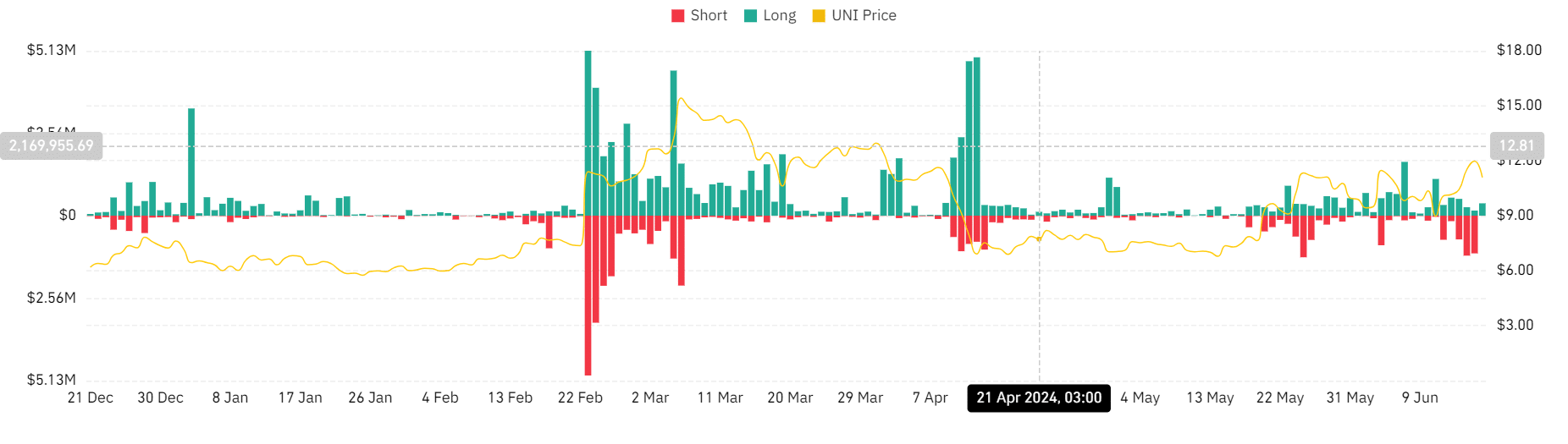

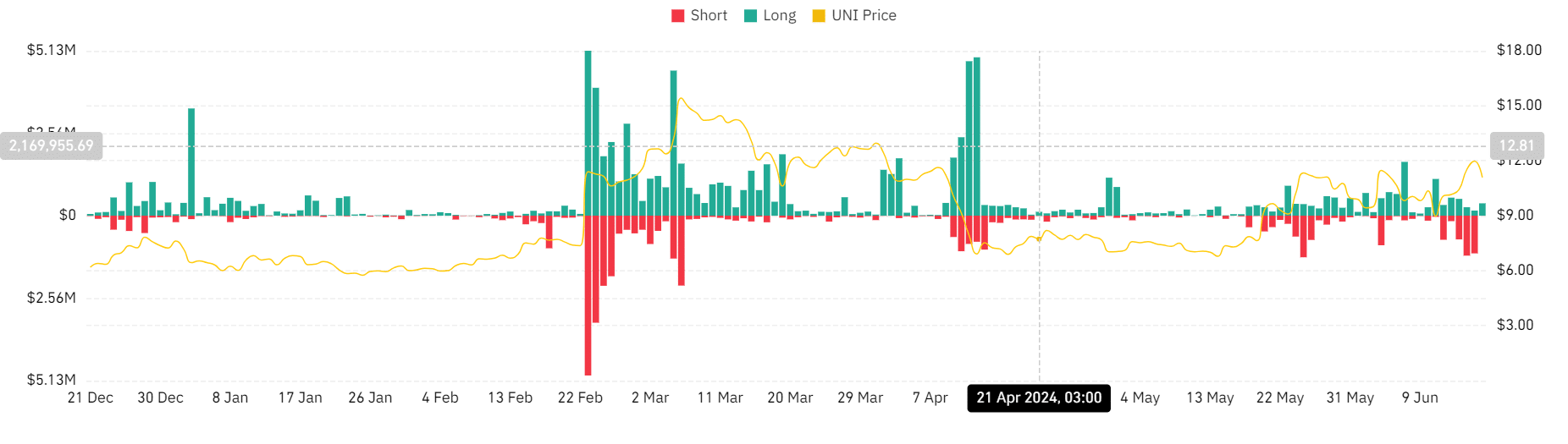

Looking further, according to Coinglass, UNI has reported low liquidation rates. Coinglass data indicates that investors at short positions have the lowest liquidation rates of $2.43k at press time.

Source: Coinglass

At the same time, long positions have higher liquidity levels of $383k.

However, the overall liquidation is low and sets for a further fall. This low liquidation shows stable market conditions, with fewer traders having to sell their positions.

Thus, low selling pressure helps maintain existing prices while supporting a gradual price increase.

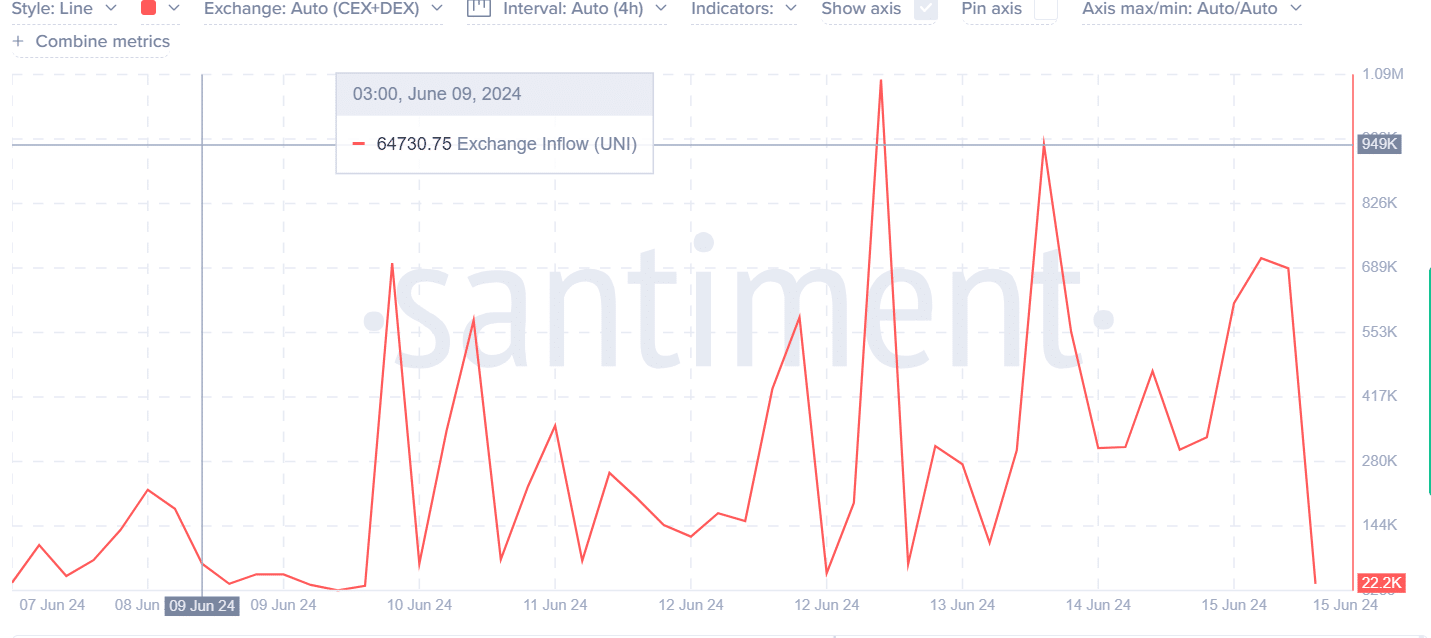

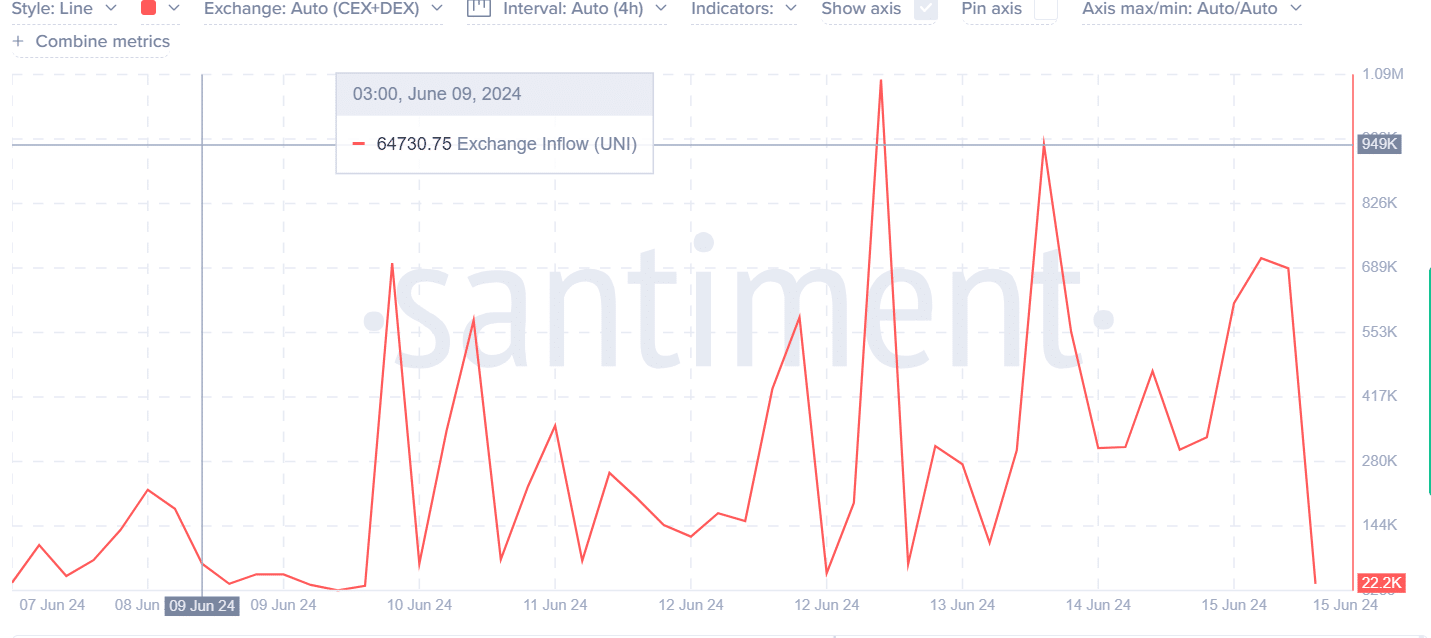

Source: Santiment

Broadly, Santiment’s data on exchange inflow shows a downtrend. Reduced exchange inflow implies lower selling pressure, which drives prices up.

Lower selling pressure is equated with market stability. This data implies that the UNI market is stable and set for further price increases as the market sentiment indicates no intention to sell.

Is your portfolio green? Check out the UNI Profit Calculator

How far will the bullish momentum hold?

UNI’s current price at $10.9 is testing the resistance level, indicating the potential breakout from the pattern. If it breaks out off the $12 resistance level, it indicates that buyers could aim toward $17 and pass it.

If the market moves past a high of $17, it could aim past $22 if the exact price change holds.

- Uniswap has recorded a 13.34% surge in the last four days

- Key indicators show a continued bullish momentum and a breakout from $12.

Uniswap [UNI], the decentralized exchange, has been in recovery for the last seven days as it’s price surged by over 13%. However, in the last 24 hours, it has recorded a 2.7% drop after experiencing a price surge the previous day.

In fact, at press time, UNI was trading at $11 following its latest correction at $6.7. Since starting a bullish trend, the asset has gained over 70% in three weeks, pushing the prices to $11.9.

Source: Tradingview

AMBCrypto’s analysis indicates that the current price was 74% below its highest level while enjoying a 2540% increase from ATL. From its lowest price of $6.9 on 3rd May, it has recovered by 56.4% to $10.92.

The current price indicates a continued bullish trend with the potential to break the $12 resistance level. With a 56% rise above the resistance level, the prices can surge past $14 with $13.7 as its potential next price shift.

Source: Tradingview

Also, the current positive CMF of 0.07 indicates higher buying pressure than selling. A higher buying pressure implies extended accumulation rates than sell-offs.

The indicators reinforce the bullish trend’s continuity.

Uniswap’s market outlook

Looking further, according to Coinglass, UNI has reported low liquidation rates. Coinglass data indicates that investors at short positions have the lowest liquidation rates of $2.43k at press time.

Source: Coinglass

At the same time, long positions have higher liquidity levels of $383k.

However, the overall liquidation is low and sets for a further fall. This low liquidation shows stable market conditions, with fewer traders having to sell their positions.

Thus, low selling pressure helps maintain existing prices while supporting a gradual price increase.

Source: Santiment

Broadly, Santiment’s data on exchange inflow shows a downtrend. Reduced exchange inflow implies lower selling pressure, which drives prices up.

Lower selling pressure is equated with market stability. This data implies that the UNI market is stable and set for further price increases as the market sentiment indicates no intention to sell.

Is your portfolio green? Check out the UNI Profit Calculator

How far will the bullish momentum hold?

UNI’s current price at $10.9 is testing the resistance level, indicating the potential breakout from the pattern. If it breaks out off the $12 resistance level, it indicates that buyers could aim toward $17 and pass it.

If the market moves past a high of $17, it could aim past $22 if the exact price change holds.

where to get clomid no prescription can i purchase clomiphene without insurance can i get generic clomiphene without rx can you get clomid without a prescription where buy clomiphene no prescription buy clomiphene price how to get generic clomiphene tablets

More posts like this would prosper the blogosphere more useful.

Thanks on putting this up. It’s well done.

order azithromycin online – order ciprofloxacin 500 mg without prescription order metronidazole for sale

order motilium 10mg pill – brand tetracycline 250mg flexeril generic

generic augmentin 1000mg – https://atbioinfo.com/ ampicillin uk

buy esomeprazole 40mg capsules – nexium to us order nexium 20mg for sale

coumadin 5mg cheap – https://coumamide.com/ buy losartan

mobic 15mg sale – https://moboxsin.com/ mobic oral

prednisone generic – https://apreplson.com/ generic prednisone 5mg

non prescription erection pills – fastedtotake.com buy ed pills gb

order amoxicillin pill – cheap amoxil pills amoxil pills

buy diflucan 100mg online – on this site cheap diflucan

buy cenforce 50mg pills – cenforcers.com cenforce cost

maximpeptide tadalafil review – https://ciltadgn.com/# cialis high blood pressure

ranitidine 150mg tablet – buy generic ranitidine online zantac 300mg tablet

buy cialis tadalafil – https://strongtadafl.com/ tadalafil how long to take effect

This is a keynote which is forthcoming to my verve… Numberless thanks! Quite where can I lay one’s hands on the contact details for questions? efectos secundarios neurontin 300

order viagra cialis canada – sildenafil 100 mg precio buy generic viagra online overnight

The sagacity in this tune is exceptional. https://buyfastonl.com/isotretinoin.html

I am in truth enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://ursxdol.com/get-metformin-pills/

This is the make of enter I unearth helpful. https://prohnrg.com/product/loratadine-10-mg-tablets/

Thanks on sharing. It’s first quality. site

More peace pieces like this would make the web better. https://ondactone.com/spironolactone/

Palatable blog you procure here.. It’s hard to find great worth belles-lettres like yours these days. I honestly recognize individuals like you! Go through guardianship!!

buy metoclopramide generic

More text pieces like this would insinuate the web better. http://fulloyuntr.10tl.net/member.php?action=profile&uid=3136