- Lido’s price rise leads to an increase in the market cap of liquid staking assets.

- At the time of this writing, LDO was trading at approximately $2.13

As the past week drew to a close and the new one began, Ethereum [ETH] experienced a minor rebound. Similarly, Lido Dao witnessed a comparable movement.

Data indicates that while the volume of staked Ethereum continued to rise, the dominance of the DAO also persisted.

Lido’s rise helps liquid staking market cap

Data from Santiment indicates that Liquid staking assets experienced a favorable performance over the weekend, with Lido being one of the notable gainers.

Reports show that the market capitalization of liquid staking assets surged by more than 5%. Specifically, LDO demonstrated a commendable increase of over 5% during this period.

How Lido has trended

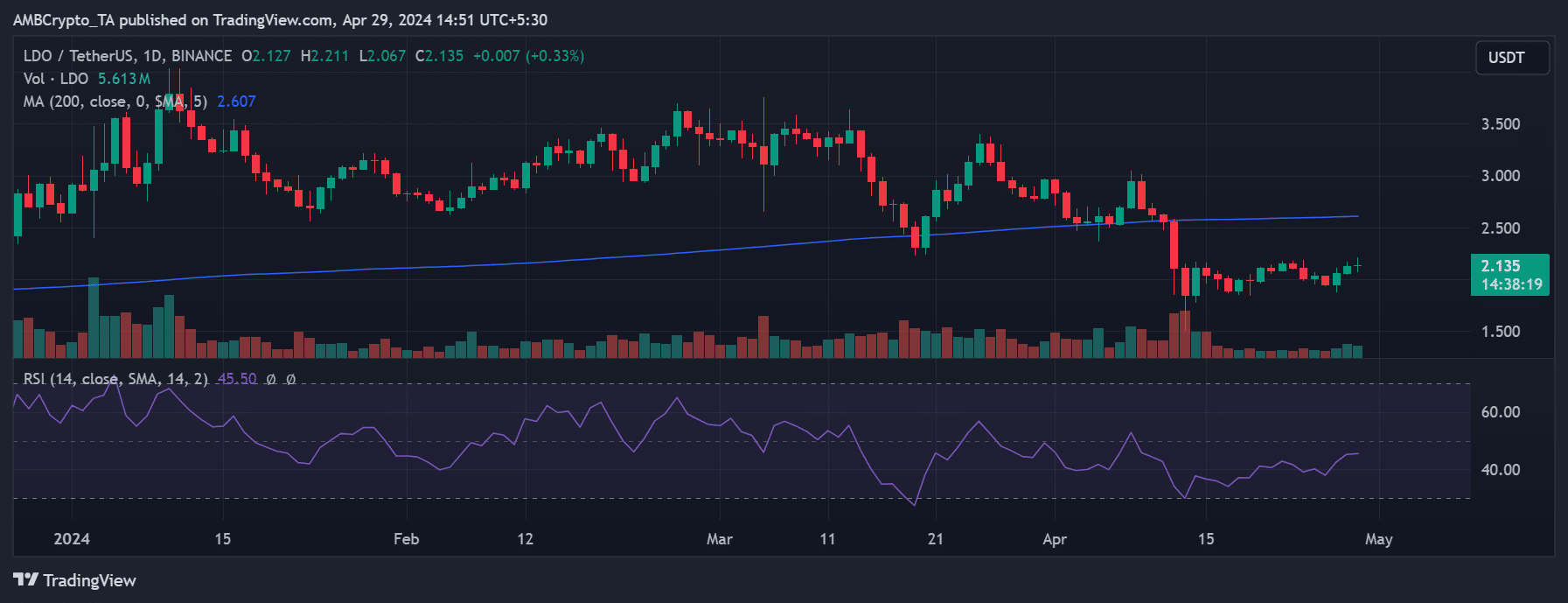

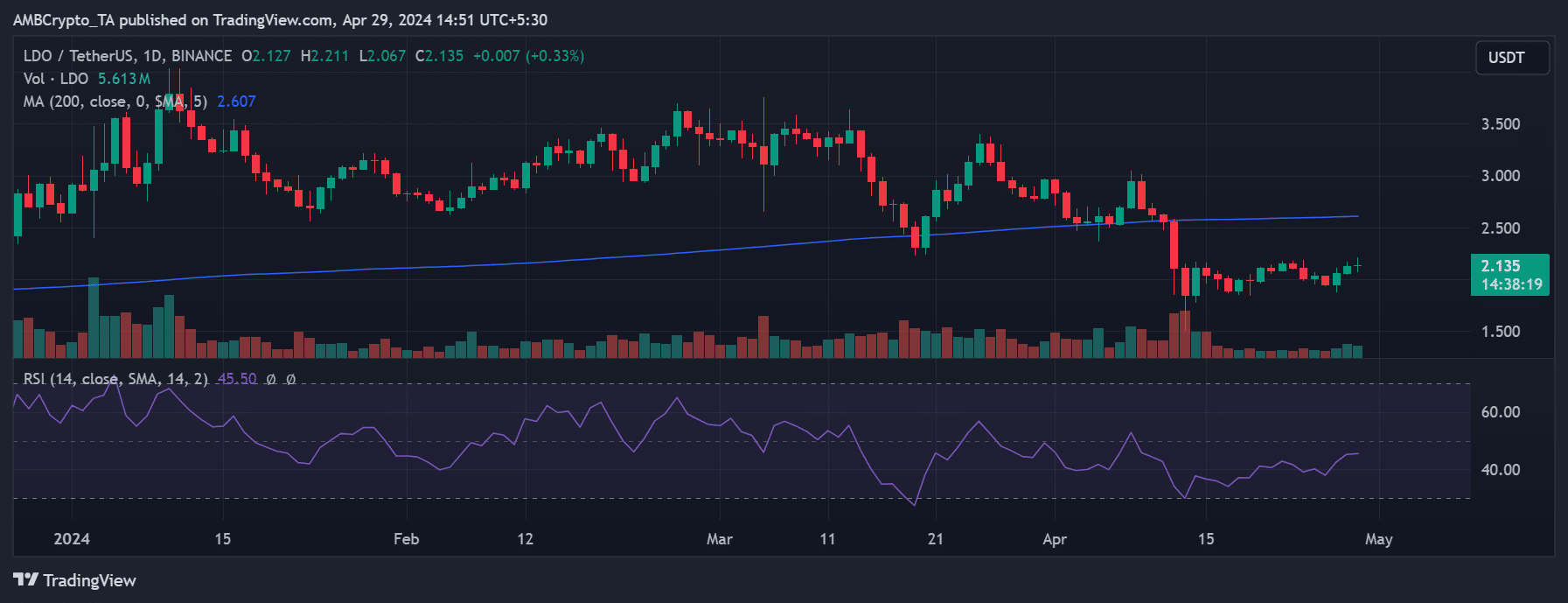

Analysis of Lido Dao’s price trend on a daily timeframe chart revealed a positive trajectory at the end of the previous week.

On 27th April, LDO experienced a notable increase of over 5%, reaching a trading price of approximately $2.05. The following day, 28th April, the upward trend continued with a further 3% increase, pushing the price to around $2.12.

At the time of this writing, it was trading at approximately $2.13, with a slight increase of less than 1%.

Source: TradingView

If this trend persists until the end of 29th April, it will mark the first and only three consecutive days of uptrend for LDO in the month. Before this, the last occurrence of such an uptrend was observed in March, happening only once.

Additionally, analysis of its Relative Strength Index (RSI) indicates that despite the recent positive movements, LDO remains in a bearish trend.

At the time of this writing, the RSI was below the neutral zone. Further examination suggests that since February, LDO has not sustained an extended period above the neutral zone, indicating a prevailing bearish trend in recent months.

However, despite the price fluctuations, the platform continues to maintain dominance in Ethereum staking.

Lido gets the most Ethereum stakes

According to data from Dune Analytics, more than 32 million Ethereum have been staked thus far, accounting for over 27% of the total supply.

Notably, Lido contributes significantly to this figure, representing 28% of the total staked ETH. This equates to over 9.3 million ETH staked through Lido.

Is your portfolio green? Check out the Lido Profit Calculator

Furthermore, the data reveals that staking activity has increased by approximately 6% over the last six months, indicating the platform’s continued dominance in Ethereum staking.

However, a closer examination of the data also unveils a recent decline in staking netflow over the past few weeks. This decline has coincided with decreases in Lido’s native token (LDO) and Ethereum prices.

- Lido’s price rise leads to an increase in the market cap of liquid staking assets.

- At the time of this writing, LDO was trading at approximately $2.13

As the past week drew to a close and the new one began, Ethereum [ETH] experienced a minor rebound. Similarly, Lido Dao witnessed a comparable movement.

Data indicates that while the volume of staked Ethereum continued to rise, the dominance of the DAO also persisted.

Lido’s rise helps liquid staking market cap

Data from Santiment indicates that Liquid staking assets experienced a favorable performance over the weekend, with Lido being one of the notable gainers.

Reports show that the market capitalization of liquid staking assets surged by more than 5%. Specifically, LDO demonstrated a commendable increase of over 5% during this period.

How Lido has trended

Analysis of Lido Dao’s price trend on a daily timeframe chart revealed a positive trajectory at the end of the previous week.

On 27th April, LDO experienced a notable increase of over 5%, reaching a trading price of approximately $2.05. The following day, 28th April, the upward trend continued with a further 3% increase, pushing the price to around $2.12.

At the time of this writing, it was trading at approximately $2.13, with a slight increase of less than 1%.

Source: TradingView

If this trend persists until the end of 29th April, it will mark the first and only three consecutive days of uptrend for LDO in the month. Before this, the last occurrence of such an uptrend was observed in March, happening only once.

Additionally, analysis of its Relative Strength Index (RSI) indicates that despite the recent positive movements, LDO remains in a bearish trend.

At the time of this writing, the RSI was below the neutral zone. Further examination suggests that since February, LDO has not sustained an extended period above the neutral zone, indicating a prevailing bearish trend in recent months.

However, despite the price fluctuations, the platform continues to maintain dominance in Ethereum staking.

Lido gets the most Ethereum stakes

According to data from Dune Analytics, more than 32 million Ethereum have been staked thus far, accounting for over 27% of the total supply.

Notably, Lido contributes significantly to this figure, representing 28% of the total staked ETH. This equates to over 9.3 million ETH staked through Lido.

Is your portfolio green? Check out the Lido Profit Calculator

Furthermore, the data reveals that staking activity has increased by approximately 6% over the last six months, indicating the platform’s continued dominance in Ethereum staking.

However, a closer examination of the data also unveils a recent decline in staking netflow over the past few weeks. This decline has coincided with decreases in Lido’s native token (LDO) and Ethereum prices.

can i buy cheap clomid without prescription can i get clomiphene without a prescription buy cheap clomiphene pill where to buy generic clomiphene without dr prescription cost clomiphene without rx cost clomid for sale cost cheap clomiphene for sale

More posts like this would force the blogosphere more useful.

Thanks an eye to sharing. It’s top quality.

purchase rybelsus online – buy rybelsus online cheap order periactin online

motilium generic – purchase tetracycline without prescription purchase flexeril generic

inderal 10mg uk – methotrexate 5mg uk order methotrexate online cheap

cheap clavulanate – https://atbioinfo.com/ order ampicillin without prescription

esomeprazole 40mg tablet – https://anexamate.com/ esomeprazole pills

coumadin cheap – anticoagulant buy cozaar without prescription

mobic without prescription – https://moboxsin.com/ order meloxicam 15mg pills

erection pills – best ed pills at gnc buy ed pills online

buy amoxil pill – comba moxi cheap amoxil without prescription

order fluconazole 100mg online cheap – forcan cost purchase diflucan pill

cenforce 100mg oral – click order cenforce 100mg for sale

difference between tadalafil and sildenafil – site free cialis samples

purchase cialis online – https://strongtadafl.com/ cialis priligy online australia

cost zantac 300mg – https://aranitidine.com/# oral ranitidine 150mg

sildenafil 50 mg for sale – buy viagra professional online no prescription sildenafil 50mg

This is the tolerant of advise I recoup helpful. https://gnolvade.com/

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/amoxicillin.html

Thanks for putting this up. It’s well done. https://ursxdol.com/sildenafil-50-mg-in/

Greetings! Extremely serviceable advice within this article! It’s the crumb changes which wish turn the largest changes. Thanks a a quantity in the direction of sharing! https://prohnrg.com/

More posts like this would force the blogosphere more useful. https://ondactone.com/spironolactone/

I’ll certainly carry back to review more.

https://doxycyclinege.com/pro/metoclopramide/

Proof blog you have here.. It’s severely to find strong status script like yours these days. I justifiably comprehend individuals like you! Rent care!! http://forum.ttpforum.de/member.php?action=profile&uid=425020

dapagliflozin online order – https://janozin.com/# forxiga 10mg uk

buy xenical pills – https://asacostat.com/ buy xenical 60mg sale