- ETH’s Futures Open Interest touched an all-time high.

- Its Funding Rate across exchanges remained positive.

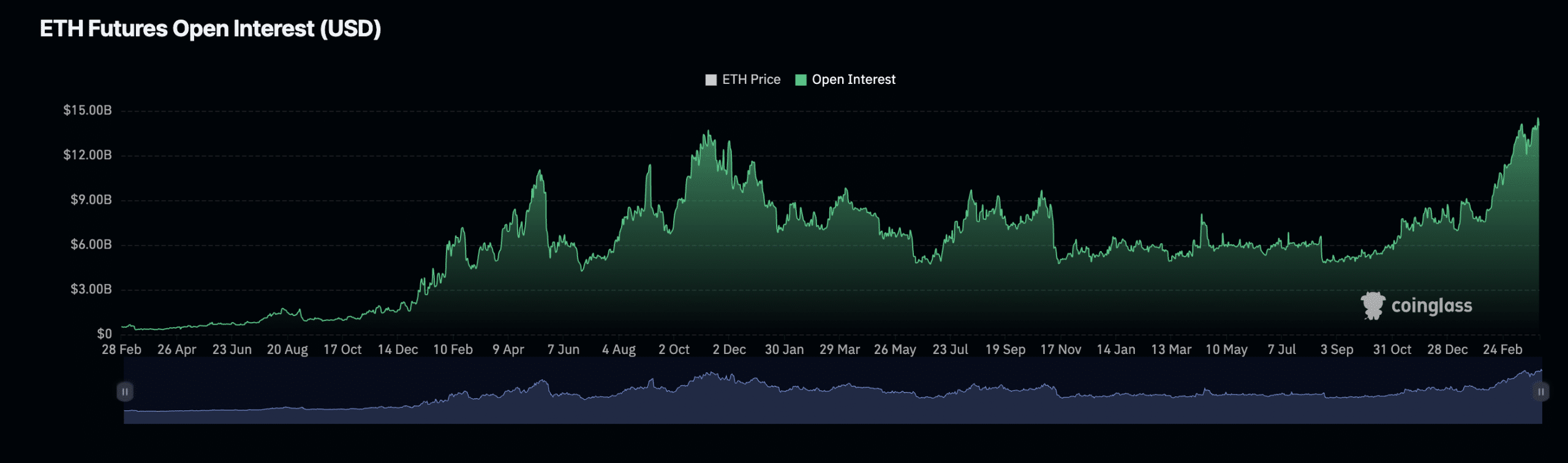

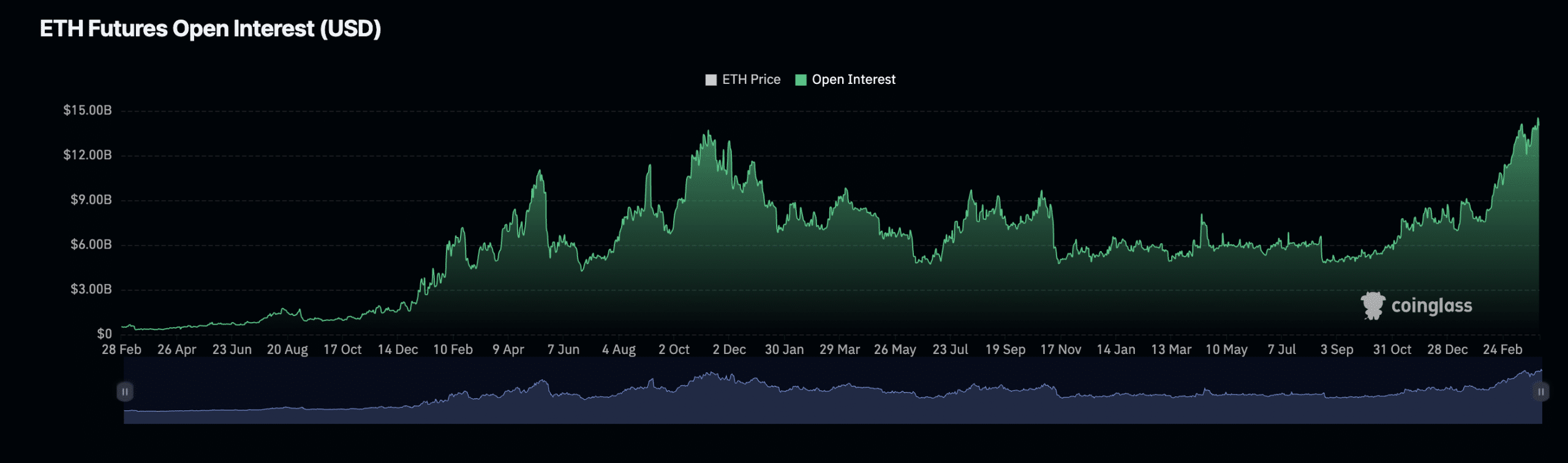

Ethereum [ETH] Futures Open Interest climbed to an all-time high as the uncertainty around the potential approval of a spot Ether exchange-traded fund (ETF) in the U.S. deepened.

Futures Open Interest refers to the total number of a coin’s Futures contracts that have yet to be settled or closed. When it rises, it indicates an increase in the number of market participants entering new positions.

According to AMBCrypto’s analysis of Coinglass’ data, ETH’s Futures Open Interest totaled $14.53 billion on the 1st of April, having risen by 86% year-to-date.

For context, ETH’s Futures Open Interest was below $10 billion at the beginning of the year.

Source: Coinglass

March was good for Ethereum’s Futures market

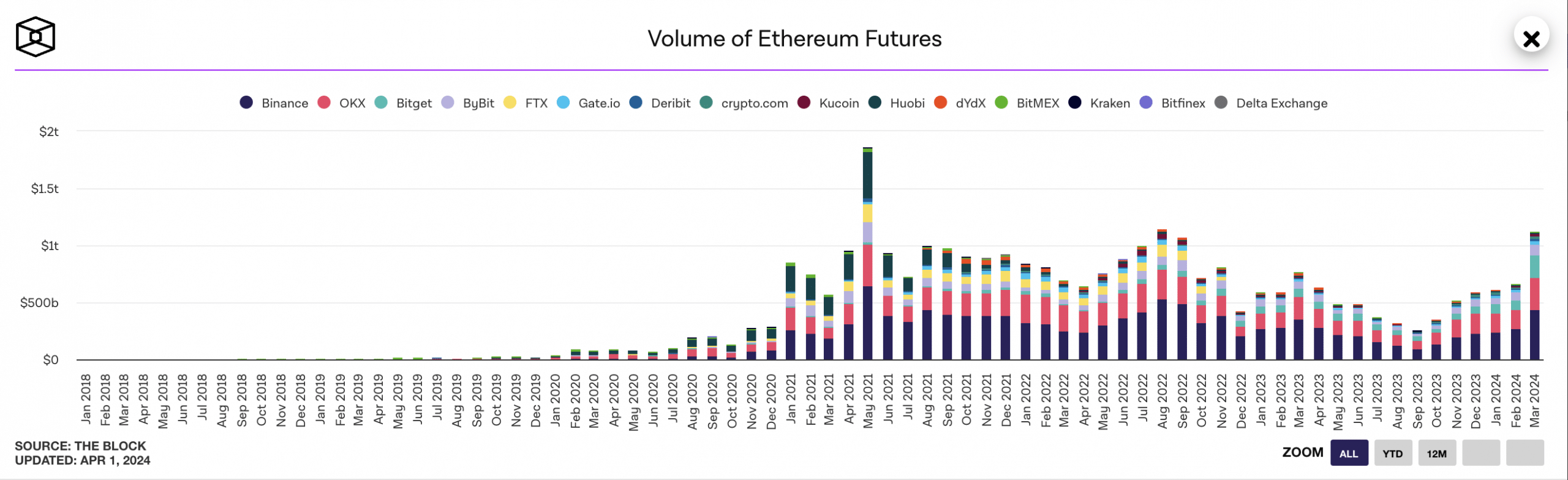

ETH’s Futures market recorded significant success in March, on-chain data has revealed.

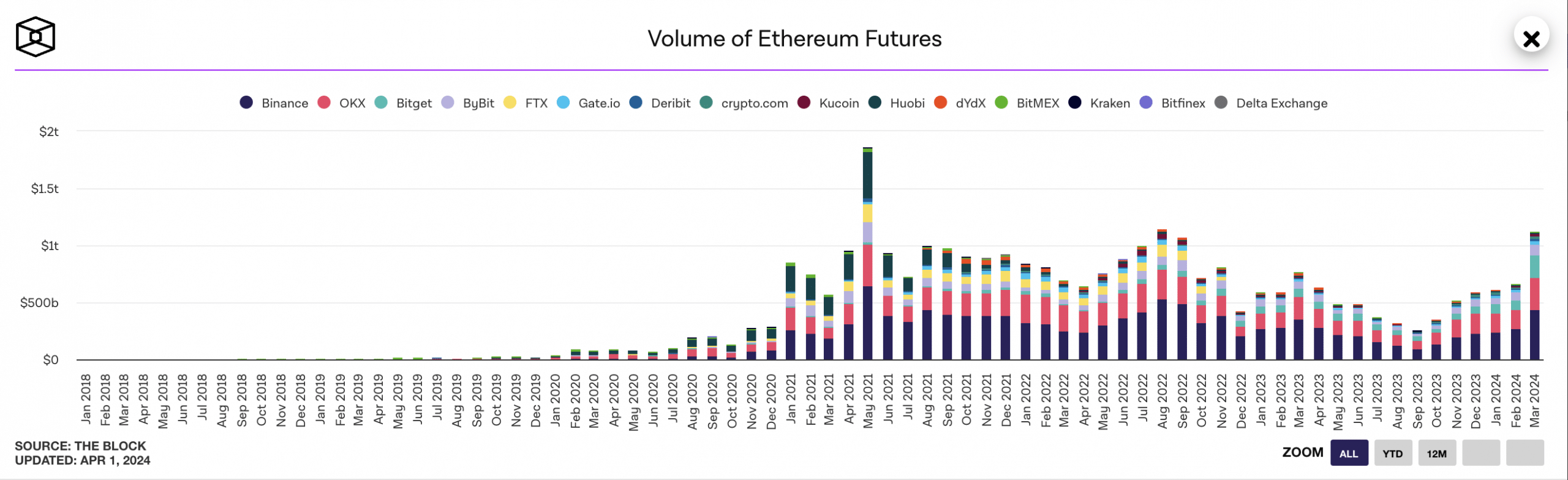

According to AMBCrypto’s analysis of The Block’s data dashboard, ETH Futures’ monthly trading volume across the largest cryptocurrency exchanges touched a three-year during the 31-day period.

Our look at The Block further showed that ETH Futures trading volume across these platforms exceeded $1 trillion. The last time the coin’s monthly trading volume was that high was in May 2021.

Source: The Block

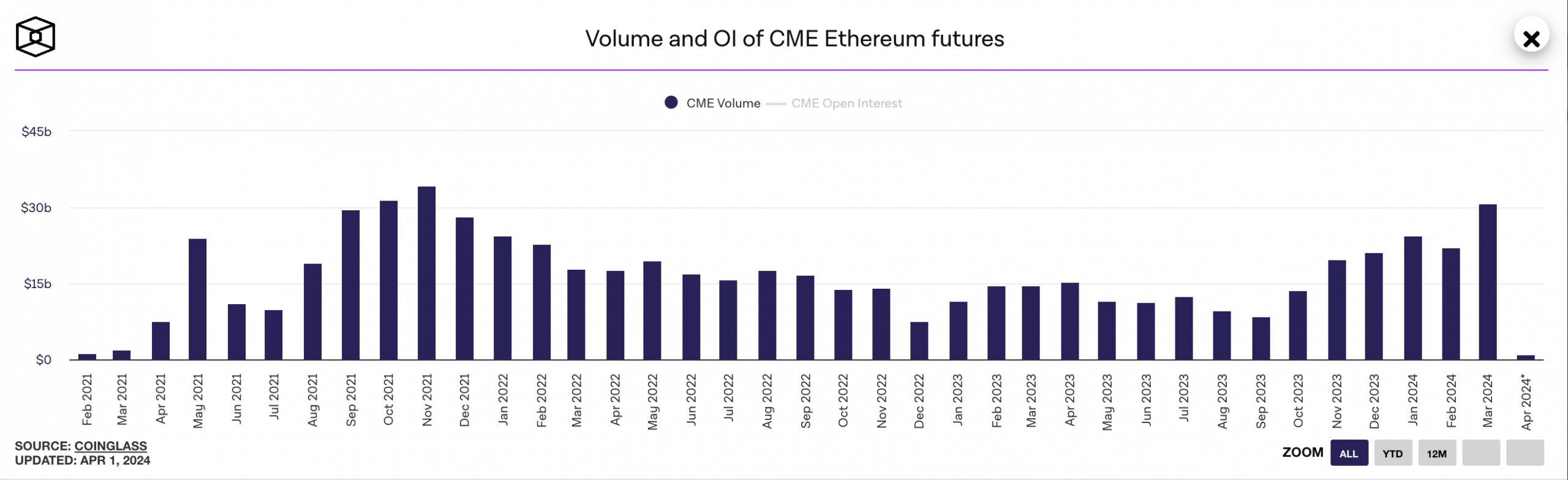

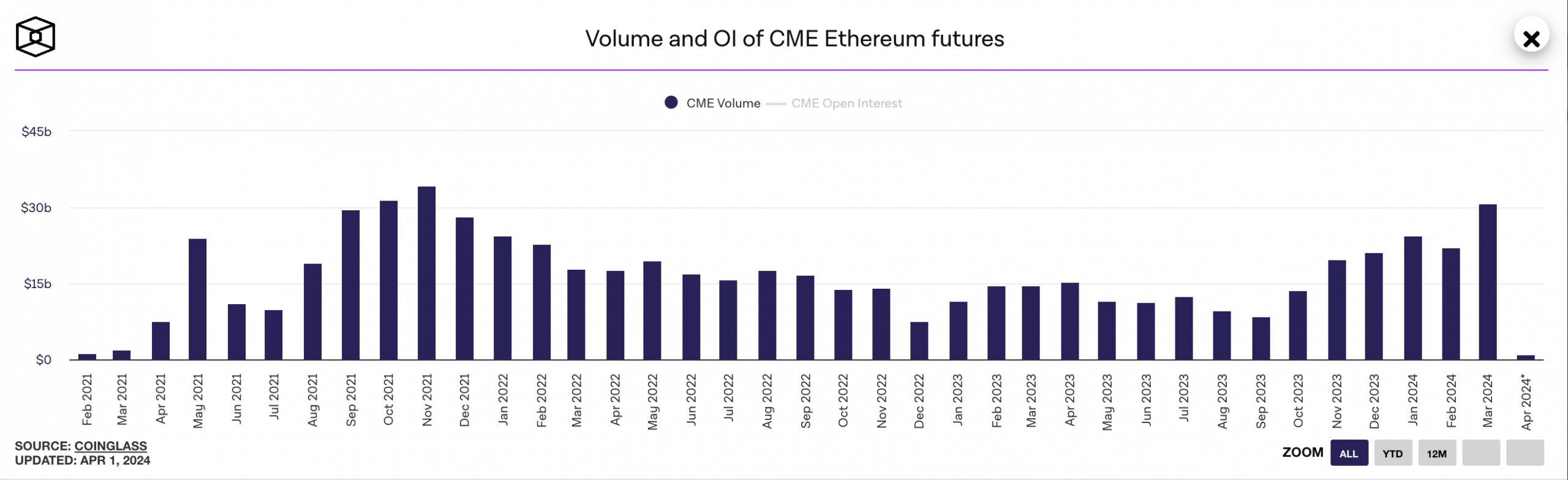

Following a similar trend, the coin’s monthly futures trading volume on the Chicago Mercantile Exchange (CME) market also rose to a three-year high.

With over 120,000 active users spread across 60 countries, CME is one of the world’s largest derivatives marketplaces.

When the trading volume on the exchange climbs in this manner, it signals a spike in market participation by institutional investors such as hedge funds and large asset managers.

AMBCrypto found that during the 31-day period, the aggregated monthly trading volumes of CME Ethereum Futures totaled $30 billion. The last time it was this high was in November 2021.

Source: The Block

Market unmoved by recent headwinds

ETH’s price has faced significant headwinds in the last month as it continued to face resistance at the $3500 level at press time.

In fact, on the 20th of March, the coin’s value plummeted to a 30-day low of $3100 before reclaiming its gains to exchange hands at $3354 at press time.

Despite this, the coin’s Funding Rates across cryptocurrency exchanges remained positive at press time.

Is your portfolio green? Check out the ETH Profit Calculator

A positive Funding Rate is a good sign, as it suggests a surge in market demand for bullish leverage positions. This means more market participants are entering trade positions in favor of a price rally.

At press time, ETH’s Funding Rate was 0.019%

- ETH’s Futures Open Interest touched an all-time high.

- Its Funding Rate across exchanges remained positive.

Ethereum [ETH] Futures Open Interest climbed to an all-time high as the uncertainty around the potential approval of a spot Ether exchange-traded fund (ETF) in the U.S. deepened.

Futures Open Interest refers to the total number of a coin’s Futures contracts that have yet to be settled or closed. When it rises, it indicates an increase in the number of market participants entering new positions.

According to AMBCrypto’s analysis of Coinglass’ data, ETH’s Futures Open Interest totaled $14.53 billion on the 1st of April, having risen by 86% year-to-date.

For context, ETH’s Futures Open Interest was below $10 billion at the beginning of the year.

Source: Coinglass

March was good for Ethereum’s Futures market

ETH’s Futures market recorded significant success in March, on-chain data has revealed.

According to AMBCrypto’s analysis of The Block’s data dashboard, ETH Futures’ monthly trading volume across the largest cryptocurrency exchanges touched a three-year during the 31-day period.

Our look at The Block further showed that ETH Futures trading volume across these platforms exceeded $1 trillion. The last time the coin’s monthly trading volume was that high was in May 2021.

Source: The Block

Following a similar trend, the coin’s monthly futures trading volume on the Chicago Mercantile Exchange (CME) market also rose to a three-year high.

With over 120,000 active users spread across 60 countries, CME is one of the world’s largest derivatives marketplaces.

When the trading volume on the exchange climbs in this manner, it signals a spike in market participation by institutional investors such as hedge funds and large asset managers.

AMBCrypto found that during the 31-day period, the aggregated monthly trading volumes of CME Ethereum Futures totaled $30 billion. The last time it was this high was in November 2021.

Source: The Block

Market unmoved by recent headwinds

ETH’s price has faced significant headwinds in the last month as it continued to face resistance at the $3500 level at press time.

In fact, on the 20th of March, the coin’s value plummeted to a 30-day low of $3100 before reclaiming its gains to exchange hands at $3354 at press time.

Despite this, the coin’s Funding Rates across cryptocurrency exchanges remained positive at press time.

Is your portfolio green? Check out the ETH Profit Calculator

A positive Funding Rate is a good sign, as it suggests a surge in market demand for bullish leverage positions. This means more market participants are entering trade positions in favor of a price rally.

At press time, ETH’s Funding Rate was 0.019%

where can i get clomiphene tablets can i get clomid online where to buy clomid price clomiphene cost buying cheap clomiphene price can you buy cheap clomid for sale buy generic clomiphene without dr prescription

This website absolutely has all of the low-down and facts I needed about this thesis and didn’t positive who to ask.

I am in point of fact happy to gleam at this blog posts which consists of tons of profitable facts, thanks for providing such data.

zithromax online order – ciprofloxacin tablet buy flagyl pill

semaglutide us – purchase semaglutide generic periactin 4mg canada

cost domperidone 10mg – order flexeril 15mg online cheap order generic flexeril 15mg

buy augmentin 625mg sale – atbioinfo brand ampicillin

esomeprazole 20mg tablet – https://anexamate.com/ nexium ca

how to buy warfarin – https://coumamide.com/ buy cozaar 25mg pill

where to buy mobic without a prescription – relieve pain order meloxicam generic

buy pills for erectile dysfunction – mens erection pills non prescription ed drugs

buy generic amoxicillin for sale – https://combamoxi.com/ cheap amoxil for sale

buy generic diflucan 200mg – https://gpdifluca.com/# buy diflucan 200mg generic

oral cenforce 50mg – click buy cenforce generic

cheap cialis – buying generic cialis tadalafil 20 mg directions

tadalafil generico farmacias del ahorro – strong tadafl when will teva’s generic tadalafil be available in pharmacies

order zantac online – aranitidine zantac 300mg for sale

cialis viagra levitra for sale – strong vpls sildenafil citrate 100mg tab

This is the stripe of glad I enjoy reading. buy amoxicillin paypal

This is the big-hearted of criticism I positively appreciate. https://ursxdol.com/augmentin-amoxiclav-pill/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/omeprazole-20-mg/

Proof blog you possess here.. It’s hard to find great quality belles-lettres like yours these days. I really comprehend individuals like you! Take mindfulness!! https://aranitidine.com/fr/cialis-super-active/

Thanks recompense sharing. It’s top quality. https://ondactone.com/spironolactone/