- StanChart’s Geoffrey Kendrick projected that Base has clawed $50B from ETH’s market cap.

- Amberdata believed ETH could offer more shorting gains in the near term.

Standard Chartered (StanChart) has massively downgraded its Ethereum [ETH] price target for 2025 from $10K to $4K, a 60% slash.

According to a report by The Block, StanChart’s Head of Digital Assets Research, Geoffrey Kendrick, singled out Coinbase’s Base as one short-term risk factor.

Kendrick noted,

“Layer 2s, and Base in particular, now extract super-profits from the Ethereum ecosystem…We estimate that Base (the dominant Layer 2) has removed $50 billion of market cap from Ethereum alone.”

The analyst added that L2s now dominate transaction fees and bypass the mainnet. To solve this, he recommended Ethereum slapping a ‘super tax’ on L2s, or else the ETH/BTC ratio would dip lower.

Market reactions: What’s next for ETH?

Kendrick also highlighted that the past Ethereum changes, including ‘The Merge’ and ‘Dencun’ upgrades, were necessary for long-term scalability but have been ‘value destructive.’

Reacting to the report, Solana’s Co-Founder Anatoly Yakavenko termed it ‘spicy.’

When asked whether a similar ‘Base scenario’ on Solana would drag SOL to single digit value, Yakavenko downplayed it, citing Ethereum’s weak ‘alignment.’

Source: X

For his part, Ceteris, pseudonymous Head of Research at Delphi Research, jibed that StanChart’s $4K target was relatively higher.

“Standard Chartered is notorious for having ridiculously unrealistic price targets, they’re always way too high.”

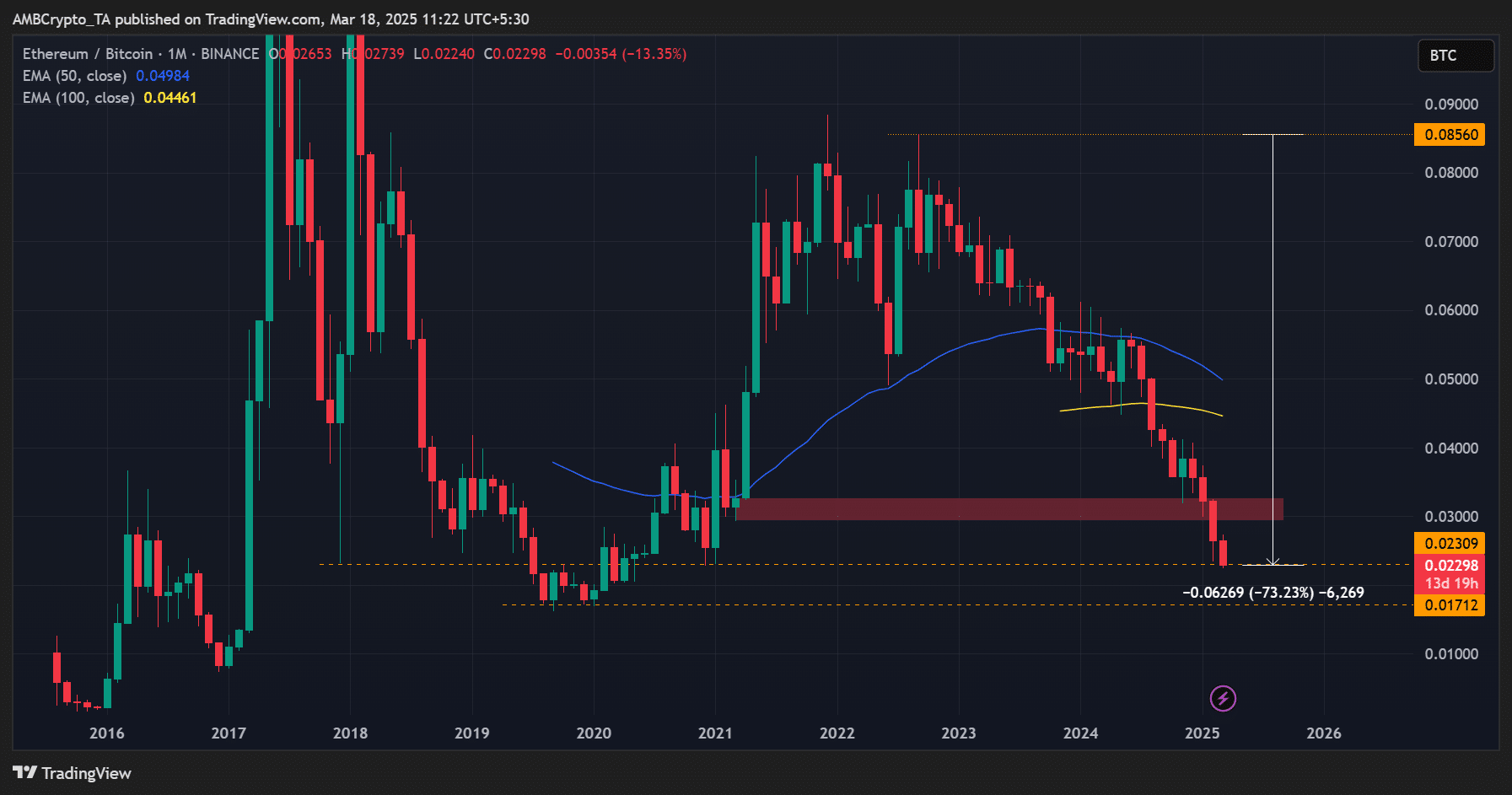

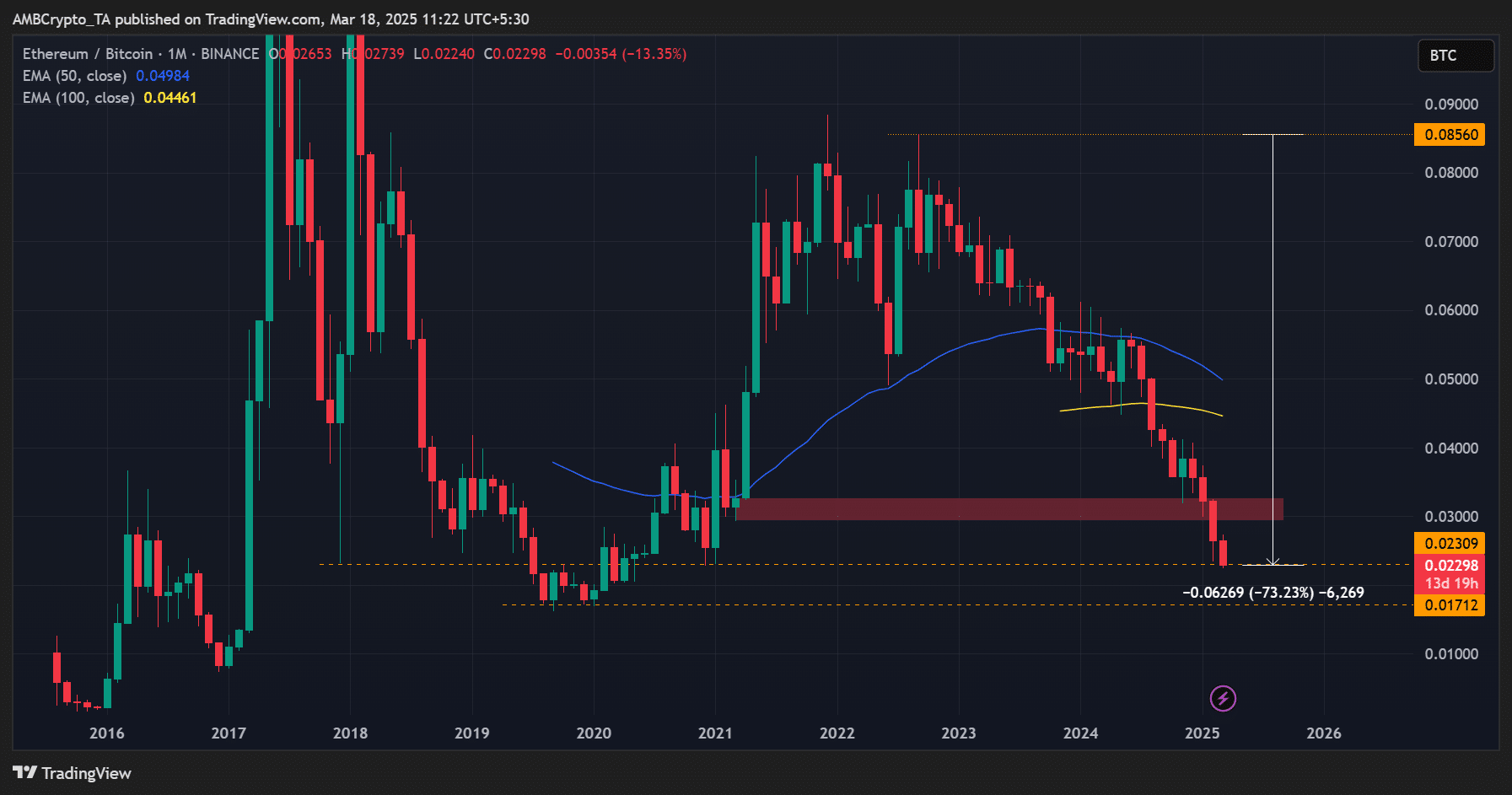

That said, the ETH/BTC ratio, which tracks ETH price performance relative to BTC, marked a new 5-year low of 0.22 and was down 73% from its 2022 highs. Simply put, ETH has underperformed BTC for 5 years.

Source: ETH/BTC, TradingView

In fact, compared to the S&P 500 Index, SPX, ETH has underperformed U.S. equities since 2018, noted Quinn Thompson, Founder of Lekker Capital, a macro-focused crypto VC.

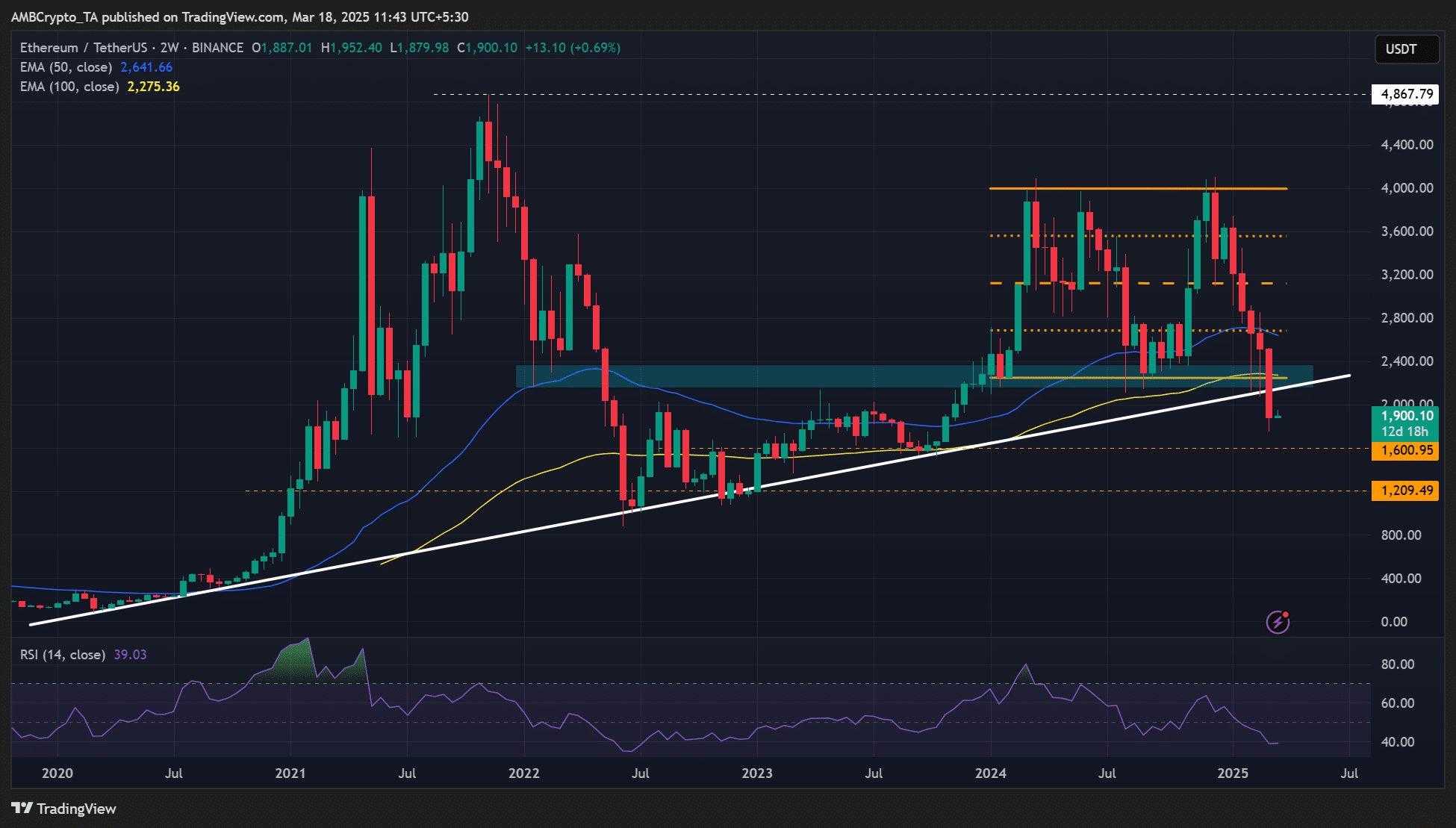

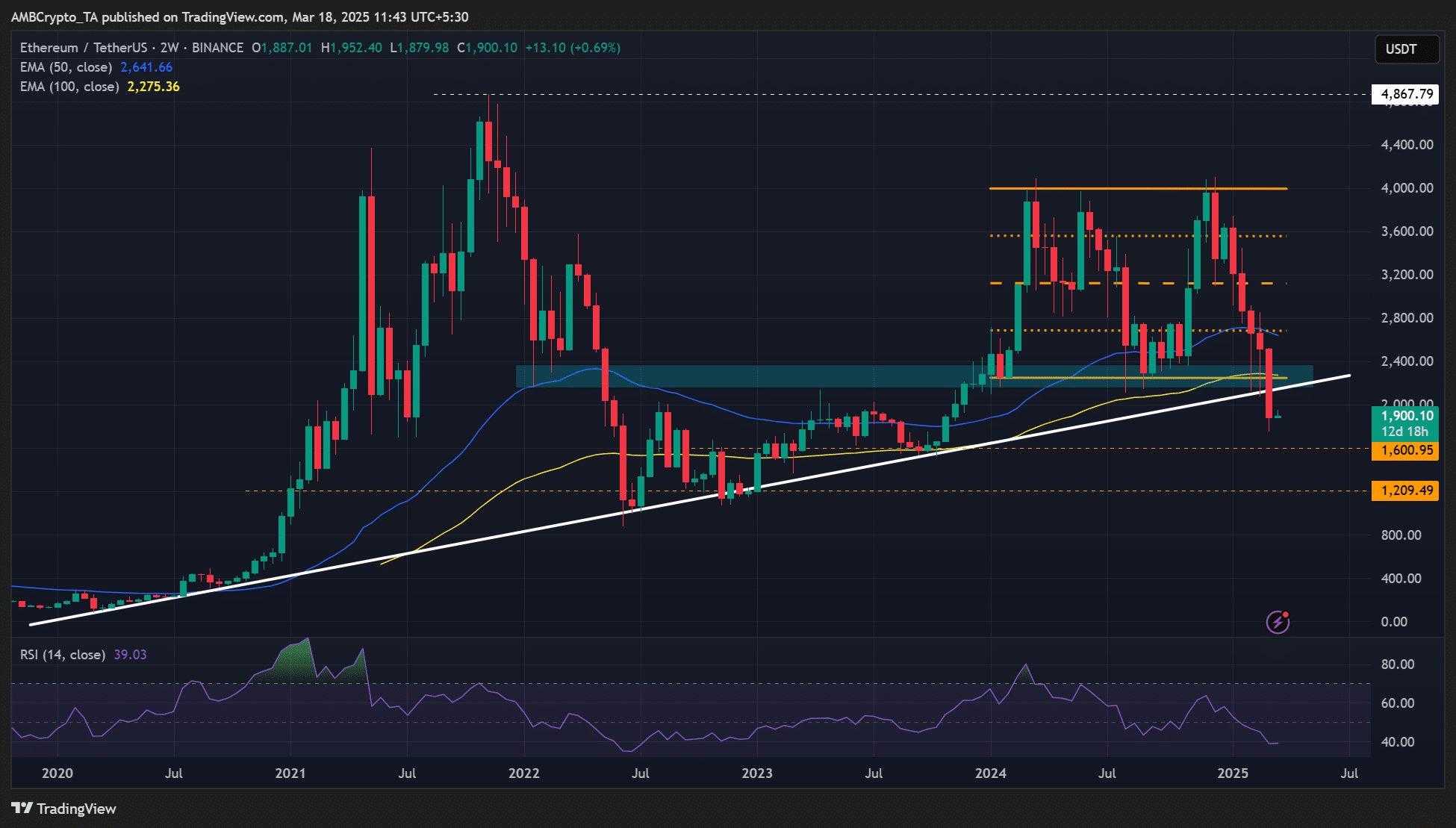

At the start of this cycle, ETH jumped 167%, rallying from $1600 to $4K between late 2023 and early 2024. However, as of this writing, the altcoin was valued at $1.9K and was on course to erasing all this cycle gains if it dipped lower.

According to Amberdata’s Greg Magadini, ETH could still offer more shorting opportunities, citing altcoins’ sell-off and ETH/BTC decline. He said,

“ETH remains the most interesting short-trade. The strong ETH/BTC ratio and the overall altcoin sell-off seem like strong trends that will continue to drag ETH much lower.”

Source: ETH/USDT, TradingView

From a price action perspective, ETH broke below its 5-year trendline support, further reinforcing the weak market structure stated by Magadini.

Whether short sellers will drag it to $1.6K or $1.2K remains to be seen.

- StanChart’s Geoffrey Kendrick projected that Base has clawed $50B from ETH’s market cap.

- Amberdata believed ETH could offer more shorting gains in the near term.

Standard Chartered (StanChart) has massively downgraded its Ethereum [ETH] price target for 2025 from $10K to $4K, a 60% slash.

According to a report by The Block, StanChart’s Head of Digital Assets Research, Geoffrey Kendrick, singled out Coinbase’s Base as one short-term risk factor.

Kendrick noted,

“Layer 2s, and Base in particular, now extract super-profits from the Ethereum ecosystem…We estimate that Base (the dominant Layer 2) has removed $50 billion of market cap from Ethereum alone.”

The analyst added that L2s now dominate transaction fees and bypass the mainnet. To solve this, he recommended Ethereum slapping a ‘super tax’ on L2s, or else the ETH/BTC ratio would dip lower.

Market reactions: What’s next for ETH?

Kendrick also highlighted that the past Ethereum changes, including ‘The Merge’ and ‘Dencun’ upgrades, were necessary for long-term scalability but have been ‘value destructive.’

Reacting to the report, Solana’s Co-Founder Anatoly Yakavenko termed it ‘spicy.’

When asked whether a similar ‘Base scenario’ on Solana would drag SOL to single digit value, Yakavenko downplayed it, citing Ethereum’s weak ‘alignment.’

Source: X

For his part, Ceteris, pseudonymous Head of Research at Delphi Research, jibed that StanChart’s $4K target was relatively higher.

“Standard Chartered is notorious for having ridiculously unrealistic price targets, they’re always way too high.”

That said, the ETH/BTC ratio, which tracks ETH price performance relative to BTC, marked a new 5-year low of 0.22 and was down 73% from its 2022 highs. Simply put, ETH has underperformed BTC for 5 years.

Source: ETH/BTC, TradingView

In fact, compared to the S&P 500 Index, SPX, ETH has underperformed U.S. equities since 2018, noted Quinn Thompson, Founder of Lekker Capital, a macro-focused crypto VC.

At the start of this cycle, ETH jumped 167%, rallying from $1600 to $4K between late 2023 and early 2024. However, as of this writing, the altcoin was valued at $1.9K and was on course to erasing all this cycle gains if it dipped lower.

According to Amberdata’s Greg Magadini, ETH could still offer more shorting opportunities, citing altcoins’ sell-off and ETH/BTC decline. He said,

“ETH remains the most interesting short-trade. The strong ETH/BTC ratio and the overall altcoin sell-off seem like strong trends that will continue to drag ETH much lower.”

Source: ETH/USDT, TradingView

From a price action perspective, ETH broke below its 5-year trendline support, further reinforcing the weak market structure stated by Magadini.

Whether short sellers will drag it to $1.6K or $1.2K remains to be seen.

can i order cheap clomid without a prescription cost of cheap clomiphene without rx cost cheap clomid without rx where can i buy clomid without prescription buy generic clomiphene no prescription buying cheap clomiphene cost cheap clomid online

More articles like this would remedy the blogosphere richer.

rybelsus medication – rybelsus 14 mg tablet periactin order online

buy inderal 20mg sale – buy methotrexate 2.5mg generic order methotrexate pill

buy generic amoxil online – buy ipratropium 100mcg sale order ipratropium generic

buy augmentin online cheap – atbioinfo ampicillin tablet

nexium uk – https://anexamate.com/ nexium over the counter

oral coumadin – blood thinner cozaar 25mg ca

meloxicam 7.5mg without prescription – https://moboxsin.com/ buy meloxicam pills

purchase deltasone online cheap – corticosteroid deltasone 40mg pills

best otc ed pills – fast ed to take buy ed pills online

buy generic amoxil for sale – combamoxi where to buy amoxicillin without a prescription

diflucan buy online – https://gpdifluca.com/ forcan brand

cenforce 50mg for sale – on this site where to buy cenforce without a prescription

zantac online order – order generic ranitidine 300mg zantac online order

cialis over the counter in spain – site cheap cialis dapoxitine cheap online

The reconditeness in this ruined is exceptional. https://gnolvade.com/

order viagra generic – https://strongvpls.com/# cheap kamagra/viagra

This is a question which is in to my heart… Numberless thanks! Exactly where can I upon the phone details in the course of questions? https://ursxdol.com/prednisone-5mg-tablets/

Greetings! Jolly productive recommendation within this article! It’s the crumb changes which liking espy the largest changes. Thanks a a quantity quest of sharing! https://buyfastonl.com/isotretinoin.html

Greetings! Extremely productive par‘nesis within this article! It’s the crumb changes which choice turn the largest changes. Thanks a portion towards sharing! https://ondactone.com/simvastatin/

With thanks. Loads of conception!

https://doxycyclinege.com/pro/spironolactone/

This website positively has all of the tidings and facts I needed to this participant and didn’t positive who to ask. http://mi.minfish.com/home.php?mod=space&uid=1411822

buy cheap generic forxiga – https://janozin.com/# dapagliflozin over the counter

order orlistat sale – on this site order xenical 120mg generic

More articles like this would make the blogosphere richer. http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98750