- There has been a growth in new demand for BTC over the past week

- The last 12 hours have seen a decline in the same though

The count of Bitcoin’s [BTC] non-zero wallets has risen, despite the recent pullbacks in the coin’s price, according to Santiment’s data.

According to the on-chain data provider, 370,000 new wallets holding at least one BTC have been created in the last six days. The number of BTC holders now totals 52.94 million, growing by 0.1% since the beginning of the year.

Source: Santiment

At press time, BTC was trading at $67,734. Owing to negativity across traditional markets and the geopolitical uncertainty, the cryptocurrency fell on the charts and took the rest of the market down with it. It was down by over 5% in the last 24 hours, according to CoinMarketCap’s data.

More decline in the short term?

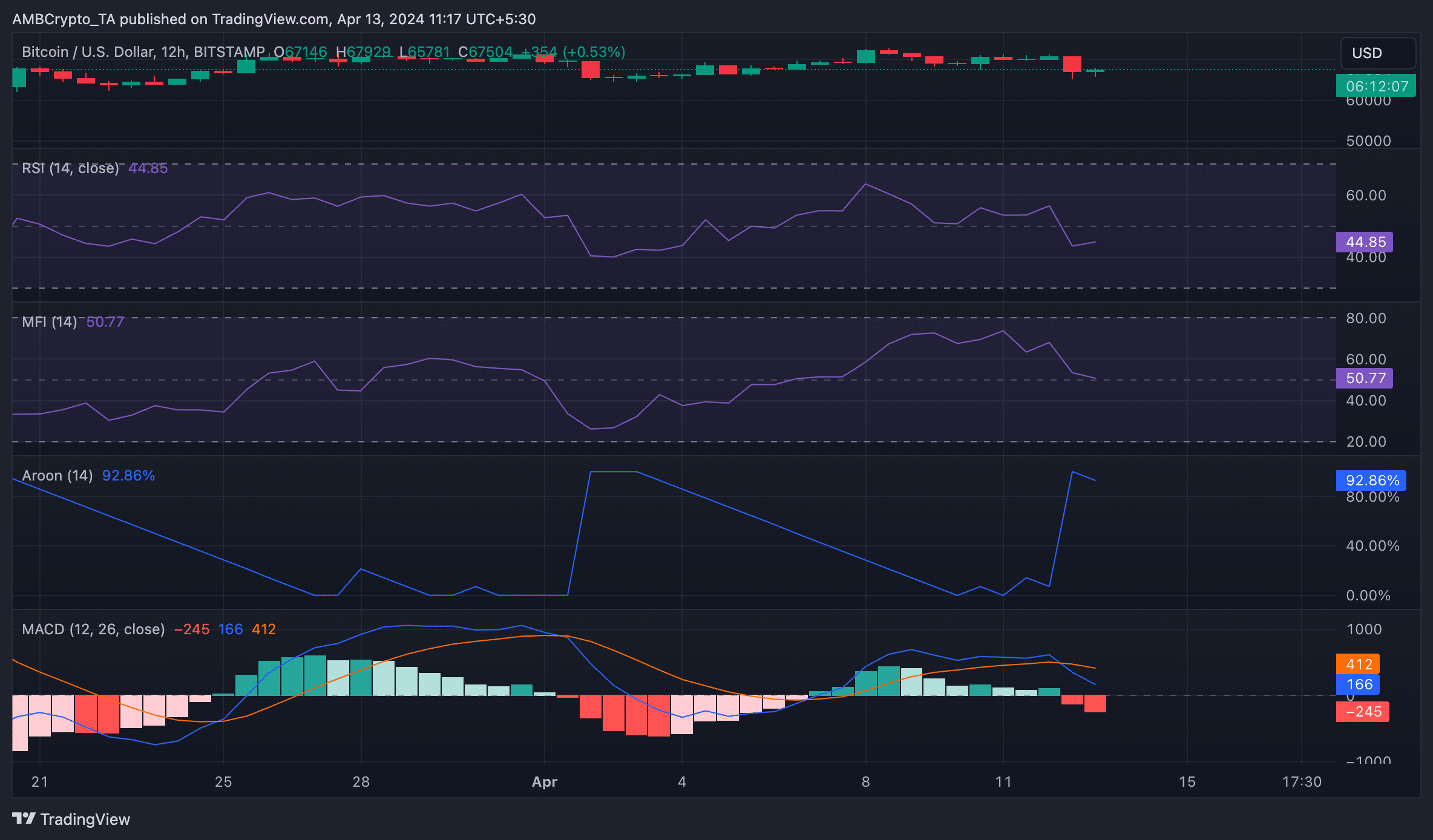

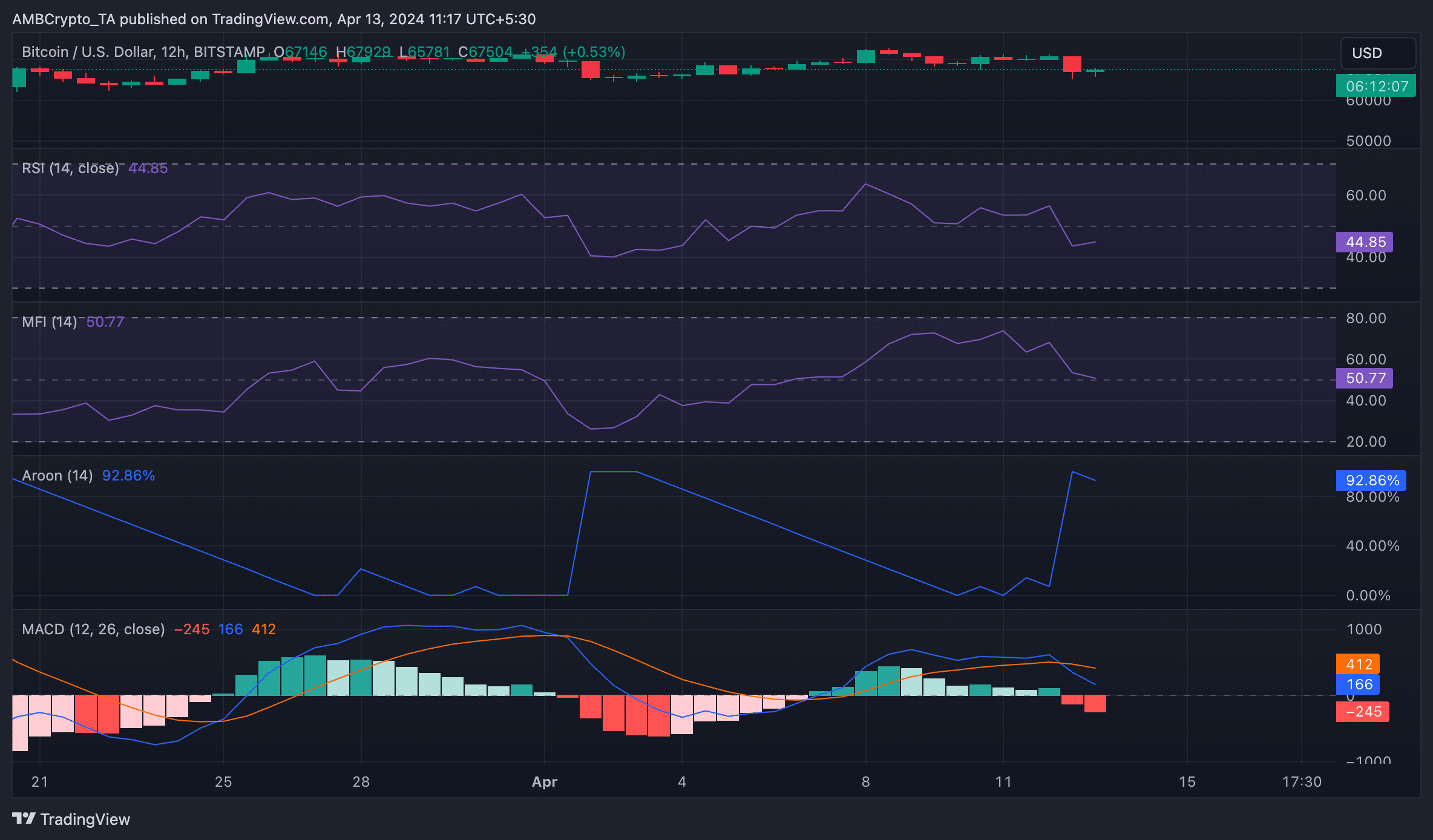

An assessment of the coin’s performance on the daily chart hinted at the possibility of a further price downside in the short term. Key indicators observed confirmed that bearish activity significantly outpaced bullish trends in BTC’s market. If the crypto’s market depreciates even more, $65,000 could be on the cards for BTC too.

For example, its Aroon Down Line (blue) had a reading of 92.86% at press time. An asset’s Aroon indicator measures its trend strength and identifies potential reversal points in its price movement. When the Aroon Down line is close to 100, as in this case, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

According to CoinMarketCap data, BTC last traded around the $67,000-zone a month ago.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Confirming the bearish trend in the coin’s market, during the intraday trading session on 12th April, the coin’s MACD crossed below its signal line.

When an asset’s MACD line intersects its signal line this way, it indicates that the short-term trend is weakening relative to the longer-term trend. It has been known to precede a downtrend in price. Traders often interpret it as a sign to consider selling their holdings or taking short positions.

As expected, with Bitcoin’s price falling as it did, there has been a pullback in general demand for the coin too. The same was underlined by the findings of the Relative Strength Index and the Money Flow Index, with the latter all set to cross the mid-line at press time – A very bearish sign.

Source: TradingView

The values of these indicators revealed that market participants are favoring BTC distribution over accumulation right now. Ergo, it’s too soon to say whether the cryptocurrency will go on a sustained uptrend now, even as the Halving looms closer.

- There has been a growth in new demand for BTC over the past week

- The last 12 hours have seen a decline in the same though

The count of Bitcoin’s [BTC] non-zero wallets has risen, despite the recent pullbacks in the coin’s price, according to Santiment’s data.

According to the on-chain data provider, 370,000 new wallets holding at least one BTC have been created in the last six days. The number of BTC holders now totals 52.94 million, growing by 0.1% since the beginning of the year.

Source: Santiment

At press time, BTC was trading at $67,734. Owing to negativity across traditional markets and the geopolitical uncertainty, the cryptocurrency fell on the charts and took the rest of the market down with it. It was down by over 5% in the last 24 hours, according to CoinMarketCap’s data.

More decline in the short term?

An assessment of the coin’s performance on the daily chart hinted at the possibility of a further price downside in the short term. Key indicators observed confirmed that bearish activity significantly outpaced bullish trends in BTC’s market. If the crypto’s market depreciates even more, $65,000 could be on the cards for BTC too.

For example, its Aroon Down Line (blue) had a reading of 92.86% at press time. An asset’s Aroon indicator measures its trend strength and identifies potential reversal points in its price movement. When the Aroon Down line is close to 100, as in this case, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

According to CoinMarketCap data, BTC last traded around the $67,000-zone a month ago.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Confirming the bearish trend in the coin’s market, during the intraday trading session on 12th April, the coin’s MACD crossed below its signal line.

When an asset’s MACD line intersects its signal line this way, it indicates that the short-term trend is weakening relative to the longer-term trend. It has been known to precede a downtrend in price. Traders often interpret it as a sign to consider selling their holdings or taking short positions.

As expected, with Bitcoin’s price falling as it did, there has been a pullback in general demand for the coin too. The same was underlined by the findings of the Relative Strength Index and the Money Flow Index, with the latter all set to cross the mid-line at press time – A very bearish sign.

Source: TradingView

The values of these indicators revealed that market participants are favoring BTC distribution over accumulation right now. Ergo, it’s too soon to say whether the cryptocurrency will go on a sustained uptrend now, even as the Halving looms closer.

generic clomiphene order cheap clomiphene tablets where can i buy generic clomiphene without prescription can i get cheap clomiphene pill cost of clomiphene price how to buy cheap clomid without dr prescription cost of cheap clomid pills

More posts like this would add up to the online space more useful.

This is the compassionate of writing I rightly appreciate.

purchase zithromax – buy generic ciprofloxacin online buy metronidazole 400mg without prescription

rybelsus 14mg pills – periactin tablet periactin 4mg price

purchase motilium without prescription – flexeril 15mg sale buy flexeril 15mg generic

esomeprazole 40mg us – https://anexamate.com/ cost nexium

order warfarin pill – blood thinner buy losartan paypal

buy meloxicam online – mobo sin purchase meloxicam pill

deltasone 20mg without prescription – asthma deltasone 20mg uk

amoxil tablets – combamoxi amoxil brand

buy diflucan online – https://gpdifluca.com/ order diflucan 200mg pills

escitalopram ca – https://escitapro.com/# buy generic escitalopram online

cenforce 50mg us – cenforce 100mg tablet cenforce 50mg sale

cialis manufacturer coupon free trial – ciltad generic cialis or levitra

generic cialis tadalafil 20 mg from india – https://strongtadafl.com/ us cialis online pharmacy

buy ranitidine online – https://aranitidine.com/# buy zantac 150mg generic

buy viagra in ottawa – strong vpls buy viagra with paypal

I’ll certainly return to be familiar with more. on this site

The thoroughness in this break down is noteworthy. https://buyfastonl.com/

More articles like this would make the blogosphere richer. https://ursxdol.com/ventolin-albuterol/

Proof blog you procure here.. It’s obdurate to find elevated calibre writing like yours these days. I honestly respect individuals like you! Withstand mindfulness!! https://prohnrg.com/product/get-allopurinol-pills/

I couldn’t hold back commenting. Profoundly written! qu’est-ce qui peut remplacer le viagra professional sans ordonnance

Thanks on putting this up. It’s well done. https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

https://doxycyclinege.com/pro/levofloxacin/

The reconditeness in this piece is exceptional. http://club.dcrjs.com/link.php?url=https://www.startus.cc/company/stockholm

Good blog you have here.. It’s obdurate to find great status belles-lettres like yours these days. I truly recognize individuals like you! Rent mindfulness!! http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24578

order dapagliflozin 10mg generic – dapagliflozin 10 mg tablet buy dapagliflozin 10 mg sale

buy orlistat sale – https://asacostat.com/# buy xenical cheap

The thoroughness in this draft is noteworthy. http://mi.minfish.com/home.php?mod=space&uid=1420976