- Bitcoin is predicted to rebound above $50k by October, with a 60% likelihood.

- Peterson also sees a 25% chance of Bitcoin reaching a new all-time high within the same period.

Bitcoin [BTC] was trading back above $57,000 at press time, marking a significant recovery from last week’s sharp decline that brought it down to $53,000—a price point last observed in February.

This resurgence is particularly noteworthy, given the early signs today of a continuing downtrend, with Bitcoin hitting a 24-hour low of $54,320.

In light of recent fluctuations, Timothy Peterson, a respected Bitcoin analyst and economist, has provided an optimistic forecast for the cryptocurrency’s trajectory heading into the fourth quarter of 2024.

Peterson suggested a robust return of bullish sentiment for Bitcoin, particularly noting the importance of its performance in the upcoming months.

Analyzing Bitcoin’s potential surge

Peterson’s analysis presented a promising outlook for Bitcoin enthusiasts and investors.

He argued that if Bitcoin can close July above the $50,000 threshold, there’s a substantial likelihood of the cryptocurrency maintaining or exceeding this level well into October.

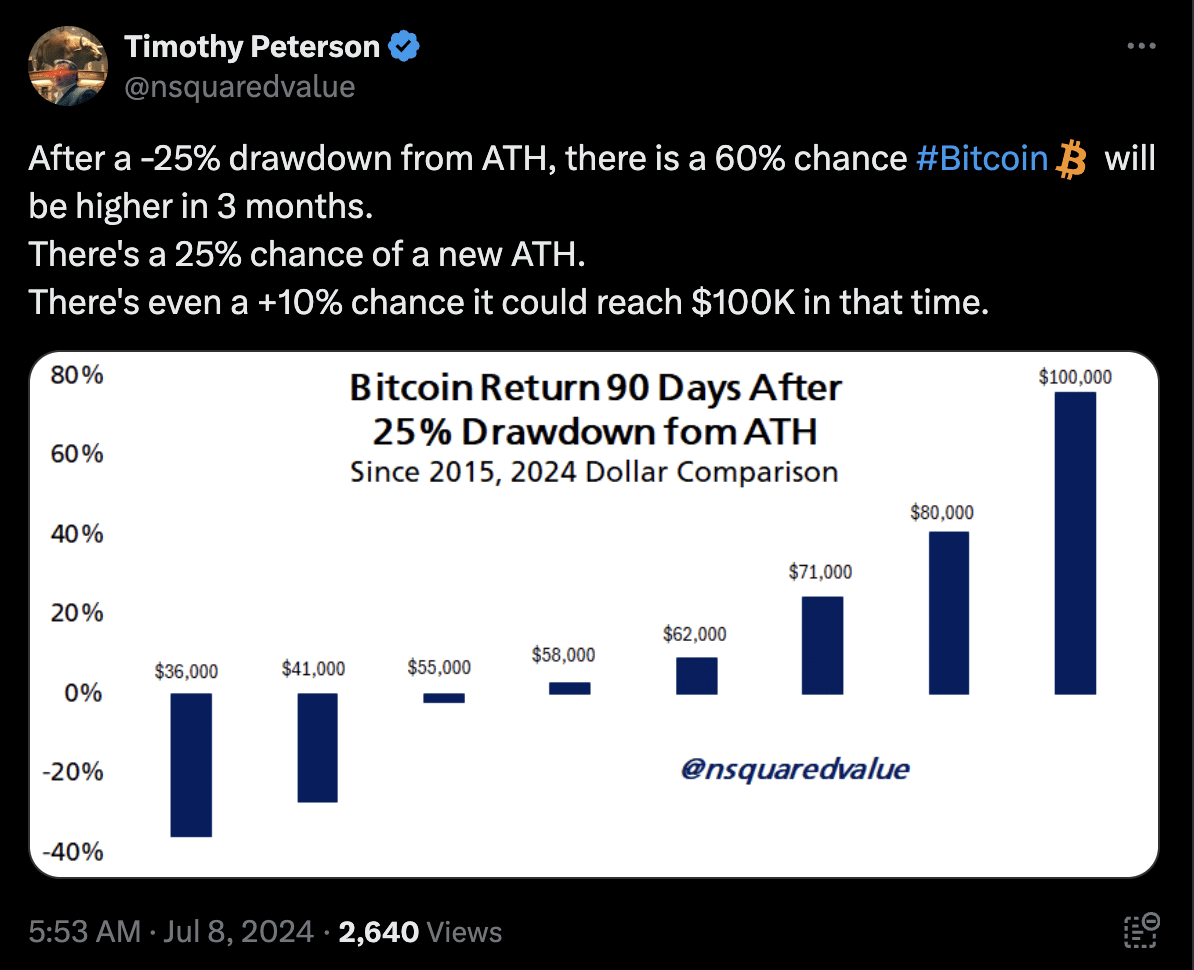

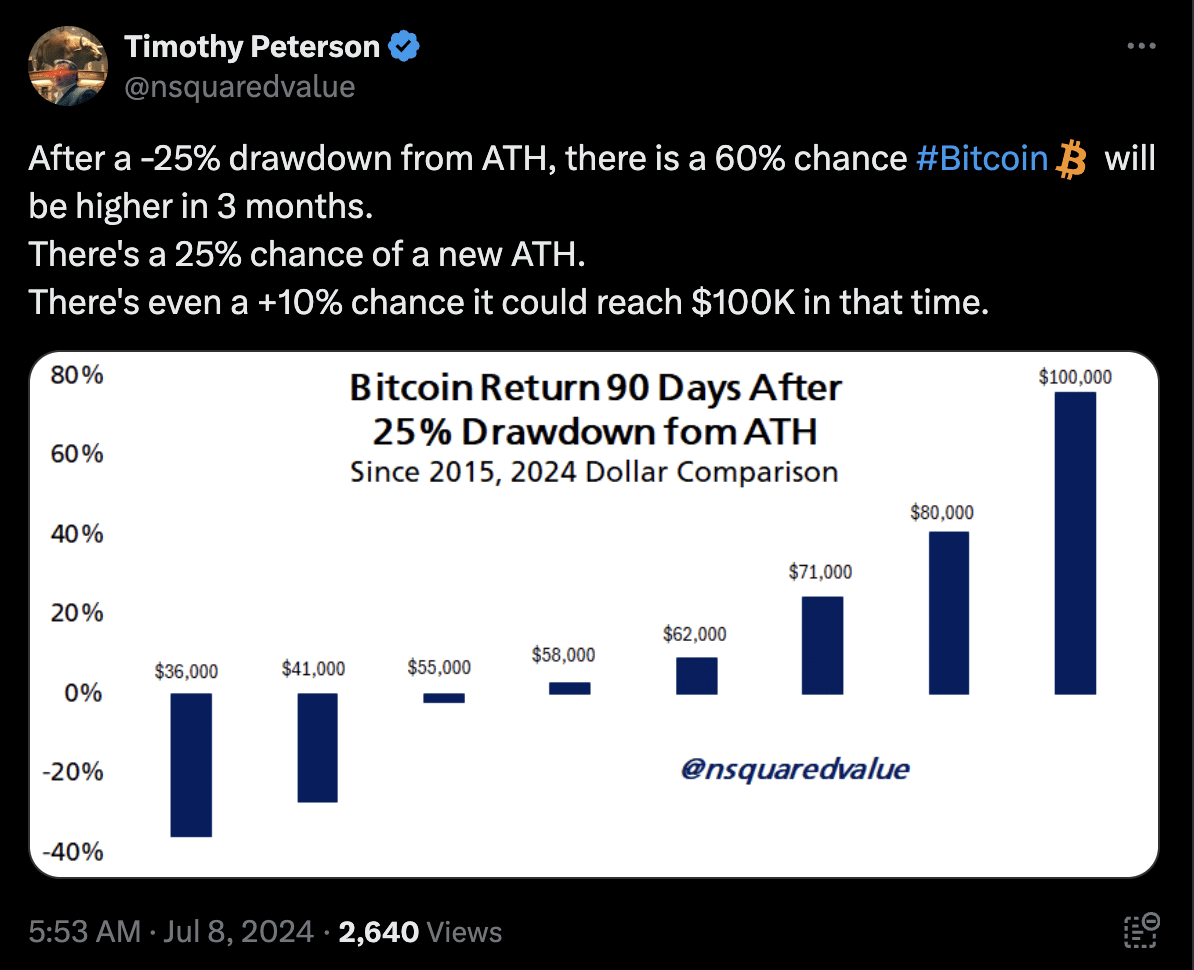

According to his statistical model, following a 25% drawdown from its all-time high (ATH), there’s a 60% chance that Bitcoin’s price will climb higher within the next three months.

Source: Timothy Peterson

Peterson posited that there was a 25% probability that Bitcoin could set a new ATH within this timeframe.

The potential for Bitcoin to hit $100,000, while less likely, still stands at a notable 10% chance, adding excitement to the mix of forecasts and speculations swirling around the asset’s future.

Is BTC ready for the potential surge?

Beyond predictions, Bitcoin’s fundamentals provided insights into its capacity to achieve these optimistic targets.

Data from market intelligence platform Santiment showed that wallets holding over 10,000 BTC have significantly benefited from the recent market volatility.

Over the past six weeks, these large-scale holders have increased their holdings by 12,450 BTC.

Source: Santiment

This accumulation, representing a 1.05% increase in the total Bitcoin supply held, indicated strong confidence among major investors and could be a bullish signal for the market.

Such movements often suggest that large holders, potentially including exchange liquidity providers, anticipated higher prices or more significant market shifts.

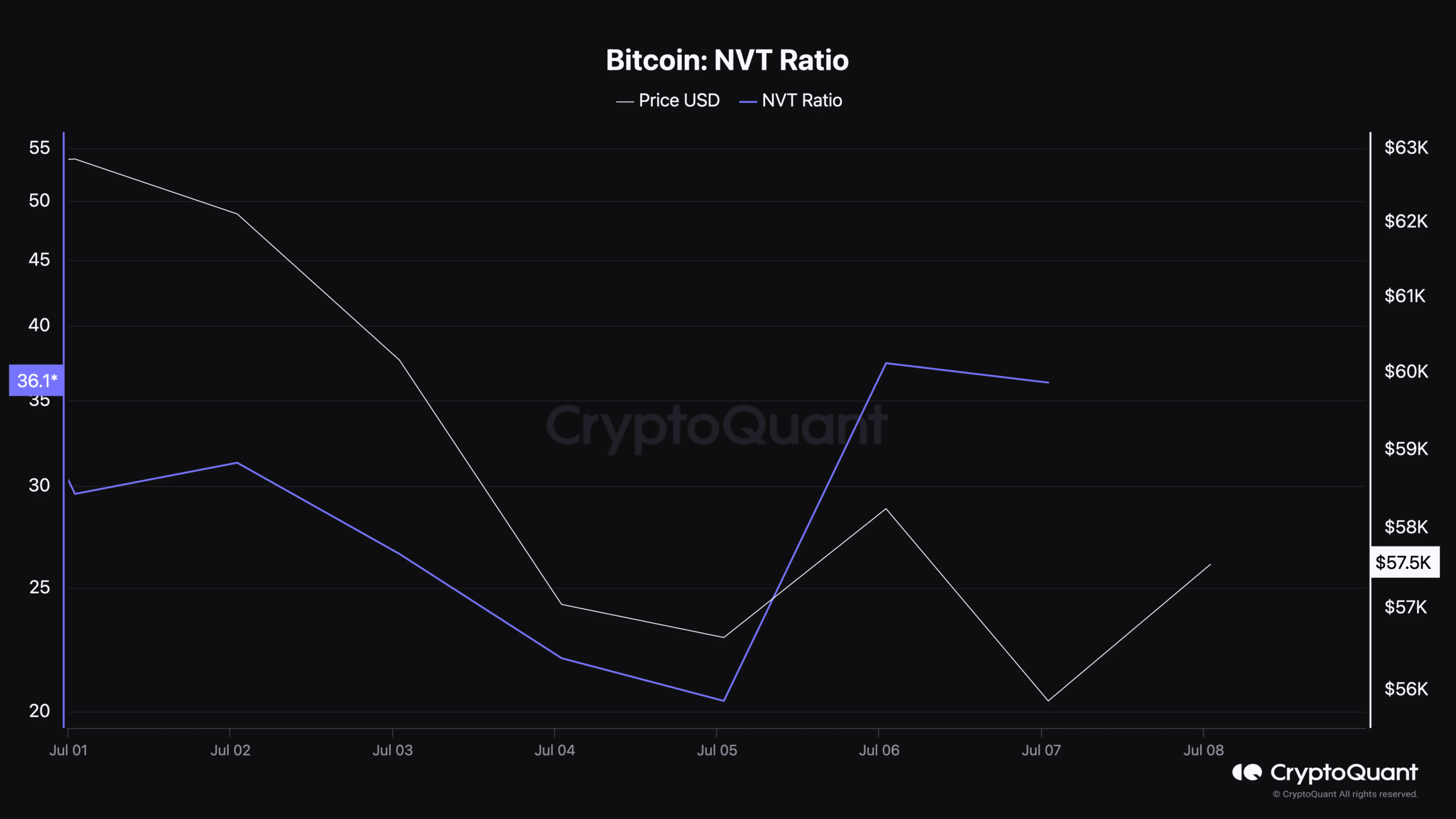

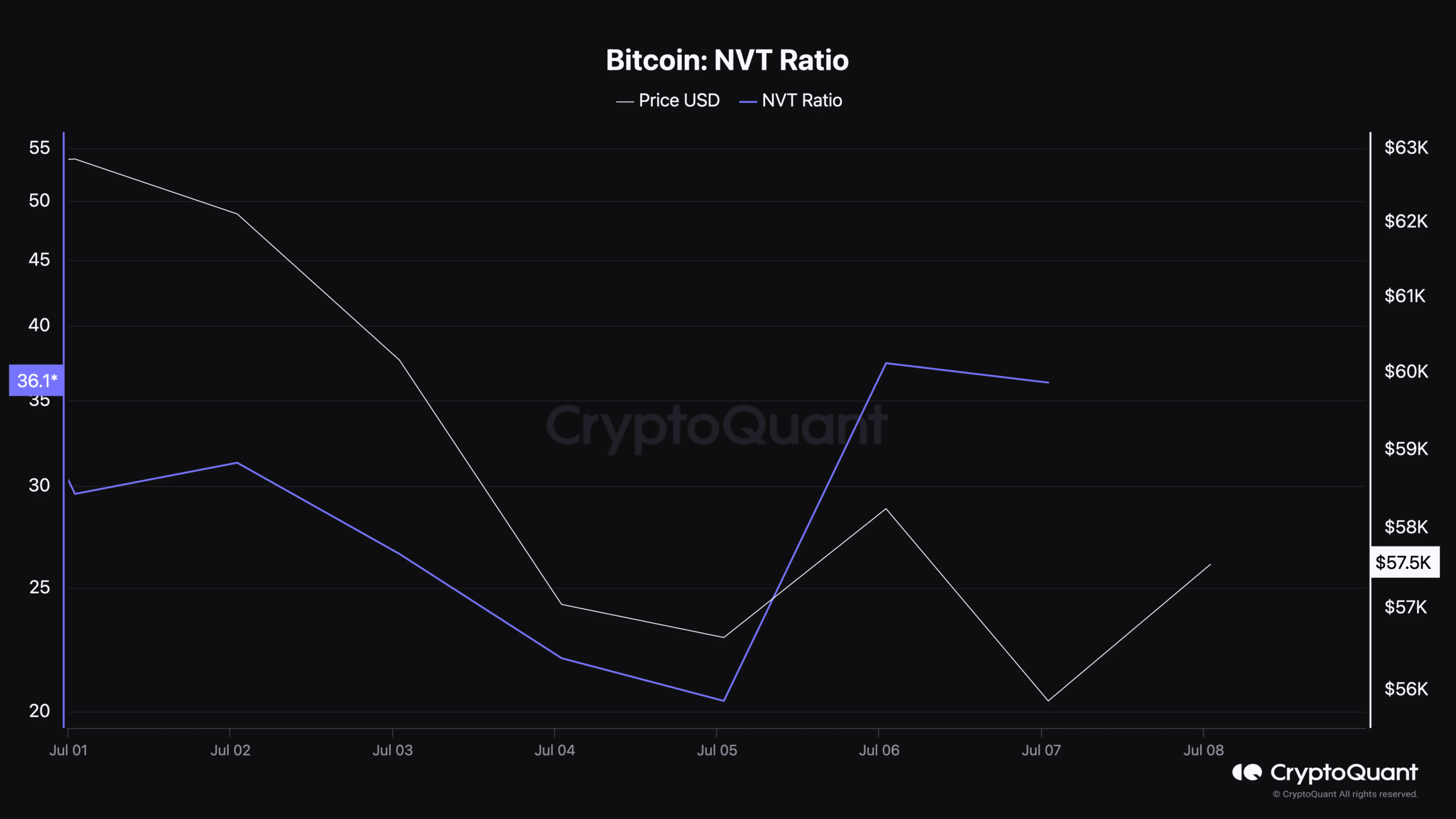

Additionally, Bitcoin’s Network Value to Transactions (NVT) ratio, which was 36.1 at press time, provided further clues about the cryptocurrency’s valuation.

The NVT ratio, by comparing market cap to the volume of transactions on the blockchain, helps assess whether the coin is overvalued or undervalued.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

A lower NVT ratio typically indicates that the network is healthy and transactions are high relative to the market cap, suggesting the asset is undervalued and potentially poised for a price increase.

As for the short-term forecast, AMBCrypto has reported that Bitcoin does not have enough demand in the short term to sustain a rally beyond $60k.

- Bitcoin is predicted to rebound above $50k by October, with a 60% likelihood.

- Peterson also sees a 25% chance of Bitcoin reaching a new all-time high within the same period.

Bitcoin [BTC] was trading back above $57,000 at press time, marking a significant recovery from last week’s sharp decline that brought it down to $53,000—a price point last observed in February.

This resurgence is particularly noteworthy, given the early signs today of a continuing downtrend, with Bitcoin hitting a 24-hour low of $54,320.

In light of recent fluctuations, Timothy Peterson, a respected Bitcoin analyst and economist, has provided an optimistic forecast for the cryptocurrency’s trajectory heading into the fourth quarter of 2024.

Peterson suggested a robust return of bullish sentiment for Bitcoin, particularly noting the importance of its performance in the upcoming months.

Analyzing Bitcoin’s potential surge

Peterson’s analysis presented a promising outlook for Bitcoin enthusiasts and investors.

He argued that if Bitcoin can close July above the $50,000 threshold, there’s a substantial likelihood of the cryptocurrency maintaining or exceeding this level well into October.

According to his statistical model, following a 25% drawdown from its all-time high (ATH), there’s a 60% chance that Bitcoin’s price will climb higher within the next three months.

Source: Timothy Peterson

Peterson posited that there was a 25% probability that Bitcoin could set a new ATH within this timeframe.

The potential for Bitcoin to hit $100,000, while less likely, still stands at a notable 10% chance, adding excitement to the mix of forecasts and speculations swirling around the asset’s future.

Is BTC ready for the potential surge?

Beyond predictions, Bitcoin’s fundamentals provided insights into its capacity to achieve these optimistic targets.

Data from market intelligence platform Santiment showed that wallets holding over 10,000 BTC have significantly benefited from the recent market volatility.

Over the past six weeks, these large-scale holders have increased their holdings by 12,450 BTC.

Source: Santiment

This accumulation, representing a 1.05% increase in the total Bitcoin supply held, indicated strong confidence among major investors and could be a bullish signal for the market.

Such movements often suggest that large holders, potentially including exchange liquidity providers, anticipated higher prices or more significant market shifts.

Additionally, Bitcoin’s Network Value to Transactions (NVT) ratio, which was 36.1 at press time, provided further clues about the cryptocurrency’s valuation.

The NVT ratio, by comparing market cap to the volume of transactions on the blockchain, helps assess whether the coin is overvalued or undervalued.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

A lower NVT ratio typically indicates that the network is healthy and transactions are high relative to the market cap, suggesting the asset is undervalued and potentially poised for a price increase.

As for the short-term forecast, AMBCrypto has reported that Bitcoin does not have enough demand in the short term to sustain a rally beyond $60k.

clomiphene one fallopian tube cost generic clomiphene for sale can i purchase clomid without rx where can i buy clomiphene where to get cheap clomiphene pill can i purchase cheap clomiphene without a prescription can i get cheap clomid without prescription

Facts blog you be undergoing here.. It’s obdurate to assign great status writing like yours these days. I truly comprehend individuals like you! Withstand mindfulness!!

Good blog you possess here.. It’s hard to assign high calibre article like yours these days. I honestly comprehend individuals like you! Withstand vigilance!!

azithromycin order – metronidazole online purchase flagyl generic

where can i buy rybelsus – periactin cost order periactin 4 mg online cheap

order motilium without prescription – oral motilium 10mg flexeril without prescription

purchase inderal online cheap – brand methotrexate 5mg order methotrexate sale

oral amoxil – order combivent sale order combivent 100 mcg generic

buy generic azithromycin online – tindamax 500mg for sale bystolic 20mg sale

augmentin 375mg for sale – atbioinfo how to get ampicillin without a prescription

buy coumadin generic – anticoagulant cozaar ca

order meloxicam online – swelling mobic ca

prednisone cheap – apreplson.com order deltasone 5mg sale

purchase amoxicillin generic – https://combamoxi.com/ order amoxil generic

diflucan pill – click fluconazole for sale online

buy cenforce 100mg generic – oral cenforce 100mg order cenforce 50mg generic

how to get cialis prescription online – does cialis make you harder when does cialis go off patent

order zantac 150mg without prescription – https://aranitidine.com/ buy ranitidine 300mg pills

tamsulosin vs. tadalafil – https://strongtadafl.com/# how long does cialis take to work 10mg

how much does 50 mg viagra cost – this buy viagra paypal accepted

Greetings! Jolly productive par‘nesis within this article! It’s the petty changes which wish turn the largest changes. Thanks a a quantity for sharing! https://ursxdol.com/propecia-tablets-online/

More posts like this would persuade the online time more useful. https://buyfastonl.com/

With thanks. Loads of knowledge! https://prohnrg.com/product/cytotec-online/

More text pieces like this would create the web better. https://aranitidine.com/fr/viagra-100mg-prix/

More content pieces like this would insinuate the web better. https://ondactone.com/spironolactone/

Facts blog you have here.. It’s obdurate to find strong quality writing like yours these days. I honestly comprehend individuals like you! Go through guardianship!!

https://doxycyclinege.com/pro/dutasteride/

Good blog you have here.. It’s obdurate to on elevated calibre writing like yours these days. I truly respect individuals like you! Go through care!! http://zqykj.com/bbs/home.php?mod=space&uid=302439

buy forxiga 10 mg online cheap – forxiga 10 mg pills how to get dapagliflozin without a prescription

purchase xenical pills – https://asacostat.com/# generic orlistat 120mg

With thanks. Loads of knowledge! https://www.forum-joyingauto.com/member.php?action=profile&uid=49498