- Bitcoin has a strong bullish bias this week.

- The recent dip might be to engineer liquidity and more volatility was likely.

Bitcoin [BTC] was trading at the range highs at $67 at press time. This range has been in place since mid-April. The past few days’ momentum, particularly the recovery past $65k, convinced bulls that further gains were likely.

Other signals from on-chain analysis highlighted bullish sentiment in the market. Yet, the liquidity in the $68k-$69k region could see a bearish reversal. What are the chances that this scenario would play out?

How liquidity runs can be engineered

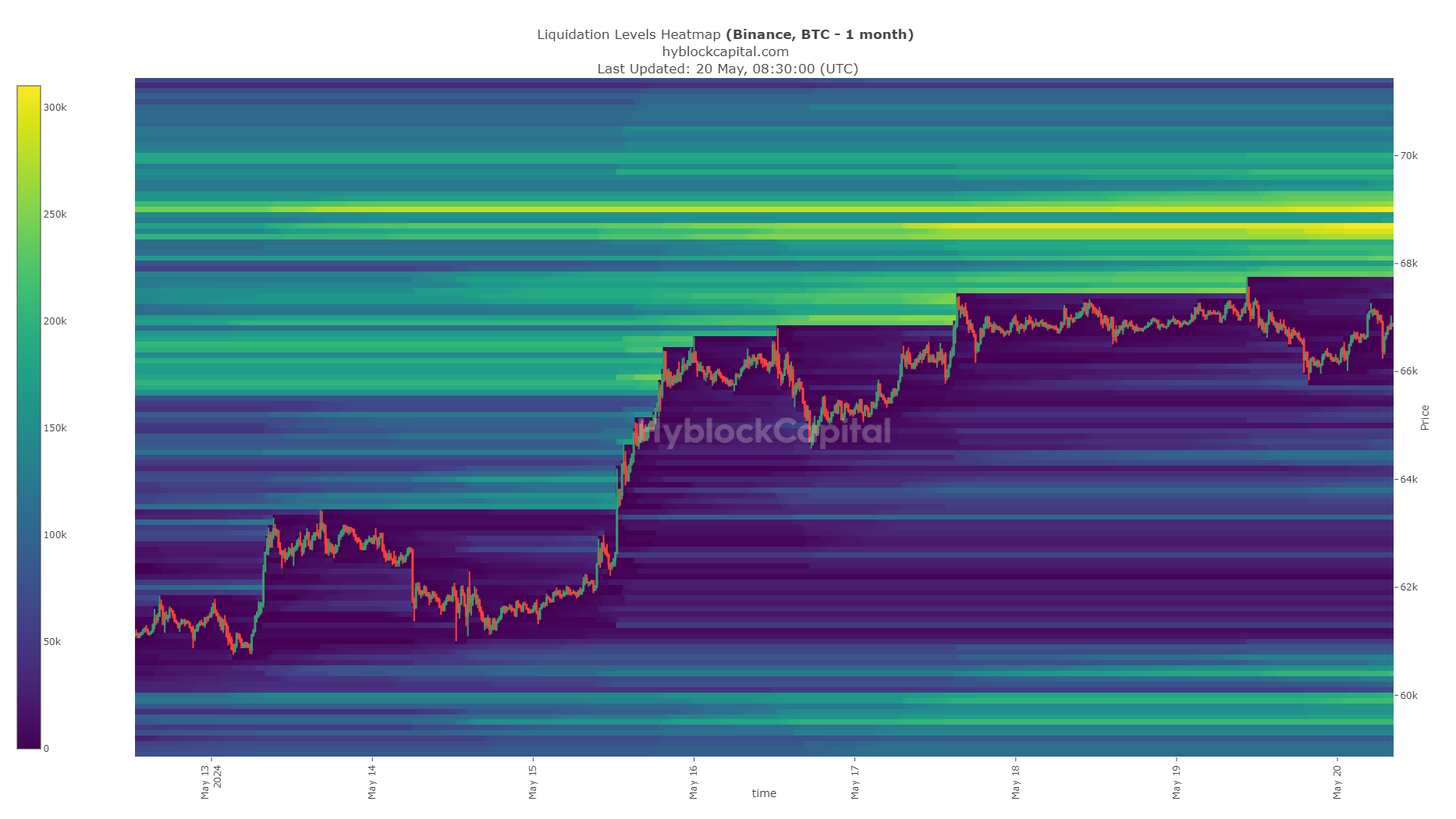

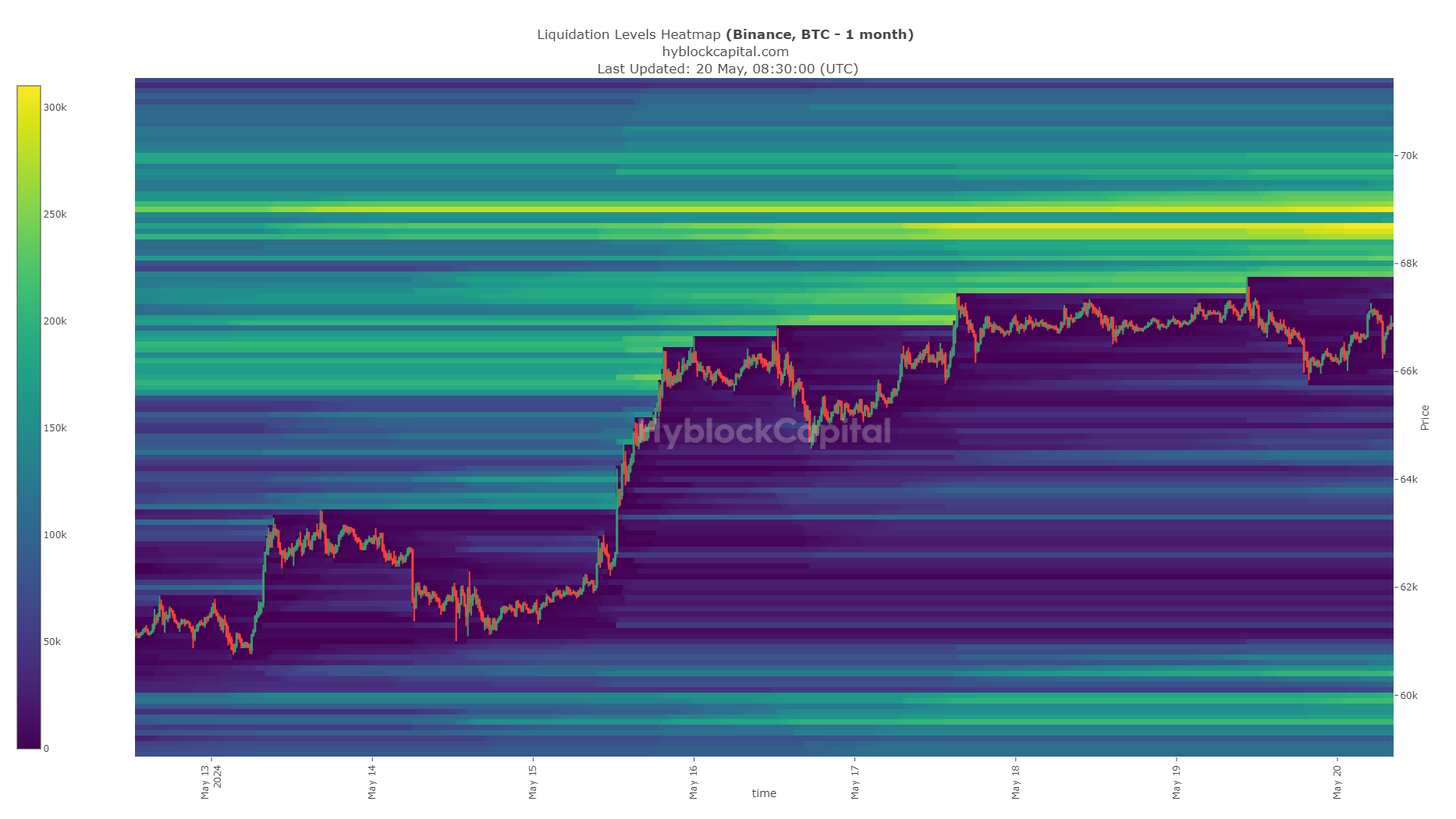

Crypto analyst CrypNuevo pointed out in a post on X (formerly Twitter) that the $69k region had a large cluster of liquidation levels. This level could attract prices in the coming days, but it could be accompanied by some volatility.

The idea is that a sharp, quick downward move before this large liquidity pocket is hit could encourage more short positions. It could also create false confidence in traders who are already short, which builds even more liquidity around the $69k region.

Source: Hyblock

He also pointed out that these aggressive moves happen at the start of the week. The 50-EMA on the 4-hour chart at $65k was another potential support for Bitcoin. Such a deep drop could encourage even more short-selling.

Source: CrypNuevo on X

However, the liquidation heatmap showcased the $68.6k-$69.2k as a critical resistance zone. The analyst expects a drop to $65k this week, followed by a rally to $69k.

What does the 4-hour timeframe technical analysis reveal?

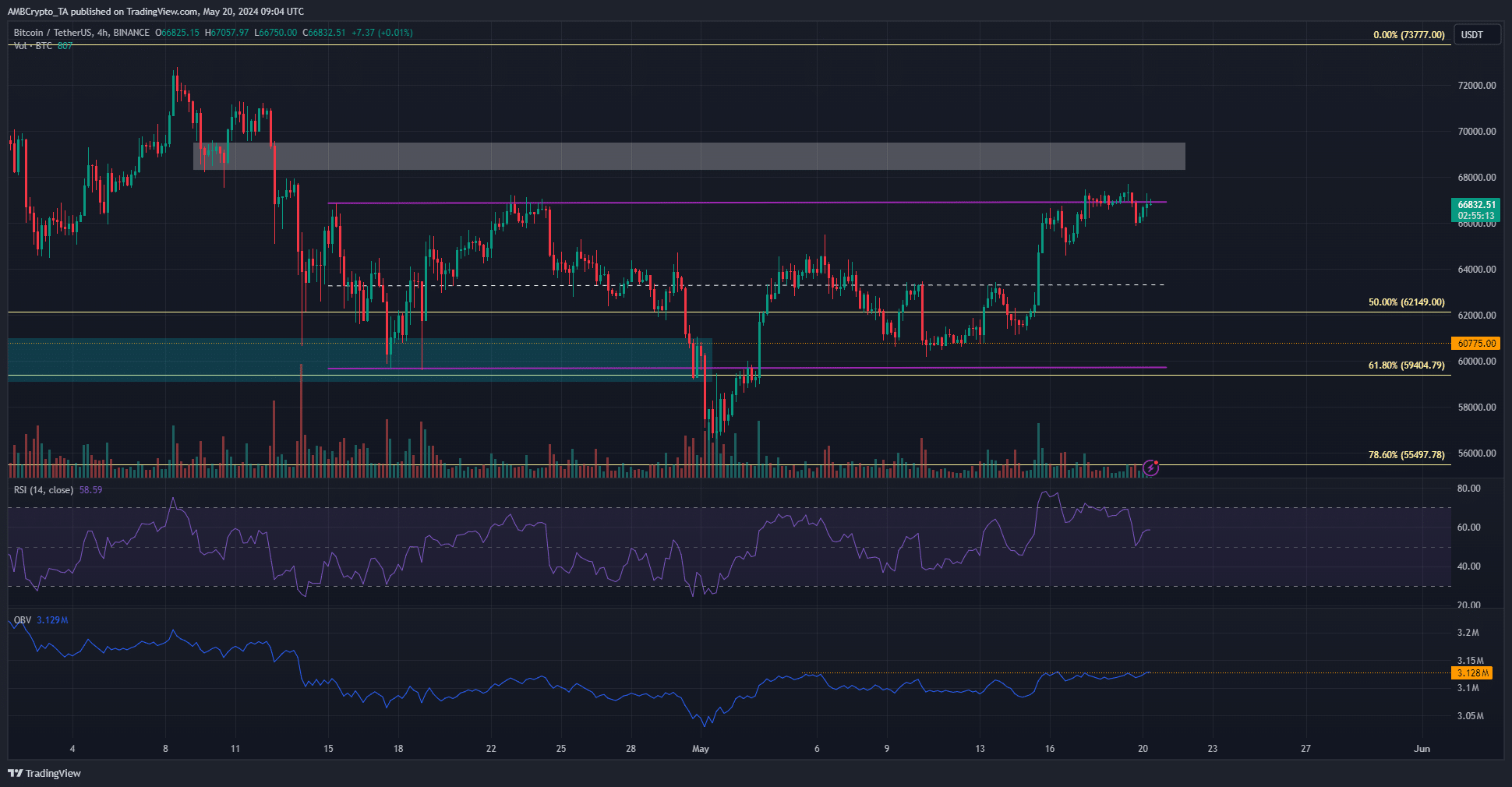

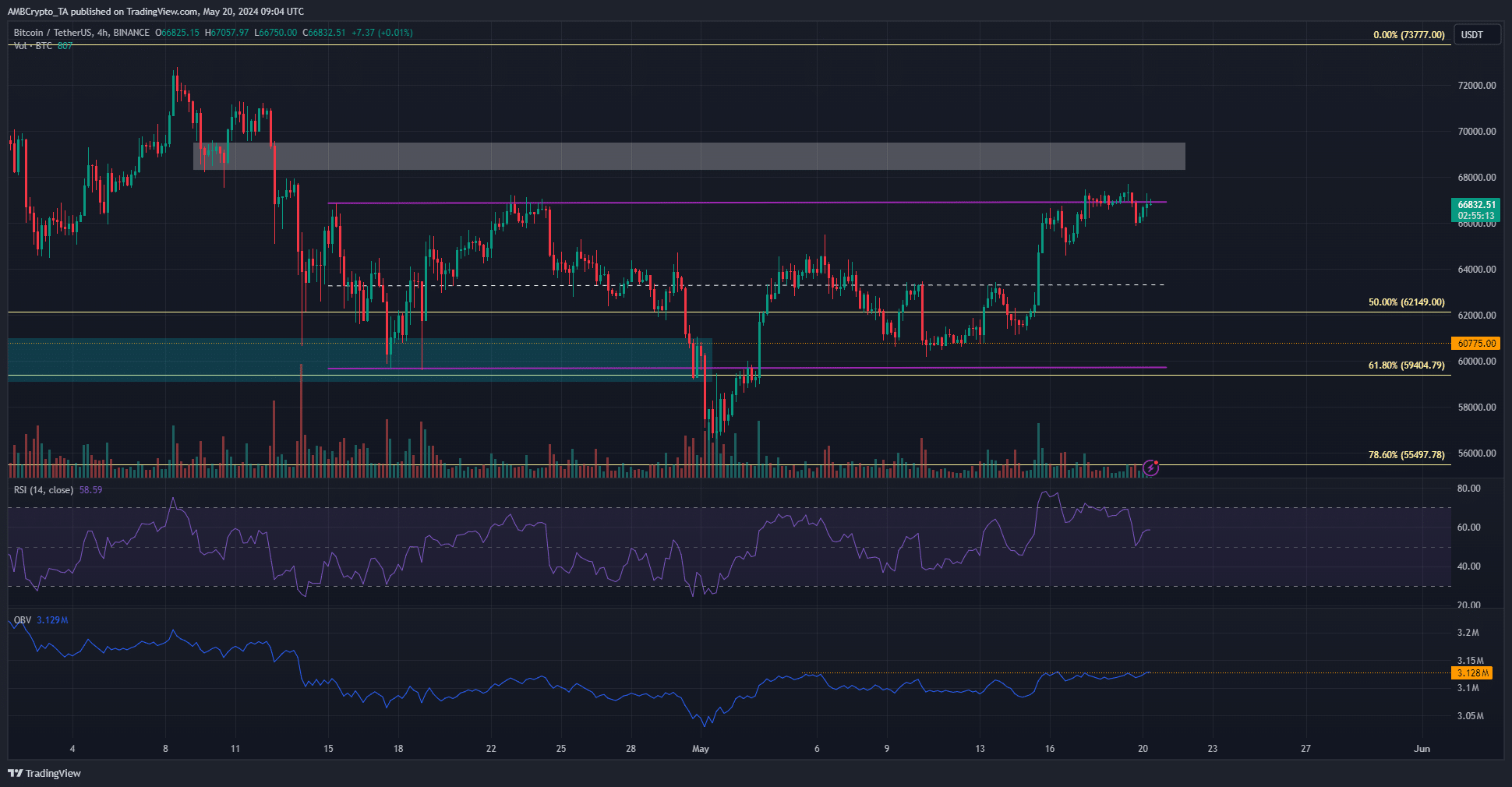

Source: BTC/USDT on TradingView

The H4 RSI continued to move above neutral 50 and indicated strong bullish momentum. Yet, the BTC trading volume has been low since Friday. However, the OBV was on the verge of clearing a local resistance level, which could add to the bullish impetus.

Is your portfolio green? Check the Bitcoin Profit Calculator

The 4-hour chart revealed strong resistance at $69k-$69.5k, but short liquidations could fuel a surge past this tricky resistance zone.

Hence, traders should be prepared for some volatility but continued bullish progress this week.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin has a strong bullish bias this week.

- The recent dip might be to engineer liquidity and more volatility was likely.

Bitcoin [BTC] was trading at the range highs at $67 at press time. This range has been in place since mid-April. The past few days’ momentum, particularly the recovery past $65k, convinced bulls that further gains were likely.

Other signals from on-chain analysis highlighted bullish sentiment in the market. Yet, the liquidity in the $68k-$69k region could see a bearish reversal. What are the chances that this scenario would play out?

How liquidity runs can be engineered

Crypto analyst CrypNuevo pointed out in a post on X (formerly Twitter) that the $69k region had a large cluster of liquidation levels. This level could attract prices in the coming days, but it could be accompanied by some volatility.

The idea is that a sharp, quick downward move before this large liquidity pocket is hit could encourage more short positions. It could also create false confidence in traders who are already short, which builds even more liquidity around the $69k region.

Source: Hyblock

He also pointed out that these aggressive moves happen at the start of the week. The 50-EMA on the 4-hour chart at $65k was another potential support for Bitcoin. Such a deep drop could encourage even more short-selling.

Source: CrypNuevo on X

However, the liquidation heatmap showcased the $68.6k-$69.2k as a critical resistance zone. The analyst expects a drop to $65k this week, followed by a rally to $69k.

What does the 4-hour timeframe technical analysis reveal?

Source: BTC/USDT on TradingView

The H4 RSI continued to move above neutral 50 and indicated strong bullish momentum. Yet, the BTC trading volume has been low since Friday. However, the OBV was on the verge of clearing a local resistance level, which could add to the bullish impetus.

Is your portfolio green? Check the Bitcoin Profit Calculator

The 4-hour chart revealed strong resistance at $69k-$69.5k, but short liquidations could fuel a surge past this tricky resistance zone.

Hence, traders should be prepared for some volatility but continued bullish progress this week.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

how can i get generic clomiphene no prescription can i purchase cheap clomiphene without a prescription clomid tablets how can i get generic clomiphene no prescription can i get cheap clomid price how can i get clomid tablets where can i buy generic clomiphene

More peace pieces like this would create the интернет better.

This is the kind of post I unearth helpful.

oral zithromax – zithromax 250mg usa metronidazole price

rybelsus 14 mg cheap – periactin 4 mg price buy periactin 4 mg pill

purchase motilium online – buy domperidone for sale buy cyclobenzaprine online cheap

brand amoxicillin – buy ipratropium no prescription order generic combivent 100mcg

buy azithromycin 250mg pill – buy tinidazole 500mg sale bystolic 5mg tablet

buy clavulanate no prescription – atbioinfo.com brand ampicillin

buy esomeprazole 20mg generic – https://anexamate.com/ order nexium 40mg without prescription

order medex for sale – https://coumamide.com/ order losartan 50mg online cheap

meloxicam 7.5mg sale – relieve pain order mobic online

deltasone pills – https://apreplson.com/ generic prednisone 40mg

buy ed pills best price – https://fastedtotake.com/ gnc ed pills

buy amoxicillin generic – combamoxi.com buy amoxicillin without prescription

fluconazole 100mg brand – https://gpdifluca.com/ buy fluconazole generic

buy cenforce sale – https://cenforcers.com/# cenforce for sale online

tadalafil troche reviews – click where can i buy cialis

ranitidine 150mg ca – order zantac generic purchase ranitidine online

buy cialis/canada – this generic tadalafil in us

The sagacity in this piece is exceptional. https://gnolvade.com/

where can i buy real viagra online – viagra usa buy 50mg sildenafil

More peace pieces like this would urge the интернет better. https://buyfastonl.com/gabapentin.html

Thanks for sharing. It’s first quality. https://ursxdol.com/azithromycin-pill-online/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/diltiazem-online/

Greetings! Extremely serviceable advice within this article! It’s the scarcely changes which liking turn the largest changes. Thanks a lot quest of sharing! online

More posts like this would make the blogosphere more useful. https://ondactone.com/product/domperidone/