- BTC has surged by 4.16% over the past week, with fundamentals indicating positive sentiments.

- Despite the lows, RSI confirms a bullish trend with a bullish RSI divergence.

Bitcoin [BTC] has experienced a strong upward momentum throughout the month. Historically, September is associated with a bearish trend. However, this month has seen a dramatic shift with BTC making higher lows.

In fact, as of this writing, Bitcoin was trading at $65,530. This marked a 10.52% increase on monthly charts with the extension of the uptrend by a 4.16% surge over the past week.

However, the last 24 hours have seen a minor correction with Bitcoin declining by 0.46%.

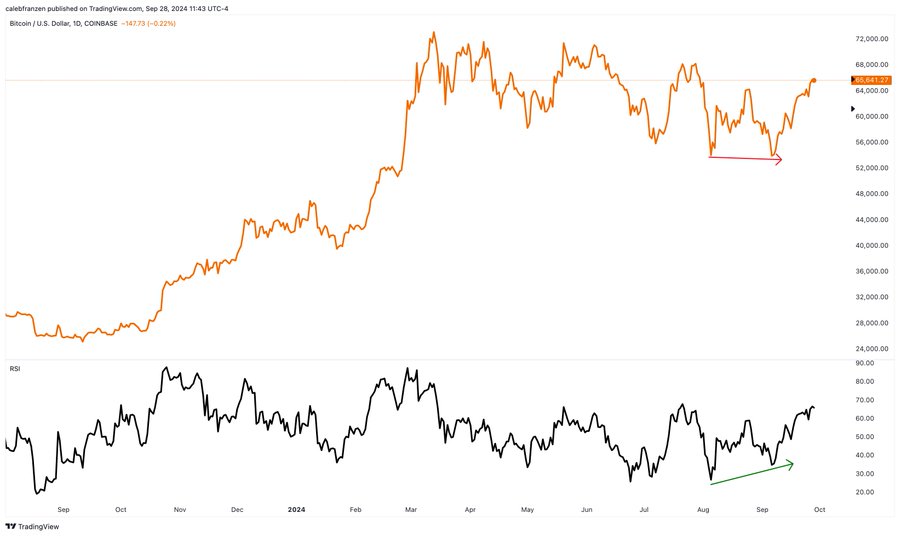

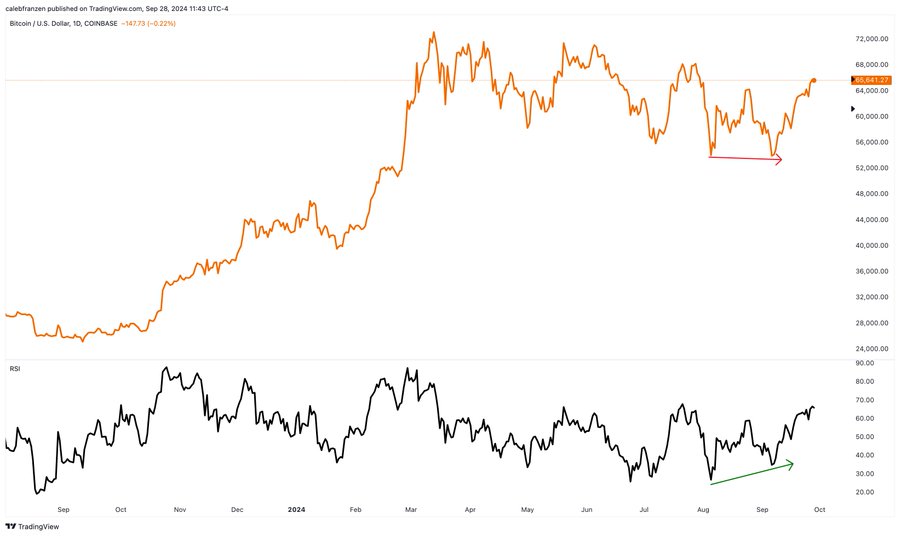

Therefore, the current market conditions have left analysts talking over Bitcoin’s trajectory. One of them is the popular crypto analyst Caleb Franzen who suggested that a bullish trend is set to continue citing bullish RSI divergence.

What market sentiment says

In his analysis, Franzen Cited bullish RSI divergence to argue that, the bulls are dominating the market.

Source: X

According to the analyst, RSI has not formed a bearish RSI divergence on daily charts. However, the RSI is continuing to confirm the bullish trend off the lows. Therefore, it has been confirming the bullish RSI divergence.

In context, the fact that there is no bearish divergence implies that the price increase is supported by momentum and there’s no significant sign of a reversal at this time.

When a bearish RSI divergence occurs, it indicates a weakening upward momentum and could suggest that a price correction is imminent.

Thus, although BTC might have made lower lows recently, the RSI is making higher lows indicating that momentum is building despite lower prices.

Usually, a bullish RSI divergence suggests that selling pressure is weakening and buying interest is growing leading to a further upside.

What BTC charts say

As observed by Frazen, Bitcoin is enjoying favorable market conditions. Therefore, these market conditions could set BTC for further gains on price charts.

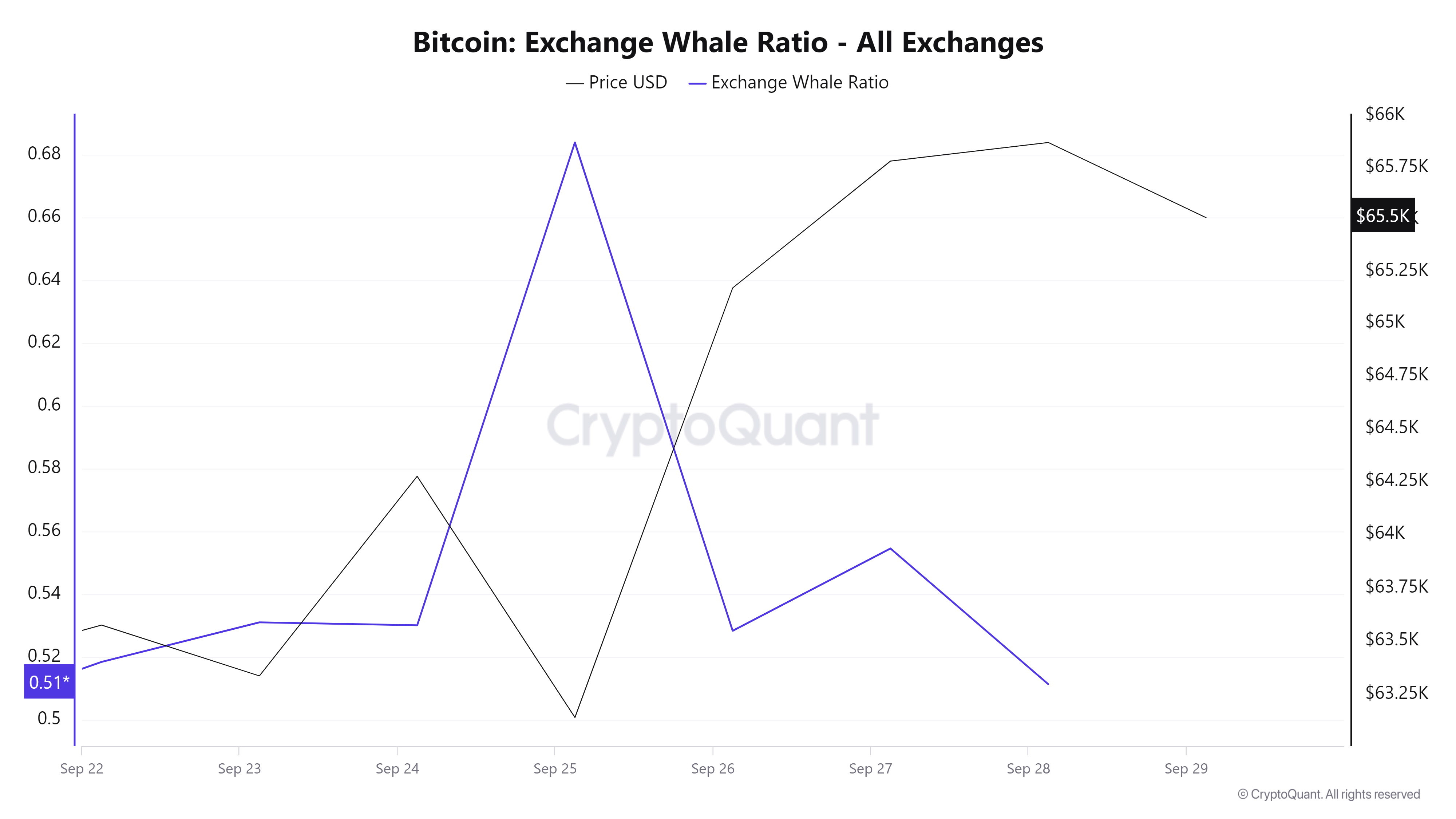

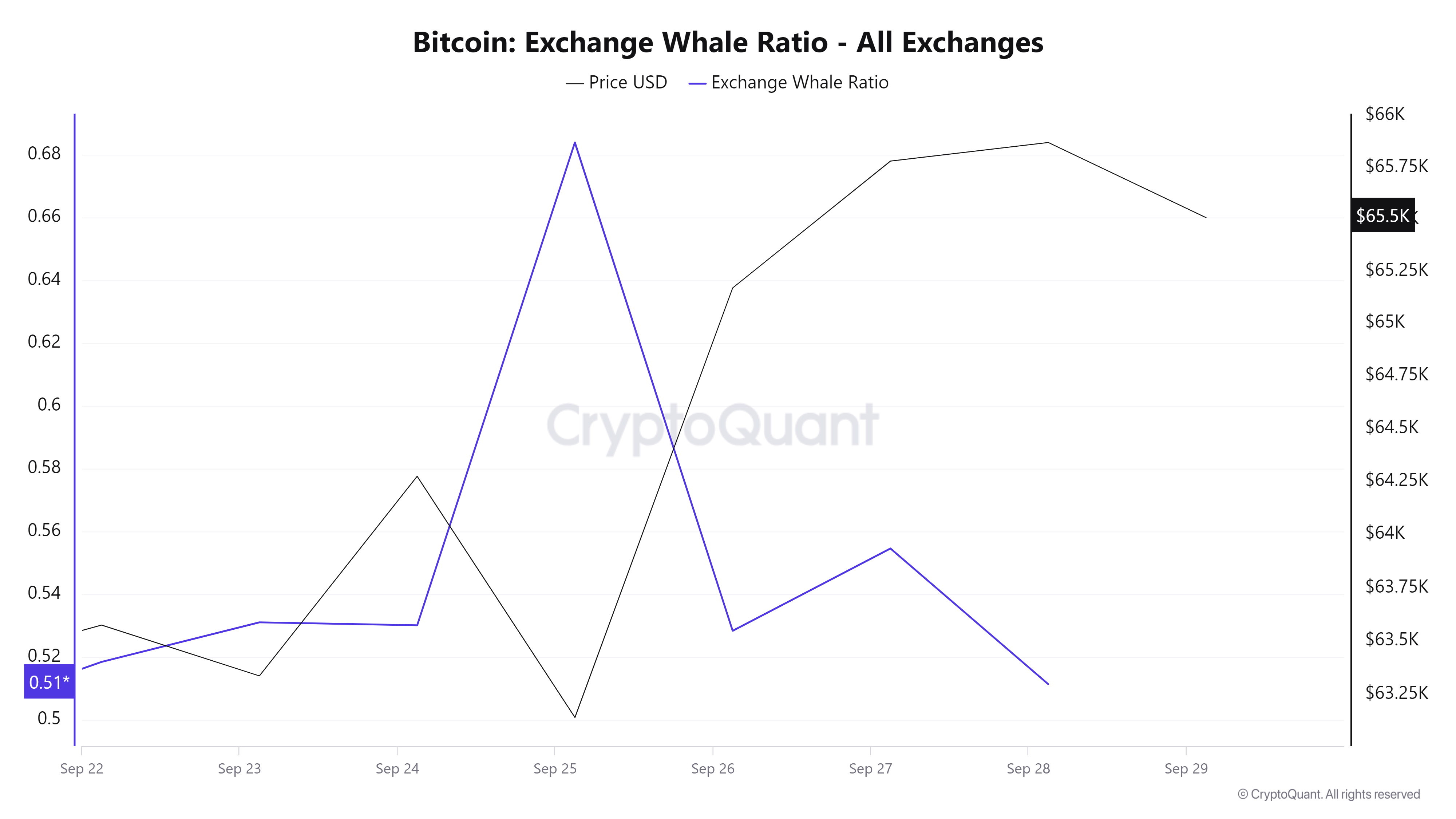

Source: Cryptoquant

For example, the Exchange whale ratio has declined from a high of 0.68 to 0.511 at press time. This decline suggests that whales are moving their BT off exchanges into private wallets.

Such market behavior is a bullish signal indicating that large holders have no plan to sell in the short term.

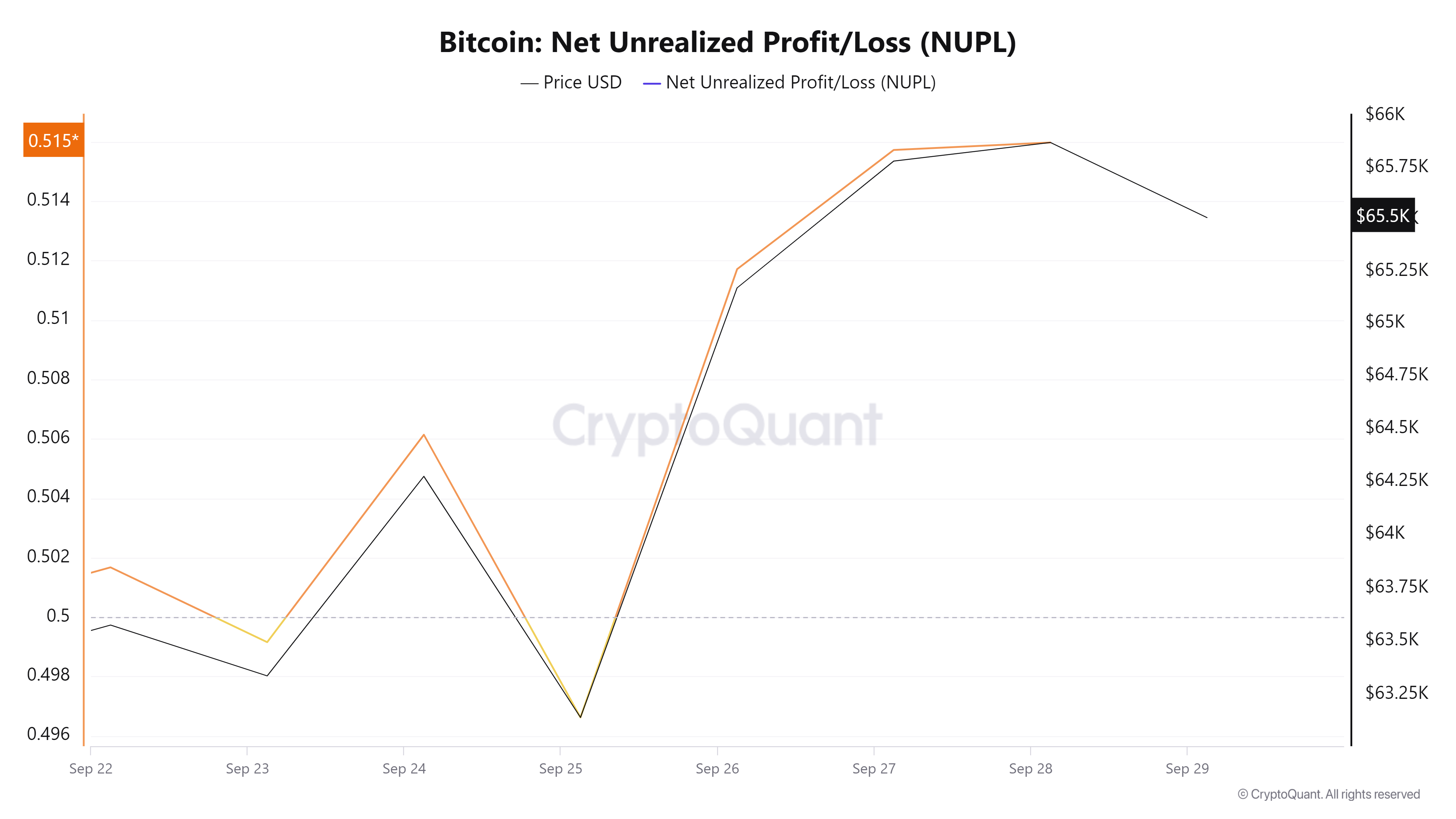

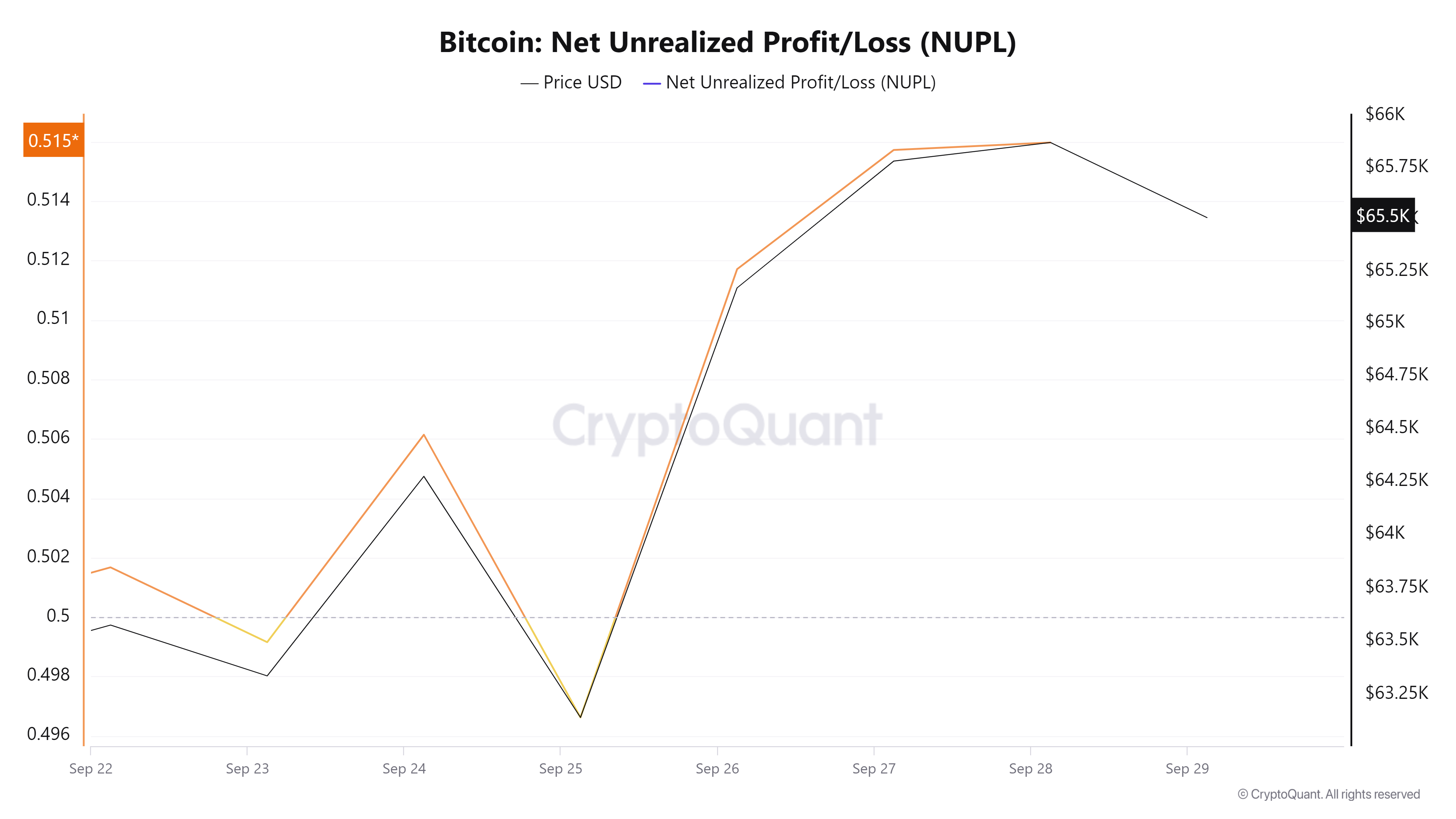

Source: Cryptoquant

Additionally, Bitcoin’s Net Unrealized profit/loss (NUPL) has risen from a low of 0.4 to 0.51 over the past week. As NUPL rises, it indicates that investors are seeing profits.

This usually occurs during the market bullish phase as prices increase exceeding the purchasing value. Therefore, it results in increased optimism as participants feel more confident in the market’s future potential, expecting further price gains.

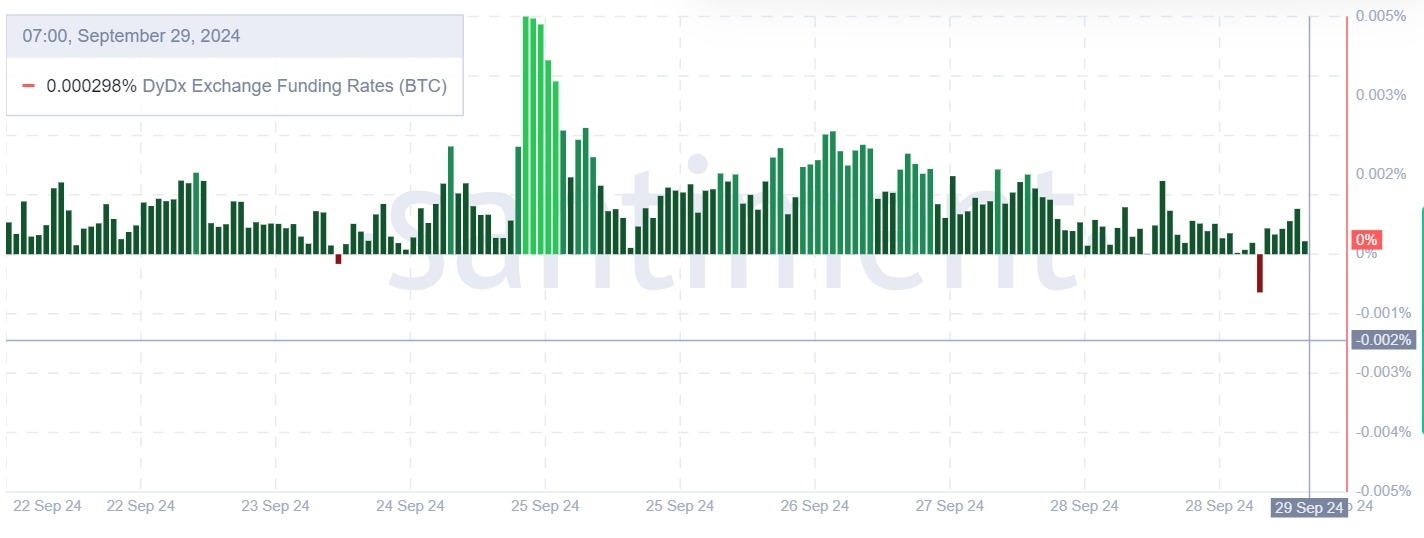

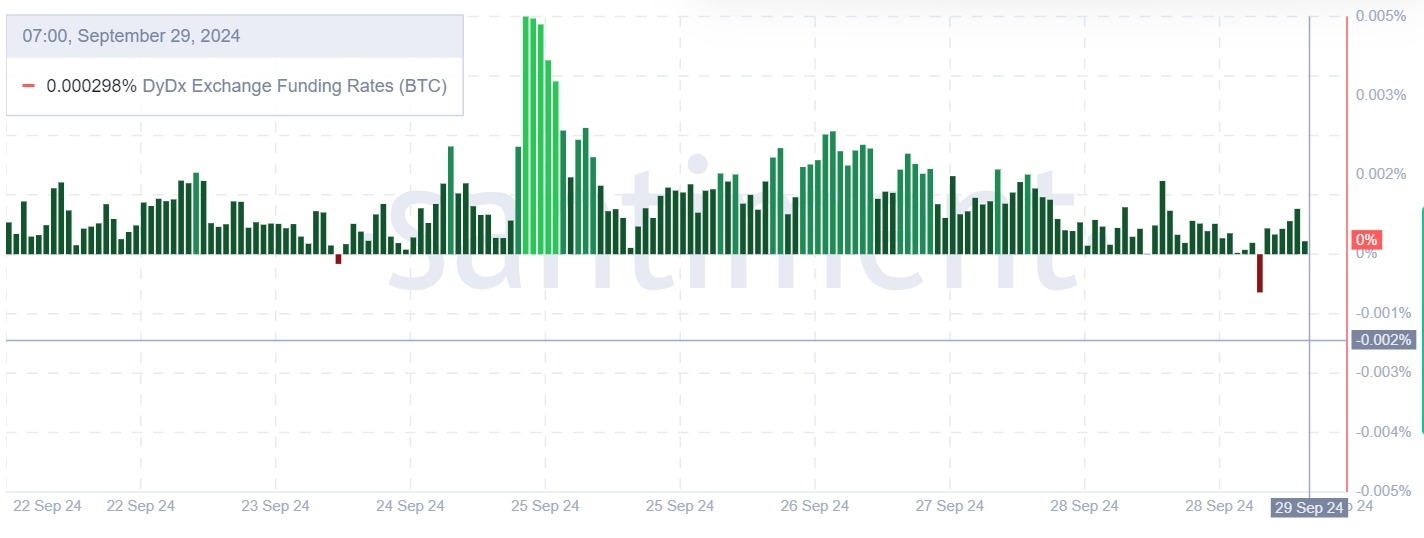

Source: Santiment

Finally, Bitcoin’s DyDx exchange funding rate has remained positive over the past week. A positive DyDx exchange funding rate suggests long position holders are paying those taking shorts to hold their position.

Is your portfolio green? Check out the BTC Profit Calculator

In such a market situation, investors are more inclined to take long positions anticipating prices to rise.

Simply put, Bitcoin is experiencing a strong upward momentum will bulls dominating the market. Therefore, in these conditions, BTC will make further gains on price charts by reclaiming the $66500 resistance level in the short term.

- BTC has surged by 4.16% over the past week, with fundamentals indicating positive sentiments.

- Despite the lows, RSI confirms a bullish trend with a bullish RSI divergence.

Bitcoin [BTC] has experienced a strong upward momentum throughout the month. Historically, September is associated with a bearish trend. However, this month has seen a dramatic shift with BTC making higher lows.

In fact, as of this writing, Bitcoin was trading at $65,530. This marked a 10.52% increase on monthly charts with the extension of the uptrend by a 4.16% surge over the past week.

However, the last 24 hours have seen a minor correction with Bitcoin declining by 0.46%.

Therefore, the current market conditions have left analysts talking over Bitcoin’s trajectory. One of them is the popular crypto analyst Caleb Franzen who suggested that a bullish trend is set to continue citing bullish RSI divergence.

What market sentiment says

In his analysis, Franzen Cited bullish RSI divergence to argue that, the bulls are dominating the market.

Source: X

According to the analyst, RSI has not formed a bearish RSI divergence on daily charts. However, the RSI is continuing to confirm the bullish trend off the lows. Therefore, it has been confirming the bullish RSI divergence.

In context, the fact that there is no bearish divergence implies that the price increase is supported by momentum and there’s no significant sign of a reversal at this time.

When a bearish RSI divergence occurs, it indicates a weakening upward momentum and could suggest that a price correction is imminent.

Thus, although BTC might have made lower lows recently, the RSI is making higher lows indicating that momentum is building despite lower prices.

Usually, a bullish RSI divergence suggests that selling pressure is weakening and buying interest is growing leading to a further upside.

What BTC charts say

As observed by Frazen, Bitcoin is enjoying favorable market conditions. Therefore, these market conditions could set BTC for further gains on price charts.

Source: Cryptoquant

For example, the Exchange whale ratio has declined from a high of 0.68 to 0.511 at press time. This decline suggests that whales are moving their BT off exchanges into private wallets.

Such market behavior is a bullish signal indicating that large holders have no plan to sell in the short term.

Source: Cryptoquant

Additionally, Bitcoin’s Net Unrealized profit/loss (NUPL) has risen from a low of 0.4 to 0.51 over the past week. As NUPL rises, it indicates that investors are seeing profits.

This usually occurs during the market bullish phase as prices increase exceeding the purchasing value. Therefore, it results in increased optimism as participants feel more confident in the market’s future potential, expecting further price gains.

Source: Santiment

Finally, Bitcoin’s DyDx exchange funding rate has remained positive over the past week. A positive DyDx exchange funding rate suggests long position holders are paying those taking shorts to hold their position.

Is your portfolio green? Check out the BTC Profit Calculator

In such a market situation, investors are more inclined to take long positions anticipating prices to rise.

Simply put, Bitcoin is experiencing a strong upward momentum will bulls dominating the market. Therefore, in these conditions, BTC will make further gains on price charts by reclaiming the $66500 resistance level in the short term.

Подготовьте самые интересные планы для вашего следующего шага вперед. Вы можете легко подтвердить все необходимое моментально. Ознакомьтесь лучшие места для отдыха. Не упустите возможность пройти новые места и эмоции!

Оформить

Легко и быстро определите лучшее решения для своих нужд. Вы можете освоить быстро все необходимое без проблем. Просмотрите новейшие вещи и методы, чтобы сделать свою жизнь проще. Не забудьте сравнить лучшие предложения и применить на практике скидки!

can you buy cheap clomiphene without a prescription where can i buy generic clomiphene clomiphene rx cost clomid without insurance get generic clomiphene for sale how can i get cheap clomid without prescription cost of clomid without insurance

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks object of providing such data.

buy zithromax without prescription – buy generic sumycin flagyl 400mg canada

order semaglutide 14 mg generic – periactin over the counter periactin for sale

motilium over the counter – buy domperidone pill buy generic flexeril

amoxil pills – cost valsartan 80mg ipratropium 100 mcg tablet

azithromycin for sale online – buy tinidazole tablets bystolic 20mg uk

buy generic augmentin online – https://atbioinfo.com/ acillin canada

nexium 40mg ca – https://anexamate.com/ cost esomeprazole 20mg

oral coumadin 5mg – coumamide cozaar 50mg usa

cheap meloxicam 15mg – https://moboxsin.com/ cheap mobic

order deltasone 5mg sale – https://apreplson.com/ buy prednisone cheap

generic ed pills – https://fastedtotake.com/ otc ed pills that work

cost diflucan 200mg – this oral fluconazole 200mg

cenforce price – cenforce usa order cenforce online cheap

cialis daily review – cialis sales in victoria canada how much does cialis cost at cvs

best place to buy tadalafil online – site us cialis online pharmacy

ranitidine generic – ranitidine 150mg without prescription buy ranitidine 150mg for sale

how to order generic viagra – https://strongvpls.com/ red viagra tablets

More articles like this would make the blogosphere richer. clomid 50 mg para que sirve

I’ll certainly carry back to skim more. https://buyfastonl.com/amoxicillin.html

Thanks towards putting this up. It’s evidently done. https://ursxdol.com/synthroid-available-online/

Thanks towards putting this up. It’s okay done. https://prohnrg.com/product/atenolol-50-mg-online/

I am actually delighted to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://aranitidine.com/fr/en_ligne_kamagra/