- BTC has declined by 10% over the past 30 days, yet it was in declining bullish consolidation.

- An analyst eyed a new ATH, based on previous consolidation cycles.

Bitcoin [BTC], the largest cryptocurrency, has experienced a sharp decline over the last weeks. In fact, at press time, the king coin was trading at $57736 after recording a 9.58% decline in the past week.

The month of August saw the crypto experience an extremely volatile market. The period saw the crypto drop to a local low of $49k before making a moderate recovery.

Despite the recent decline, BTC is still 16.6% above its recent local low, consolidating in a declining yet bullish trend. Equally, it was 59.94% above the yearly low of $38505 recorded earlier this year.

These indicators and market behavior have left analysts predicting a repeat of a bull run 2.0 to a new record high. For instance, popular crypto analysts Mags eyes a new record high, citing historical cycles.

Market sentiment

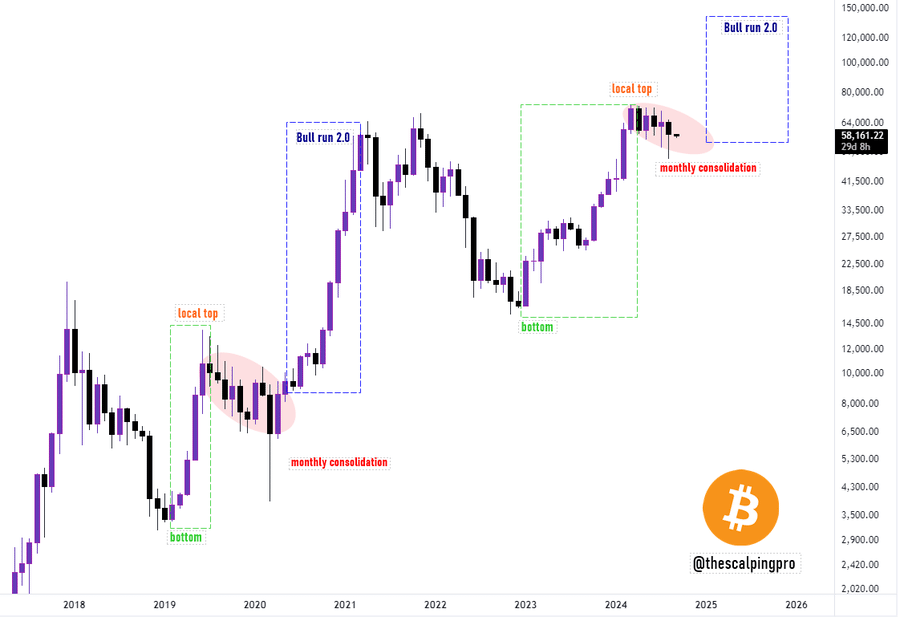

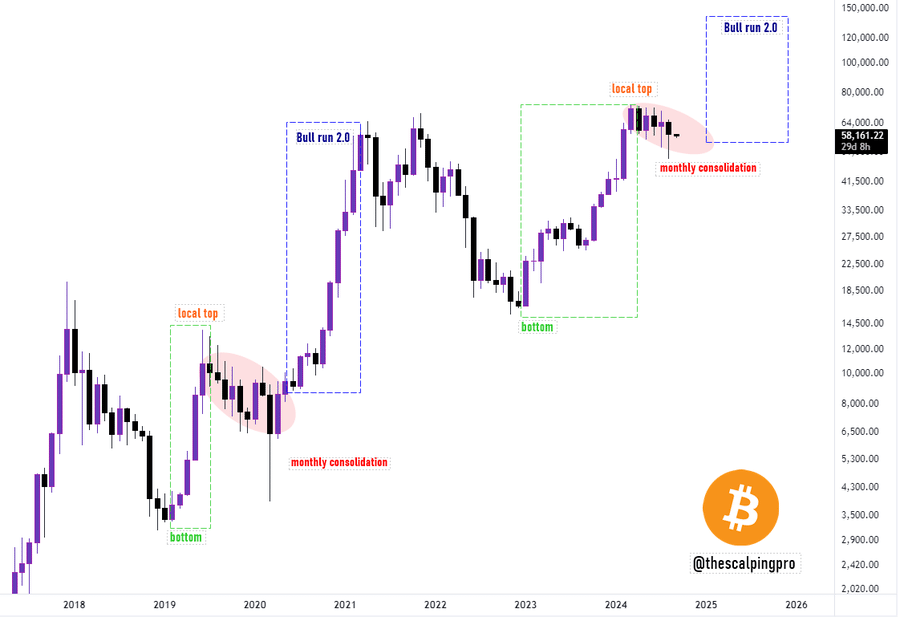

In his analysis, Mags cited the previous two cycles with monthly consolidation, resulting in another bull run.

Based on the cycle analogy, after BTC hits a bottom and then a local top, a period of consolidation follows, which is later preceded by a strong bull run.

He shared his analysis through X (formerly Twitter), noting that,

“Bitcoin – Bull run 2.0 Incoming. The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.”

Source: X

This argument points to the previous bull run, which resulted from months of consolidation.

Notably, consolidation plays a crucial role in stabilizing the markets. This period allows the market to absorb recent price action, thus preventing extreme volatility.

Also, it helps in the reduction of speculative pressure since short-term traders tend to close their positions.

With the entrants of long-term traders, investors start accumulating which gradually builds demand thus resulting in increased buying activity.

What Bitcoin’s charts suggest

Mags believed that another bull run was imminent for the king coin. The question is, what do other indicators show?

Source: CryptoQuant

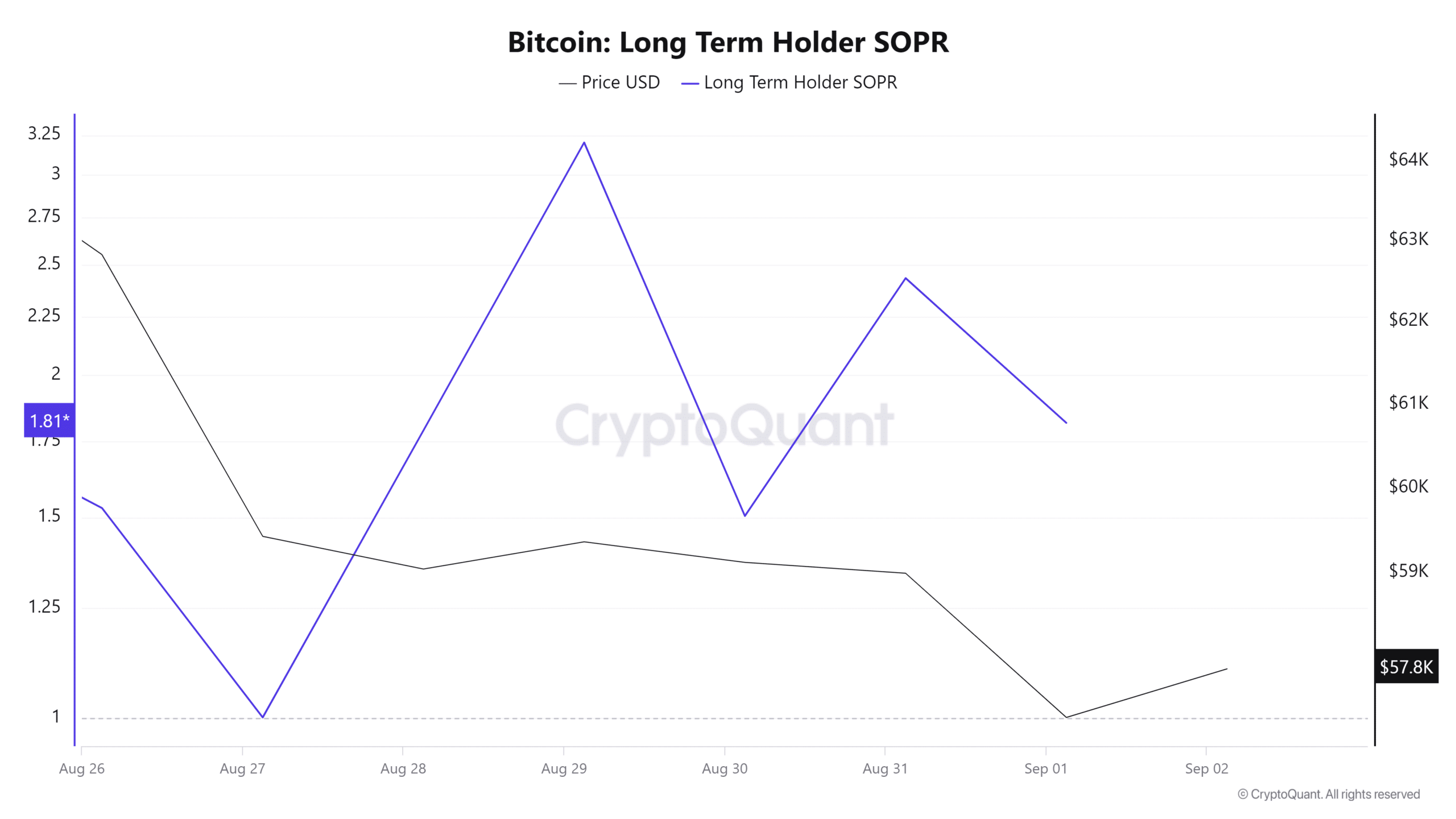

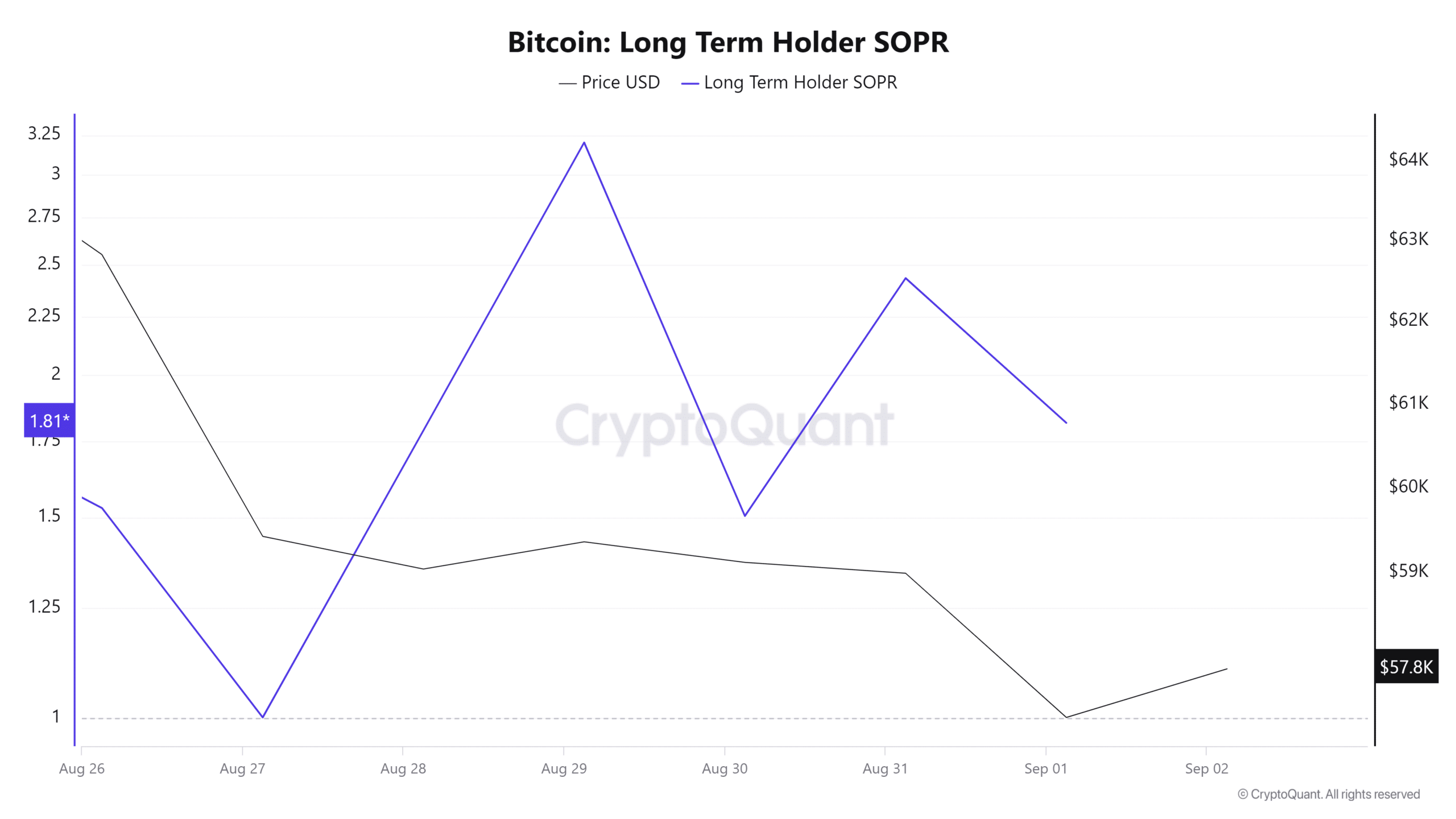

For starters, Bitcoin’s long-term holder’s SOPR has averaged around one over the past seven days. When long-term holders’ spent output profit ratio remains around one, it suggests crypto is sold at a cost basis.

This shows market consolidation, with long-term holders neither in profit nor losses. Such a scenario makes long-term holders continue holding to wait for profitable sales in the future.

Source: CryptoQuant

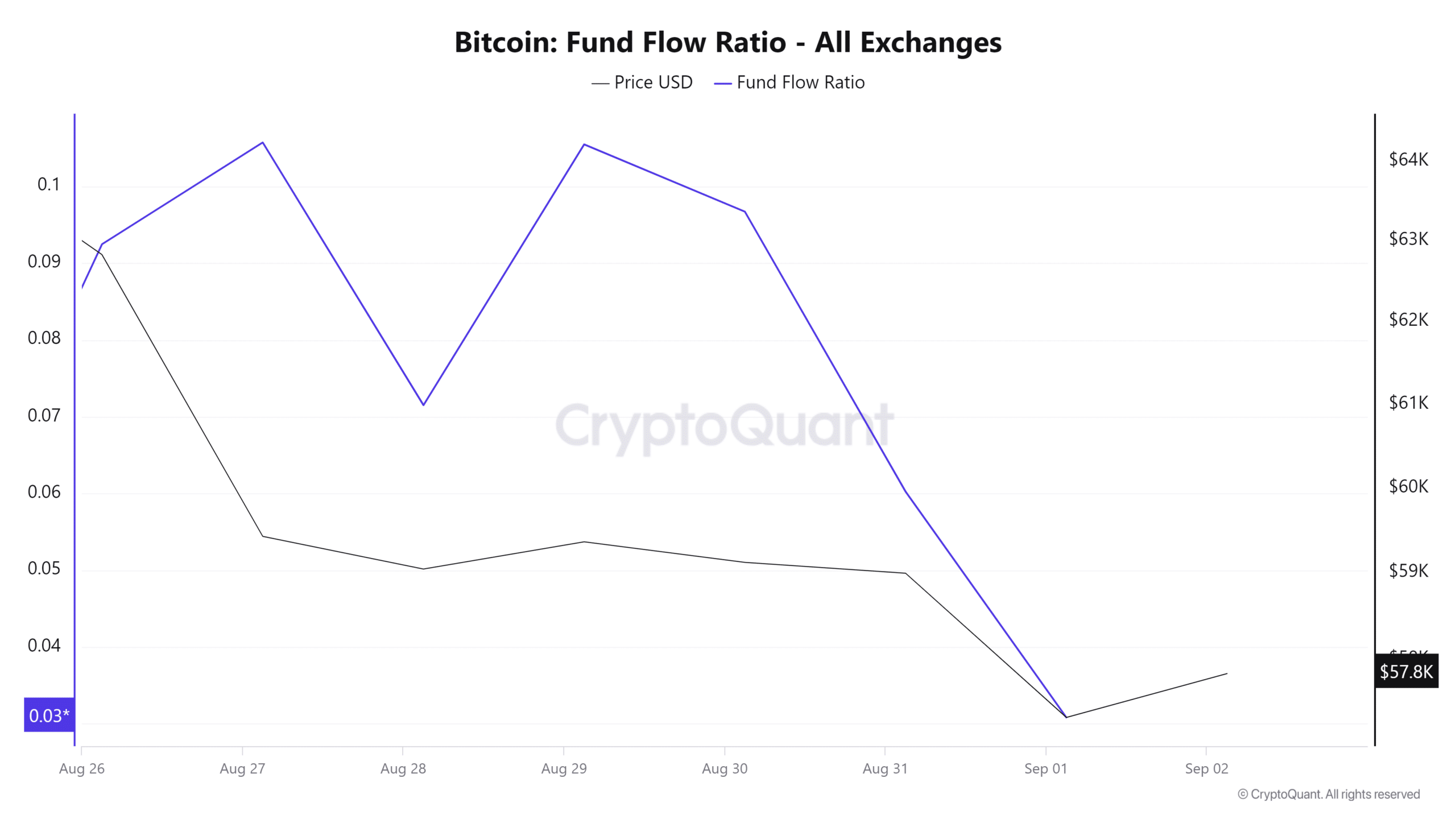

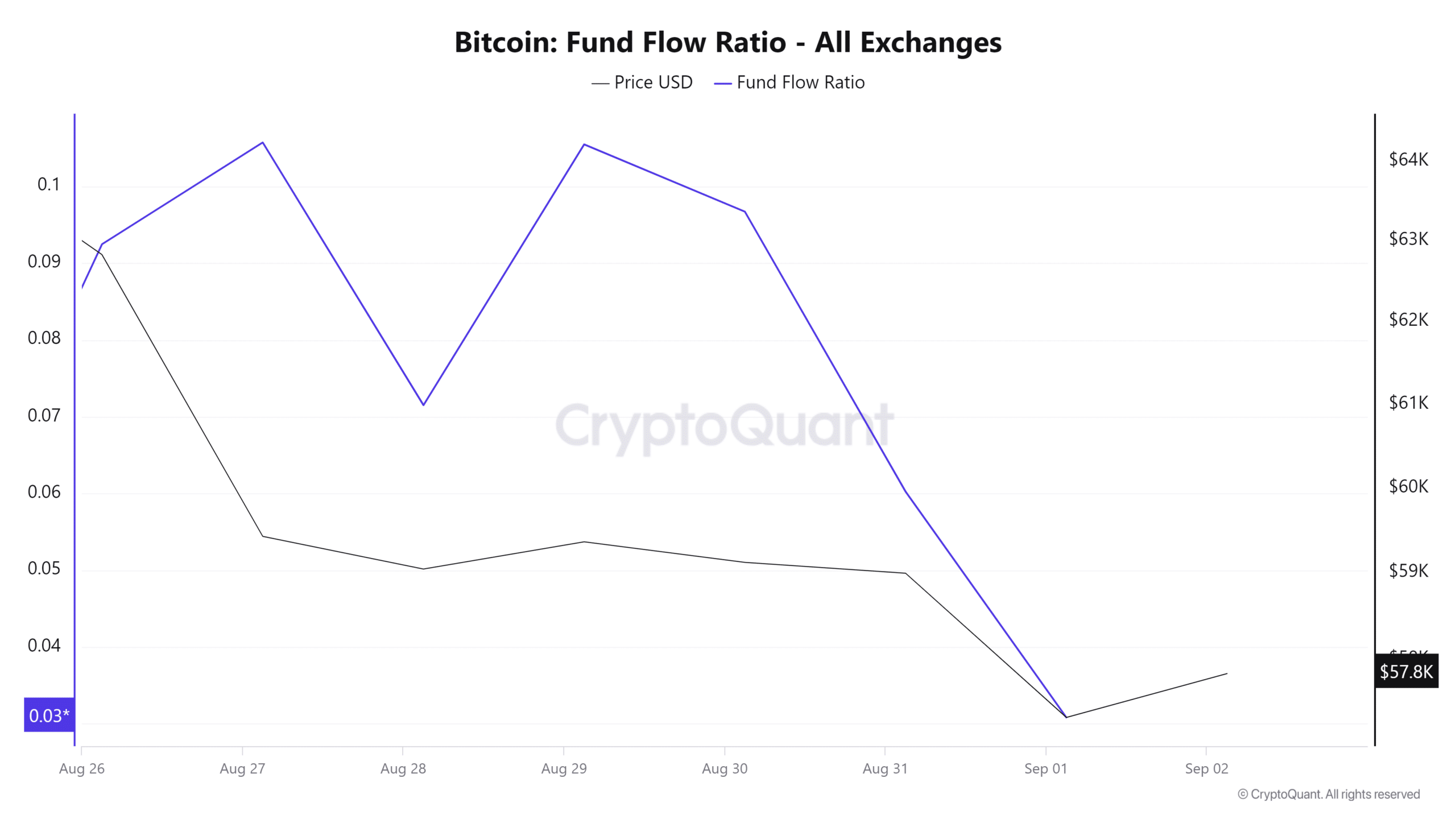

Additionally, the fund flow ratio has been consistently below 1 over the past seven days. This means that more BTC has been withdrawn from exchanges, rather than being deposited.

This is a bullish signal, indicating investors are moving their crypto off exchanges for long-term holding, thus reducing supply available for immediate sell.

Such moves reduce selling pressure and increase demand, which in turn helps in trend reversal.

Source: Cryptoquant

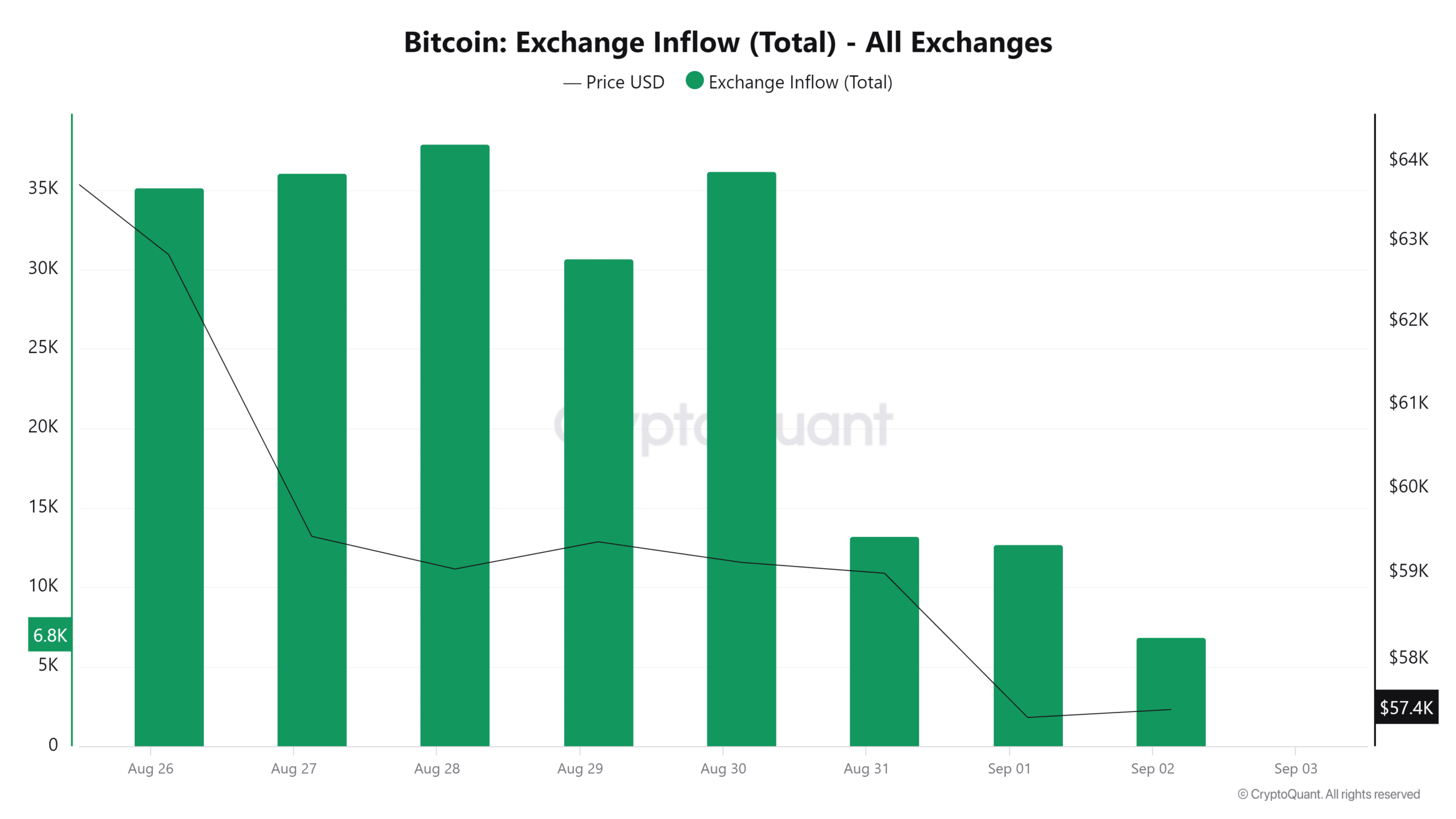

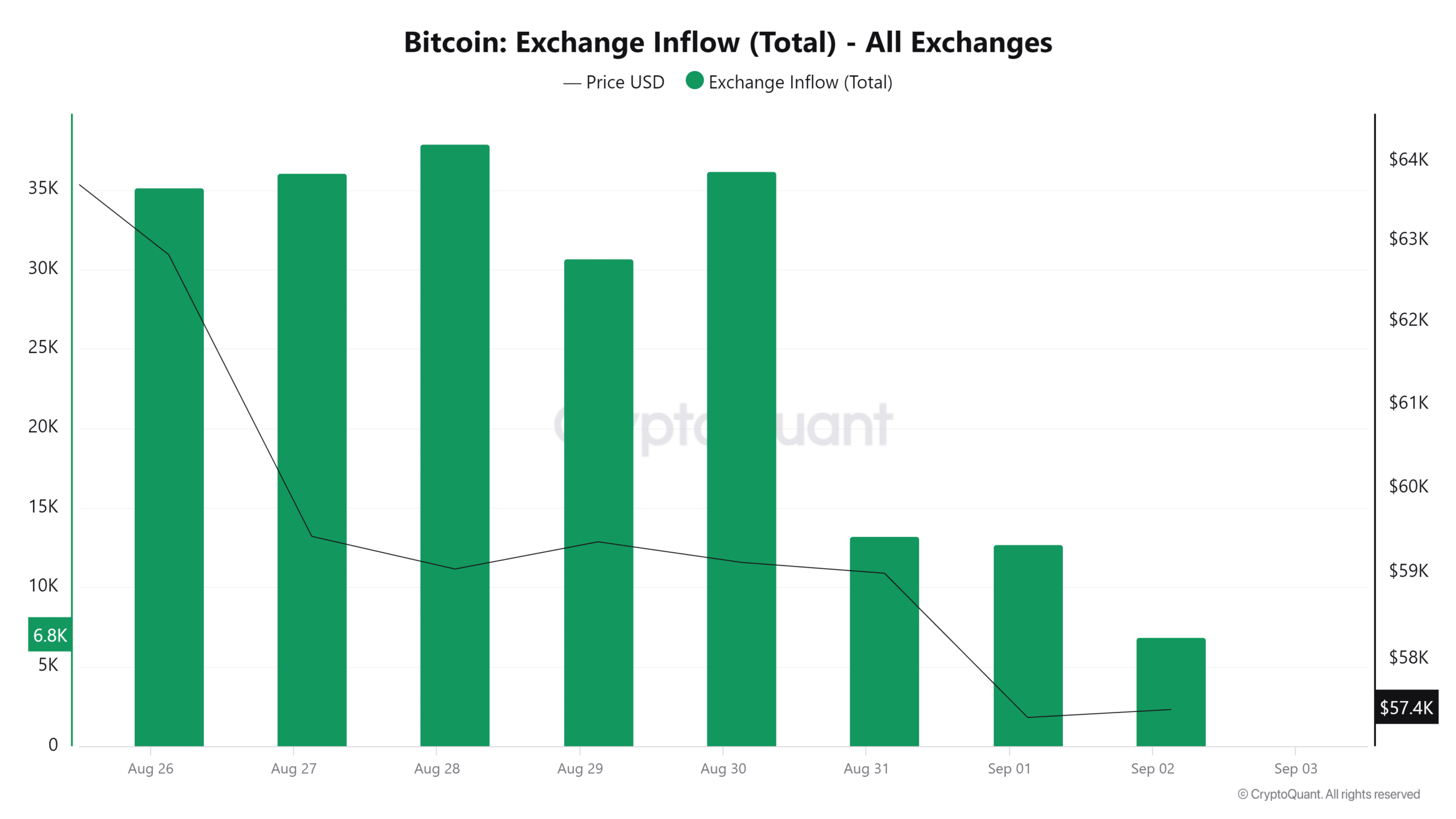

Finally, BTC exchange inflow has reduced over the past three days, from a weekly high of 37899.7 to a low of 6869. Such a decline in exchange inflow indicates holding behavior, as investors anticipate higher prices.

This market sentiment reduces selling activity, which is bullish as fewer coins are readily available for trade.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although BTC has declined over the past 30 days, it’s in declining but a bullish consolidation. With increased market indecision, investors are turning to hold, thus reducing supply.

Such accumulation behavior leads to reduced supply and an increase in demand, which allows bulls to reclaim the markets. This will lead to BTC breaking out above the $61159 resistance level, potentially towards $70k.

- BTC has declined by 10% over the past 30 days, yet it was in declining bullish consolidation.

- An analyst eyed a new ATH, based on previous consolidation cycles.

Bitcoin [BTC], the largest cryptocurrency, has experienced a sharp decline over the last weeks. In fact, at press time, the king coin was trading at $57736 after recording a 9.58% decline in the past week.

The month of August saw the crypto experience an extremely volatile market. The period saw the crypto drop to a local low of $49k before making a moderate recovery.

Despite the recent decline, BTC is still 16.6% above its recent local low, consolidating in a declining yet bullish trend. Equally, it was 59.94% above the yearly low of $38505 recorded earlier this year.

These indicators and market behavior have left analysts predicting a repeat of a bull run 2.0 to a new record high. For instance, popular crypto analysts Mags eyes a new record high, citing historical cycles.

Market sentiment

In his analysis, Mags cited the previous two cycles with monthly consolidation, resulting in another bull run.

Based on the cycle analogy, after BTC hits a bottom and then a local top, a period of consolidation follows, which is later preceded by a strong bull run.

He shared his analysis through X (formerly Twitter), noting that,

“Bitcoin – Bull run 2.0 Incoming. The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.”

Source: X

This argument points to the previous bull run, which resulted from months of consolidation.

Notably, consolidation plays a crucial role in stabilizing the markets. This period allows the market to absorb recent price action, thus preventing extreme volatility.

Also, it helps in the reduction of speculative pressure since short-term traders tend to close their positions.

With the entrants of long-term traders, investors start accumulating which gradually builds demand thus resulting in increased buying activity.

What Bitcoin’s charts suggest

Mags believed that another bull run was imminent for the king coin. The question is, what do other indicators show?

Source: CryptoQuant

For starters, Bitcoin’s long-term holder’s SOPR has averaged around one over the past seven days. When long-term holders’ spent output profit ratio remains around one, it suggests crypto is sold at a cost basis.

This shows market consolidation, with long-term holders neither in profit nor losses. Such a scenario makes long-term holders continue holding to wait for profitable sales in the future.

Source: CryptoQuant

Additionally, the fund flow ratio has been consistently below 1 over the past seven days. This means that more BTC has been withdrawn from exchanges, rather than being deposited.

This is a bullish signal, indicating investors are moving their crypto off exchanges for long-term holding, thus reducing supply available for immediate sell.

Such moves reduce selling pressure and increase demand, which in turn helps in trend reversal.

Source: Cryptoquant

Finally, BTC exchange inflow has reduced over the past three days, from a weekly high of 37899.7 to a low of 6869. Such a decline in exchange inflow indicates holding behavior, as investors anticipate higher prices.

This market sentiment reduces selling activity, which is bullish as fewer coins are readily available for trade.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although BTC has declined over the past 30 days, it’s in declining but a bullish consolidation. With increased market indecision, investors are turning to hold, thus reducing supply.

Such accumulation behavior leads to reduced supply and an increase in demand, which allows bulls to reclaim the markets. This will lead to BTC breaking out above the $61159 resistance level, potentially towards $70k.

can you buy clomiphene online can i order clomiphene without a prescription where buy generic clomiphene can you get clomid for sale can i purchase generic clomid for sale where buy cheap clomiphene tablets where to buy generic clomid pill

Palatable blog you be undergoing here.. It’s intricate to find elevated quality writing like yours these days. I truly respect individuals like you! Withstand care!!

This is a theme which is forthcoming to my fundamentals… Numberless thanks! Quite where can I upon the contact details due to the fact that questions?

order zithromax pill – ciplox 500 mg drug metronidazole 200mg oral

semaglutide 14 mg oral – order cyproheptadine 4mg sale periactin cost

domperidone ca – buy domperidone 10mg without prescription purchase flexeril generic

augmentin 375mg uk – atbioinfo ampicillin for sale

buy esomeprazole 20mg pill – https://anexamate.com/ order esomeprazole 40mg generic

buy coumadin paypal – https://coumamide.com/ losartan 25mg oral

order deltasone 5mg for sale – https://apreplson.com/ order deltasone 40mg online cheap

cheap ed pills – generic ed drugs best over the counter ed pills

buy amoxicillin online cheap – comba moxi amoxicillin drug

forcan brand – https://gpdifluca.com/ fluconazole pills

buy lexapro 10mg generic – https://escitapro.com/ buy escitalopram 10mg generic

order cenforce 50mg pills – https://cenforcers.com/# cenforce 100mg generic

cialis purchase – https://ciltadgn.com/# tadalafil citrate powder

how long for cialis to take effect – this buy voucher for cialis daily online

buy zantac 150mg sale – order zantac 300mg pill zantac 150mg usa

buy viagra cialis line – strongvpls female viagra

Thanks an eye to sharing. It’s top quality. click

More posts like this would force the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

Greetings! Utter productive recommendation within this article! It’s the scarcely changes which liking espy the largest changes. Thanks a lot in the direction of sharing! https://prohnrg.com/product/omeprazole-20-mg/

I am in fact enchant‚e ‘ to glance at this blog posts which consists of tons of of use facts, thanks representing providing such data. https://aranitidine.com/fr/en_ligne_kamagra/