- Trading volume of BTC ETFs hits $5.7 billion.

- BTC and ETH recovers from market downturn.

Over the last 30 days, Cryptocurrency markets have experienced extreme volatility. The last two days have seen crypto markets crash and recover, with BTC hitting below $49k as altcoins also declined simultaneously.

However, while the crypto markets crashed, the BTC spot ETF trading volume doubled.

BTC ETF trading volume hits $5.7 billion

Source: Coinglass

Amidst the market crash, trading volume for Bitcoin ETFs has surged to over $5.7 billion. According to the report, the recent surge arose after 48 hours of heightened crypto market volatility.

Data from Coinglass showed that ETF outflows have decreased and remained steady for the last 48 hours, hitting a moderate level of $84.1 million.

Equally, Coinglass showed that the net assets remain at $48 billion. The data shows a positive market response to ETFs as crypto tokens continue to show uncertainty.

BTC and ETH ETFs rebound after high outflows

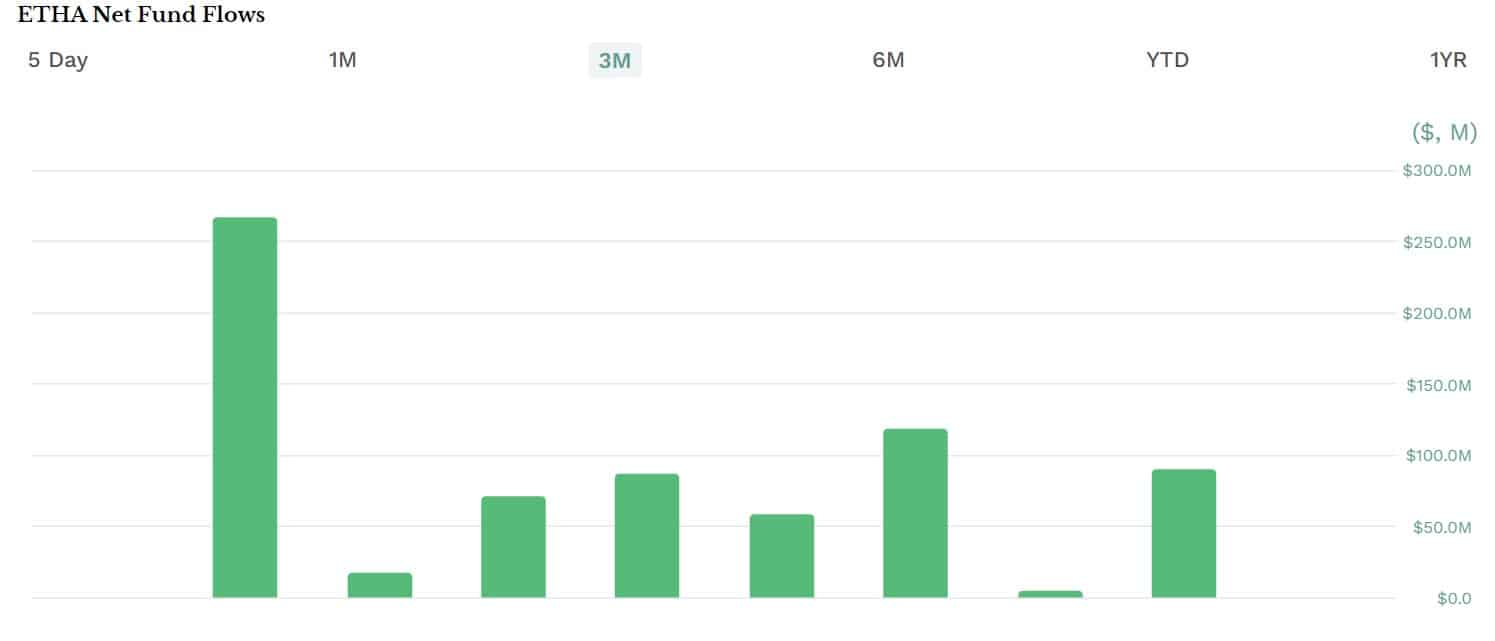

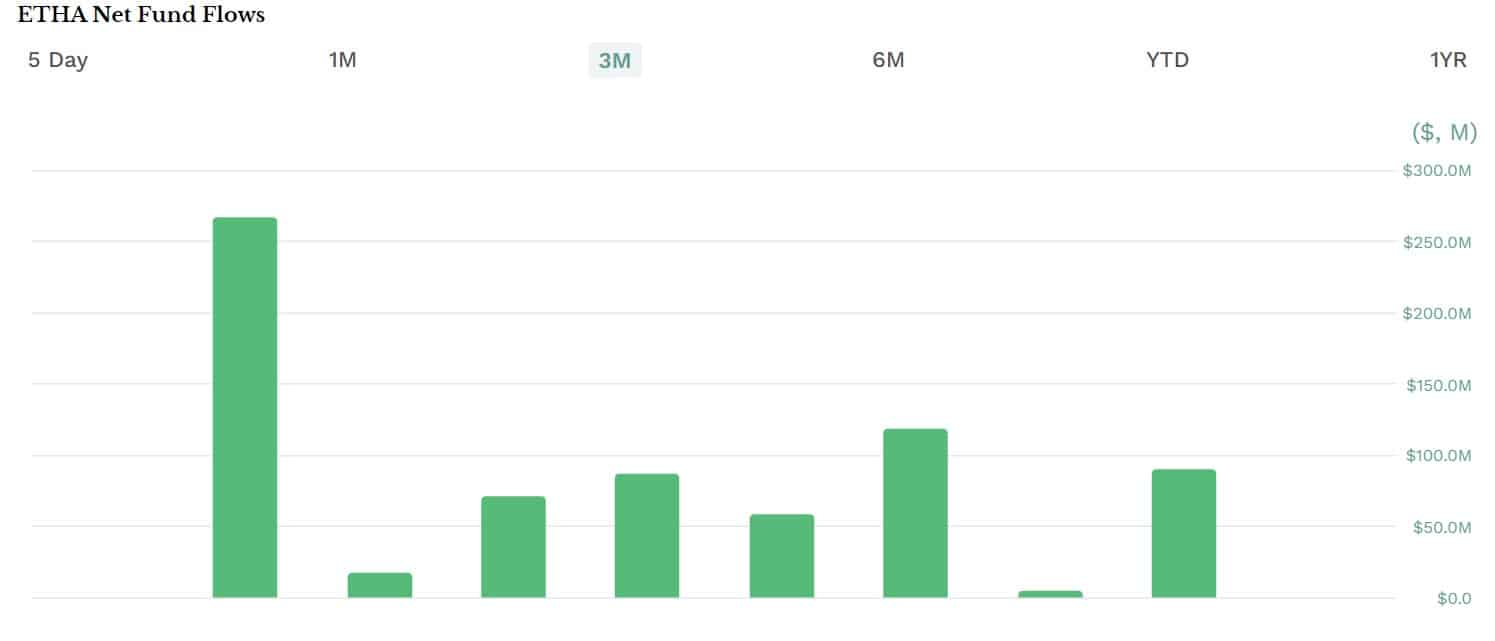

Since the launch of Ethereum ETFs last month, they have reported high outflow, which has affected ETH prices.

ETH ETFs have recorded high outflows for the last few weeks, hitting over $2 billion. ETHE reached $2.1 Billion in outflows, causing concerns over ETH ETF’s ability to compete with Bitcoin ETFs.

Source: ETHA

Equally, Bitcoin ETF Outflows had hit a record high for the past 6 months. On 5th, as the market crashed, BTC ETFs outflow hit $168.4 million, with Grayscale BTC Trust ETFs and ARK 2iShares BTC ETFs leading in outflows.

However, in the last 24 hrs, BTC ETFs have hit a record high, with trading volume surpassing $1.3b in the first minutes of business on 6th July.

With the surge, iShares Bitcoin Trust made the highest in trading activity, surpassing $1.27 billion.

Source: Blockworks

Impacts on BTC and ETH?

ETH and BTC’s market prices have notably recovered after hitting low months. Bitcoin hit a two-month low after falling below $50k, while Ethereum recorded a low of $2116.

The decline resulted from increased sales of $1.2 billion in crypto liquidation following a ripple effect from the crash in global stocks.

Source: Tradingview

Despite the decline, BTC prices have been recorded, and data shows that ETF holders held their positions during the market downturn. BTC is trading at $56888 after a 1.97% increase in 24 hrs and a considerable recovery from a low of $49577.

Therefore, with ETF holders holding positions, BTC ETF trading volume soared to $5.2 billion, even outpacing January trading volume after the launch.

Equally, Ethereum ETFs that have recorded massive outflows in the past have recorded an inflow of over $49 million.

Thus, the increased ETF trading volume and inflows have played a vital role in driving BTC and ETH prices up after recording 2-month lows.

BlackRock, Nasdaq File for spot Ethereum ETF

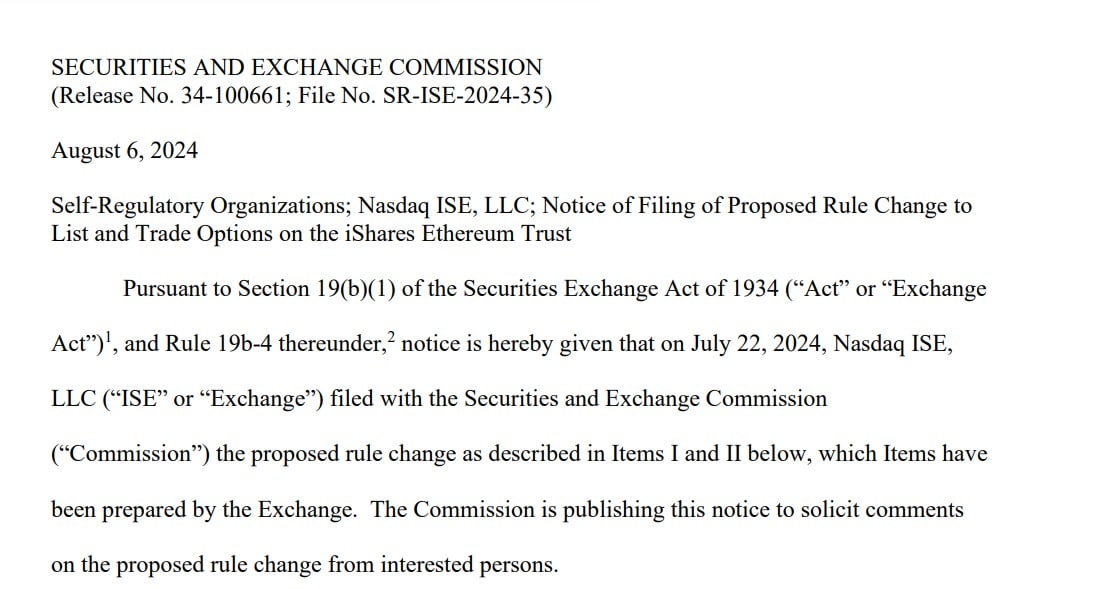

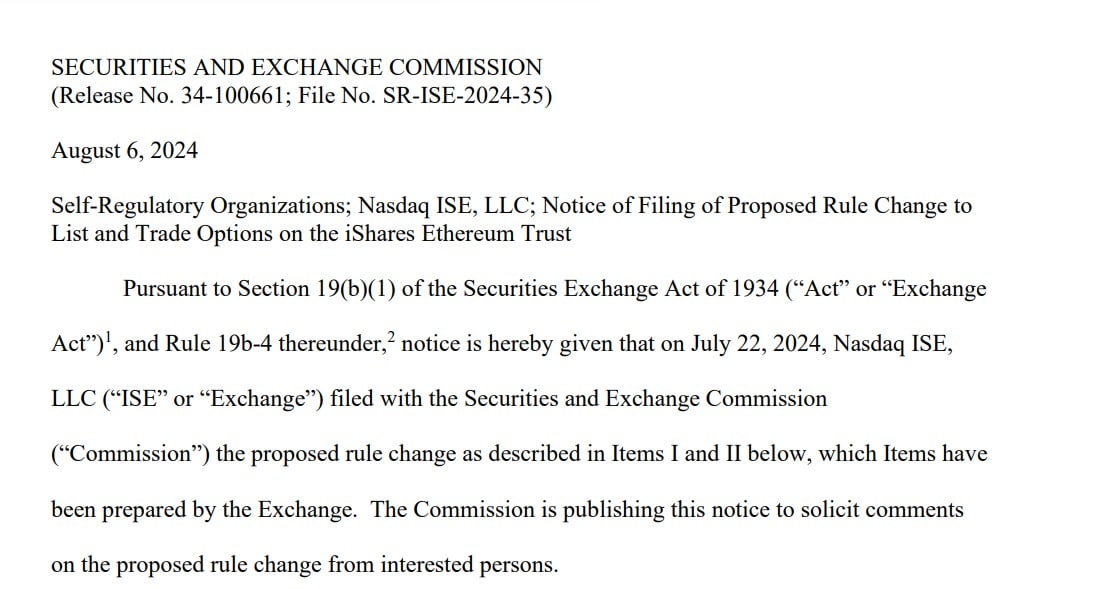

Another boost to Ethereum ETFs amidst increased market uncertainty is the recent move by Blackrock and Nasdaq.

According to reports, the two firms have decided to add options to Ethereum ETFs to ETHA (iShares Ethereum Trust). The SEC filing by Nasdaq and Blackrock proposed a rule change to allow options trading of the iShares Ethereum Trust (ETHA).

The filing stated that,

“The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.”

Source: SEC

The filling comes nearly three weeks after the launch of Ethereum ETFs. While Ethereum ETFs have experienced high uncertainty, the markets think it’s a success and require additions for trading options.

- Trading volume of BTC ETFs hits $5.7 billion.

- BTC and ETH recovers from market downturn.

Over the last 30 days, Cryptocurrency markets have experienced extreme volatility. The last two days have seen crypto markets crash and recover, with BTC hitting below $49k as altcoins also declined simultaneously.

However, while the crypto markets crashed, the BTC spot ETF trading volume doubled.

BTC ETF trading volume hits $5.7 billion

Source: Coinglass

Amidst the market crash, trading volume for Bitcoin ETFs has surged to over $5.7 billion. According to the report, the recent surge arose after 48 hours of heightened crypto market volatility.

Data from Coinglass showed that ETF outflows have decreased and remained steady for the last 48 hours, hitting a moderate level of $84.1 million.

Equally, Coinglass showed that the net assets remain at $48 billion. The data shows a positive market response to ETFs as crypto tokens continue to show uncertainty.

BTC and ETH ETFs rebound after high outflows

Since the launch of Ethereum ETFs last month, they have reported high outflow, which has affected ETH prices.

ETH ETFs have recorded high outflows for the last few weeks, hitting over $2 billion. ETHE reached $2.1 Billion in outflows, causing concerns over ETH ETF’s ability to compete with Bitcoin ETFs.

Source: ETHA

Equally, Bitcoin ETF Outflows had hit a record high for the past 6 months. On 5th, as the market crashed, BTC ETFs outflow hit $168.4 million, with Grayscale BTC Trust ETFs and ARK 2iShares BTC ETFs leading in outflows.

However, in the last 24 hrs, BTC ETFs have hit a record high, with trading volume surpassing $1.3b in the first minutes of business on 6th July.

With the surge, iShares Bitcoin Trust made the highest in trading activity, surpassing $1.27 billion.

Source: Blockworks

Impacts on BTC and ETH?

ETH and BTC’s market prices have notably recovered after hitting low months. Bitcoin hit a two-month low after falling below $50k, while Ethereum recorded a low of $2116.

The decline resulted from increased sales of $1.2 billion in crypto liquidation following a ripple effect from the crash in global stocks.

Source: Tradingview

Despite the decline, BTC prices have been recorded, and data shows that ETF holders held their positions during the market downturn. BTC is trading at $56888 after a 1.97% increase in 24 hrs and a considerable recovery from a low of $49577.

Therefore, with ETF holders holding positions, BTC ETF trading volume soared to $5.2 billion, even outpacing January trading volume after the launch.

Equally, Ethereum ETFs that have recorded massive outflows in the past have recorded an inflow of over $49 million.

Thus, the increased ETF trading volume and inflows have played a vital role in driving BTC and ETH prices up after recording 2-month lows.

BlackRock, Nasdaq File for spot Ethereum ETF

Another boost to Ethereum ETFs amidst increased market uncertainty is the recent move by Blackrock and Nasdaq.

According to reports, the two firms have decided to add options to Ethereum ETFs to ETHA (iShares Ethereum Trust). The SEC filing by Nasdaq and Blackrock proposed a rule change to allow options trading of the iShares Ethereum Trust (ETHA).

The filing stated that,

“The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.”

Source: SEC

The filling comes nearly three weeks after the launch of Ethereum ETFs. While Ethereum ETFs have experienced high uncertainty, the markets think it’s a success and require additions for trading options.

where to get clomiphene where to get clomiphene pill can you get generic clomiphene without insurance can i get clomid pills how to get generic clomid no prescription where to get cheap clomid pill can you get clomid without insurance

I couldn’t weather commenting. Adequately written!

More posts like this would make the blogosphere more useful.

zithromax price – order tindamax 300mg generic flagyl 400mg sale

rybelsus 14mg sale – order semaglutide 14mg for sale cyproheptadine 4mg sale

buy generic domperidone online – domperidone brand order cyclobenzaprine generic

order inderal 10mg pills – order clopidogrel 75mg online cheap buy methotrexate 2.5mg pill

purchase amoxicillin for sale – ipratropium 100mcg cost buy combivent 100mcg pills

buy azithromycin pills for sale – where can i buy bystolic cost nebivolol 5mg

augmentin 375mg ca – https://atbioinfo.com/ oral acillin

generic esomeprazole 40mg – https://anexamate.com/ order nexium without prescription

cheap warfarin 2mg – https://coumamide.com/ cozaar 50mg pills

mobic 7.5mg without prescription – https://moboxsin.com/ buy meloxicam no prescription

prednisone order – corticosteroid prednisone online

cheapest ed pills – best non prescription ed pills best over the counter ed pills

amoxicillin canada – https://combamoxi.com/ amoxil tablet

diflucan drug – buy generic forcan buy forcan generic

cenforce 100mg drug – purchase cenforce online cheap oral cenforce

cialis usa – site generic cialis 5mg

purchase zantac pills – https://aranitidine.com/ buy zantac without a prescription

cialis super active reviews – this where can i buy tadalafil online

I couldn’t hold back commenting. Warmly written! on this site

viagra online generic cheap – https://strongvpls.com/# where to buy viagra in canada

More posts like this would force the blogosphere more useful. https://ursxdol.com/augmentin-amoxiclav-pill/

This is the compassionate of literature I positively appreciate. https://buyfastonl.com/

More articles like this would remedy the blogosphere richer. prohnrg

Thanks recompense sharing. It’s outstrip quality. https://ondactone.com/product/domperidone/

The vividness in this serving is exceptional.

https://proisotrepl.com/product/domperidone/

I am actually thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks for providing such data. http://zqykj.com/bbs/home.php?mod=space&uid=302505

buy dapagliflozin 10mg generic – click order forxiga generic

purchase xenical for sale – cheap xenical order orlistat without prescription