- SOL’s market cap increased by over 130% in Q1.

- Sentiment around the token turned bearish last week.

Like most cryptos, the first quarter of 2024 ended on a positive note for Solana [SOL], as it performed well on multiple fronts. Therefore, here’s a closer look at SOL’s Q1 performance and what you should expect in Q2.

Solana’s Q1 stats

Coin98 Analytics, a data analytics platform, recently posted a tweet highlighting Solana’s network stats during Q1. As per the tweet, SOL displayed remarkable performance in terms of captured value.

SOL’s fees and revenue increased 7 times compared to the previous quarter and 27 times compared to the same period last year.

However, it was surprising to see that despite the massive surge in revenue, the blockchain’s total earnings dropped by 131% in the last quarter. The reason behind this was a 141% rise in Solana’s expenses in Q1.

Nonetheless, the blockchain’s network activity remained robust. This was the case as its daily active addresses surged by 214% and exceeded 591k.

AMBCrypto then checked Artemis’ data to find out how things were looking in Q2. We found that both its feeds and revenue declined during the last week.

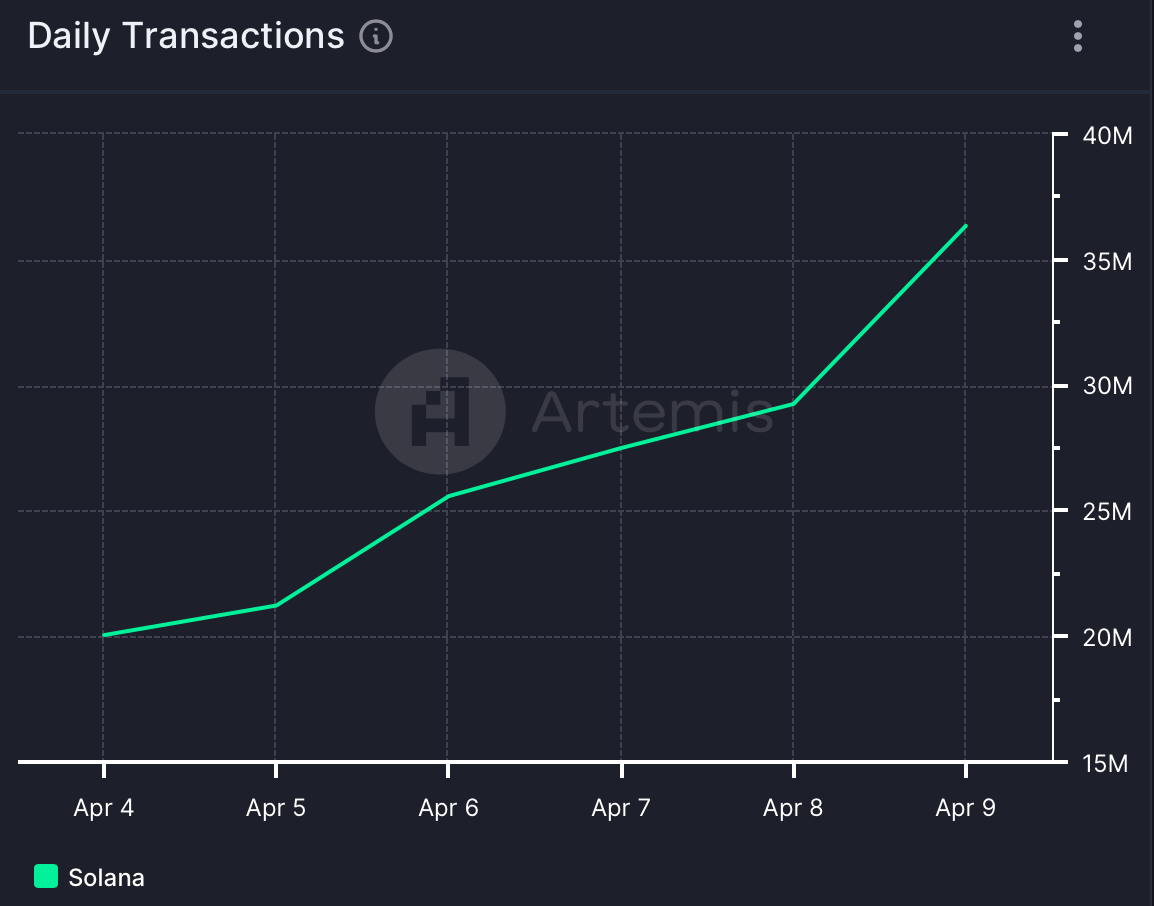

A similar declining trend was also noted in terms of daily active addresses. Nonetheless, SOL’s daily transactions increased last week, reflecting a rise in usage.

Source: Artemis

Solana investors took profit

Coin98’s tweet also mentioned how SOL’s price increased during Q1, thanks to the bullish market condition. As per the report, SOL’s circulating market capitalization exceeded $53 billion as it surged by over 130% in Q1.

However, the growth momentum slowed down in Q2 as bears jumped in.

According to CoinMarketCap, SOL’s price dropped by more than 5% in the last seven days. At the time of writing, SOL was trading at $173.25 with a market cap of over $77 billion. To see how the drop in the token’s price affected market sentiments, AMBCrypto took a look at Santiment’s data.

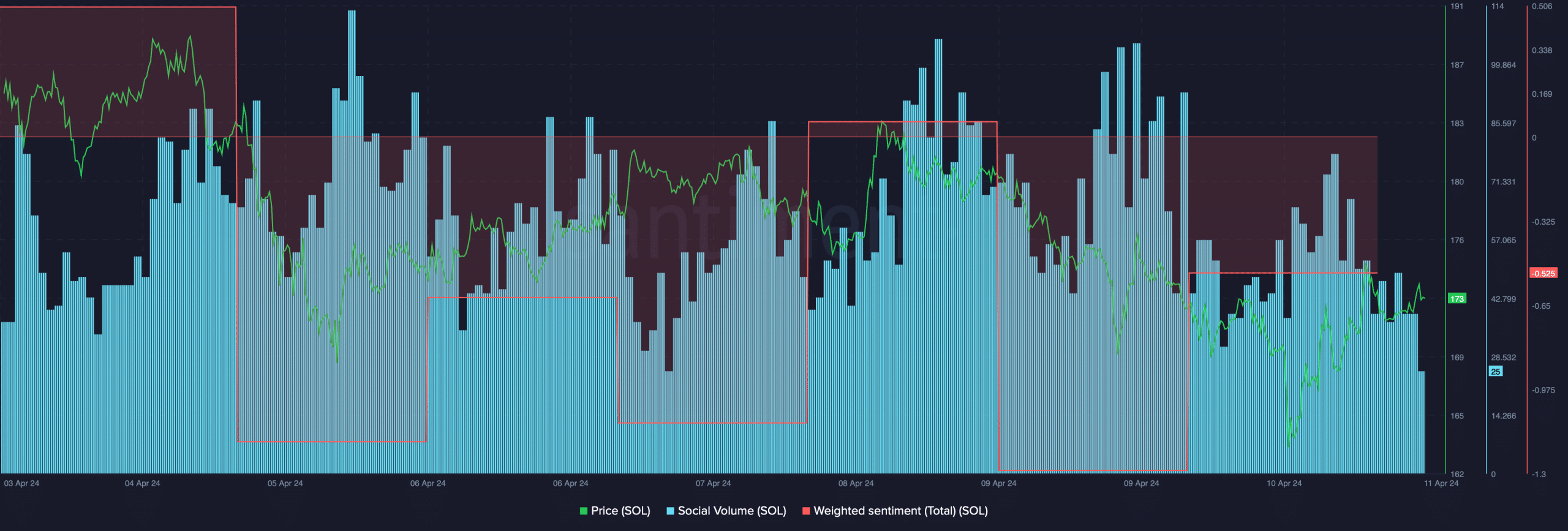

Our analysis revealed that Solana’s social volume remained high last week, which reflected its popularity in the crypto space. However, investors’ confidence in SOL dwindled because of the price action.

The token’s weighted sentiment remained in the negative zone, meaning that bearish sentiment around SOL was dominant in the market.

Source: Santiment

Realistic or not, here’s SOL’s market cap in BTC’s terms

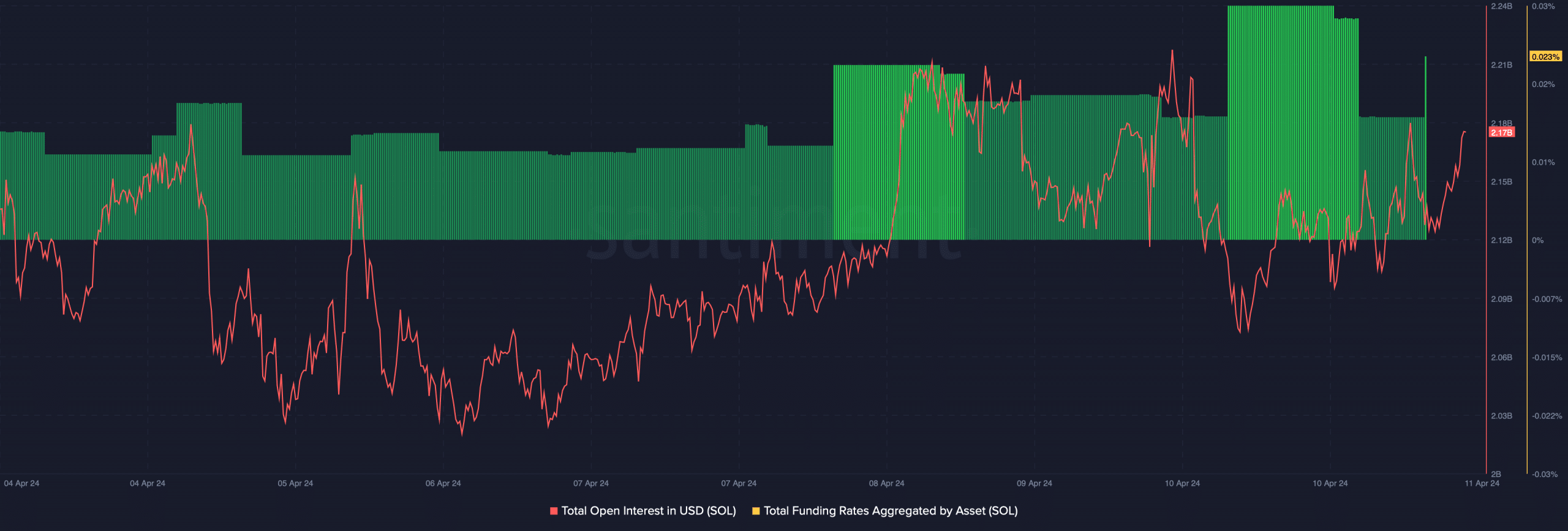

Things in the derivatives market also looked pretty bearish on SOL. Its open interest increased while its price dropped, indicating that the declining price trend might continue further.

Additionally, its funding rate was also high. This suggested that futures investors were buying SOL activity at its low price.

Source: Santiment

where can i buy clomid without prescription how to get clomid without prescription where to buy clomiphene price cost clomiphene without insurance cost of generic clomid online clomiphene for sale uk buy clomiphene no prescription

This website absolutely has all of the low-down and facts I needed there this participant and didn’t comprehend who to ask.

More posts like this would add up to the online play more useful.

zithromax 250mg usa – floxin generic buy metronidazole 400mg for sale

buy semaglutide generic – buy semaglutide without prescription buy cyproheptadine medication

motilium for sale – cyclobenzaprine cheap flexeril 15mg canada

buy cheap generic augmentin – https://atbioinfo.com/ ampicillin online

buy cheap generic nexium – https://anexamate.com/ nexium cheap

medex where to buy – https://coumamide.com/ order cozaar online

meloxicam 15mg pills – https://moboxsin.com/ buy generic meloxicam

buy deltasone – https://apreplson.com/ prednisone 40mg without prescription

buy pills for erectile dysfunction – site medication for ed

amoxicillin over the counter – combamoxi.com buy amoxicillin medication

fluconazole generic – https://gpdifluca.com/ cost forcan

cenforce 50mg generic – https://cenforcers.com/# buy cenforce 100mg without prescription

cialis w/dapoxetine – ciltad genesis non prescription cialis

how long before sex should i take cialis – https://strongtadafl.com/ mambo 36 tadalafil 20 mg