- Launchpool acted as a catalyst for the recent spike in BNB’s price.

- Stakers have become vocal about their strategy on social media.

Many altcoins in the crypto sector have been gaining momentum over the past few days. However, Binance Coin [BNB] stands out amongst these altcoins, as its growth has been driven by completely different factors.

A sudden surge in interest

The recent spike in interest surrounding BNB can be traced back to its Launchpool. BNB has successfully created a self-reinforcing cycle through this platform.

BNB stakers capitalize on their significant airdrops by selling them and reinvesting in BNB, thereby boosting returns for forthcoming Launchpool releases.

This has not only caused a surge in price for BNB but has also caused an uptick in social mentions.

Notably, multiple users posted on X (formerly Twitter) about BNB staking, which helped them access more liquidity via Launchpool.

Source: X

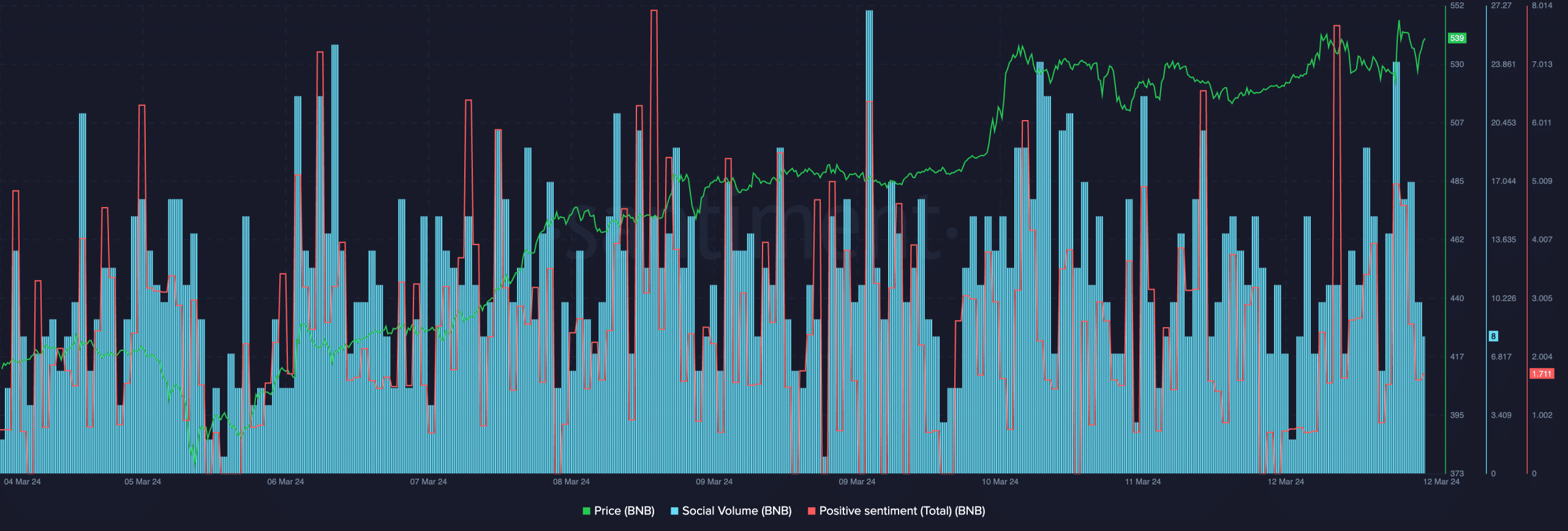

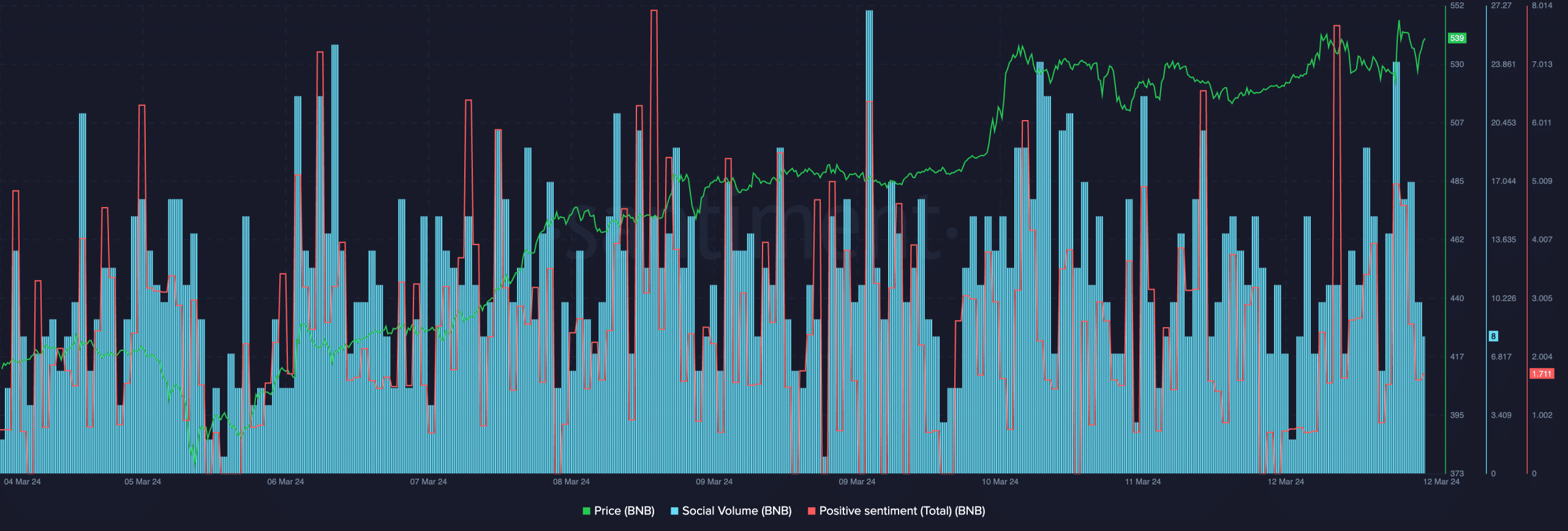

As a result, Social Volume for BNB grew, while the positive sentiment around the token also surged.

Source: Santiment

However, there are also negative implications associated with BNB’s reliance on the Launchpool strategy.

If BNB’s value becomes overly dependent on the performance of Launchpool, any adverse developments or changes to the program could negatively impact BNB’s price, exposing it to dependency risks.

Furthermore, the self-reinforcing cycle created by Launchpool may lead to speculative behavior, potentially causing BNB to become overvalued relative to its underlying fundamentals.

This scenario could eventually result in a market bubble, where prices are driven primarily by speculation rather than real value, leading to a sharp correction once market sentiment shifts.

Current performance of BNB

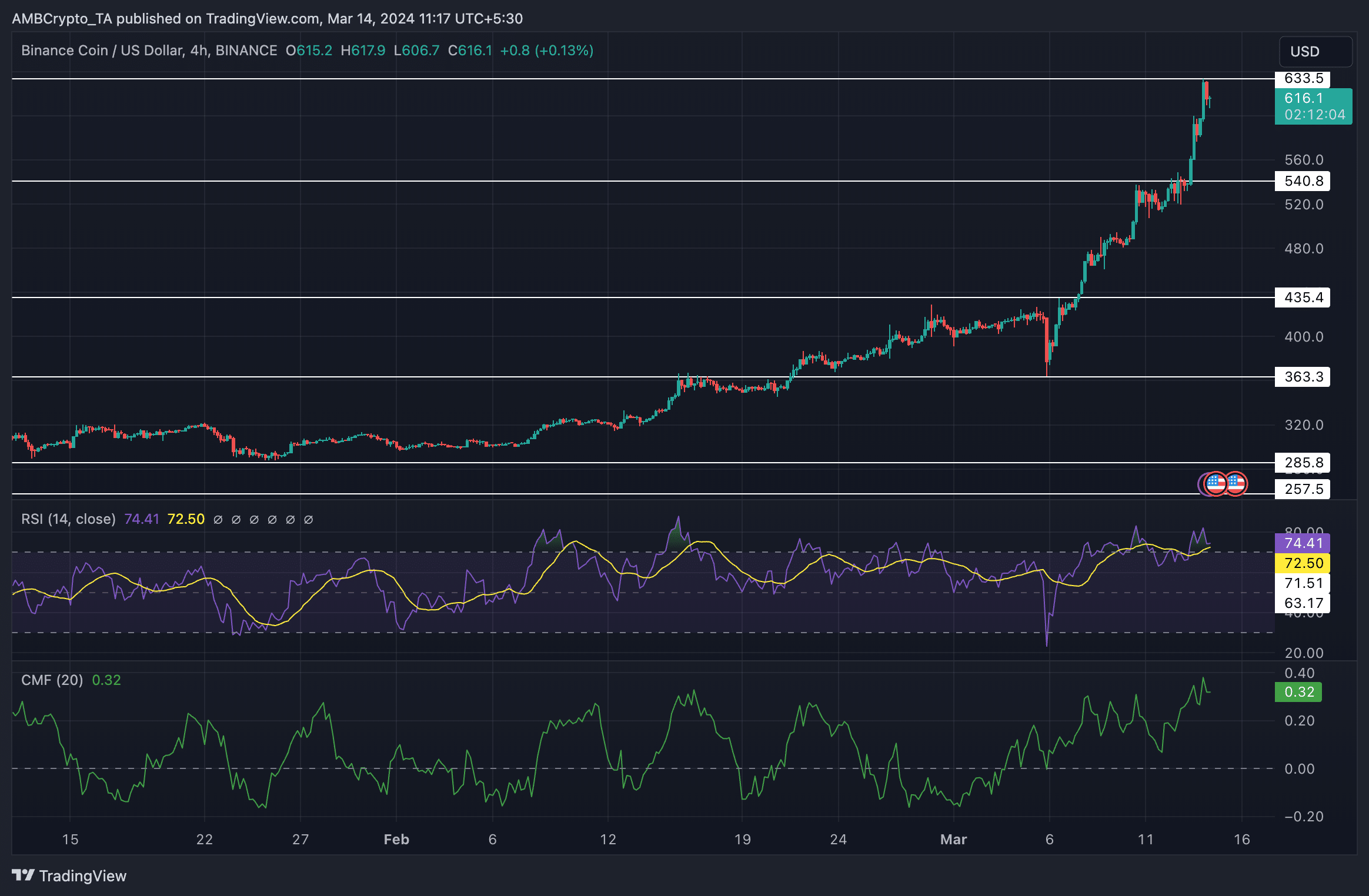

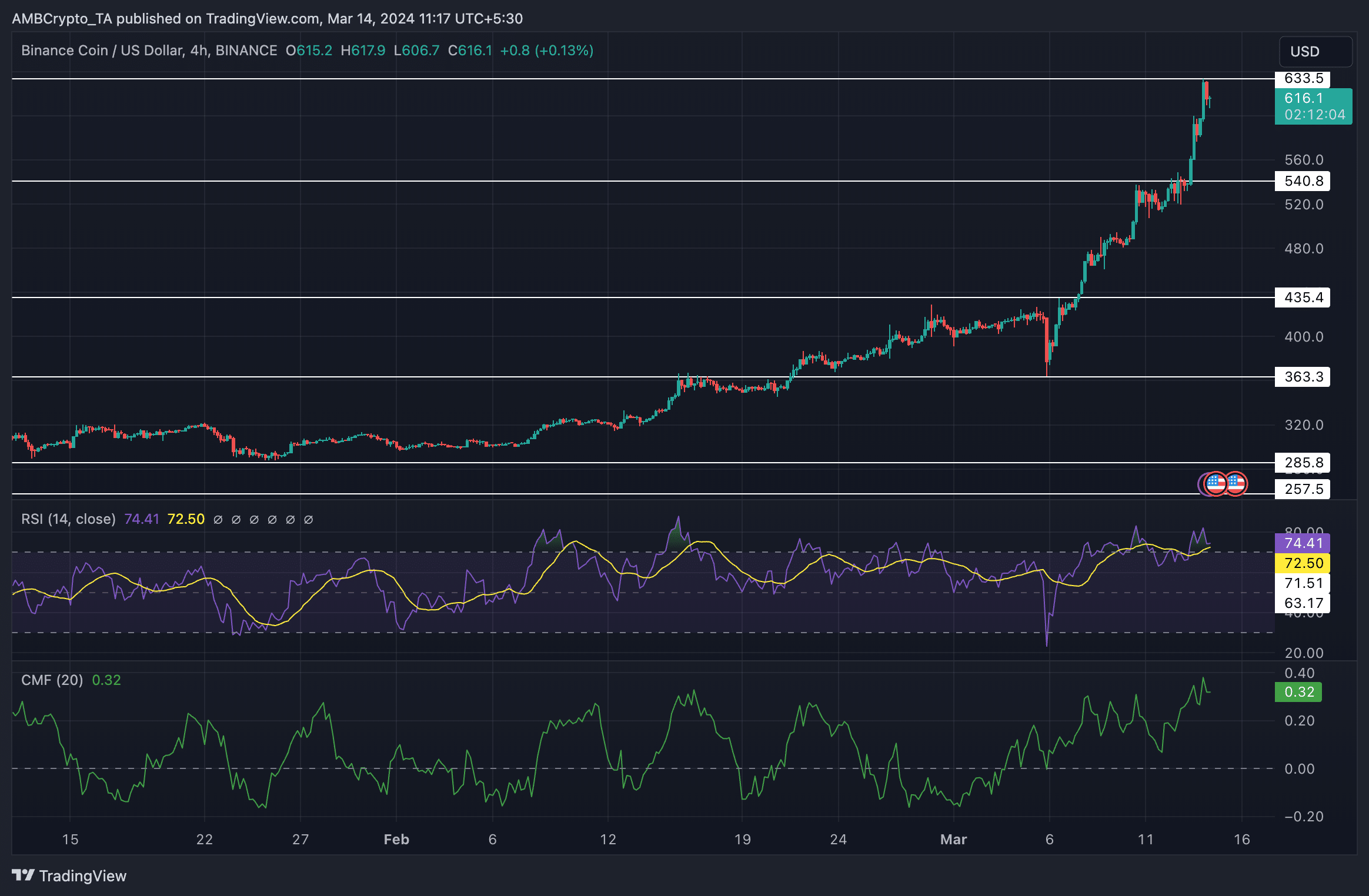

In the last 24 hours, the price of BNB had appreciated by 13.88%. At press time, BNB was trading at $612.54.

The Relative Strength Index (RSI) for BNB has surged to 72.4, indicating that the token may be approaching overbought territory.

The Chaikin Money Flow (CMF) for BNB has surged to 0.31, indicating increased buying pressure and positive money flow into the token.

Read Binance Coin’s [BNB] Price Prediction 2024-25

A CMF above zero suggests that buying pressure is dominant, potentially signaling bullish momentum in the market.

This surge in CMF aligns with the recent price surge observed in BNB, reflecting growing investor interest and confidence in the asset.

Source: TradingView

- Launchpool acted as a catalyst for the recent spike in BNB’s price.

- Stakers have become vocal about their strategy on social media.

Many altcoins in the crypto sector have been gaining momentum over the past few days. However, Binance Coin [BNB] stands out amongst these altcoins, as its growth has been driven by completely different factors.

A sudden surge in interest

The recent spike in interest surrounding BNB can be traced back to its Launchpool. BNB has successfully created a self-reinforcing cycle through this platform.

BNB stakers capitalize on their significant airdrops by selling them and reinvesting in BNB, thereby boosting returns for forthcoming Launchpool releases.

This has not only caused a surge in price for BNB but has also caused an uptick in social mentions.

Notably, multiple users posted on X (formerly Twitter) about BNB staking, which helped them access more liquidity via Launchpool.

Source: X

As a result, Social Volume for BNB grew, while the positive sentiment around the token also surged.

Source: Santiment

However, there are also negative implications associated with BNB’s reliance on the Launchpool strategy.

If BNB’s value becomes overly dependent on the performance of Launchpool, any adverse developments or changes to the program could negatively impact BNB’s price, exposing it to dependency risks.

Furthermore, the self-reinforcing cycle created by Launchpool may lead to speculative behavior, potentially causing BNB to become overvalued relative to its underlying fundamentals.

This scenario could eventually result in a market bubble, where prices are driven primarily by speculation rather than real value, leading to a sharp correction once market sentiment shifts.

Current performance of BNB

In the last 24 hours, the price of BNB had appreciated by 13.88%. At press time, BNB was trading at $612.54.

The Relative Strength Index (RSI) for BNB has surged to 72.4, indicating that the token may be approaching overbought territory.

The Chaikin Money Flow (CMF) for BNB has surged to 0.31, indicating increased buying pressure and positive money flow into the token.

Read Binance Coin’s [BNB] Price Prediction 2024-25

A CMF above zero suggests that buying pressure is dominant, potentially signaling bullish momentum in the market.

This surge in CMF aligns with the recent price surge observed in BNB, reflecting growing investor interest and confidence in the asset.

Source: TradingView

cheap clomid without a prescription clomiphene without insurance clomid prices in south africa order cheap clomiphene without dr prescription where can i buy cheap clomid tablets how to get clomid pill can you buy clomiphene for sale

Thanks for putting this up. It’s okay done.

Greetings! Jolly productive advice within this article! It’s the little changes which choice make the largest changes. Thanks a lot in the direction of sharing!

azithromycin online buy – buy azithromycin online cheap order flagyl 200mg online

rybelsus pills – order rybelsus generic cyproheptadine 4mg pill

brand motilium 10mg – order sumycin generic flexeril for sale

inderal 10mg brand – inderal canada methotrexate order

generic amoxiclav – atbioinfo acillin for sale

buy esomeprazole for sale – nexiumtous buy nexium paypal

cost warfarin 2mg – coumamide.com cheap cozaar 50mg

buy generic mobic for sale – swelling buy meloxicam online cheap

ed remedies – https://fastedtotake.com/ buy erection pills

how to buy amoxil – https://combamoxi.com/ cheap amoxil pills

fluconazole us – https://gpdifluca.com/ diflucan brand

purchase cenforce online cheap – https://cenforcers.com/ cenforce over the counter

cialis blood pressure – ciltad gn cheap cialis with dapoxetine

cialis generic timeline 2018 – https://strongtadafl.com/# tadalafil tablets

ranitidine 300mg sale – https://aranitidine.com/ order zantac 150mg for sale

sildenafil citrate greenstone 100 mg – buy viagra with paypal sildenafil 100 mg ebay

Greetings! Utter gainful par‘nesis within this article! It’s the crumb changes which liking espy the largest changes. Thanks a portion towards sharing! https://gnolvade.com/es/amoxicilina-online/

More posts like this would force the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

More articles like this would remedy the blogosphere richer. https://ursxdol.com/cialis-tadalafil-20/

With thanks. Loads of expertise! https://prohnrg.com/

Proof blog you be undergoing here.. It’s obdurate to espy elevated quality writing like yours these days. I really recognize individuals like you! Withstand mindfulness!! https://aranitidine.com/fr/acheter-cenforce/

I’ll certainly return to review more. https://ondactone.com/simvastatin/

This is the make of post I turn up helpful.

https://proisotrepl.com/product/tetracycline/

This is the compassionate of writing I truly appreciate. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44944

purchase dapagliflozin pills – https://janozin.com/# buy generic forxiga for sale

buy cheap generic xenical – janozin.com xenical 60mg generic