- BNB corrects 10% below its all-time high with a slightly bearish RSI of 49.91.

- Rising MACD and high social dominance hint at possible bullish rebound.

After hitting an all-time high last week, it seems that Binance Coin [BNB] bulls are taking a step back, plunging the token right into a somewhat expected correction.

At press time, prices were over 12% below the all-time high. In what way could BNB end the week?

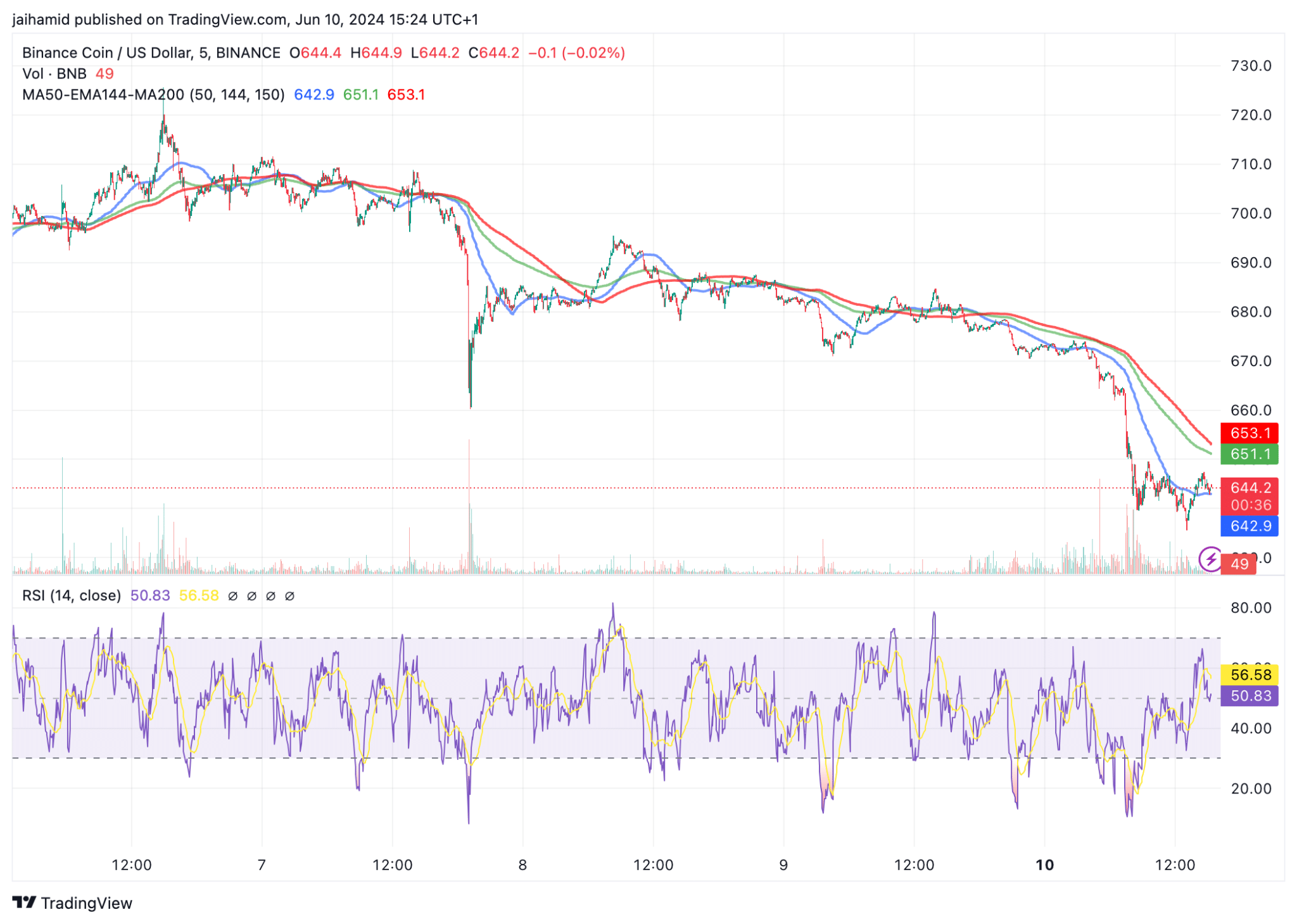

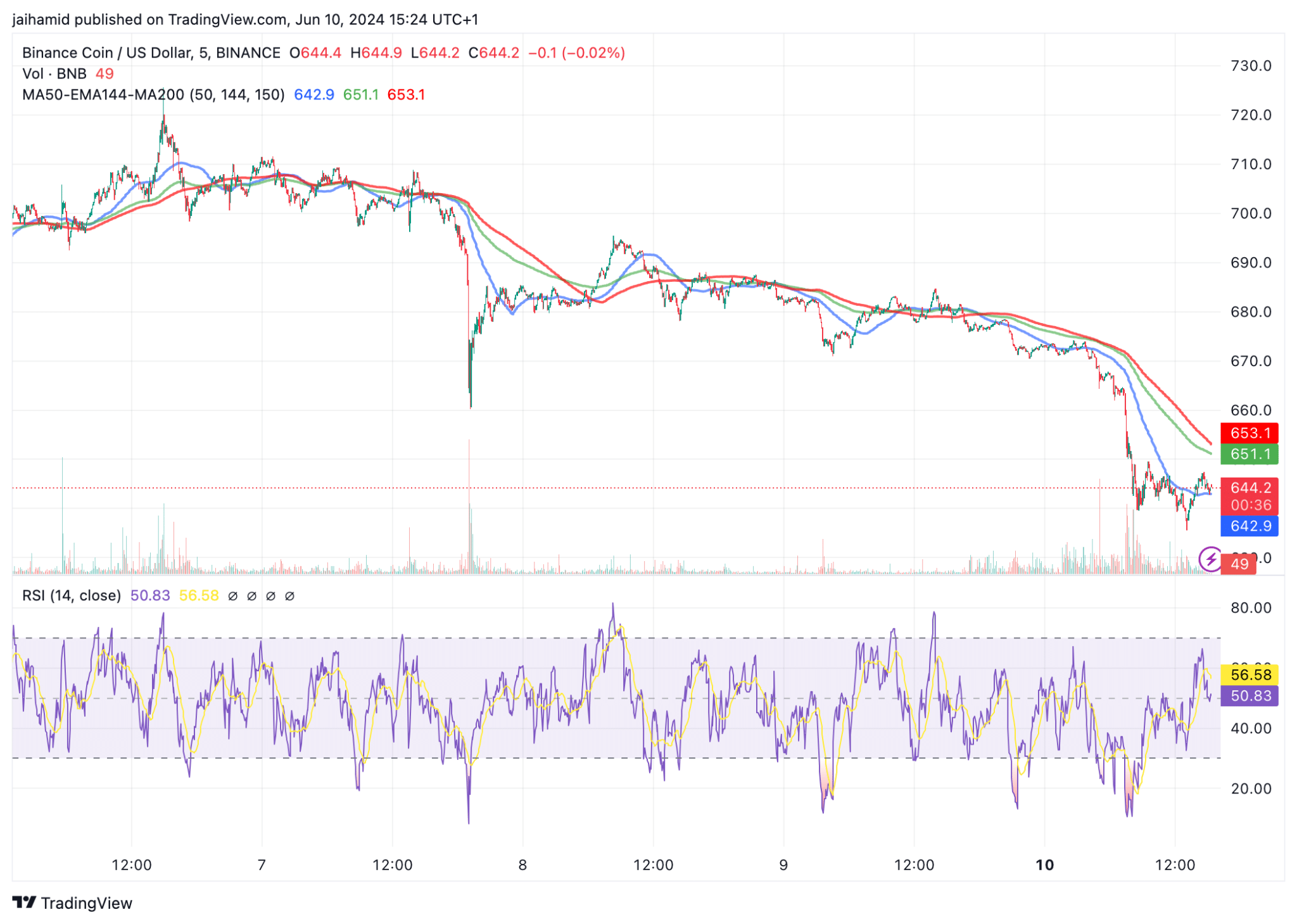

Taking a look at BNB’s 5-day chart, we see the RSI is currently just below the neutral 50 level at around 49.91, suggesting a balanced but slightly bearish momentum.

However, the MACD line is above the signal line and above zero, suggesting some bullish momentum is starting to build.

Source: TradingView

Will BNB recover soon?

Current trading was close to $644, well below the recent high, indicating the correction is in full swing. However, the exponential moving average also shows the price below it, reinforcing the bearish trend.

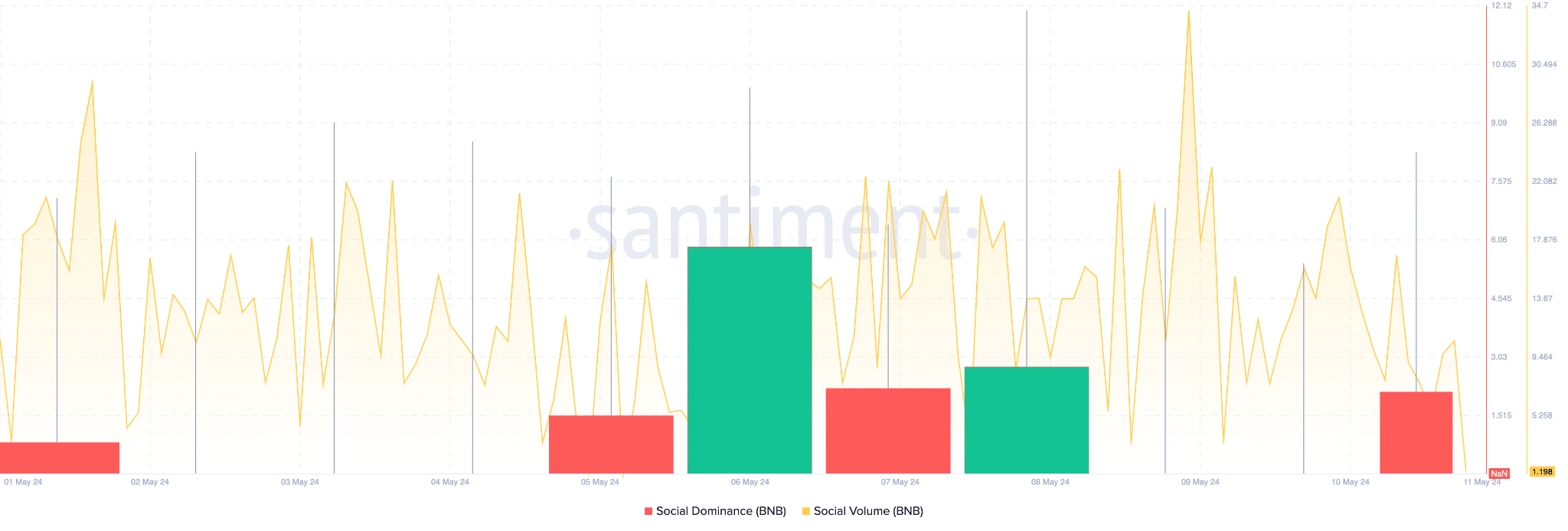

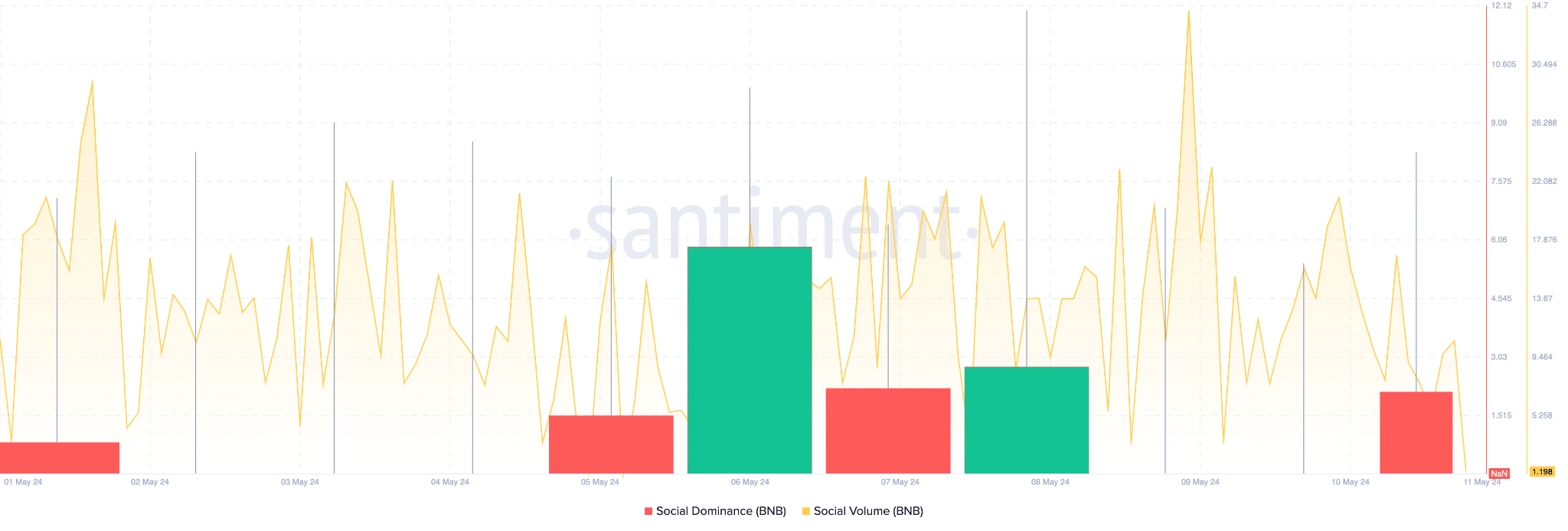

Notably, there was a significant spike in BNB’s social volume that coincides with the price drop.

During periods of high social volume, BNB’s dominance also shows spikes, indicating that it is still a very popular topic of discussion in crypto communities and will remain so for the foreseeable future.

Source: Santiment

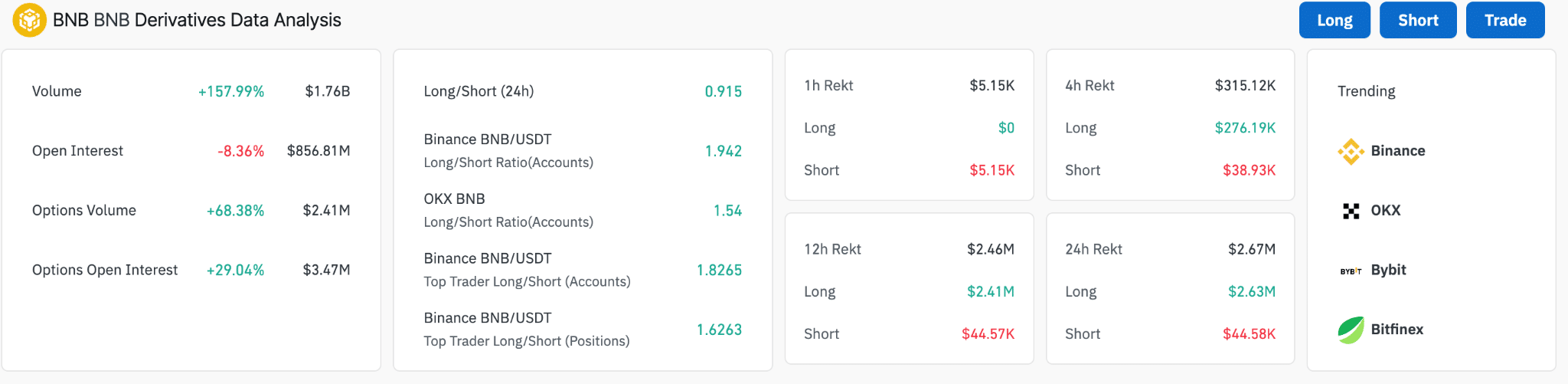

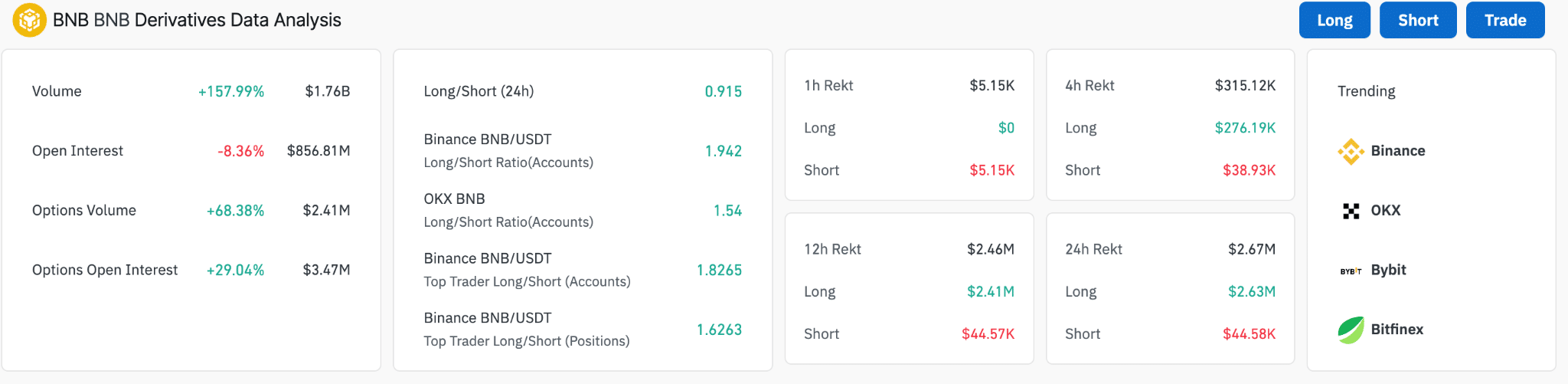

The trading volume for BNB derivatives has surged by 157.99%, as it has steadily been doing for the past ten days.

The Long/Short ratio across different platforms shows a dominance of long positions, particularly with ratios over 1.5 on OKX and top traders on Binance.

Source: Coinglass

This bias towards long positions can reflect a generally bullish sentiment among active traders.

Considering the current technical setup and market sentiment, BNB may continue to experience some level of volatility throughout the week as it seeks to find a new equilibrium post-correction.

Realistic or not, here’s BNB’s market cap in BTC terms

If the momentum holds and the broader market stays relatively bullish, the bulls will likely successfully push past the all-time high of $717 by the end of Friday.

All in all, BNB is set to have quite a volatile week.

- BNB corrects 10% below its all-time high with a slightly bearish RSI of 49.91.

- Rising MACD and high social dominance hint at possible bullish rebound.

After hitting an all-time high last week, it seems that Binance Coin [BNB] bulls are taking a step back, plunging the token right into a somewhat expected correction.

At press time, prices were over 12% below the all-time high. In what way could BNB end the week?

Taking a look at BNB’s 5-day chart, we see the RSI is currently just below the neutral 50 level at around 49.91, suggesting a balanced but slightly bearish momentum.

However, the MACD line is above the signal line and above zero, suggesting some bullish momentum is starting to build.

Source: TradingView

Will BNB recover soon?

Current trading was close to $644, well below the recent high, indicating the correction is in full swing. However, the exponential moving average also shows the price below it, reinforcing the bearish trend.

Notably, there was a significant spike in BNB’s social volume that coincides with the price drop.

During periods of high social volume, BNB’s dominance also shows spikes, indicating that it is still a very popular topic of discussion in crypto communities and will remain so for the foreseeable future.

Source: Santiment

The trading volume for BNB derivatives has surged by 157.99%, as it has steadily been doing for the past ten days.

The Long/Short ratio across different platforms shows a dominance of long positions, particularly with ratios over 1.5 on OKX and top traders on Binance.

Source: Coinglass

This bias towards long positions can reflect a generally bullish sentiment among active traders.

Considering the current technical setup and market sentiment, BNB may continue to experience some level of volatility throughout the week as it seeks to find a new equilibrium post-correction.

Realistic or not, here’s BNB’s market cap in BTC terms

If the momentum holds and the broader market stays relatively bullish, the bulls will likely successfully push past the all-time high of $717 by the end of Friday.

All in all, BNB is set to have quite a volatile week.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

buy clomid where buy generic clomid tablets get cheap clomid prices where buy cheap clomid price clomiphene bula profissional cost clomiphene without a prescription order generic clomid online

More articles like this would make the blogosphere richer.

This is a theme which is near to my callousness… Many thanks! Quite where can I upon the contact details an eye to questions?

order zithromax 250mg without prescription – tindamax 300mg for sale order flagyl 400mg generic

rybelsus 14 mg ca – cyproheptadine medication order periactin pills

buy generic motilium over the counter – order domperidone 10mg online buy flexeril generic

buy inderal without a prescription – inderal medication buy methotrexate 10mg without prescription