- BNB’s price declined by more than 10% in the last seven days.

- A few metrics hinted at a trend reversal.

Binance Coin [BNB] bears dominated in the last week as the coin’s price dropped by double digits. However, BNB was testing a crucial resistance level at press time. A breakout above could result in a bull rally.

Let’s take a closer look at what’s going on.

BNB tests a crucial resistance

CoinMarketCap’s data revealed that BNB’s price had dropped by more than 10% in the last seven days. The declining trend continued in the last 24 hours as the coin’s moved down marginally.

At the time of writing, BNB was trading at $604 with a market capitalization of over $89 billion.

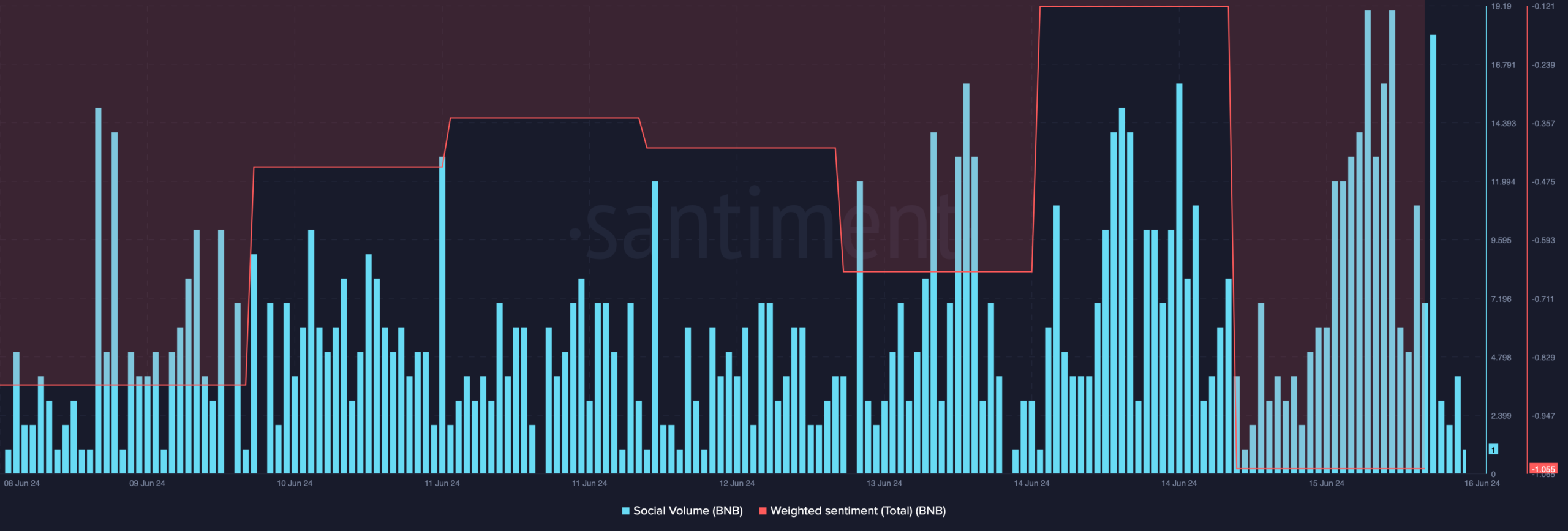

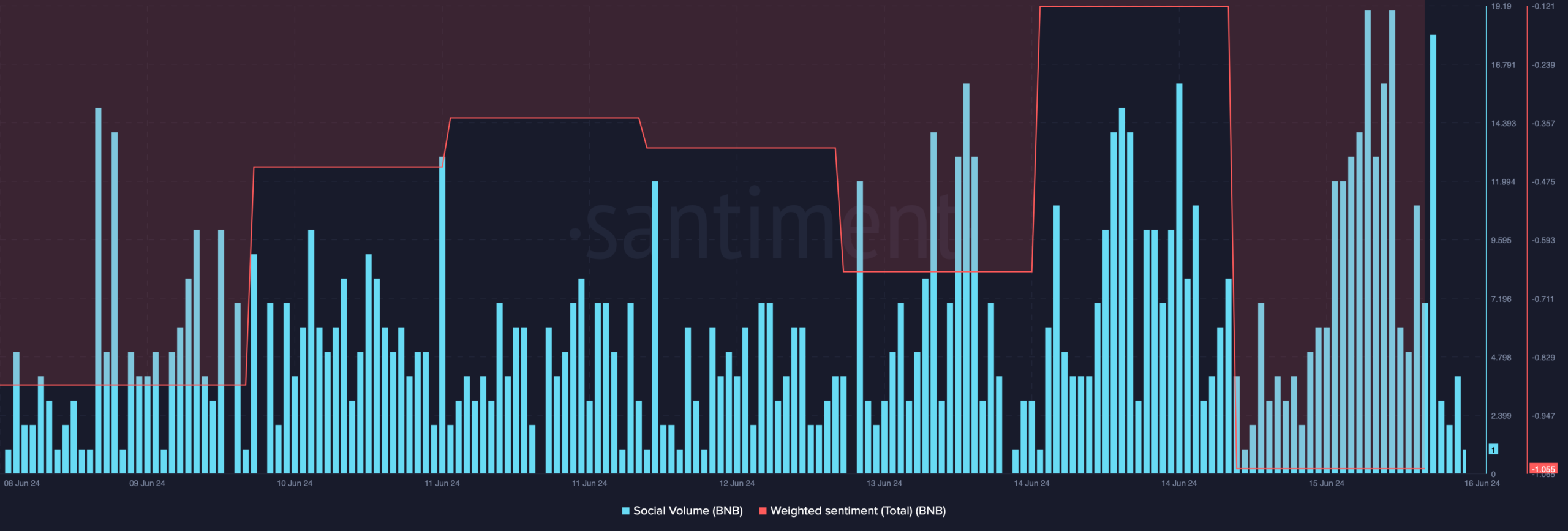

The declining price action made BNB a topic of discussion in the crypto space, which was evident from the rise in its social volume.

But its Weighted Sentiment dropped sharply, meaning that bearish sentiment around the coin was dominant in the market.

Source: Santiment

However, things can take a U-turn in the coming days as the coin is testing a crucial resistance level.

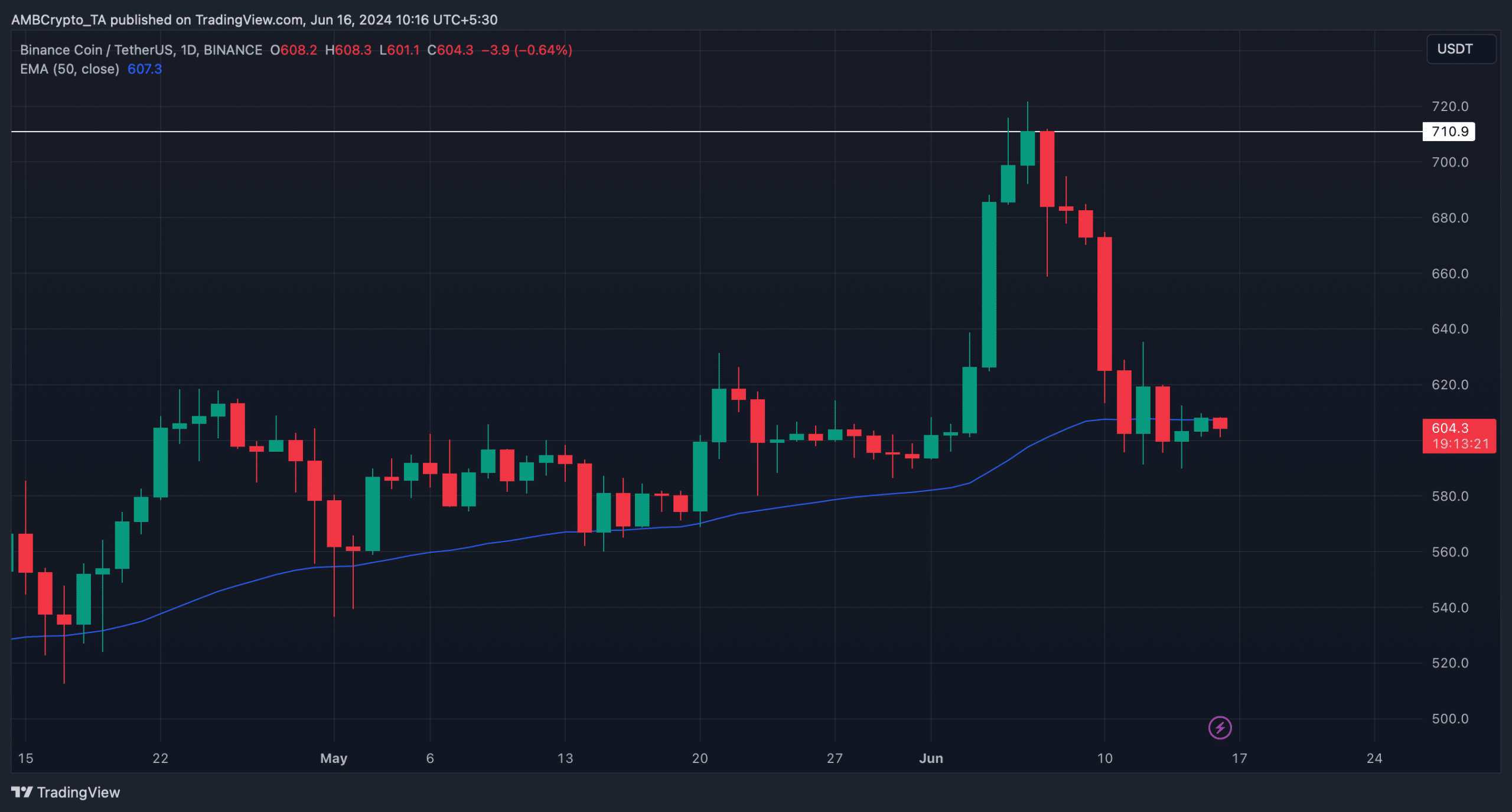

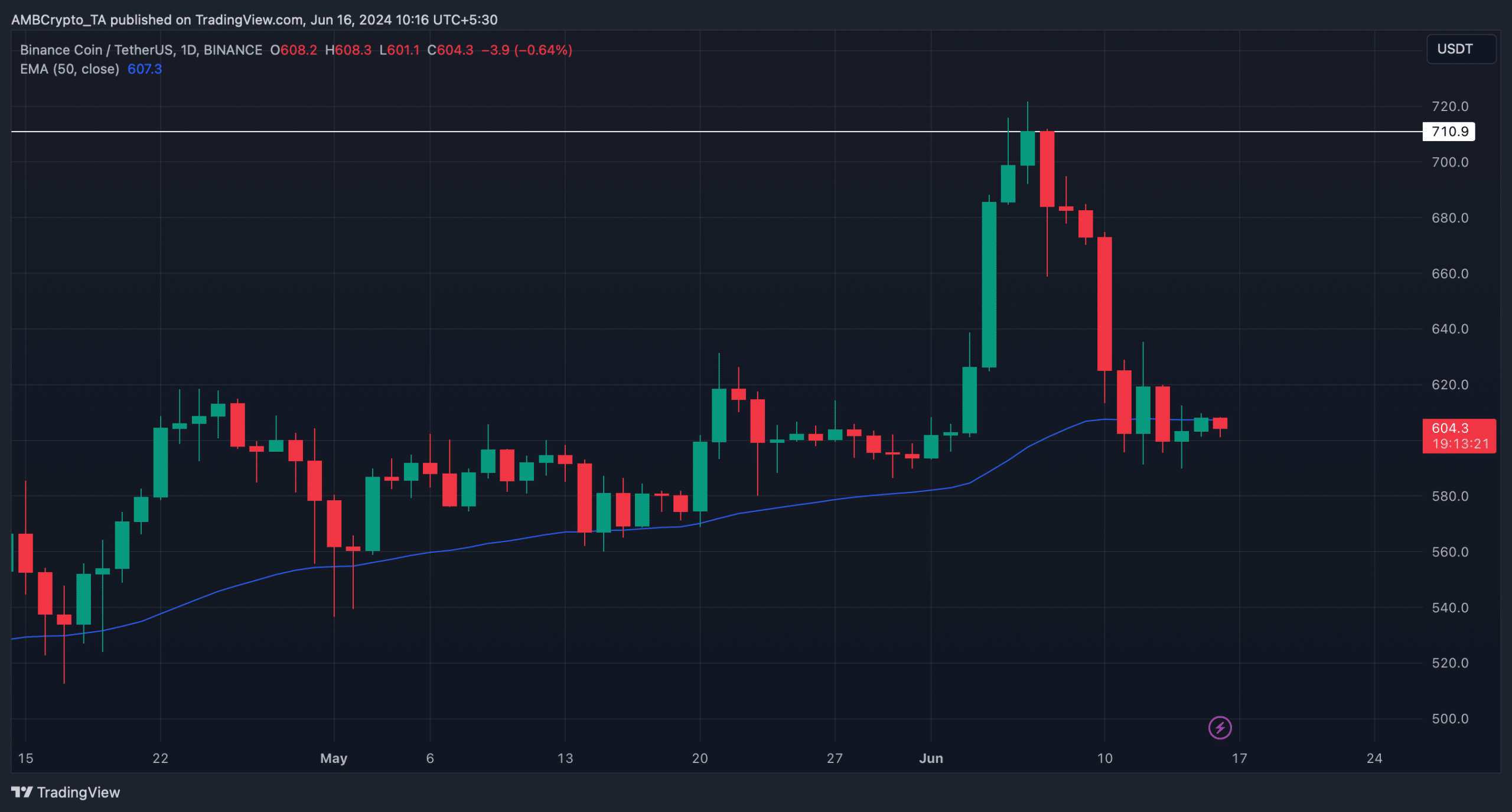

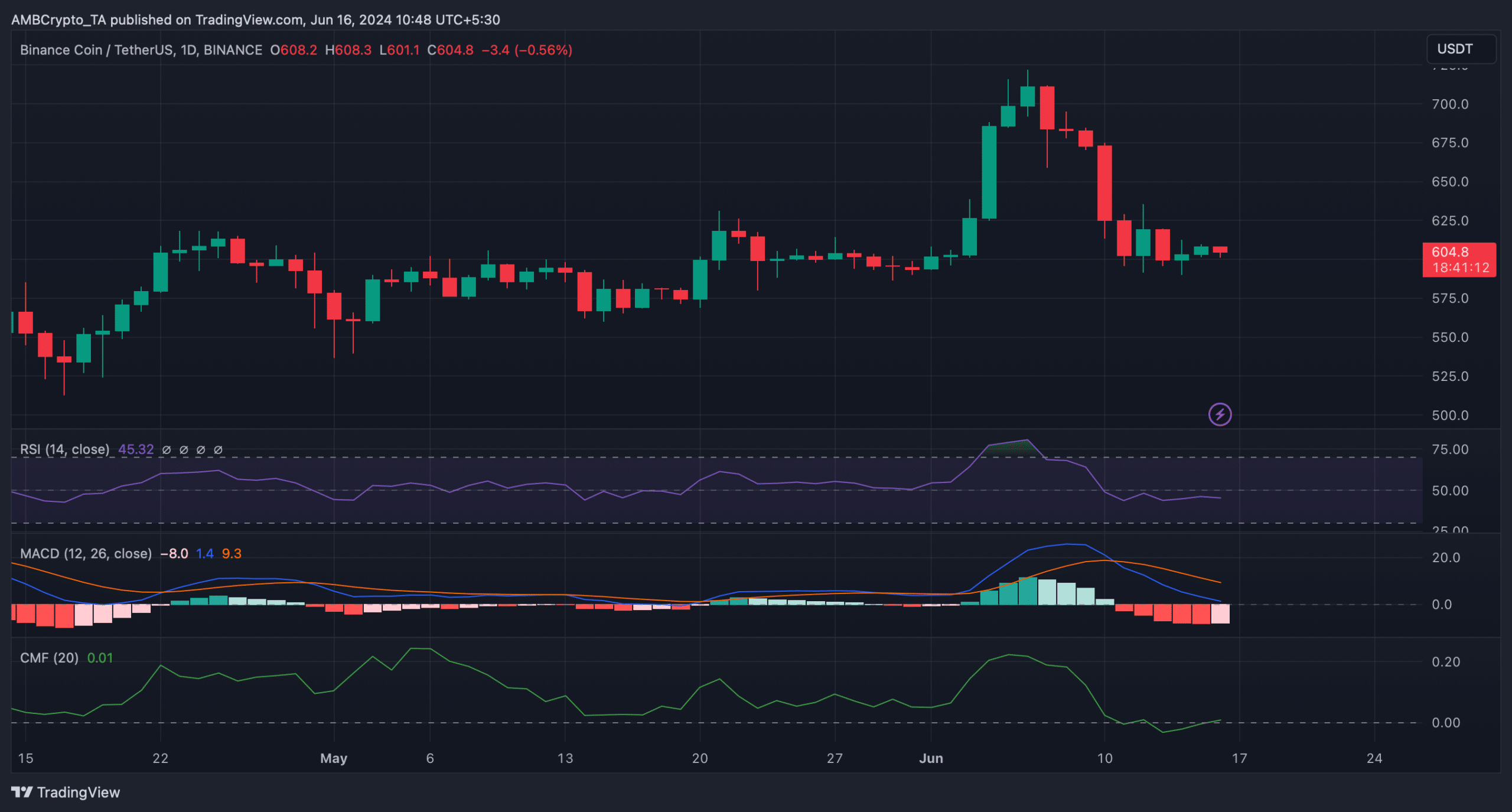

AMBCrypto’s analysis of BNB’s daily chart revealed that the coin was testing its 50-day Exponential Moving Average (EMA). Generally, the 50-day EMA acts as a support and resistance level.

Therefore, a breakout above that level usually results in a bull rally.

On this occasion, if BNB manages to break out, then investors might witness a massive price increase. This might allow BNB to reclaim $710 again.

Source: TradingView

Is a bullish breakout possible?

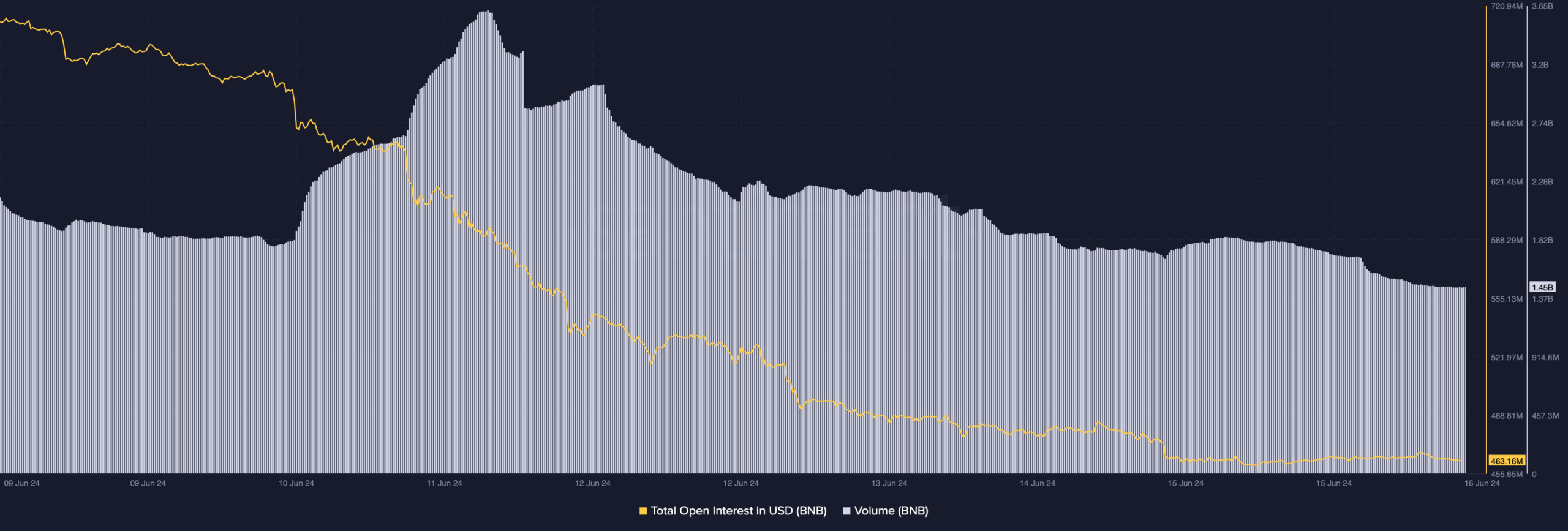

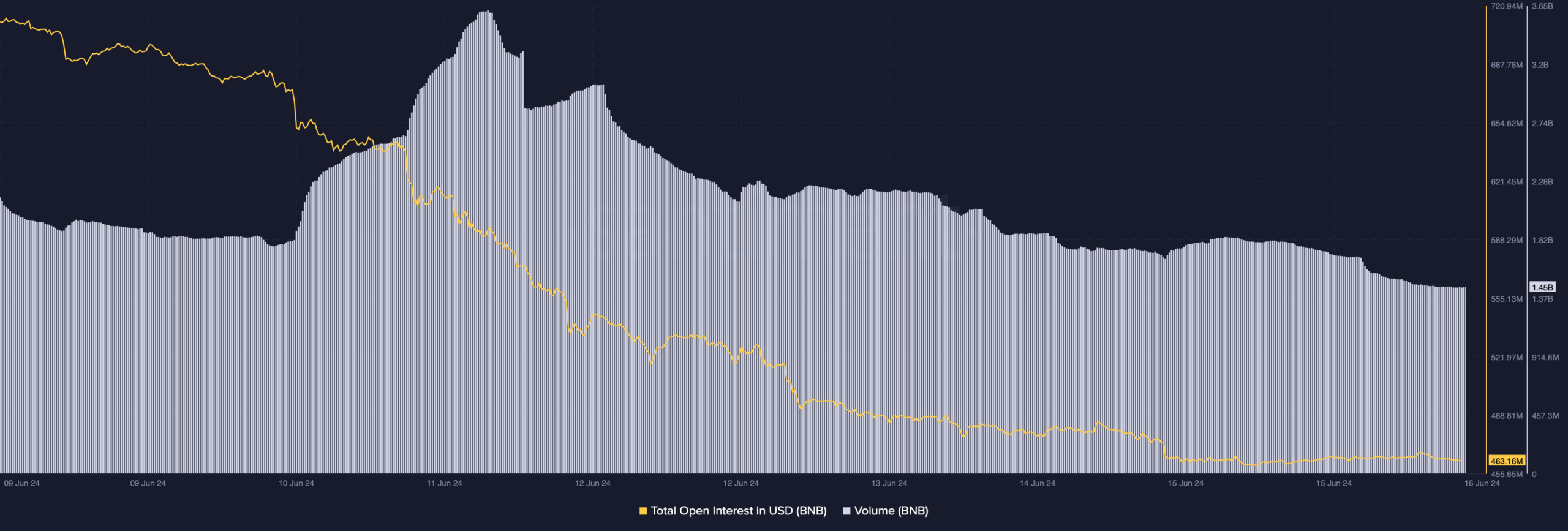

Since there was a chance of a trend reversal, AMBCrypto analyzed Santiment’s data to see whether metrics supported that possibility. We found that BNB’s Open Interest dropped along with its price.

A decline in the metric suggests that the possibility of the ongoing price trend changing is high. Moreover, BNB’s volume also declined, which hinted at a trend reversal soon.

Source: Santiment

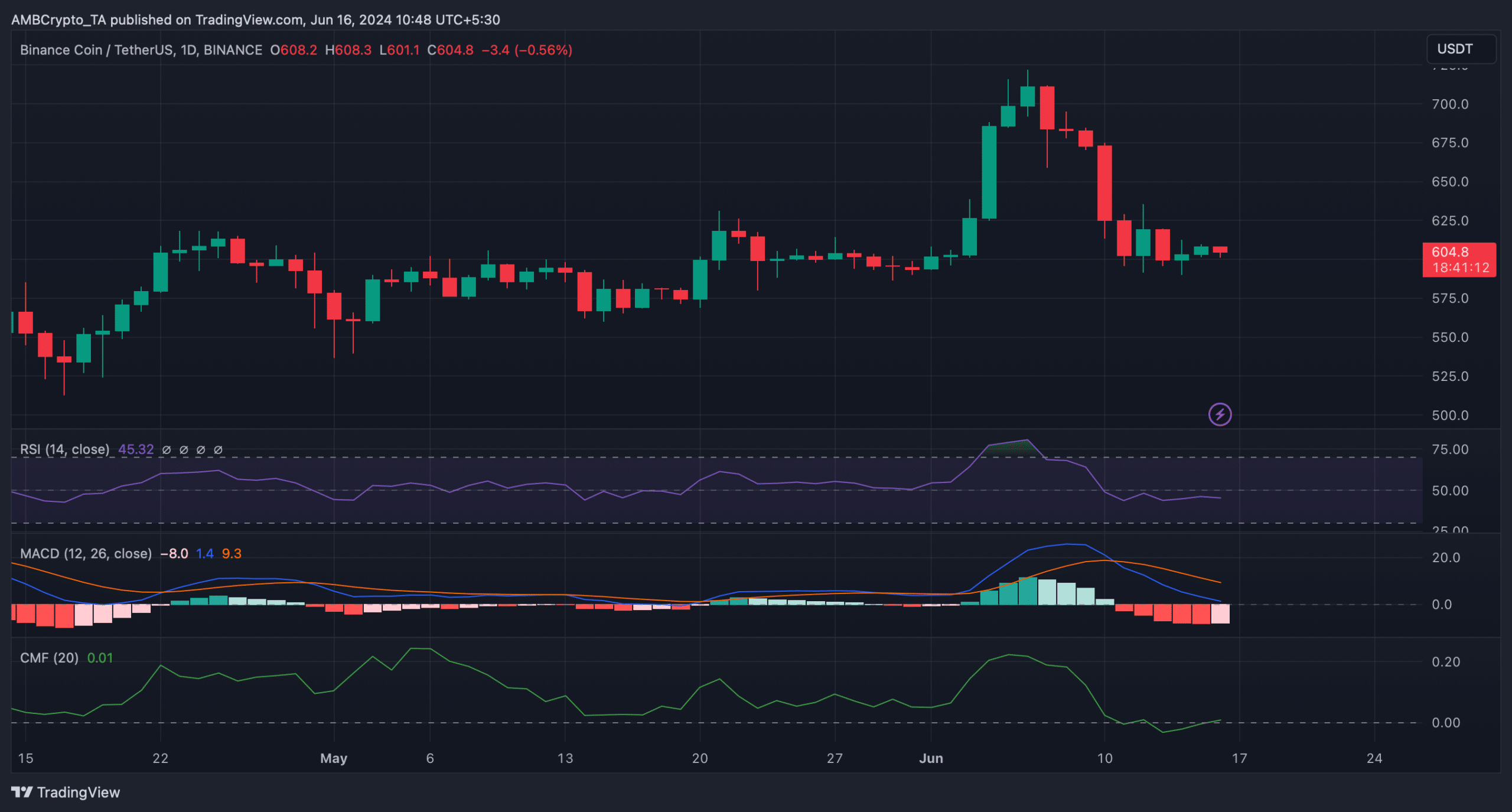

Interestingly, the coin’s Chaikin Money Flow (CMF) also registered an uptick and was headed above the neutral mark at press time. This hinted at a possible price increase.

Nonetheless, the rest of the indicators were bearish.

For instance, the MACD displayed a bearish advantage in the market. The Relative Strength Index (RSI) continued to rest under the neutral mark, hinting at a continued price decline.

Source: TradingView

Realistic or not, here’s BNB’s market cap in BTC terms

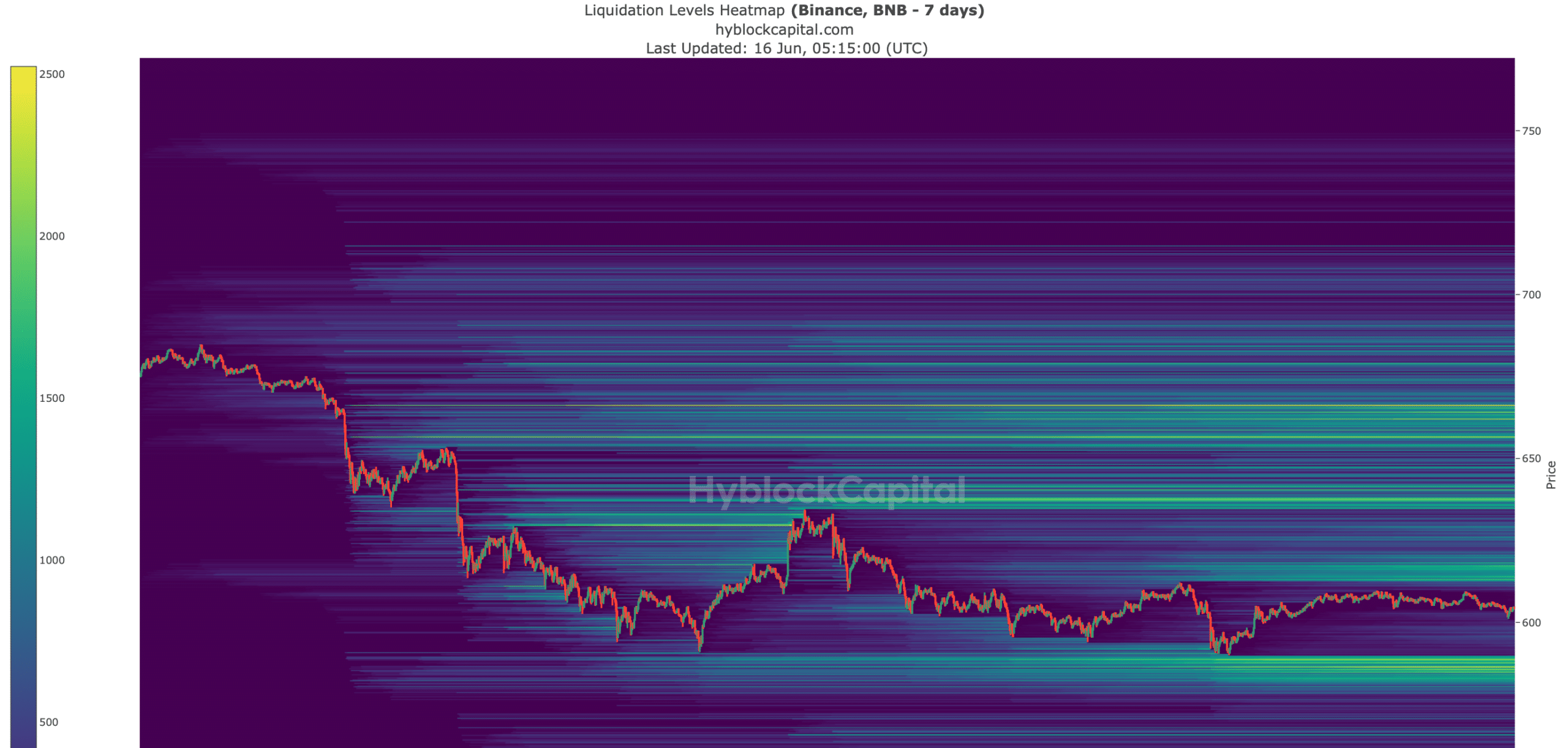

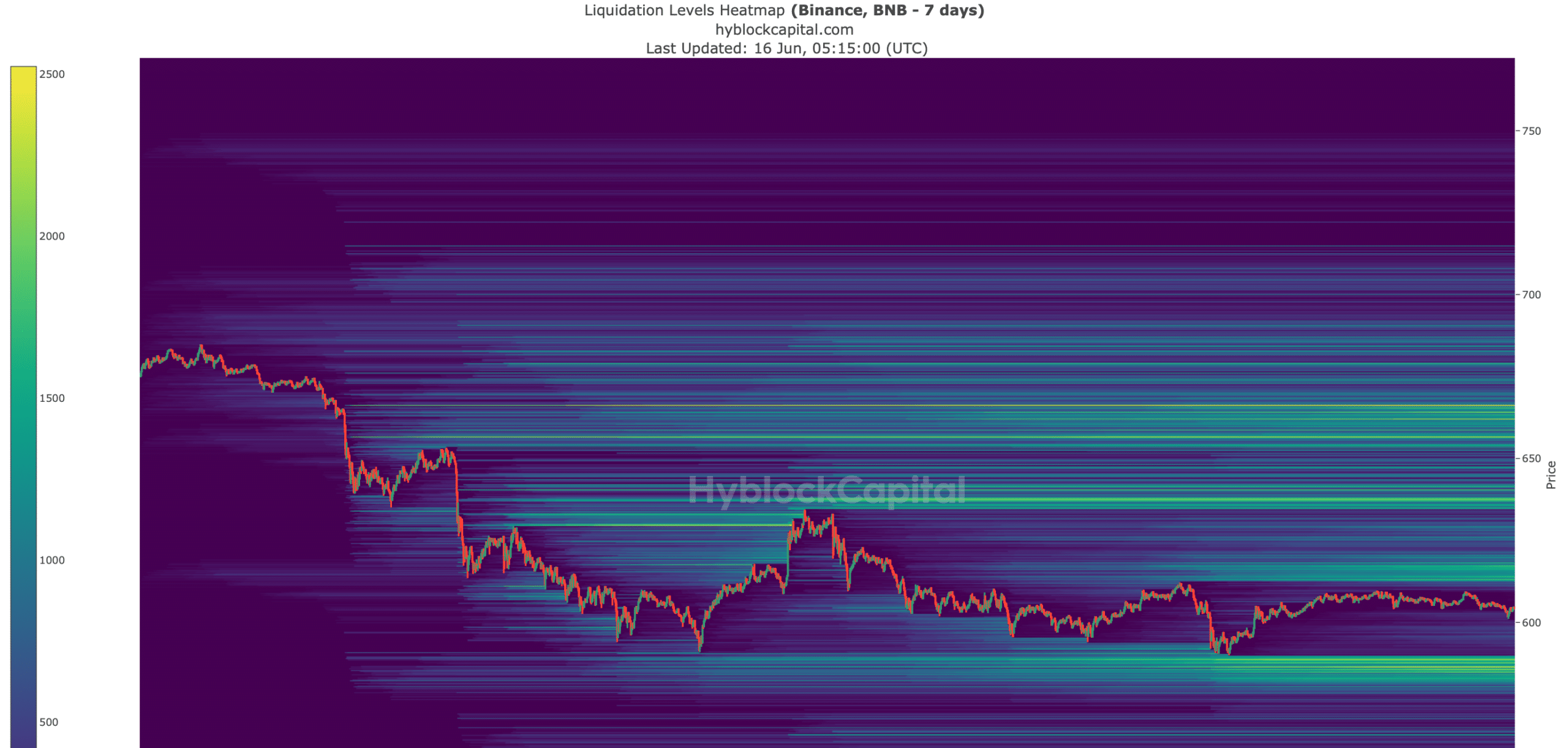

If BNB manages to initiate a bull rally by going above its 50-day EMA, the coin would witness high liquidation near $617. High liquidation often results in short-term price corrections.

A breakout above that level might allow the coin to touch $637 in the upcoming week. However, if the bearish trend lasts, then BNB might drop to $603.

Source: Hyblock Capital

- BNB’s price declined by more than 10% in the last seven days.

- A few metrics hinted at a trend reversal.

Binance Coin [BNB] bears dominated in the last week as the coin’s price dropped by double digits. However, BNB was testing a crucial resistance level at press time. A breakout above could result in a bull rally.

Let’s take a closer look at what’s going on.

BNB tests a crucial resistance

CoinMarketCap’s data revealed that BNB’s price had dropped by more than 10% in the last seven days. The declining trend continued in the last 24 hours as the coin’s moved down marginally.

At the time of writing, BNB was trading at $604 with a market capitalization of over $89 billion.

The declining price action made BNB a topic of discussion in the crypto space, which was evident from the rise in its social volume.

But its Weighted Sentiment dropped sharply, meaning that bearish sentiment around the coin was dominant in the market.

Source: Santiment

However, things can take a U-turn in the coming days as the coin is testing a crucial resistance level.

AMBCrypto’s analysis of BNB’s daily chart revealed that the coin was testing its 50-day Exponential Moving Average (EMA). Generally, the 50-day EMA acts as a support and resistance level.

Therefore, a breakout above that level usually results in a bull rally.

On this occasion, if BNB manages to break out, then investors might witness a massive price increase. This might allow BNB to reclaim $710 again.

Source: TradingView

Is a bullish breakout possible?

Since there was a chance of a trend reversal, AMBCrypto analyzed Santiment’s data to see whether metrics supported that possibility. We found that BNB’s Open Interest dropped along with its price.

A decline in the metric suggests that the possibility of the ongoing price trend changing is high. Moreover, BNB’s volume also declined, which hinted at a trend reversal soon.

Source: Santiment

Interestingly, the coin’s Chaikin Money Flow (CMF) also registered an uptick and was headed above the neutral mark at press time. This hinted at a possible price increase.

Nonetheless, the rest of the indicators were bearish.

For instance, the MACD displayed a bearish advantage in the market. The Relative Strength Index (RSI) continued to rest under the neutral mark, hinting at a continued price decline.

Source: TradingView

Realistic or not, here’s BNB’s market cap in BTC terms

If BNB manages to initiate a bull rally by going above its 50-day EMA, the coin would witness high liquidation near $617. High liquidation often results in short-term price corrections.

A breakout above that level might allow the coin to touch $637 in the upcoming week. However, if the bearish trend lasts, then BNB might drop to $603.

Source: Hyblock Capital

how to get cheap clomiphene price clomid for men generic clomiphene 100mg c10m1d cost cheap clomid without insurance buy cheap clomid tablets clomid rx for men how to buy generic clomid

I couldn’t hold back commenting. Well written!

More articles like this would remedy the blogosphere richer.

buy azithromycin generic – buy metronidazole medication order flagyl

buy generic semaglutide over the counter – buy cyproheptadine 4mg buy periactin 4mg generic

motilium for sale online – order flexeril for sale buy flexeril sale

amoxiclav uk – https://atbioinfo.com/ ampicillin online order

buy generic esomeprazole online – https://anexamate.com/ nexium for sale online

warfarin brand – https://coumamide.com/ losartan 50mg tablet

order generic deltasone 40mg – apreplson.com prednisone 5mg cost

hims ed pills – where to buy over the counter ed pills how to buy ed pills

order amoxicillin without prescription – order amoxil sale buy amoxil online

buy generic forcan online – on this site order diflucan 100mg for sale

cenforce 50mg ca – on this site cheap cenforce

how long does it take cialis to start working – cialis for sale toronto cialis 10 mg

buy zantac pills – online order ranitidine 300mg generic

sildenafil genfar 50mg – on this site buy generic viagra online overnight

I couldn’t weather commenting. Warmly written! click

Greetings! Jolly serviceable advice within this article! It’s the petty changes which liking turn the largest changes. Thanks a quantity for sharing! https://buyfastonl.com/azithromycin.html

This is a question which is in to my heart… Diverse thanks! Unerringly where can I upon the contact details in the course of questions? https://ursxdol.com/cenforce-100-200-mg-ed/

This is the kind of enter I unearth helpful. https://prohnrg.com/product/acyclovir-pills/

Thanks for sharing. It’s outstrip quality. https://aranitidine.com/fr/acheter-fildena/