- BlackRock’s Bitcoin holdings exceed 400,000 BTC, valued at $26.98 billion.

- BlackRock’s Bitcoin ETF sees consistent inflows, surpassing $23 billion in total value.

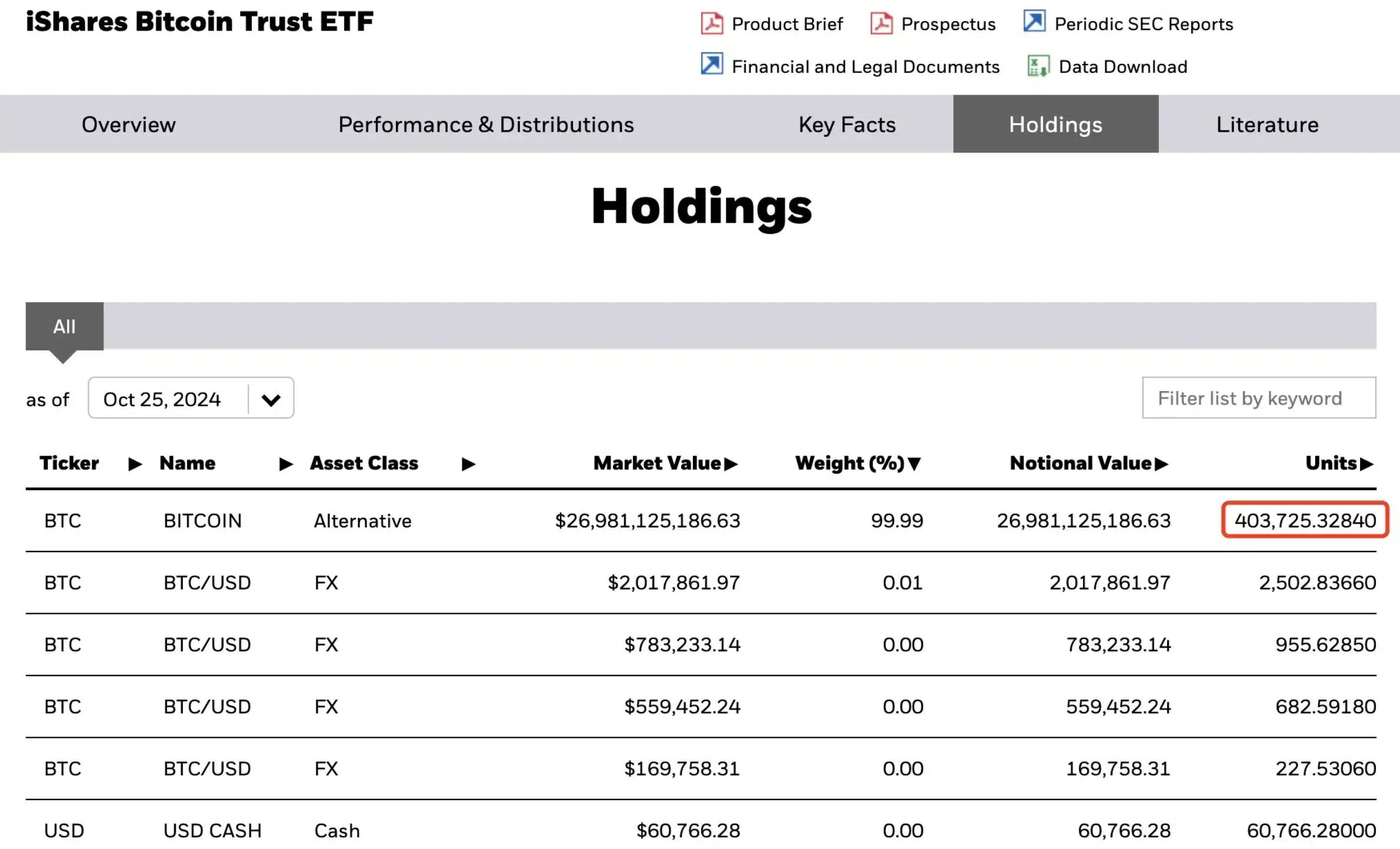

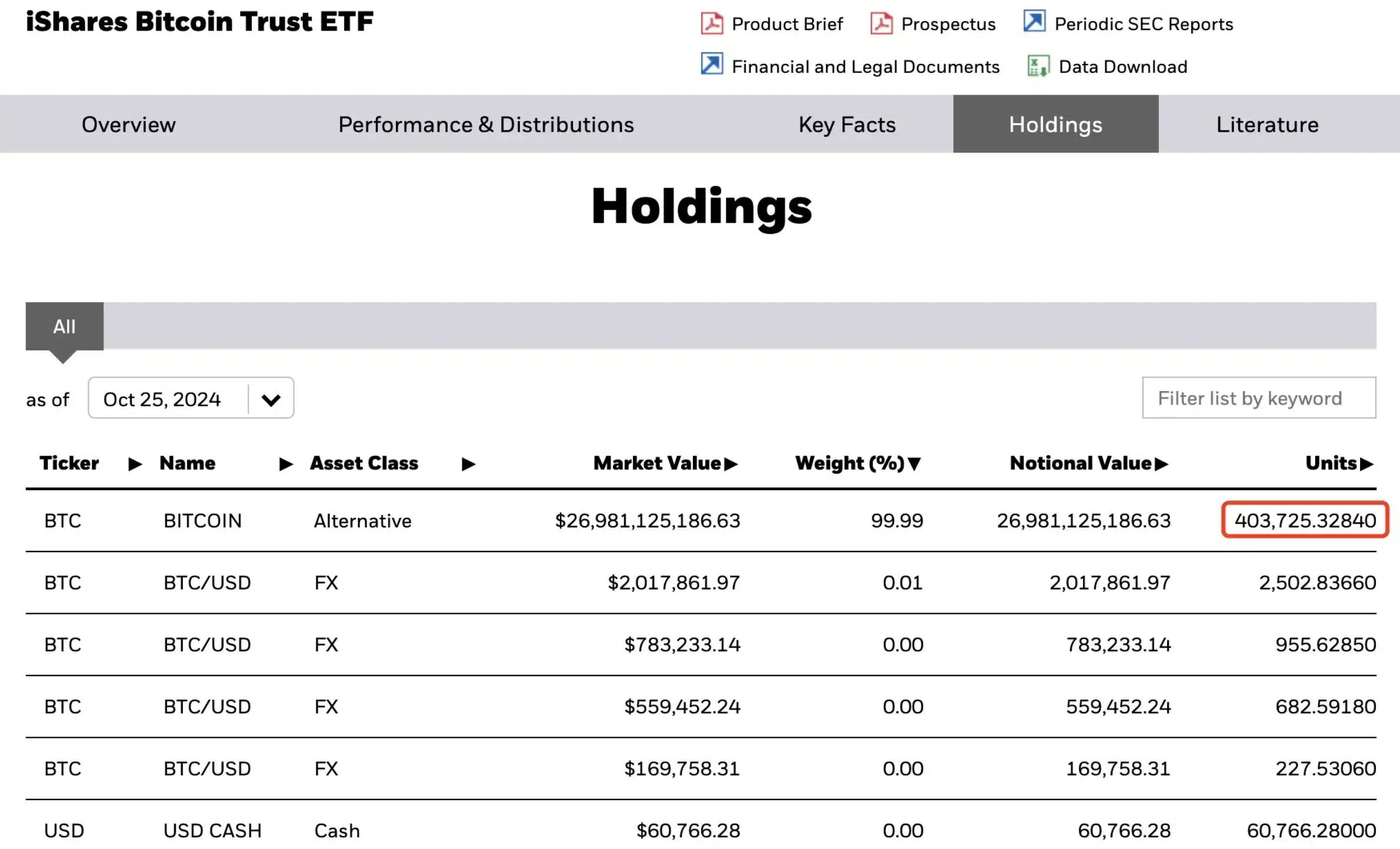

Amid growing speculation that Bitcoin [BTC] ETFs may soon surpass the holdings of Satoshi Nakamoto, BlackRock has hit a significant milestone in its BTC accumulation.

Blackrock’s Bitcoin accumulation

According to a recent update from Lookonchain, the asset management giant now holds over 400,000 Bitcoin. At press time, it was valued at approximately $26.98 billion.

Source: Lookonchain/X

Over the past two weeks alone, BlackRock has added 34,085 BTC to its portfolio, worth roughly $2.3 billion. This latest acquisition highlighted BlackRock’s dominance in the cryptocurrency space as it continues to expand its Bitcoin holdings.

On the flip side, BlackRock’s BTC ETF (IBIT) has seen remarkable growth, surpassing the $23 billion mark, according to Farside Investors. Notably, IBIT has been on a consistent inflow streak since the 14th of October.

Between the 14th and 25th October, IBIT recorded inflows nearing $400 million on some days, reflecting strong investor interest and confidence in BlackRock’s BTC strategy. This underscored BlackRock’s strategic approach to Bitcoin amid its growing adoption.

Community reaction and impact on Bitcoin

Seeing this the crypto community has responded with optimism.

Source: X

As of the latest update, Bitcoin was trading at $67,773.35, marking a rise of over 1% within the past 24 hours as per CoinMarketCap.

Additioanlly, the Relative Strength Index (RSI) was also lying above the neutral threshold, signaling that bullish momentum was overtaking bearish forces.

Source: Trading View

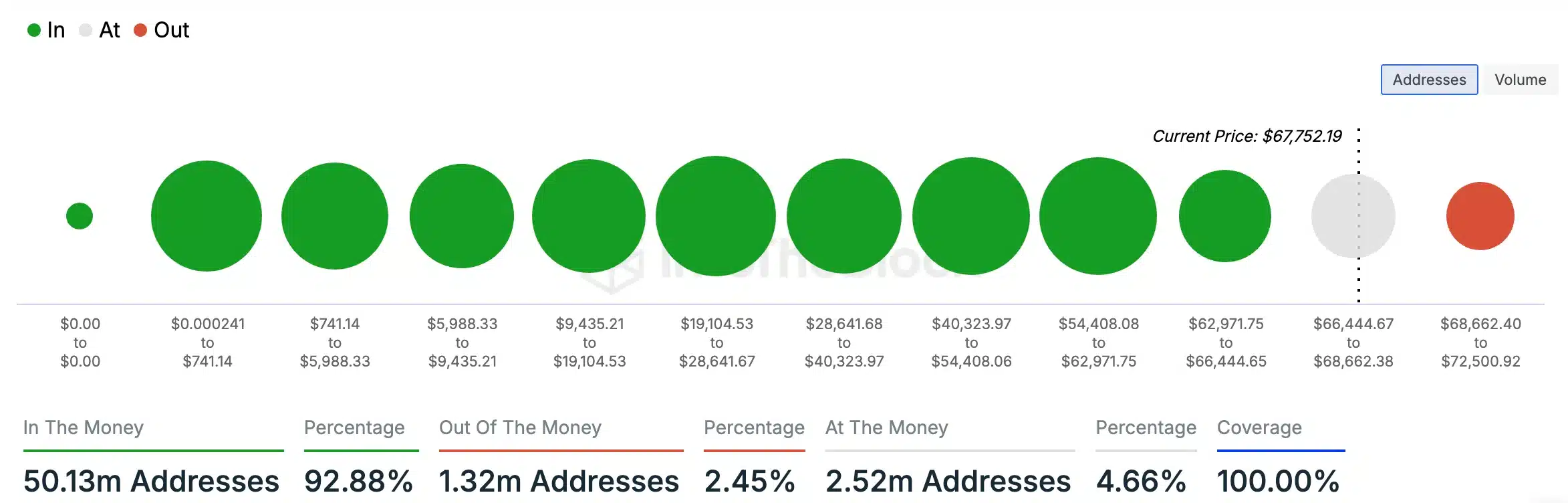

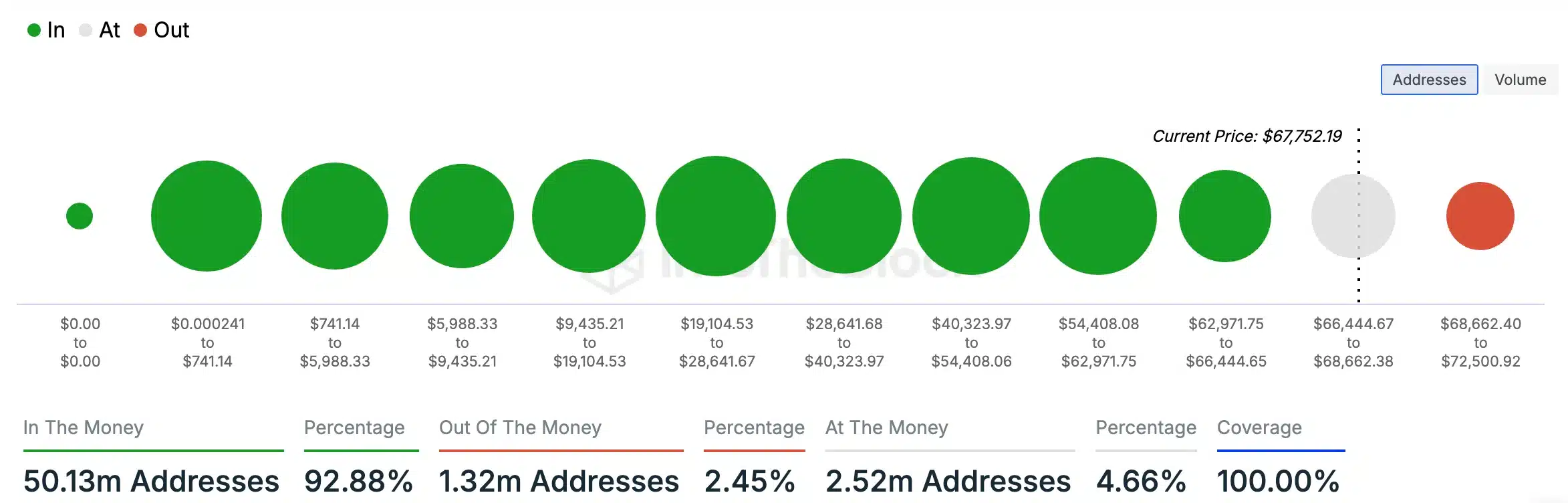

For Bitcoin’s roadmap ahead, an analysis by IntoTheBlock, cited by AMBCrypto, revealed that approximately 92.88% of BTC holders were “in the money,” meaning their holdings were valued higher than their initial purchase price.

Meanwhile, only 2.45% of holders were “out of the money,” reflecting a robust market sentiment and suggesting potential for further price gains.

Source: IntoTheBlock

Is this the start of the “Bitcoin war”?

Speculation about future “Bitcoin wars” is already circulating, with some predicting that giants like BlackRock could eventually seek to fork the original Bitcoin chain and promote their own version as the legitimate one.

While such a scenario may currently seem like a conspiracy theory, the rapid accumulation of BTC by BlackRock has raised concerns about its growing influence over the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, they are not alone—other major players such as MicroStrategy, led by Michael Saylor, as well as Tesla, Binance, and SpaceX, have also been steadily amassing Bitcoin.

Therefore, whether MicroStrategy and other institutions will be able to challenge BlackRock’s dominance remains an open question.

- BlackRock’s Bitcoin holdings exceed 400,000 BTC, valued at $26.98 billion.

- BlackRock’s Bitcoin ETF sees consistent inflows, surpassing $23 billion in total value.

Amid growing speculation that Bitcoin [BTC] ETFs may soon surpass the holdings of Satoshi Nakamoto, BlackRock has hit a significant milestone in its BTC accumulation.

Blackrock’s Bitcoin accumulation

According to a recent update from Lookonchain, the asset management giant now holds over 400,000 Bitcoin. At press time, it was valued at approximately $26.98 billion.

Source: Lookonchain/X

Over the past two weeks alone, BlackRock has added 34,085 BTC to its portfolio, worth roughly $2.3 billion. This latest acquisition highlighted BlackRock’s dominance in the cryptocurrency space as it continues to expand its Bitcoin holdings.

On the flip side, BlackRock’s BTC ETF (IBIT) has seen remarkable growth, surpassing the $23 billion mark, according to Farside Investors. Notably, IBIT has been on a consistent inflow streak since the 14th of October.

Between the 14th and 25th October, IBIT recorded inflows nearing $400 million on some days, reflecting strong investor interest and confidence in BlackRock’s BTC strategy. This underscored BlackRock’s strategic approach to Bitcoin amid its growing adoption.

Community reaction and impact on Bitcoin

Seeing this the crypto community has responded with optimism.

Source: X

As of the latest update, Bitcoin was trading at $67,773.35, marking a rise of over 1% within the past 24 hours as per CoinMarketCap.

Additioanlly, the Relative Strength Index (RSI) was also lying above the neutral threshold, signaling that bullish momentum was overtaking bearish forces.

Source: Trading View

For Bitcoin’s roadmap ahead, an analysis by IntoTheBlock, cited by AMBCrypto, revealed that approximately 92.88% of BTC holders were “in the money,” meaning their holdings were valued higher than their initial purchase price.

Meanwhile, only 2.45% of holders were “out of the money,” reflecting a robust market sentiment and suggesting potential for further price gains.

Source: IntoTheBlock

Is this the start of the “Bitcoin war”?

Speculation about future “Bitcoin wars” is already circulating, with some predicting that giants like BlackRock could eventually seek to fork the original Bitcoin chain and promote their own version as the legitimate one.

While such a scenario may currently seem like a conspiracy theory, the rapid accumulation of BTC by BlackRock has raised concerns about its growing influence over the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, they are not alone—other major players such as MicroStrategy, led by Michael Saylor, as well as Tesla, Binance, and SpaceX, have also been steadily amassing Bitcoin.

Therefore, whether MicroStrategy and other institutions will be able to challenge BlackRock’s dominance remains an open question.

clomiphene tablete clomid without dr prescription buying cheap clomid tablets can i buy generic clomid pill can you buy clomid without rx can i order cheap clomiphene pills can i purchase generic clomiphene without a prescription

This website absolutely has all of the information and facts I needed there this thesis and didn’t positive who to ask.

I am actually enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks representing providing such data.

brand azithromycin – floxin where to buy order metronidazole sale

rybelsus tablet – rybelsus 14 mg ca cyproheptadine 4mg over the counter

motilium 10mg us – order motilium for sale order flexeril 15mg pills

amoxicillin cost – order valsartan generic order generic combivent

azithromycin 500mg pill – azithromycin us bystolic cost

order amoxiclav generic – at bio info ampicillin ca

nexium medication – https://anexamate.com/ order esomeprazole pills

buy warfarin pill – https://coumamide.com/ losartan 50mg usa

order mobic online cheap – https://moboxsin.com/ mobic 7.5mg without prescription

prednisone 40mg tablet – corticosteroid buy deltasone generic

cheapest ed pills online – home remedies for ed erectile dysfunction cheap erectile dysfunction

purchase amoxicillin online cheap – buy amoxil online amoxicillin oral

diflucan cost – https://gpdifluca.com/# order generic fluconazole

cenforce brand – buy cheap cenforce cheap cenforce 100mg

what happens if you take 2 cialis – cialis medicine cialis daily side effects

tadalafil no prescription forum – how to get cialis without doctor cheap cialis 20mg

order ranitidine 150mg without prescription – aranitidine buy ranitidine pill

buy viagra cheap australia – https://strongvpls.com/# can i buy viagra in japan

I couldn’t hold back commenting. Warmly written! https://buyfastonl.com/amoxicillin.html

I am actually happy to gleam at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. https://gnolvade.com/es/como-comprar-cialis-en-es/

The thoroughness in this piece is noteworthy. https://ursxdol.com/provigil-gn-pill-cnt/

I am in point of fact delighted to glance at this blog posts which consists of tons of of use facts, thanks for providing such data. https://prohnrg.com/product/acyclovir-pills/

This website exceedingly has all of the information and facts I needed to this thesis and didn’t comprehend who to ask. https://ondactone.com/spironolactone/

I couldn’t turn down commenting. Warmly written!

https://doxycyclinege.com/pro/levofloxacin/

The vividness in this piece is exceptional. http://zqykj.cn/bbs/home.php?mod=space&uid=302442

order forxiga pills – forxiga 10 mg ca order forxiga 10 mg pills

order orlistat online – https://asacostat.com/# order orlistat pill

More peace pieces like this would make the web better. http://3ak.cn/home.php?mod=space&uid=230406