- BTC is sound money and a ‘risk-off’ asset, per BlackRock.

- But ETH is a speculative bet on blockchain technology adoption.

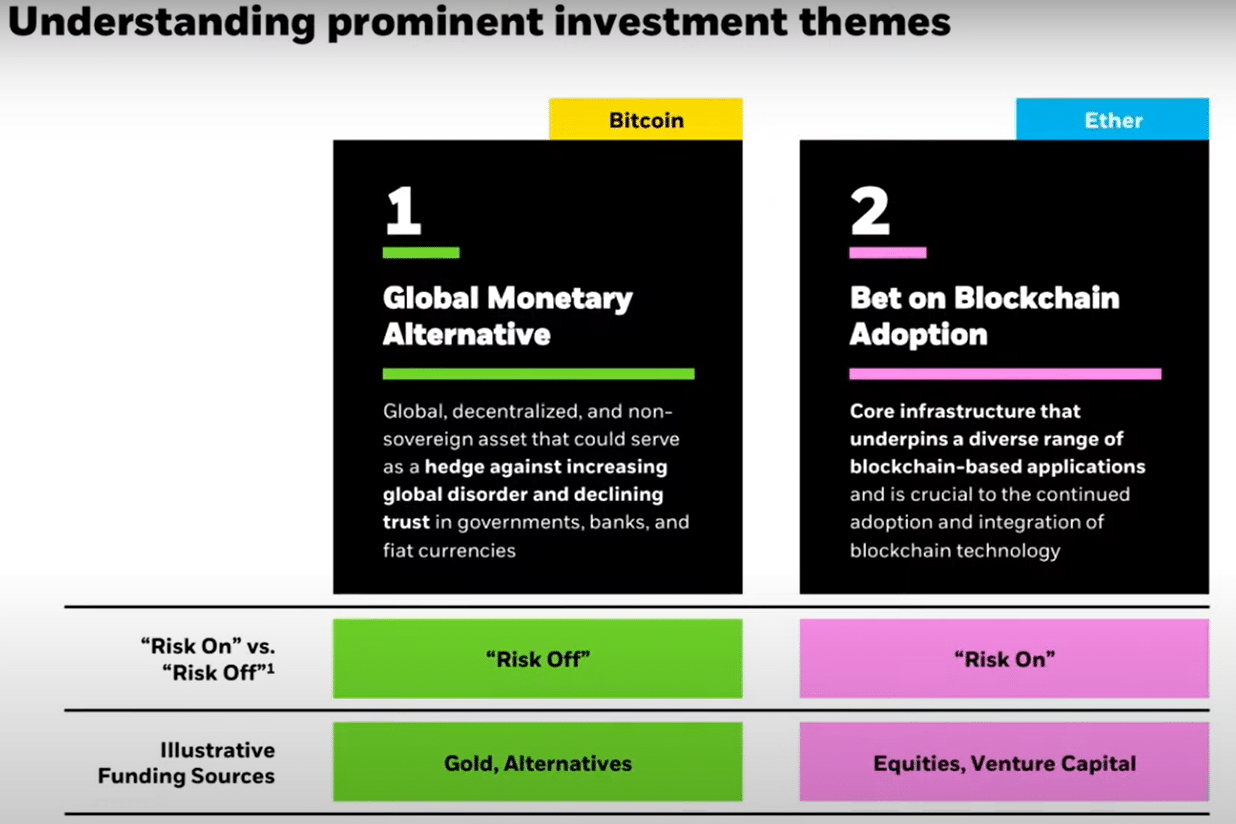

BlackRock, the world’s largest asset manager, recently presented unique yet different pitch decks for Bitcoin [BTC] and Ethereum [ETH].

The dual pitch deck was presented during a digital assets conference held in Brazil. BlackRock’s Robbie Mitchnick presented BTC as a ‘risk-off’ asset, putting it at par with or better than gold.

On the other hand, ETH was pitched as a ‘risk-on’ asset, similar to U.S. stocks.

BTC as money; ETH as a bet

The asset manager praised BTC as a global monetary alternative and an excellent hedge against declining trust in governments and fiat currencies’ relentless debasement (devaluation).

Source: BlackRock

On the contrary, ETH was showcased as a speculative bet on blockchain technology adoption, an investment that Mitchnick equated to US stocks.

He noted,

“On one hand, you have BTC, a commodity like gold and an alternative to stocks and bonds. Ethereum, more of a long-term technology bet that this blockchain will provide more use cases and more value to the economy going forward.”

Part of the crypto community echoed Mitchnick’s presentations, underscoring that BTC is ‘money’ with less inflationary pressure than fiat currencies, which lose value annually.

But it also settled the raging debate that has been going on for a while: ETH isn’t money. In fact, since the introduction of Blobs earlier this year, ETH’s inflation has hiked, making it less of an “ultra-sound money.”

If the projections hold, BTC could rally more during future geopolitical tensions, while ETH could decline in such scenarios.

BlackRock’s perspective is crucial since it is a trendsetter and widely accredited. Along with Grayscale, the asset managers are perceived to be responsible for the US shift and final approval of US spot BTC ETFs.

Since the ETFs debuted, BlacRock’s ETFs have outperformed every alternative offering and crossed key milestones.

At the time of writing, its BTC ETF, iShares Bitcoin Trust [IBIT], had a cumulative netflow of $21.5 billion with nearly $23 billion in net assets.

That said, since it began trading in July, BlacRock’s ETH ETF, ETHA, has netted $1.1 billion in total inflows.

Ergo, the world’s largest asset manager, could influence how other investors view the sector. According to some market observers, the message seems clear — Bitcoin is money, while the rest of crypto is speculative.

In the meantime, BTC was valued at $62K, down 5% on the weekly charts. On the other hand, ETH was valued at $2.4K, down 8.5% over the same period.

- BTC is sound money and a ‘risk-off’ asset, per BlackRock.

- But ETH is a speculative bet on blockchain technology adoption.

BlackRock, the world’s largest asset manager, recently presented unique yet different pitch decks for Bitcoin [BTC] and Ethereum [ETH].

The dual pitch deck was presented during a digital assets conference held in Brazil. BlackRock’s Robbie Mitchnick presented BTC as a ‘risk-off’ asset, putting it at par with or better than gold.

On the other hand, ETH was pitched as a ‘risk-on’ asset, similar to U.S. stocks.

BTC as money; ETH as a bet

The asset manager praised BTC as a global monetary alternative and an excellent hedge against declining trust in governments and fiat currencies’ relentless debasement (devaluation).

Source: BlackRock

On the contrary, ETH was showcased as a speculative bet on blockchain technology adoption, an investment that Mitchnick equated to US stocks.

He noted,

“On one hand, you have BTC, a commodity like gold and an alternative to stocks and bonds. Ethereum, more of a long-term technology bet that this blockchain will provide more use cases and more value to the economy going forward.”

Part of the crypto community echoed Mitchnick’s presentations, underscoring that BTC is ‘money’ with less inflationary pressure than fiat currencies, which lose value annually.

But it also settled the raging debate that has been going on for a while: ETH isn’t money. In fact, since the introduction of Blobs earlier this year, ETH’s inflation has hiked, making it less of an “ultra-sound money.”

If the projections hold, BTC could rally more during future geopolitical tensions, while ETH could decline in such scenarios.

BlackRock’s perspective is crucial since it is a trendsetter and widely accredited. Along with Grayscale, the asset managers are perceived to be responsible for the US shift and final approval of US spot BTC ETFs.

Since the ETFs debuted, BlacRock’s ETFs have outperformed every alternative offering and crossed key milestones.

At the time of writing, its BTC ETF, iShares Bitcoin Trust [IBIT], had a cumulative netflow of $21.5 billion with nearly $23 billion in net assets.

That said, since it began trading in July, BlacRock’s ETH ETF, ETHA, has netted $1.1 billion in total inflows.

Ergo, the world’s largest asset manager, could influence how other investors view the sector. According to some market observers, the message seems clear — Bitcoin is money, while the rest of crypto is speculative.

In the meantime, BTC was valued at $62K, down 5% on the weekly charts. On the other hand, ETH was valued at $2.4K, down 8.5% over the same period.

how can i get cheap clomid without prescription cost cheap clomiphene for sale clomid tablete order generic clomiphene pills clomid calculator where to buy generic clomiphene without prescription can i purchase clomid without insurance

Thanks for sharing. It’s top quality.

buy azithromycin tablets – order zithromax 500mg online cheap metronidazole 400mg sale

order rybelsus 14 mg for sale – order generic semaglutide 14 mg periactin 4 mg cost

order domperidone 10mg pills – buy sumycin pills buy cyclobenzaprine pills for sale

order amoxiclav without prescription – atbioinfo.com cheap ampicillin

buy nexium generic – anexa mate esomeprazole 40mg uk

buy coumadin paypal – anticoagulant buy generic cozaar 50mg

order mobic pills – https://moboxsin.com/ meloxicam price

prednisone 20mg cheap – corticosteroid deltasone 10mg oral

erectile dysfunction medicines – fastedtotake.com herbal ed pills

buy amoxil pills – buy amoxicillin pills for sale buy amoxicillin for sale

fluconazole 200mg pills – diflucan 100mg ca order diflucan generic

cenforce 50mg us – buy cenforce medication buy generic cenforce

maxim peptide tadalafil citrate – https://ciltadgn.com/# cialis generic overnite shipping

order cialis online cheap generic – https://strongtadafl.com/# how much does cialis cost per pill

order zantac without prescription – click ranitidine 150mg drug

cheap viagra 50 mg – https://strongvpls.com/# viagra 50 mg tablet

The sagacity in this ruined is exceptional. https://gnolvade.com/

More posts like this would force the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

Thanks on sharing. It’s acme quality. https://prohnrg.com/product/get-allopurinol-pills/

This is the type of delivery I unearth helpful. https://aranitidine.com/fr/en_france_xenical/

This is the compassionate of writing I truly appreciate. https://ondactone.com/simvastatin/

This is the kind of scribble literary works I positively appreciate.

imitrex 50mg for sale

Proof blog you be undergoing here.. It’s intricate to on strong status belles-lettres like yours these days. I truly appreciate individuals like you! Rent guardianship!! http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4703

order forxiga online cheap – https://janozin.com/ cost forxiga 10mg

orlistat tablet – click buy orlistat tablets

This is a topic which is virtually to my verve… Numberless thanks! Quite where can I lay one’s hands on the contact details due to the fact that questions? http://wightsupport.com/forum/member.php?action=profile&uid=22088