- Politicians’ Bitcoin endorsements reflected major shifts in U.S. financial strategies.

- BTC’s recent decline is tempered by an optimistic RSI and potential bullish reversal.

The Bitcoin [BTC] 2024 conference took center stage in July, drawing attention from enthusiasts and industry leaders alike.

Hougan’s unique take on Bitcoin

Amidst the excitement, Bitwise’s chief investment officer, Matt Hougan, offered a fresh and insightful perspective, especially following the endorsement of BTC by several prominent U.S. politicians.

In a recent blog post dated the 31st of July, titled- “We’re Not Bullish Enough: The Big Takeaway From the 2024 Bitcoin Conference,” Hougan said,

“What’s happening in the bitcoin market right now is making me rethink what’s possible.”

The political shift

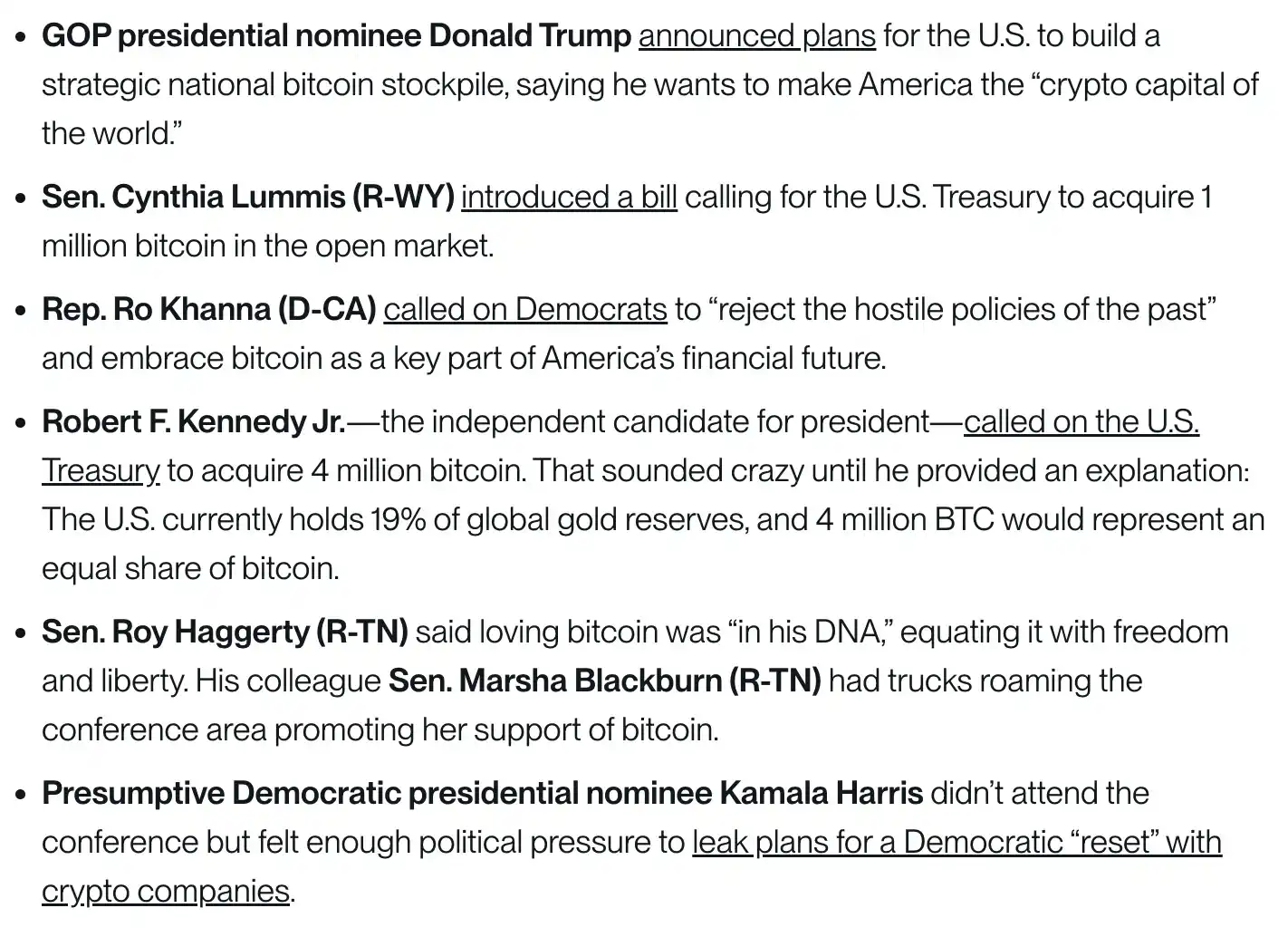

This aligns with the ambitious plans of several U.S. political figures to integrate BTC into national financial strategies.

For context, Donald Trump proposed creating a strategic Bitcoin reserve for the country, while Senator Cynthia Lummis suggested a bill that would use BTC reserves to address the U.S.’s $35 trillion debt crisis.

Additionally, Robert F. Kennedy Jr. pledged that if elected, the U.S. Treasury would purchase 500 Bitcoin daily until accumulating at least 4 million BTC.

Key takeaways from the conference

That being said, Hougan also highlighted several key takeaways from the conference, which included,

Source: Matt Hougan/Bitwiseinvestments

Here it’s important to note that the sudden shift of politicians toward cryptocurrency has surprised many, not just Hougan.

He captured the sentiment aptly when he said,

“Less than two years ago, FTX was collapsing in a historic fraud, bitcoin was trading at $17,000, and skeptics were dancing on crypto’s grave. Now politicians are openly talking about building a ‘Bitcoin Fort Knox’.”

Fueling optimism about BTC’s future and broader crypto adoption, Hougan remarked,

“These ideas would have been the stuff of daydreams a year ago. But after what I witnessed last week, they look more likely than not.”

Trump’s Bitcoin influence

In fact, Bitcoin hit a two-week peak on the 12th of July as per Reuters, driven by the increased likelihood of President Trump winning the upcoming election following an attempted assassination.

As of the latest update, BTC had fallen by 2.40%, trading around the $64,000 mark as per CoinMarketCap.

Despite this decline, the Relative Strength Index (RSI) nearing a neutral level at 49 and trending upwards indicated a potential shift where bulls might soon overtake bears.

Source: TradingView

- Politicians’ Bitcoin endorsements reflected major shifts in U.S. financial strategies.

- BTC’s recent decline is tempered by an optimistic RSI and potential bullish reversal.

The Bitcoin [BTC] 2024 conference took center stage in July, drawing attention from enthusiasts and industry leaders alike.

Hougan’s unique take on Bitcoin

Amidst the excitement, Bitwise’s chief investment officer, Matt Hougan, offered a fresh and insightful perspective, especially following the endorsement of BTC by several prominent U.S. politicians.

In a recent blog post dated the 31st of July, titled- “We’re Not Bullish Enough: The Big Takeaway From the 2024 Bitcoin Conference,” Hougan said,

“What’s happening in the bitcoin market right now is making me rethink what’s possible.”

The political shift

This aligns with the ambitious plans of several U.S. political figures to integrate BTC into national financial strategies.

For context, Donald Trump proposed creating a strategic Bitcoin reserve for the country, while Senator Cynthia Lummis suggested a bill that would use BTC reserves to address the U.S.’s $35 trillion debt crisis.

Additionally, Robert F. Kennedy Jr. pledged that if elected, the U.S. Treasury would purchase 500 Bitcoin daily until accumulating at least 4 million BTC.

Key takeaways from the conference

That being said, Hougan also highlighted several key takeaways from the conference, which included,

Source: Matt Hougan/Bitwiseinvestments

Here it’s important to note that the sudden shift of politicians toward cryptocurrency has surprised many, not just Hougan.

He captured the sentiment aptly when he said,

“Less than two years ago, FTX was collapsing in a historic fraud, bitcoin was trading at $17,000, and skeptics were dancing on crypto’s grave. Now politicians are openly talking about building a ‘Bitcoin Fort Knox’.”

Fueling optimism about BTC’s future and broader crypto adoption, Hougan remarked,

“These ideas would have been the stuff of daydreams a year ago. But after what I witnessed last week, they look more likely than not.”

Trump’s Bitcoin influence

In fact, Bitcoin hit a two-week peak on the 12th of July as per Reuters, driven by the increased likelihood of President Trump winning the upcoming election following an attempted assassination.

As of the latest update, BTC had fallen by 2.40%, trading around the $64,000 mark as per CoinMarketCap.

Despite this decline, the Relative Strength Index (RSI) nearing a neutral level at 49 and trending upwards indicated a potential shift where bulls might soon overtake bears.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Please let me know if you’re looking for a article author for your weblog. You have some really great articles and I believe I would be a good asset. If you ever want to take some of the load off, I’d love to write some content for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Thanks!

Can I just say what a aid to find somebody who truly knows what theyre talking about on the internet. You undoubtedly know how to bring an issue to mild and make it important. Extra folks have to learn this and understand this aspect of the story. I cant imagine youre not more well-liked since you definitely have the gift.

I’ll right away grab your rss feed as I can not find your e-mail subscription link or e-newsletter service. Do you’ve any? Kindly let me know in order that I could subscribe. Thanks.

You actually make it appear really easy with your presentation however I find this matter to be actually something that I feel I might never understand. It sort of feels too complicated and very wide for me. I’m having a look forward for your next put up, I’ll attempt to get the grasp of it!

Hi! This post could not be written any better! Reading through this post reminds me of my old room mate! He always kept chatting about this. I will forward this post to him. Fairly certain he will have a good read. Many thanks for sharing!

clomiphene or serophene for men clomid usa how to get clomiphene pill can i buy clomid no prescription can you buy cheap clomiphene without insurance clomid for men can i order clomiphene online

Really clean internet site, appreciate it for this post.

This is the big-hearted of criticism I truly appreciate.

Palatable blog you have here.. It’s severely to find great worth belles-lettres like yours these days. I honestly comprehend individuals like you! Withstand guardianship!!

order zithromax 500mg – buy tindamax 300mg without prescription order metronidazole 200mg pills

motilium pills – order domperidone for sale cyclobenzaprine 15mg usa

Excellent goods from you, man. I have understand your stuff previous to and you are just too fantastic. I really like what you have acquired here, really like what you’re saying and the way in which you say it. You make it entertaining and you still care for to keep it smart. I can’t wait to read far more from you. This is actually a tremendous website.