- USDT dominance dropped this week, confirming $62 as BTC’s new local low

- Weekend action would be crucial for BTC’s next move as it neared key support on the charts

The market hasn’t yet entered the extreme greed phase that often signals a market top, like when Bitcoin [BTC] hit its ATH of $73k in March.

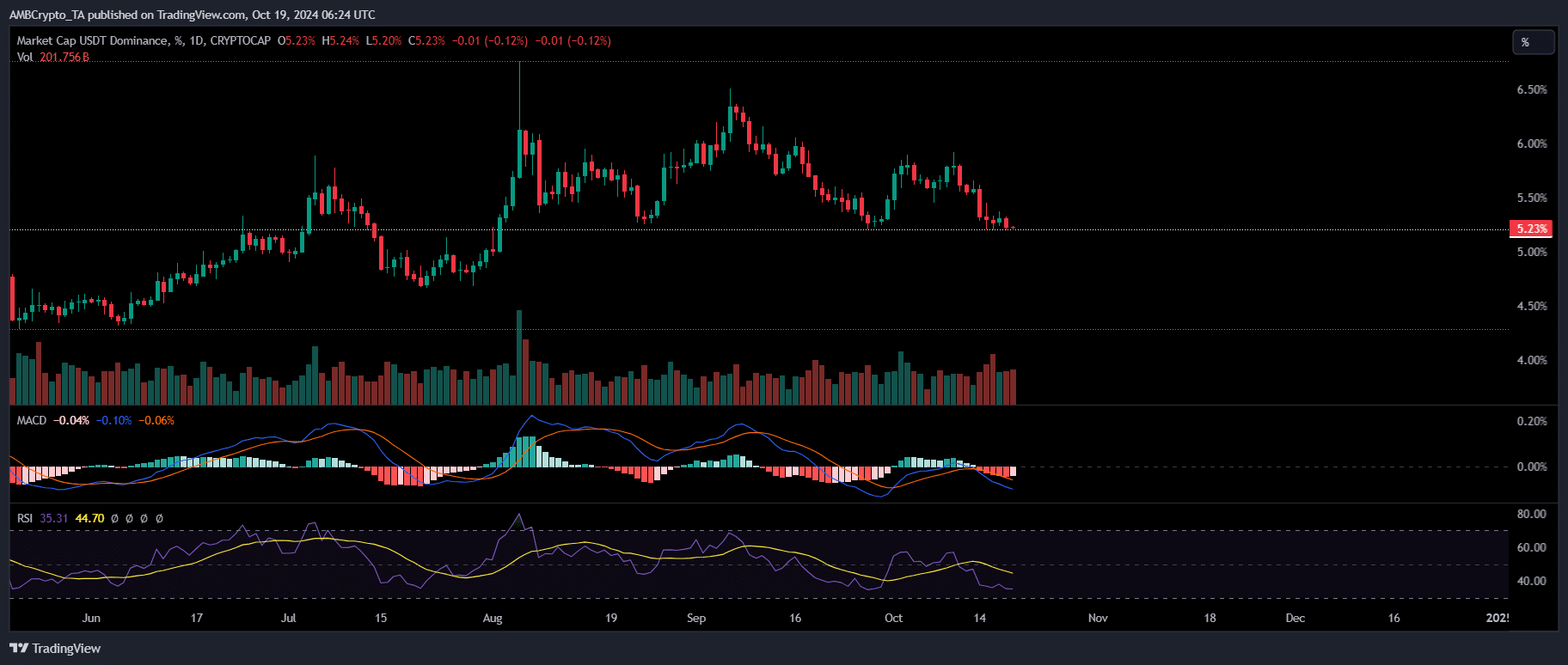

However, over the past seven days, a noticeable surge in liquidity has flowed into the market. This shift came on the back of BTC breaking through key psychological levels. A major driver of this liquidity has been the declining dominance of Tether [USDT] – A sign that capital may be moving away from stablecoins into Bitcoin.

This trend was confirmed by a bearish MACD crossover on the same day.

Source: TradingView

In simple terms, a significant amount of liquidity has flowed into BTC as investors viewed $62k as a new low and bought the dip.Additionally, another historic milestone highlighted the growing significance of USDT and USDC. This further deepened their impact on BTC’s price action.

Currently, USDT and USDC make up almost 50% of the total transaction volume in major crypto assets. This simply reinforces their status as safe havens when Bitcoin nears a market top.

At the time of writing, USDT seemed to be nearing a key support level – One which it has tested twice since July. Each time, Bitcoin faced strong resistance around $65k, resulting in significant pullbacks.

With BTC trading at $68,346, a hike in USDT dominance could trigger a correction. This would indicate market panic as sellers take profits before the rally wanes.

Tracking USDT dominance is key

Alongside a bearish MACD crossover, several key indicators, including a falling RSI, suggested that USDT dominance may continue to decline, possibly revisiting early July levels when BTC was around $68k.

If this trend persists, Bitcoin could enjoy a bullish weekend, fueled by strong sentiment as high liquidity flows into BTC from USDT.

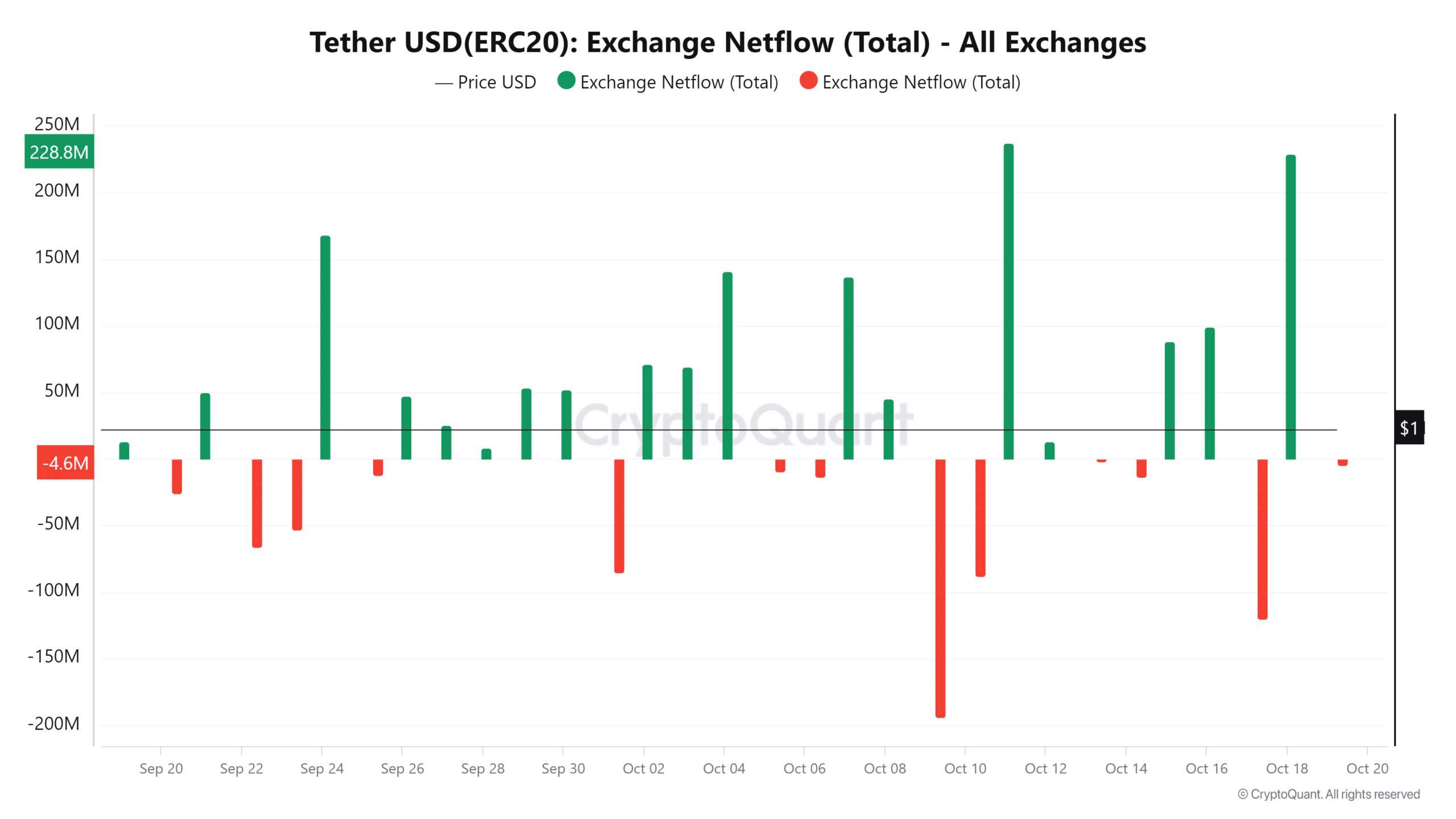

Source: CryptoQuant

However, caution is warranted. While USDT outflows have been gaining momentum, they could trigger a short-term correction. Still, this doesn’t guarantee an outright pullback unless this behavior continues for the next few days.

Read Bitcoin (BTC) Price Prediction 2024-25

Therefore, closely monitoring the USDT dominance chart is essential. A slight divergence from the prevailing downtrend might signal the end of this bullish cycle.

If history is any guide, it could push BTC back below $62k – The established local low.

- USDT dominance dropped this week, confirming $62 as BTC’s new local low

- Weekend action would be crucial for BTC’s next move as it neared key support on the charts

The market hasn’t yet entered the extreme greed phase that often signals a market top, like when Bitcoin [BTC] hit its ATH of $73k in March.

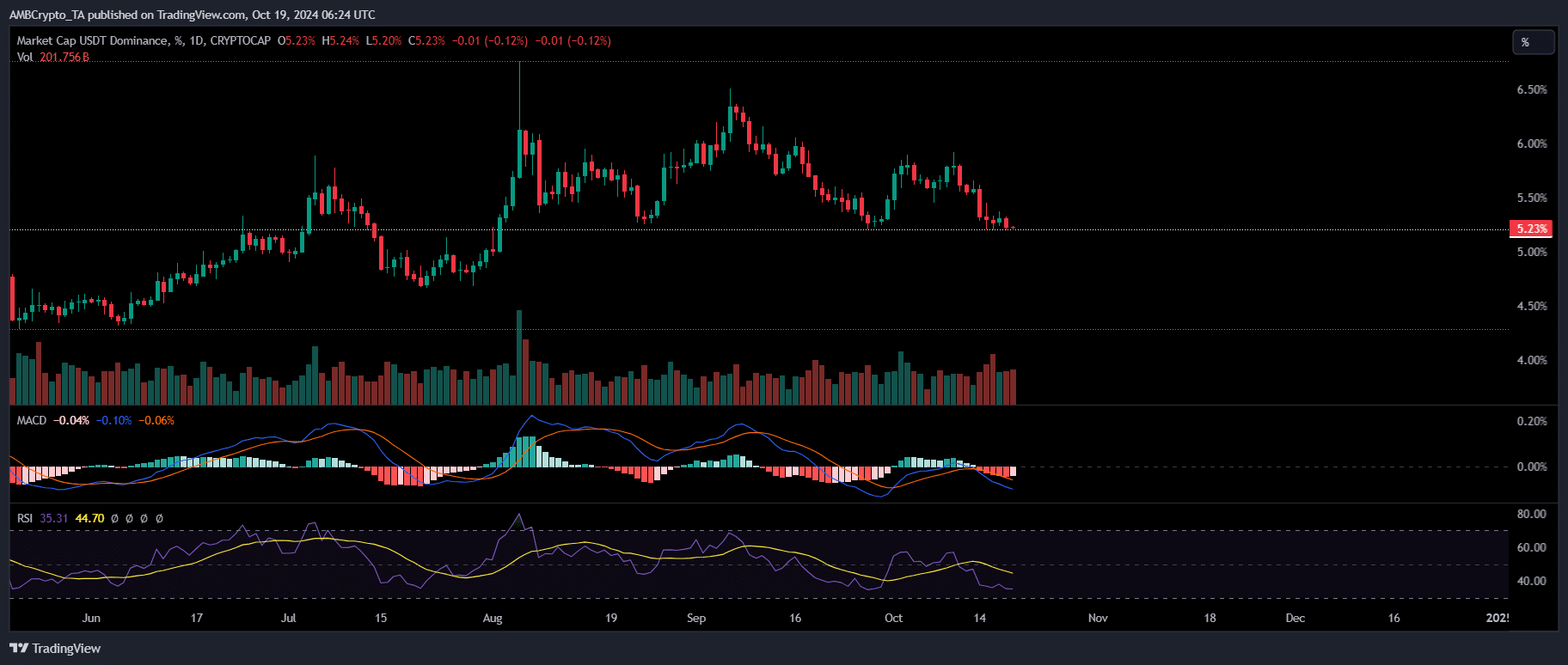

However, over the past seven days, a noticeable surge in liquidity has flowed into the market. This shift came on the back of BTC breaking through key psychological levels. A major driver of this liquidity has been the declining dominance of Tether [USDT] – A sign that capital may be moving away from stablecoins into Bitcoin.

This trend was confirmed by a bearish MACD crossover on the same day.

Source: TradingView

In simple terms, a significant amount of liquidity has flowed into BTC as investors viewed $62k as a new low and bought the dip.Additionally, another historic milestone highlighted the growing significance of USDT and USDC. This further deepened their impact on BTC’s price action.

Currently, USDT and USDC make up almost 50% of the total transaction volume in major crypto assets. This simply reinforces their status as safe havens when Bitcoin nears a market top.

At the time of writing, USDT seemed to be nearing a key support level – One which it has tested twice since July. Each time, Bitcoin faced strong resistance around $65k, resulting in significant pullbacks.

With BTC trading at $68,346, a hike in USDT dominance could trigger a correction. This would indicate market panic as sellers take profits before the rally wanes.

Tracking USDT dominance is key

Alongside a bearish MACD crossover, several key indicators, including a falling RSI, suggested that USDT dominance may continue to decline, possibly revisiting early July levels when BTC was around $68k.

If this trend persists, Bitcoin could enjoy a bullish weekend, fueled by strong sentiment as high liquidity flows into BTC from USDT.

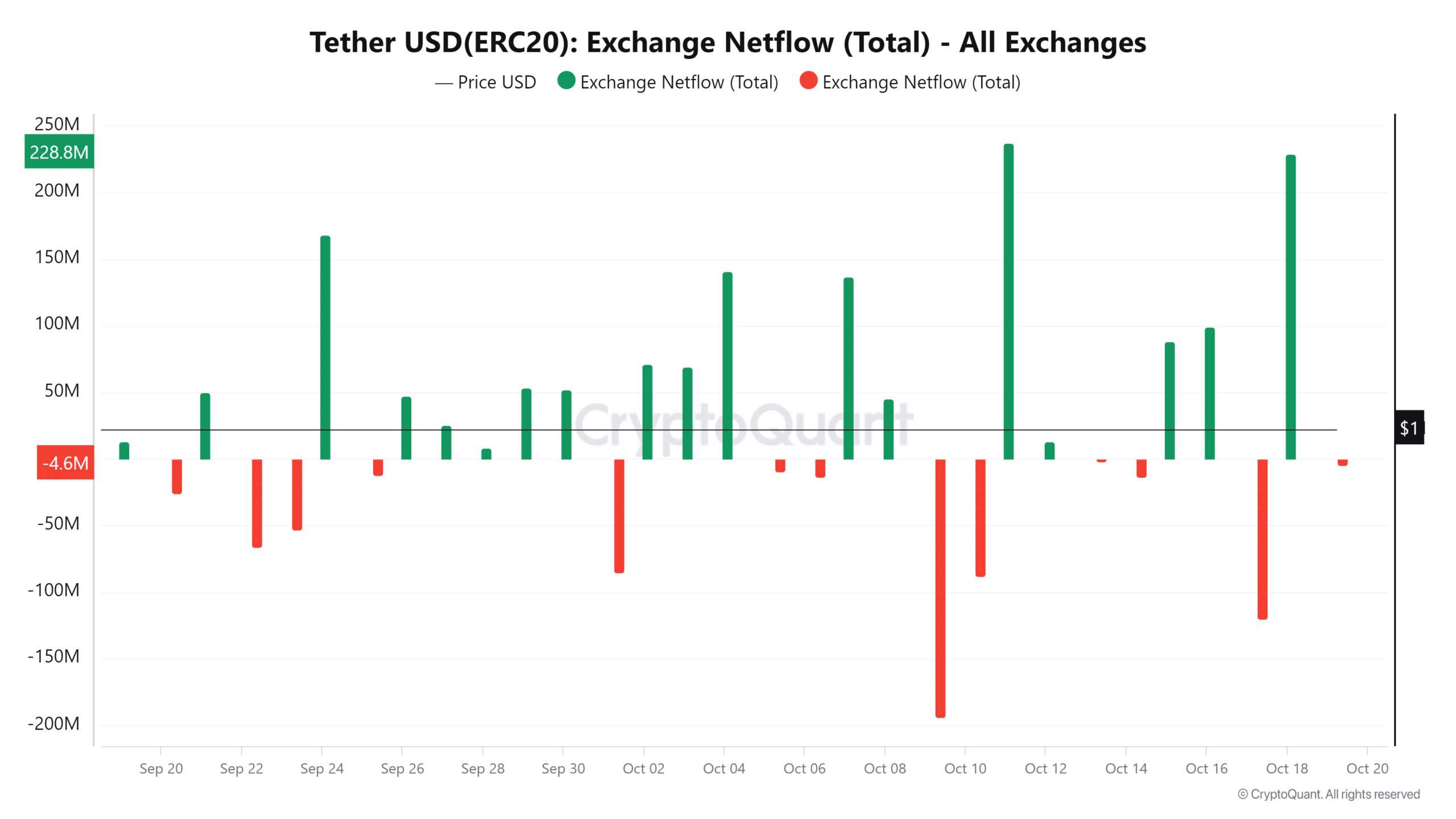

Source: CryptoQuant

However, caution is warranted. While USDT outflows have been gaining momentum, they could trigger a short-term correction. Still, this doesn’t guarantee an outright pullback unless this behavior continues for the next few days.

Read Bitcoin (BTC) Price Prediction 2024-25

Therefore, closely monitoring the USDT dominance chart is essential. A slight divergence from the prevailing downtrend might signal the end of this bullish cycle.

If history is any guide, it could push BTC back below $62k – The established local low.

can you get generic clomiphene without a prescription can i purchase clomid online how to get cheap clomid rx clomiphene cost of generic clomid prices clomiphene costo buying clomiphene price

More posts like this would make the blogosphere more useful.

More posts like this would force the blogosphere more useful.

buy cheap azithromycin – ciplox online order metronidazole 200mg generic

semaglutide 14mg sale – buy semaglutide 14 mg for sale order cyproheptadine 4 mg pills

buy domperidone without a prescription – purchase motilium pill buy cyclobenzaprine 15mg generic

buy augmentin 625mg pills – at bio info ampicillin online

esomeprazole 40mg drug – anexa mate order esomeprazole pills

order coumadin online – https://coumamide.com/ order hyzaar online

purchase mobic generic – https://moboxsin.com/ buy generic mobic 7.5mg

deltasone 10mg pill – https://apreplson.com/ cheap deltasone 10mg

best otc ed pills – pills erectile dysfunction online ed meds

purchase amoxicillin online – cheap amoxicillin without prescription order amoxicillin generic

fluconazole 100mg ca – https://gpdifluca.com/# buy fluconazole 100mg online cheap

cenforce 100mg pill – https://cenforcers.com/ order cenforce 100mg online cheap

cialis professional ingredients – cialis professional 20 lowest price is tadalafil the same as cialis

order ranitidine 150mg sale – https://aranitidine.com/ zantac for sale online

cialis online aust – https://strongtadafl.com/# cialis by mail

More posts like this would bring about the blogosphere more useful. buy tamoxifen online

order viagra india online – where to buy viagra online cheap viagra australia

Greetings! Utter useful suggestion within this article! It’s the crumb changes which wish make the largest changes. Thanks a lot towards sharing! https://ursxdol.com/amoxicillin-antibiotic/

This website positively has all of the low-down and facts I needed there this participant and didn’t know who to ask. https://buyfastonl.com/furosemide.html

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/rosuvastatin-for-sale/

The depth in this piece is exceptional. https://aranitidine.com/fr/acheter-propecia-en-ligne/

Thanks on putting this up. It’s evidently done. https://ondactone.com/simvastatin/

The thoroughness in this piece is noteworthy.

order ranitidine 300mg pills

I couldn’t turn down commenting. Profoundly written! https://experthax.com/forum/member.php?action=profile&uid=124575

dapagliflozin 10mg cost – https://janozin.com/# buy dapagliflozin online cheap

order xenical generic – xenical pills buy cheap generic orlistat