- This was the largest spike in the movement of BTC’s dormant supply in more than two years.

- Whales continued to add Bitcoin exposure to their portfolios.

Bitcoin [BTC] consolidated in the $64k — $67k range over the week, facing a stiff resistance at $68k.

At press time, the king coin was exchanging hands at $64.14k, 12% lower than the all-time high (ATH) hit earlier in the month, according to CoinMarketCap.

What to expect next?

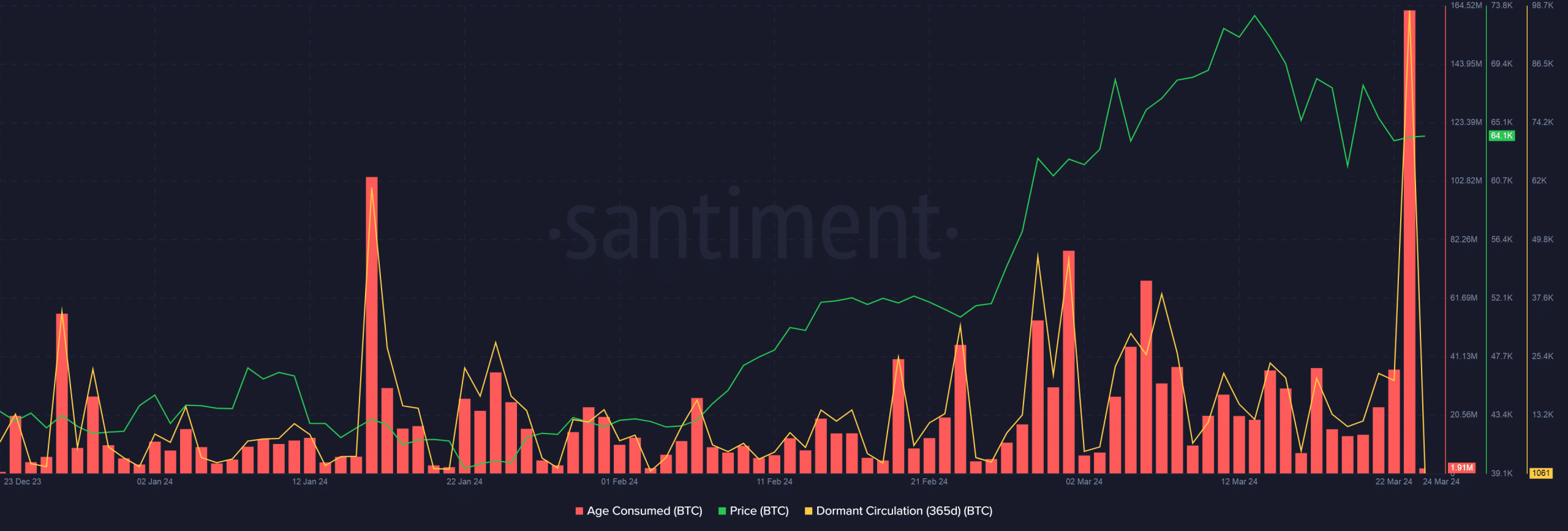

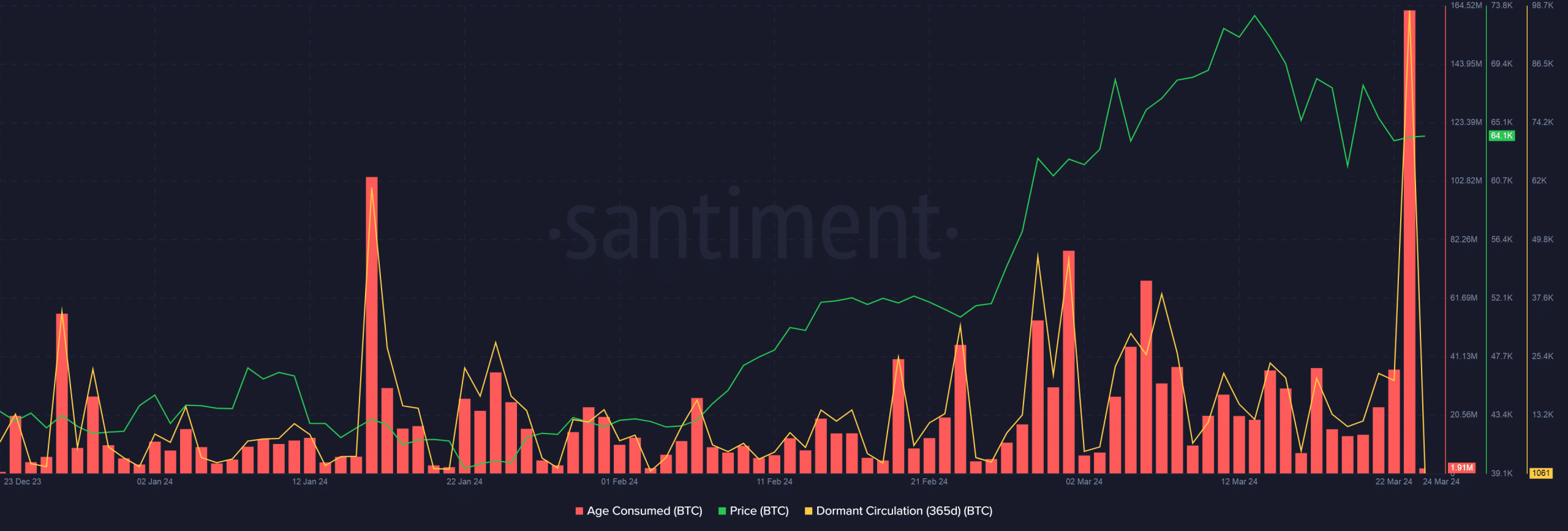

However, days ahead could witness a significant bout of volatility. According to AMBCrypto’s analysis of Santiment’s data, many previously inactive BTCs started moving between addresses on the 23rd of March.

In fact, this was the largest spike in the movement of BTC’s dormant supply in more than two years.

Source: Santiment

For much of 2023, dormant supply across major age bands hit new highs, signaling a market strategy of caution and HODLing.

But with Bitcoin’s price zooming to new highs in 2024, these long-term holders began chasing profits, freeing up more Bitcoins for active trading. Typically, fall in dormant supply precedes volatility and price surges.

Current market structure supports price increase

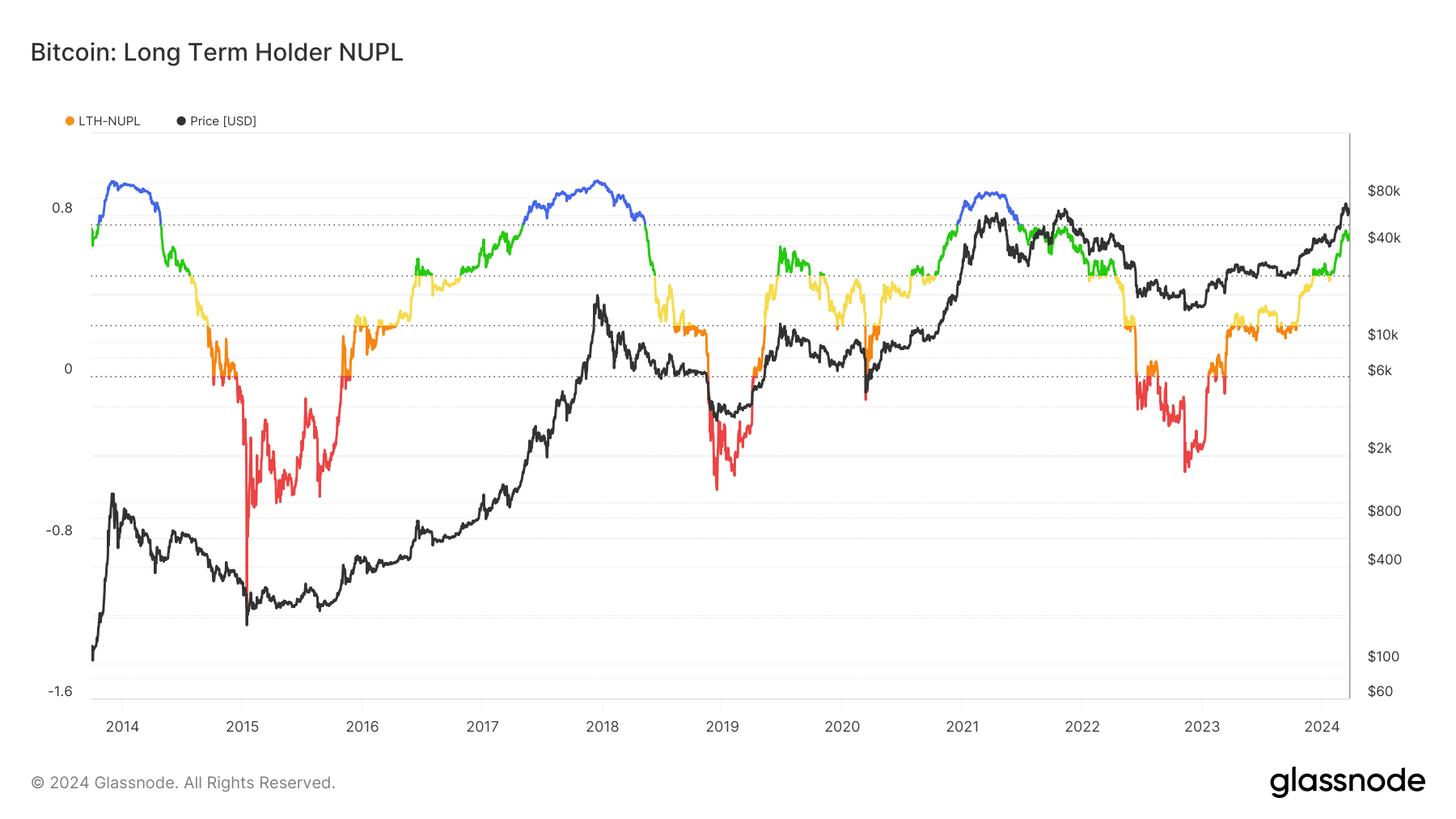

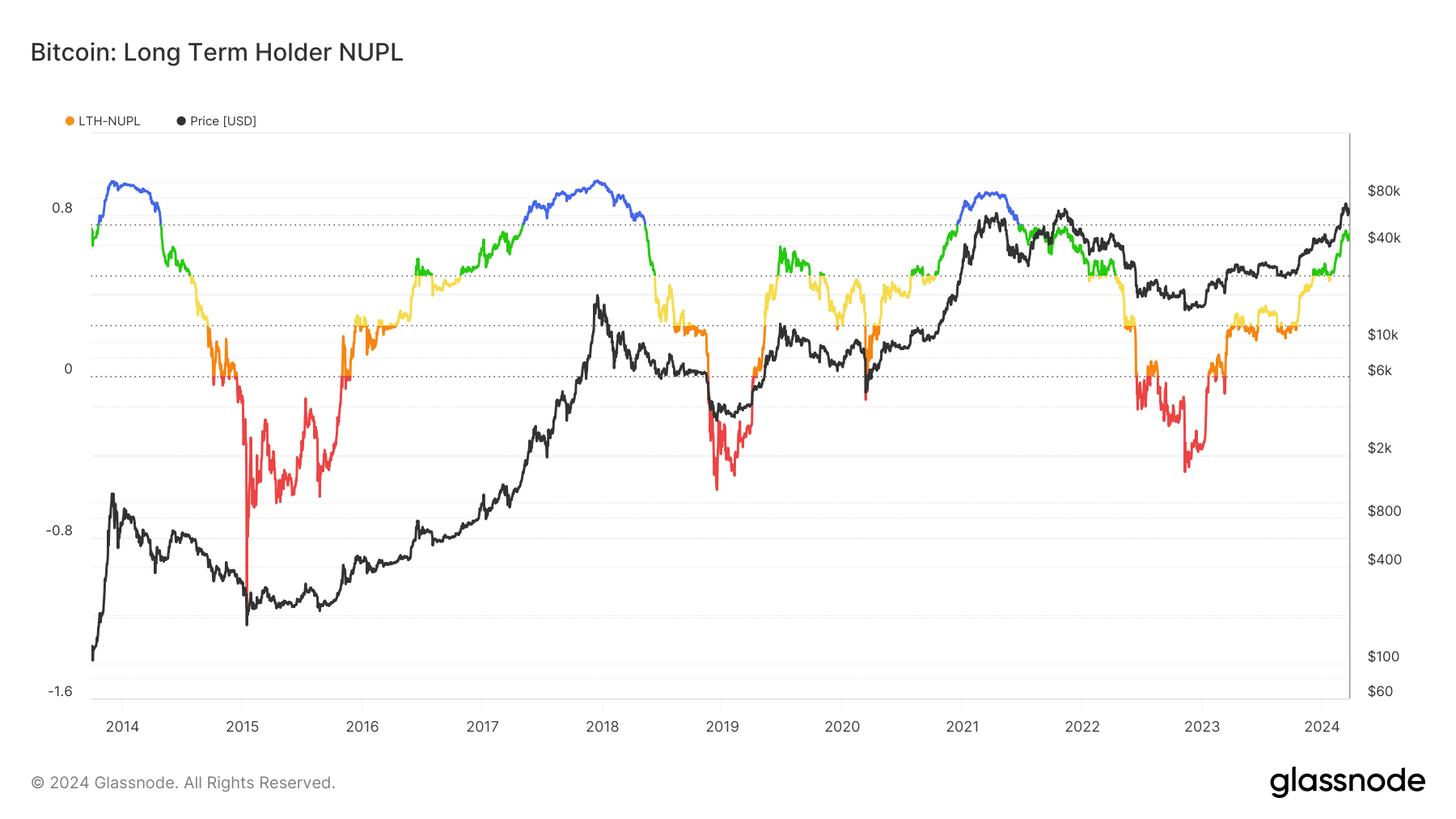

Notably, most of the long-term holders were in a state of profit, AMBCrypto analyzed using Glassnode’s Net Unrealized Profit/Loss metric.

This market phase, dubbed as one of belief, has historically aided further price increases, as shown below. The market top, generally associated with euphoria and greed, was still a long way off.

Source: Glassnode

Whales continue to stockpile

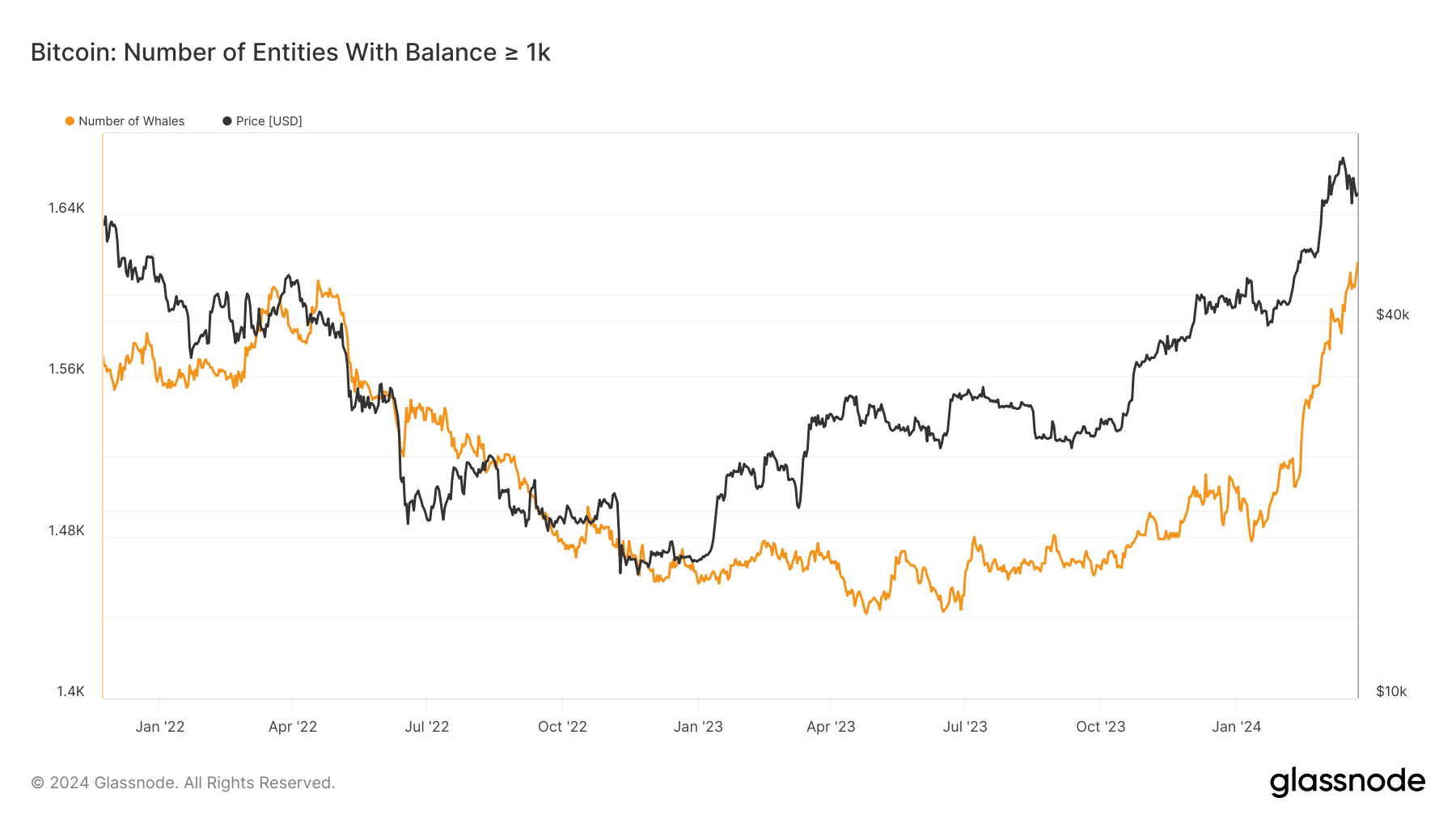

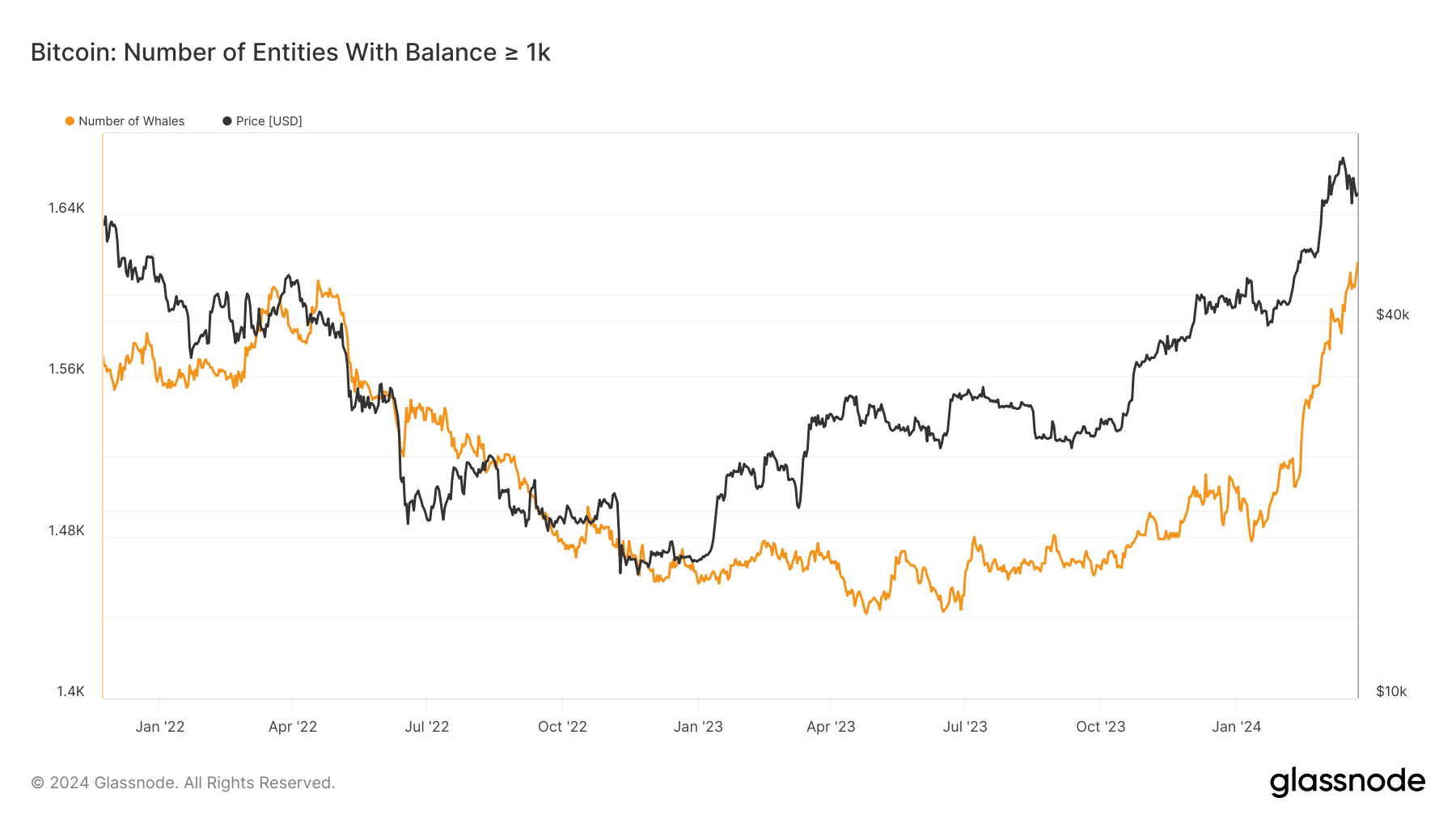

Meanwhile, whales were making full use of the suppressed market to add more Bitcoin exposure to their portfolios.

The number of unique entities holding at least 1k coins jumped to 1,616 on the 23rd of March, the highest since February 2021.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Interestingly, the accumulation didn’t slow down despite Bitcoin’s sharp correction from its peak, suggesting a belief in the crypto’s long-term price appreciation.

Source: Glassnode

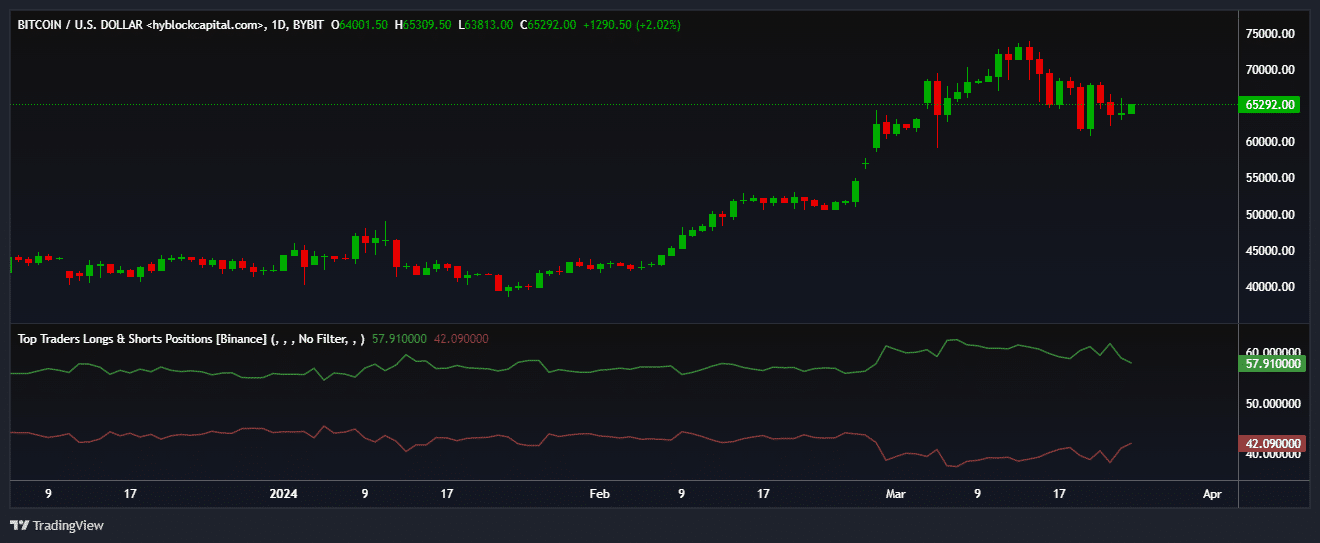

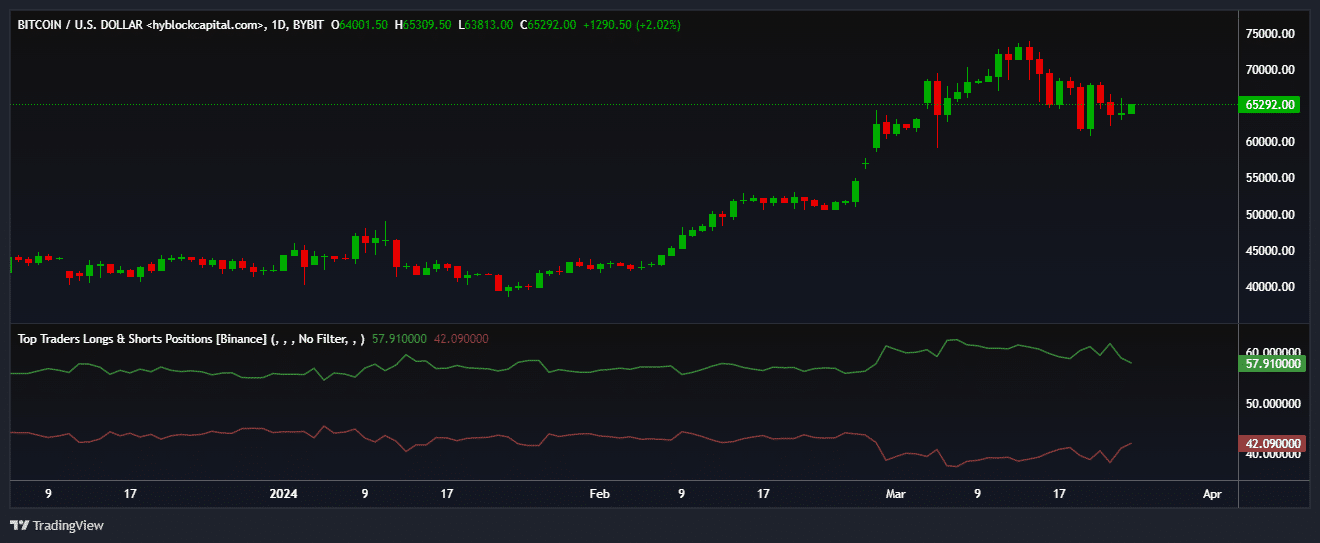

Whales exhibited their optimism in the derivatives markets as well. At press time, nearly 58% of all whale positions on Binance were long on Bitcoin, as per Hyblock Capital.

Source: Hyblock Capital

- This was the largest spike in the movement of BTC’s dormant supply in more than two years.

- Whales continued to add Bitcoin exposure to their portfolios.

Bitcoin [BTC] consolidated in the $64k — $67k range over the week, facing a stiff resistance at $68k.

At press time, the king coin was exchanging hands at $64.14k, 12% lower than the all-time high (ATH) hit earlier in the month, according to CoinMarketCap.

What to expect next?

However, days ahead could witness a significant bout of volatility. According to AMBCrypto’s analysis of Santiment’s data, many previously inactive BTCs started moving between addresses on the 23rd of March.

In fact, this was the largest spike in the movement of BTC’s dormant supply in more than two years.

Source: Santiment

For much of 2023, dormant supply across major age bands hit new highs, signaling a market strategy of caution and HODLing.

But with Bitcoin’s price zooming to new highs in 2024, these long-term holders began chasing profits, freeing up more Bitcoins for active trading. Typically, fall in dormant supply precedes volatility and price surges.

Current market structure supports price increase

Notably, most of the long-term holders were in a state of profit, AMBCrypto analyzed using Glassnode’s Net Unrealized Profit/Loss metric.

This market phase, dubbed as one of belief, has historically aided further price increases, as shown below. The market top, generally associated with euphoria and greed, was still a long way off.

Source: Glassnode

Whales continue to stockpile

Meanwhile, whales were making full use of the suppressed market to add more Bitcoin exposure to their portfolios.

The number of unique entities holding at least 1k coins jumped to 1,616 on the 23rd of March, the highest since February 2021.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Interestingly, the accumulation didn’t slow down despite Bitcoin’s sharp correction from its peak, suggesting a belief in the crypto’s long-term price appreciation.

Source: Glassnode

Whales exhibited their optimism in the derivatives markets as well. At press time, nearly 58% of all whale positions on Binance were long on Bitcoin, as per Hyblock Capital.

Source: Hyblock Capital

where can i buy clomid pill can you get generic clomid pills buy generic clomid no prescription can you buy cheap clomid without rx where can i get cheap clomid without dr prescription where can i buy clomiphene tablets where to buy clomiphene

Proof blog you possess here.. It’s intricate to assign strong worth script like yours these days. I honestly respect individuals like you! Take guardianship!!

More posts like this would make the online play more useful.

zithromax drug – ofloxacin 200mg generic buy metronidazole 200mg generic

buy rybelsus 14 mg online cheap – order rybelsus 14mg sale periactin usa

purchase motilium – generic flexeril 15mg brand flexeril 15mg

buy inderal 20mg without prescription – buy generic plavix over the counter buy methotrexate 10mg online

brand amoxil – purchase combivent pill purchase combivent pills

order zithromax 250mg online – purchase zithromax for sale order nebivolol 20mg pill

buy generic augmentin for sale – https://atbioinfo.com/ cost ampicillin

buy nexium online – anexa mate esomeprazole 20mg ca

order medex generic – https://coumamide.com/ cozaar oral

buy meloxicam 15mg without prescription – https://moboxsin.com/ mobic online order

deltasone cost – https://apreplson.com/ buy deltasone 10mg online

cheapest ed pills – fastedtotake the blue pill ed

buy generic amoxil – comba moxi amoxicillin tablets

forcan buy online – purchase diflucan pill forcan ca

buy generic lexapro over the counter – anxiety pro escitalopram 10mg us

cenforce 100mg usa – https://cenforcers.com/ order cenforce 50mg online

how long does it take cialis to start working – cialis priligy online australia cialis coupon walgreens

cialis generic 20 mg 30 pills – https://strongtadafl.com/ where can i buy tadalafil online