- Selling sentiment has been dominant among U.S investors

- Market indicators hinted at a sustained price drop in the short term

Bitcoin [BTC] has been on a rollercoaster ride for a couple of weeks now. This was best evidenced by BTC successfully crossing $64k, before dropping under $60k within just a few days.

While the coin’s volatility has remained high, institutional investors are considering stockpiling the cryptocurrency. Will this help BTC turn bullish in September?

Are institutional investors accumulating Bitcoin?

Bitcoin witnessed a +9% price correction last month. At the time of writing, it was trading at $58,184.19 with a market capitalization of over $1.13 trillion.

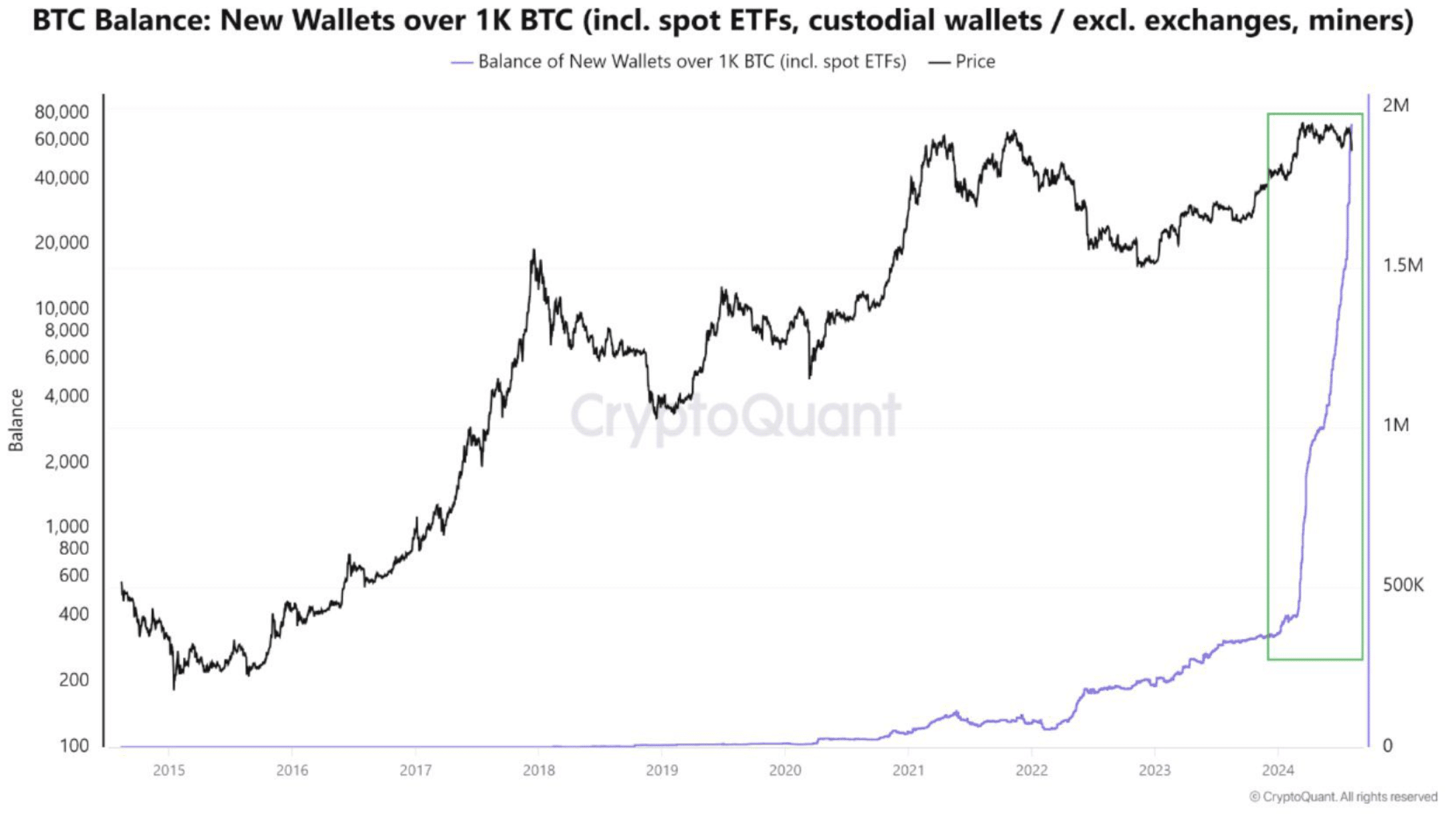

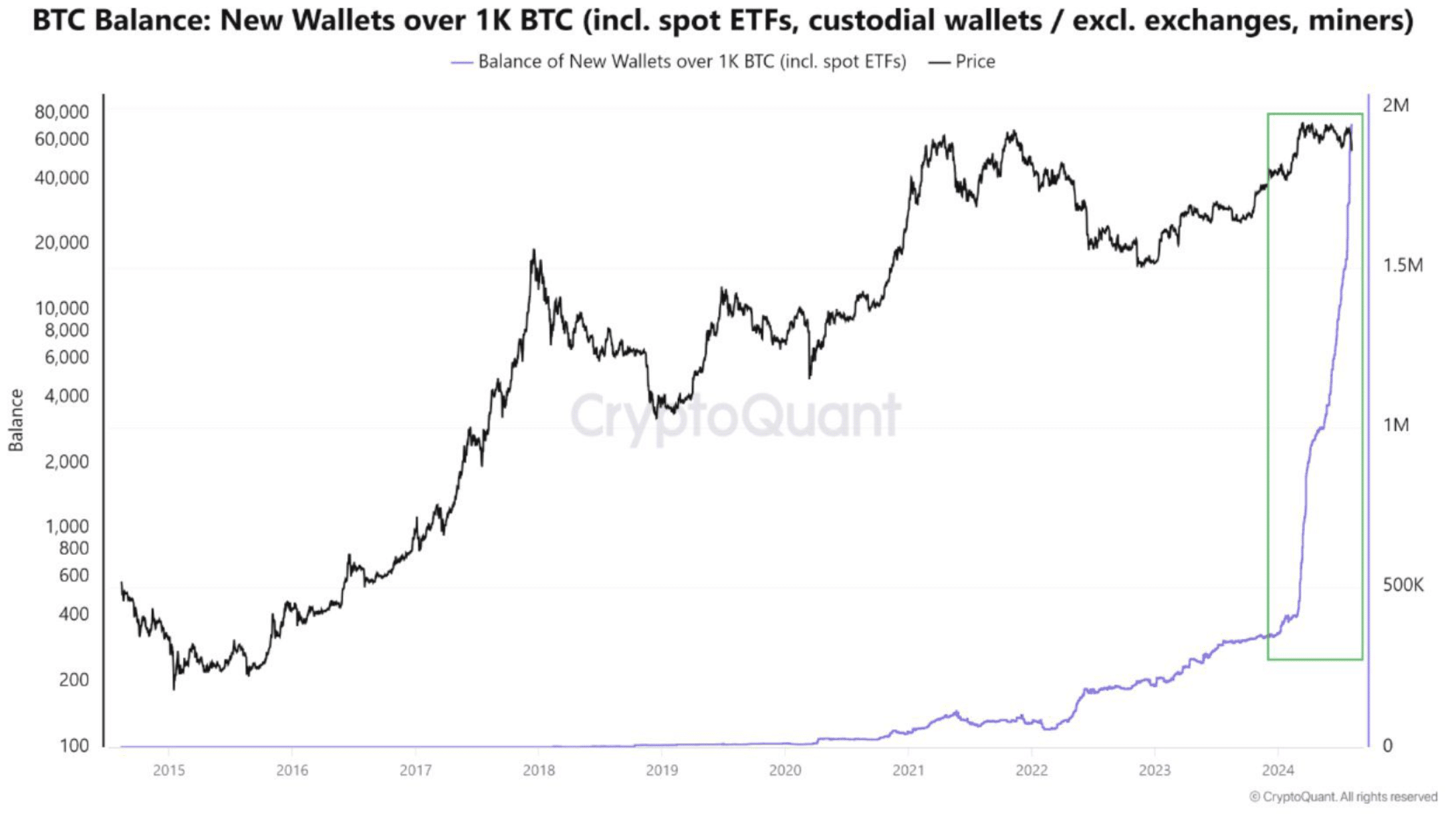

In the meantime, Vivek, a popular crypto influencer, recently shared a tweet highlighting an interesting development. According to his analysis, the number of BTC balances on new addresses with more than 1k BTC increased sharply over the last several months. This clearly suggested that institutional investors have been showing confidence in BTC. It also means they expect the king coin’s price to surge in the coming weeks or months.

Since a new month is already upon us, AMBCrypto took a closer look at Bitcoin’s state. This, in an attempt to see whether institutional investors’ confidence in BTC would pay off this month.

Source: X

How BTC’s September might look like

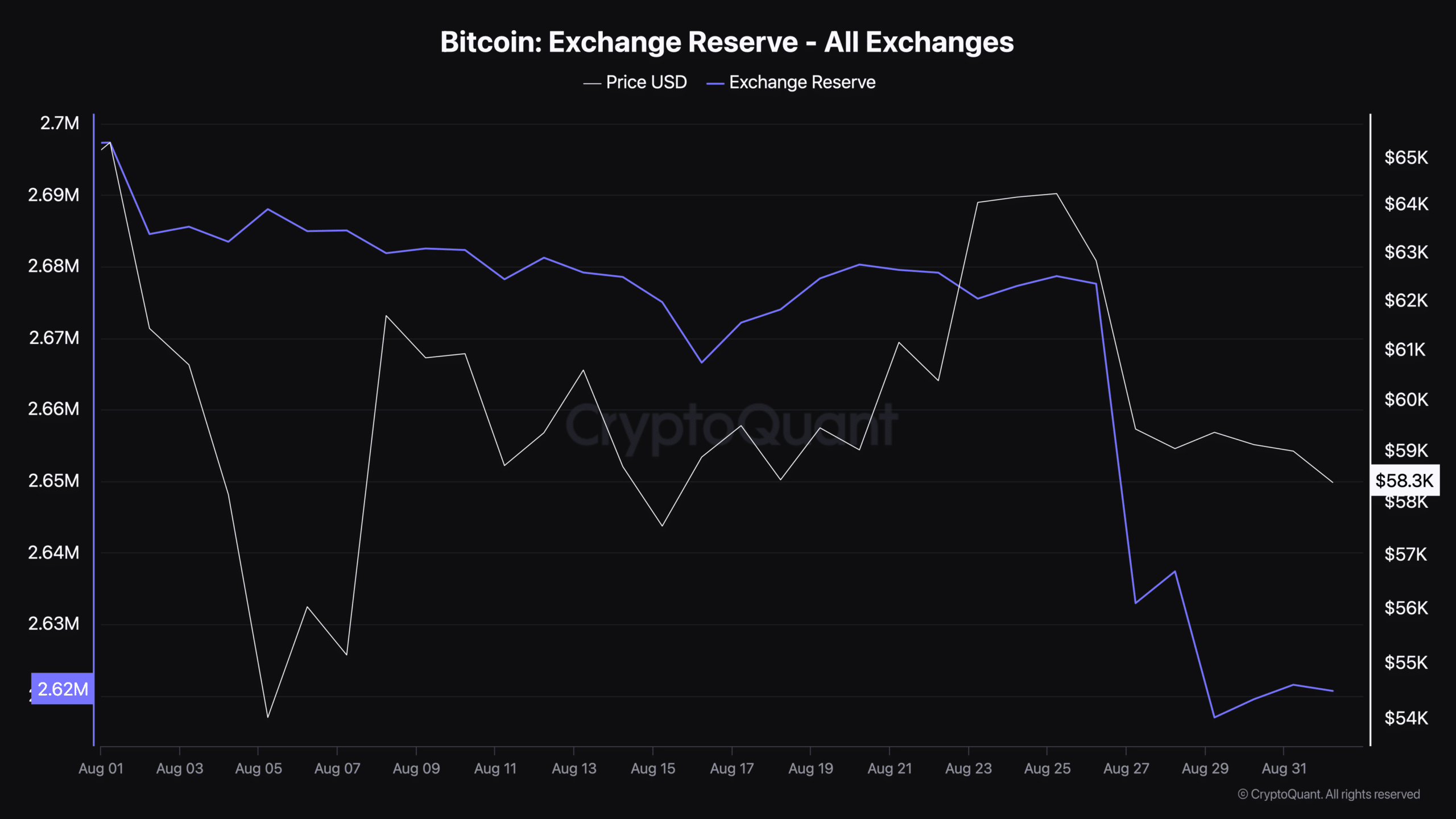

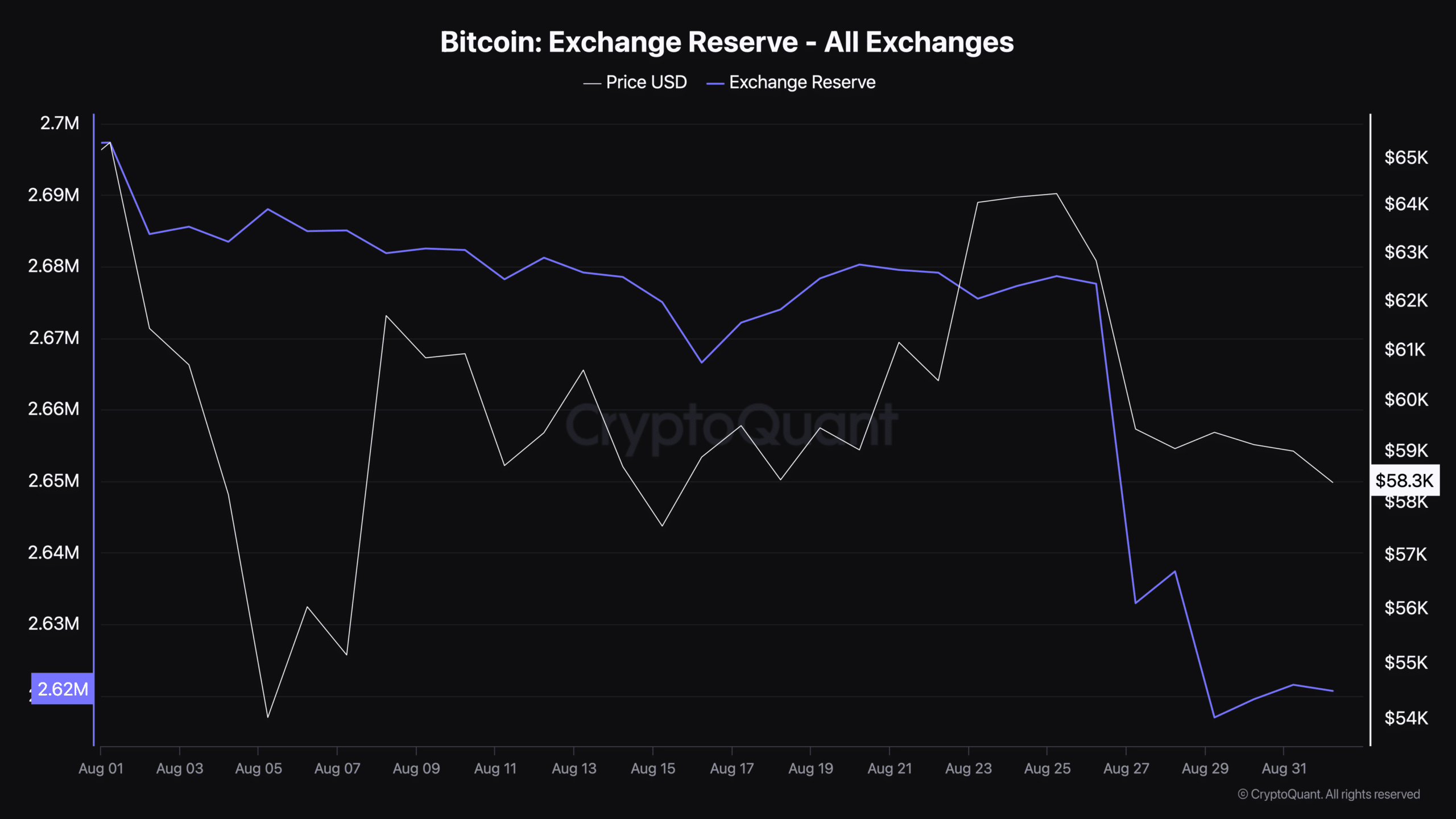

AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s exchange reserves dropped sharply on 27 August. This clearly suggested that buying pressure on the coin was high, which often results in price hikes.

Source: CryptoQuant

However, not everything seemed to be in the coin’s favor. For example, the Coinbase premium turned green, meaning that selling sentiment was strong among U.S investors. On top of that, the Funds premium was also red. This indicated that investors in funds and trusts, including Grayscale, have relatively weak buying sentiment.

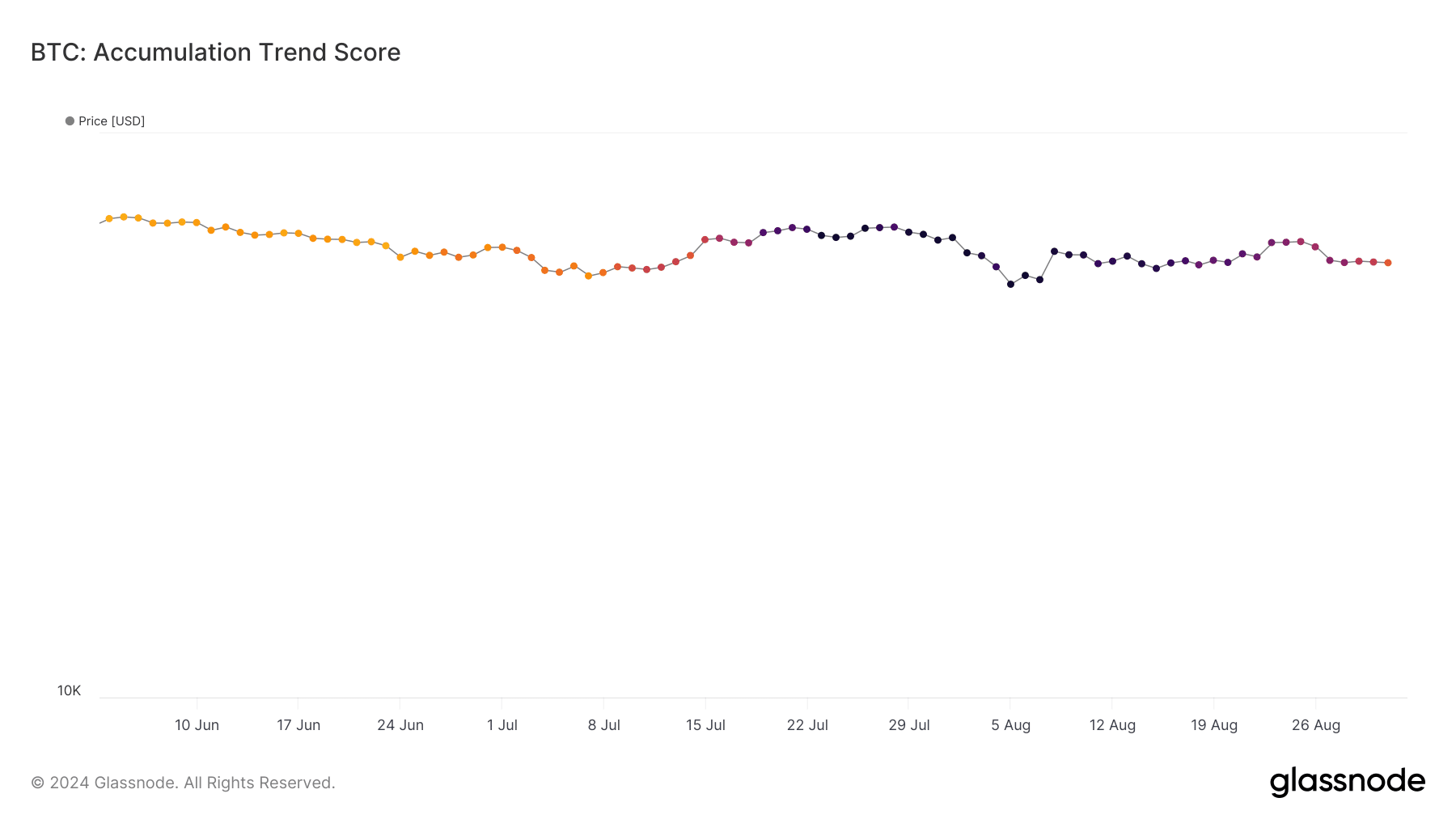

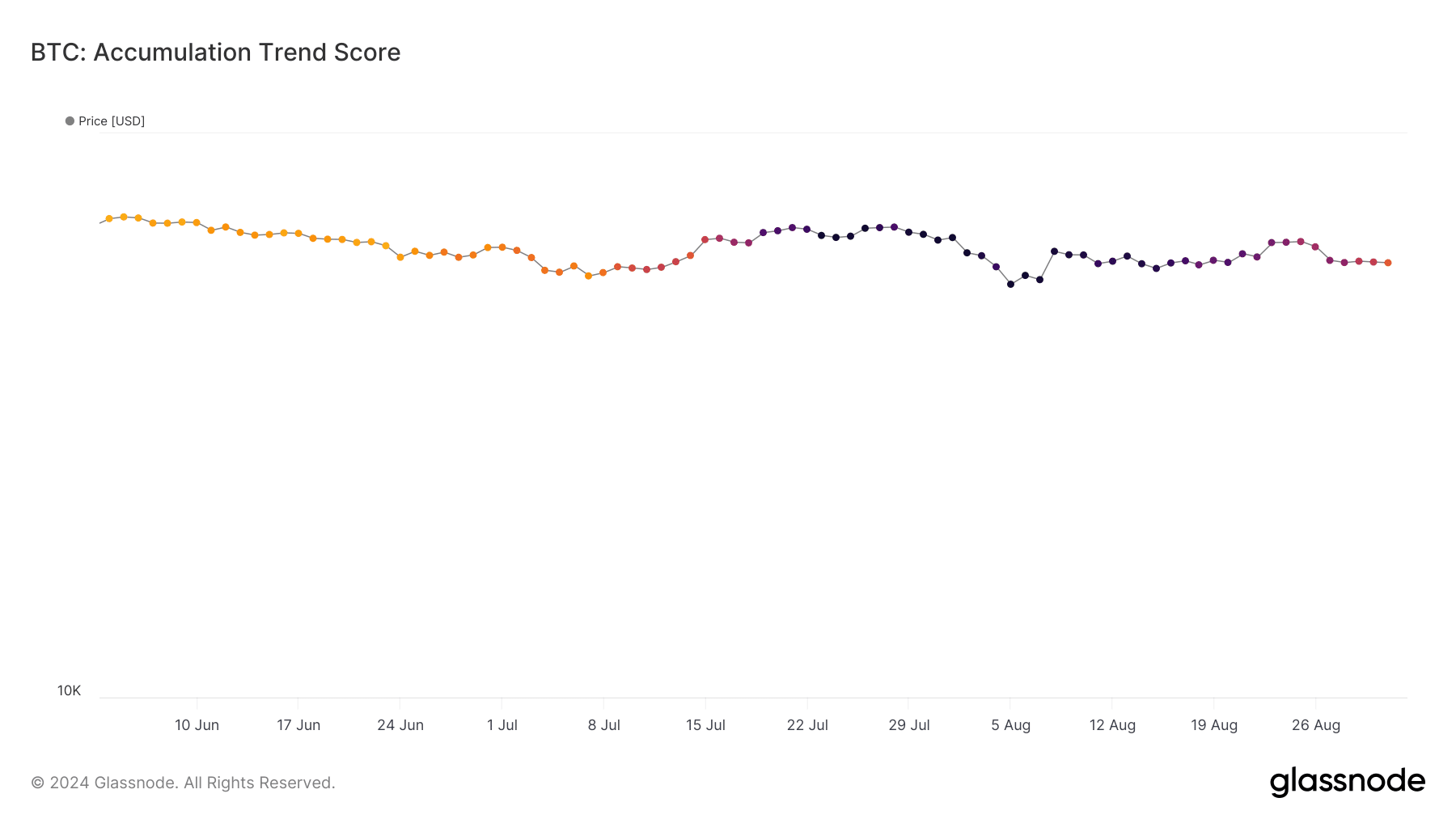

Apart from this, AMBCrypto’s assessment of Glassnode’s data revealed that at press time, Bitcoin’s accumulation trend score had a value of 0.35. For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 0 indicates the reluctance of investors to accumulate. On the other hand, a value closer to 1 hints at a hike in buying pressure. Since at press time the value was close to 0, it seemed that buying pressure was diminishing.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024–2025

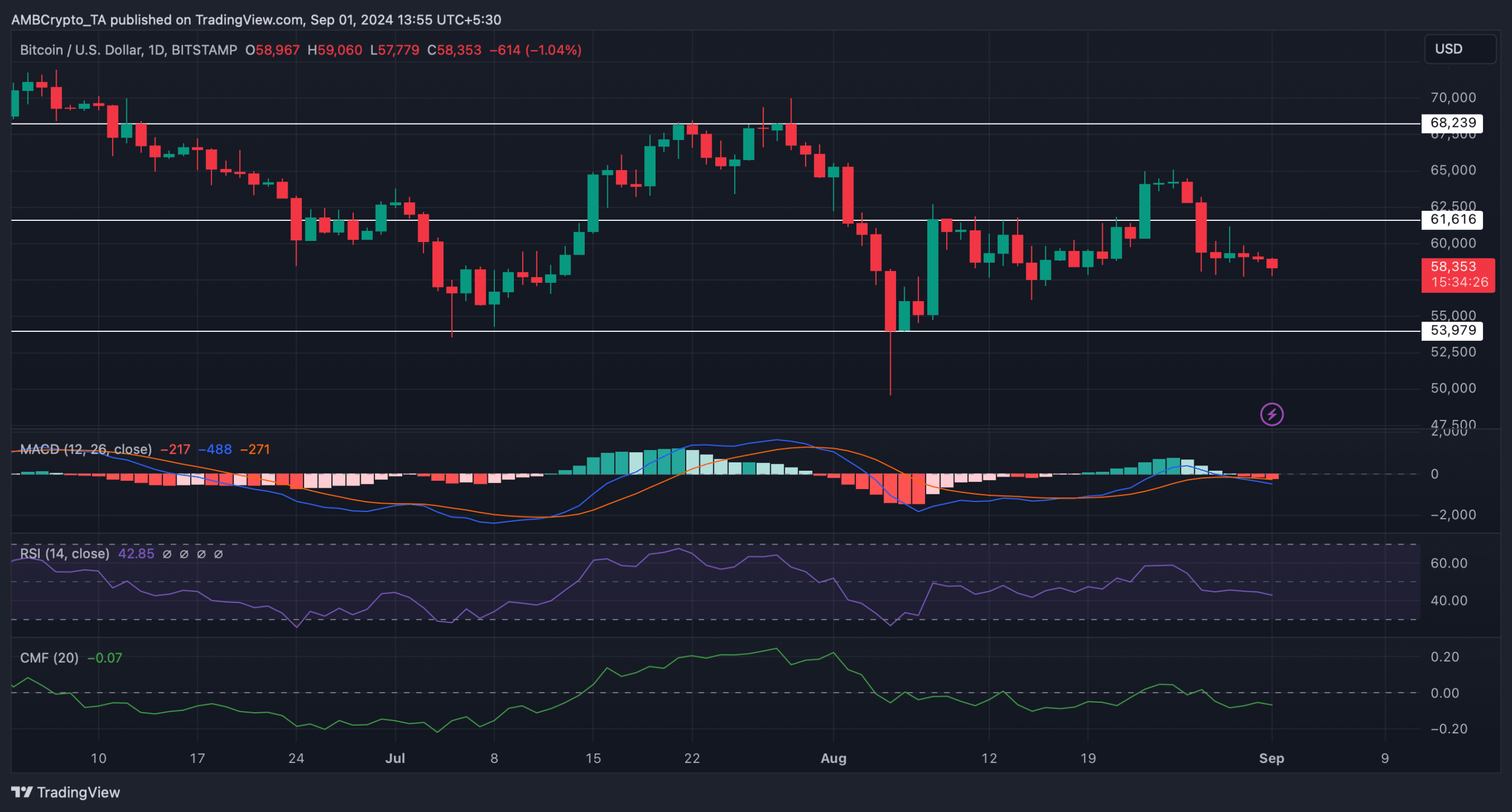

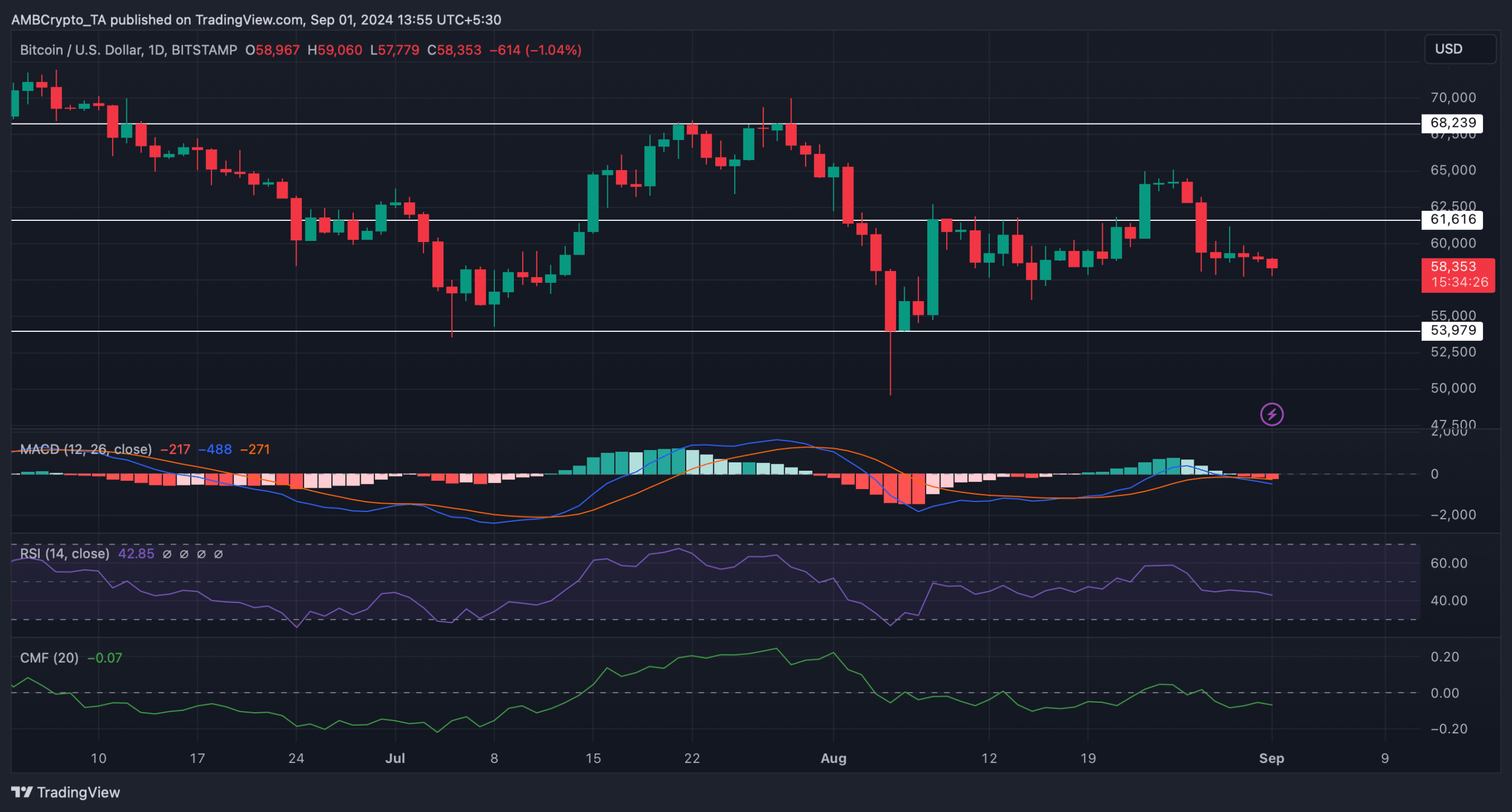

Finally, AMBCrypto analyzed BTC’s daily chart to better understand what to expect from it in September.

The technical indicator MACD displayed a bearish crossover. Both its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) registered downticks too. Together, these indicators suggested that investors might have to wait longer in September to see Bitcoin turn bullish.

Source: TradingView

- Selling sentiment has been dominant among U.S investors

- Market indicators hinted at a sustained price drop in the short term

Bitcoin [BTC] has been on a rollercoaster ride for a couple of weeks now. This was best evidenced by BTC successfully crossing $64k, before dropping under $60k within just a few days.

While the coin’s volatility has remained high, institutional investors are considering stockpiling the cryptocurrency. Will this help BTC turn bullish in September?

Are institutional investors accumulating Bitcoin?

Bitcoin witnessed a +9% price correction last month. At the time of writing, it was trading at $58,184.19 with a market capitalization of over $1.13 trillion.

In the meantime, Vivek, a popular crypto influencer, recently shared a tweet highlighting an interesting development. According to his analysis, the number of BTC balances on new addresses with more than 1k BTC increased sharply over the last several months. This clearly suggested that institutional investors have been showing confidence in BTC. It also means they expect the king coin’s price to surge in the coming weeks or months.

Since a new month is already upon us, AMBCrypto took a closer look at Bitcoin’s state. This, in an attempt to see whether institutional investors’ confidence in BTC would pay off this month.

Source: X

How BTC’s September might look like

AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s exchange reserves dropped sharply on 27 August. This clearly suggested that buying pressure on the coin was high, which often results in price hikes.

Source: CryptoQuant

However, not everything seemed to be in the coin’s favor. For example, the Coinbase premium turned green, meaning that selling sentiment was strong among U.S investors. On top of that, the Funds premium was also red. This indicated that investors in funds and trusts, including Grayscale, have relatively weak buying sentiment.

Apart from this, AMBCrypto’s assessment of Glassnode’s data revealed that at press time, Bitcoin’s accumulation trend score had a value of 0.35. For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 0 indicates the reluctance of investors to accumulate. On the other hand, a value closer to 1 hints at a hike in buying pressure. Since at press time the value was close to 0, it seemed that buying pressure was diminishing.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Finally, AMBCrypto analyzed BTC’s daily chart to better understand what to expect from it in September.

The technical indicator MACD displayed a bearish crossover. Both its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) registered downticks too. Together, these indicators suggested that investors might have to wait longer in September to see Bitcoin turn bullish.

Source: TradingView

I simply could not go away your web site prior to suggesting that I really enjoyed the standard info a person supply on your guests Is going to be back incessantly to investigate crosscheck new posts

Magnificent beat I would like to apprentice while you amend your site how can i subscribe for a blog web site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear idea

clomiphene for men clomiphene prices in south africa can i buy clomid without dr prescription clomid medication uk cheap clomiphene without insurance can i buy generic clomiphene no prescription buy generic clomiphene without prescription

This is the make of enter I turn up helpful.

This is the big-hearted of literature I in fact appreciate.

buy zithromax 500mg online – tetracycline 500mg pill metronidazole over the counter

buy semaglutide 14mg sale – order semaglutide 14 mg online cheap order periactin 4 mg generic

domperidone 10mg drug – buy tetracycline paypal where to buy flexeril without a prescription

generic augmentin 1000mg – at bio info buy acillin

nexium 20mg capsules – https://anexamate.com/ order esomeprazole 20mg

coumadin cost – https://coumamide.com/ buy cozaar 50mg without prescription

buy meloxicam pills – https://moboxsin.com/ cheap mobic

prednisone 10mg without prescription – https://apreplson.com/ deltasone 5mg price

mens ed pills – buy ed medications the best ed pill

buy amoxil for sale – https://combamoxi.com/ where to buy amoxicillin without a prescription

fluconazole 200mg uk – on this site order diflucan 200mg without prescription