- Key events that could impact BTC’s price are coming up this week.

- BTC has lost some gains from its previous trading session.

Bitcoin [BTC] has encountered volatile price movements in recent days, exemplified by a notable over 3% decline on the 10th of May, which drove its value down to $60,000.

However, indications suggest that these choppy fluctuations may persist, largely influenced by the impending Federal Reserve meetings.

Bitcoin investors await BLS events outcomes

The upcoming events scheduled by the US Bureau of Labor Statistics (BLS) this week are noteworthy for investors due to their potential impact on investment decisions.

Historical data suggests that announcements from the Federal Reserve (Fed) have influenced Bitcoin prices in the past.

Therefore, the upcoming speech by Fed Chair Jerome Powell, scheduled for the 14th of May, is particularly significant.

The BLS schedule indicates two key events: the Producer Price Index (PPI) today and the Consumer Price Index (CPI) on the 15th of May.

The PPI measures changes in prices received by producers for goods and services, while the CPI tracks changes in prices paid by consumers for those same goods and services.

Both indices serve as vital economic indicators that investors rely on to gauge the state of the economy.

Additionally, the BLS website indicates an upcoming event focused on employment claims later in the week.

These macroeconomic events are poised to influence Bitcoin price movements as investors closely monitor them to inform their investment strategies.

What to expect from Bitcoin price moves

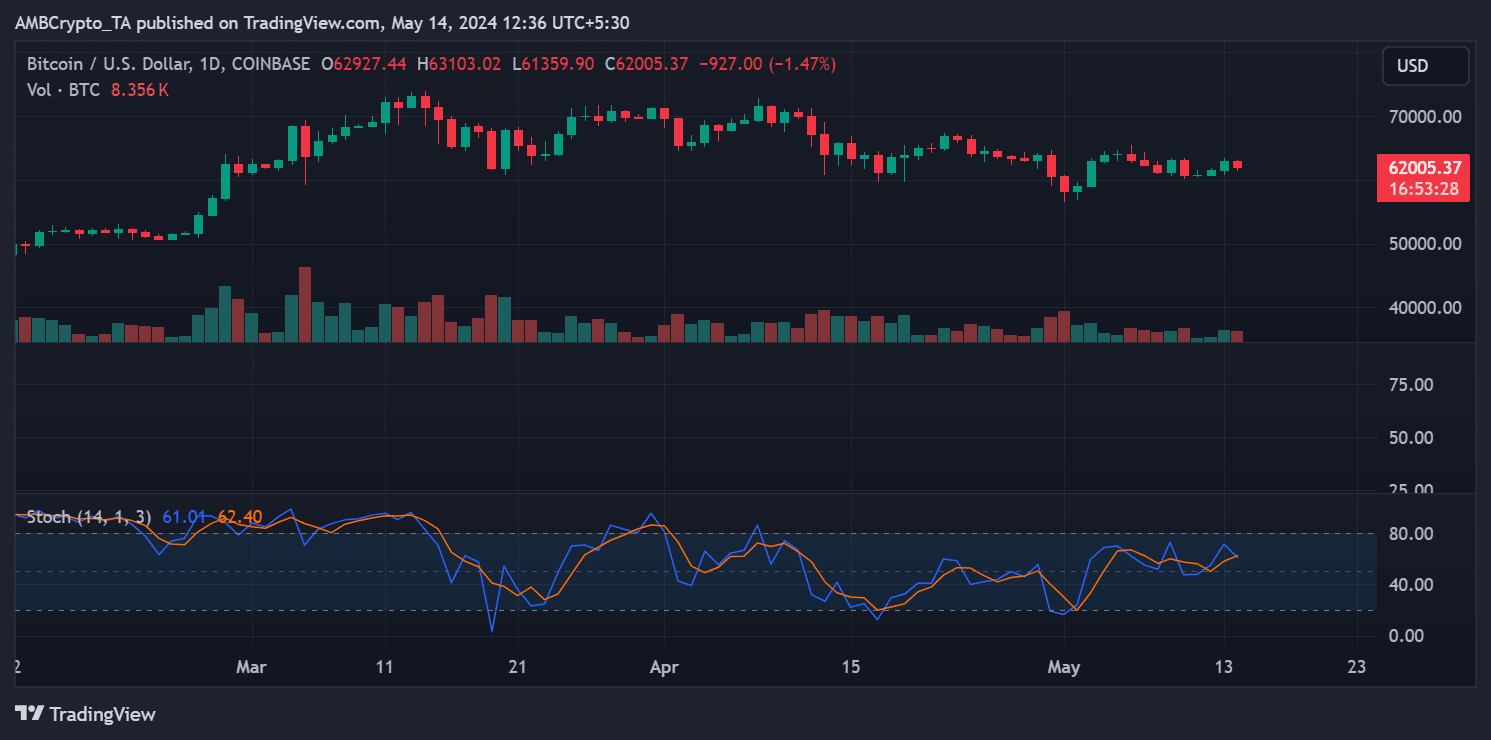

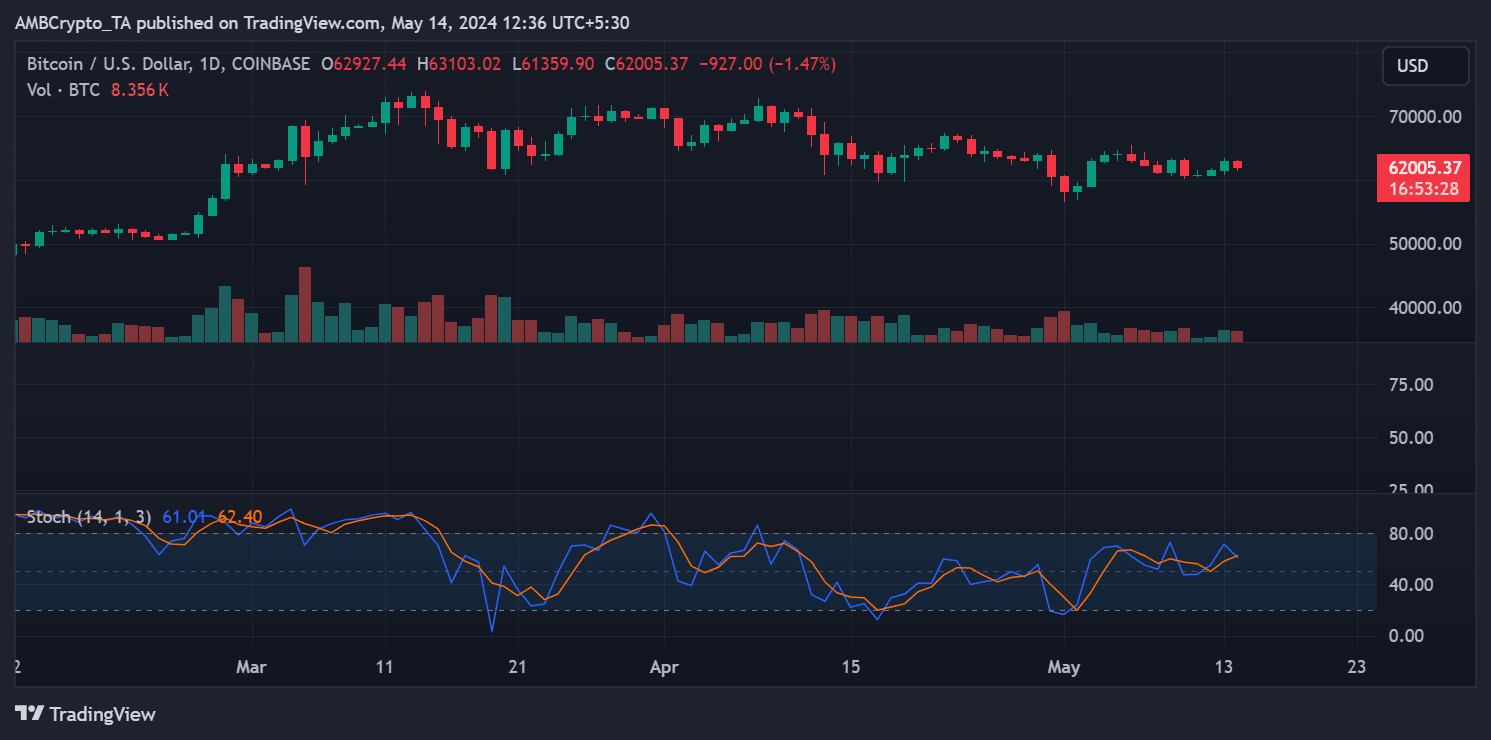

AMBCrypto’s analysis of Bitcoin’s price trend on a daily timeframe chart indicated a sluggish performance over recent weeks.

On the 10th of May, the price experienced a significant drop from over $63,000 to around $60,000, reflecting a loss of over 3%.

While attempting to recover since the 11th of May, Bitcoin could only reach approximately $62,900. At the time of this writing, it was trading at around $62,000, with a decline of over 1%.

Source: TradingView

Examination of the stochastic indicator suggested the possibility of further decline, as a crossover was still ongoing.

However, based on recent price action, the $60,000 level appears to serve as a strong support region. Should the price drop further, around $57,000 might act as another level of support to prevent further decline.

Possible rise in BTC volume expected

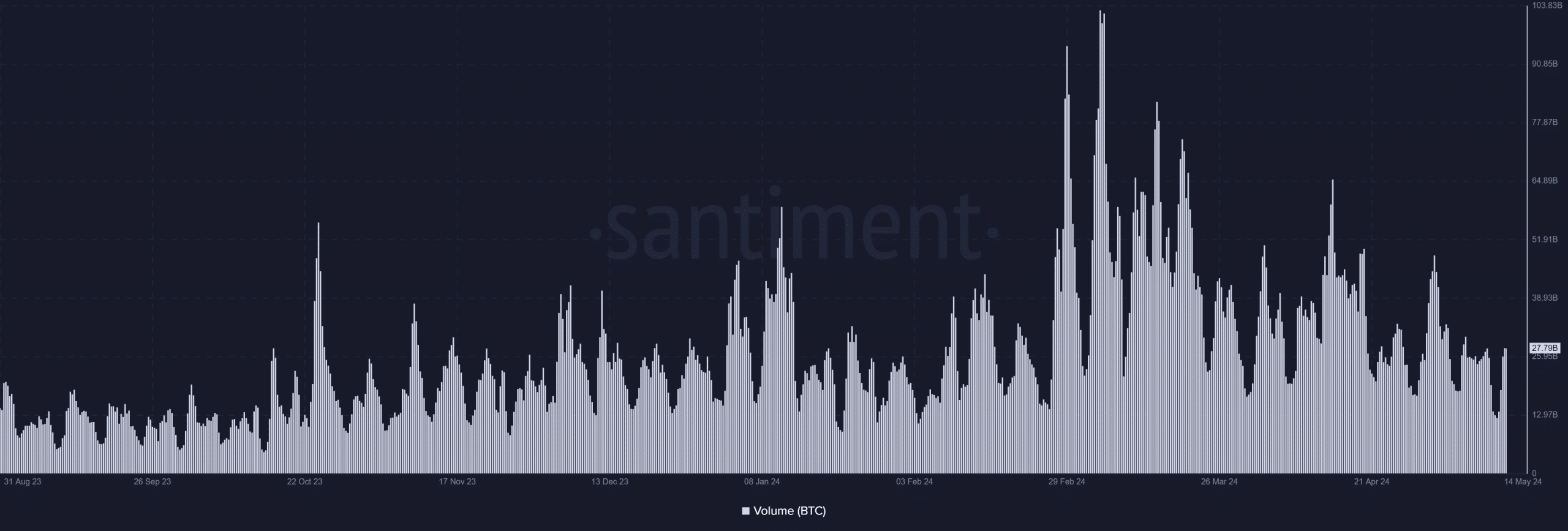

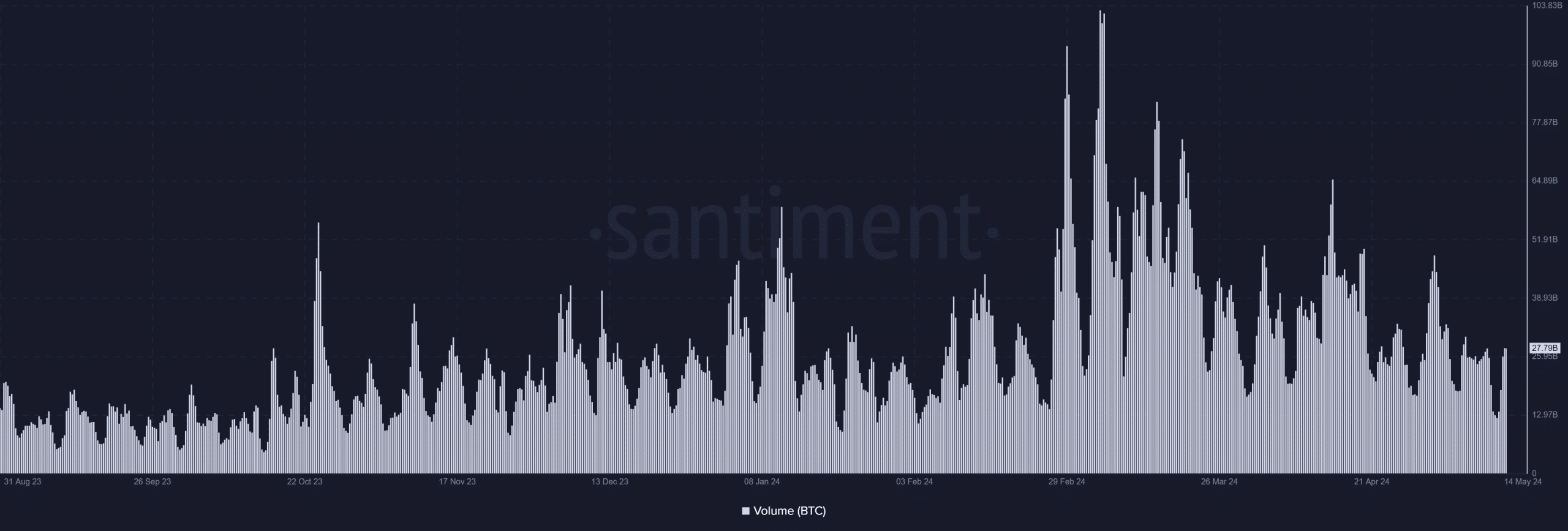

The volume metric for Bitcoin could experience increased activity if the price begins to decline.

The chart revealed that during the previous trading session, when the Bitcoin price was rising, the volume was approximately $25 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, at the time of writing, as the BTC price has dropped, the volume has already surged to nearly $28 billion.

This uptick in volume suggests heightened trading activity, potentially indicating increased selling pressure if the price continues to fall.

Source: Santiment

- Key events that could impact BTC’s price are coming up this week.

- BTC has lost some gains from its previous trading session.

Bitcoin [BTC] has encountered volatile price movements in recent days, exemplified by a notable over 3% decline on the 10th of May, which drove its value down to $60,000.

However, indications suggest that these choppy fluctuations may persist, largely influenced by the impending Federal Reserve meetings.

Bitcoin investors await BLS events outcomes

The upcoming events scheduled by the US Bureau of Labor Statistics (BLS) this week are noteworthy for investors due to their potential impact on investment decisions.

Historical data suggests that announcements from the Federal Reserve (Fed) have influenced Bitcoin prices in the past.

Therefore, the upcoming speech by Fed Chair Jerome Powell, scheduled for the 14th of May, is particularly significant.

The BLS schedule indicates two key events: the Producer Price Index (PPI) today and the Consumer Price Index (CPI) on the 15th of May.

The PPI measures changes in prices received by producers for goods and services, while the CPI tracks changes in prices paid by consumers for those same goods and services.

Both indices serve as vital economic indicators that investors rely on to gauge the state of the economy.

Additionally, the BLS website indicates an upcoming event focused on employment claims later in the week.

These macroeconomic events are poised to influence Bitcoin price movements as investors closely monitor them to inform their investment strategies.

What to expect from Bitcoin price moves

AMBCrypto’s analysis of Bitcoin’s price trend on a daily timeframe chart indicated a sluggish performance over recent weeks.

On the 10th of May, the price experienced a significant drop from over $63,000 to around $60,000, reflecting a loss of over 3%.

While attempting to recover since the 11th of May, Bitcoin could only reach approximately $62,900. At the time of this writing, it was trading at around $62,000, with a decline of over 1%.

Source: TradingView

Examination of the stochastic indicator suggested the possibility of further decline, as a crossover was still ongoing.

However, based on recent price action, the $60,000 level appears to serve as a strong support region. Should the price drop further, around $57,000 might act as another level of support to prevent further decline.

Possible rise in BTC volume expected

The volume metric for Bitcoin could experience increased activity if the price begins to decline.

The chart revealed that during the previous trading session, when the Bitcoin price was rising, the volume was approximately $25 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, at the time of writing, as the BTC price has dropped, the volume has already surged to nearly $28 billion.

This uptick in volume suggests heightened trading activity, potentially indicating increased selling pressure if the price continues to fall.

Source: Santiment

where buy clomid pill can i buy clomiphene tablets can you buy clomiphene for sale can i get generic clomiphene for sale can you buy clomid online can you get cheap clomiphene for sale where buy cheap clomid without dr prescription

More peace pieces like this would create the web better.

More delight pieces like this would urge the интернет better.

buy zithromax 500mg without prescription – flagyl us flagyl 400mg price

rybelsus over the counter – semaglutide 14mg for sale cyproheptadine 4mg sale

buy propranolol generic – order methotrexate 2.5mg generic methotrexate usa

purchase amoxil generic – combivent 100mcg uk buy combivent paypal

azithromycin usa – zithromax 250mg cost purchase nebivolol

clavulanate oral – atbioinfo ampicillin uk

esomeprazole 40mg cost – https://anexamate.com/ buy esomeprazole 20mg for sale

purchase warfarin for sale – https://coumamide.com/ losartan 25mg pills

buy meloxicam generic – https://moboxsin.com/ buy meloxicam 15mg online cheap

amoxicillin without prescription – combamoxi.com purchase amoxil generic

fluconazole cost – flucoan order diflucan 100mg online cheap

buy escitalopram cheap – order lexapro 10mg buy lexapro generic

order generic cenforce – how to get cenforce without a prescription cenforce brand

cialis purchase canada – cialis brand no prescription 365 where to buy cialis online for cheap

cialis no perscription overnight delivery – https://strongtadafl.com/ cialis none prescription

ranitidine brand – https://aranitidine.com/# buy ranitidine 150mg online cheap

buy viagra 100 mg – https://strongvpls.com/ sildenafil 50 mg buy online india

More posts like this would persuade the online space more useful. click

I’ll certainly bring back to be familiar with more. order azithromycin pills

This website positively has all of the low-down and facts I needed there this thesis and didn’t identify who to ask. https://ursxdol.com/furosemide-diuretic/

This is the compassionate of scribble literary works I in fact appreciate. https://prohnrg.com/product/atenolol-50-mg-online/

More delight pieces like this would urge the web better. https://aranitidine.com/fr/en_france_xenical/

More articles like this would pretence of the blogosphere richer. https://ondactone.com/product/domperidone/

This is the gentle of literature I truly appreciate.

https://doxycyclinege.com/pro/metoclopramide/

forxiga 10 mg drug – https://janozin.com/# forxiga 10 mg cost

buy orlistat generic – https://asacostat.com/# order xenical generic