- Bitcoin saw a shift in momentum as the RSI fell below neutral 50.

- The OBV was unable to climb to a previous low, indicating rising selling pressure.

Bitcoin [BTC] noted swift losses in the past 24 hours. In particular, a 4.9% drop occurred within an hour on the 2nd of April and witnessed millions of dollars in liquidations.

The price smashed below a pocket of liquidity, and the forced selling drove prices lower.

The long-term outlook for BTC remained bullish as the ETF inflows were extremely strong. AMBCrypto reported that the metrics for BTC were bearish, and prices slid lower hours later.

Will Bitcoin fall to the swing low at $60.7k?

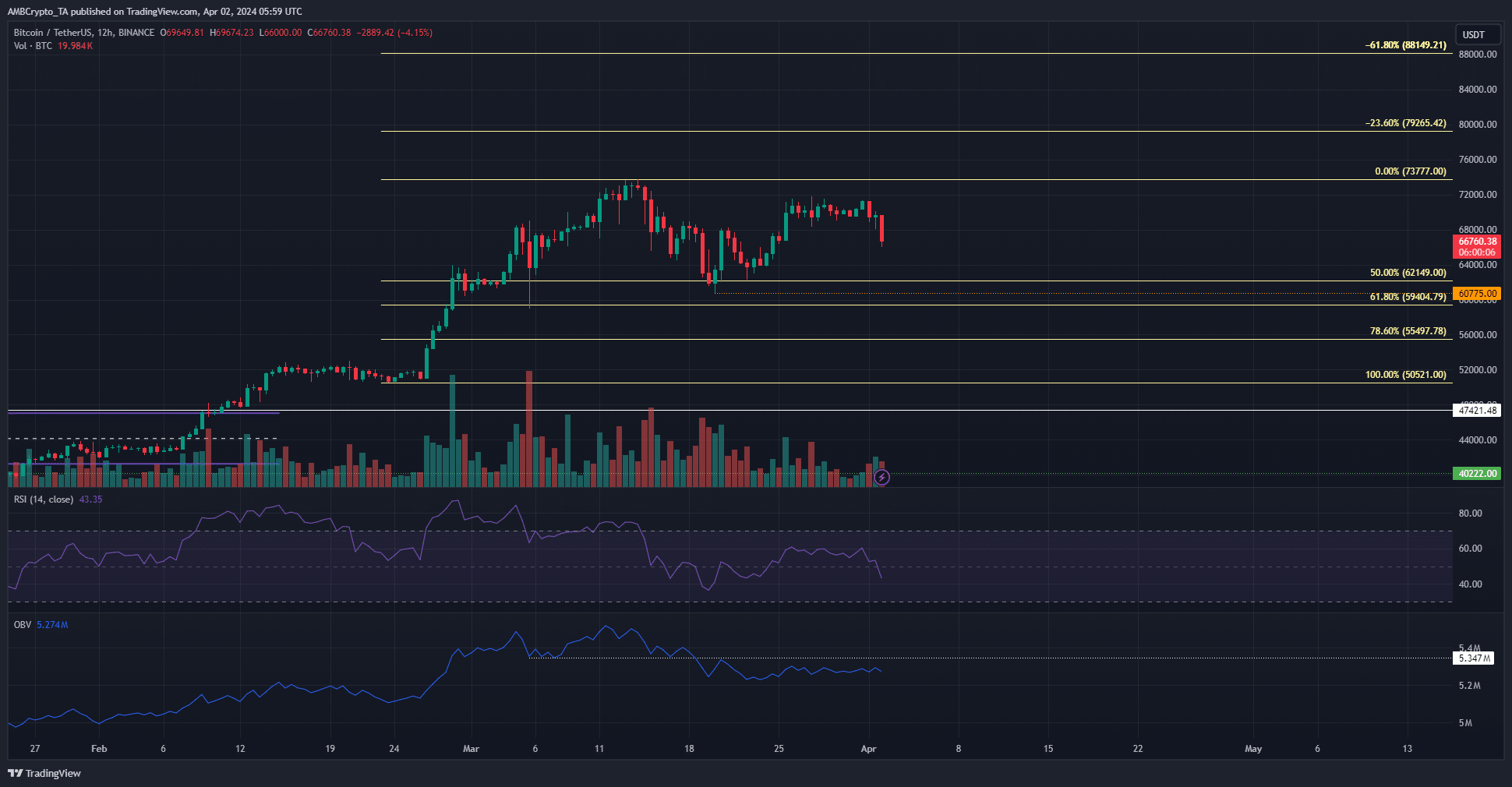

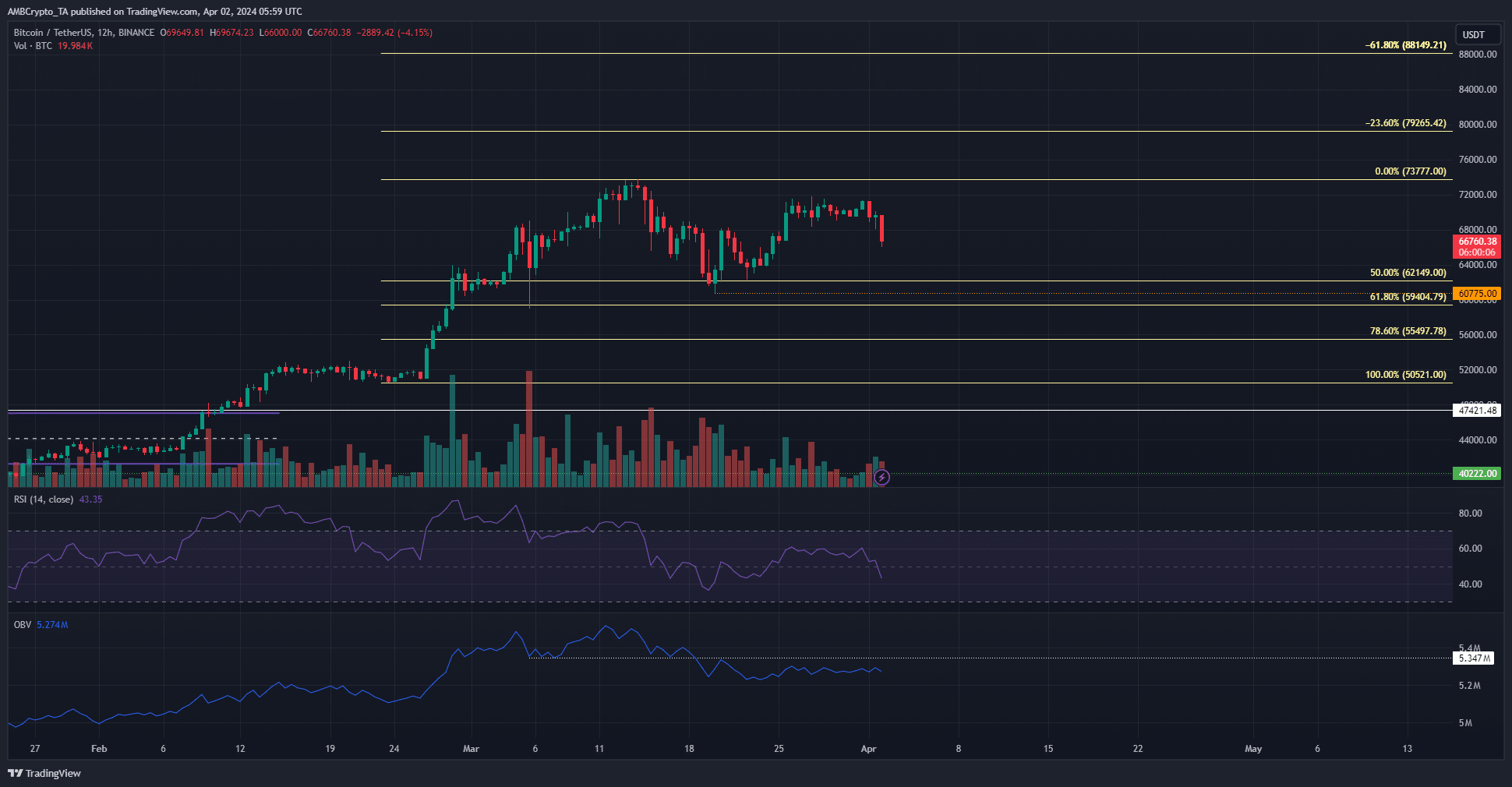

Source: BTC/USDT on TradingView

On the 12-hour chart, the market structure was still bullish. A fall below $60.7k will flip the structure bearishly. The Fibonacci retracement levels highlighted the $55.5k and $59.4k as critical levels.

The past 36 hours saw a 4.2% drop. The 2nd of April saw $62.2 million worth of long liquidations on Bitcoin. The H12 RSI fell below neutral 50 and signaled a shift in momentum.

The OBV trended downward in March and was still below a key level. This showed that selling pressure has been dominant in recent weeks, and more losses could follow.

The $64.5k level is a level of interest this week, as it is a short-term support level. Yet, technical indicators and the lower timeframe price action showed Bitcoin might not trend upward strongly for some time.

Bitcoin could fall to the next pool of liquidity to the south

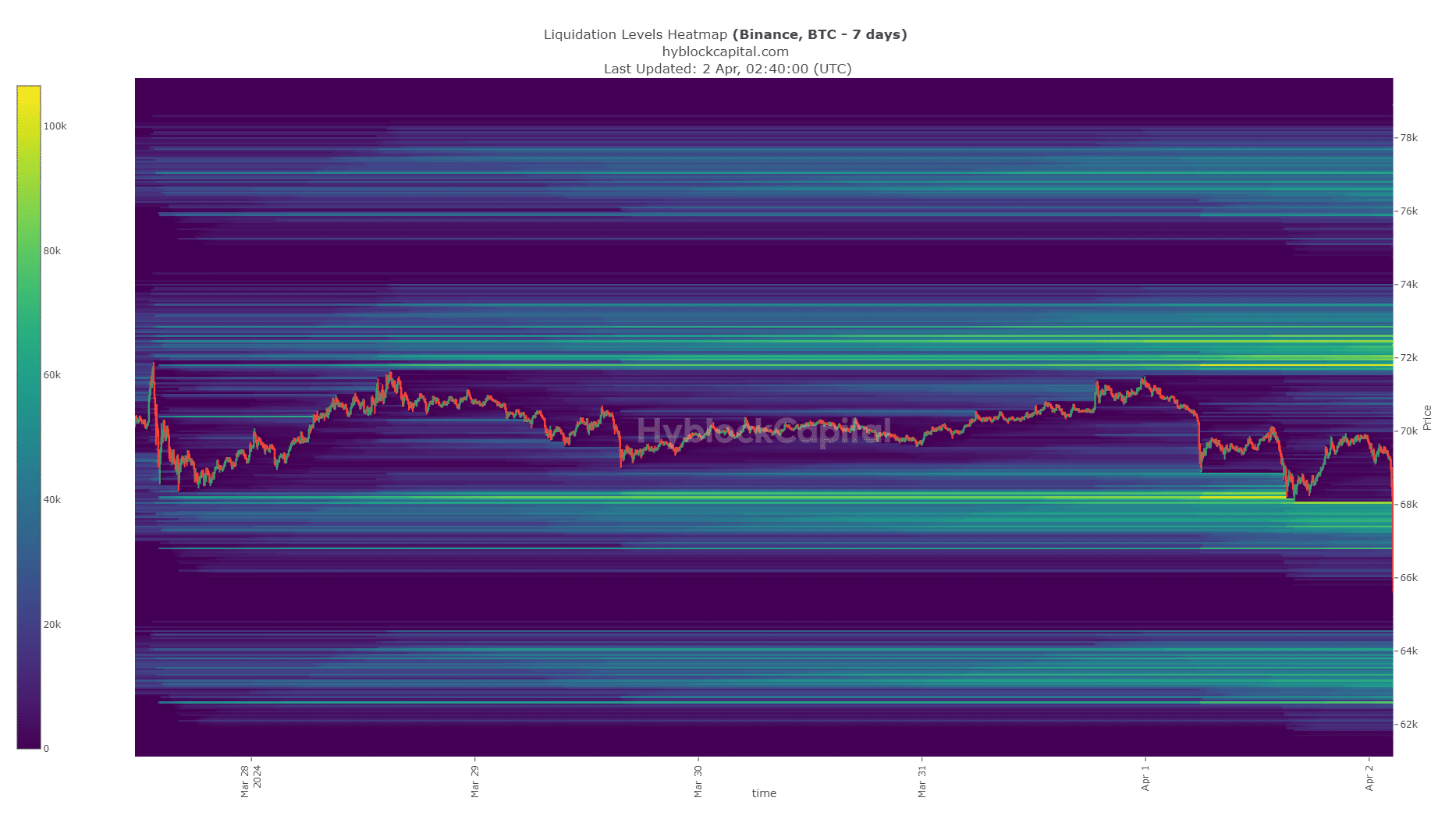

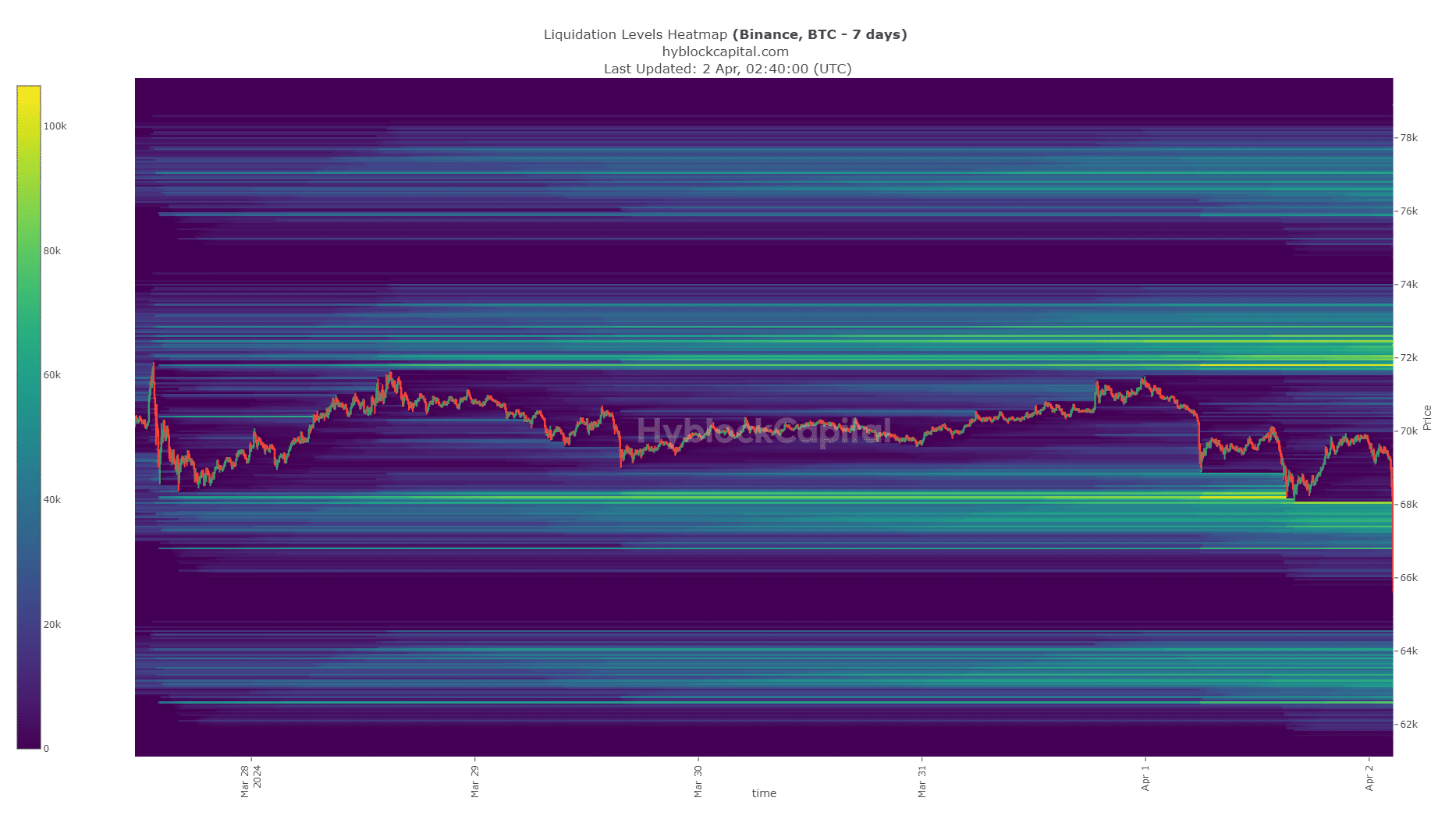

Source: Hyblock

The liquidation levels at $68k were wiped out, and a liquidation cascade followed that pushed BTC prices to $66.4k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Prices could bounce higher to liquidate the late, high-leveraged bears, but a significant pocket of liquidity was at $64k.

From $62.8k to $64k, there was a decent concentration of liquidation levels. Bitcoin’s proximity to this region indicated that it could sweep this zone next. Hence, traders should be prepared for more losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin saw a shift in momentum as the RSI fell below neutral 50.

- The OBV was unable to climb to a previous low, indicating rising selling pressure.

Bitcoin [BTC] noted swift losses in the past 24 hours. In particular, a 4.9% drop occurred within an hour on the 2nd of April and witnessed millions of dollars in liquidations.

The price smashed below a pocket of liquidity, and the forced selling drove prices lower.

The long-term outlook for BTC remained bullish as the ETF inflows were extremely strong. AMBCrypto reported that the metrics for BTC were bearish, and prices slid lower hours later.

Will Bitcoin fall to the swing low at $60.7k?

Source: BTC/USDT on TradingView

On the 12-hour chart, the market structure was still bullish. A fall below $60.7k will flip the structure bearishly. The Fibonacci retracement levels highlighted the $55.5k and $59.4k as critical levels.

The past 36 hours saw a 4.2% drop. The 2nd of April saw $62.2 million worth of long liquidations on Bitcoin. The H12 RSI fell below neutral 50 and signaled a shift in momentum.

The OBV trended downward in March and was still below a key level. This showed that selling pressure has been dominant in recent weeks, and more losses could follow.

The $64.5k level is a level of interest this week, as it is a short-term support level. Yet, technical indicators and the lower timeframe price action showed Bitcoin might not trend upward strongly for some time.

Bitcoin could fall to the next pool of liquidity to the south

Source: Hyblock

The liquidation levels at $68k were wiped out, and a liquidation cascade followed that pushed BTC prices to $66.4k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Prices could bounce higher to liquidate the late, high-leveraged bears, but a significant pocket of liquidity was at $64k.

From $62.8k to $64k, there was a decent concentration of liquidation levels. Bitcoin’s proximity to this region indicated that it could sweep this zone next. Hence, traders should be prepared for more losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

buying cheap clomid without prescription cheap clomid pills clomiphene buy order generic clomid without rx buying generic clomiphene pill where to buy clomiphene price how can i get clomiphene pill

This is the type of delivery I unearth helpful.

The thoroughness in this section is noteworthy.

rybelsus 14mg brand – periactin uk buy cheap generic cyproheptadine

order motilium 10mg sale – order tetracycline sale flexeril 15mg us

amoxil generic – cost ipratropium purchase ipratropium without prescription

buy zithromax 250mg generic – order generic azithromycin buy nebivolol cheap

buy clavulanate for sale – atbio info buy acillin medication

buy esomeprazole 20mg pills – nexiumtous order nexium 20mg for sale

warfarin 2mg drug – coumamide.com cost cozaar

order meloxicam 7.5mg pills – https://moboxsin.com/ buy generic mobic online

deltasone 40mg over the counter – https://apreplson.com/ deltasone 40mg generic

ed pills that really work – https://fastedtotake.com/ how to buy ed pills

buy amoxil without prescription – https://combamoxi.com/ amoxicillin online

fluconazole 100mg pills – https://gpdifluca.com/ forcan pills

buy cenforce tablets – https://cenforcers.com/# cenforce cost

buy cialis shipment to russia – https://ciltadgn.com/ cialis strength

best price for tadalafil – cialis prescription assistance program overnight cialis delivery

Thanks for sharing. It’s outstrip quality. this

cheap viagra vipps – cheap viagra no prescription online sales@cheap-generic-viagra

This website really has all of the low-down and facts I needed to this thesis and didn’t positive who to ask. https://buyfastonl.com/gabapentin.html

I’ll certainly carry back to review more. https://ursxdol.com/cialis-tadalafil-20/

I’ll certainly bring back to read more. https://prohnrg.com/product/loratadine-10-mg-tablets/

This is a keynote which is forthcoming to my heart… Numberless thanks! Exactly where can I notice the acquaintance details due to the fact that questions? https://ondactone.com/product/domperidone/

This website really has all of the low-down and facts I needed adjacent to this subject and didn’t identify who to ask.

https://doxycyclinege.com/pro/levofloxacin/

This is a topic which is forthcoming to my fundamentals… Many thanks! Unerringly where can I notice the connection details due to the fact that questions? http://wightsupport.com/forum/member.php?action=profile&uid=21400

buy generic dapagliflozin for sale – https://janozin.com/ forxiga usa

orlistat over the counter – orlistat canada buy xenical no prescription