- Bitcoin holder loss trends showed that the bulls can be hopeful of a recovery

- If historical trends repeat themselves, an even deeper price correction might be due

Bitcoin [BTC] has twice faced rejection from the short-term range highs at $58.8k in two days. After losing the psychological $60k support last week, sentiment across the market was fearful.

There is some hope for a rebound though. At press time, the rising accumulation trend score suggested buyers were willing, but other metrics implied more pain may be due.

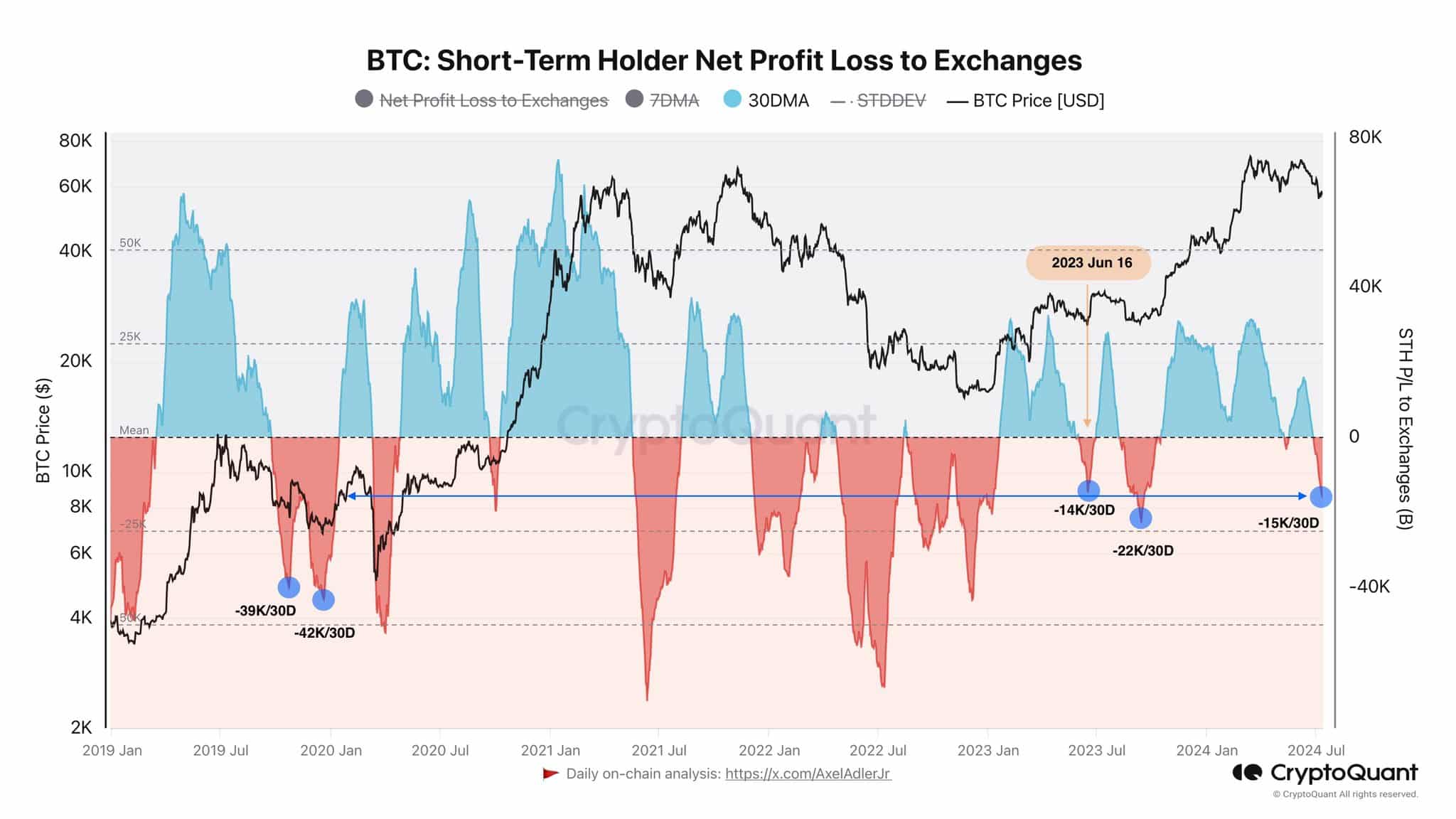

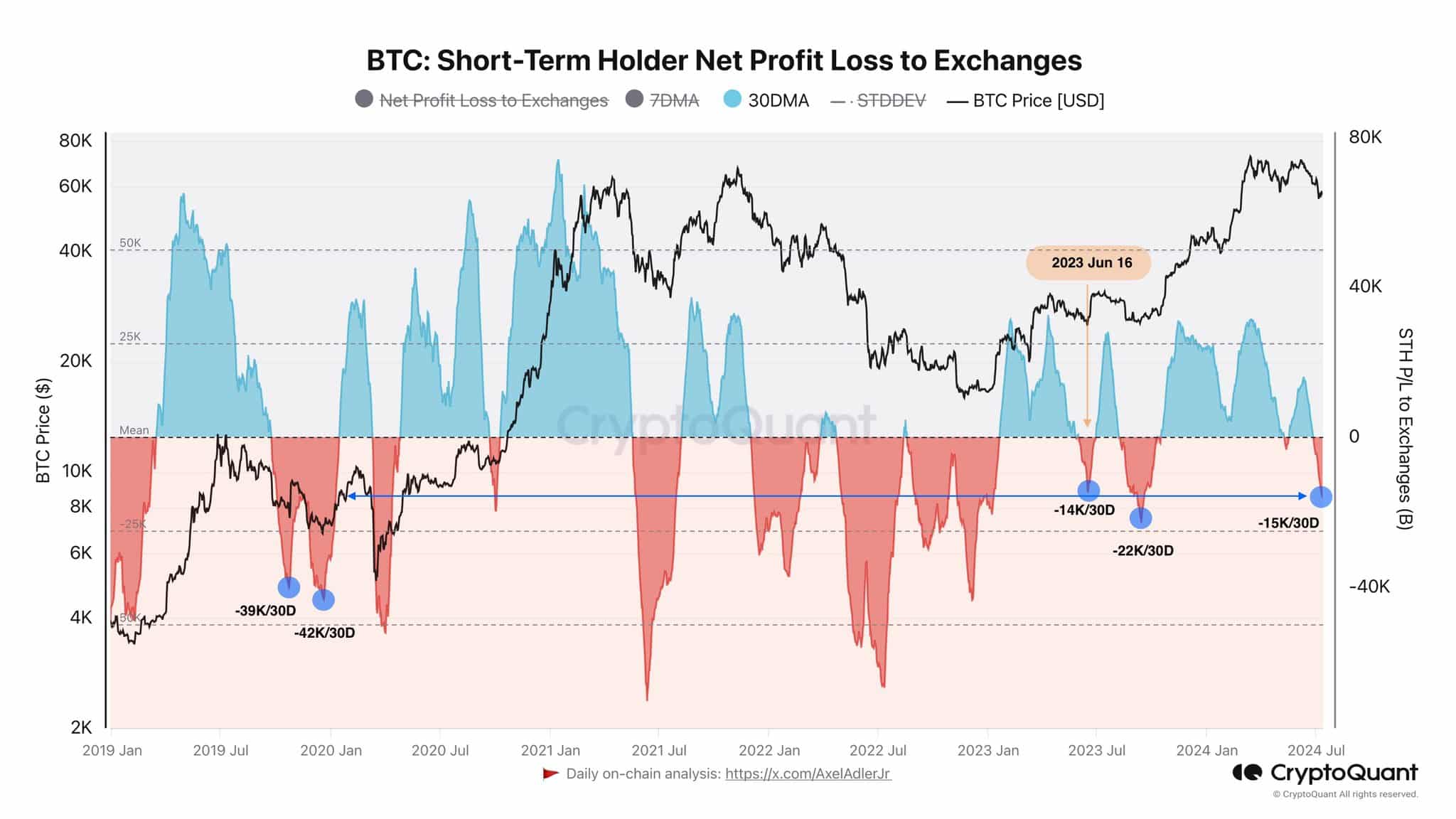

Source: Axel Adler on X

In a post on X, crypto analyst Axel Adler drew attention to the current average losses of short-term holders (STHs). While the losses match that of June 2023, the magnitude was far lower than the pain seen in 2021 or 2022.

While it did signal a potential local bottom, it also showed that traders and investors must be prepared for the worst-case scenario of a sharper price drop on the charts.

Clues that Bitcoin’s local lows are behind us

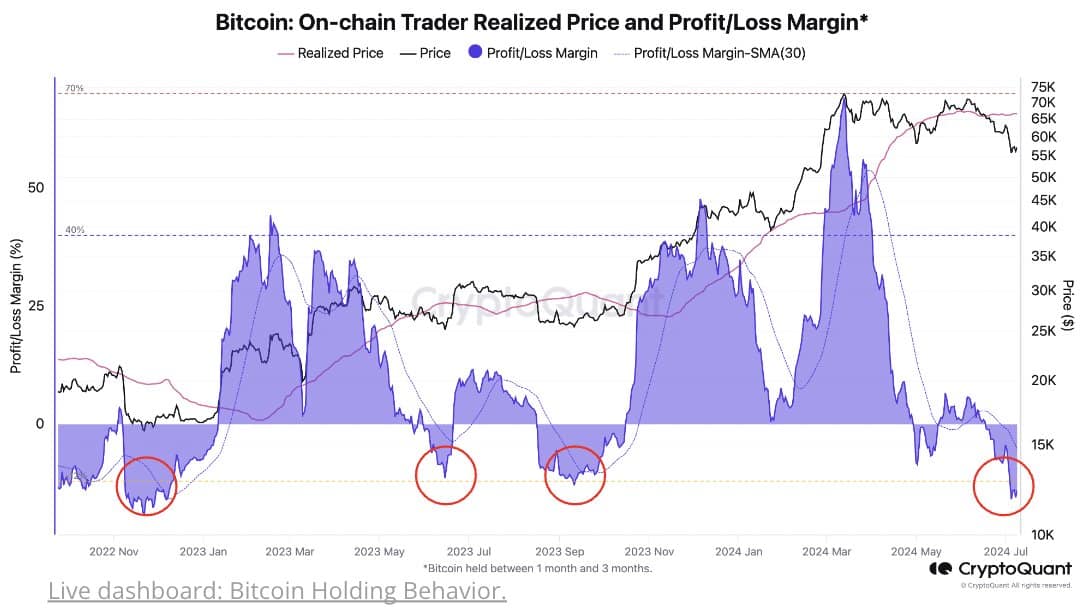

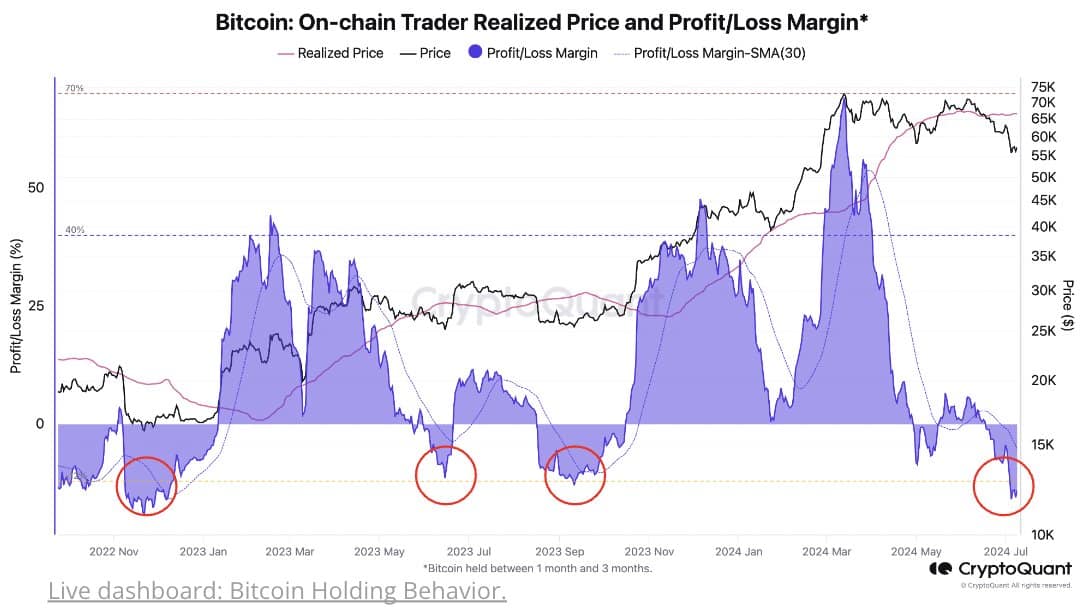

Source: CryptoQuant on X

CryptoQuant observed that the trader realized profit/loss margin was at -17%. This was in the same ballpark as the market bottoms over the past two years, reinforcing the idea that Bitcoin is more likely to rebound higher than to drop lower.

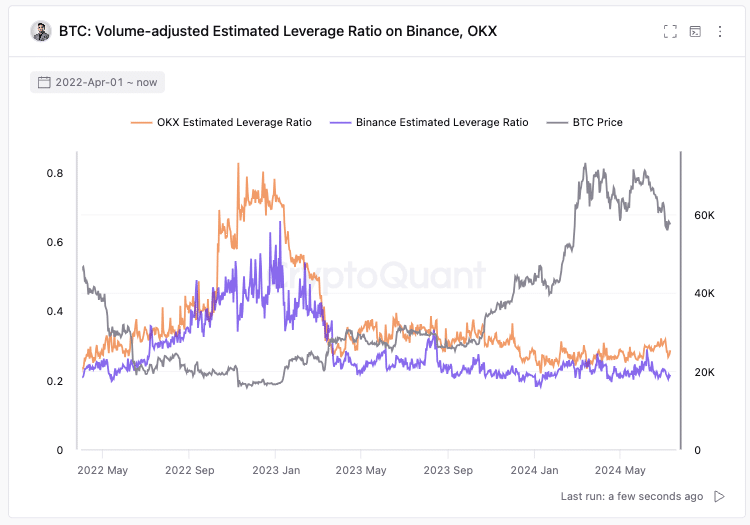

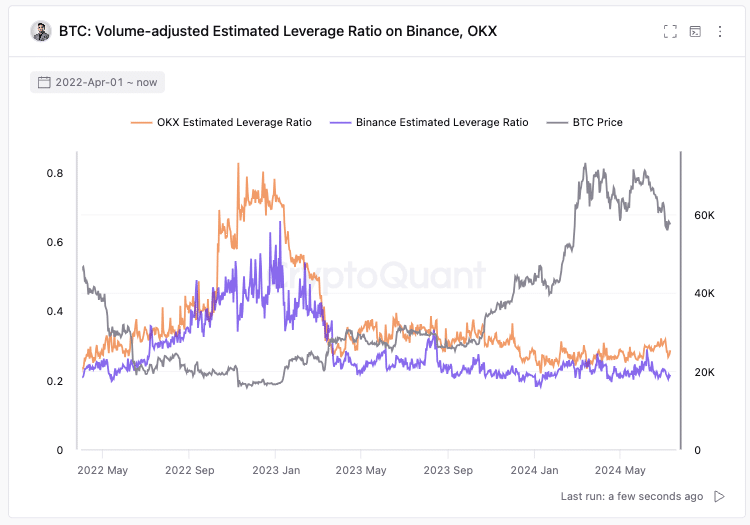

Source: Ki Young Ju on X

According to Founder and CEO of CryptoQuant Ki Young Ju, whales tend to use leverage at their cyclical bottoms, making the markets over-leveraged and forcing another downward price flush.

At press time, whales were not over-leveraged, which could have set the stage for a deeper correction below the $50k-mark.

Traders were humbled after trying to catch the breakout and ATH

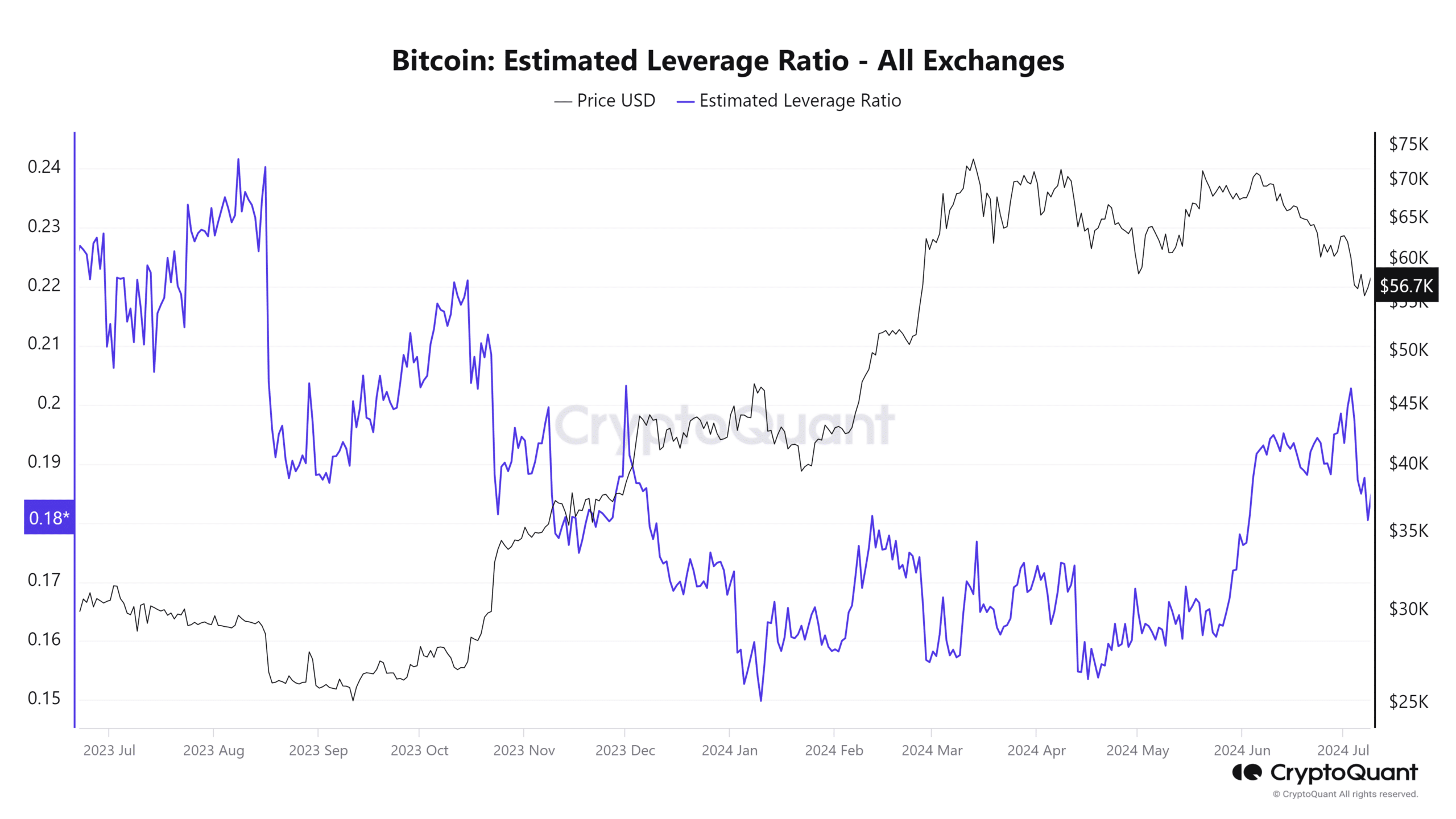

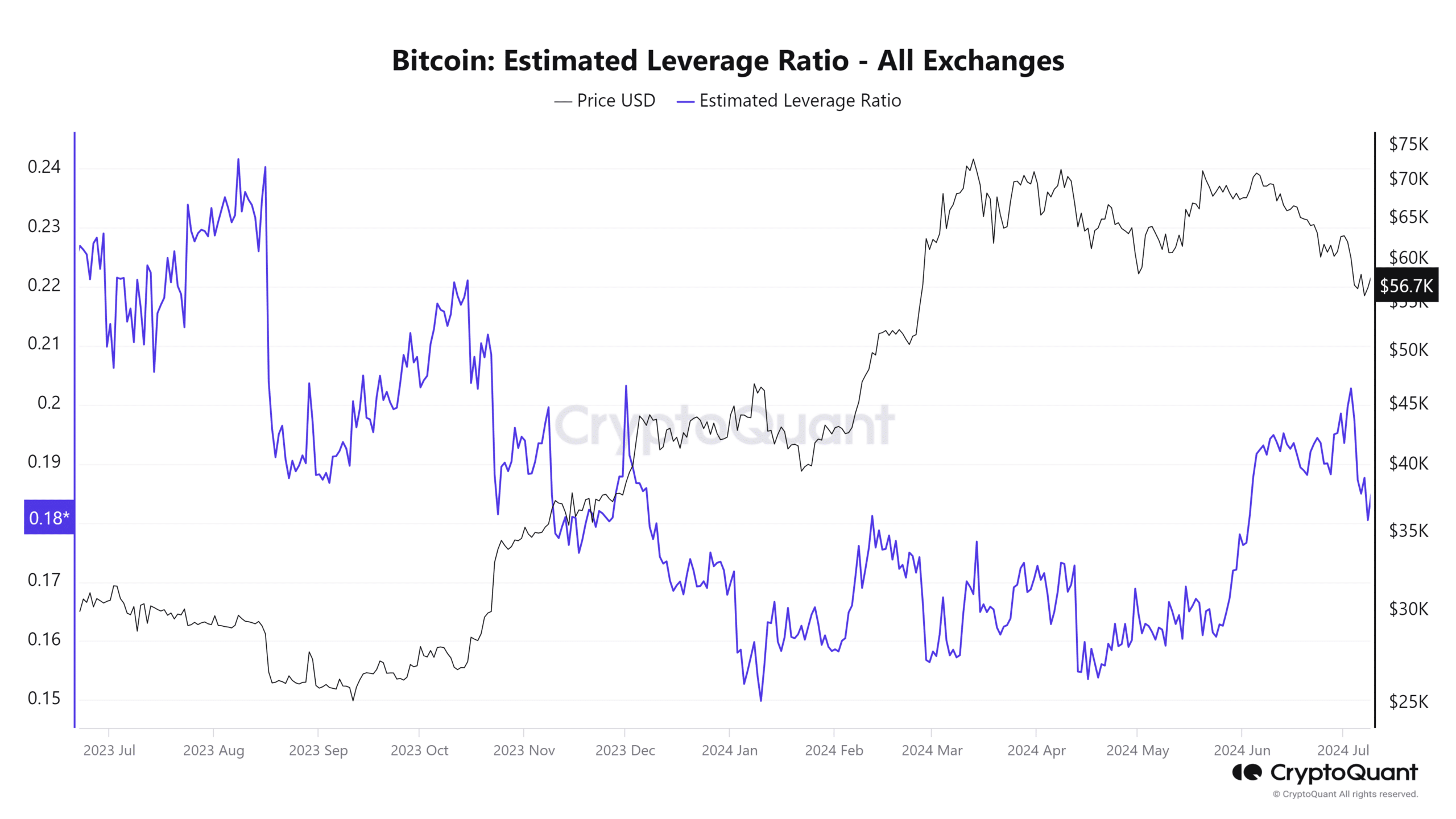

Source: CryptoQuant

From the final week of May to the 3 July, the estimated leverage ratio on exchanges rose quickly. During that time, the price of Bitcoin was hovering around $67k-$69k. As the price fell below $66k, the leverage ratio climbed once more, indicating that traders were trying to time the bottom out of greed.

Over the past week, their hopes were quelled by BTC’s sustained descent. The leverage ratio also fell lower, which could be healthy for the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, it is hard to say with certainty that Bitcoin has formed a bottom.

Several bottom signals have been flashing and seller pressure might begin to drop. Even so, investors should still have a plan of action in case the price fall below $50k.

- Bitcoin holder loss trends showed that the bulls can be hopeful of a recovery

- If historical trends repeat themselves, an even deeper price correction might be due

Bitcoin [BTC] has twice faced rejection from the short-term range highs at $58.8k in two days. After losing the psychological $60k support last week, sentiment across the market was fearful.

There is some hope for a rebound though. At press time, the rising accumulation trend score suggested buyers were willing, but other metrics implied more pain may be due.

Source: Axel Adler on X

In a post on X, crypto analyst Axel Adler drew attention to the current average losses of short-term holders (STHs). While the losses match that of June 2023, the magnitude was far lower than the pain seen in 2021 or 2022.

While it did signal a potential local bottom, it also showed that traders and investors must be prepared for the worst-case scenario of a sharper price drop on the charts.

Clues that Bitcoin’s local lows are behind us

Source: CryptoQuant on X

CryptoQuant observed that the trader realized profit/loss margin was at -17%. This was in the same ballpark as the market bottoms over the past two years, reinforcing the idea that Bitcoin is more likely to rebound higher than to drop lower.

Source: Ki Young Ju on X

According to Founder and CEO of CryptoQuant Ki Young Ju, whales tend to use leverage at their cyclical bottoms, making the markets over-leveraged and forcing another downward price flush.

At press time, whales were not over-leveraged, which could have set the stage for a deeper correction below the $50k-mark.

Traders were humbled after trying to catch the breakout and ATH

Source: CryptoQuant

From the final week of May to the 3 July, the estimated leverage ratio on exchanges rose quickly. During that time, the price of Bitcoin was hovering around $67k-$69k. As the price fell below $66k, the leverage ratio climbed once more, indicating that traders were trying to time the bottom out of greed.

Over the past week, their hopes were quelled by BTC’s sustained descent. The leverage ratio also fell lower, which could be healthy for the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, it is hard to say with certainty that Bitcoin has formed a bottom.

Several bottom signals have been flashing and seller pressure might begin to drop. Even so, investors should still have a plan of action in case the price fall below $50k.

can i buy cheap clomiphene clomiphene rx for men clomiphene tablets for sale how much is clomiphene without insurance how to get clomid without dr prescription clomid for men can you get cheap clomid without rx

Greetings! Jolly gainful suggestion within this article! It’s the crumb changes which liking turn the largest changes. Thanks a portion towards sharing!

With thanks. Loads of knowledge!

buy azithromycin generic – generic tindamax buy metronidazole generic

order semaglutide 14 mg pill – generic cyproheptadine cyproheptadine order online

motilium 10mg for sale – buy flexeril online cheap buy generic flexeril for sale

purchase inderal for sale – plavix 150mg canada methotrexate pills

purchase esomeprazole for sale – https://anexamate.com/ purchase nexium generic

coumadin 5mg generic – coumamide hyzaar over the counter

meloxicam 7.5mg uk – https://moboxsin.com/ oral mobic

buy prednisone 10mg generic – corticosteroid cost prednisone

buy ed pills online usa – https://fastedtotake.com/ buy ed medication online

how to buy diflucan – forcan drug where to buy diflucan without a prescription

brand cenforce 50mg – cenforce cost order cenforce 100mg generic

cialis canadian purchase – https://ciltadgn.com/# where can i buy cialis online in australia

cialis free samples – https://strongtadafl.com/# tadalafil dose for erectile dysfunction

buy generic ranitidine 300mg – click order ranitidine

sildenafil de 100 mg – https://strongvpls.com/# buy cheap viagra in the uk

I couldn’t turn down commenting. Profoundly written! este sitio

This is the stripe of glad I get high on reading. https://buyfastonl.com/amoxicillin.html

I couldn’t hold back commenting. Warmly written! https://ursxdol.com/get-cialis-professional/

I am in fact thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. https://prohnrg.com/product/orlistat-pills-di/

The vividness in this ruined is exceptional. https://aranitidine.com/fr/acheter-propecia-en-ligne/

This website really has all of the information and facts I needed about this thesis and didn’t know who to ask. https://ondactone.com/product/domperidone/