- Bitcoin maintains strength above key level despite signs of potential downside.

- Shorts face the sharp edge of the knife as price sustains in the $58k range.

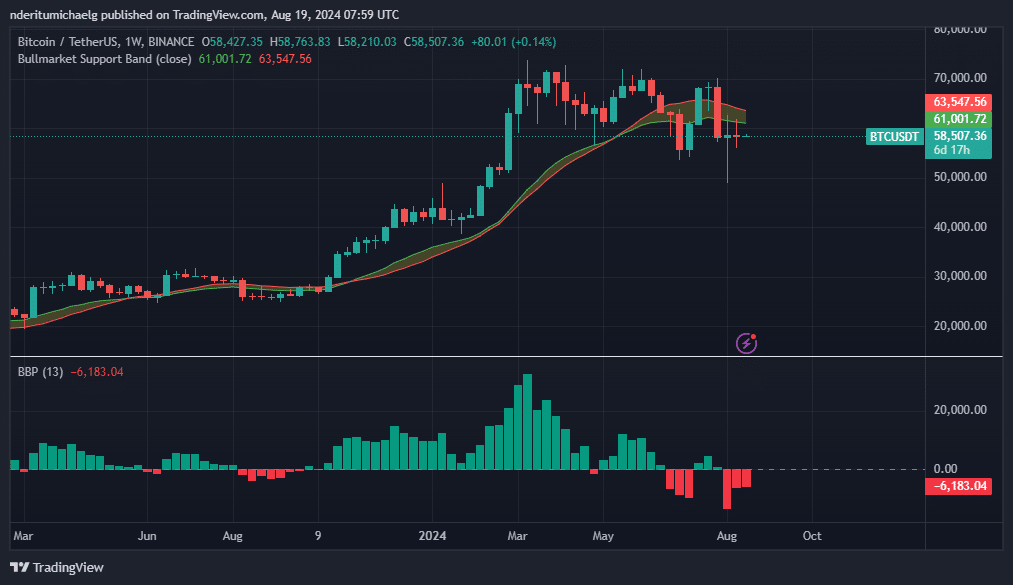

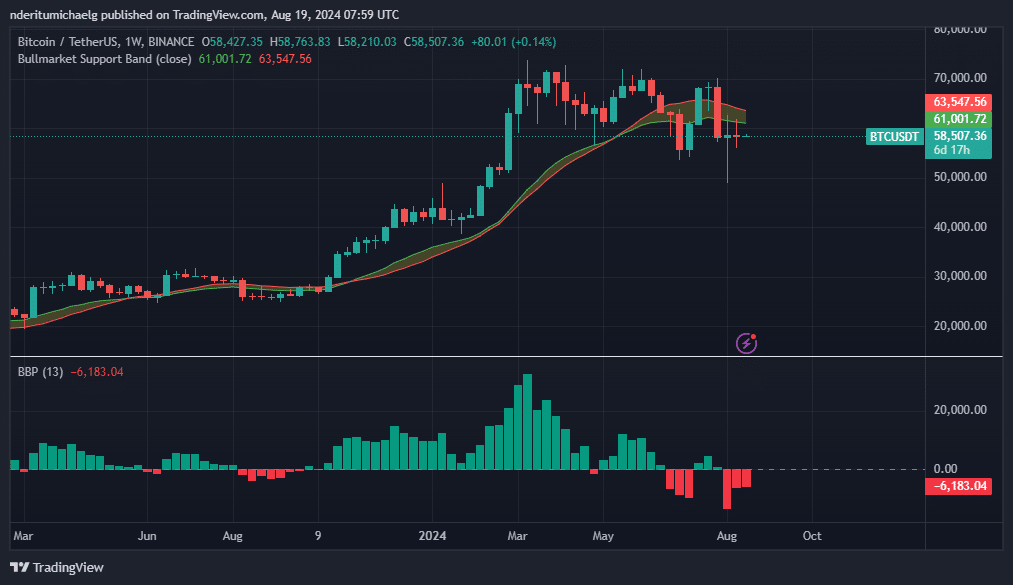

Bitcoin [BTC] just closed another week below its bullish market support band on the 1-week time frame. Consequently, more traders are turning bearish, but despite this, things have been quite rocky for leveraged shorts traders.

Although Bitcoin made a recovery attempt after its crash earlier this year, weak bullish momentum triggered more bearish sentiments.

Meanwhile, the price has been stuck in a narrow range evident in the weekly timeframe. On top of that, Bitcoin’s price remained below bullish support band, fueling more bearish speculation.

Source: TradingView

The Bitcoin bull market support band inversion is just one of the bearish signals suggesting more potential downside ahead. Short traders have been doubling down on their positions.

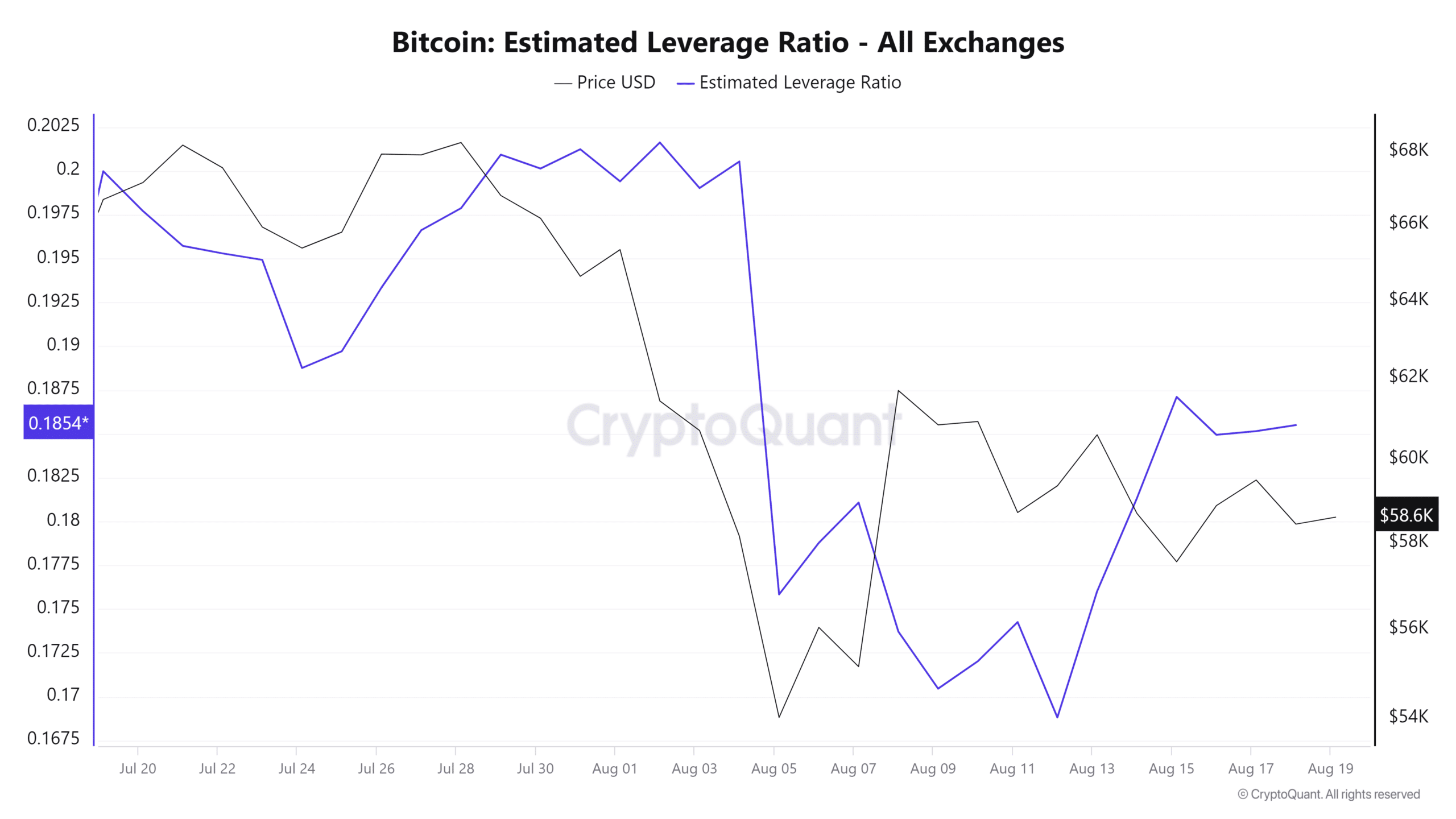

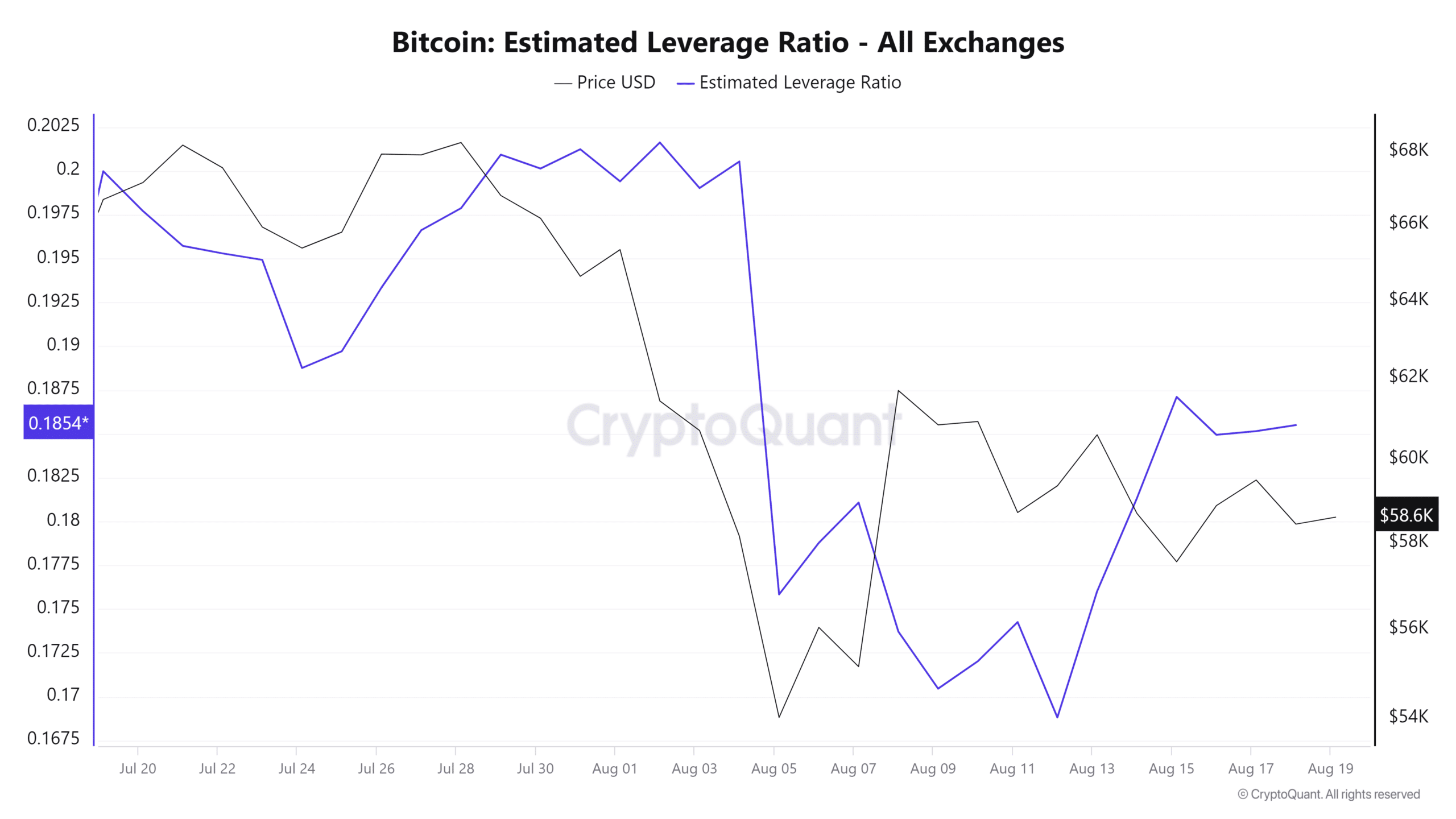

Appetite for leverage has been on the rise for the last week or so. This is evident in the estimated leverage ratio which bottomed out on 12 August. This suggests that the market anticipates more volatility in the coming days.

Source: CryptoQuant

The number of Bitcoin leveraged shorts have been growing, with the expectations of more price weakness. However, BTC’s price action appears to be putting on a show of strength against the downside near the $58,000 price range.

Recent findings revealed that over $1.65 billion worth of leveraged shorts were recently liquidated.

Despite these findings, the number of shorts liquidations were still low compared to what we observed earlier this month. But the most important question on most Bitcoin holders’ minds is whether the cryptocurrency will continue to drop.

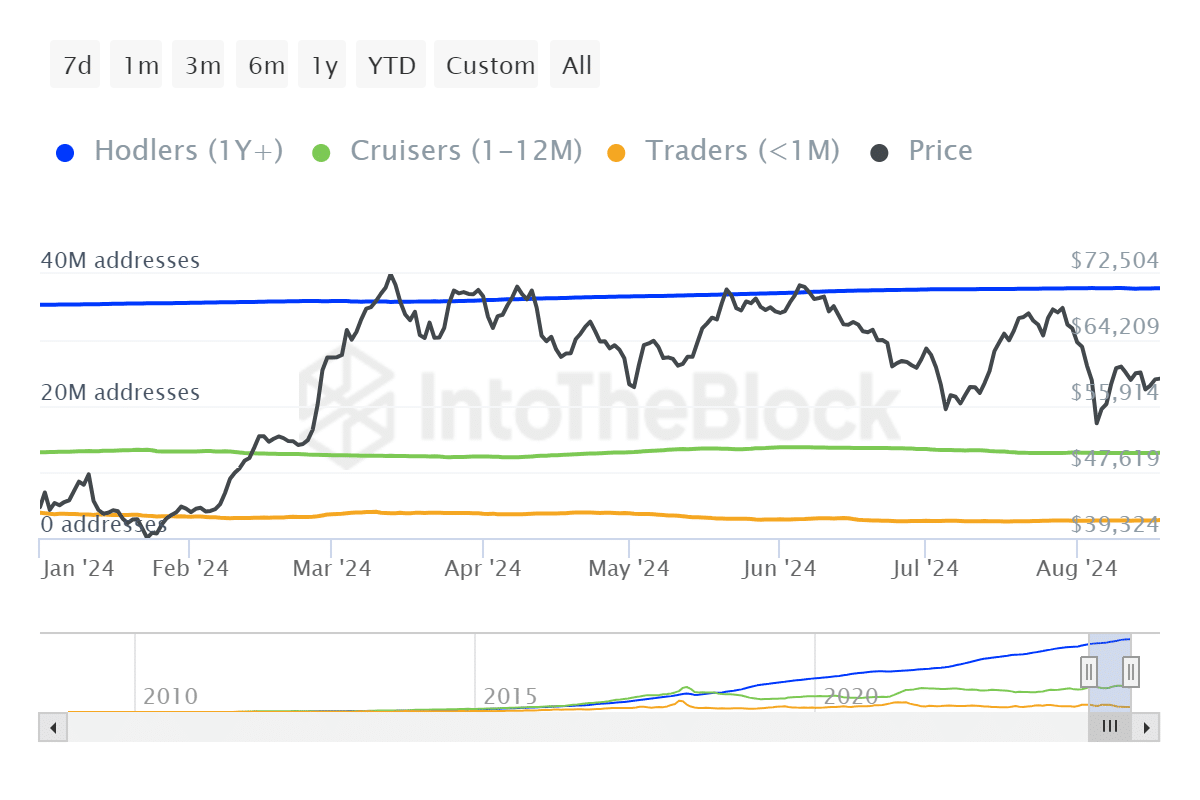

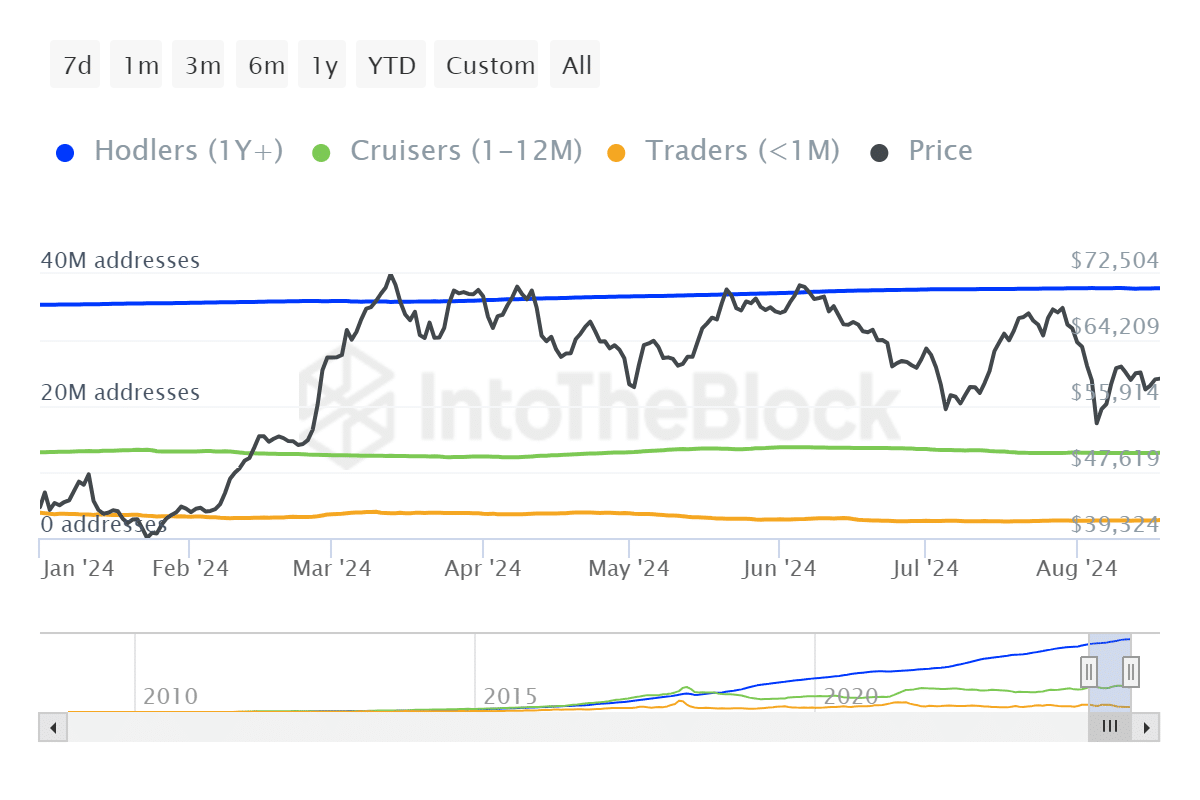

Several key observations to note. The narrow price range suggests that Bitcoin holders are still opting to hold on to their coins.

Bitcoin ownership stats by time held reveals that whales continue to HODL. For example, the number of whales HODLing BTC on a YTD time frame grew from 35.33 million addresses to 37.88 million addresses as of the latest stats.

Source: IntoTheBlock

Whales holding on to Bitcoin is a good sign because they have a significant impact on the market collectively. However, the same data also indicates that the retail class of holders have declined during the same period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A potential reason for the above could be that the higher cost of living and market uncertainty may have forced retail holders to sell.

Meanwhile, whales opting to HODL suggests long term bullish expectations remain strong despite short-term headwinds. Every dip so far has been accompanied by robust accumulation, which has shielded Bitcoin from more downside.

- Bitcoin maintains strength above key level despite signs of potential downside.

- Shorts face the sharp edge of the knife as price sustains in the $58k range.

Bitcoin [BTC] just closed another week below its bullish market support band on the 1-week time frame. Consequently, more traders are turning bearish, but despite this, things have been quite rocky for leveraged shorts traders.

Although Bitcoin made a recovery attempt after its crash earlier this year, weak bullish momentum triggered more bearish sentiments.

Meanwhile, the price has been stuck in a narrow range evident in the weekly timeframe. On top of that, Bitcoin’s price remained below bullish support band, fueling more bearish speculation.

Source: TradingView

The Bitcoin bull market support band inversion is just one of the bearish signals suggesting more potential downside ahead. Short traders have been doubling down on their positions.

Appetite for leverage has been on the rise for the last week or so. This is evident in the estimated leverage ratio which bottomed out on 12 August. This suggests that the market anticipates more volatility in the coming days.

Source: CryptoQuant

The number of Bitcoin leveraged shorts have been growing, with the expectations of more price weakness. However, BTC’s price action appears to be putting on a show of strength against the downside near the $58,000 price range.

Recent findings revealed that over $1.65 billion worth of leveraged shorts were recently liquidated.

Despite these findings, the number of shorts liquidations were still low compared to what we observed earlier this month. But the most important question on most Bitcoin holders’ minds is whether the cryptocurrency will continue to drop.

Several key observations to note. The narrow price range suggests that Bitcoin holders are still opting to hold on to their coins.

Bitcoin ownership stats by time held reveals that whales continue to HODL. For example, the number of whales HODLing BTC on a YTD time frame grew from 35.33 million addresses to 37.88 million addresses as of the latest stats.

Source: IntoTheBlock

Whales holding on to Bitcoin is a good sign because they have a significant impact on the market collectively. However, the same data also indicates that the retail class of holders have declined during the same period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A potential reason for the above could be that the higher cost of living and market uncertainty may have forced retail holders to sell.

Meanwhile, whales opting to HODL suggests long term bullish expectations remain strong despite short-term headwinds. Every dip so far has been accompanied by robust accumulation, which has shielded Bitcoin from more downside.

how to buy clomiphene without dr prescription cheap clomiphene pills cost of clomiphene without insurance clomid challenge test clomid buy cost cheap clomiphene for sale order cheap clomid without prescription

This is a keynote which is forthcoming to my heart… Myriad thanks! Quite where can I notice the connection details due to the fact that questions?

Greetings! Extremely productive par‘nesis within this article! It’s the petty changes which wish make the largest changes. Thanks a lot quest of sharing!

zithromax 500mg drug – ofloxacin buy online buy metronidazole 400mg without prescription

purchase semaglutide generic – order semaglutide 14 mg generic periactin 4mg uk

domperidone 10mg pill – motilium 10mg oral flexeril where to buy

propranolol sale – inderal canada how to buy methotrexate

buy cheap amoxil – diovan 80mg pill combivent over the counter

azithromycin 250mg tablet – zithromax where to buy purchase nebivolol online

buy generic augmentin – https://atbioinfo.com/ ampicillin for sale online

order esomeprazole 20mg – https://anexamate.com/ nexium online order

coumadin us – https://coumamide.com/ buy cozaar tablets

buy meloxicam 15mg generic – relieve pain buy mobic pills for sale

prednisone 5mg over the counter – aprep lson prednisone 40mg canada

causes of erectile dysfunction – fast ed to take medication for ed dysfunction

order amoxicillin generic – comba moxi purchase amoxicillin online cheap

where can i buy fluconazole – buy diflucan 200mg sale buy fluconazole 100mg sale

cenforce 100mg drug – https://cenforcers.com/# buy cenforce tablets

tadalafil tamsulosin combination – cost of cialis for daily use cialis 5mg cost per pill

what does generic cialis look like – buying cheap cialis online cialis next day delivery

buy cheap generic zantac – https://aranitidine.com/ zantac oral

cheap herbal viagra pills – buy viagra express delivery viagra pill 50mg

I am in point of fact happy to glance at this blog posts which consists of tons of profitable facts, thanks representing providing such data. https://gnolvade.com/

This is a theme which is near to my callousness… Diverse thanks! Exactly where can I find the connection details for questions? https://ursxdol.com/azithromycin-pill-online/

This is the kind of delivery I recoup helpful. https://prohnrg.com/product/priligy-dapoxetine-pills/

More posts like this would persuade the online space more useful. viagra professional 100mg prix

I couldn’t turn down commenting. Adequately written! https://ondactone.com/spironolactone/

Palatable blog you possess here.. It’s obdurate to on elevated worth belles-lettres like yours these days. I truly recognize individuals like you! Rent vigilance!!

https://doxycyclinege.com/pro/esomeprazole/

I couldn’t hold back commenting. Warmly written! https://sportavesti.ru/forums/users/mwuat-2/

pill forxiga 10mg – https://janozin.com/# buy generic dapagliflozin online

purchase xenical without prescription – https://asacostat.com/# buy xenical 120mg

This website positively has all of the low-down and facts I needed to this case and didn’t know who to ask. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24863