- After a 20% monthly fall, BTC’s price appreciated by 2% in the last 24 hours

- Most metrics suggested that BTC would remain bullish in the short-term

Bitcoin’s [BTC] price has been falling on the charts for several weeks now. 6 July was an exception though, with the crypto managing to stay green.

However, its insignificant 24-hour recovery was not comparable with cryptos that registered double-digit percentage hikes over the last 24 hours. That being said, the world’s largest cryptocurrency might soon turn a corner.

Bitcoin turns green

The past month was somewhat of a bloodbath for the king of cryptos as its price declined by nearly 20%. A similar declining trend was also seen last week. While the last 24 hours have brought better news for Bitcoin holders, the crypto is still far from hitting its former highs, with BTC trading just under $57k at press time.

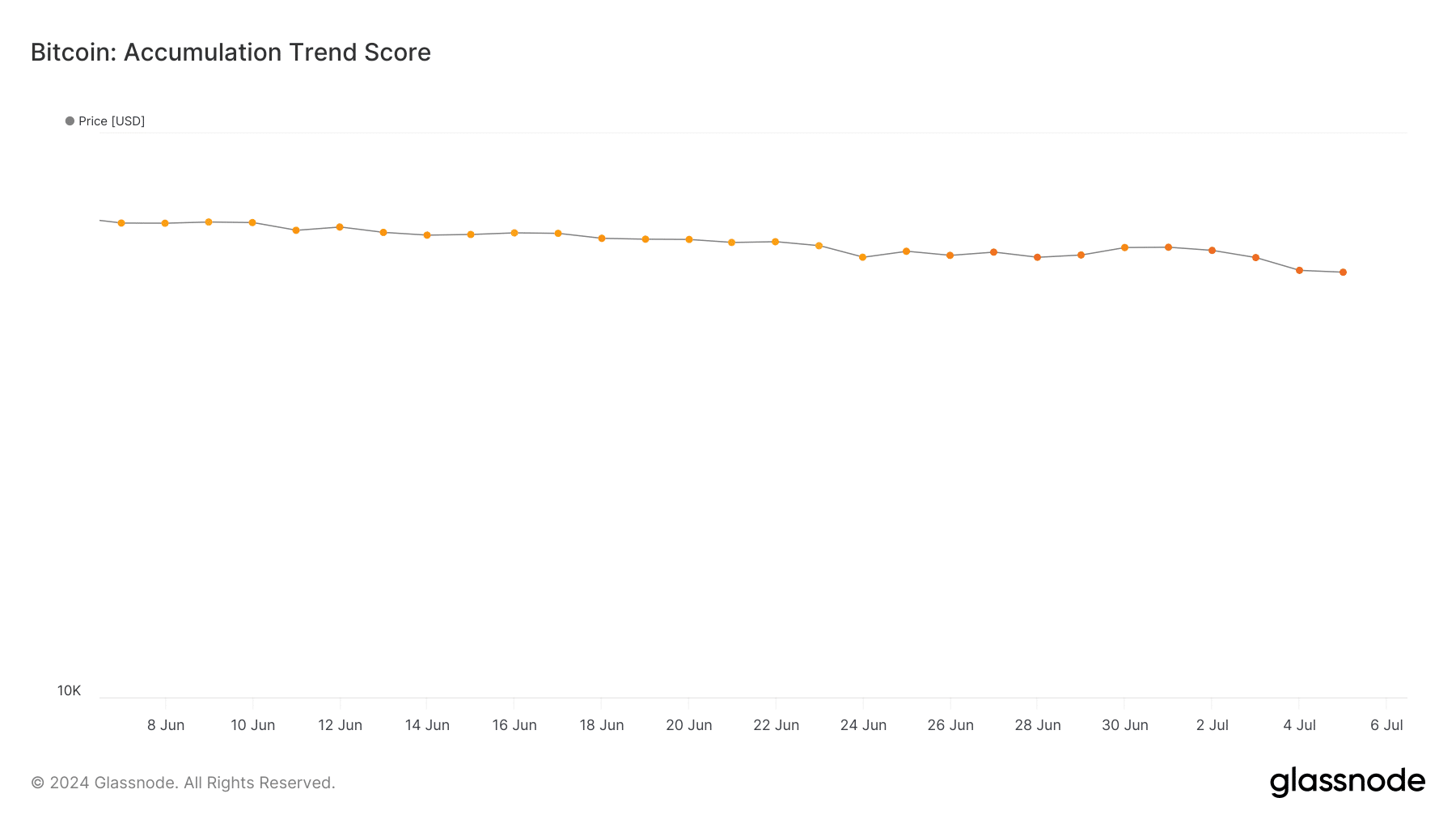

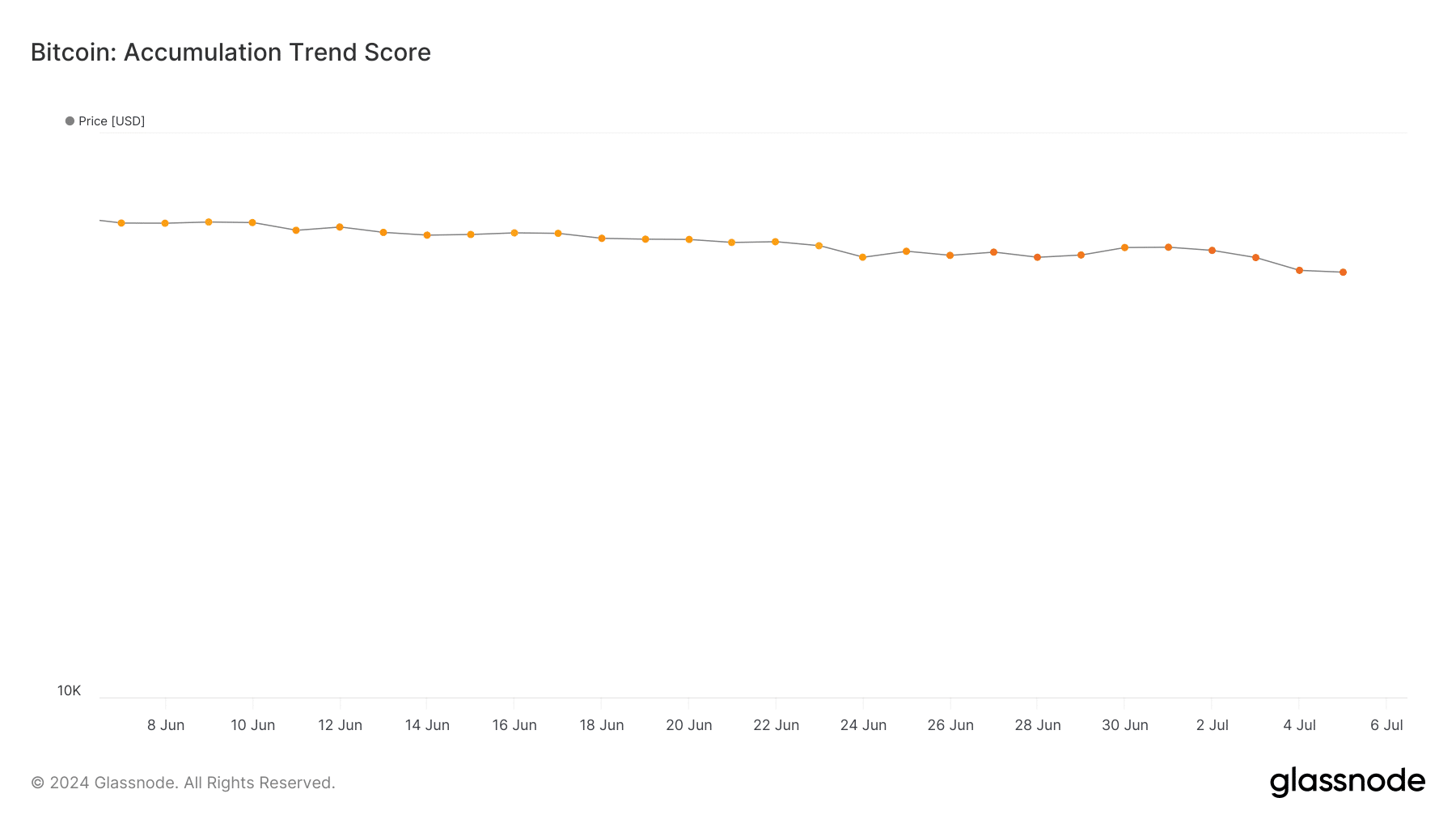

AMBCrypto’s look at CryptoQuant’s data revealed that BTC’s exchange reserves rose last month, meaning that investors were selling their holdings. Additionally, BTC’s accumulation trend score remained somewhere in the range of 0.16–0.11. Ordinarily, the closer the metric is to 1, the greater the buying pressure.

Here, it’s worth pointing out that the Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain, in terms of their BTC holdings.

Source: Glassnode

Will BTC recover anytime soon?

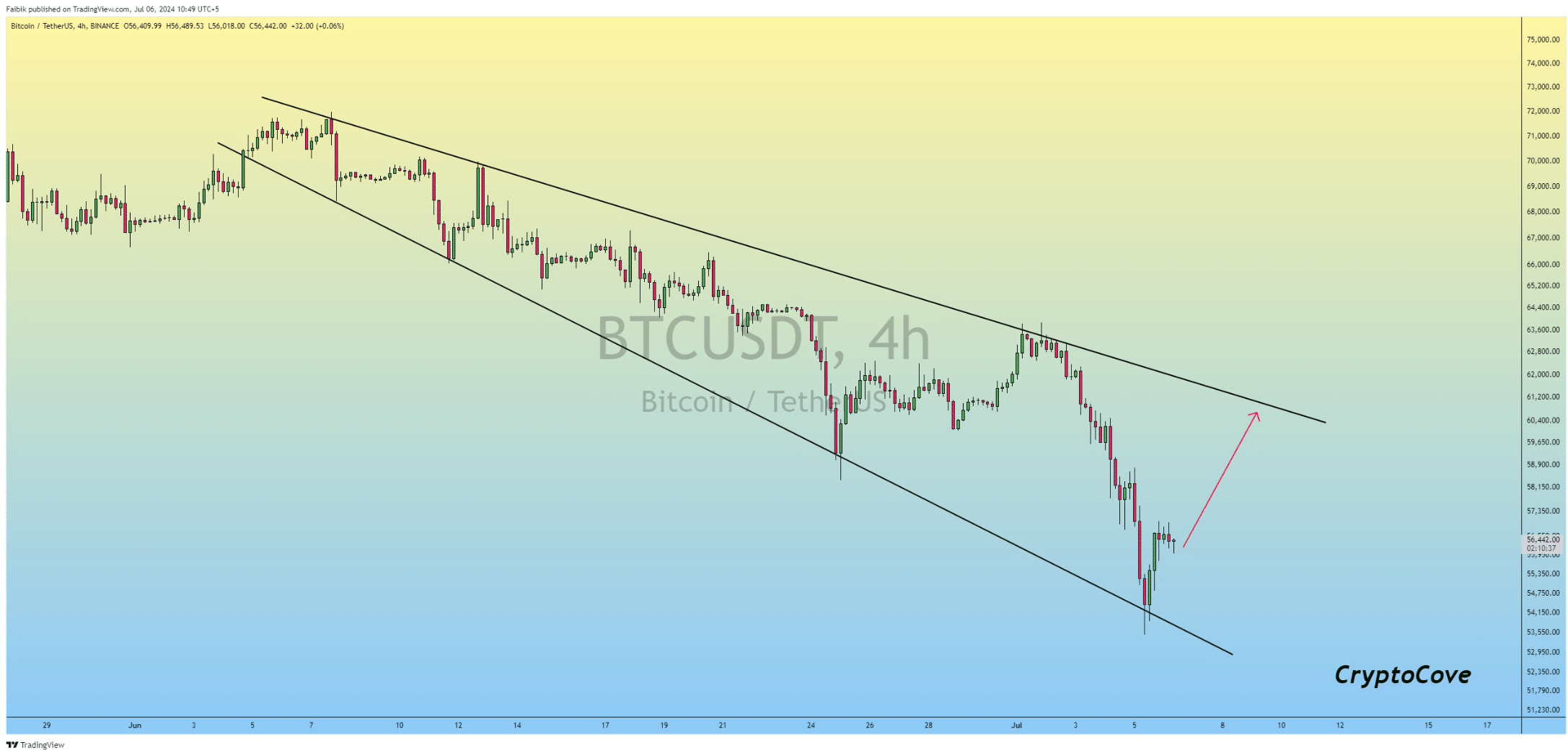

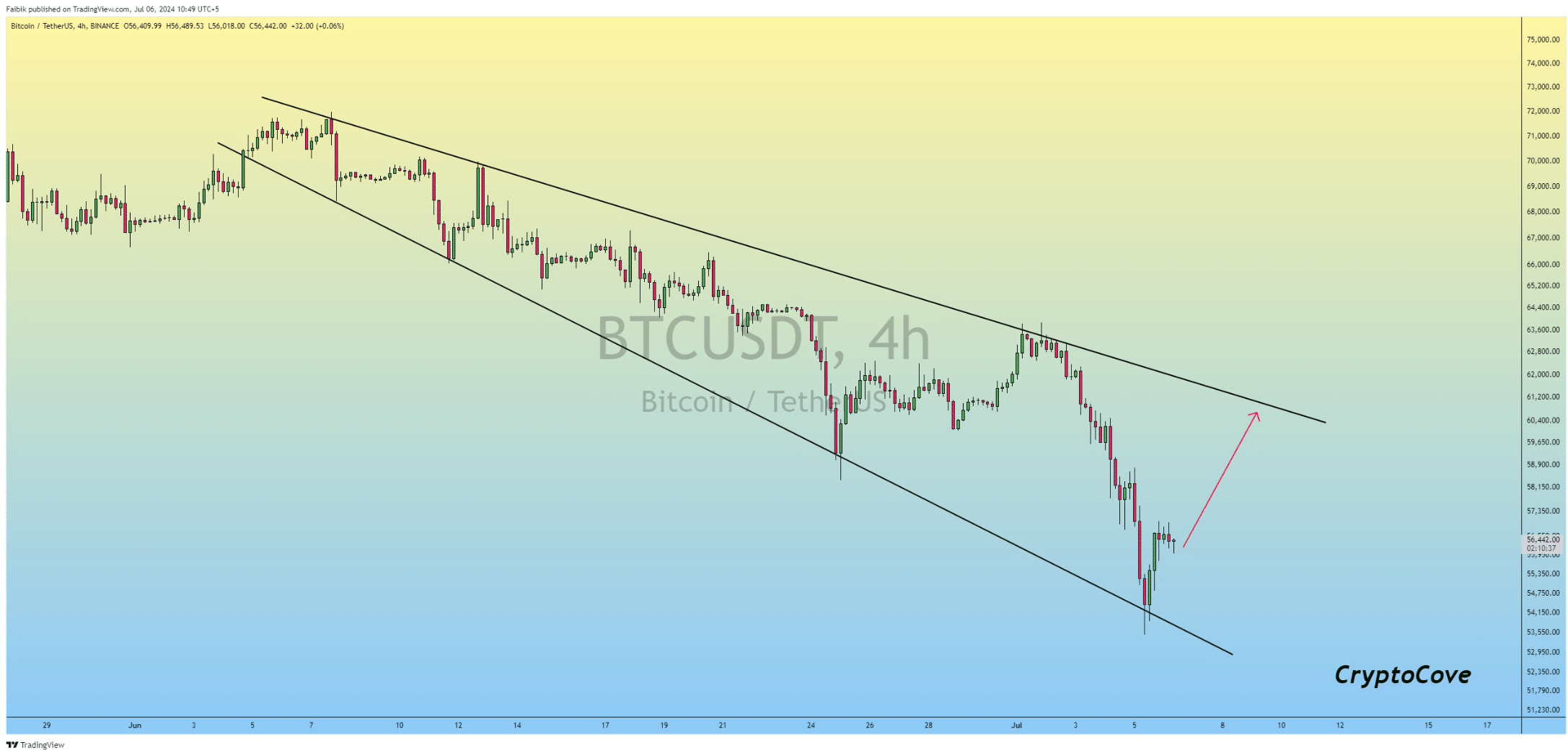

While that happened, Captain Faibik, a popular crypto analyst, shared a tweet revealing a possible reason behind BTC’s fall on the charts.

As per the analyst’s findings, BTC’s price has been consolidating inside a widening, falling wedge pattern. The tweet also mentioned that Bitcoin bulls need to clear the $61k resistance area to regain bullish momentum.

Source: X

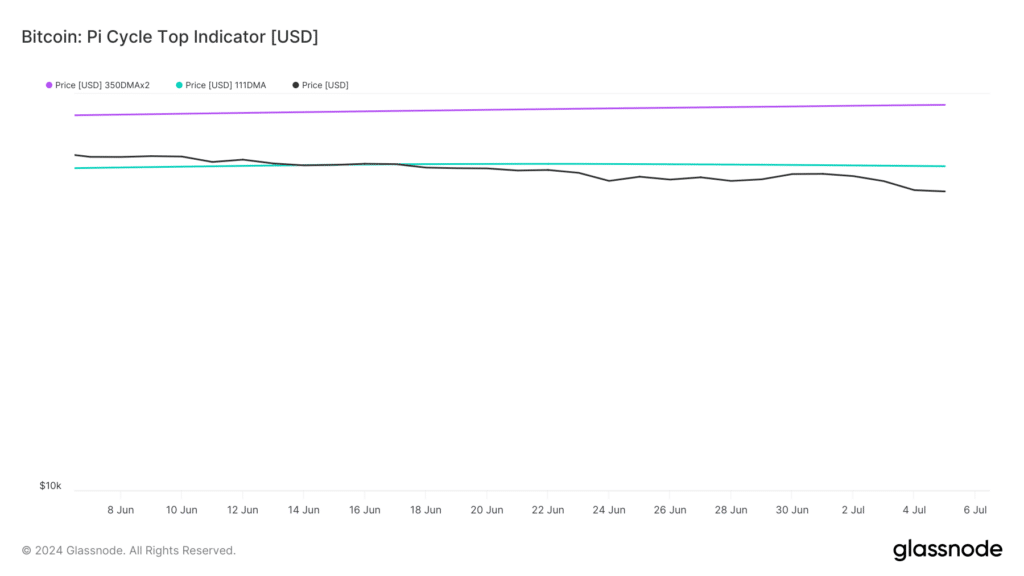

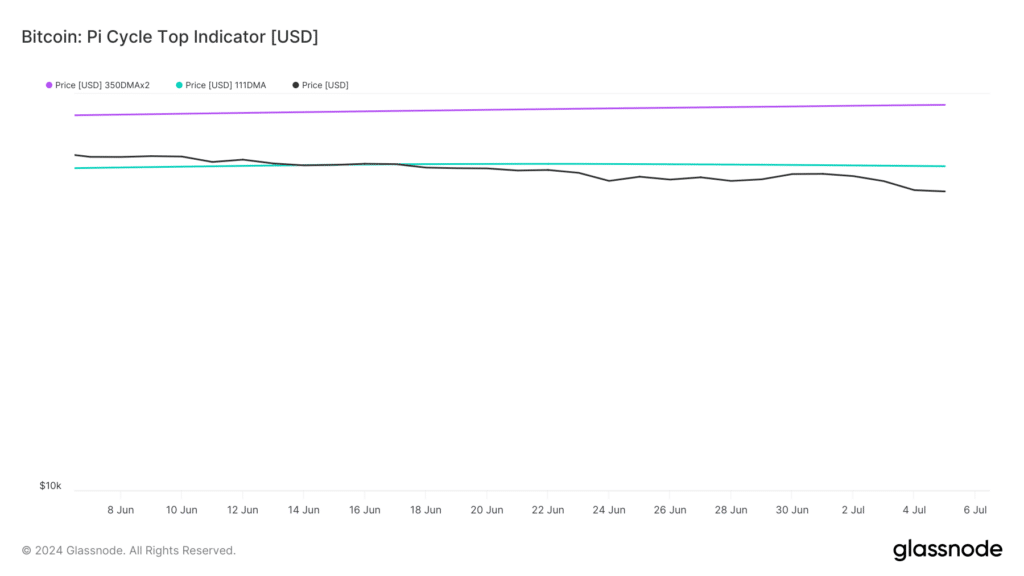

Additionally, AMBCrypto’s analysis of BTC’s Pi Cycle Top indicator highlighted that the crypto has been resting under its possible market bottom for quite some time now.

As per the same, BTC’s possible market bottom and tops were $65k and $93k, respectively. Moreover, BTC’s fear and greed index showed that it had a value of 23, meaning that the market was in a “fear” phase. Whenever that happens, the chance of a price hike are high.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

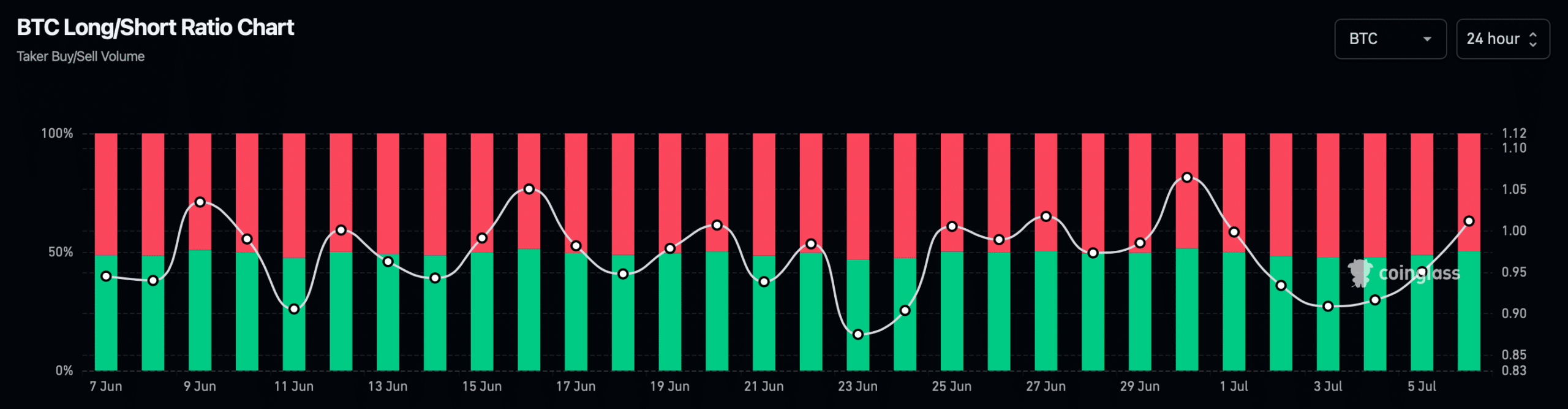

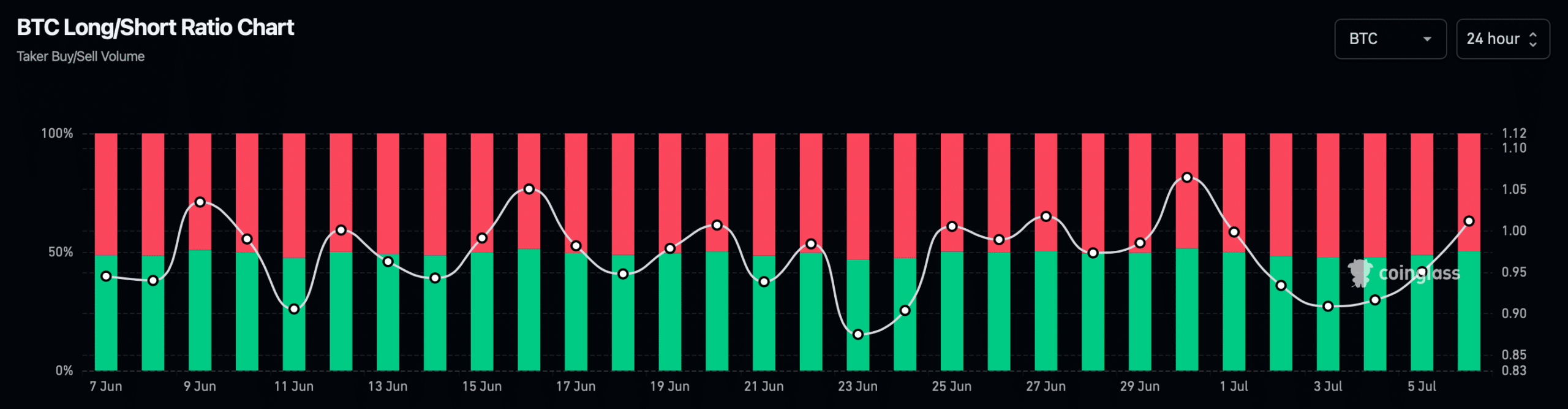

Apart from this, it looked pretty optimistic on the derivatives market front too.

AMBCrypto’s analysis of Coinglass’ data identified that BTC’s long/short ratio increased too. A hike in this metric means that there are more long positions in the market, compared to short positions.

In this case, the long/short ratio suggested that the market sentiment around BTC has been mostly bullish over the last 24 hours.

Source: Coinglass

- After a 20% monthly fall, BTC’s price appreciated by 2% in the last 24 hours

- Most metrics suggested that BTC would remain bullish in the short-term

Bitcoin’s [BTC] price has been falling on the charts for several weeks now. 6 July was an exception though, with the crypto managing to stay green.

However, its insignificant 24-hour recovery was not comparable with cryptos that registered double-digit percentage hikes over the last 24 hours. That being said, the world’s largest cryptocurrency might soon turn a corner.

Bitcoin turns green

The past month was somewhat of a bloodbath for the king of cryptos as its price declined by nearly 20%. A similar declining trend was also seen last week. While the last 24 hours have brought better news for Bitcoin holders, the crypto is still far from hitting its former highs, with BTC trading just under $57k at press time.

AMBCrypto’s look at CryptoQuant’s data revealed that BTC’s exchange reserves rose last month, meaning that investors were selling their holdings. Additionally, BTC’s accumulation trend score remained somewhere in the range of 0.16–0.11. Ordinarily, the closer the metric is to 1, the greater the buying pressure.

Here, it’s worth pointing out that the Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain, in terms of their BTC holdings.

Source: Glassnode

Will BTC recover anytime soon?

While that happened, Captain Faibik, a popular crypto analyst, shared a tweet revealing a possible reason behind BTC’s fall on the charts.

As per the analyst’s findings, BTC’s price has been consolidating inside a widening, falling wedge pattern. The tweet also mentioned that Bitcoin bulls need to clear the $61k resistance area to regain bullish momentum.

Source: X

Additionally, AMBCrypto’s analysis of BTC’s Pi Cycle Top indicator highlighted that the crypto has been resting under its possible market bottom for quite some time now.

As per the same, BTC’s possible market bottom and tops were $65k and $93k, respectively. Moreover, BTC’s fear and greed index showed that it had a value of 23, meaning that the market was in a “fear” phase. Whenever that happens, the chance of a price hike are high.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

Apart from this, it looked pretty optimistic on the derivatives market front too.

AMBCrypto’s analysis of Coinglass’ data identified that BTC’s long/short ratio increased too. A hike in this metric means that there are more long positions in the market, compared to short positions.

In this case, the long/short ratio suggested that the market sentiment around BTC has been mostly bullish over the last 24 hours.

Source: Coinglass

buying clomiphene price how to buy cheap clomiphene without dr prescription can i get generic clomid pills where to get generic clomid without prescription clomid costo cost of cheap clomid prices buy cheap clomid price

I will immediately grasp your rss as I can’t in finding your email subscription link or e-newsletter service. Do you’ve any? Please allow me know in order that I could subscribe. Thanks.

Thanks for putting this up. It’s well done.

More content pieces like this would make the интернет better.

azithromycin 500mg canada – azithromycin order how to get flagyl without a prescription

order domperidone 10mg for sale – oral tetracycline 250mg cyclobenzaprine online buy

where can i buy propranolol – order clopidogrel pill order methotrexate online

I see something truly special in this site.

amoxil for sale – combivent 100 mcg uk combivent order

buy azithromycin 250mg without prescription – how to buy zithromax nebivolol 5mg without prescription

buy augmentin 625mg pills – atbioinfo.com purchase ampicillin sale

purchase nexium for sale – anexamate nexium 20mg over the counter

coumadin 2mg without prescription – https://coumamide.com/ cozaar 25mg us

cost meloxicam 15mg – https://moboxsin.com/ order generic mobic 15mg

It’s actually a nice and helpful piece of information. I am happy that you simply shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

order deltasone 5mg for sale – corticosteroid order deltasone 40mg online cheap

I got good info from your blog

how to buy ed pills – https://fastedtotake.com/ buy erectile dysfunction medication

amoxil pills – https://combamoxi.com/ cheap amoxil

forcan order – click buy generic diflucan 200mg

cenforce uk – cenforce online order buy cenforce cheap

buy ranitidine 150mg online cheap – ranitidine 150mg pill ranitidine 150mg uk

cialis online without a prescription – https://strongtadafl.com/# cialis online pharmacy australia

Thanks recompense sharing. It’s top quality. click

how to order viagra in australia – canadian viagra 100mg sildenafil 100mg price india

I am in truth delighted to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. buy prednisone

Thanks for sharing. It’s first quality. https://ursxdol.com/doxycycline-antibiotic/

Greetings! Very useful recommendation within this article! It’s the petty changes which liking espy the largest changes. Thanks a a quantity in the direction of sharing! https://prohnrg.com/product/omeprazole-20-mg/

Very interesting information!Perfect just what I was looking for! “Time is money.” by Benjamin Franklin.

This is the kind of serenity I enjoy reading. https://ondactone.com/product/domperidone/

I am actually delighted to glitter at this blog posts which consists of tons of of use facts, thanks object of providing such data.

generic zantac

I couldn’t weather commenting. Warmly written! http://www.zgqsz.com/home.php?mod=space&uid=846483