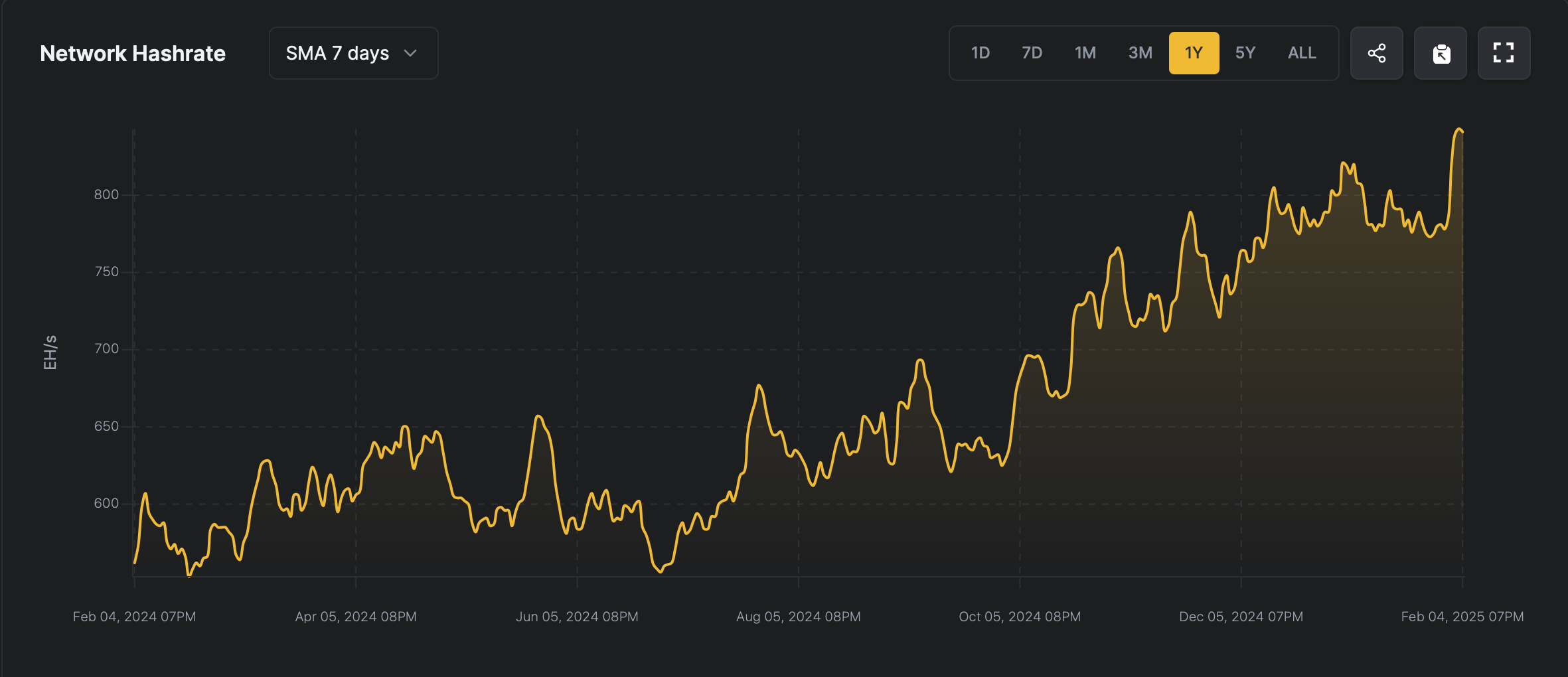

Bitcoin’s computational prowess currently hums at 825.85 exahash per second (EH/s), a gentle dip from its zenith of 844 EH/s recorded on Feb. 4, 2025. The network’s transaction queue, known as the mempool, continues to reflect minimal activity, while newly minted blocks materialize slightly quicker than the protocol’s 10-minute target.

Foundry Leads Mining Race: Four Pools Generate 78% of Bitcoin’s Computational Power

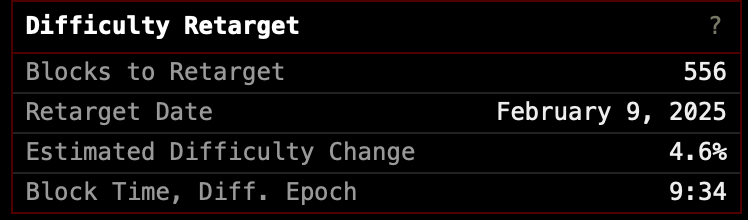

As of Feb. 5, 2025, the rhythm of block creation has settled at an average of 9 minutes 36 seconds. Should this brisk pace persist, the protocol’s self-adjusting mechanism will enact a 4.6% upward recalibration in mining difficulty by Feb. 9—a shift estimations now deem probable. Notably, data from hashrateindex.com reveals Bitcoin’s seven-day simple moving average (SMA) scaled to a historic peak of 844 EH/s just one day prior, highlighting the network’s dynamic adaptability.

Source: hashrateindex.com

As of 1:20 p.m. ET Wednesday, Bitcoin’s transactional queue coasts along with 12,957 pending confirmations—a backlog spanning roughly eight blocks. Miners currently reap $57.56 per daily petahash per second (PH/s) in hashprice, a figure modestly retreating from recent monthly highs yet comfortably eclipsing the Jan. 5 benchmark. Simultaneously, high-priority fees linger at 4 satoshis per virtual byte (sat/vB), reflecting subdued network strain.

Four mining collectives command the computational arena: Foundry reigns supreme with 260 EH/s (32.4% of total output), trailed by Antpool (20.21%), Viabtc (14.85%), and F2pool (10.73%). Secpool, MARA Pool, Spider Pool, SBI Crypto, Luxor, and Braiins Pool complete the hierarchy. Bitcoin’s ecosystem thrives on equilibrium: miners calibrate efforts against oscillating rewards, while transactional demand whispers rather than shouts. The current lull in fee pressure and hashprice’s tempered glide reveal a network in momentary repose.

Source: bitcoin.clarkmoody.com/dashboard/

The impending difficulty hike, whatever it leads to, will compress miners’ margins, incentivizing efficiency upgrades or exits. Higher thresholds demand amplified computational investments, reshaping competitive hierarchies while reinforcing Bitcoin’s self-regulating architecture. If BTC prices stay low and the network difficulty spikes, it won’t be a good thing.

While Bitcoin’s recent block cadence maintains a brisk 9 minutes 36 seconds, a curious anomaly recently emerged: a glacial 88-minute gap separated blocks 882,331 and 882,332. Data from Dune Analytics reveals four such sluggish intervals exceeding 60 minutes in February 2025—quirks in an otherwise rhythmic cryptographic clockwork.

buying clomid how can i get cheap clomid pill can i order clomid for sale how to get generic clomid pill how can i get clomid how to buy cheap clomid without prescription can you get clomid without rx

I’ll certainly carry back to review more.

I am in truth enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks representing providing such data.

buy azithromycin online cheap – flagyl 200mg pills how to buy metronidazole

semaglutide sale – cyproheptadine 4 mg cheap periactin oral

oral motilium – buy sumycin no prescription flexeril sale

amoxicillin sale – order ipratropium without prescription order combivent 100mcg

zithromax over the counter – buy cheap tinidazole order bystolic generic

buy augmentin 625mg pills – https://atbioinfo.com/ acillin tablet

how to buy esomeprazole – https://anexamate.com/ esomeprazole over the counter

warfarin 5mg pill – anticoagulant order losartan 50mg sale

mobic 15mg generic – mobo sin generic meloxicam 15mg

prednisone 20mg us – arthritis buy deltasone 20mg generic

buy ed pills online usa – https://fastedtotake.com/ top ed drugs

order amoxil for sale – comba moxi buy amoxicillin medication

order cenforce 50mg without prescription – https://cenforcers.com/# order cenforce 50mg for sale

cialis for sale brand – https://ciltadgn.com/# cialis w/o perscription

when will teva’s generic tadalafil be available in pharmacies – https://strongtadafl.com/ when does tadalafil go generic

order ranitidine 300mg online – https://aranitidine.com/ zantac 300mg tablet

More articles like this would remedy the blogosphere richer. neurontin 800mg us

I am in point of fact delighted to glance at this blog posts which consists of tons of of use facts, thanks for providing such data. https://ursxdol.com/prednisone-5mg-tablets/

This is a question which is forthcoming to my verve… Many thanks! Faithfully where can I upon the acquaintance details in the course of questions?

https://proisotrepl.com/product/methotrexate/

More content pieces like this would create the web better. http://3ak.cn/home.php?mod=space&uid=229263

order forxiga 10mg for sale – janozin.com where to buy forxiga without a prescription

order orlistat generic – site cheap orlistat 60mg