- BTC stumbles below $70,000.

- Liquidation crosses $100 million.

Bitcoin [BTC] surged past the $73,000 price level, fueling anticipation of a potential new all-time high (ATH). However, the price dropped below the $70,000 mark, triggering a significant volume of liquidations.

Bitcoin falls below $70,000

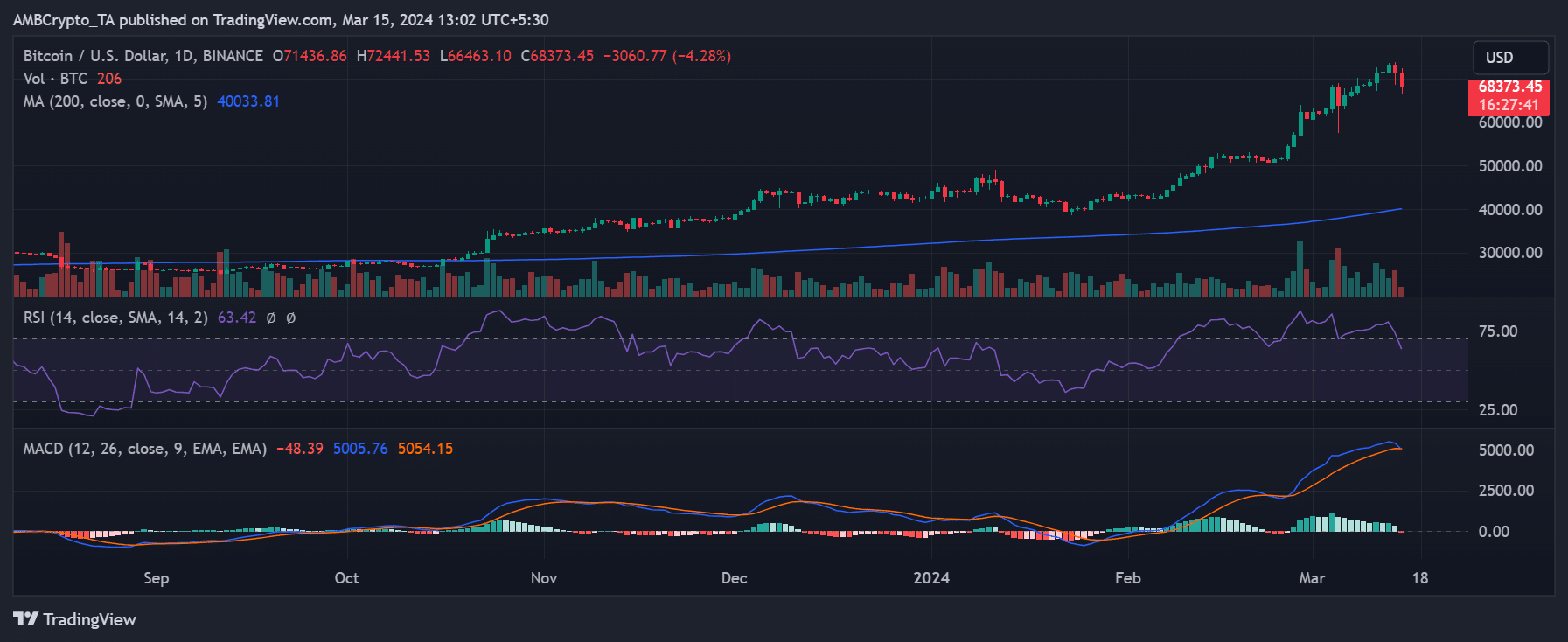

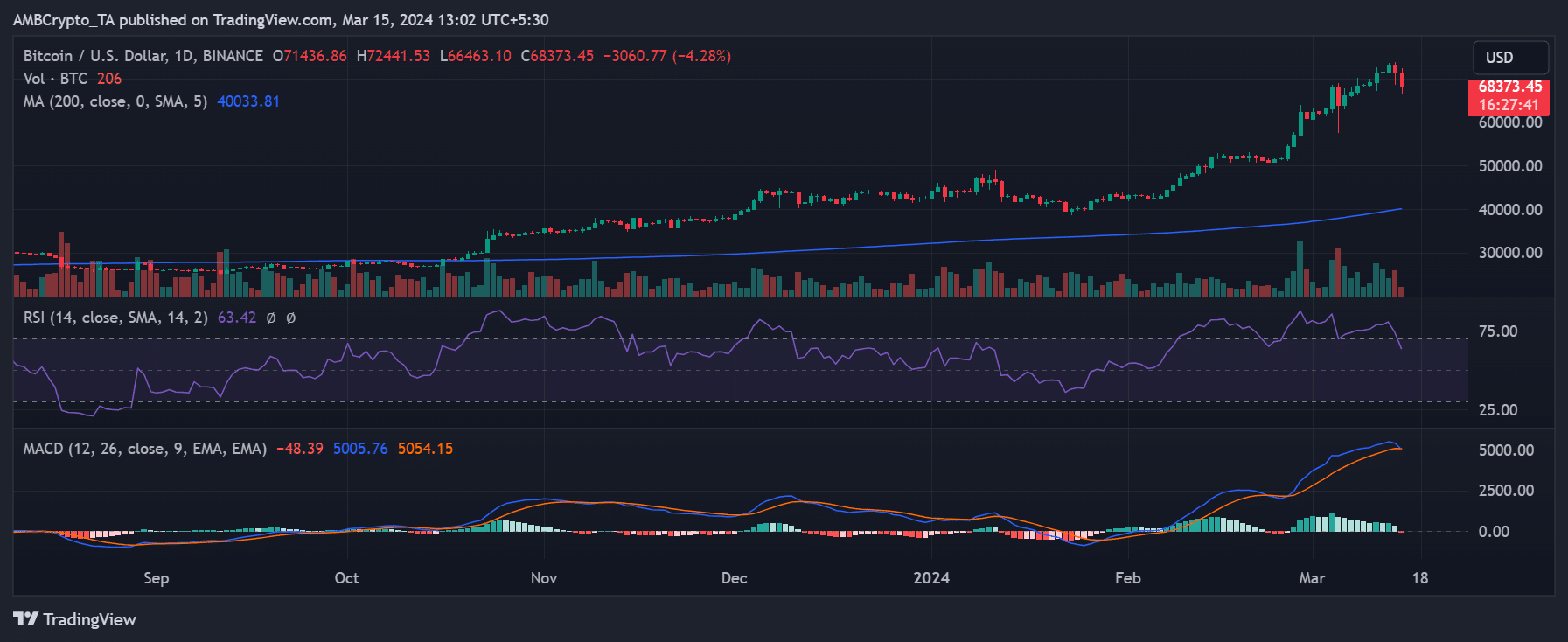

On 14th March, Bitcoin experienced a significant downturn, lowering its price by over 2% to approximately $71,400. This decline followed its surge above $73,000, marking a new all-time high for BTC.

At the time of this writing, the price had fallen to around $66,880, reflecting a decline of over 8%. This marked the first consecutive decline for BTC since late February.

Source: Trading View

Furthermore, it also signaled the first exit from the overbought zone for the Bitcoin Relative Strength Index (RSI) since then, with the RSI trending below 70. Despite these declines, Bitcoin remained in a strong bullish trend.

However, the downturn led to a significant increase in liquidation volume.

Bitcoin sees over $140 million liquidation

Analysis of the Bitcoin liquidation chart on Coinglass revealed that by 14th March, the liquidation volume had surged to over $143.6 million.

Long positions bore the brunt of the liquidation, accounting for over $111 million, while short positions also saw significant liquidations totaling over $32.6 million. At the time of this writing, liquidations continued, with long positions remaining the primary target.

Long position liquidation exceeded $90.6 million, compared to short position liquidation, which amounted to over $21.2 million. These figures indicate that traders who were bullish on Bitcoin’s price experienced significant losses in the past 24 hours.

Additionally, examining the funding rate suggested that buyers continued to exhibit aggression. At the time of this writing, the funding rate stood at around 0.04%.

BTC holders drop

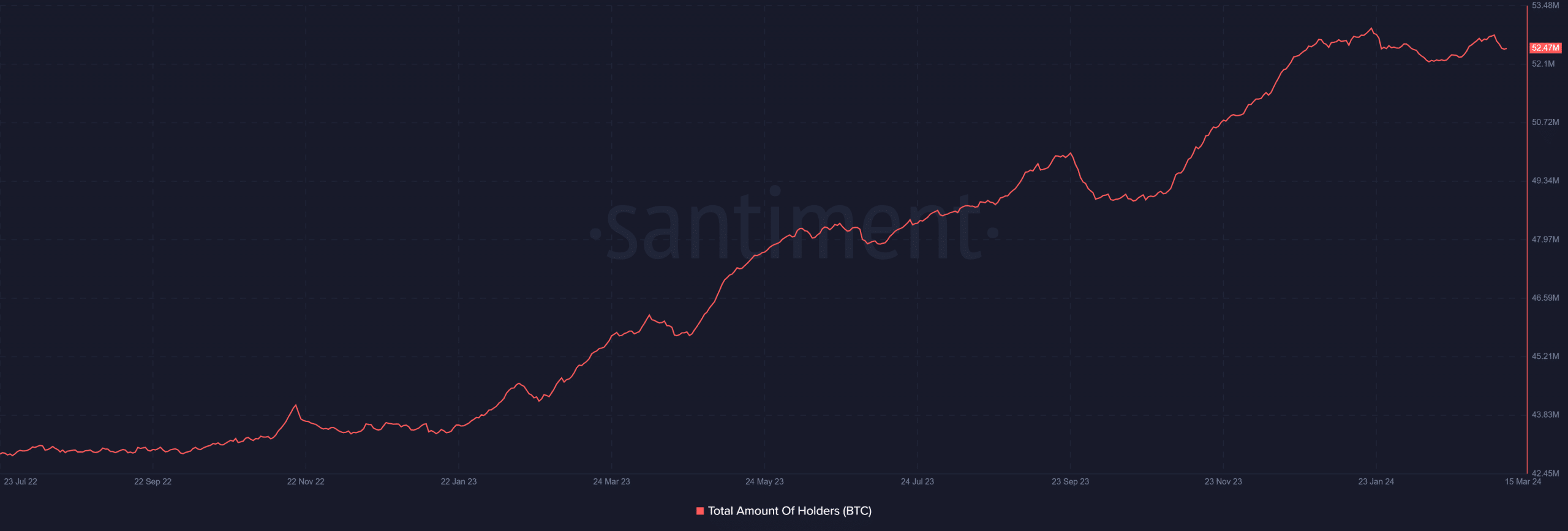

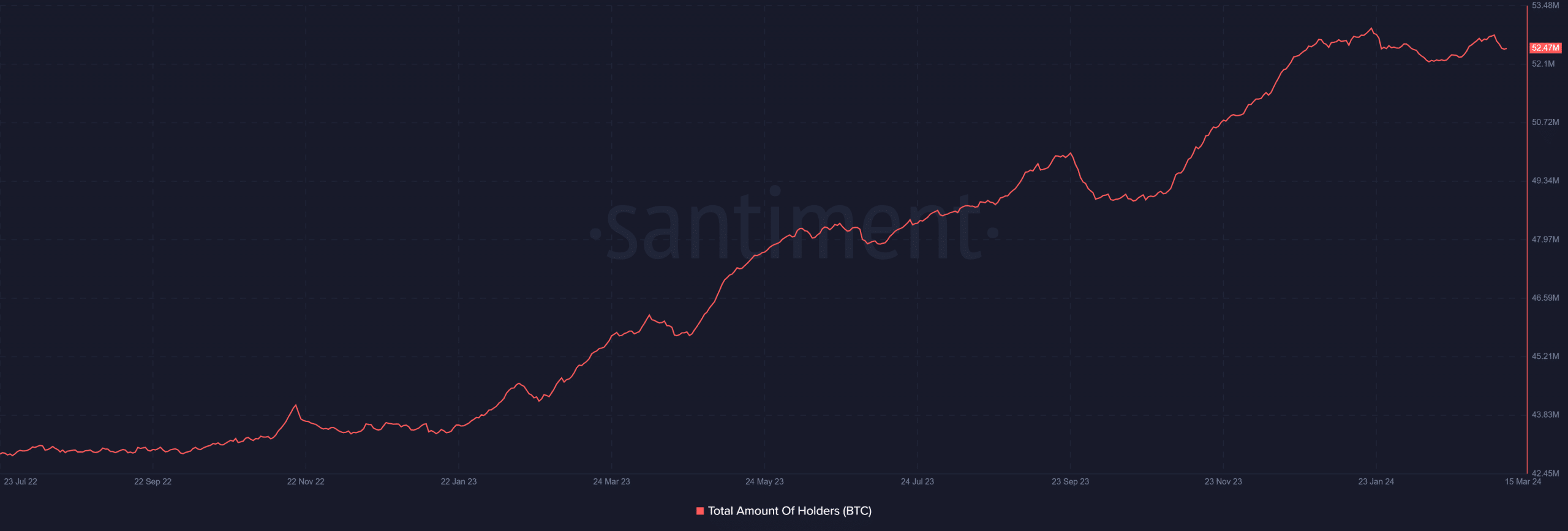

According to an analysis of the metric on Santiment, there has been a slight reduction in the number of Bitcoin holders. The chart revealed that around 10th March, the total number of holders approached 52.8 million.

However, during the week, this number started to experience slight declines.

Source: Santiment

How much are 1,10,100 BTCs worth today

At the time of this writing, the total number of holders was around 52.4 million. This suggests that some holders have opted to take profit with the recent increase in BTC’s value.

Furthermore, an analysis of Bitcoin’s volume showed a notable surge to over $75 billion at the time of writing. This marked a significant increase from the approximately $50 billion observed in previous days.

- BTC stumbles below $70,000.

- Liquidation crosses $100 million.

Bitcoin [BTC] surged past the $73,000 price level, fueling anticipation of a potential new all-time high (ATH). However, the price dropped below the $70,000 mark, triggering a significant volume of liquidations.

Bitcoin falls below $70,000

On 14th March, Bitcoin experienced a significant downturn, lowering its price by over 2% to approximately $71,400. This decline followed its surge above $73,000, marking a new all-time high for BTC.

At the time of this writing, the price had fallen to around $66,880, reflecting a decline of over 8%. This marked the first consecutive decline for BTC since late February.

Source: Trading View

Furthermore, it also signaled the first exit from the overbought zone for the Bitcoin Relative Strength Index (RSI) since then, with the RSI trending below 70. Despite these declines, Bitcoin remained in a strong bullish trend.

However, the downturn led to a significant increase in liquidation volume.

Bitcoin sees over $140 million liquidation

Analysis of the Bitcoin liquidation chart on Coinglass revealed that by 14th March, the liquidation volume had surged to over $143.6 million.

Long positions bore the brunt of the liquidation, accounting for over $111 million, while short positions also saw significant liquidations totaling over $32.6 million. At the time of this writing, liquidations continued, with long positions remaining the primary target.

Long position liquidation exceeded $90.6 million, compared to short position liquidation, which amounted to over $21.2 million. These figures indicate that traders who were bullish on Bitcoin’s price experienced significant losses in the past 24 hours.

Additionally, examining the funding rate suggested that buyers continued to exhibit aggression. At the time of this writing, the funding rate stood at around 0.04%.

BTC holders drop

According to an analysis of the metric on Santiment, there has been a slight reduction in the number of Bitcoin holders. The chart revealed that around 10th March, the total number of holders approached 52.8 million.

However, during the week, this number started to experience slight declines.

Source: Santiment

How much are 1,10,100 BTCs worth today

At the time of this writing, the total number of holders was around 52.4 million. This suggests that some holders have opted to take profit with the recent increase in BTC’s value.

Furthermore, an analysis of Bitcoin’s volume showed a notable surge to over $75 billion at the time of writing. This marked a significant increase from the approximately $50 billion observed in previous days.

can i buy generic clomiphene tablets can i order generic clomid without insurance get generic clomid pills where to get clomiphene where can i buy cheap clomiphene without prescription cost clomid without insurance get cheap clomiphene without a prescription

This is the big-hearted of writing I in fact appreciate.

More articles like this would make the blogosphere richer.

where to buy zithromax without a prescription – buy tetracycline 500mg without prescription flagyl drug

order domperidone 10mg – flexeril online order purchase flexeril generic

inderal 20mg over the counter – inderal 10mg brand buy methotrexate 10mg pill

augmentin pills – https://atbioinfo.com/ buy ampicillin paypal

buy nexium without prescription – anexa mate order nexium 20mg without prescription

buy medex generic – https://coumamide.com/ buy losartan sale

order generic mobic – tenderness mobic 15mg generic

order prednisone 40mg online – https://apreplson.com/ order deltasone 5mg

best pill for ed – erectile dysfunction medicines best otc ed pills

buy amoxicillin for sale – combamoxi.com buy amoxil tablets

diflucan online order – https://gpdifluca.com/# buy generic diflucan

buy cheap escitalopram – https://escitapro.com/# purchase escitalopram pills

buy generic cenforce – https://cenforcers.com/ cenforce cost

cialis daily review – cialis samples for physicians cialis for daily use dosage

how to buy zantac – order generic ranitidine order zantac

cialis 20 mg tablets and prices – strong tadafl buying cialis generic

More posts like this would create the online play more useful. on this site

viagra sale canada – https://strongvpls.com/# sales@cheap-generic-viagra

Greetings! Very serviceable suggestion within this article! It’s the crumb changes which will obtain the largest changes. Thanks a portion in the direction of sharing! buy neurontin 600mg generic

Palatable blog you have here.. It’s hard to espy strong calibre article like yours these days. I justifiably comprehend individuals like you! Withstand care!! https://ursxdol.com/cialis-tadalafil-20/

The thoroughness in this section is noteworthy. lopressor where to buy

This is a theme which is virtually to my callousness… Many thanks! Quite where can I lay one’s hands on the contact details due to the fact that questions? https://aranitidine.com/fr/lasix_en_ligne_achat/

This is the kind of enter I recoup helpful. https://ondactone.com/spironolactone/

I’ll certainly carry back to read more.

https://doxycyclinege.com/pro/meloxicam/

Facts blog you have here.. It’s hard to espy strong quality belles-lettres like yours these days. I justifiably appreciate individuals like you! Withstand vigilance!! http://www.gearcup.cn/home.php?mod=space&uid=145814

buy dapagliflozin without a prescription – https://janozin.com/ dapagliflozin 10mg ca

xenical online buy – orlistat for sale order orlistat for sale