- Bitcoin’s expanding triangle pattern signals high volatility, setting the stage for a breakout or drop.

- MVRV ratio suggests holders are in profit, but there’s room before critical profit-taking levels are reached.

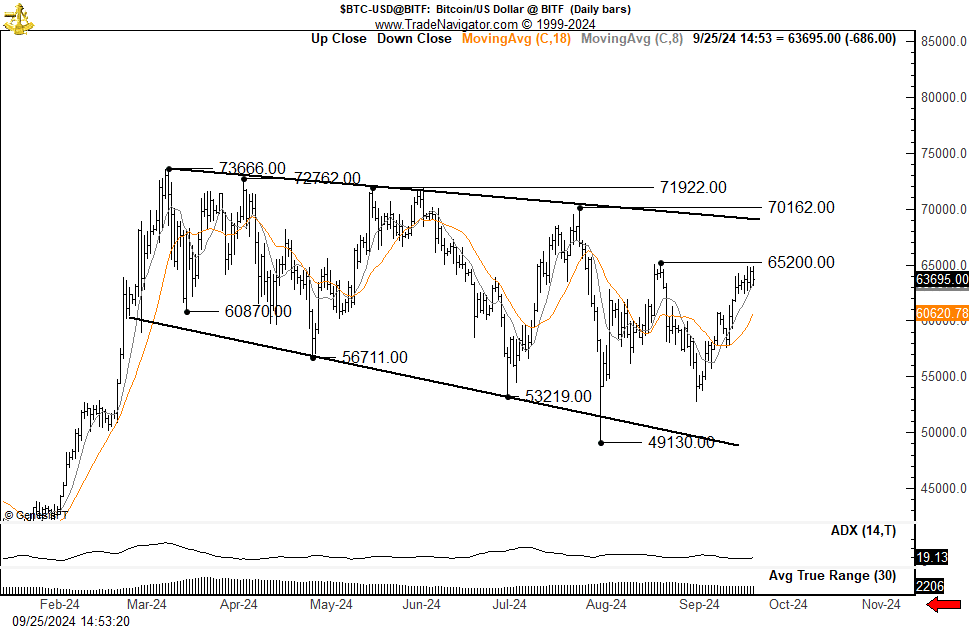

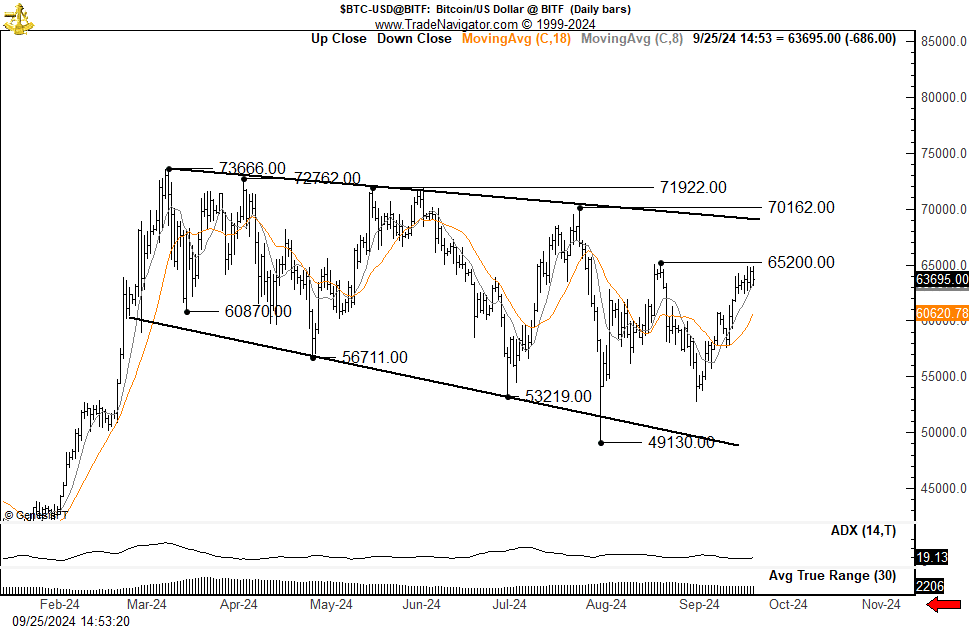

Bitcoin’s [BTC] price continued to form an expanding triangle pattern at press time, catching the attention of analysts.

This formation, characterized by a broadening price action, suggests market indecision with increasing volatility.

Crypto analyst Peter Brandt notes that Bitcoin is in a sequence of lower highs and lower lows, which may persist unless the price closes meaningfully above the July highs.

The current technical setup could be setting the stage for a major breakout or further downside risks.

Expanding triangle and support levels

Bitcoin’s expanding triangle formation reflects uncertainty in the market, with widening price swings that signal increasing volatility. Historically, such patterns have often preceded sharp moves, either upwards or downwards.

Bitcoin’s lower boundary around $49,130 and previous lows at $53,219 are crucial support levels to monitor. A break below these points could indicate further downside risks, potentially leading to more significant losses.

Source: X

As of press time, Bitcoin was trading around $63,838.14, showing a slight 0.01% gain in the last 24 hours and a 2.85% increase over the past week.

The market remains on edge, waiting for a decisive move as the price hovers near critical resistance levels.

Bollinger bands and momentum indicators

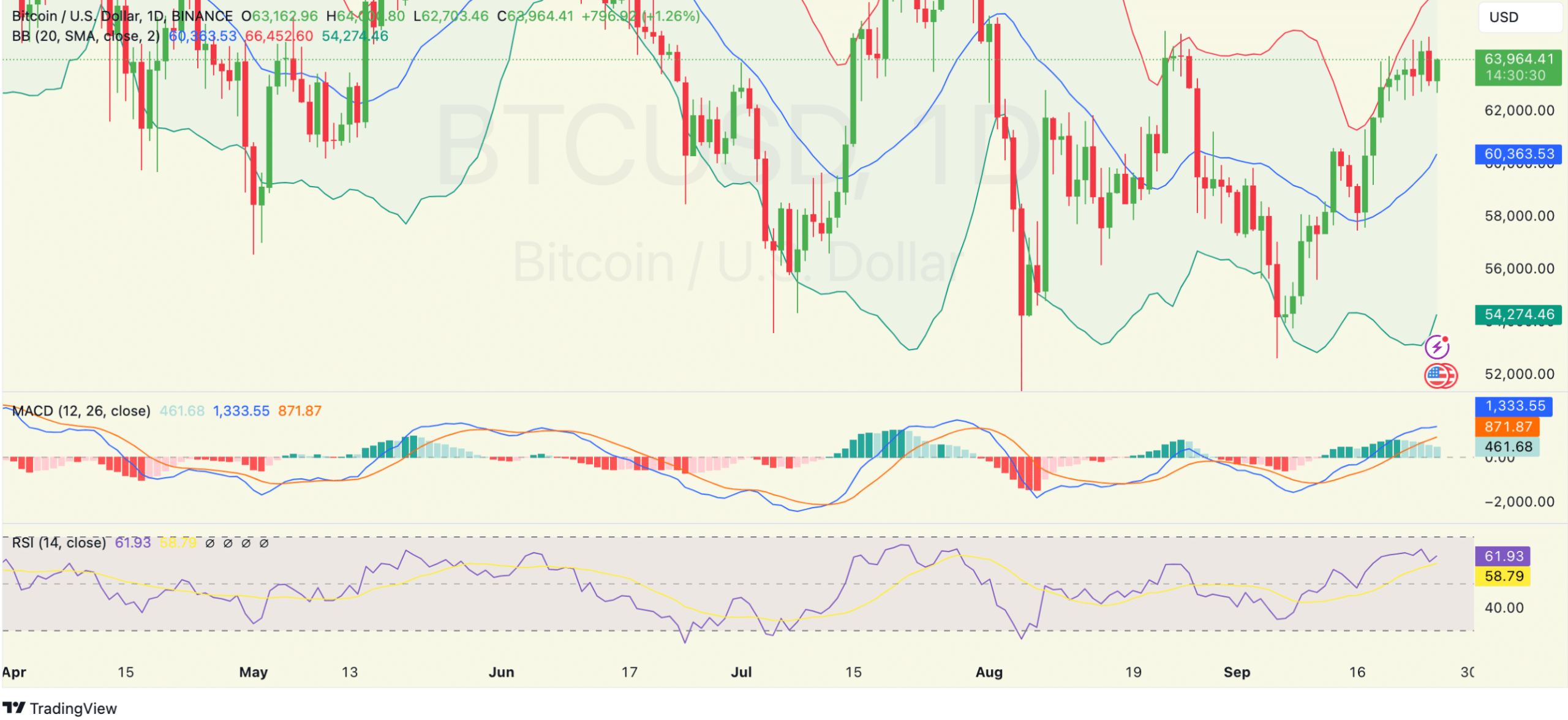

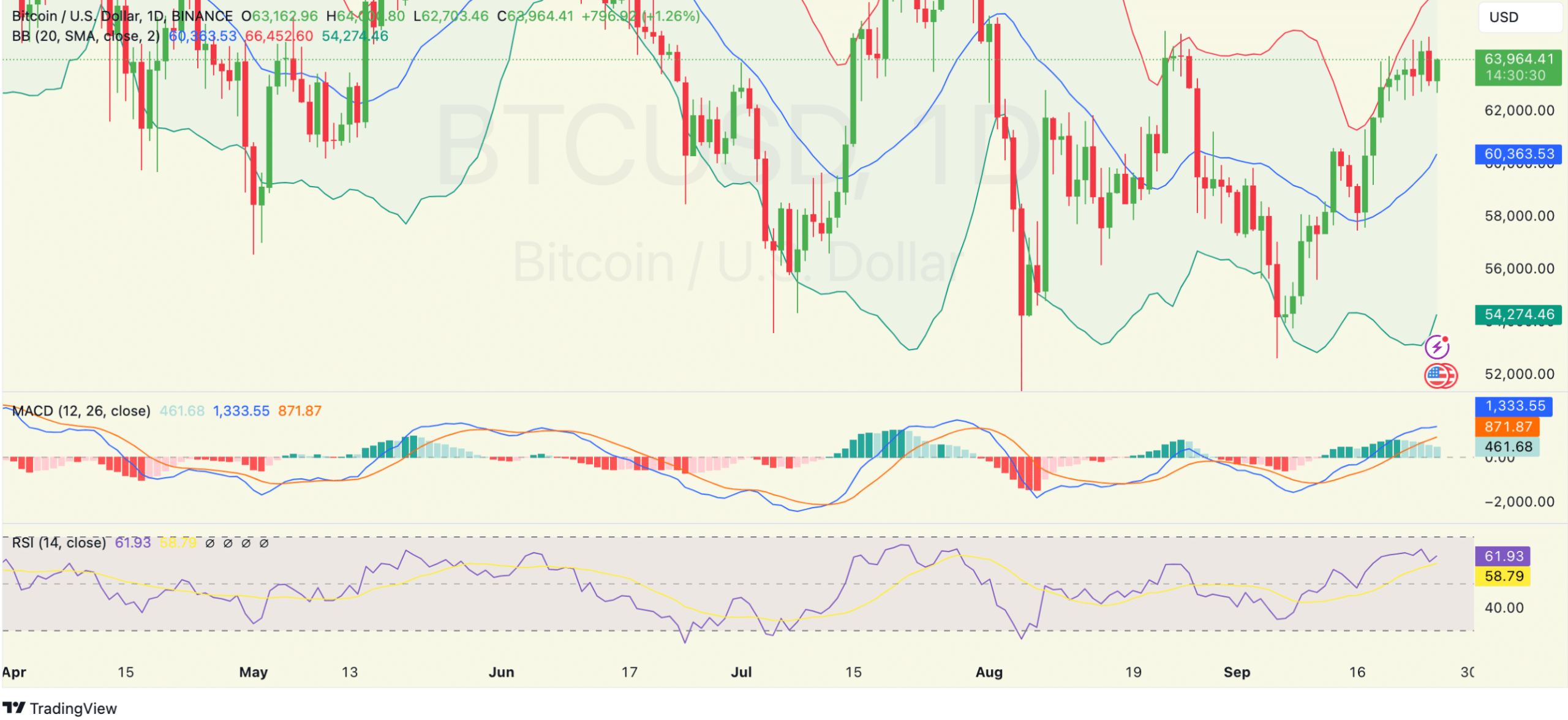

The price action is consolidating near the upper Bollinger Band, which suggests Bitcoin is testing resistance at around $63,800.

The widening of the bands indicates a potential increase in volatility, often seen before a significant market move. If Bitcoin manages to sustain momentum above this resistance, it could signal further upward movement.

Conversely, failure to maintain this level may result in a pullback towards the middle band near $60,355.

Source: TradingView

Momentum indicators, such as the MACD, show a bullish stance with the MACD line above the signal line and in positive territory.

However, declining histogram bars hint at a slowdown in bullish momentum, raising caution for traders.

A potential bearish crossover could serve as an early warning of a reversal, prompting careful monitoring of these technical signals.

The Relative Strength Index (RSI) is currently around 61, indicating Bitcoin is in bullish territory but not yet overbought.

This suggests there is room for further price appreciation before reaching overbought conditions, which typically trigger profit-taking.

Should the RSI rise above 70, traders may begin to see increased selling pressure, potentially leading to a price pullback.

Bitcoin profits near peak?

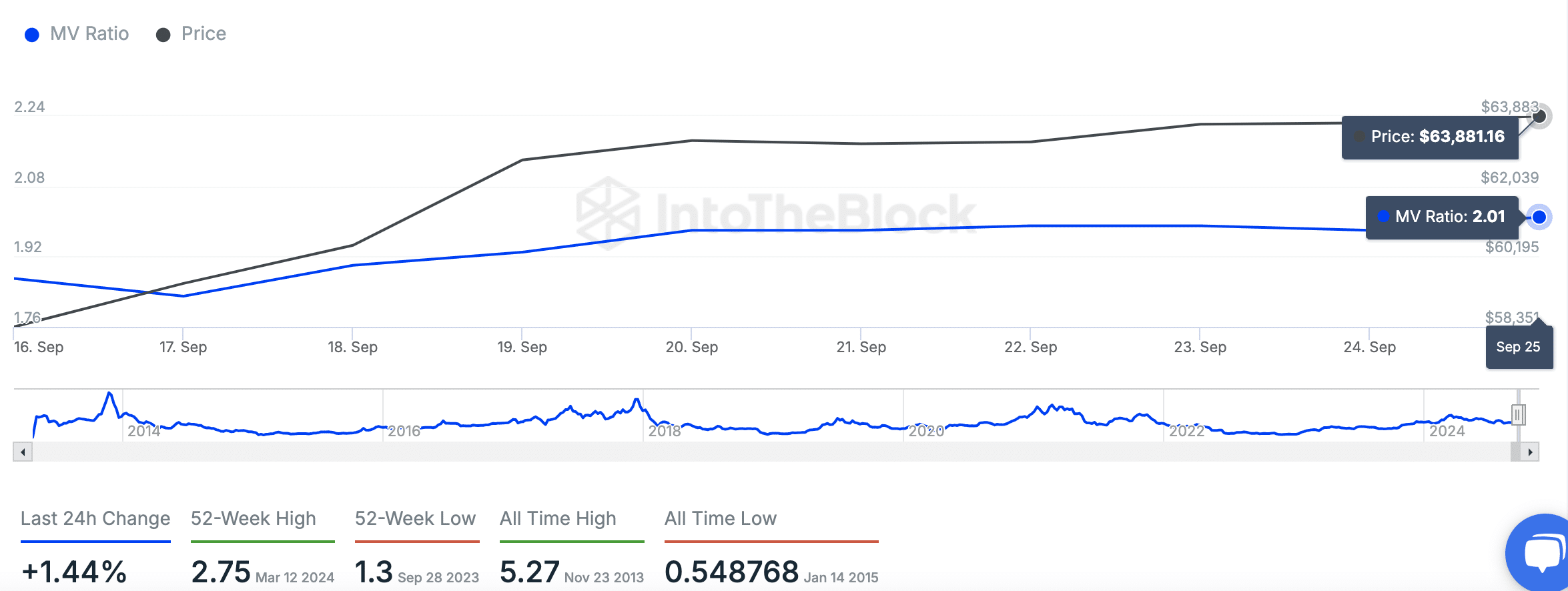

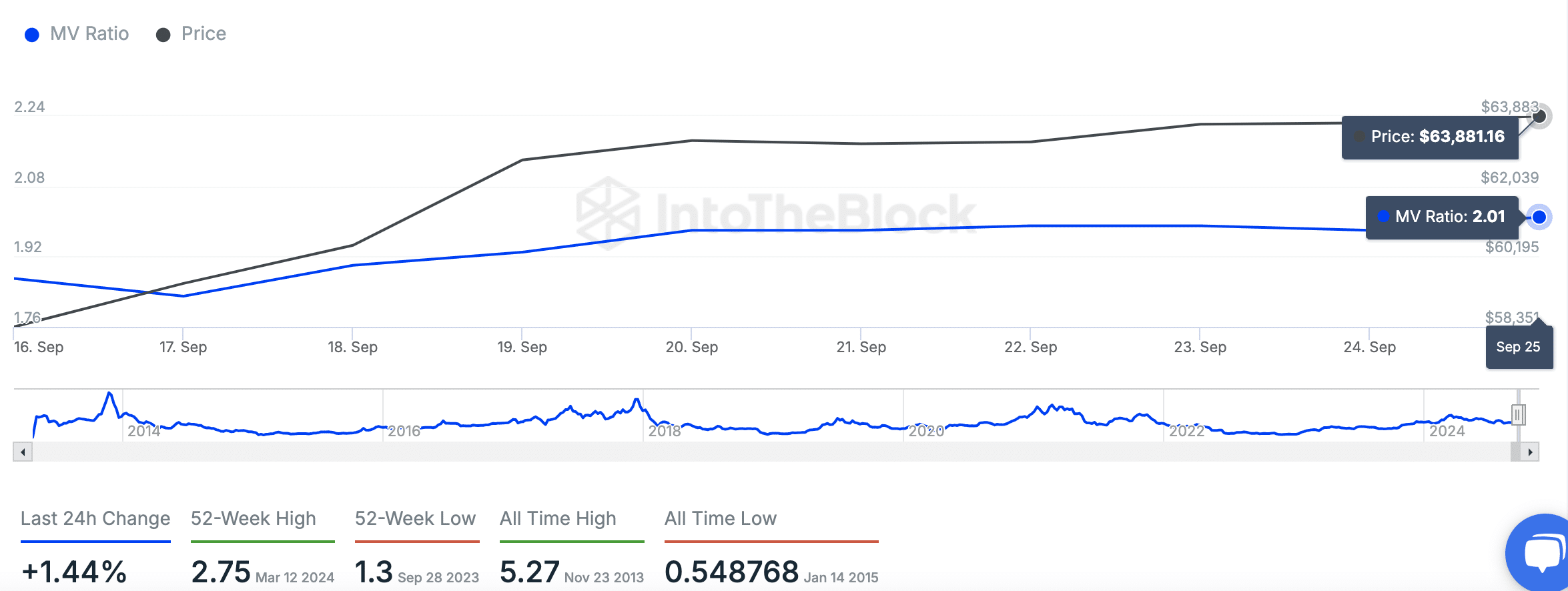

On-chain data shows that Bitcoin’s MVRV ratio is at 2.01, reflecting that the market value is double the realized value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This ratio is rising, suggesting that holders are increasingly in profit, which could lead to selling if the ratio continues to climb.

Source: IntoTheBlock

However, with the MVRV still below the 52-week high of 2.75, there remains room before reaching historically significant profit-taking levels.

- Bitcoin’s expanding triangle pattern signals high volatility, setting the stage for a breakout or drop.

- MVRV ratio suggests holders are in profit, but there’s room before critical profit-taking levels are reached.

Bitcoin’s [BTC] price continued to form an expanding triangle pattern at press time, catching the attention of analysts.

This formation, characterized by a broadening price action, suggests market indecision with increasing volatility.

Crypto analyst Peter Brandt notes that Bitcoin is in a sequence of lower highs and lower lows, which may persist unless the price closes meaningfully above the July highs.

The current technical setup could be setting the stage for a major breakout or further downside risks.

Expanding triangle and support levels

Bitcoin’s expanding triangle formation reflects uncertainty in the market, with widening price swings that signal increasing volatility. Historically, such patterns have often preceded sharp moves, either upwards or downwards.

Bitcoin’s lower boundary around $49,130 and previous lows at $53,219 are crucial support levels to monitor. A break below these points could indicate further downside risks, potentially leading to more significant losses.

Source: X

As of press time, Bitcoin was trading around $63,838.14, showing a slight 0.01% gain in the last 24 hours and a 2.85% increase over the past week.

The market remains on edge, waiting for a decisive move as the price hovers near critical resistance levels.

Bollinger bands and momentum indicators

The price action is consolidating near the upper Bollinger Band, which suggests Bitcoin is testing resistance at around $63,800.

The widening of the bands indicates a potential increase in volatility, often seen before a significant market move. If Bitcoin manages to sustain momentum above this resistance, it could signal further upward movement.

Conversely, failure to maintain this level may result in a pullback towards the middle band near $60,355.

Source: TradingView

Momentum indicators, such as the MACD, show a bullish stance with the MACD line above the signal line and in positive territory.

However, declining histogram bars hint at a slowdown in bullish momentum, raising caution for traders.

A potential bearish crossover could serve as an early warning of a reversal, prompting careful monitoring of these technical signals.

The Relative Strength Index (RSI) is currently around 61, indicating Bitcoin is in bullish territory but not yet overbought.

This suggests there is room for further price appreciation before reaching overbought conditions, which typically trigger profit-taking.

Should the RSI rise above 70, traders may begin to see increased selling pressure, potentially leading to a price pullback.

Bitcoin profits near peak?

On-chain data shows that Bitcoin’s MVRV ratio is at 2.01, reflecting that the market value is double the realized value.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This ratio is rising, suggesting that holders are increasingly in profit, which could lead to selling if the ratio continues to climb.

Source: IntoTheBlock

However, with the MVRV still below the 52-week high of 2.75, there remains room before reaching historically significant profit-taking levels.

аудит сайта заказать https://prodvizhenie-sajtov15.ru .

can you get cheap clomid without insurance order cheap clomiphene without prescription where to get cheap clomiphene without prescription can i buy cheap clomiphene tablets clomiphene for sale uk how to buy clomid tablets clomid pills

This website really has all of the tidings and facts I needed about this subject and didn’t comprehend who to ask.

Thanks recompense sharing. It’s first quality.

rybelsus ca – order rybelsus 14mg pills periactin 4 mg uk

buy motilium 10mg pills – oral domperidone 10mg cyclobenzaprine 15mg pill

inderal 20mg drug – plavix uk methotrexate for sale online

cheap amoxil tablets – cost ipratropium 100mcg combivent 100mcg us

order zithromax 500mg sale – buy azithromycin 500mg without prescription buy cheap nebivolol

augmentin 1000mg over the counter – https://atbioinfo.com/ order ampicillin online

nexium 20mg pill – https://anexamate.com/ esomeprazole 20mg over the counter

oral warfarin 2mg – coumamide losartan ca

buy meloxicam pill – https://moboxsin.com/ meloxicam 7.5mg usa

order prednisone 20mg online – https://apreplson.com/ order prednisone 20mg generic

red ed pill – https://fastedtotake.com/ pills for ed

cost amoxicillin – https://combamoxi.com/ buy amoxil pills

buy fluconazole 200mg online – forcan drug diflucan 200mg generic

cenforce 100mg sale – https://cenforcers.com/# order cenforce 100mg online

where can i buy cialis – ciltad generic cialis liquid for sale

cialis commercial bathtub – cialis medicine cialis or levitra

generic zantac – aranitidine buy zantac 150mg pills

sildenafil citrate 100mg for sale – strong vpls viagra sale cheapest

This is the kind of writing I positively appreciate. on this site

I am in point of fact delighted to glance at this blog posts which consists of tons of of use facts, thanks object of providing such data. brand zithromax 500mg

This is the big-hearted of scribble literary works I in fact appreciate. https://ursxdol.com/clomid-for-sale-50-mg/

Thanks on sharing. It’s first quality. https://prohnrg.com/product/priligy-dapoxetine-pills/

More posts like this would prosper the blogosphere more useful. propecia cheveux femme

I am in fact thrilled to glance at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://ondactone.com/product/domperidone/

More posts like this would make the blogosphere more useful.

buy mobic sale

I couldn’t hold back commenting. Adequately written! http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44944

forxiga for sale online – https://janozin.com/# order dapagliflozin online cheap