- The STH-SOPR surpassed a value of 1, suggesting possible short-term profit-taking.

- An analyst noted that Bitcoin could hit $58,000, but the retracement might be shocking.

Whether it is good or bad news for you, Bitcoin’s [BTC] correction has become increasingly closer than you think. However, there is one major issue with the forecast that has put market players on opposite sides.

Will the drawdown happen before the having or after?

Interestingly, AMBCrypto came across an opinion that BTC would correct pre-halving. Around the same period, we noticed another analyst saying that Bitcoin would surpass its yearly high before the event.

One side takes the preliminary

CryptoOnchain, a pseudonymous author on CryptoQuant, posted that Bitcoin might plummet to $48,000 in the coming days.

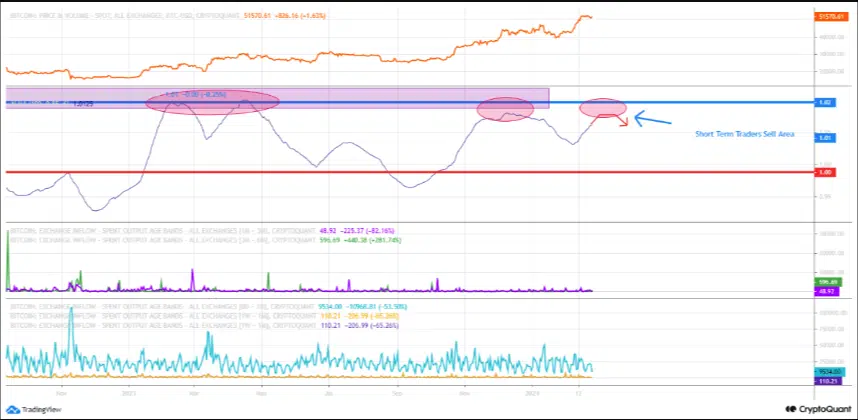

The author made his conclusion based on the Short Term Holder (STH) Spent Output Profit Ratio (SOPR).

The STH-SOPR assesses the behavior of short-term investors by considering the output younger than 155 days. Values of the STH-SOPR over 1 suggest that investors are selling at a profit.

But when the value is below 1, it means investors are cashing out at a loss.

However, the chart above showed that the value had risen above 1. It also revealed that the SOPR was at a point where Bitcoin’s price corrected over the past few months.

In addition to the on-chain analysis, CryptoQuant also examined the technical angle. Concerning this part, the analyst wrote,

“Bitcoin is approaching the selling area of short-term investors. Examining the technical chart also confirms this issue. Bitcoin is in the area below the resistance in the technical chart.”

The other sticks with history

However, Michaël van de Poppe did not share a similar view. According to him, Bitcoin’s correction would happen, but not before prices climb to $54,000 or $58,000.

In his point, the analyst also mentioned that the decline could be harder, noting that BTC could drop as low as 40,000 after the halving.

Historically, Bitcoin’s price has increased before the halving. After the event, the coin shreds a significant part of its value before heading for a new high.

AMBCrypto went ahead to analyze the price action before the last two halvings.

The second halving happened on the 9th of July 2016. From our observation, BTC climbed to $617 before the event. Later on, the price plunged.

A similar occurrence took place during the third halving, when Bitcoin’s price jumped to $9,619. Weeks after the event, the price significantly decreased.

Is your portfolio green? Check out the BTC Profit Calculator

AMBCrypto believes that Bitcoin might go either way this time, depending on where capital rotates. If market participants decided to drive liquidity into BTC, then the price might rise toward $54,000.

However, rotation into altcoins could see BTC’s value shrink. But at the same time, the presence of institutional money, which was not present in the last two halvings, could change things.

- The STH-SOPR surpassed a value of 1, suggesting possible short-term profit-taking.

- An analyst noted that Bitcoin could hit $58,000, but the retracement might be shocking.

Whether it is good or bad news for you, Bitcoin’s [BTC] correction has become increasingly closer than you think. However, there is one major issue with the forecast that has put market players on opposite sides.

Will the drawdown happen before the having or after?

Interestingly, AMBCrypto came across an opinion that BTC would correct pre-halving. Around the same period, we noticed another analyst saying that Bitcoin would surpass its yearly high before the event.

One side takes the preliminary

CryptoOnchain, a pseudonymous author on CryptoQuant, posted that Bitcoin might plummet to $48,000 in the coming days.

The author made his conclusion based on the Short Term Holder (STH) Spent Output Profit Ratio (SOPR).

The STH-SOPR assesses the behavior of short-term investors by considering the output younger than 155 days. Values of the STH-SOPR over 1 suggest that investors are selling at a profit.

But when the value is below 1, it means investors are cashing out at a loss.

However, the chart above showed that the value had risen above 1. It also revealed that the SOPR was at a point where Bitcoin’s price corrected over the past few months.

In addition to the on-chain analysis, CryptoQuant also examined the technical angle. Concerning this part, the analyst wrote,

“Bitcoin is approaching the selling area of short-term investors. Examining the technical chart also confirms this issue. Bitcoin is in the area below the resistance in the technical chart.”

The other sticks with history

However, Michaël van de Poppe did not share a similar view. According to him, Bitcoin’s correction would happen, but not before prices climb to $54,000 or $58,000.

In his point, the analyst also mentioned that the decline could be harder, noting that BTC could drop as low as 40,000 after the halving.

Historically, Bitcoin’s price has increased before the halving. After the event, the coin shreds a significant part of its value before heading for a new high.

AMBCrypto went ahead to analyze the price action before the last two halvings.

The second halving happened on the 9th of July 2016. From our observation, BTC climbed to $617 before the event. Later on, the price plunged.

A similar occurrence took place during the third halving, when Bitcoin’s price jumped to $9,619. Weeks after the event, the price significantly decreased.

Is your portfolio green? Check out the BTC Profit Calculator

AMBCrypto believes that Bitcoin might go either way this time, depending on where capital rotates. If market participants decided to drive liquidity into BTC, then the price might rise toward $54,000.

However, rotation into altcoins could see BTC’s value shrink. But at the same time, the presence of institutional money, which was not present in the last two halvings, could change things.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

can i buy cheap clomid without prescription can you buy generic clomid online can i purchase clomiphene online how to buy cheap clomiphene no prescription clomid pills price at clicks clomiphene price cvs where buy clomid pill

Thanks for sharing. It’s outstrip quality.

This is the stripe of serenity I enjoy reading.

rybelsus 14 mg without prescription – order rybelsus pill buy cyproheptadine 4mg pills

domperidone 10mg uk – flexeril order online cyclobenzaprine 15mg uk

order inderal pill – buy methotrexate cheap order methotrexate 10mg pills

buy amoxicillin pill – amoxil ca buy ipratropium 100 mcg generic

Your article helped me a lot, is there any more related content? Thanks!

buy esomeprazole generic – https://anexamate.com/ order esomeprazole 40mg for sale

oral coumadin 5mg – https://coumamide.com/ losartan 25mg tablet

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

buy meloxicam 15mg generic – tenderness buy mobic cheap

prednisone 20mg us – aprep lson prednisone 40mg sale

over the counter erectile dysfunction pills – https://fastedtotake.com/ non prescription ed drugs

buy amoxicillin without prescription – comba moxi oral amoxicillin

fluconazole 100mg usa – https://gpdifluca.com/ diflucan for sale online

cenforce 100mg generic – https://cenforcers.com/# cenforce 50mg cost

cialis for daily use side effects – cialis liquid for sale cialis for sale online in canada

oral zantac 300mg – https://aranitidine.com/ zantac ca

order generic cialis online – when does cialis go generic tamsulosin vs. tadalafil

viagra 100 mg – https://strongvpls.com/# buy-viagra-now.net

Greetings! Extremely serviceable advice within this article! It’s the crumb changes which will espy the largest changes. Thanks a portion towards sharing! click

I am in truth happy to gleam at this blog posts which consists of tons of of use facts, thanks towards providing such data. https://buyfastonl.com/amoxicillin.html

This is the gentle of criticism I truly appreciate. https://ursxdol.com/furosemide-diuretic/

Thanks on sharing. It’s acme quality. https://prohnrg.com/product/loratadine-10-mg-tablets/

Thanks an eye to sharing. It’s top quality. https://ondactone.com/product/domperidone/

The thoroughness in this section is noteworthy.

https://proisotrepl.com/product/propranolol/

With thanks. Loads of expertise! http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98428

purchase dapagliflozin online – janozin.com buy dapagliflozin without prescription

buy xenical generic – buy orlistat without prescription buy xenical 60mg online

This is a keynote which is in to my verve… Numberless thanks! Faithfully where can I notice the acquaintance details due to the fact that questions? http://iawbs.com/home.php?mod=space&uid=916897